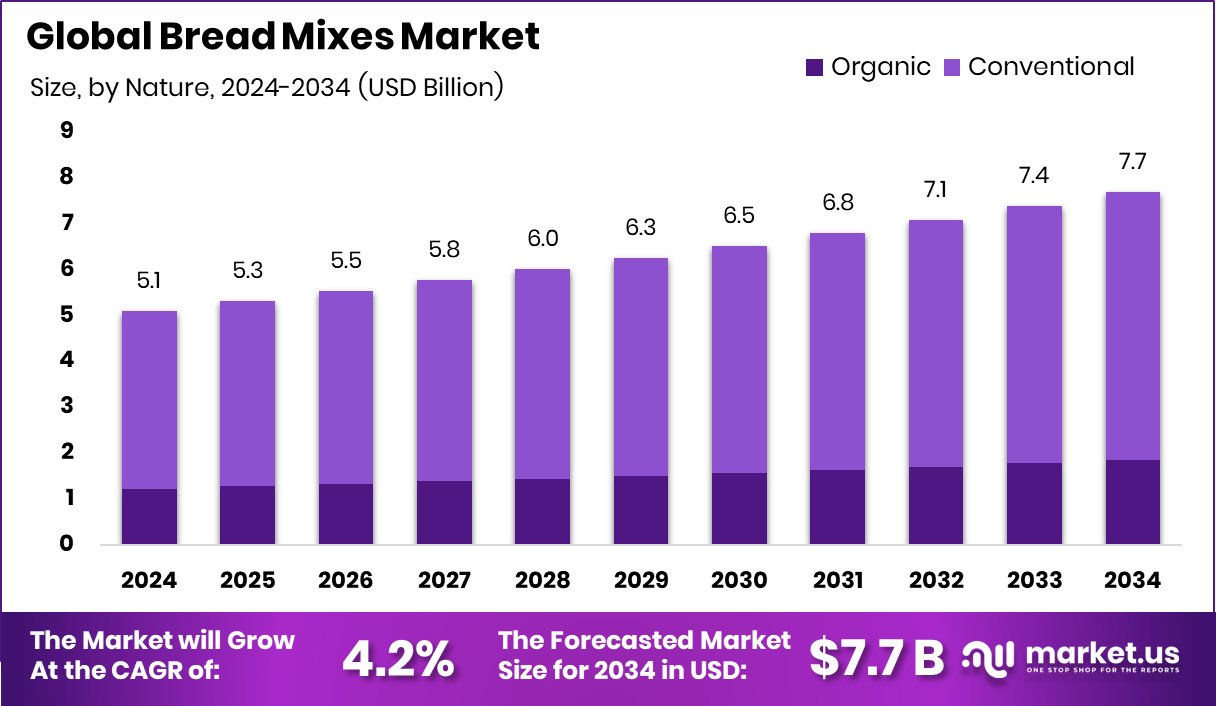

Bread Mixes Market is projected to reach USD 7.7 Billion by 2034, with a 4.2% CAGR from 2025 to 2034. Global Bread Mixes Market Size, Share, And Business Benefits By Nature (Organic, Conventional), By Product Type (Conventional Wheat-based, Whole Grain and Multigrain, Gluten Free, Functional and High Protein, Others), By Type (Bread and Roll Mixes, Sourdough Bread Mixes, Pizza Mixes, Rue Bread Mixes), By Distribution Channel (Hypermarkets and Supermarkets, Convenience stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154488

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Bread Mixes Market is expected to be worth around USD 7.7 billion by 2034, up from USD 5.1 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034. Strong retail presence and home baking trends supported Europe’s 43.2% market leadership.

Bread mixes are ready-to-use dry blends made from pre-measured ingredients such as flour, yeast, salt, sugar, and other additives that simplify the process of baking bread. These mixes are designed to deliver consistent taste and texture while reducing preparation time. They can be used at home or in commercial settings to prepare different types of bread, including whole wheat, multigrain, rye, and specialty variants. Some variants also include fortified ingredients such as seeds, herbs, or dried fruits for enhanced nutritional value and flavor.

The bread mixes market refers to the global trade and production of pre-packaged baking blends used to make various bread products. This market covers retail and foodservice segments and includes mixes suited for traditional ovens, bread machines, and industrial baking setups. The market is shaped by changing consumer habits, health-conscious eating patterns, and the demand for time-saving food solutions. According to an industry report, The Health Factory, a healthy bread brand, secured $3.5 million in funding from Peak XV’s Surge.

Growth of the bread mixes market is largely driven by rising urbanization and changing lifestyles, where convenience and speed in food preparation have become priorities. Additionally, an increasing number of consumers are turning toward home baking, particularly post-pandemic, which has supported steady demand for ready-made baking mixes. Health trends such as demand for gluten-free, organic, or high-fiber options are also influencing manufacturers to diversify their offerings, further expanding the market base. According to an industry report, Bread & Butter Ventures launched a new fund valued at $40 million.

There is consistent demand for bread mixes among consumers who want homemade freshness without the complexity of measuring and mixing from scratch. This demand is further strengthened by families seeking to control ingredients for dietary reasons, including those with allergies or preferences for clean-label products. According to an industry report, Bread Financial revealed a $150 million tender offer for its outstanding notes.

Key Takeaways

- The Global Bread Mixes Market is expected to be worth around USD 7.7 billion by 2034, up from USD 5.1 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034.

- In 2024, conventional dominated the Bread Mixes Market by nature, holding a 76.2% market share.

- Conventional wheat-based products led the Bread Mixes Market by product type, capturing 41.6% in 2024.

- Bread and roll mixes held the highest share in 2024 Bread Mixes Market by type, at 47.3%.

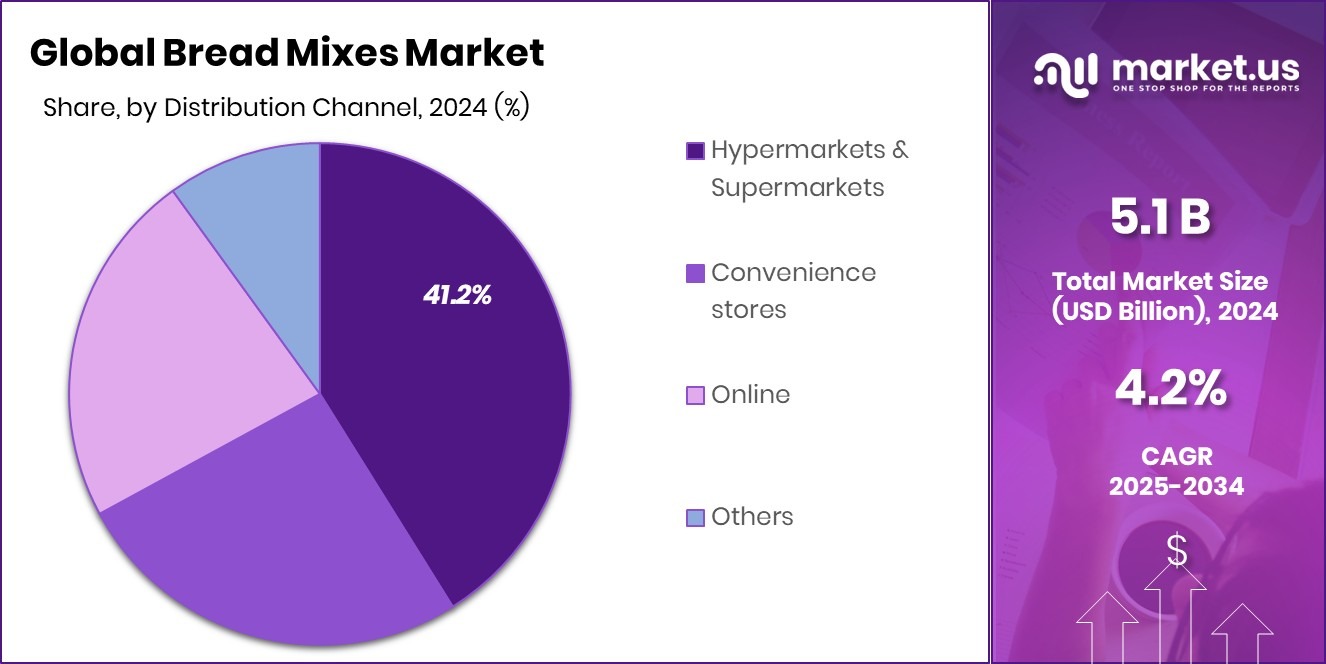

- Hypermarkets and supermarkets led distribution in the Bread Mixes Market in 2024 with 41.2% share.

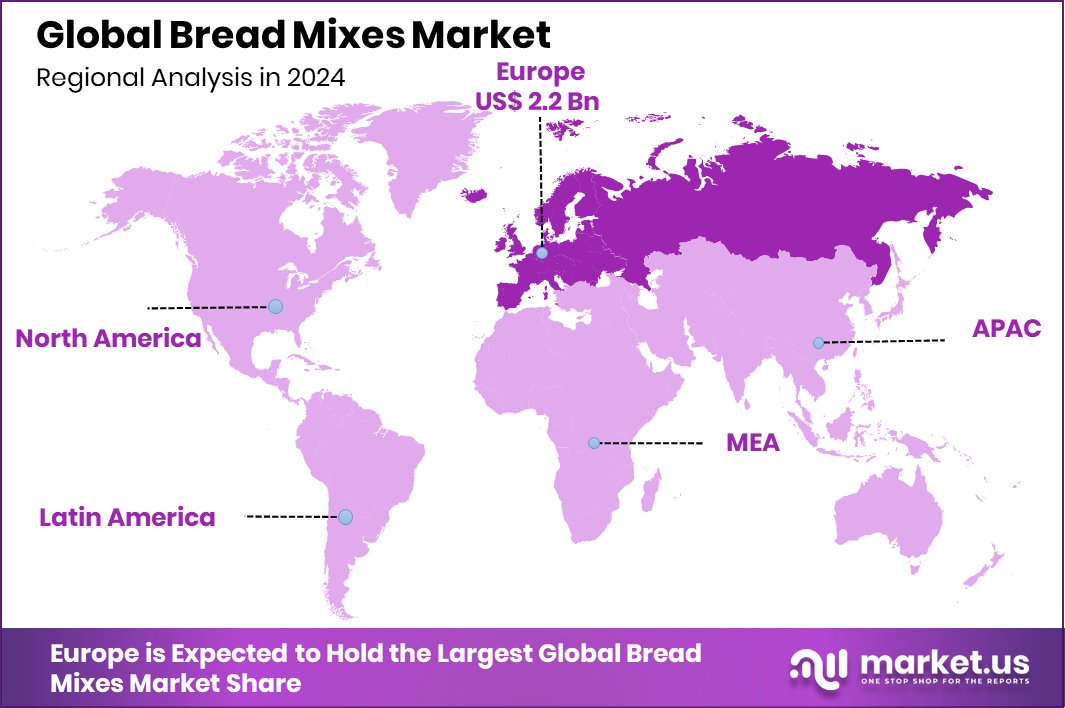

- The Europe market generated revenue worth approximately USD 2.2 billion during the year.

By Nature Analysis

Conventional dominates the Bread Mixes Market, holding 76.2% of the market share.

In 2024, Conventional held a dominant market position in the By Nature segment of the Bread Mixes Market, with a 76.2% share. This strong presence can be attributed to its widespread consumer acceptance, affordability, and ease of availability across both urban and semi-urban retail channels. Conventional bread mixes are often preferred for their consistent performance in baking and their ability to cater to diverse bread varieties without altering traditional taste profiles.

The dominance of this segment also reflects the long-standing familiarity and trust among home bakers and small-scale commercial bakers who rely on proven, cost-effective ingredients. Conventional mixes often align with established culinary habits and are less expensive compared to alternative or specialized options.

Moreover, this segment benefits from strong distribution through supermarkets, local grocery chains, and online platforms, which have enabled broader accessibility and sustained volume sales. Its high market share in 2024 indicates that despite the growth of health-oriented alternatives, a significant majority of consumers still prioritize convenience, value, and traditional taste—core advantages offered by conventional bread mixes.

By Product Type Analysis

Conventional wheat-based products lead with 41.6% in product type.

In 2024, Conventional Wheat-based held a dominant market position in the By Product Type segment of the Bread Mixes Market, with a 41.6% share. This leading position is primarily supported by the widespread use of wheat as a staple grain in bread production across many regions. The consistent texture, elasticity, and baking performance of wheat-based mixes continue to meet the preferences of both home bakers and commercial users who rely on familiar, reliable results.

The dominance of this segment also reflects strong consumer familiarity with wheat-based bread, particularly in households where traditional bread consumption remains a daily dietary habit. These mixes are widely available in supermarkets and retail stores and are often priced competitively, further supporting their accessibility and popularity.

In addition, the ease of preparation and versatility of conventional wheat-based mixes contribute to their steady demand. Whether used for basic white loaves or simple sandwich bread, they remain the go-to option for many consumers looking for dependable quality and taste.

By Type Analysis

Bread and roll mixes hold 47.3% in type segment.

In 2024, Bread and Roll Mixes held a dominant market position in the By Type segment of the Bread Mixes Market, with a 47.3% share. This significant share reflects the consistent demand for essential bread varieties and everyday bakery items such as dinner rolls, sandwich buns, and table breads. These mixes are commonly used in both household kitchens and commercial bakeries due to their simplicity, speed, and ability to deliver uniform quality in every batch.

The popularity of Bread and Roll Mixes is further supported by their compatibility with a wide range of baking equipment, including bread machines and conventional ovens, making them suitable for varied user preferences. Their ease of preparation and time-saving appeal contribute to their leading market position, especially in busy households and small foodservice establishments.

Furthermore, these mixes cater to the need for consistent output in volume-based settings such as cafés, catering units, and institutional kitchens. Their ability to produce soft texture, reliable rise, and consistent flavor enhances customer satisfaction and repeat purchase behavior.

By Distribution Channel Analysis

Hypermarkets and supermarkets drive 41.2 of % distribution in this market.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel segment of the Bread Mixes Market, with a 41.2% share. This leadership is primarily driven by the widespread presence of these retail formats, offering consumers convenient access to a broad variety of bread mix products under one roof. Their strong foothold in both urban and suburban areas allows for large-scale product visibility and impulse purchasing, contributing significantly to overall sales volume.

The organized shelf space, promotional displays, and availability of multiple brands in these stores enhance consumer trust and purchasing decisions. Shoppers benefit from the ability to compare ingredients, prices, and packaging directly, making hypermarkets and supermarkets a preferred choice for purchasing everyday baking essentials like bread mixes.

Moreover, the convenience of one-stop shopping and frequent discount offerings has continued to attract repeat buyers, further reinforcing this channel’s leading position. These retail outlets also maintain consistent stock levels, enabling regular supply and encouraging habitual purchases.

Key Market Segments

By Nature

- Organic

- Conventional

By Product Type

- Conventional Wheat-based

- Whole Grain and Multigrain

- Gluten Free

- Functional and High Protein

- Others

By Type

- Bread and Roll Mixes

- Sourdough Bread Mixes

- Pizza Mixes

- Rue Bread Mixes

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience stores

- Online

- Others

Driving Factors

Rising Home Baking Trend Boosting Market Growth

One of the main factors driving the growth of the bread mixes market is the increasing trend of home baking. More people are now choosing to bake bread at home due to convenience, health concerns, and the desire for fresh, homemade food. Bread mixes make it easy for anyone to bake without needing advanced skills or a long list of ingredients.

These mixes save time and give consistent results, which is why families and individuals prefer them. The trend became stronger during the pandemic and has continued as many consumers discovered the joy and ease of baking. This growing interest in home cooking is expected to keep supporting the demand for bread mixes across different regions.

Restraining Factors

Limited Shelf Life Reduces Long-Term Storage Appeal

One of the key factors holding back the growth of the bread mixes market is its limited shelf life. Although bread mixes are convenient, many of them contain natural ingredients like yeast or whole grains that can expire faster than highly processed products. This makes storage a concern for both retailers and consumers, especially in regions with high humidity or inconsistent refrigeration.

Retailers may hesitate to stock large quantities, and consumers may be cautious about bulk buying due to spoilage risks. The short shelf life also affects export and long-distance shipping potential. As a result, the limited storage time becomes a challenge for expanding the market reach, especially in areas without advanced storage and distribution systems.

Growth Opportunity

Premium and Specialty Mixes for Health-Conscious Consumers

One major growth opportunity in the bread mixes market lies in the development and promotion of premium and specialty mixes tailored for health-conscious consumers. Increasing awareness of dietary needs—such as gluten intolerance, protein intake, fiber content, or preference for organic ingredients—has created demand for mixes that offer nutritional and functional benefits.

By introducing blends that include ingredients like plant-based proteins, whole grains, seeds, and probiotics, manufacturers can capture a growing segment of consumers who seek better-for-you options. These specialty mixes often command higher price points and can drive increased margins. Retailers also benefit from tiered product offerings, appealing to both mainstream users and niche buyers.

Latest Trends

Gut‑Health Functional Bread Mixes Gain Rapid Popularity Globally

One of the latest key trends in the bread mixes market is the increasing uptake of functional mixes that support digestive well‑being. New product launches with gut‑health claims—particularly those including fiber, probiotics, or other prebiotic ingredients—have risen by more than 22% over the past year.

Consumers are seeking options that combine convenient baking with added nutritional benefits, driving formulation shifts toward digestive support. This trend aligns with broader food industry movement toward functional ingredients, gut‑focused wellness, and clean labeling.

Regional Analysis

In 2024, Europe dominated the Bread Mixes Market with 43.2% share.

In 2024, Europe held a dominant position in the global Bread Mixes Market, accounting for 43.2% of the total market share and generating a revenue of approximately USD 2.2 billion. This dominance can be attributed to the strong cultural inclination toward home baking, coupled with the widespread availability of bread mixes in hypermarkets, supermarkets, and specialty stores across the region. High consumer awareness and preference for convenience products have further supported consistent demand throughout Western and Central Europe.

North America also contributed significantly to the market, driven by steady retail consumption and the presence of an established baking culture in the United States and Canada. In Asia Pacific, demand is growing due to urbanization and increased interest in Western-style bakery goods. Middle East & Africa and Latin America represented emerging regional markets, where awareness and availability of bread mixes are expanding gradually, particularly in urban centers and through e-commerce platforms.

While these regions currently account for smaller shares, changing food habits and rising disposable incomes are expected to support future growth. Overall, Europe remains the clear leader in 2024, reflecting a mature and well-penetrated market with strong consumer loyalty toward ready-to-bake solutions, especially among busy households and artisanal baking enthusiasts.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ancient Nutrition distinguishes itself through a focus on functional and health-oriented formulations. Known for integrating ancient ingredients with modern nutrition, the company is likely to contribute niche, wellness-driven bread mixes, appealing to the growing demographic of health-conscious and gluten-sensitive consumers. Their innovation-oriented branding gives them leverage in premium product segments.

Angel Yeast Co., Ltd., with its specialized expertise in yeast and biotechnology, is expected to play a critical upstream role. As a leading supplier of baking ingredients, Angel Yeast likely supports both in-house and third-party bread mix production. Their technical strength and global distribution footprint make them a vital enabler of high-performance, standardized mixes for industrial and artisanal bakers alike.

Archer Daniels Midland Company (ADM) brings unmatched scale and vertical integration. With a robust portfolio in grains, processing, and ingredient innovation, ADM is well-positioned to supply both base flours and value-added bread mix solutions globally. Their ability to offer customized, sustainable, and bulk solutions strengthens their position in both commercial and foodservice channels.

Associated British Foods Plc, through its baking division (including brands like Allinson and Kingsmill), maintains a direct consumer-facing advantage. Their control over both branded and private-label offerings allows responsiveness to shifting consumer tastes, especially in convenience and healthier formulations.

Top Key Players in the Market

- Ancient Nutrition

- Angel Yeast Co., Ltd.

- Archer Daniels Midland Company

- Associated British Foods Plc

- Bakels Group

- Bob’s Red Mill Natural Foods, Inc.

- Cargill, Incorporated

- Corbion N.V

- Gaia Herbs

- General Mills, Inc

- Grupo Bimbo, S.A.B. de C.V.

- Healthworks

Recent Developments

- In January 2025, Ancient Nutrition was acquired by Wellful Inc., a health & wellness platform backed by Kainos Capital. This deal transferred ownership from investors like VMG Partners and Hillhouse. The move strengthens Wellful’s presence in vitamins, minerals, supplements and expands Ancient Nutrition’s distribution in natural retail channels. Ancient Nutrition’s CEO, Colt Morton, continues leading the brand under its mission-driven approach.

- In December 2024, Angel Yeast continued to push ahead in microbial protein and flavor innovation. They launched new functional yeast protein products and deepened strategic partnerships while expanding yeast protein production for wider application—including baking and savory uses—though these were more related to ingredients than direct mixes .

Report Scope

Report Features Description Market Value (2024) USD 5.1 Billion Forecast Revenue (2034) USD 7.7 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Natur (Organic, Conventional), By Product Type (Conventional Wheat-based, Whole Grain and Multigrain, Gluten Free, Functional and High Protein, Others), By Type (Bread and Roll Mixes, Sourdough Bread Mixes, Pizza Mixes, Rue Bread Mixes), By Distribution Channel (Hypermarkets and Supermarkets, Convenience stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ancient Nutrition, Angel Yeast Co., Ltd., Archer Daniels Midland Company, Associated British Foods Plc, Bakels Group, Bob’s Red Mill Natural Foods, Inc., Cargill, Incorporated, Corbion N.V, Gaia Herbs, General Mills, Inc, Grupo Bimbo, S.A.B. de C.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ancient Nutrition

- Angel Yeast Co., Ltd.

- Archer Daniels Midland Company

- Associated British Foods Plc

- Bakels Group

- Bob's Red Mill Natural Foods, Inc.

- Cargill, Incorporated

- Corbion N.V

- Gaia Herbs

- General Mills, Inc

- Grupo Bimbo, S.A.B. de C.V.

- Healthworks