Global Natural Oil Polyols Market By Product(Soy Oil, Castor Oil, Palm Oil, Canola Oil, Sunflower Oil, Others), By Application(Polyurethane, Coatings, Adhesives & Sealants, Elastomers, Others), By End-Use(Construction, Furniture and Interiors, Electronics & Appliances, Automotive, Footwear, Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 41143

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

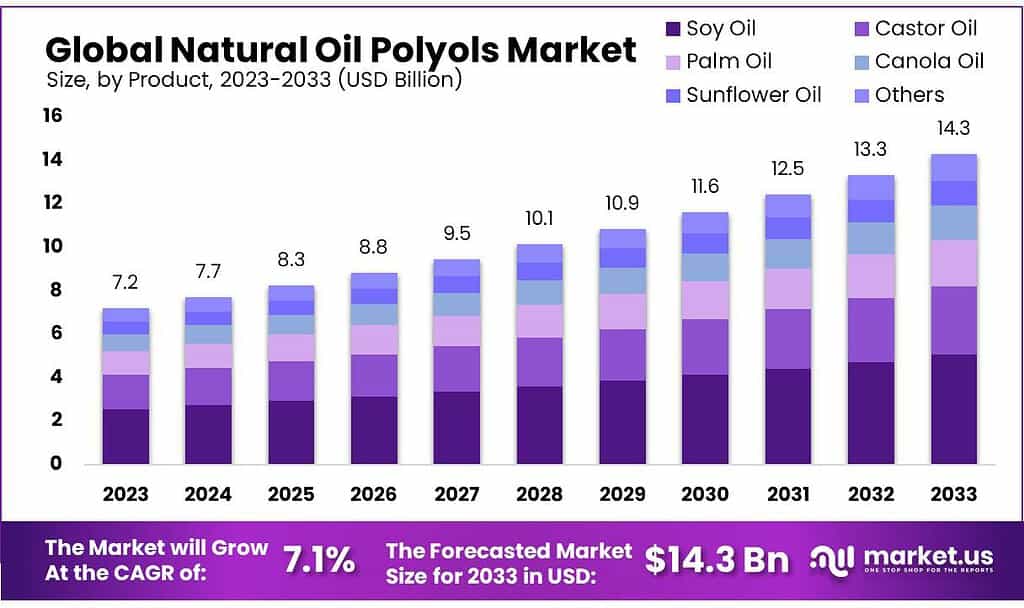

The Natural Oil Polyols Market size is expected to be worth around USD 14.3 billion by 2033, from USD 7.2 Bn in 2023, growing at a CAGR of 7.1% during the forecast period from 2023 to 2033.

Natural Oil Polyols (NOPs) are a type of polyol derived from renewable and natural resources such as vegetable oils, plant-based oils, or animal fats. Through a process called transesterification, these natural oils are chemically modified to produce polyols, which are essential components in the production of polyurethane foams, coatings, adhesives, sealants, and elastomers.

NOPs serve as sustainable alternatives to traditional petrochemical-based polyols, contributing to reduced dependence on fossil fuels and promoting environmental sustainability in various industrial applications.

Key Takeaways

- Market Growth: Anticipated to hit USD 14.3 billion by 2033, the Natural Oil Polyols Market exhibited a robust 7.1% CAGR from 2023, starting at USD 7.2 billion.

- Soy Oil Dominance: Leading the market with a 35.5% share in 2023, Soy Oil’s popularity stems from versatility, cost-effectiveness, and eco-friendliness.

- Diversity in Oils: Besides Soy Oil, Castor Oil, Palm Oil, Canola Oil, and Sunflower Oil contribute, each offering unique strengths and advantages.

- Top Application – Polyurethane: In 2023, Polyurethane claimed over 43.9% market share, favored for its versatility and energy-efficient properties in construction and automotive sectors.

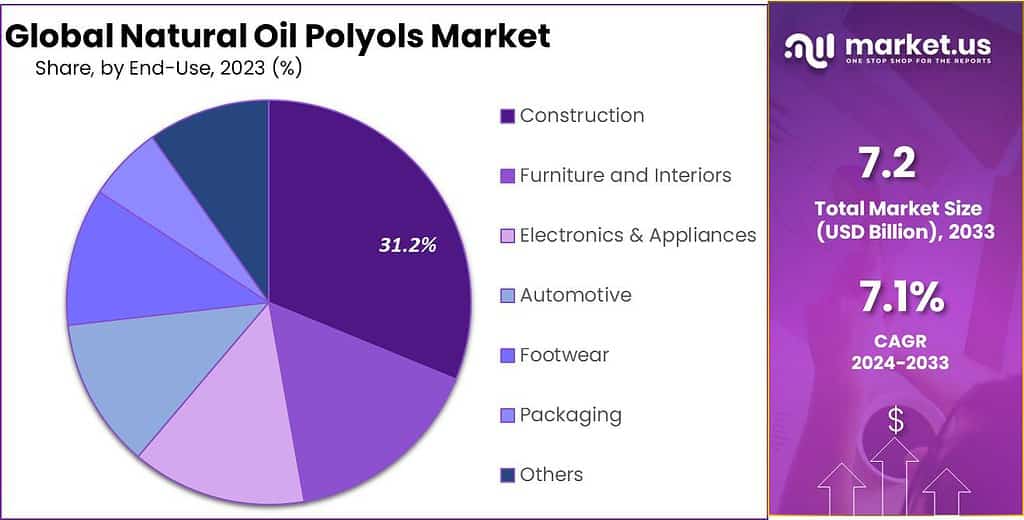

- Construction Sector Leadership: Construction led end-use sectors in 2023, capturing 31.2% market share, driven by the demand for eco-friendly materials enhancing energy efficiency.

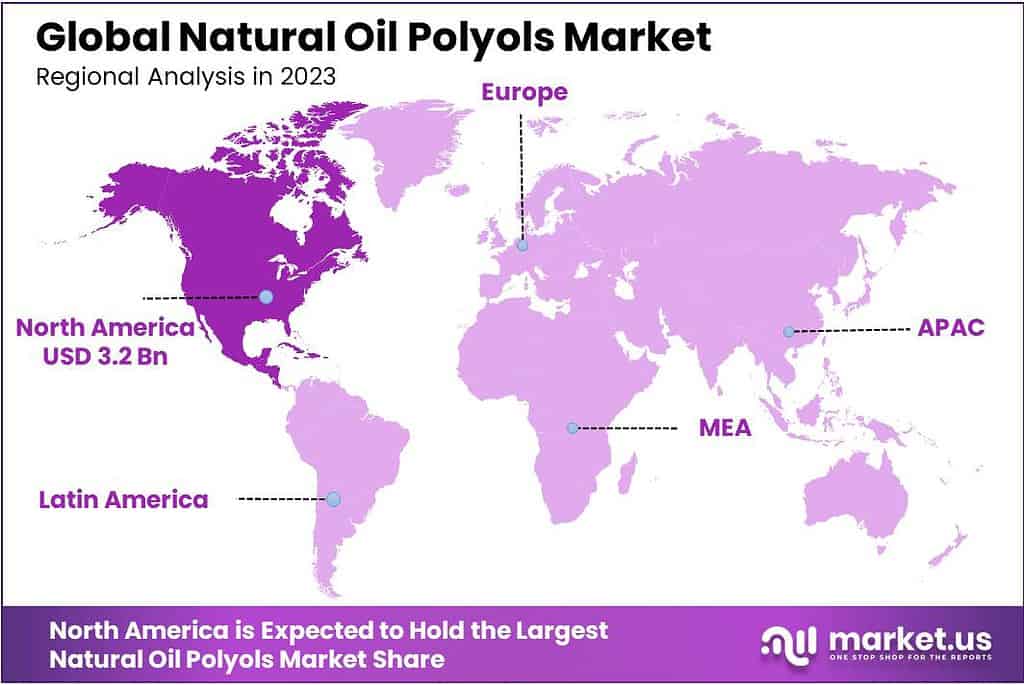

- Regional Dominance – North America: Holding over 45.0% revenue share in 2023, North America’s leadership is attributed to sustainable practices and demand from construction, electronics, and furniture sectors.

Product Information

In 2023, Soy Oil became a top player in the Natural Oil Polyols market, grabbing more than a 35.5% share. This strong performance is because Soy Oil has become a popular choice in the industry for various reasons. Soy Oil comes from soybeans and is widely used in making Natural Oil Polyols. People like using it because it has good qualities, like being really useful and working well in polyol mixtures.

Manufacturers like Soy Oil because it’s good for the environment and comes from renewable sources. This fits well with the growing demand for products that are eco-friendly and mindful of the environment. What makes Soy Oil stand out in the market is that it’s cost-effective compared to other natural oils. This means it’s a smart choice for both big industries and smaller markets that want to keep costs in check.

Looking ahead, Soy Oil is likely to keep its strong position. People are still working on making it even better, and as the industry focuses more on being sustainable, Soy Oil’s eco-friendly image will continue to help it stay at the top. While Soy Oil is leading the way, other oils like Castor Oil, Palm Oil, Canola Oil, Sunflower Oil, and more also play important roles in the Natural Oil Polyols market. Each of these oils has its own strengths, making the market diverse and competitive.

So, while Soy Oil is the star right now, there’s a lot of variety in the market to meet different needs. The economic feasibility of Soy Oil makes it an attractive option for both large-scale industrial applications and smaller niche markets. Looking ahead, the growth trajectory of Soy Oil in the Natural Oil Polyols market is expected to continue, fueled by ongoing research and development efforts aimed at enhancing its properties further. As the industry embraces sustainable practices, Soy Oil is likely to maintain its stronghold, supported by its eco-friendly profile and positive market perception.

Other key players in the Natural Oil Polyols market, including Castor Oil, Palm Oil, Canola Oil, Sunflower Oil, and various others, are also contributing to the market landscape. Each of these oils brings unique characteristics and advantages, catering to diverse industry requirements. While Soy Oil currently leads the pack, these other segments play pivotal roles in meeting specific formulation needs, providing a diversified and competitive market environment.

In conclusion, the Natural Oil Polyols market showcases a dynamic landscape with Soy Oil at the forefront, exemplifying its dominance with a significant market share. However, the market remains vibrant and diverse, with other natural oil segments contributing their distinct features to meet the evolving demands of the industry.

By Application

In 2023, Polyurethane stood out as the go-to application in the Natural Oil Polyols market, securing a strong position by claiming over 43.9% of the market share. This dominance can be attributed to various factors that make Polyurethane a preferred choice in the industry.

Polyurethane is like a jack-of-all-trades, getting used in lots of stuff, from squishy foams to protective coatings, and more. People like using it a lot because it’s super flexible, tough, and great at keeping things warm or cool. This makes it a favorite for companies because they can make all sorts of things with different features to fit different needs.

A big reason why Polyurethane is so popular is because it plays a major role in building things and making cars. The construction and automotive industries really like it because it helps make things more energy-efficient and lightweight. These qualities are crucial for creating things that are good for the environment, and that’s a big deal these days. Moreover, Polyurethane is popular because it works really well in different weather conditions, making it useful for many things like furniture and big machines.

Polyurethane looks promising in the Natural Oil Polyols market. People are still working on making it even better, so it stays useful for a long time. Since companies are focusing more on being kind to the environment, Polyurethane is in a good spot because it’s versatile and eco-friendly, which means it will keep growing.

Even though Polyurethane is getting a lot of attention, there are also other uses like Coatings, Adhesives & Sealants, Elastomers, and more in the Natural Oil Polyols market. All of these have special features, making the market interesting and able to help lots of different industries. So, while Polyurethane is the star, there are many other applications in the Natural Oil Polyols market to help with various needs.

End Use Analysis

In 2023, Construction was the big player in the Natural Oil Polyols market, grabbing more than a 31.2% share. This means it was the most important area using these natural oils. Let’s look at why. Construction folks really liked using Natural Oil Polyols. These are special oils that come from nature, and they’re used to make all sorts of things, like foams and coatings. The reason Construction liked them so much is that they’re good for the environment, and that’s a big deal in building stuff nowadays.

The oils are used to make materials that go into houses, buildings, and other construction projects. The Natural Oil Polyols help in making things sturdy and environmentally friendly. They play a crucial role in creating insulation materials that keep the temperature just right inside buildings, making them energy-efficient.

Construction is likely to stay on top in the Natural Oil Polyols game. People are still working to make these oils even better for construction needs. More and more people are caring about using materials that are good for the environment in construction. This means the demand for Natural Oil Polyols, which are eco-friendly, is going up, especially in building things.

Even though construction is using these special oils the most, other places like making furniture, designing interiors, creating electronics & appliances, building cars, making shoes, and packaging things also use Natural Oil Polyols. Each of these areas has its own reasons for choosing these special oils.

So, while construction is leading the way, there are many different uses for Natural Oil Polyols in various places.Each of these areas has its own reasons for liking these special oils, making the market diverse and ready to meet the needs of different industries. So, while Construction is the star for now, there’s a mix of uses for Natural Oil Polyols across various end-use sectors.

Key Market Segments

By Product

- Soy Oil

- Castor Oil

- Palm Oil

- Canola Oil

- Sunflower Oil

- Others

By Application

- Polyurethane

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

By End-Use

- Construction

- Furniture and Interiors

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

Drivers

The Natural Oil Polyols market is growing because more and more people care about using things that are good for the environment. This is happening in many industries. People want products that don’t harm the Earth as much, so there’s a bigger demand for Natural Oil Polyols. This is because businesses and regular people are choosing things that are friendlier to our planet. People want to be more sustainable because they worry about climate change and using up Earth’s resources.

That’s why there’s a growing preference for materials like Natural Oil Polyols, which come from plants such as soybeans, castor, palm, canola, and sunflower. These materials are renewable, meaning we can keep using them without running out. This push for sustainability is because folks want to move away from products made with traditional chemicals, like petrochemicals, which harm the environment and aren’t sustainable.

Government rules also play a big role in guiding the Natural Oil Polyols market. Countries and international groups are making strict rules and standards to encourage using things that are good for the environment and lower the carbon footprint. Businesses have to follow these rules, so they are more likely to use Natural Oil Polyols in what they make to be in line with these regulations.

Economic considerations also contribute to the momentum of the Natural Oil Polyols market. The cost-effectiveness of these oils compared to some traditional alternatives is a compelling factor for manufacturers. As the cost of petrochemical-based raw materials fluctuates and the demand for sustainable solutions increases, Natural Oil Polyols present a viable and economically attractive option for businesses aiming to balance both cost efficiency and environmental responsibility.

New technologies and ongoing efforts to learn and improve are helping the Natural Oil Polyols market grow. Scientists and researchers are finding better ways to process these oils and come up with improved mixtures, making them work even better. This makes these oils more attractive for use in a wider range of things in different industries.

To sum it up, what’s making the Natural Oil Polyols market grow are the worldwide move towards being more eco-friendly, rules that encourage using greener products, thinking about costs, and always trying to make these oils better with new technologies. All these things together are pushing the market forward, making Natural Oil Polyols an important choice in the bigger picture of environmentally friendly and cost-effective options.

Restraints

Even though the Natural Oil Polyols market is growing, there are some things that make it a bit hard for everyone to use them. One big problem is the cost. Making Natural Oil Polyols can sometimes be more expensive than using regular chemicals. Even though many people want things that are good for the environment, the higher cost can make it tough for businesses to choose Natural Oil Polyols over other options.

Another challenge is that the things needed to make Natural Oil Polyols, like soybeans, castor, palm, canola, and sunflower, aren’t always easy to get. The weather, how people farm, and the way things are traded globally can all affect the supply and prices of these materials. This uncertainty in getting the materials can make it tricky for companies to plan and make sure there’s enough for everyone who wants to use Natural Oil Polyols.

So, even though Natural Oil Polyols have good potential, the higher cost and the not-so-easy availability of materials can make it a bit tough for them to become really popular in the market. The performance characteristics of Natural Oil Polyols may not always align with the specific requirements of certain industries.

While these oils offer versatility, there are instances where traditional petrochemical-based products may still outperform them in terms of certain properties, such as durability or resistance to certain conditions. This limitation can hinder the widespread adoption of Natural Oil Polyols, particularly in applications where specific performance criteria must be met.

Regulatory challenges also contribute to the restraints facing the Natural Oil Polyols market. Even though rules can push things forward, following these rules can be tough for businesses. The laws about the environment keep changing and can be hard to understand. Companies have to spend a lot of money on research, development, and making sure they follow all the rules.

This adds up to their overall costs. While Natural Oil Polyols are getting more popular, there are challenges. These include the higher costs, not always getting the materials easily, and sometimes not performing as well as other options. Also, dealing with the changing rules and making sure everything is in line can be tricky. Figuring out how to deal with these challenges is important for Natural Oil Polyols to keep growing and becoming a good choice in different industries.

Opportunities

The Natural Oil Polyols market has a chance to grow a lot. This is because more and more people want things that are good for the environment. They like using products that don’t harm the Earth. Natural Oil Polyols, which come from plants like soybeans, castor, palm, canola, and sunflower, are a good fit for this because they are made from renewable sources.

So, there’s a big opportunity for these oils as people look for goods and materials that are better for the environment. Using Natural Oil Polyols in construction is a big opportunity. People are focusing more on building in a way that’s good for the environment, and they want eco-friendly materials. Natural Oil Polyols, which come from things like soybeans and sunflowers, are a good match for this. They can be used to create insulation materials and other stuff used in construction that is good for the Earth.

Another good chance is in the car industry. There’s a push to make cars using lighter materials that are also good for the environment to help save fuel and lower the overall impact on the Earth. Natural Oil Polyols, because they are versatile and eco-friendly, can be used more in making parts for cars. This can help the car industry reach its goals for sustainability.

Using Natural Oil Polyols in packaging is a great opportunity. People are becoming more aware of the problems with plastic waste, and they want packaging that’s better for the environment. So, there’s a growing demand for options other than plastic. Natural Oil Polyols can be part of the solution by helping create packaging materials that are made from natural sources and can break down without harming the environment. This matches the trend of using materials that are better for the Earth.

There’s a chance for even more improvements in Natural Oil Polyols. Scientists and experts are working to make these oils work even better by enhancing their performance and properties. This ongoing research can lead to exciting new uses for Natural Oil Polyols in different areas where traditional materials are currently more common.

So, there’s a lot of potential for these oils to become even more useful and widely used. In summary, the Natural Oil Polyols market holds significant opportunities across various sectors, driven by the increasing demand for sustainable and environmentally friendly solutions. The alignment with consumer preferences, coupled with potential applications in construction, automotive, packaging, and ongoing research efforts, positions Natural Oil Polyols as a promising player in the landscape of eco-conscious alternatives. seizing these opportunities will be crucial for the continued growth and success of the Natural Oil Polyols market.

Challenges

While the Natural Oil Polyols market holds promising opportunities, it also faces several challenges that could impact its growth trajectory. One significant challenge stems from the economic aspect, particularly the production costs associated with Natural Oil Polyols. Getting Natural Oil Polyols from plants like soybeans, castor, palm, canola, and sunflower can sometimes cost more than using traditional chemicals from oil.

This higher cost might make it harder for these oils to be accepted widely, especially in industries that are careful about costs and need to think about both the environment and money. Also, the way we get the materials for Natural Oil Polyols, like the plants, can be a bit tricky. The supply can change because of things like the weather, how people farm, and global trade. This uncertainty in getting the materials can make it tough for companies to plan things like pricing and making sure they have enough for everyone who wants to use Natural Oil Polyols.

The performance characteristics of Natural Oil Polyols represent another challenge, especially when compared to certain traditional materials. While these oils offer versatility and eco-friendly attributes, there may be instances where they do not match the specific performance criteria required by certain industries. Overcoming these performance limitations and demonstrating the efficacy of Natural Oil Polyols in diverse applications is crucial for expanding their market share.

Following the rules about using Natural Oil Polyols can be hard for businesses. Even though rules can be a good thing to encourage eco-friendly choices, they can also be complicated and change a lot. Companies need to spend a lot of money on research, making things better, and following all the rules. This adds up to their overall costs, making it more challenging for them in the Natural Oil Polyols sector.

In conclusion, while the Natural Oil Polyols market offers significant opportunities, challenges related to production costs, supply chain uncertainties, performance limitations, and regulatory complexities need to be carefully addressed for sustained and widespread market success. Overcoming these challenges will be essential to position Natural Oil Polyols as viable alternatives in various industries committed to sustainable and environmentally friendly practices.

Regional Analysis

North America held the highest revenue share at over 45.0% in 2023. This can be attributed to rising energy costs and volatile petrochemical prices, which have increased biofuel demand. This market growth will also be supported by the increasing demand from the region’s end-use sectors, such as construction, electronic and electrical appliances, furniture, and interiors.

Germany is one of Europe’s most important automotive markets. This country is the most prominent European producer of passenger vehicles, accounting for over 30% of all member countries of the EU. These factors will be key to the market’s continued growth during the forecast period.

Low manufacturing costs and a growing manufacturing sector will be key factors in natural oils polyol production. Several major international companies have expanded their regional production capacity due to the above-mentioned factors. This is expected to strengthen the production landscape for the regional market.

Strong growth potential is being created by the growing use of soy, palm-based, and other oilseeds-based polyurethanes for appliances and developments in electronics. Saudi Arabia is one of the fastest-growing construction and real estate markets in the Gulf. The forecast period will increase demand for natural oil oils due to the expanding construction industry.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Because of the number of multinationals actively involved in research & development, this market is highly competitive. Global companies focus on capacity expansions and signing partnership agreements for advanced biotechnology companies to gain an advantage in this competitive market.

Cargill, Incorporated, for example, purchased Agrol, a product collection of natural oil polyols from BioBased Technology LLC. These strategies will reflect increased competition in the years ahead.

Маrkеt Кеу Рlауеrѕ

- The Dow Chemical Company

- Cargill Incorporation

- BASF SE

- Huntsman Corporation

- Jayant Agro Organics Ltd.

- Emery Oleochemicals

- IFS Chemicals Group

- Vertellus Holdings LLC

- Stepan Company

- BioBased Technologies LLC

- Elevance Renewable Sciences, Inc.

- The Dow Chemical Company

- Bayer AG

- Chemtura Corporation

- Bio-Chem Technology Group Company Limited

Recent Developments

In November 2022, C16 Biosciences, Inc. shared its plans to introduce a new kind of oil that comes from fermentation instead of using palm oil. This new oil is meant for use in personal care products and food. The company is getting everything ready to give the details of this new product to the FDA for approval. They aim to do this by the year 2024.

In March 2023, Perstorp Holding AB introduced two new types of polyols: Evyron T100 (made from trimethylolpropane) and Neeture N100 (made from neopentyl glycol). These polyols are special because they come entirely from renewable sources. The company carefully manages the entire process, making sure to reduce the carbon footprint at every step. They also make an effort to use raw materials that are both renewable and recycled from sustainable sources. By adding these new products to their collection, Perstorp Holding AB is showing their commitment to being a leading provider of chemicals that have a very low impact on the environment.

In September 2022, Ingevity has finished making its manufacturing facility in DeRidder, Louisiana, bigger. Now, the facility can produce 40% more polyols, which are special chemicals. This expansion also makes it quicker to get products to customers. With these upgrades, Ingevity can now help its clients better and keep up with the growing demand for the Capa range of products.

Report Scope

Report Features Description Market Value (2022) US$ 7.2 Bn Forecast Revenue (2032) US$ 14.3 Bn CAGR (2023-2032) 7.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Soy Oil, Castor Oil, Palm Oil, Canola Oil, Sunflower Oil, Others), By Application(Polyurethane, Coatings, Adhesives & Sealants, Elastomers, Others), By End-Use(Construction, Furniture and Interiors, Electronics & Appliances, Automotive, Footwear, Packaging, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape The Dow Chemical Company, Cargill Incorporation, BASF SE, Huntsman Corporation, Jayant Agro Organics Ltd., Emery Oleochemicals, IFS Chemicals Group, Vertellus Holdings LLC, Stepan Company, BioBased Technologies LLC, Elevance Renewable Sciences, Inc., The Dow Chemical Company, Bayer AG, Chemtura Corporation, Bio-Chem Technology Group Company Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Dow Chemical Company

- Cargill Incorporation

- BASF SE

- Huntsman Corporation

- Jayant Agro Organics Ltd.

- Emery Oleochemicals

- IFS Chemicals Group

- Vertellus Holdings LLC

- Stepan Company

- BioBased Technologies LLC

- Elevance Renewable Sciences, Inc.

- The Dow Chemical Company

- Bayer AG

- Chemtura Corporation

- Bio-Chem Technology Group Company Limited