Global Black Pepper Oleoresin Market By Nature (Organic, Conventional), By End Use (Food and Beverage, Pharmaceuticals, Nutraceuticals, Others), By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150704

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

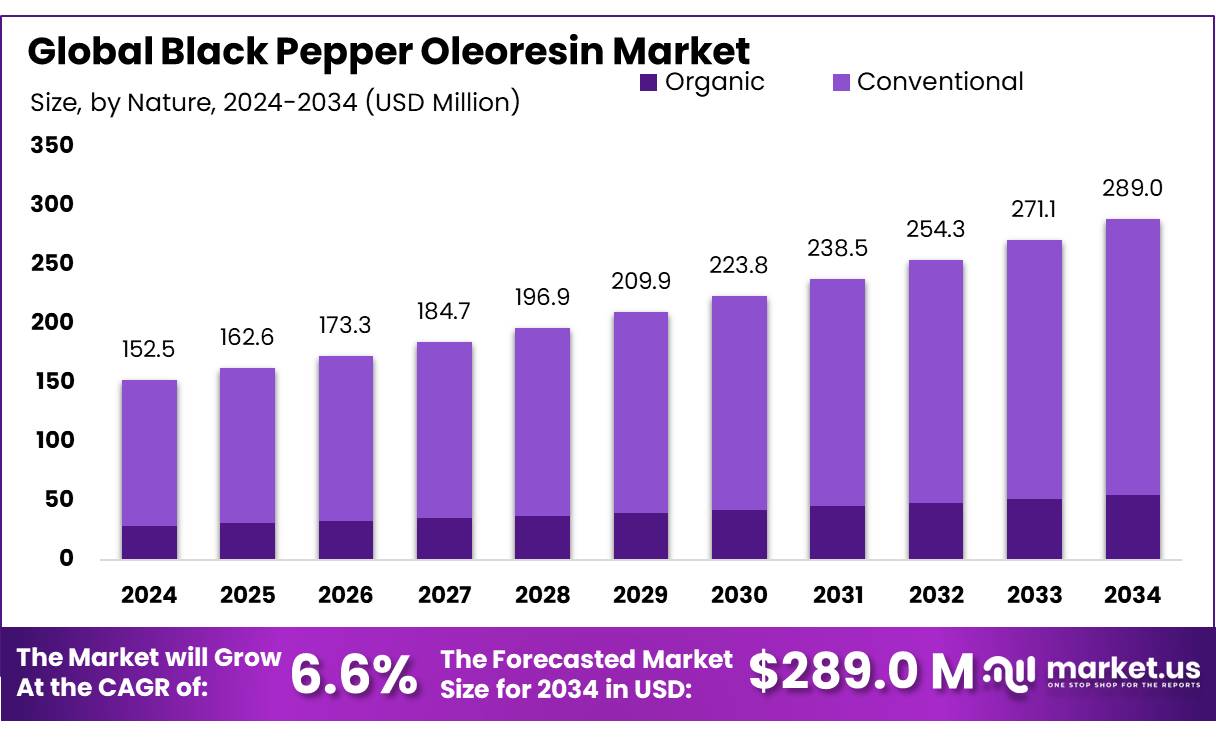

The Global Black Pepper Oleoresin Market size is expected to be worth around USD 289.0 Million by 2034, from USD 152.5 Million in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034.

Black pepper oleoresin is a concentrated extract derived from black peppercorns, containing key bioactive compounds such as piperine, essential oils, and resins. Typically, piperine content in oleoresins ranges from approximately 30–70%, depending on extraction processes and raw material quality.

This product serves as a natural flavoring agent in food processing, pharmaceuticals, nutraceuticals, and cosmetics. The natural and clean-label trend has elevated its status as a preferred alternative to synthetic additives, reinforcing its role in modern industrial applications.

The Mission Organic Value Chain Development for North Eastern Region (MOVCDNER)—initiated in 2015–16—has supported organic spice production including black pepper. It has facilitated the establishment of over 100 Farmer Producer Organizations across 50,000 ha and engaged 50,000 farmers in value-chain activities, including processing infrastructure.

Key Takeaways

- Black Pepper Oleoresin Market size is expected to be worth around USD 289.0 Million by 2034, from USD 152.5 Million in 2024, growing at a CAGR of 6.6%.

- Conventional black pepper oleoresin held a dominant market position, capturing more than a 81.2% share of the global market.

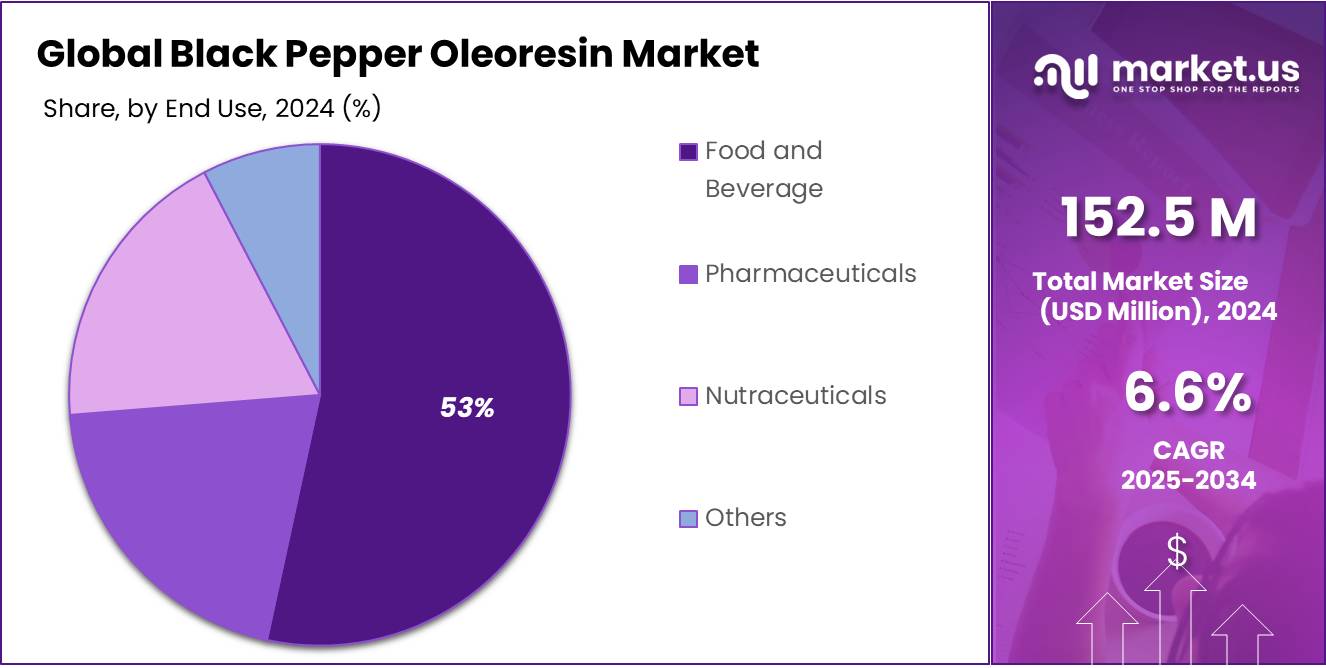

- Food and Beverage held a dominant market position, capturing more than a 53.8% share of the global black pepper oleoresin market.

- Hypermarket/Supermarket held a dominant market position, capturing more than a 39.4% share of the black pepper oleoresin market.

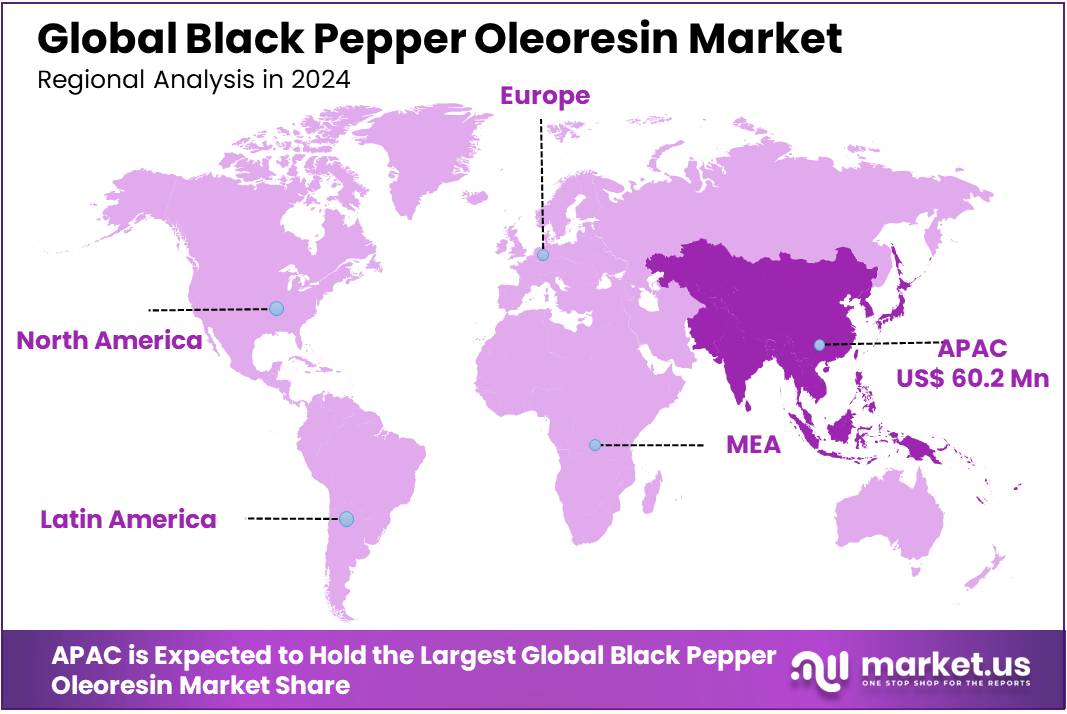

- Asia-Pacific (APAC) region held a dominant position in the global black pepper oleoresin market, accounting for 39.5% of total market share, valued at approximately USD 60.2 million.

By Nature

Conventional Black Pepper Oleoresin dominates with 81.2% share in 2024 driven by easier sourcing and stable extraction processes.

In 2024, conventional black pepper oleoresin held a dominant market position, capturing more than a 81.2% share of the global market. This strong lead can be attributed to the wide availability of conventionally farmed black pepper, which remains more accessible and cost-effective compared to organic alternatives. Most oleoresin manufacturers continue to prefer conventional pepper due to its consistent supply chains and established processing systems that ensure high piperine content and reliable oil yield.

In developing markets such as India, Vietnam, and Indonesia, conventional farming remains the norm, supporting steady raw material input. Additionally, the infrastructure for solvent-based extraction, predominantly used in conventional processing, is already well-established across major production hubs, allowing economies of scale and smoother regulatory clearance. As of 2025, the conventional segment is expected to maintain its leadership, supported by the food processing industry’s growing demand for strong, stable, and familiar spice extracts at competitive prices.

By End Use

Food and Beverage leads with 53.8% share in 2024 as demand for natural flavoring continues to rise globally.

In 2024, Food and Beverage held a dominant market position, capturing more than a 53.8% share of the global black pepper oleoresin market. This strong presence was largely driven by the growing preference for natural, concentrated spice extracts in packaged foods, sauces, ready-to-eat meals, snacks, and seasoning blends. Food manufacturers favor black pepper oleoresin for its consistent pungency, easy blending, and longer shelf life compared to raw spices.

Its ability to deliver uniform flavor without altering texture or appearance has made it a top choice, especially in processed foods and frozen meals. Additionally, the rising global demand for convenience foods and international cuisines has further boosted its inclusion in large-scale food production. Looking ahead to 2025, the food and beverage segment is expected to retain its leadership, supported by the clean-label movement and increased interest in natural ingredients among consumers across North America, Europe, and Asia-Pacific.

By Distribution Channel

Hypermarket/Supermarket takes the lead with 39.4% share in 2024 owing to greater shelf visibility and consumer accessibility.

In 2024, Hypermarket/Supermarket held a dominant market position, capturing more than a 39.4% share of the black pepper oleoresin market by distribution channel. The dominance of this segment can be linked to the strong consumer preference for purchasing food ingredients and spice-based products from physical retail formats that offer immediate product availability, trusted brands, and variety under one roof. Supermarkets often dedicate shelf space to both food-grade oleoresin extracts and blended seasoning products, making them more visible to health-conscious and culinary-focused shoppers.

In regions like North America and Europe, branded spice concentrates are commonly sold in hypermarkets as part of premium cooking ingredient lines, while in emerging markets, they are increasingly seen in urban retail chains. As of 2025, the hypermarket/supermarket segment is likely to hold its advantage due to expansion of retail infrastructure, rising in-store promotions, and continued consumer reliance on physical stores for grocery shopping.

Key Market Segments

By Nature

- Organic

- Conventional

By End Use

- Food and Beverage

- Pharmaceuticals

- Nutraceuticals

- Others

By Distribution Channel

- Hypermarket/Supermarket

- Specialty Stores

- Online Retail

- Others

Drivers

Piperine as a Potent Natural Bioenhancer

A major driver of the black pepper oleoresin market has been the increasing recognition of piperine’s unique role in enhancing the bioavailability of other nutrients and compounds. Piperine, the primary alkaloid in black pepper, has been scientifically validated as an effective bioenhancer—it can increase the absorption of key nutrients such as curcumin and resveratrol by as much as 2,000%.

This exceptional bioavailability effect has created strong interest among food and nutraceutical companies, significantly bolstering demand for black pepper oleoresin. Instead of delivering standalone flavour, the oleoresin is increasingly used as a functional ingredient that boosts the efficacy of health supplements. For example, clinical formulations that combine curcumin with piperine are marketed for their enhanced anti inflammatory and antioxidant effects—benefits largely attributed to piperine’s enzyme inhibiting action in the gut lining.

Government and institutional initiatives have supported this trend by fostering scientific research and food safety standards. In India, the Department of Biotechnology has funded numerous studies on piperine’s impact on nutrient absorption and metabolic health. These studies provide robust, locally derived evidence to guide formulation of pepper based nutraceutical products. Additionally, the Indian Council of Medical Research (ICMR) has included piperine enhanced formulations in its recent guidelines for complementary medicines, helping legitimize their use and encouraging greater uptake by manufacturers.

Restraints

Raw Material Price Volatility Weakens Profit Margins

Global pepper production faced disruptions in 2024, as reported by the International Pepper Community—output dropped by 11% from 2020 levels. This decline was due to adverse weather and reduced investments, which tightened supply and led to higher pepper prices early in 2025. Since oleoresin extraction uses pepper as its only feedstock, such production dips narrowed profit margins for manufacturers and made pricing unpredictable.

Price volatility stems from a mix of climatic, agronomic, and market-linked factors. Weather-related shocks—such as droughts, floods, and pest attacks—lead to supply instability, while delayed crop planting and inelastic pepper output amplify price swings. This unpredictability pressures extractors, who are unable to hedge effectively and often absorb costs if buyers resist higher prices.

Governments and institutions have begun responding. In India, research has shown that trade liberalization and contract farming can mitigate price fluctuations. One study found that farmers with formalized sales agreements achieved improved price realisation and more stable income, helping stabilize raw material supply for oleoresin operations. Additionally, the FAO’s 2024 “Food Outlook” noted that while food commodity markets have stabilized, they remain sensitive to extreme weather, policy shifts, and geopolitical tensions—underscoring the vulnerability of spice markets to disruption.

Opportunity

Bioenhancer Role Unlocks Functional Food Potential

One major growth opportunity for the black pepper oleoresin market lies in its role as a natural bioenhancer, particularly boosting the effectiveness of functional foods and supplements. Piperine, the active compound in black pepper oleoresin, has been scientifically shown to increase the bioavailability of various nutrients and medications—such as curcumin, resveratrol, and beta-carotene—by up to 2,000%. This remarkable capability positions black pepper oleoresin as a strategic ingredient in the growing functional food sector.

In 2024, government institutions and food regulators increasingly acknowledged this benefit. The European Food Safety Authority (EFSA) reported an average daily intake of 6.2 µg of isolated piperine per person in Europe. Meanwhile, the U.S. Dietary Guidelines for Americans 2020–2025 recognized that spices with bioactive components, like piperine, can reduce reliance on added fats and salts while enhancing nutrient efficacy. This policy support encourages manufacturers to integrate black pepper oleoresin into fortified foods and dietary supplements.

From a production standpoint, this creates new formulation pathways. Producers can blend black pepper oleoresin into nutrient-dense beverages, protein shakes, digestive aids, and plant-based meals to increase absorption of vitamins A, D, and E, as well as minerals like iron and zinc, leveraging its enzyme-inhibiting properties. Such innovation meets consumer demand for clean-label, functional products that offer both taste and enhanced health benefits. Scientific backing from clinical studies—demonstrating up to 2,000% increased nutrient uptake—brings credibility to these formulations.

Trends

Rise of Organic and Sustainable Oleoresin Highlighting Consumer Values

A prominent trend in the black pepper oleoresin market is the increasing shift toward organic and sustainable sources, driven by growing consumer demand for transparent and eco-friendly products. While conventional oleoresin still dominates, the organic segment is outpacing others in terms of growth, reflecting a broader move toward responsibly sourced ingredients.

Furthermore, the increasing traceability requirements in the supply chain are fostering demand for organic certification. Governments in major pepper-producing nations, such as India and Vietnam, are supporting this shift through agricultural reforms that promote climate-smart farming, reduced chemical use, and better harvest traceability. These initiatives help smaller farms secure organic certification and improve the credibility of organic pepper supplies for oleoresin producers.

On the consumer side, data from the International Pepper Community and regulatory agencies suggest a surge in preferences for eco‑friendly extraction methods, such as solvent-free or CO₂-based techniques. This aligns with tighter regulations around solvent residues and consumer concerns for clean-label assurances.

Regional Analysis

Asia-Pacific Dominates the Global Black Pepper Oleoresin Market with 39.5% Share in 2024

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global black pepper oleoresin market, accounting for 39.5% of total market share, valued at approximately USD 60.2 million. This leadership is strongly attributed to the presence of major black pepper-producing countries such as India, Vietnam, Indonesia, and Sri Lanka, which not only supply raw materials but also support a robust oleoresin extraction and export ecosystem.

India and Vietnam together contribute more than 70% of global black pepper production, making the region a natural hub for oleoresin manufacturing. According to the International Pepper Community (IPC), Vietnam alone exported over 260,000 metric tons of pepper in 2023, reinforcing its role as a backbone in the spice extract supply chain.

The demand for black pepper oleoresin in APAC is supported by expanding food processing, nutraceutical, and personal care industries across countries like China, India, and Thailand. The rising trend toward clean-label ingredients and natural flavorings in urbanizing Asian markets has further boosted the consumption of concentrated spice extracts.

Moreover, the Government of India, through bodies like the Spices Board and ICAR-IISR, has implemented schemes to enhance pepper cultivation and promote high-piperine varieties suitable for oleoresin extraction. These initiatives have improved quality, ensured backward linkages, and increased the competitiveness of Indian producers in global markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Mane KANCOR Ozone Naturals, a division of the France-based Mane Group, is a major producer of black pepper oleoresin in India. The company focuses on clean-label spice extracts, offering standardized piperine-rich oleoresins for food, nutraceutical, and pharmaceutical applications. In 2024, it expanded capacity at its Angamaly facility to cater to rising global demand. With operations in over 70 countries and a strong emphasis on sustainable sourcing and CO2 extraction, it remains a key player in the global oleoresin sector.

Synthite Industries Ltd., headquartered in Kerala, India, is one of the world’s largest spice extract manufacturers and a pioneer in black pepper oleoresin. In 2024, the company maintained its leadership by processing over 30,000 tons of raw spices annually. Synthite’s black pepper oleoresins are used in food flavoring, perfumery, and health supplements. With advanced R&D and global clients in over 80 countries, Synthite is known for quality assurance, solvent-free extraction technologies, and consistent high-piperine content.

Universal Oleoresins, based in Cochin, India, specializes in the production of spice oleoresins and essential oils, with black pepper oleoresin being one of its flagship products. In 2024, the company continued to supply high-purity extracts to food, seasoning, and pharma industries across Europe and the Middle East. Its commitment to sustainable sourcing, quality testing, and customized formulations has earned it a steady market presence. The firm focuses on medium-scale, high-quality batches catering to premium ingredient buyers.

Top Key Players in the Market

- Mane KANCOR Ozone Naturals

- Synthite Industries Ltd.

- Universal Oleoresins

- Akay

- Bioingredia Natural Pvt Ltd.

- Plant Lipids Private Limited

- BOS Natural Flavors Pvt. Ltd.

- Vidya Herbs Pvt. Ltd.

- Sami Spices

- TMV Group

- HDDES Group

Recent Developments

In May 2024, Universal Oleoresins exported over 66 pails (15 kg each) of black pepper oleoresin 40/20 grade to the Philippines, illustrating active trade engagement in the Asian region.

In 2024, Akay Natural Ingredients Pvt Ltd strengthened its position in the black pepper oleoresin market by exporting 17 cartons (18 kg each) of 40/20 grade oleoresin to the Philippines in March.

Report Scope

Report Features Description Market Value (2024) USD 152.5 Mn Forecast Revenue (2034) USD 289.0 Mn CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By End Use (Food and Beverage, Pharmaceuticals, Nutraceuticals, Others), By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mane KANCOR Ozone Naturals, Synthite Industries Ltd., Universal Oleoresins, Akay, Bioingredia Natural Pvt Ltd., Plant Lipids Private Limited, BOS Natural Flavors Pvt. Ltd., Vidya Herbs Pvt. Ltd., Sami Spices, TMV Group, HDDES Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Black Pepper Oleoresin MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Black Pepper Oleoresin MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mane KANCOR Ozone Naturals

- Synthite Industries Ltd.

- Universal Oleoresins

- Akay

- Bioingredia Natural Pvt Ltd.

- Plant Lipids Private Limited

- BOS Natural Flavors Pvt. Ltd.

- Vidya Herbs Pvt. Ltd.

- Sami Spices

- TMV Group

- HDDES Group