Global Titanium Tetrachloride Market By Production Process (Chlorination, Magnesium Thermal Reduction, Sodium Thermal Reduction, Aluminum Reduction), By Derivatives (Titanium Nitride, Titanium Dioxide, Titanium Metal, Smoke Screens, Others), By Grade (High Purity, Technical Grade, Others), By End Use (Aerospace, Defense, Dyes, Others), By Sales Channel (Direct Sale , Indirect Sale) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2024-2033

- Published date: Dec 2024

- Report ID: 134791

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

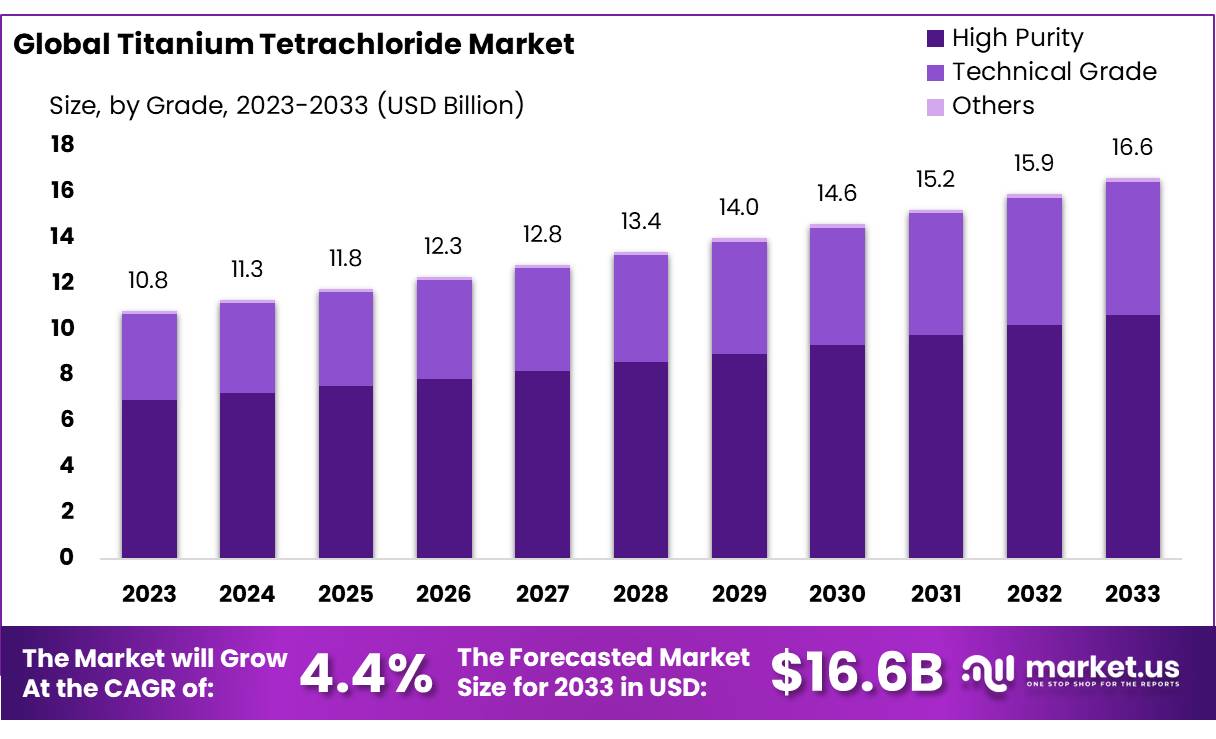

The Global Titanium Tetrachloride Market size is expected to be worth around USD 16.6 Bn by 2033, from USD 10.8 Bn in 2023, growing at a CAGR of 4.4% during the forecast period from 2024 to 2033.

Titanium tetrachloride, often denoted as TiCl4, is a colorless, volatile liquid with a pungent odor. It is an inorganic compound that is used extensively in both industrial and chemical synthesis processes. When exposed to moisture, titanium tetrachloride reacts vigorously, producing white clouds of titanium dioxide and hydrogen chloride, a reaction that illustrates its strong hygroscopic properties.

Reached approximately 125,000 tons, with a significant share of this production dedicated to the aerospace industry, which requires titanium’s high strength-to-weight ratio for various components, including aircraft frames, engines, and turbine blades. Titanium tetrachloride is a key intermediate in the Kroll process, which is used to extract titanium metal from ore.

In 2022, global titanium dioxide production was estimated to be around 6.4 million metric tons, with more than 90% of this used in the pigment industry. This reflects the essential role of TiO2 in creating white, opaque pigments used in products like paints, coatings, plastics, and paper. The demand for high-quality titanium dioxide has driven the growth of the titanium tetrachloride market, as TiCl4 is the precursor in its production.

The global market for titanium tetrachloride is forecasted to grow at a CAGR of 4.6% over the next five years, driven by demand from end-use industries such as aerospace, automotive, construction, and consumer goods.

The Asia Pacific region, particularly China and India, holds the largest share of both titanium tetrachloride production and consumption, accounting for over 45% of the global market. This is due to their robust manufacturing and industrial sectors, which rely heavily on titanium for a range of applications, from automotive parts to electronics.

As for government involvement, many nations have recognized the importance of titanium production for strategic sectors like defense and aerospace. For example, in 2021, the Chinese government announced plans to invest USD 1.5 billion into the development of titanium production facilities, enhancing domestic capacity and reducing reliance on foreign suppliers.

Similarly, in the U.S., the Department of Energy has allocated USD 7.5 million for research into advanced titanium production technologies to improve efficiency and reduce environmental impact.

Key Takeaways

- Titanium Tetrachloride Market size is expected to be worth around USD 16.6 Bn by 2033, from USD 10.8 Bn in 2023, growing at a CAGR of 4.4%.

- Chlorination held a dominant market position in the Titanium Tetrachloride production process, capturing more than a 58.4% share.

- Titanium Dioxide held a dominant market position in the Titanium Tetrachloride derivatives market, capturing more than a 49.1% share.

- High Purity grade titanium tetrachloride held a dominant market position, capturing more than a 64.4% share.

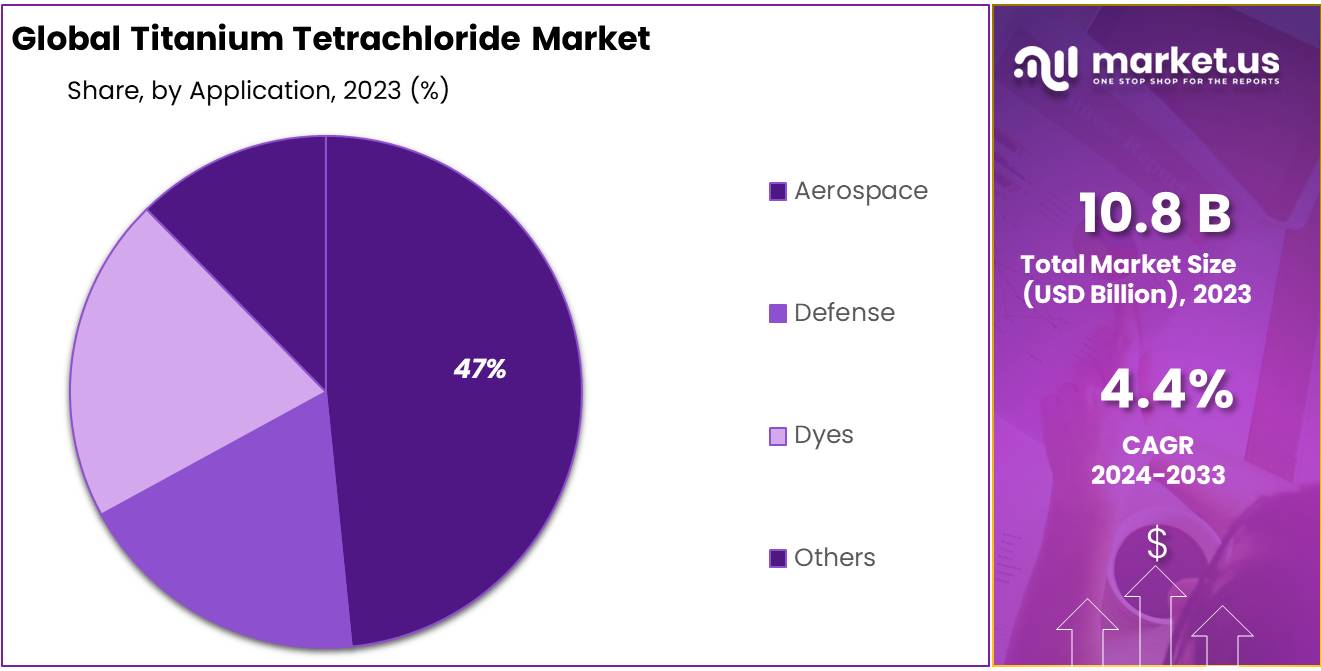

- Aerospace sector held a dominant market position in the Titanium Tetrachloride market, capturing more than a 47.4% share.

- Direct Sale held a dominant market position in the Titanium Tetrachloride market, capturing more than a 78.2% share.

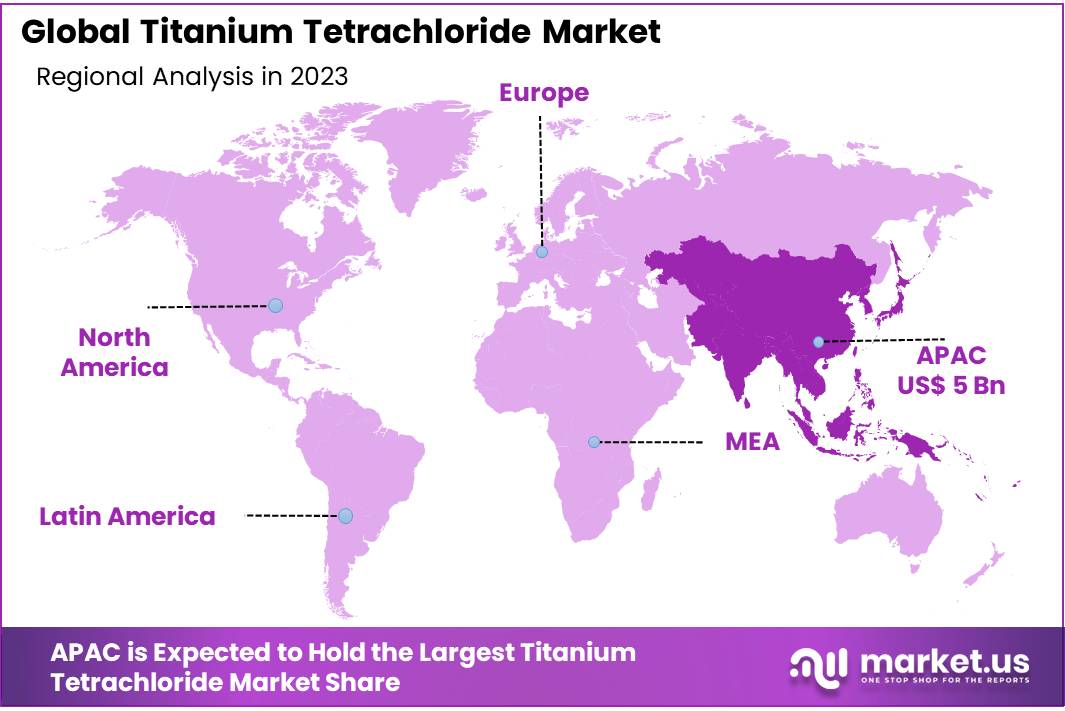

- In 2023, APAC dominated the market, accounting for 39.8% with a valuation of USD 5 billion.

By Production Process

In 2023, Chlorination held a dominant market position in the Titanium Tetrachloride production process, capturing more than a 58.4% share. This method is favored due to its cost-effectiveness and efficiency in producing high-purity titanium tetrachloride. Chlorination involves the reaction of titanium-containing raw materials with chlorine gas at high temperatures, a process that is widely adopted in large-scale operations due to its ability to handle various feedstocks like titanium ores and slag.

Following Chlorination, the Magnesium Thermal Reduction method also plays a significant role but to a lesser extent. This process involves the reduction of titanium tetrachloride with magnesium to produce titanium metal. Although it is more energy-intensive than Chlorination, it is critical for applications requiring exceptionally pure titanium, such as in aerospace and medical industries.

The Sodium Thermal Reduction process is another important method, especially in contexts where lower production scales are acceptable or where specific metallurgical properties are desired in the final titanium product. This method, similar to magnesium reduction, uses sodium as the reducing agent and is noted for its application in producing fine titanium powders used in high-performance applications.

Aluminum Reduction, while less common, is utilized in specific niche applications. This method involves reducing titanium tetrachloride with aluminum to form titanium aluminides, which are essential in high-temperature applications due to their excellent strength and lightweight properties. Each of these production processes contributes uniquely to the diverse applications and demands of the titanium tetrachloride market.

By Derivatives

In 2023, Titanium Dioxide held a dominant market position in the Titanium Tetrachloride derivatives market, capturing more than a 49.1% share. This derivative is extensively used as a white pigment in industries such as paints, coatings, plastics, and paper due to its superior brightness and high refractive index. The widespread application in these sectors underscores its significant market share, driven by global demand for durable and aesthetically appealing finishes.

Following Titanium Dioxide, Titanium Metal is another key derivative, prized for its high strength-to-weight ratio and corrosion resistance. This metal finds critical applications in aerospace, military, and medical industries, where lightweight and durable materials are essential. The production of titanium metal via the Kroll process, which involves the reduction of titanium tetrachloride with magnesium, underscores its strategic importance in high-tech sectors.

Titanium Nitride, known for its hardness and thermal properties, is used as a coating material to extend the life of cutting and machining tools. Its ability to protect base materials from wear makes it valuable in manufacturing and engineering applications, albeit with a smaller market share compared to Titanium Dioxide and Titanium Metal.

Smoke Screens represent a niche but vital application of Titanium Tetrachloride. The derivative’s ability to produce dense clouds when exposed to moisture makes it ideal for military and safety applications where visual obscuration is needed quickly.

By Grade

In 2023, High Purity grade titanium tetrachloride held a dominant market position, capturing more than a 64.4% share. This grade is especially favored for its use in applications requiring the highest quality and purity levels, such as in the production of titanium metal and titanium dioxide used in high-end applications like aerospace, automotive, and electronics. The demand for high purity titanium tetrachloride is driven by its essential role in producing materials that meet stringent industry standards for performance and reliability.

Technical Grade titanium tetrachloride also plays a significant role in the market, though it caters more to general industrial uses where extreme purity may not be as critical. This grade is commonly utilized in the manufacture of pigments, catalysts, and in the chemical synthesis processes where lower cost and broader application versatility are required.

By End Use

In 2023, the Aerospace sector held a dominant market position in the Titanium Tetrachloride market, capturing more than a 47.4% share. This significant market share is attributed to the critical use of titanium tetrachloride in the production of titanium metal, which is extensively used in aerospace for its high strength-to-weight ratio and corrosion resistance. The material’s properties are essential for manufacturing various aerospace components, including airframes and engine parts, driving its high demand in this industry.

The Defense sector also utilizes titanium tetrachloride, particularly for producing smoke screens and other titanium-based products that are pivotal in military applications. While this sector holds a smaller share compared to Aerospace, its need for titanium tetrachloride is driven by the material’s utility in defensive strategies and equipment manufacturing, emphasizing its importance in national security measures.

In the Dyes industry, titanium tetrachloride is used as a catalyst in the production of various pigments and dyes, where it helps in the synthesis and processing of colorants used in textile and other manufacturing processes. Though its share is less than that of Aerospace, the role of titanium tetrachloride in this sector is vital for creating a wide range of industrial dyes.

By Sales Channel

In 2023, Direct Sale held a dominant market position in the Titanium Tetrachloride market, capturing more than a 78.2% share. This sales channel is preferred primarily because it allows manufacturers to maintain greater control over their product distribution, ensuring the delivery of high-purity and specialized products directly to end users in industries such as aerospace, defense, and manufacturing. Direct sales help in establishing strong customer relationships and provide opportunities for customized product solutions tailored to specific industrial needs.

Indirect Sales, while holding a smaller market share, play a crucial role by facilitating the distribution of titanium tetrachloride through various intermediaries such as distributors, traders, and resellers. This channel is particularly valuable for reaching markets where direct sales operations are not feasible or cost-effective. Indirect sales are essential for expanding market reach, especially in regions with less direct access to major manufacturers, helping to cater to a broader range of smaller consumers and specialized sectors.

Key Market Segments

By Production Process

- Chlorination

- Magnesium Thermal Reduction

- Sodium Thermal Reduction

- Aluminum Reduction

By Derivatives

- Titanium Nitride

- Titanium Dioxide

- Titanium Metal

- Smoke Screens

- Others

By Grade

- High Purity

- Technical Grade

- Others

By End Use

- Aerospace

- Defense

- Dyes

- Others

By Sales Channel

- Direct Sale

- Indirect Sale

Drivers

Increasing Demand for Titanium Dioxide in Food and Beverage Industry

A significant driving factor for the growing demand for Titanium Tetrachloride (TiCl₄) is its crucial role in the production of Titanium Dioxide (TiO₂), which is widely used in the food and beverage industry as a whitening agent and food colorant. The global market for food-grade titanium dioxide, a key end-use application for TiCl₄, is expected to continue its growth trajectory, fueled by the expansion of the food industry and increasing consumer demand for visually appealing and aesthetically pleasing products.

According to the European Food Safety Authority (EFSA), titanium dioxide has been approved as a safe food additive (E171), and it is commonly used in a wide range of products, including confectionery, dairy items, sauces, and even pharmaceuticals. As consumer preferences shift towards more visually attractive foods, especially in emerging markets, the demand for food-grade TiO₂ is expected to grow.

The China National Petroleum Corporation (CNPC) reports that the country’s overall construction spending reached nearly USD 1.1 trillion in 2022, further boosting demand for TiO₂ in coatings and paints. In this context, the demand for TiCl₄ is expected to remain strong as it is used as a precursor in the production of high-quality titanium dioxide.

According to the World Bank, emerging economies, particularly in Asia, are experiencing high GDP growth rates, with countries like China, India, and Brazil projected to grow at rates of 5.3%, 6.1%, and 2.9%, respectively, in the coming years.

This economic expansion is contributing to increased demand for consumer goods and industrial products that rely on titanium dioxide, such as paints, coatings, plastics, and even food products. For example, in India, the paint industry alone is expected to grow at a CAGR of 8% between 2023 and 2028, further increasing the demand for titanium dioxide and, by extension, titanium tetrachloride.

Restraints

Health and Environmental Hazards Associated with Titanium Tetrachloride

According to the U.S. Occupational Safety and Health Administration (OSHA), exposure to titanium tetrachloride fumes or vapors can lead to serious health issues, including respiratory distress, irritation of the eyes and skin, and potential long-term lung damage. Inhalation of titanium tetrachloride vapors can cause chemical bronchitis, pneumonitis, and other respiratory diseases.

OSHA has set the permissible exposure limit (PEL) for titanium tetrachloride at 0.1 mg/m³, which indicates the severity of its potential hazards. Additionally, the National Institute for Occupational Safety and Health (NIOSH) classifies TiCl₄ as a hazardous substance, requiring workers to follow strict safety protocols, including wearing protective equipment and using proper ventilation systems.

The Global Titanium Dioxide Industry is also facing pressures from governments and environmental organizations to adopt more sustainable practices in TiO₂ production. While the demand for TiO₂ remains strong, the push for environmentally friendly and less hazardous production processes is restraining the growth of TiCl₄, a key precursor in TiO₂ manufacturing.

According to the European Food Safety Authority (EFSA), the global trend towards green chemistry and the use of non-toxic materials in food and consumer products is gaining traction, which could limit the reliance on titanium tetrachloride in the long run.

Opportunity

Expanding Demand for Titanium Dioxide in Emerging Markets

One of the key growth opportunities for Titanium Tetrachloride (TiCl₄) is the increasing demand for Titanium Dioxide (TiO₂), primarily driven by emerging markets. TiO₂, a major derivative of TiCl₄, is widely used in industries such as food, cosmetics, and pharmaceuticals. In particular, the food industry utilizes TiO₂ as a whitening agent and colorant for products like confectionery, dairy, and sauces.

In 2022, the global market for food-grade TiO₂ was valued at approximately USD 2.5 billion and is expected to grow at a CAGR of 4.5% over the next five years. This growth is primarily driven by an increase in consumer demand for processed and packaged foods, especially in countries like India, China, and Brazil, where rapid urbanization and rising disposable incomes are transforming dietary habits.

According to the Food and Agriculture Organization (FAO), consumption of processed foods in these regions is increasing at a rate of 6-7% annually, creating strong demand for high-quality food additives like TiO₂.

For example, China has invested heavily in innovative titanium production technologies. As of 2023, China accounts for nearly 60% of the world’s TiCl₄ production, driven by the country’s efforts to develop more energy-efficient methods that lower environmental impact. The China Titanium Dioxide Industry Association (CTDIA) reported that innovations in chlorination technology and the use of waste heat recovery systems in production processes have helped reduce production costs by up to 15-20%.

For example, the European Union’s Food Safety Authority (EFSA) has imposed strict standards on food additives, requiring rigorous testing and certification before TiO₂ can be used in food products. These regulations push producers of TiCl₄ and TiO₂ to adopt more advanced quality control measures, which can help enhance product safety and purity.

Trends

Growing Demand for Sustainable and Eco-friendly Titanium Dioxide

A significant trend influencing the market for Titanium Tetrachloride (TiCl₄) is the increasing demand for sustainable and eco-friendly titanium dioxide (TiO₂) production. With growing awareness of environmental issues and consumer preference for green products, industries are shifting towards more sustainable production methods. TiCl₄, as a key precursor in TiO₂ manufacturing, is closely linked to these trends.

The European Union has implemented stricter environmental regulations in recent years, promoting cleaner production methods. As per the EU Commission, all titanium dioxide used in consumer goods like food and cosmetics must meet specific environmental standards, including reducing carbon emissions during production.

This has led to innovations in TiCl₄ processing, with companies investing in greener technologies to reduce waste and improve energy efficiency. In 2021, it was reported that the European market for eco-friendly TiO₂ grew by 7.4% year-over-year, driven by increased demand in industries such as food coloring, pharmaceuticals, and personal care products.

Similarly, in the United States, the Environmental Protection Agency (EPA) is focused on reducing the environmental impact of industrial chemicals, including TiCl₄. The increasing regulatory push for sustainable practices is driving innovation in TiO₂ production, where the focus is on improving TiCl₄ conversion rates and reducing byproducts.

Additionally, American companies are adopting new technologies like water-based systems and low-emission processing techniques to meet these sustainability demands.

Regional Analysis

The Titanium Tetrachloride market demonstrates diverse dynamics across different regions, with Asia-Pacific (APAC) leading the charge. In 2023, APAC dominated the market, accounting for 39.8% with a valuation of USD 5 billion.

This dominance is driven by rapid industrialization and extensive construction activities, particularly in China and India, which are major consumers and producers of titanium tetrachloride. The region’s strong manufacturing base in paints, coatings, and plastics significantly contributes to its market share.

North America also holds a significant position in the global market, driven by advanced technological capabilities and a robust aerospace sector. The U.S. and Canada are notable contributors, leveraging titanium tetrachloride in the production of aerospace components and automotive parts due to its strength and lightweight properties.

Europe’s market is influenced by stringent environmental regulations and high demand for eco-friendly manufacturing processes. Countries like Germany, France, and the UK are key players, focusing on incorporating titanium tetrachloride in automotive, paints, and coatings industries to enhance product quality and environmental compliance.

The Middle East and Africa, as well as Latin America, though smaller in comparison, are gradually expanding their market presence. These regions are experiencing growth through infrastructure development and increased investments in industrial sectors, which in turn are expected to boost the demand for titanium tetrachloride in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Titanium Tetrachloride market is marked by a diverse set of key players, each contributing to the dynamic landscape of this industry with their unique strengths and strategic initiatives. Companies like Chemours, Tronox Limited, and Venator are prominent in the global arena, leveraging extensive operational capabilities and deep market penetration to solidify their market presence.

These companies focus on innovation and sustainable practices to meet the rigorous demands of industries requiring high-quality titanium tetrachloride for applications in coatings, plastics, and laminates.

On the other hand, regional specialists like Ansteel (Pangang Group Vanadium & Titanium), CRISTAL, and TOHO TITANIUM exhibit strong dominance in local markets, particularly in Asia, which is a crucial region for titanium tetrachloride production due to its rapid industrial growth and significant consumption of titanium dioxide. These companies invest heavily in technology and capacity expansion to cater to the burgeoning demand from both local and international markets.

Furthermore, newer entrants and specialized producers such as Henan Longxing Titanium and Cangzhou Heli Chemicals are making significant strides by focusing on niche applications and improving production efficiencies.

These companies enhance their competitive edge through strategic partnerships, research and development investments, and expanding their geographical reach to tap into less saturated markets. Collectively, these key players drive the global titanium tetrachloride market towards growth and innovation, catering to a wide array of industrial applications.

Top Key Players in the Market

- Ansteel(Pangang Group Vanadium&Titanium)

- Cangzhou Heli Chemicals

- Chemours

- CITIC Titanium

- CRISTAL

- DowDuPont Inc.

- Henan Longxing Titanium

- Huntsman International LLC

- INEOS

- ISK

- ISK Industries

- Kronos Lab Sciences Pvt. Ltd.

- Lomon Billions

- Merck KgA

- OSAKA Titanium Technologies

- The Kerala Minerals & Metal Ltd.

- Tianyuan Group

- TOHO TITANIUM

- Tronox Limited

- Venator

- Xiantao Zhongxing Electronic Materials

Recent Developments

In 2023 Cangzhou Heli Chemicals is actively involved in the Titanium Tetrachloride sector, contributing to the market primarily through its production capabilities aimed at meeting the demands of various industrial applications.

For 2024, Chemours has shown a steady financial performance with an emphasis on expanding its market share in the titanium tetrachloride sector.

Report Scope

Report Features Description Market Value (2023) USD 10.8 Bn Forecast Revenue (2033) USD 16.6 Bn CAGR (2024-2033) 4.4% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Production Process (Chlorination, Magnesium Thermal Reduction, Sodium Thermal Reduction, Aluminum Reduction), By Derivatives (Titanium Nitride, Titanium Dioxide, Titanium Metal, Smoke Screens, Others), By Grade (High Purity, Technical Grade, Others), By End Use (Aerospace, Defense, Dyes, Others), By Sales Channel (Direct Sale , Indirect Sale) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ansteel(Pangang Group Vanadium&Titanium), Cangzhou Heli Chemicals, Chemours, CITIC Titanium, CRISTAL, DowDuPont Inc., Henan Longxing Titanium, Huntsman International LLC, INEOS, ISK, ISK Industries, Kronos Lab Sciences Pvt. Ltd., Lomon Billions, Merck KgA, OSAKA Titanium Technologies, The Kerala Minerals & Metal Ltd., Tianyuan Group, TOHO TITANIUM, Tronox Limited, Venator, Xiantao Zhongxing Electronic Materials Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Titanium Tetrachloride MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Titanium Tetrachloride MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Ansteel(Pangang Group Vanadium&Titanium)

- Cangzhou Heli Chemicals

- Chemours

- CITIC Titanium

- CRISTAL

- DowDuPont Inc.

- Henan Longxing Titanium

- Huntsman International LLC

- INEOS

- ISK

- ISK Industries

- Kronos Lab Sciences Pvt. Ltd.

- Lomon Billions

- Merck KgA

- OSAKA Titanium Technologies

- The Kerala Minerals & Metal Ltd.

- Tianyuan Group

- TOHO TITANIUM

- Tronox Limited

- Venator

- Xiantao Zhongxing Electronic Materials