Global Disposable Incontinence Products Market By Product Type (Protective Garments, Urinary Catheters and Urine Bags), By Application (Chronic Kidney Failure, Benign Prostatic Hyperplasia (BPH) and Others), By End-User (Home-Care Settings, Hospitals & Clinics and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174300

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

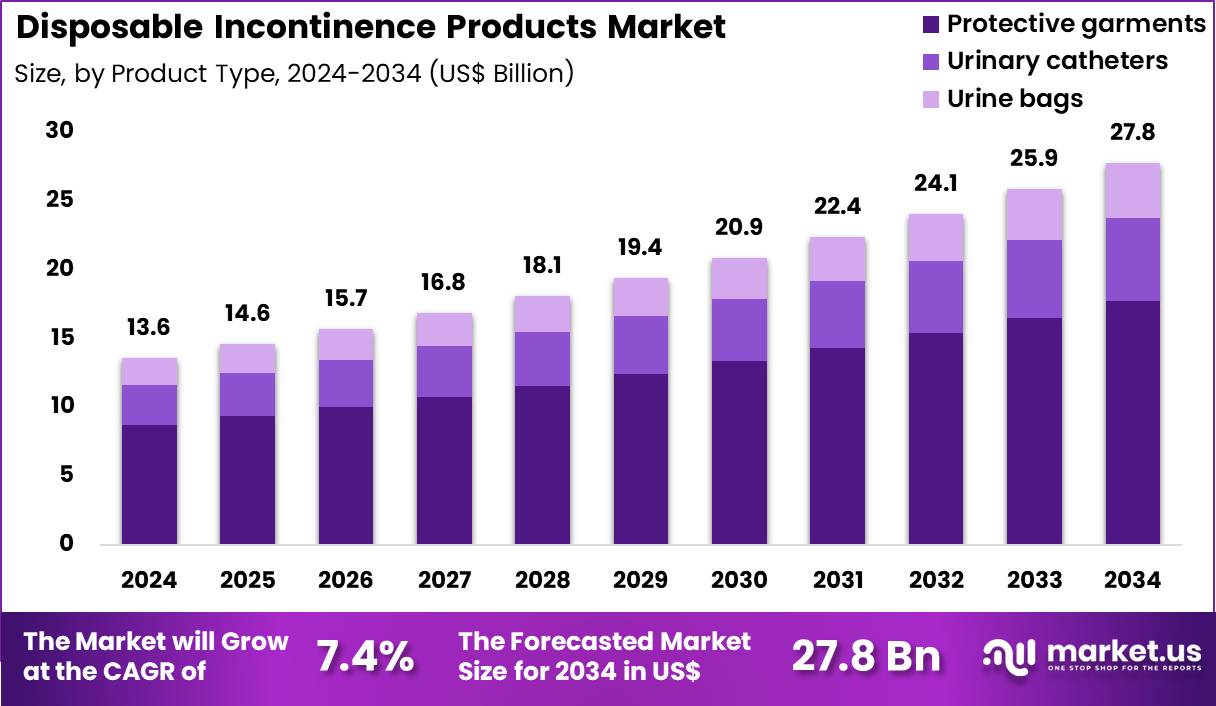

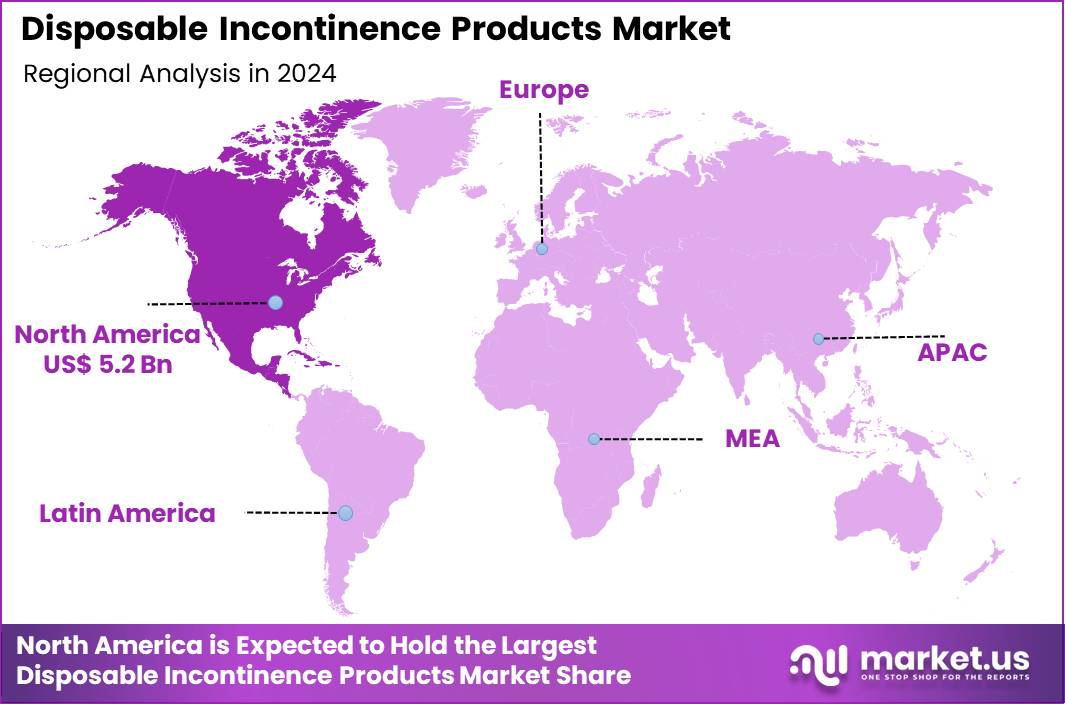

The Global Disposable Incontinence Products Market size is expected to be worth around US$ 27.8 Billion by 2034 from US$ 13.6 Billion in 2024, growing at a CAGR of 7.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.9% share with a revenue of US$ 5.2 Billion.

Increasing prevalence of urinary and fecal incontinence among adults and children drives manufacturers to innovate disposable products that ensure dignity, hygiene, and comfort in daily management. Caregivers and patients increasingly select adult briefs and pull-ups to handle moderate to heavy leakage, providing secure fit and odor control during extended wear in home or institutional settings. These products support light incontinence through thin, discreet pads and liners that absorb minor leaks, enabling active lifestyles without interruption.

Pediatric applications include disposable diapers and training pants that manage bedwetting or daytime accidents, offering gentle skin protection and easy changes for growing children. Healthcare providers utilize protective underpads to safeguard bedding and furniture from overflow, maintaining cleanliness in long-term care for immobile patients.

In February 2025, BASF introduced HySorb B 6610 ZeroPCF, a superabsorbent polymer developed for hygiene applications with a net zero product carbon footprint. The material enables diaper manufacturers to lower environmental impact without compromising absorbency performance, supporting broader industry efforts to integrate low emission raw materials into disposable hygiene products.

Manufacturers seize opportunities to incorporate advanced superabsorbent materials that enhance fluid retention and skin dryness, expanding applications in high-absorbency guards for overnight protection against severe incontinence. Developers create gender-specific designs with anatomical shaping, improving fit and leakage prevention in both male and female users across varying activity levels.

These innovations facilitate eco-conscious formulations that reduce plastic content, appealing to environmentally aware consumers managing chronic conditions. Opportunities arise in customizable sizing and adhesion options for liners, addressing diverse body types and mobility needs in active adults.

Companies advance odor-neutralizing technologies embedded in disposable briefs, elevating user confidence during social and professional engagements. Firms invest in breathable backsheets that promote skin health, minimizing irritation in prolonged wear scenarios for bedridden individuals.

Key Takeaways

- In 2024, the market generated a revenue of US$ 13.6 Billion, with a CAGR of 7.4%, and is expected to reach US$ 27.8 Billion by the year 2034.

- The product type segment is divided into protective garments, urinary catheters and urine bags, with protective garments taking the lead in 2024 with a market share of 63.9%.

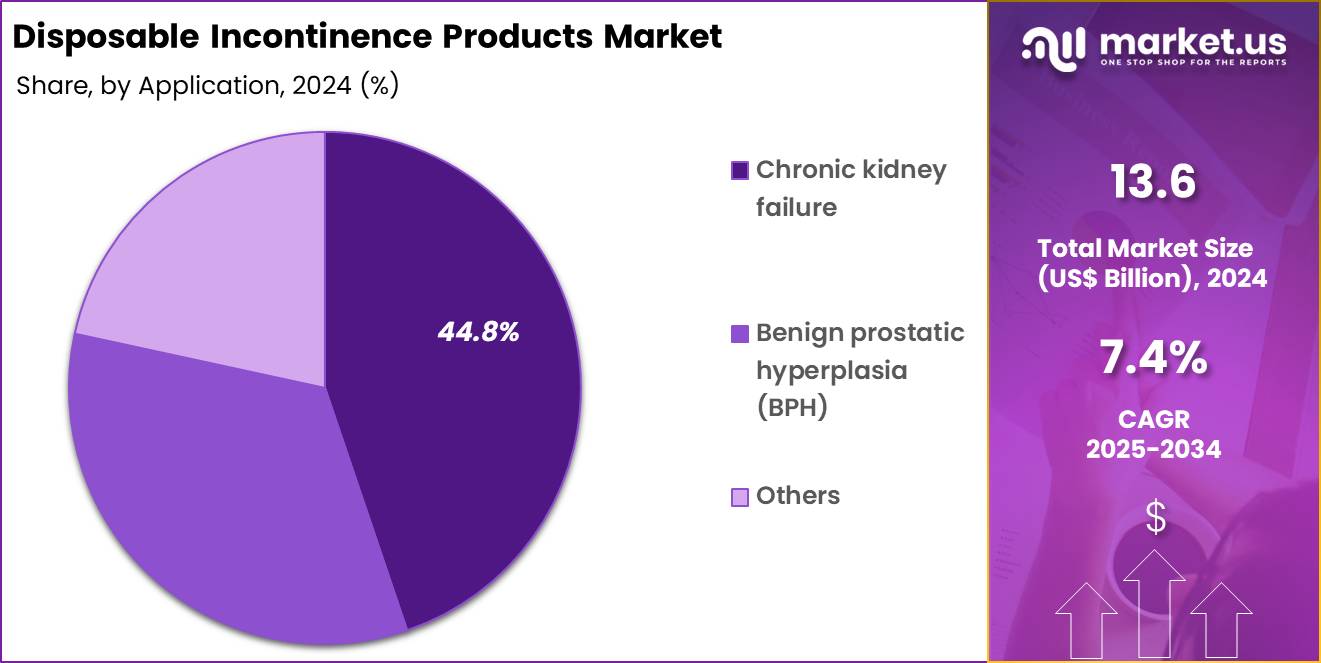

- Considering application, the market is divided into chronic kidney failure, benign prostatic hyperplasia (BPH) and others. Among these, chronic kidney failure held a significant share of 44.8%.

- Furthermore, concerning the end-user segment, the market is segregated into home-care settings, hospitals & clinics and others. The home-care settings sector stands out as the dominant player, holding the largest revenue share of 52.7% in the market.

- North America led the market by securing a market share of 37.9% in 2024.

Product Type Analysis

Protective garments accounted for 63.9% of growth within the product type category and represent the largest volume driver in the Disposable Incontinence Products market. Aging populations increase the number of consumers managing daily leakage and mobility limitations. Caregivers and users prefer protective garments because they resemble regular underwear and support dignity. Manufacturers improve absorbent core technology to increase dryness and reduce odor.

Breathable back sheets and skin-friendly topsheets reduce rashes, which improves repeat purchasing. Product portfolios expand into pull-ups, taped briefs, and gender-specific fits to address different severity levels. Retail availability improves access for home users who buy monthly packs. Subscription and bulk packs reduce unit cost, which supports higher consumption. Growing awareness of postpartum and stress incontinence increases adoption among adults.

Facilities increasingly standardize garment-based solutions for routine continence care. Better leakage barriers reduce night-time incidents, which improves user satisfaction. Discreet designs support use outside the home, strengthening everyday demand. Innovation in superabsorbent polymers improves performance without increasing bulk. Eco-focused variants using less plastic improve brand preference in premium segments. Private label offerings expand affordability in mass channels.

Clinical recommendations often start with garments before invasive options, sustaining demand. Home-care growth increases garment usage because caregivers need easy-change products. Better sizing ranges reduce fit issues and returns. Brand marketing emphasizes confidence and skin health, strengthening loyalty. The segment is projected to retain dominance due to convenience, comfort, and broad user suitability. Overall growth reflects daily-use frequency and continuous product upgrades.

Application Analysis

Chronic kidney failure represented 44.8% of growth within the application category and stands as a major clinical driver for disposable continence consumption. CKD patients often experience urinary symptoms linked to fluid management, comorbid diabetes, and reduced mobility. Dialysis routines increase time spent in clinics and transit, which raises the need for reliable protection. Patients managing fatigue and muscle weakness prefer products that reduce bathroom urgency stress.

Care teams emphasize hygiene and skin integrity, which supports consistent use of disposable products. CKD prevalence rises alongside hypertension and diabetes trends, expanding the patient pool. Older CKD patients show higher leakage rates, supporting higher product volumes. Post-hospital discharge planning often includes continence supplies for CKD patients. Night-time leakage management becomes important due to disrupted sleep patterns.

Caregivers choose high-absorbency garments to reduce change frequency. Reduced mobility during acute CKD episodes increases reliance on protective solutions. Home dialysis growth supports in-home product usage. Patient education improves adoption of appropriate absorbency levels. Product features that protect skin reduce infection and irritation risks. Public health focus on chronic disease management increases diagnosis and long-term care continuity.

Insurance and reimbursement support in some settings improves affordability. Pharmacies and medical supply channels improve access for recurring CKD needs. Higher survival rates increase long-term usage duration. The segment is anticipated to remain dominant due to chronic care pathways and recurring demand. Overall growth reflects disease burden, care routines, and continuous consumption needs.

End-User Analysis

Home-care settings accounted for 52.7% of growth within the end-user category and dominate the Disposable Incontinence Products market. Aging in place trends increase the number of users managing continence at home rather than in institutions. Families and caregivers prefer home-care because it reduces facility costs and improves patient comfort.

Home-care routines require easy-to-use products with quick change capability. Protective garments suit home use due to simple application without clinical assistance. E-commerce and subscription services simplify repeat ordering for home caregivers. Bulk purchasing supports cost control for long-term users. Home health agencies increasingly include continence management in care plans. Post-surgery recovery at home increases short-term demand for disposable products.

Rising prevalence of chronic diseases increases long-duration home support needs. Product education through digital channels improves correct usage and reduces leakage incidents. Discreet packaging and delivery improve user privacy and willingness to purchase. Technology-enabled caregiving increases monitoring and timely changes, improving outcomes. Skin care integration in home routines supports higher quality product selection.

Improved product fit reduces caregiver workload and change time. Higher household awareness reduces stigma and increases adoption. Rural access improves through online and pharmacy delivery services. Caregiver shortage pressures favor products that reduce change frequency. Home-care demand is projected to grow due to demographic aging and cost-driven care shifts. Overall dominance reflects convenience, recurring consumption, and expanding home-based healthcare models.

Key Market Segments

By Product Type

- Protective garments

- Urinary catheters

- Urine bags

By Application

- Chronic kidney failure

- Benign prostatic hyperplasia (BPH)

- Others

By End-User

- Home-care settings

- Hospitals & clinics

- Others

Drivers

Rising prevalence of urinary incontinence is driving the market

The disposable incontinence products market is significantly driven by the rising prevalence of urinary incontinence, which affects millions of adults and increases the demand for convenient and effective management solutions. Healthcare providers recommend disposable products for their hygiene benefits and ease of use in daily life for patients with moderate to severe symptoms.

Regulatory bodies emphasize the importance of accessible products to address this condition, supporting market growth through standardized guidelines. Pharmaceutical and device companies invest in innovations to meet the needs of an aging population prone to incontinence. Clinical protocols integrate disposable products into care plans for long-term management, improving quality of life.

Global health organizations track prevalence trends to inform policy on product availability. Academic research validates the efficacy of disposable products in reducing skin irritation and infections. Patient education campaigns promote awareness, boosting utilization of absorbent pads and guards.

Economic burdens from untreated incontinence, including healthcare costs, further justify market expansion. According to a StatPearls publication by the National Institutes of Health updated in 2024, approximately 24% to 45% of women reported urinary incontinence, with 7% to 37% among those aged 20 to 39 experiencing some degree.

Restraints

High costs of premium disposable products are restraining the market

The disposable incontinence products market is restrained by the high costs of premium products, which include advanced absorbent materials and odor control features, limiting affordability for low-income households. Manufacturers face elevated production expenses for eco-friendly and high-performance items, passing these onto consumers. Regulatory compliance for product safety adds to financial burdens, deterring widespread adoption in budget-constrained regions.

Healthcare systems in developing areas struggle with funding for premium products, reducing market penetration. Clinical practices may opt for basic alternatives, compromising user comfort and effectiveness. Global disparities in reimbursement exacerbate affordability issues for disposable technologies.

Academic analyses highlight the impact on equity in incontinence care. Patient access is limited in areas with inadequate insurance coverage for hygiene products. Economic models project slower growth without cost reduction strategies. From Essity’s 2022 Annual Report, the company noted pricing pressures in incontinence care due to rising raw material costs, affecting profitability in the segment.

Opportunities

Expansion in e-commerce sales channels is creating growth opportunities

The disposable incontinence products market offers growth opportunities through the expansion in e-commerce sales channels, which provide discreet and convenient purchasing options for consumers seeking privacy in managing their condition. Developers can leverage online platforms to reach underserved populations with customized product recommendations.

Regulatory frameworks for digital health support e-commerce growth, facilitating market entry for subscription-based models. Healthcare providers can partner with online retailers to offer educational resources alongside products. Pharmaceutical collaborations focus on bundling disposable items with telehealth services for comprehensive care. Clinical research explores consumer preferences in online shopping for incontinence supplies.

Global adoption in emerging markets aligns with digital infrastructure development for direct-to-consumer sales. Academic collaborations refine e-commerce strategies to ensure product quality and delivery efficiency. Patient therapies benefit from home delivery reducing stigma and improving adherence. From Procter & Gamble’s 2024 Annual Report, the company reported double-digit e-commerce growth in personal health care, including incontinence products, driven by digital platforms.

Impact of Macroeconomic / Geopolitical Factors

Global economic progress drives greater healthcare spending on elderly care, strengthening the disposable incontinence products market through rising demand for absorbent pads and protective underwear in developed regions. Companies benefit from expanding middle-class populations that prioritize dignity and hygiene solutions for chronic conditions.

However, widespread inflation elevates prices for pulp and super-absorbent materials, challenging producers to sustain affordable offerings amid tightening consumer budgets. Ongoing geopolitical strains in pulp-producing nations hinder steady raw material availability, prompting delays in manufacturing for worldwide suppliers. Teams navigate these uncertainties by broadening supplier bases across stable areas, which fortifies continuity and encourages shared innovation efforts.

Current US tariffs on imported hygiene items and key components from major trading partners raise overall input expenses for importers serving the American segment. Home-based manufacturers gain momentum by enhancing local production lines, which creates employment opportunities and advances material efficiencies internally. Persistent focus on odor-control and skin-friendly advancements reliably uplifts the market’s trajectory, delivering reliable expansion and improved quality of life for users globally.

Latest Trends

Adoption of sustainable and biodegradable materials is a recent trend

In 2024, the disposable incontinence products market has exhibited a prominent trend toward the adoption of sustainable and biodegradable materials, which address environmental concerns and appeal to eco-conscious consumers. Manufacturers are focusing on plant-based absorbers and recyclable packaging to reduce plastic waste.

Healthcare professionals are recommending these products for their skin-friendly properties and lower ecological impact. Regulatory agencies are encouraging the shift through guidelines on green manufacturing practices. Clinical implementations benefit from materials that maintain high absorbency while degrading naturally. Academic studies are evaluating the performance of biodegradable products in real-world use. Global supply chains are adapting to source renewable materials for production.

Patient satisfaction increases with products that align with personal values on sustainability. Ethical protocols ensure testing for allergenicity in new materials. From Kimberly-Clark’s 2024 Annual Report, the company highlighted investments in sustainable materials for incontinence care products, aiming for 75% reduction in plastic footprint by 2030.

Regional Analysis

North America is leading the Disposable Incontinence Products Market

North America accounted for 37.9% of the overall market in 2024, and the Disposable Incontinence Products market expanded as demand rose across aging populations and patients managing chronic conditions. Higher diagnosis rates of urinary incontinence encouraged greater acceptance of disposable pads, briefs, and protective underwear in both homecare and institutional settings.

Home healthcare growth supported consistent product usage among elderly individuals seeking comfort and dignity. Product innovations improved absorbency, odor control, and skin-friendliness, increasing repeat purchases. Retail pharmacies and e-commerce channels enhanced discreet access, supporting consumer confidence.

The U.S. Census Bureau reported that adults aged 65 and above reached 58.9 million in 2022, a demographic with higher incontinence prevalence and sustained product need. Increased caregiver awareness strengthened adoption across long-term care facilities. These factors collectively drove solid market growth in North America during 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience strong growth during the forecast period as the Disposable Incontinence Products market benefits from rapid population aging and expanding healthcare access. Urbanization and changing lifestyles increase awareness of bladder health and hygiene management. Governments strengthen elderly care infrastructure, supporting higher adoption in hospitals and nursing facilities. Rising middle-class income improves affordability of disposable hygiene solutions.

Manufacturers introduce cost-effective products tailored to regional needs, improving penetration across developing economies. The United Nations reported that Asia Pacific had over 414 million people aged 65 and above in 2023, highlighting a large and expanding target population. E-commerce growth improves distribution reach beyond major cities. These trends position the region for sustained and accelerating market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Disposable Incontinence Products market drive growth by enhancing absorbency performance, odor control, and skin-friendly materials to improve comfort and dignity for aging and mobility-impaired users. Companies expand demand through segmentation strategies that address adult, pediatric, and post-acute care needs across homecare and institutional settings.

Commercial approaches emphasize strong retail presence, healthcare channel partnerships, and direct-to-consumer platforms that increase accessibility and recurring purchases. Innovation priorities focus on thinner designs, breathable layers, and sustainable raw materials that balance performance with environmental expectations.

Market expansion targets regions experiencing rapid population aging and rising awareness of continence care solutions. Essity operates as a leading participant with a broad continence care portfolio, global manufacturing scale, and strong healthcare relationships that support consistent adoption and long-term brand leadership in personal care markets.

Top Key Players

- Kimberly-Clark Corporation

- Essity AB

- Procter & Gamble Company

- Unicharm Corporation

- Domtar Corporation

- Cardinal Health

- Medline Industries, Inc.

- First Quality Enterprises, Inc.

- Ontex Group

- Svenska Cellulosa Aktiebolaget (SCA)

Recent Developments

- In February 2025, Ontex Group NV brought its Dreamshields technology to market for baby diapers, emphasizing enhanced leakage prevention, improved wearer comfort, and responsible material use. The technology supports better moisture management while aligning with sustainability objectives, reflecting shifting consumer and retailer preferences toward high performing and environmentally considerate hygiene products.

- In October 2023, Unicharm Corporation introduced LIFREE Ultra Slim Comfort Pants across Japan, with nationwide availability beginning in mid November. The product incorporates ultrasonic bonding in the waist region to reduce thickness and make handling easier for users and caregivers. This launch addresses growing demand for discreet, lightweight adult incontinence solutions suited to aging populations and home care settings.

Report Scope

Report Features Description Market Value (2024) US$ 13.6 Billion Forecast Revenue (2034) US$ 27.8 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Protective Garments, Urinary Catheters and Urine Bags), By Application (Chronic Kidney Failure, Benign Prostatic Hyperplasia (BPH) and Others), By End-User (Home-Care Settings, Hospitals & Clinics and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kimberly-Clark Corporation, Essity AB, Procter & Gamble Company, Unicharm Corporation, Domtar Corporation, Cardinal Health, Medline Industries, Inc., First Quality Enterprises, Inc., Ontex Group, Svenska Cellulosa Aktiebolaget (SCA) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Disposable Incontinence Products MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Disposable Incontinence Products MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Kimberly-Clark Corporation

- Essity AB

- Procter & Gamble Company

- Unicharm Corporation

- Domtar Corporation

- Cardinal Health

- Medline Industries, Inc.

- First Quality Enterprises, Inc.

- Ontex Group

- Svenska Cellulosa Aktiebolaget (SCA)