Global Breathable Antimicrobial Coatings Market By Type (Metallic, Non-metallic), By Technology (Water-based, Solvent-based, Powder Coating, Aerosol, UV Curable), By End-use (Medical And Healthcare, Food and Beverage, Building and Construction, HVAC System, Protective Clothing, Automotive and Transportation, Consumer Goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 62337

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

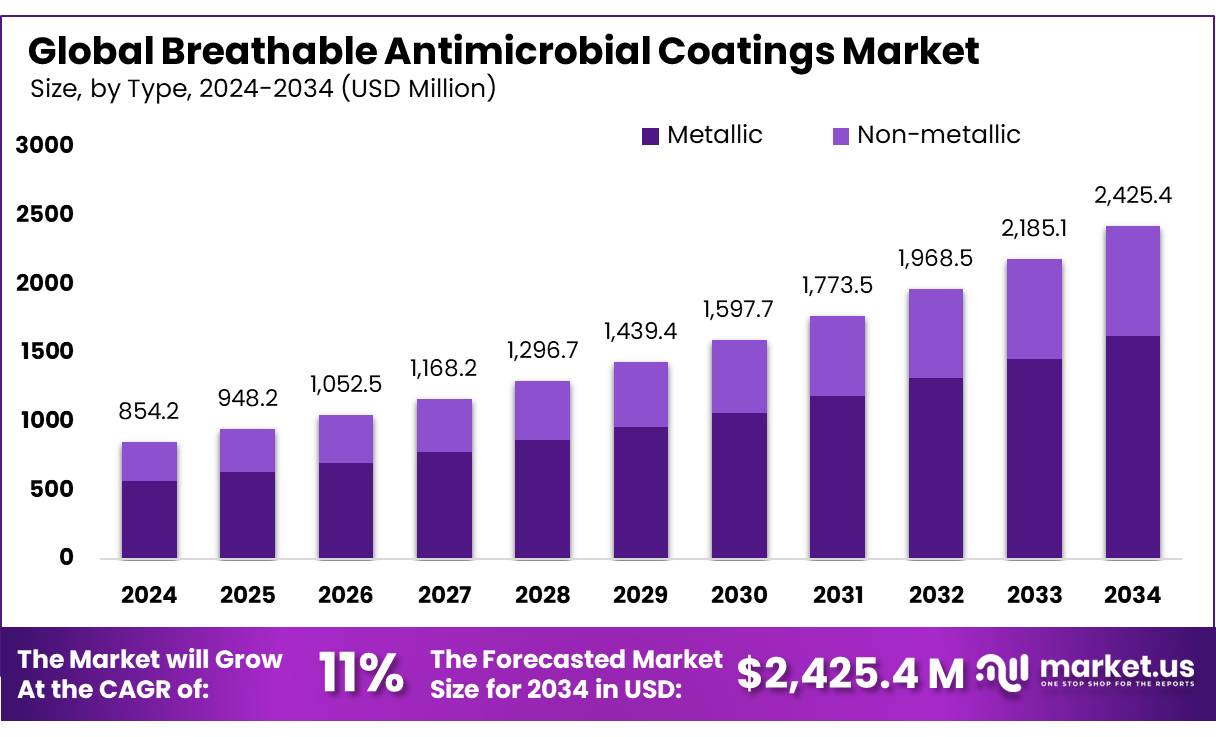

The Breathable Antimicrobial Coatings Market size is expected to be worth around USD 2425.4 Million by 2034, from USD 854.2 Million in 2024, growing at a CAGR of 11% during the forecast period from 2025 to 2034.

Breathable antimicrobial coatings represent a rapidly evolving subset of the coatings industry, combining permeability with microbial resistance to meet growing hygienic and environmental demands. These coatings allow water vapor to escape while preventing microbial growth on treated surfaces, offering advantages in healthcare, construction, food processing, and consumer goods sectors.

Breathable antimicrobial coatings are increasingly integrated into building materials, HVAC systems, textiles, and high-touch surfaces to address microbial risks without trapping moisture. The U.S. Environmental Protection Agency (EPA) continues to regulate antimicrobial product claims under FIFRA (Federal Insecticide, Fungicide, and Rodenticide Act), ensuring that products marketed for public health benefits meet stringent performance and safety standards.

Additionally, Europe’s Biocidal Products Regulation (BPR, Regulation (EU) 528/2012) controls the market entry of antimicrobial-treated articles, encouraging manufacturers to develop safer, breathable solutions. In 2023, the U.S. coatings manufacturing capacity utilization stood at 80.4%, up from 76.1% in 2020, as per data from the U.S. Federal Reserve—demonstrating steady industrial recovery with rising demand for advanced coatings.

Several factors are driving growth in the breathable antimicrobial coatings sector. Firstly, increasing healthcare infrastructure investment globally is a major catalyst. For example, the U.S. Department of Health and Human Services (HHS) allocated $10 billion in 2023 toward infection control improvements in healthcare facilities. Additionally, green building certifications like LEED are promoting the use of breathable, antimicrobial surface solutions to enhance indoor air quality and occupant health. Moreover, the construction sector, responsible for 13% of global GDP according to the World Bank, is adopting antimicrobial coatings in wall paints, facades, and insulation systems, further boosting market potential.

Future growth opportunities look promising due to escalating urbanization, regulatory support, and material science innovations. Governments in regions like North America and Europe are funding R&D into next-generation, non-toxic antimicrobial agents based on silver nanoparticles, copper oxides, and organic compounds.

The U.S. National Science Foundation (NSF) invested $104 million in materials research projects in 2023 alone, with breathable antimicrobial coatings identified as a target application. The convergence of breathable film technologies with antimicrobial properties is also expected to open pathways in sportswear, electronics, and automotive interiors, where moisture control and hygiene are critical.

Key Takeaways

- Breathable Antimicrobial Coatings Market size is expected to be worth around USD 2425.4 Million by 2034, from USD 854.2 Million in 2024, growing at a CAGR of 11%.

- Metallic coatings holding a significant lead, capturing more than a 66.9% share.

- Water-based technology in the breathable antimicrobial coatings market held a dominant market position, capturing more than a 37.2% share.

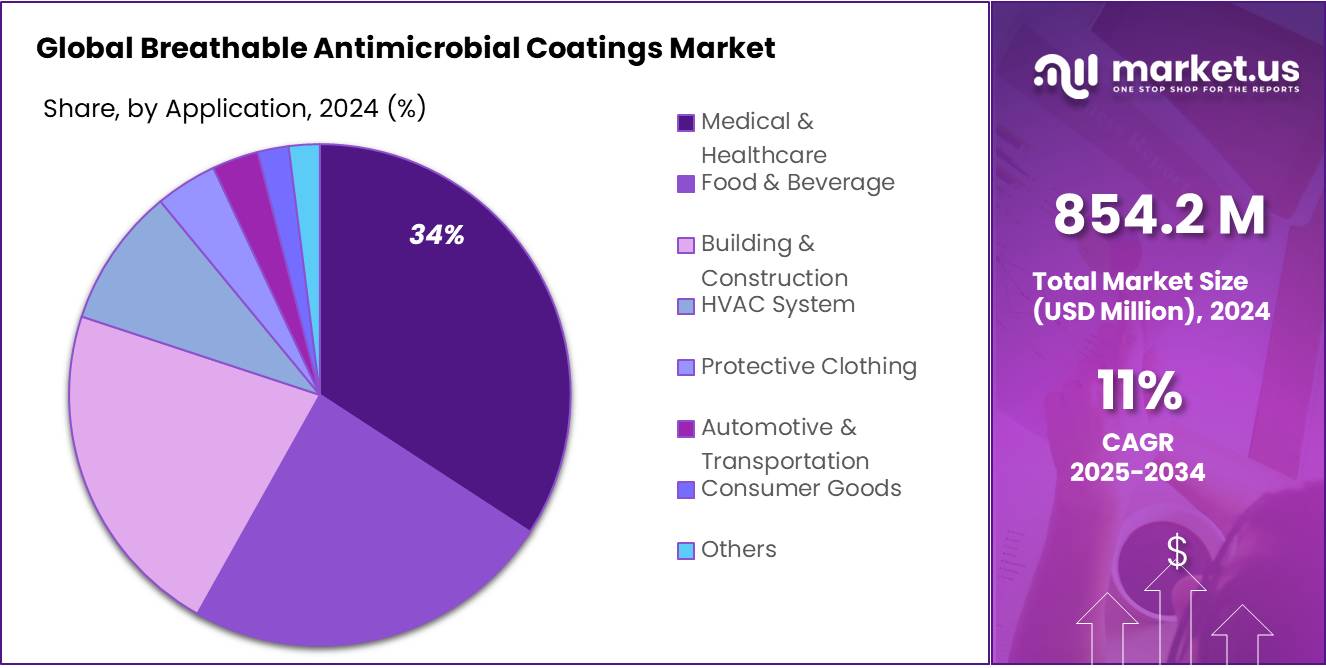

- Medical & Healthcare held a dominant market position in the breathable antimicrobial coatings market, capturing more than a 34.3% share.

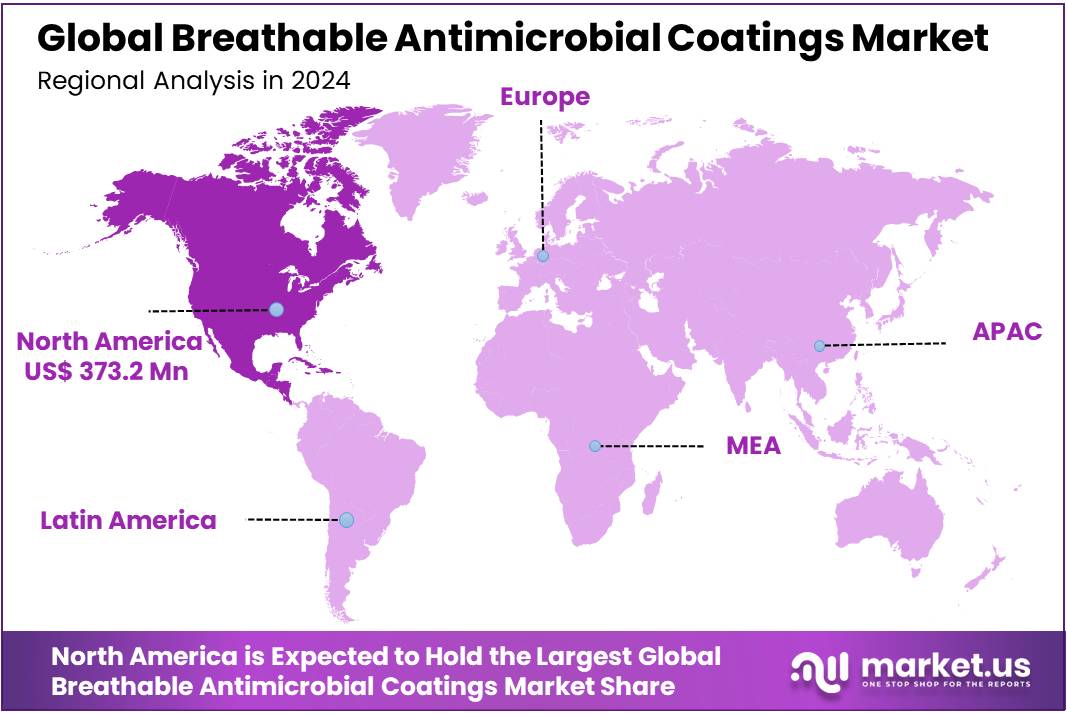

- North America stands out as a dominant region, capturing a substantial market share of 43.7%, valued at approximately USD 373.2 million.

Analysts’ Viewpoint

From an investment perspective, breathable antimicrobial coatings present a compelling opportunity, especially in sectors prioritizing hygiene and infection control. The global market for these coatings is projected to grow significantly, driven by increasing demand in healthcare, food processing, and construction industries. Technological advancements, such as the integration of nanotechnology and the development of eco-friendly formulations, are enhancing the efficacy and appeal of these coatings. However, investors should be mindful of challenges, including regulatory hurdles and the need for substantial R&D investments to stay competitive.

Consumer insights indicate a growing awareness and preference for products that offer antimicrobial protection without compromising breathability. This trend is particularly evident in the healthcare sector, where the need for sterile yet comfortable environments is paramount. Regulatory environments are becoming more stringent, with agencies like the EPA and FDA setting higher standards for antimicrobial products. Compliance with these regulations is essential for market entry and sustainability. Overall, while the breathable antimicrobial coatings market offers promising investment opportunities, success will depend on navigating technological, regulatory, and consumer-related challenges effectively.

By Type

Metallic Coatings Command a Strong Market Position with 66.9% Share Due to Their Efficacy and Durability

In 2024, the breathable antimicrobial coatings market saw Metallic coatings holding a significant lead, capturing more than a 66.9% share. This dominance is attributed to the robust performance characteristics of metallic ingredients like silver, copper, and zinc, which are highly valued for their natural antimicrobial properties. These metallic coatings are especially prevalent in environments that demand stringent hygiene standards, such as hospitals, food processing facilities, and public transport systems.

Metallic coatings are favored for their long-term durability and effectiveness in inhibiting the growth of bacteria, mold, and fungi on various surfaces. Their ability to provide a continuous shield against microbial contamination while maintaining the material’s breathability is a key factor in their widespread adoption. As industries increasingly prioritize health and hygiene, especially in the wake of global health concerns, the reliance on metallic breathable antimicrobial coatings continues to grow.

By Technology

Water-Based Technology Leads with 37.2% Share, Prioritizing Eco-Friendliness and Safety

In 2024, water-based technology in the breathable antimicrobial coatings market held a dominant market position, capturing more than a 37.2% share. This segment’s leadership is largely due to its alignment with increasing environmental regulations and a growing preference for sustainable manufacturing practices. Water-based coatings are particularly favored for their lower volatile organic compound (VOC) content compared to solvent-based alternatives, making them less harmful to both the environment and human health.

The popularity of water-based breathable antimicrobial coatings is also bolstered by their effectiveness in a wide range of applications, from medical devices and textiles to construction materials. These coatings are applied where safety, health, and environmental concerns are paramount. Their ability to offer durable antimicrobial protection without compromising the breathable properties of substrates further enhances their appeal in industries looking to meet stringent health standards while also addressing consumer demands for safer and more sustainable products.

By End-use

Medical & Healthcare Sector Leads with 34.3% Share, Boosted by Hygiene Demand in 2024

In 2024, Medical & Healthcare held a dominant market position in the breathable antimicrobial coatings market, capturing more than a 34.3% share. The healthcare industry’s increasing focus on infection control and surface hygiene greatly boosted the demand for advanced coatings that not only kill harmful microbes but also allow surfaces to breathe. Hospitals, clinics, and healthcare facilities require coatings that minimize the risk of bacterial growth while maintaining air circulation, especially on walls, ceilings, and medical equipment surfaces.

Breathable antimicrobial coatings in healthcare environments provide a critical layer of protection, especially in high-touch areas like operating rooms, patient wards, and diagnostic centers. This surge in adoption was further fueled by government-backed healthcare infrastructure investments in 2024, emphasizing the need for infection-resistant environments. In addition, global health agencies have strongly recommended the use of antimicrobial surfaces as part of broader infection prevention strategies, reinforcing the sector’s reliance on such solutions.

Кеу Маrkеt Ѕеgmеntѕ

By Type

- Metallic

- Silver Based

- Copper Based

- Zinc Based

- Titanium Based

- Others

- Non-metallic

- Polymeric

- Organic

By Technology

- Water-based

- Solvent-based

- Powder Coating

- Aerosol

- UV Curable

By End-use

- Medical & Healthcare

- Catheters

- Implantable Devices

- Surgical Instruments

- Others

- Food & Beverage

- Building & Construction

- HVAC System

- Protective Clothing

- Automotive & Transportation

- Consumer Goods

- Others

Drivers

Rising Demand in Healthcare Sector Drives Market Growth

One of the major driving factors for the breathable antimicrobial coatings market is the significantly rising demand within the healthcare sector. With a global push towards improving sanitary conditions in hospitals, clinics, and long-term care facilities, the need for effective antimicrobial solutions has never been more critical. These coatings are designed to reduce the presence of harmful bacteria and viruses on surfaces, which is essential in medical environments where the risk of infection transmission is high.

In the United States, for instance, the Centers for Disease Control and Prevention (CDC) reports that healthcare-associated infections (HAIs) account for an estimated 1.7 million infections and 99,000 associated deaths each year. To combat this, breathable antimicrobial coatings are increasingly being applied to medical equipment, walls, floors, and even textiles such as curtains and bedding used in healthcare settings.

This heightened focus on reducing HAIs is paralleled by governmental funding and initiatives aimed at enhancing infection control practices. For example, the U.S. government has allocated substantial funds towards healthcare infrastructure under the American Rescue Plan, aiming to bolster infection prevention and control capabilities across the country. This includes investments in technologies that can provide long-term antimicrobial protection without compromising environmental or human health.

Moreover, the expansion of healthcare facilities globally to accommodate rising patient numbers, spurred by both population growth and health crises like the COVID-19 pandemic, has further catalyzed the adoption of breathable antimicrobial coatings. Hospitals are not only increasing in number but also enhancing their standards for hygiene to prevent future outbreaks, thus driving continuous demand for advanced coating solutions.

Restraints

Regulatory Hurdles Pose Challenges for Market Expansion

A significant restraining factor for the growth of the breathable antimicrobial coatings market is the stringent regulatory environment surrounding the development and use of antimicrobial products. Regulatory bodies worldwide, including the Environmental Protection Agency (EPA) in the United States and the European Chemicals Agency (ECHA) in Europe, have implemented rigorous testing and approval processes for products claiming antimicrobial properties. These processes ensure that antimicrobial coatings are both effective against pathogens and safe for use in environments where human exposure is likely.

For instance, the EPA mandates that any antimicrobial product claiming to control pathogens on surfaces must undergo extensive efficacy testing to prove its claims before it can be marketed. This requirement adds a significant time and financial burden on manufacturers, slowing down the pace of innovation and market entry for new products. Additionally, the variability in regulatory standards across different regions makes it challenging for manufacturers to launch their products globally without undergoing multiple, sometimes conflicting, regulatory evaluations.

In the food industry, where the use of breathable antimicrobial coatings could significantly extend the shelf life of products and reduce food waste, the regulatory challenges become even more pronounced. Food contact materials are subject to additional safety evaluations to prevent any risk of harmful substances leaching into food. The Food and Drug Administration (FDA) in the U.S. sets specific guidelines for materials intended for food contact, which must be adhered to rigorously to ensure consumer safety.

These regulatory barriers not only increase the cost and complexity of bringing new antimicrobial coatings to market but also limit the pace at which these innovative products can be introduced to critical sectors like healthcare and food services. As a result, while the demand for effective antimicrobial solutions continues to rise, the supply side struggles to keep pace due to these regulatory constraints. The industry must navigate these challenges carefully to harness the full potential of breathable antimicrobial coatings while ensuring public safety and compliance with global standards.

Opportunities

Expanding Applications in Consumer Goods and Apparel Offer Significant Growth Opportunities

A major growth opportunity for the breathable antimicrobial coatings market lies in its expanding application in consumer goods and apparel. As consumers become increasingly aware of hygiene and the potential health impacts of microbes on everyday items, the demand for products with antimicrobial properties is soaring. Breathable antimicrobial coatings, which can inhibit the growth of bacteria, mold, and mildew without affecting the material’s natural properties, are seeing growing adoption in industries beyond traditional sectors like healthcare and food.

The global textile market, for instance, which includes apparel, home furnishings, and other fabric-based goods, is witnessing a surge in demand for products that offer added health and hygiene benefits. According to the U.S. Department of Commerce, the U.S. textile and apparel industry was valued at over $70 billion in 2023, highlighting the significant potential market for antimicrobial coatings (Source: U.S. Department of Commerce). Incorporating breathable antimicrobial coatings into textiles not only enhances the functional value of these goods but also appeals to health-conscious consumers.

Moreover, government initiatives aimed at promoting public health have also supported the adoption of antimicrobial technologies. For example, during the COVID-19 pandemic, several government-funded programs encouraged the development and use of antimicrobial products to reduce the transmission of the virus. These initiatives have heightened awareness of the importance of antimicrobial protections, which is likely to continue driving interest and investment in the sector.

The future growth of breathable antimicrobial coatings in the consumer goods and apparel market looks promising. As technology advances, these coatings are becoming more cost-effective and easier to integrate into a wide range of products. Innovations that improve the durability and effectiveness of these coatings will further enhance their attractiveness to manufacturers looking to meet consumer demands for safer, cleaner products in an increasingly health-aware global market.

Challenges

Integration with Smart Textiles and IoT Devices Marks a Cutting-Edge Trend

A significant and innovative trend in the breathable antimicrobial coatings market is the integration with smart textiles and Internet of Things (IoT) devices, which is reshaping how these technologies are used in daily life. As the world becomes increasingly connected, the demand for smart, functional materials that can interact with the environment and provide added value, such as health monitoring and improved hygiene, is rapidly growing.

This trend is particularly evident in the healthcare and fitness apparel sectors, where smart textiles equipped with breathable antimicrobial coatings can continuously monitor health indicators while preventing the growth of odor-causing bacteria and other microorganisms. These textiles are being integrated with sensors that can track vital signs or changes in the environment, which, when combined with antimicrobial properties, offer both comfort and safety to users.

For instance, in the fitness apparel industry, companies are developing workout gear with embedded sensors that not only help in fitness tracking but also include antimicrobial coatings to maintain hygiene and comfort during intense physical activities. According to a report by the National Retail Federation, U.S. consumers are increasingly investing in health and wellness, with the market seeing an annual growth of 6.4% in 2023. The integration of these technologies caters to this growing consumer segment that values health, wellness, and convenience.

Furthermore, government initiatives supporting the development of advanced textile technologies are aiding this trend. For example, the U.S. government’s Advanced Functional Fabrics of America (AFFOA) initiative aims to foster innovation in the textile industry, including the development of textiles that can interact with their environment and provide real-time data while ensuring user safety and comfort.

Regional Analysis

In the breathable antimicrobial coatings market, North America stands out as a dominant region, capturing a substantial market share of 43.7%, valued at approximately USD 373.2 million. This prominence is driven by several factors, including advanced healthcare infrastructure, stringent regulatory standards, and a heightened awareness of health and hygiene among consumers and industries.

North America’s leadership in this market segment is largely due to the proactive measures taken by both the government and private sectors in implementing advanced coating technologies to combat microbial growth in critical environments such as hospitals, schools, and public transport systems. The U.S., in particular, has been at the forefront of adopting these innovations, supported by policies that encourage the use of products contributing to public health safety and environmental sustainability.

The region’s market strength is also supported by robust investments in research and development. U.S. companies and research institutions are leading in the innovation of new antimicrobial materials that are safer, more effective, and environmentally friendly. These efforts are supplemented by government initiatives and funding aimed at enhancing public health infrastructure and promoting the adoption of advanced technologies in industries such as healthcare and food processing.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Sherwin-Williams Company is a major player in the breathable antimicrobial coatings market, leveraging its strong expertise in protective coatings. In 2024, the company continued expanding its portfolio by integrating antimicrobial features into architectural paints and healthcare coatings. With a wide distribution network across North America and Europe, Sherwin-Williams focuses heavily on innovation and compliance with EPA standards. Their sustainable and health-focused products have helped the company strengthen its presence in high-demand industries like healthcare and commercial construction.

PPG Industries, Inc. plays a critical role in advancing breathable antimicrobial coatings by offering solutions that combine durability, breathability, and microbe resistance. In 2024, the company launched several eco-friendly coatings aimed at public infrastructure and medical facilities. PPG emphasizes R&D investments to improve the functional performance of its coatings while aligning with growing environmental regulations. Its global footprint and partnerships with industrial sectors have positioned PPG as a trusted provider of advanced antimicrobial coatings for a wide range of applications.

Nippon Paint Holdings Co., Ltd. has been focusing heavily on breathable antimicrobial coatings, especially in Asia-Pacific markets. In 2024, the company expanded its range of antimicrobial wall paints and industrial coatings designed for hospitals, schools, and residential spaces. With a commitment to sustainable manufacturing and compliance with regional health standards, Nippon Paint integrates advanced technologies to meet evolving customer needs. Their continued focus on innovation and regional expansion efforts strengthens their competitive position in the global coatings industry.

Market Key Players

- AkzoNobel N.V.

- BASF SE

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Nippon Paint Holdings Co., Ltd.

- Axalta Coating Systems

- DSM

- Sika AG

- Lanxess AG

- Lonza

- Burke Industrial Coatings

- Jotun

- Hempel A/S

- Brillux Industrial Coatings

- Nippon Paint Holdings Co. Ltd

- Covalon OEM Technologies

- Troy Corporation

- AST Products Inc.

- Sono-Tek Corporation

- Other Key Players

Recent Developments

In 2024, The Sherwin-Williams Company reported record net sales of $23.10 billion, reflecting its strong market presence and commitment to innovation . A significant contributor to this success is their breathable antimicrobial coatings, notably the Paint Shield® Interior Latex Microbicidal Paint.

In 2024, Nippon Paint Holdings Co., Ltd. achieved a consolidated revenue of approximately ¥1.64 trillion, marking a 13.6% increase from the previous year. This growth was driven by strong sales in key markets, particularly in China, and the strategic expansion of their product portfolio.

Report Scope

Report Features Description Market Value (2024) USD 854.2 Mn Forecast Revenue (2034) USD 2425.4 Mn CAGR (2025-2034) 11.0% Base Year for Estimation 2022 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Metallic, Non-metallic), By Technology (Water-based, Solvent-based, Powder Coating, Aerosol, UV Curable), By End-use (Medical And Healthcare, Food and Beverage, Building and Construction, HVAC System, Protective Clothing, Automotive and Transportation, Consumer Goods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AkzoNobel N.V., BASF SE, The Sherwin-Williams Company, PPG Industries, Inc., Nippon Paint Holdings Co., Ltd., Axalta Coating Systems, DSM, Sika AG, Lanxess AG, Lonza, Burke Industrial Coatings, Jotun, Hempel A/S, Brillux Industrial Coatings, Nippon Paint Holdings Co. Ltd, Covalon OEM Technologies, Troy Corporation, AST Products Inc., Sono-Tek Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Breathable Antimicrobial Coatings MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Breathable Antimicrobial Coatings MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AkzoNobel N.V.

- BASF SE

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Nippon Paint Holdings Co., Ltd.

- Axalta Coating Systems

- DSM

- Sika AG

- Lanxess AG

- Lonza

- Burke Industrial Coatings

- Jotun

- Hempel A/S

- Brillux Industrial Coatings

- Nippon Paint Holdings Co. Ltd

- Covalon OEM Technologies

- Troy Corporation

- AST Products Inc.

- Sono-Tek Corporation

- Other Key Players