Global Breathable Membranes Market Size, Share Analysis Report By Type (Polyethylene, Polypropylene, Polyurethane, Others), By Application (Pitched Roof, Walls), By End-use (Residential, Commercial, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159875

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

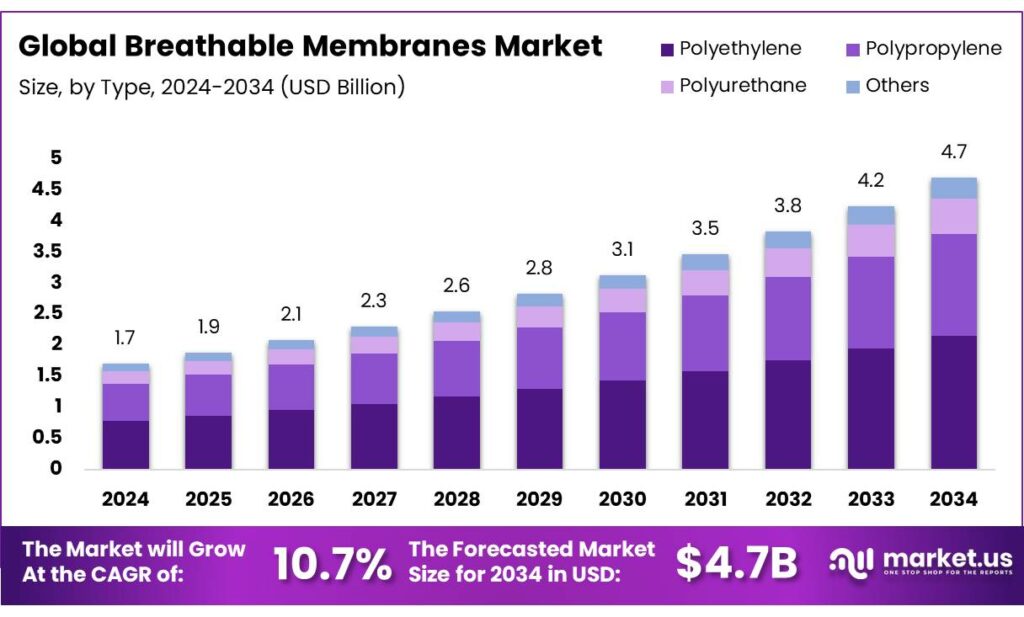

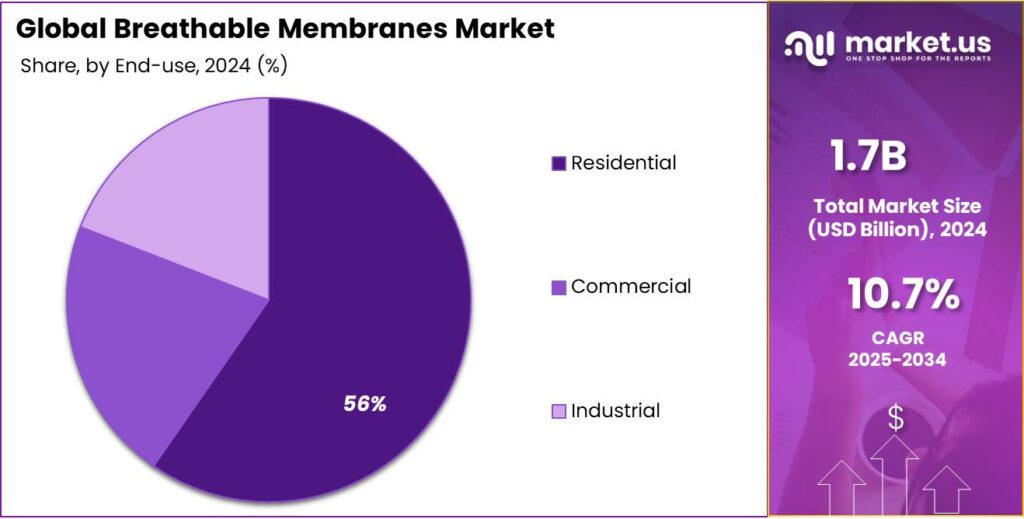

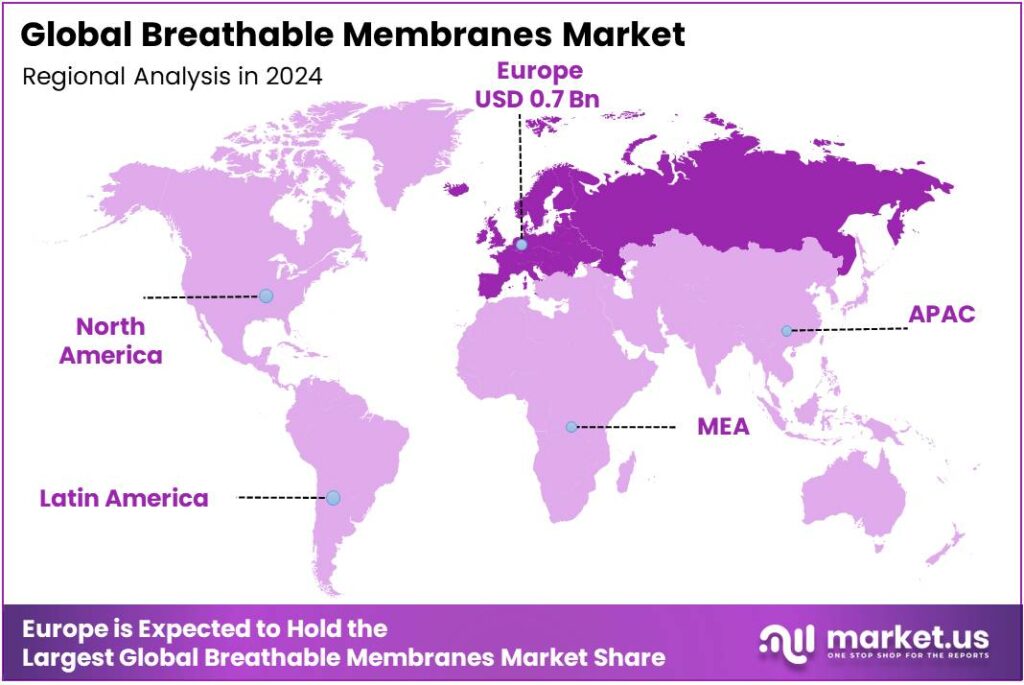

The Global Breathable Membranes Market size is expected to be worth around USD 4.7 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 10.7% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 43.9% share, holding USD 0.7 Billion in revenue.

Breathable membranes (also called breathable films or building wraps) are engineered polymeric layers that allow the diffusion or transmission of water vapor while resisting bulk liquid water penetration. In construction, they are commonly used in roofing underlays, wall wraps, and moisture control layers to prevent condensation, enhance energy efficiency, and protect structures from moisture damage. Beyond construction, breathable membranes find use in specialty applications such as medical dressings, protective garments, and performance textiles.

A number of driving factors, the push for energy efficiency in buildings makes better vapor control, moisture management, and thermal integrity more desirable. The opaque envelope (walls, roofs, foundations) is estimated to account for about 25% of building energy use (or ~10 % of total U.S. primary energy) in some assessments, highlighting the importance of improved envelope technologies including breathable membranes.

From a policy and government initiative angle, the building and energy efficiency agenda is a relevant lever. In India, for instance, the Government has implemented the Energy Conservation Building Code (ECBC) since 2007 (revised in 2017) to set minimum energy performance standards for commercial buildings, with a goal of achieving 50% reduction in energy use by 2030 relative to conventional construction practices.

The National Building Energy Efficiency Programme (BEEP) and Eco‑Niwas Samhita (ENS) strengthen building envelope and material standards in residential and commercial sectors. Under the National Mission for Enhanced Energy Efficiency (NMEEE), the government targets avoided capacity addition of 19,598 MW, fuel savings of ~23 million tonnes/year, and greenhouse gas emission reductions of ~98.55 million tonnes annually.

Key Takeaways

- Breathable Membranes Market size is expected to be worth around USD 4.7 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 10.7%.

- Polyethylene held a dominant market position, capturing more than a 45.9% share of the breathable membranes market.

- Pitched Roof held a dominant market position, capturing more than a 67.3% share of the breathable membranes market.

- Residential held a dominant market position, capturing more than a 56.2% share of the breathable membranes market.

- Europe held a dominant position in the global breathable membranes market, capturing more than 43.90% share, valued at approximately USD 0.7 billion.

By Type Analysis

Polyethylene leads the market with 45.9% share in 2024

In 2024, Polyethylene held a dominant market position, capturing more than a 45.9% share of the breathable membranes market. The strong presence of polyethylene-based membranes was supported by their high durability, lightweight structure, and resistance to tearing, making them a preferred choice in roofing and wall applications. The ability of polyethylene membranes to provide effective moisture control while maintaining vapor permeability has made them widely accepted in residential as well as commercial construction. This steady growth highlights polyethylene’s role as a cost-effective and performance-driven solution within the breathable membranes sector.

By Application Analysis

Pitched Roof dominates with 67.3% share in 2024

In 2024, Pitched Roof held a dominant market position, capturing more than a 67.3% share of the breathable membranes market. The large share was supported by the rising use of pitched roofing systems in residential housing, particularly in Europe and Asia, where weather protection and long-term durability are critical. Breathable membranes in pitched roofs provide effective moisture regulation, preventing condensation while allowing vapor escape, which enhances roof performance and longevity. This trend underlines the importance of pitched roofs as the primary application area for breathable membranes globally.

By End-use Analysis

Residential dominates with 56.2% share in 2024

In 2024, Residential held a dominant market position, capturing more than a 56.2% share of the breathable membranes market. The dominance of this segment was driven by the rapid rise in new housing construction and renovation projects, where moisture control and energy efficiency are major priorities. Homeowners and builders increasingly prefer breathable membranes in residential buildings to ensure better indoor air quality, longer structural life, and improved thermal performance. This reflects how residential construction remains the strongest end-use driver for breathable membranes worldwide.

Key Market Segments

By Type

- Polyethylene

- Polypropylene

- Polyurethane

- Others

By Application

- Pitched Roof

- Walls

By End-use

- Residential

- Commercial

- Industrial

Emerging Trends

Government Support for Sustainable Food Packaging

In India, the Ministry of Health and Family Welfare launched a national initiative in April 2025 to promote eco-friendly food packaging. This initiative includes new guidelines, industry collaboration, and the development of biodegradable packaging materials. The government is actively encouraging the use of sustainable materials to reduce plastic waste and promote a circular economy. This policy shift is expected to lead to a significant reduction in plastic waste, aligning with India’s commitment to environmental sustainability.

Additionally, the Food Safety and Standards Authority of India (FSSAI) revised food packaging regulations in March 2025 to balance environmental protection with food safety. These updated regulations support the food industry’s transition to a circular economy by encouraging the use of recyclable and compostable materials in packaging. This regulatory support is crucial for the widespread adoption of breathable membranes in food packaging applications.

Additionally, the Food Safety and Standards Authority of India (FSSAI) revised food packaging regulations in March 2025 to balance environmental protection with food safety. These updated regulations support the food industry’s transition to a circular economy by encouraging the use of recyclable and compostable materials in packaging. This regulatory support is crucial for the widespread adoption of breathable membranes in food packaging applications.

Drivers

Government Initiatives and Policy Support

Government initiatives and policy support have emerged as significant driving factors for the growth of the breathable membranes industry, particularly in the construction and industrial sectors. These initiatives aim to promote energy efficiency, sustainability, and the adoption of advanced materials in building and industrial applications.

In India, the Bureau of Energy Efficiency (BEE) has launched the “Assistance in Deploying Energy Efficient Technologies in Industries and Establishments” (ADEETIE) scheme, with a total budget of ₹1,000 crore. The scheme allocates ₹875 crore for interest subvention and ₹50 crore for implementation and capacity-building activities. It targets micro, small, and medium enterprises (MSMEs) across 60 industrial clusters and 14 energy-intensive sectors, including textiles, foundries, and food processing.

The ADEETIE scheme aims to reduce energy consumption by 30–50% in participating industries, thereby promoting the adoption of energy-efficient technologies and materials, such as breathable membranes. This initiative is expected to mobilize over ₹9,000 crore in total investments, contributing to India’s climate and net-zero goals

- Additionally, India’s National Mission for Enhanced Energy Efficiency (NMEEE), approved in 2010, focuses on reducing energy intensity and promoting energy efficiency across various sectors. The mission aims to achieve total avoided capacity addition of 19,598 MW, fuel savings of around 23 million tonnes per year, and greenhouse gas emissions reductions of 98.55 million tonnes annually. By encouraging the use of energy-efficient materials and technologies, the NMEEE indirectly supports the adoption of breathable membranes in construction and industrial applications

These government initiatives not only provide financial incentives and technical support to industries but also create a conducive policy environment for the growth of the breathable membranes market. As industries increasingly focus on energy efficiency and sustainability, the demand for advanced materials like breathable membranes is expected to rise, further driving market growth.

Restraints

Fluctuating Raw Material Prices and Their Impact on the Breathable Membranes Industry

One of the significant challenges facing the breathable membranes industry is the volatility in the prices of raw materials, particularly polyethylene (PE) and polypropylene (PP). These polymers are the primary components used in manufacturing breathable membranes, and their price fluctuations can have a substantial impact on production costs and, consequently, on the overall market dynamics.

The prices of PE and PP are influenced by various factors, including crude oil prices, supply chain disruptions, and geopolitical tensions. For instance, in 2024, the global market experienced a surge in crude oil prices due to geopolitical tensions in oil-producing regions, leading to an increase in the cost of PE and PP resins. This surge in raw material costs directly affected the production expenses of breathable membranes, making them more expensive for manufacturers and, ultimately, for consumers.

- According to a report by the U.S. National Association of Home Builders, the cost of building materials increased by approximately 20% in 2024, primarily driven by higher prices for essential materials like lumber and steel. This escalation in construction costs has led to delays in projects and, in some cases, the postponement of new developments, affecting the demand for breathable membranes in the construction sector.

Government initiatives also play a crucial role in addressing these challenges. In India, the Ministry of New and Renewable Energy (MNRE) has introduced policies to promote the use of sustainable materials in construction. These policies include financial incentives for projects that incorporate eco-friendly materials, such as breathable membranes made from recycled or bio-based polymers. Such initiatives not only support the adoption of breathable membranes but also encourage manufacturers to invest in sustainable production practices.

Opportunity

Expanding Use of Breathable Membranes in Food Packaging

One of the most promising growth opportunities for breathable membranes lies in their application within the food packaging industry. As global concerns about food waste, sustainability, and consumer health continue to rise, breathable membranes offer a practical solution to extend the shelf life of perishable goods while maintaining product quality.

Breathable membranes, such as microporous films, allow for controlled gas exchange, enabling fruits, vegetables, and other perishable items to “breathe” within their packaging. This regulation of oxygen and carbon dioxide levels helps slow down the ripening process and reduces spoilage, thereby extending the freshness of the products. For instance, the use of breathable packaging for fresh produce has been shown to reduce spoilage rates and improve shelf life, which is particularly beneficial in regions with limited access to refrigeration.

In India, the Ministry of Food Processing Industries (MoFPI) has recognized the importance of innovative packaging solutions in reducing food waste. Through initiatives like the Pradhan Mantri Kisan Sampada Yojana (PMKSY), the government has been promoting the adoption of modern packaging technologies, including breathable films, to enhance the shelf life of perishable commodities. The scheme aims to create modern infrastructure with efficient supply chain management from farm gate to retail outlet. By encouraging the use of breathable membranes, the government supports the reduction of post-harvest losses, which are estimated to be around 30-40% for fruits and vegetables in India.

Regional Insights

Europe leads the breathable membranes market with 43.9% share valued at USD 0.7 billion

In 2024, Europe held a dominant position in the global breathable membranes market, capturing more than 43.90% share, valued at approximately USD 0.7 billion. This leadership is strongly linked to the region’s advanced construction sector and stringent building energy-efficiency regulations. According to the European Commission, around 85% of buildings in the EU were built before 2000, with nearly 75% of them performing poorly in terms of energy efficiency.

This has created a large market for renovation and retrofit projects, where breathable membranes are widely used to improve thermal performance and moisture regulation in pitched roofs, façades, and wall assemblies. Moreover, the European Union’s Energy Performance of Buildings Directive (EPBD) requires member states to accelerate renovations and move towards nearly zero-energy buildings, further supporting adoption.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DuPont is a leading player in the breathable membranes market, offering high-performance membranes for various applications, including construction and industrial sectors. Known for their advanced technology, DuPont’s breathable membranes provide moisture control and enhanced building envelope performance. The company focuses on sustainability and innovation, addressing the growing demand for eco-friendly materials. DuPont is known for its commitment to quality and its position as a trusted supplier in the global market.

GAF Material Corporation, a prominent roofing manufacturer, offers breathable membrane solutions designed for energy-efficient and moisture-resistant roofing systems. The company’s products focus on providing superior weatherproofing and energy-saving properties. With a strong presence in North America, GAF is recognized for its innovation in building materials, including its high-performance breathable membranes. Their emphasis on sustainable building practices and quality makes them a key player in the market.

Kingspan Group PLC, a leading building materials provider, specializes in advanced insulation and breathable membranes for the construction industry. The company’s membranes are designed to optimize energy efficiency and moisture control in building envelopes. Kingspan has a strong reputation for sustainability and innovation, making it a key player in the market. Its product offerings are integral to reducing the environmental impact of construction projects, aligning with the growing demand for green building solutions.

Top Key Players Outlook

- DuPont

- GAF Material Corporation

- Saint Gobain SA

- Kingspan Group PLC

- Klober

- Knauf Insulation

- Porelle Membranes

- Riwega Srl GmbH

- Soprema Group

- Sungod Technology Co. Ltd.

Recent Industry Developments

In 2024, DuPont’s Performance Building Solutions and Corian® Design business achieved a 93% reduction in Scope 1 and Scope 2 greenhouse gas (GHG) emissions compared to a 2019 baseline, underscoring the company’s commitment to sustainability.

In 2024, Knauf Insulation continued its commitment to sustainability by achieving a 5.7% increase in combined Scope 1 and 2 emissions compared to 2023, primarily due to plant start-ups and market complexities. However, the company remains on track to achieve its 2032 target of reducing combined Scope 1 and 2 emissions by 50% compared to its 2021 baseline, recording a reduction of 15%

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 4.7 Bn CAGR (2025-2034) 10.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Polyethylene, Polypropylene, Polyurethane, Others), By Application (Pitched Roof, Walls), By End-use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape DuPont, GAF Material Corporation, Saint Gobain SA, Kingspan Group PLC, Klober, Knauf Insulation, Porelle Membranes, Riwega Srl GmbH, Soprema Group, Sungod Technology Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Breathable Membranes MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Breathable Membranes MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DuPont

- GAF Material Corporation

- Saint Gobain SA

- Kingspan Group PLC

- Klober

- Knauf Insulation

- Porelle Membranes

- Riwega Srl GmbH

- Soprema Group

- Sungod Technology Co. Ltd.