Global Blood Bank Market By Product Type (Red Blood Cells, Whole Blood, White Blood Cells, Platelets, and Plasma), By Application (Testing, Transportation, Storage, Processing, and Collection), By End-user (Hospital, Pharmaceutical Companies, Clinics and Nursing Homes, Ambulatory Surgery Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153851

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

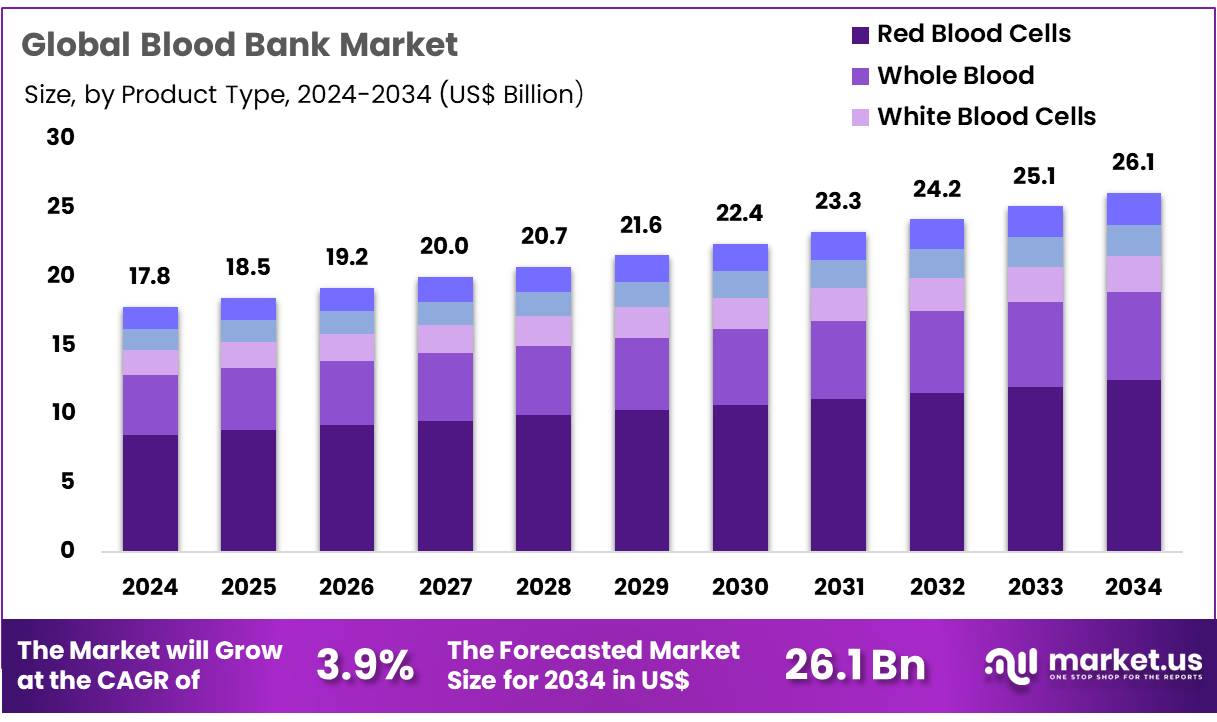

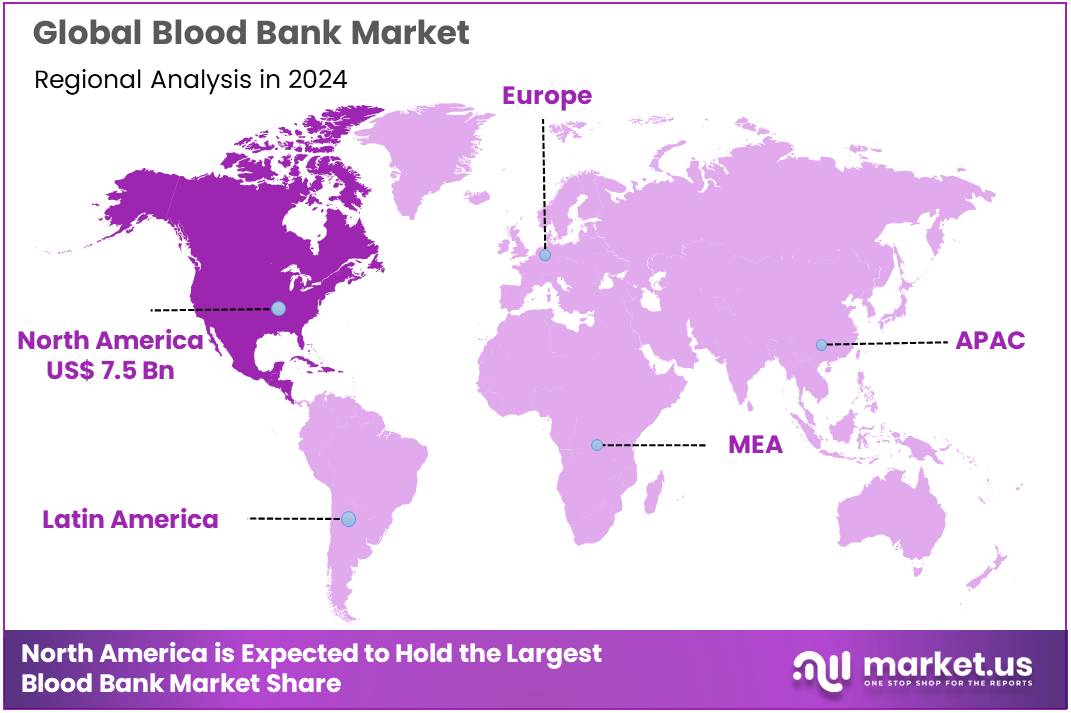

Global Blood Bank Market size is expected to be worth around US$ 26.1 Billion by 2034 from US$ 17.8 Billion in 2024, growing at a CAGR of 3.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.3% share with a revenue of US$ 7.5 Billion.

Increasing demand for safe, reliable blood products and growing advancements in blood transfusion technologies are driving the expansion of the blood bank market. Blood banks play a critical role in storing and distributing blood and blood products, such as plasma, platelets, and red blood cells, to hospitals and clinics for use in surgeries, trauma care, and treating conditions like anemia and hemophilia. Rising global incidences of chronic diseases, cancer, and trauma, combined with an aging population requiring more blood transfusions, have significantly increased the need for efficient blood bank services.

The market also benefits from innovations in blood typing and cross-matching technologies, which improve the compatibility and safety of blood transfusions. Recent trends highlight the growing adoption of automated blood bank systems, which streamline the collection, testing, and storage processes, increasing efficiency and reducing human error. In April 2024, researchers from DTU and Lund University identified enzymes capable of removing specific sugars found in the A and B antigens of the human ABO blood group system, which can enhance compatibility when mixed with red blood cells.

This discovery could significantly reduce the risks associated with transfusions by improving cross-matching techniques. Additionally, the increasing adoption of blood bank management software is optimizing inventory management, ensuring adequate supply levels, and enhancing data tracking. With continuous advancements in blood preservation techniques and a growing need for blood products worldwide, the blood bank market presents substantial opportunities for growth, especially as healthcare systems seek to improve transfusion safety, expand donor bases, and incorporate innovative technologies into blood banking operations.

Key Takeaways

- In 2024, the market for blood bank generated a revenue of US$ 17.8 Billion, with a CAGR of 3.9%, and is expected to reach US$ 26.1 Billion by the year 2034.

- The product type segment is divided into red blood cells, whole blood, white blood cells, platelets, and plasma, with red blood cells taking the lead in 2023 with a market share of 47.8%.

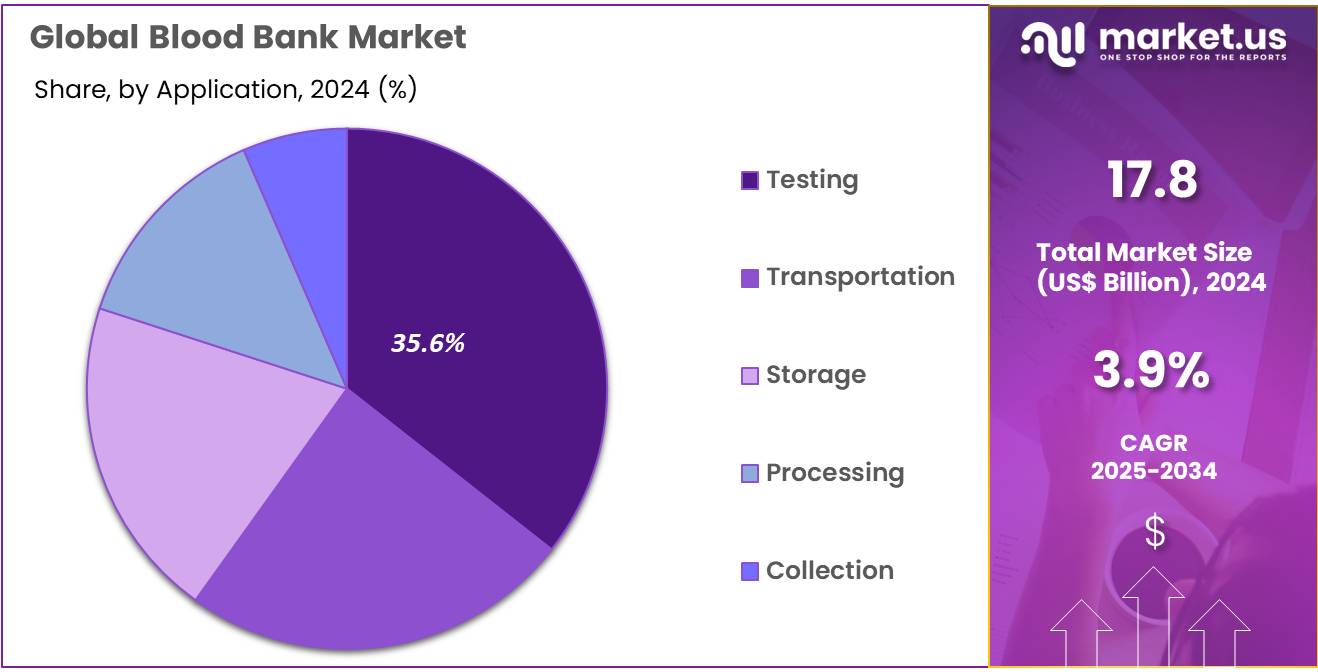

- Considering application, the market is divided into testing, transportation, storage, processing, and collection. Among these, testing held a significant share of 35.6%.

- Furthermore, concerning the end-user segment, the market is segregated into hospital, pharmaceutical companies, clinics and nursing homes, ambulatory surgery centers, and others. The hospital sector stands out as the dominant player, holding the largest revenue share of 55.3% in the blood bank market.

- North America led the market by securing a market share of 42.3% in 2023.

Product Type Analysis

Red blood cells (RBCs) dominate the blood bank market, holding 47.8% of the market share. This growth is expected to continue due to the widespread need for RBCs in medical procedures, especially during surgeries, trauma, and for patients with anemia or other blood disorders. RBCs are crucial for oxygen transport in the body, and as healthcare systems become more advanced, the demand for blood transfusions, including RBCs, is projected to rise.

The growing prevalence of chronic conditions such as cancer, cardiovascular diseases, and kidney failure, which often require frequent RBC transfusions, is anticipated to increase demand further. Additionally, RBCs are essential in emergency care settings, contributing to their high demand. The advancement in blood storage technologies, including extended shelf-life RBCs, is also expected to support the growth of this segment, improving the logistics of blood banks and making it easier to manage the supply of RBCs. As the need for life-saving blood transfusions grows worldwide, RBCs will continue to play a central role in the blood bank market.

Application Analysis

Testing is the dominant application in the blood bank market, holding 35.6% of the share. This segment’s growth is driven by the increasing need for accurate and efficient blood screening and diagnostic tests. Blood tests are critical for identifying blood type, screening for infectious diseases, and ensuring the compatibility of blood transfusions. As the global demand for blood donations and transfusions increases, so does the need for sophisticated testing systems that ensure safety and efficacy.

Additionally, advancements in molecular diagnostics and blood testing technologies are anticipated to improve the speed, accuracy, and reliability of blood tests. The rise in regulatory standards, requiring more thorough testing of donated blood to prevent transfusion-related infections, is likely to further boost the demand for blood testing solutions.

Hospitals, diagnostic labs, and blood banks are expected to continue investing in advanced testing technologies, which will drive the growth of this segment. As blood banks and healthcare providers focus on patient safety and regulatory compliance, the demand for testing will remain robust.

End-User Analysis

Hospitals represent the largest end-user segment in the blood bank market, holding 55.3% of the market share. This growth is expected to be driven by the increasing demand for blood transfusions in hospitals due to the rising number of surgeries, trauma incidents, and chronic disease treatments. Hospitals are the primary recipients of blood products, including red blood cells, plasma, and platelets, which are vital in providing life-saving treatments to patients.

The growing incidence of conditions such as cancer, cardiovascular diseases, and bleeding disorders, all of which require frequent transfusions, is anticipated to drive the demand for blood bank services in hospitals. Additionally, hospitals are adopting more advanced blood management systems to improve the efficiency of blood use, reduce waste, and ensure the availability of blood products when needed.

As hospitals continue to expand their services, particularly in emergency and trauma care, the demand for blood products will likely continue to grow, ensuring the dominance of hospitals in the blood bank market. Furthermore, the increasing focus on improving patient outcomes and care quality is projected to drive hospitals’ reliance on efficient and safe blood transfusion practices.

Key Market Segments

By Product Type

- Red Blood Cells

- Whole Blood

- White Blood Cells

- Platelets

- Plasma

By Application

- Testing

- Transportation

- Storage

- Processing

- Collection

By End-user

- Hospital

- Pharmaceutical Companies

- Clinics and Nursing Homes

- Ambulatory Surgery Centers

- Others

Drivers

Increasing Demand from Surgical Procedures and Chronic Diseases is Driving the Market

The escalating global demand for blood and blood components, driven by a rising number of complex surgical procedures and the growing incidence of chronic diseases requiring transfusions, is a significant driver propelling the blood bank market. Modern medical advancements, including advanced surgeries and aggressive cancer treatments, rely heavily on a stable and sufficient blood supply. Patients undergoing major operations often require multiple units of blood to compensate for blood loss.

Similarly, individuals with chronic conditions such as anemia, sickle cell disease, and various cancers frequently depend on regular blood transfusions for their ongoing care. The American Red Cross, a major blood supplier in the US, consistently highlights the continuous need for blood, stating that every two seconds, someone in the US needs blood for various medical reasons, including surgeries and cancer treatments.

Furthermore, the National Blood Collection and Utilization Survey (NBCUS) data, published in March 2025 by AABB, revealed that while total red blood cell (RBC) collections in the US saw a slight decrease to 11.58 million units in 2023, transfusions remained substantial at 10.32 million RBC units, with notable increases in pediatric (9.4%), obstetrics/gynecology (4.6%), and surgical (3.3%) settings compared to 2021. This sustained and diverse demand from critical healthcare sectors ensures continuous pressure on blood banks to maintain adequate supply levels, thereby driving market growth and innovation.

Restraints

Strict Donor Eligibility Criteria and Declining Donor Pools are Restraining the Market

Stringent donor eligibility criteria, coupled with a shrinking pool of eligible and willing blood donors, represent a considerable restraint on the blood bank market. Regulatory bodies impose rigorous screening processes to ensure blood safety, including deferral periods for various health conditions, travel histories, and certain behavioral risks. While essential for public health, these strict criteria exclude a significant portion of the population from donating.

The challenge is further compounded by a general decline in consistent blood donations, often attributed to busy lifestyles, lack of awareness, or donor fatigue. The World Health Organization (WHO) reported in May 2025 that while approximately 118.5 million blood donations were collected globally in 2023, high-income countries, home to only 16% of the world’s population, collected 40% of these donations. This highlights a significant disparity and a struggle to meet demand in many regions.

Additionally, a persistent issue has been the historically low percentage of eligible donors who actually donate blood. The American Red Cross states that only about 3% of age-eligible people in the US donate blood annually, which is insufficient to consistently meet patient needs. These factors collectively create persistent shortages, particularly for rare blood types, forcing blood banks to expend considerable resources on donor recruitment and retention, thus restraining market growth.

Opportunities

Advancements in Blood Processing and Storage Technologies are Creating Growth Opportunities

Significant advancements in blood processing, component separation, and long-term storage technologies are creating substantial growth opportunities in the blood bank market. Innovations in apheresis technology allow for the collection of specific blood components, such as platelets or plasma, from donors while returning other components, optimizing the utilization of each donation. Furthermore, improved preservation solutions and cryopreservation techniques extend the shelf life of blood components, reducing wastage and increasing availability for patients with rare blood types or during emergencies.

The US Food and Drug Administration (FDA) continues to review and approve new blood-related technologies. For example, in March 2024, the FDA approved the cobas Malaria Nucleic Acid Test for use on the cobas 6800/8800 Systems, enabling more accurate screening of blood samples for malaria.

Additionally, the FDA issued guidance in June 2023 on “Alternative Procedures for the Manufacture of Cold-Stored Platelets,” providing pathways for extending the viability of platelet units beyond traditional storage limits. These technological leaps enhance the safety, quality, and availability of blood products, allowing for more efficient inventory management and better support for complex medical procedures. The ability to extract more value from each donation and store components for longer periods directly translates into improved patient outcomes and expanded service capabilities for blood banks.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflationary pressures and shifting national public health investment priorities, significantly influence the blood bank market by affecting operational costs and infrastructure development. Inflation can increase the expenses associated with acquiring specialized equipment, maintaining cold chain logistics, and compensating skilled personnel, potentially straining the budgets of blood collection centers. However, governments and healthcare systems globally recognize blood supply as a critical component of national health security.

This fundamental need often ensures a baseline level of investment despite economic headwinds. According to Health Affairs, national health expenditures in the US are projected to have grown by 8.2% in 2024, exceeding US$5 trillion, and are forecast to continue outpacing GDP growth, indicating a sustained commitment to healthcare spending. While this growth reflects various healthcare sectors, it provides a broader context of financial allocation within the health economy.

Geopolitical stability also plays a role in ensuring uninterrupted supply chains for critical blood bags, reagents, and other consumables. The essential and life-saving nature of blood transfusion services ensures that governments and public health organizations prioritize maintaining a robust blood supply, fostering resilience and continued support for blood bank operations.

Evolving US trade policies, particularly the imposition of tariffs on imported medical consumables and specialized equipment, are shaping the blood bank market by influencing procurement costs and supply chain stability. Blood banks rely on a global supply chain for various essential items, including blood bags, testing reagents, apheresis kits, and specialized laboratory equipment, many of which are manufactured outside the US Tariffs on these imports can increase the operational expenses for blood collection centers and transfusion services, potentially impacting their financial sustainability or leading to higher costs for healthcare providers.

A July 2025 perspective from WNS, a global business process management company, noted that recent changes in US trade policy, including new tariffs, accelerate the urgency for operational redesign within healthcare, as they impact rising input costs for medical devices and pharmaceuticals. Furthermore, MedTech Dive reported on July 14, 2025, that the US plans to implement 30% tariffs on imports from the European Union and Mexico, which could impact a range of industrial products, including some medical equipment.

While these policies aim to strengthen domestic manufacturing and supply chain resilience, they can present immediate cost challenges. The critical importance of a safe and reliable blood supply, however, often drives efforts to mitigate these impacts, with blood banks exploring diversified sourcing strategies and advocating for tariff exemptions on essential life-saving products.

Latest Trends

Increased Adoption of Automated Blood Processing Systems is a Recent Trend

A prominent recent trend shaping the blood bank market in 2024 and continuing into 2025 is the accelerated adoption of automated blood processing and laboratory systems. Blood banks are increasingly investing in automation to streamline various operations, from donor screening and blood collection to component preparation, testing, and labeling. These automated systems reduce manual errors, improve efficiency, enhance traceability, and ensure higher standardization of processes, all critical for maintaining blood product safety and quality.

A July 2025 perspective from RAKT, a digital management system provider, emphasized that modern healthcare demands real-time traceability, instant reporting, and seamless coordination in blood banks, which manual or legacy systems cannot provide, making digital management systems essential for evolving blood bank operations. This reflects a broader industry move towards digital transformation to meet increasing demands.

For instance, advanced robotic systems are now used for high-throughput screening of infectious diseases, handling thousands of samples with minimal human intervention. This trend not only optimizes labor costs and speeds up processing times but also enhances the overall safety profile of blood products by minimizing human contact and ensuring consistent quality control. The push for greater efficiency and reduced operational risk is driving the widespread integration of automated solutions across the blood bank sector.

Regional Analysis

North America is leading the Blood Bank Market

The blood bank market in North America, holding a significant 42.3% share of the global market, experienced notable growth in 2024. This expansion was primarily driven by the increasing demand for blood and blood components stemming from a rising number of surgical procedures, an aging population more susceptible to various medical conditions requiring transfusions, and advancements in blood management technologies. The American Hospital Association (AHA) reported that total admissions in all US hospitals reached 34,426,650 in 2023, indicating a consistent need for blood products to support a wide range of medical interventions, including complex surgeries and trauma care.

Furthermore, the ongoing prevalence of chronic diseases like cancer and kidney disease, which often necessitate blood transfusions, contributes to the sustained demand. Companies specializing in blood management solutions have demonstrated robust performance, reflecting this market dynamism. Terumo, a global medical technology company with a strong presence in North America, reported that its Blood and Cell Technologies business, which includes blood center operations, achieved double-digit growth in fiscal year 2023 (ending March 31, 2024), driven by strong sales in the Americas. This growth underscores the continuous innovation in apheresis and blood processing technologies, ensuring a safer and more efficient blood supply for patients across the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The blood bank market in Asia Pacific is expected to grow significantly during the forecast period. This anticipated expansion is primarily fueled by the region’s vast and growing population, increasing healthcare expenditure, and a concerted effort by governments to improve blood collection and transfusion infrastructure. As healthcare access expands and medical procedures become more sophisticated, the demand for safe and readily available blood products will likely escalate.

China, for instance, witnessed a record high in voluntary blood donations in 2023, with a total of 16.99 million donations, representing an increase of 5.9% from 2022, according to data from China’s National Health Commission. This surge in donations highlights a growing awareness and participation in blood drives, crucial for meeting clinical demand.

Furthermore, many countries in the Asia Pacific region are actively investing in modernizing their healthcare systems, including establishing new hospitals and upgrading existing facilities, which directly impacts the need for comprehensive blood services. Terumo’s Blood and Cell Technologies business also experienced sustained growth in Asia Pacific, demonstrating the increasing adoption of advanced blood processing and collection solutions across the region. As medical tourism continues to rise and the prevalence of conditions requiring transfusions remains high, the demand for efficient and safe blood services will undoubtedly drive the expansion of this vital market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the blood bank market are adopting a range of strategies to fuel growth and improve patient care. They are leveraging technologies such as artificial intelligence (AI) and automation to optimize various processes like blood collection, testing, and storage. Additionally, these companies focus on creating scalable and efficient cloud-based solutions that facilitate real-time data sharing and integration with existing healthcare systems.

Strategic collaborations with healthcare providers, research institutions, and tech companies allow for broader market penetration and enhanced product offerings. Investment in user-centric designs and mobile solutions further enhances accessibility and improves the user experience. Expanding into emerging markets is also playing a key role in their growth trajectory.

Grifols, a major player in the healthcare sector, has positioned itself as a leader in the production of plasma-derived medicines. Founded in 1909 in Barcelona, Spain, the company has grown to become a key player in the industry, employing over 23,000 professionals worldwide. Grifols operates across more than 30 countries and serves over 110 regions, making significant strides in plasma-derived products. The company also provides transfusion medicine solutions, including diagnostic tools and devices for clinical laboratories. With a strong presence in life sciences and research, Grifols continues to expand its impact in healthcare.

Market Key Players

- SEHA

- Famicord Group

- Drugs Controller General of India

- Cryo-Cell International

- CordLife Group Ltd

- Bloodworks NW

- Bio-Rad Laboratories

- American Red Cross

Recent Developments

- In August 2024, SEHA, the largest healthcare network in the Middle East, launched the advanced RS 3400 X-Ray Blood Irradiator in Abu Dhabi. This cutting-edge device uses X-rays to treat blood and its components, ensuring improved safety during blood transfusions.

- In April 2024, the American Red Cross opened a new blood donation center in Denver to meet the rising demand for blood transfusions. In 2023, the center provided 33,600 blood units to 14 hospitals in Colorado, supported by its national inventory system.

- In January 2024, the Drugs Controller General of India implemented new guidelines for hospitals and blood banks, restricting charges to processing fees only to prevent excessive charges for blood donations. The decision reinforced the stance that “blood is not for sale.”

Report Scope

Report Features Description Market Value (2024) US$ 17.8 Billion Forecast Revenue (2034) US$ 26.1 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Red Blood Cells, Whole Blood, White Blood Cells, Platelets, and Plasma), By Application (Testing, Transportation, Storage, Processing, and Collection), By End-user (Hospital, Pharmaceutical Companies, Clinics and Nursing Homes, Ambulatory Surgery Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SEHA, Famicord Group, Drugs Controller General of India, Cryo-Cell International, CordLife Group Ltd, Bloodworks NW, Bio-Rad Laboratories, American Red Cross. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SEHA

- Famicord Group

- Drugs Controller General of India

- Cryo-Cell International

- CordLife Group Ltd

- Bloodworks NW

- Bio-Rad Laboratories

- American Red Cross