Global Beauty Drinks Market Size, Share Report By Type (Natural Drinks, Artificial Drinks), By Ingredients (Vitamins and Minerals, Protein and Peptides, Antioxidants, Co-Enzymes, Others), By Function (Anti-Aging, Detoxication, Radiance, Vitality, Others), By Distribution Channel (Grocery Retailers, Beauty Specialty Stores, Drug Stores and Pharmacies, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154420

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

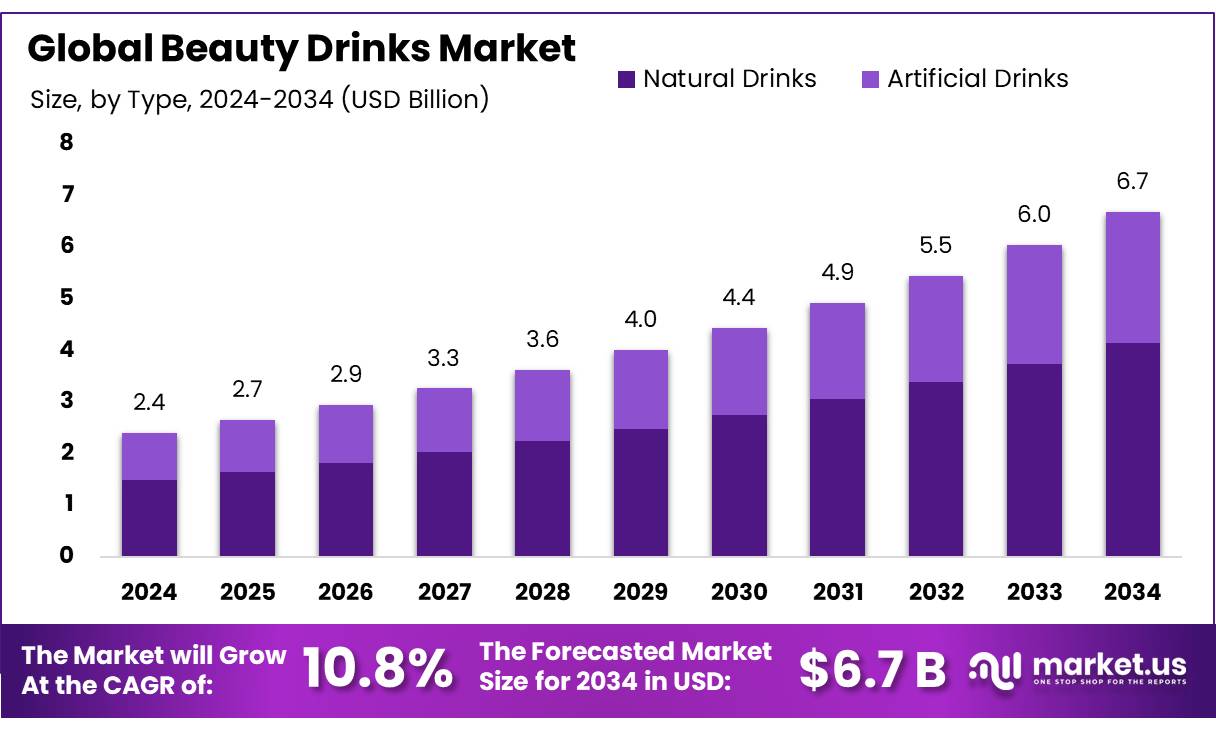

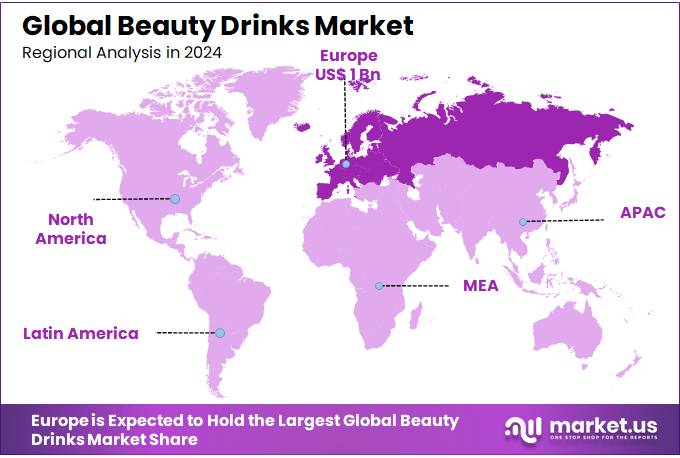

The Global Beauty Drinks Market size is expected to be worth around USD 6.7 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 10.8% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 41.7% share, holding USD 1 Billion in revenue.

The introduction to the beauty drink concentrates segment defines these products as nutraceutical-grade beverage concentrates enriched with collagen, vitamins (C, E, B‑complex), minerals, antioxidants, and botanical extracts formulated to support skin hydration, anti‑aging, radiance, and overall aesthetic wellness. These concentrates are designed for dilution prior to consumption and positioned at the intersection of functional beverages and ingestible beauty solutions.

Government and public‑sector initiatives further bolster the ecosystem: although dedicated beauty drink data is sparse, the broader food‑processing and health‑supplement space is supported. For instance, India’s Production Linked Incentive (PLI) scheme has allocated approximately INR 6,000 crore (USD 720 million) to food processing innovators, which can include functional beverage production, encouraging local manufacturing and R&D in formats such as beauty drink concentrates.

Meanwhile, the Indian government promotes agricultural raw material supply: India’s fruit production reached 110.21 million tonnes in 2022–23, projected to reach 112.08 million tonnes in 2023–24, underpinning the supply of natural extracts and raw ingredients for functional beverages.

In India, the broader beauty and personal care market is expected to hit USD 34 billion by 2028, propelled by rising disposable incomes, urbanization and digital consumption. Within FMCG, growth stems from increasing rural demand and premiumisation trends—FMCG revenue in 2023 stood at USD 144 billion, contributing ~3% to GDP. The food & beverage sector, particularly juice concentrate and ready-to-drink, saw explosive growth: e.g., RTD beverages grew by 52% YoY to USD 121 million in Q2 FY 2024, illustrating strong acceptance of convenience and health‑oriented formats.

Key Takeaways

- The global Beauty Drinks Market is projected to reach approximately USD 6.7 billion by 2034, rising from USD 2.4 billion in 2024, with a CAGR of 10.8% during the forecast period.

- Natural Drinks led the market by type in 2024, accounting for over 62.1% of the total share.

- Within the ingredients segment, Vitamins & Minerals dominated, securing more than 34.7% of the market share.

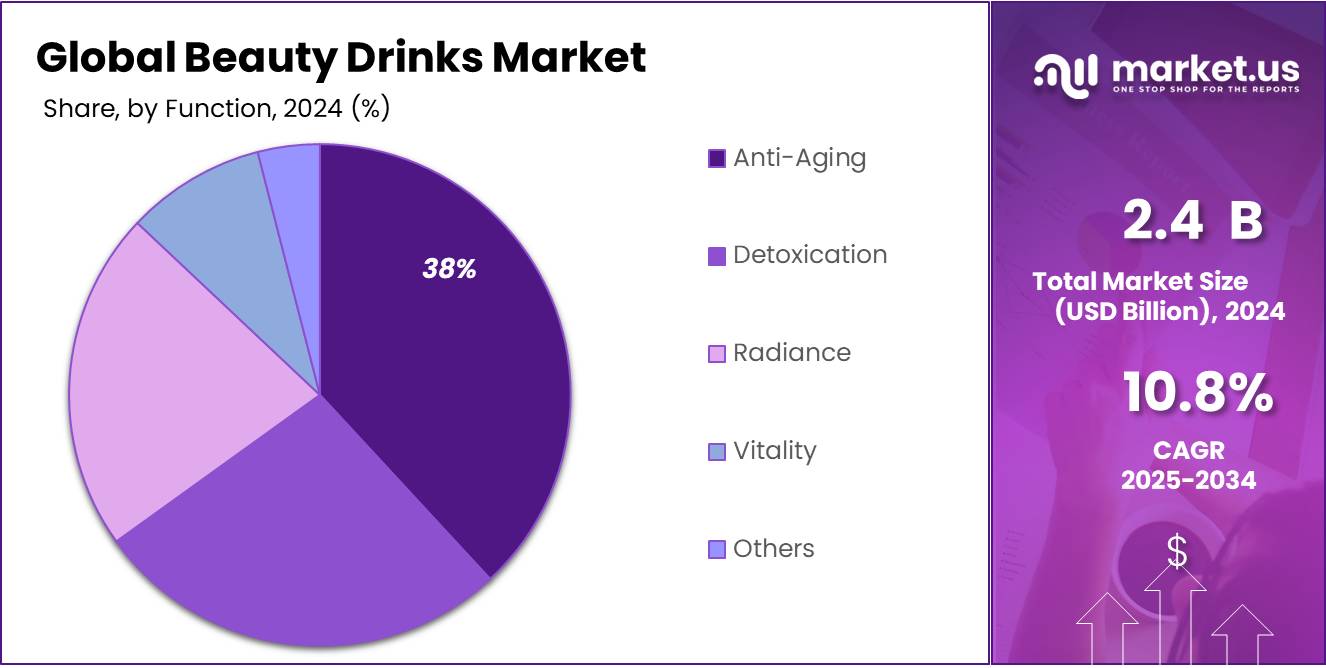

- The Anti-Aging function segment held the largest share in 2024, contributing over 38.2% to the global market.

- In terms of distribution, Grocery Retailers captured a leading 29.3% share of the beauty drinks market.

- Europe was the top-performing region in 2024, holding a market share of 41.7% and generating about USD 1 billion in revenue.

By Type Analysis

Natural Drinks dominate with 62.1% share due to rising preference for clean-label, plant-based beauty solutions.

In 2024, Natural Drinks held a dominant market position in the Beauty Drinks Market by Type segment, capturing more than a 62.1% share. This strong performance can be linked to increasing consumer preference for clean-label, organic, and plant-based ingredients. Shoppers today are more conscious about what they consume, often choosing products free from synthetic additives, artificial sweeteners, and preservatives. Natural drinks, often infused with botanicals like aloe vera, hibiscus, rose water, and fruit extracts, are seen as safer and more holistic options for beauty enhancement from within. The global wellness trend has further supported this shift, with consumers aligning beauty routines with natural health practices.

By Ingredients Analysis

Vitamins & Minerals lead with 34.7% share owing to their essential role in skin, hair, and nail health.

In 2024, Vitamins & Minerals held a dominant market position in the Beauty Drinks Market by Ingredients segment, capturing more than a 34.7% share. This dominance is mainly due to the growing awareness about the benefits of essential nutrients in improving skin clarity, hair strength, and overall appearance. Consumers are increasingly opting for beauty drinks enriched with vitamins such as A, C, E, and B-complex, along with minerals like zinc, selenium, and magnesium, which are known to support collagen production, reduce oxidative stress, and promote skin repair from within.

By Function Analysis

Anti-Aging dominates with 38.2% share as consumers seek youthful skin and long-term wellness.

In 2024, Anti-Aging held a dominant market position in the Beauty Drinks Market by Function segment, capturing more than a 38.2% share. This growth reflects rising consumer demand for products that support youthful appearance, improve skin elasticity, and reduce signs of aging such as wrinkles and fine lines. With increasing age-consciousness across both men and women, particularly in urban populations, anti-aging beauty drinks have gained strong appeal due to their convenience and internal skincare benefits. These formulations often include collagen peptides, hyaluronic acid, resveratrol, and vitamin C—ingredients known for supporting hydration, skin renewal, and antioxidant defense.

By Distribution Channel Analysis

Grocery Retailers dominate with 29.3% share driven by easy access and growing shelf presence of beauty drinks.

In 2024, Grocery Retailers held a dominant market position in the Beauty Drinks Market by Distribution Channel segment, capturing more than a 29.3% share. This leadership is largely due to the high visibility and wide availability of beauty drinks in neighborhood supermarkets, convenience stores, and health-focused grocery chains. Consumers prefer purchasing beauty beverages alongside their regular groceries, as it adds convenience and reinforces daily use. Retailers have also begun allocating dedicated shelf space for functional beverages, including beauty drinks, allowing for better brand exposure and impulse purchases.

Key Market Segments

By Type

- Natural Drinks

- Artificial Drinks

By Ingredients

- Vitamins & Minerals

- Protein & Peptides

- Antioxidants

- Co-Enzymes

- Others

By Function

- Anti-Aging

- Detoxication

- Radiance

- Vitality

- Others

By Distribution Channel

- Grocery Retailers

- Beauty Specialty Stores

- Drug Stores and Pharmacies

- Others

Emerging Trends

Collagen Remains the Cornerstone of Beauty Drinks Growth

Government and regulatory bodies are also helping by tightening standards around permissible health claims. In Europe, EFSA requires proof for labeling claims such as “supports normal collagen formation,” while in many countries, authorities scrutinize dosage, purity, and safety disclosures. That builds trust in consumers and encourages broader adoption of collagen-infused products. In the U.S., the FDA demands proper ingredient disclosure and manufacturing practices even if pre‑approval isn’t required—pressuring brands toward transparency.

In human terms, this trend feels like people caring more about what they put into their bodies, not just what goes on their skin. Consumers are treating these drinks as small daily rituals of self‑care—not vanity—and looking for proven ingredients, familiar formats, and trust-backed brands. Collagen drinks capture that mix: simple, effective, and increasingly backed by science and regulation.

In India, there’s also a clear consumer shift toward Ayurvedic, natural wellness—and this includes ingestible beauty. A recent discussion in the Indian media highlights how Ayurveda—with its emphasis on natural, life‑force (“prana”) ingredients—is influencing beauty preferences, including drinks based on herbal extracts that align with traditional health approaches.

On the government side, while India doesn’t have specific regulations for beauty drinks distinct from other food or supplement items, the Food Safety and Standards Authority of India (FSSAI) requires clear labelling, permissible ingredient lists, and safety tests for ingestible health products. Many brands also voluntarily conduct clinical trials or partner with recognized food-science labs to ensure compliance and consumer trust.

Drivers

Rising Health and Skin Consciousness Among Millennials and Gen Z Driving the Beauty Drinks Market

In recent years, a significant shift in consumer preferences has been seen — especially among younger generations — towards natural, preventive health and beauty solutions. One of the most powerful forces pushing the beauty drinks market forward is the increasing awareness around skin health and the desire for clean, glowing skin from the inside out. Unlike previous generations who focused more on topical solutions, today’s consumers — especially Millennials and Gen Z — are far more focused on nourishing beauty from within.

The World Health Organization (WHO) has repeatedly emphasized the growing burden of skin-related health conditions, including early aging and skin dehydration caused by environmental stress and poor diet. As per WHO’s data, nearly 900 million people globally experience some kind of skin disease, highlighting the importance of early and effective skin nutrition.

This awareness is translating into consumer behavior. According to Innova Market Insights, 30% of global consumers associate beauty with health and wellness, rather than cosmetics alone. Beauty drinks, packed with ingredients like collagen, antioxidants, hyaluronic acid, biotin, and vitamins, are now seen as a part of daily self-care routines rather than luxury items.

Furthermore, this rising health-conscious behavior is not just about looks. A 2023 report by the Food and Agriculture Organization (FAO) found that more than 40% of consumers globally are actively looking to improve their diet to support both immunity and skin health, reflecting a clear link between diet and outward appearance. Beauty drinks — especially those fortified with marine collagen and plant-based extracts — are emerging as go-to solutions because they align perfectly with this new wave of lifestyle habits that focus on clean eating, functional hydration, and wellness-based beauty.

Governments are also stepping up. For example, the European Food Safety Authority (EFSA) has approved several health claims for ingredients commonly found in beauty drinks, like Vitamin C (which contributes to normal collagen formation for the normal function of skin) and Zinc. These regulatory validations boost consumer confidence, helping people trust what they’re putting into their bodies.

Restraints

Safety Concerns and Regulatory Uncertainty Around Dietary Supplements

When people start reaching for beauty drinks, it’s often for a sense of wellness, inner glow, or healthier hair and skin. But a key factor holding this market back is the overlapping concerns related to safety, quality, labeling, and regulation—especially for ingredients like collagen and other beauty supplements.

Beauty drinks often feature collagen peptides or botanical extracts categorized as dietary supplements. In the U.S., these are regulated as food—not medicine—by the FDA, under the Dietary Supplement Health and Education Act of 1994. That means manufacturers do not need to prove safety or effectiveness before a product hits shelves. There is no pre-market approval, and claims made are often only structure/function statements with disclaimers like “not evaluated by the FDA.

This loose oversight means many beauty drink products may have inconsistent purity, undisclosed contaminants, or even misleading ingredient dosages. A study of dietary supplements found that 29% of adverse events reported to the FDA led to hospitalizations, and around 20% resulted in serious health issues. Collagen in supplements also can contain heavy metals or toxins, and its dosing or bioavailability isn’t always trustworthy.

Global regulators are still catching up. In the EU, botanical or collagen-containing drinks must meet safety and dosage standards—but enforcement can be patchy, and labeling clarity often varies by country. Consumers are expected to rely on third-party testing or brand integrity to vet quality—something not guaranteed for many smaller brands.

On top of safety worries, many beauty drinks contain high levels of sugar to improve taste. Functional beverages more broadly are flagged by international health organizations for contributing to obesity, heart disease, and excess calorie intake. That can undercut claims around wellness or skin health, eroding consumer trust over time.

Opportunity

Plant-Based Beauty Drinks: A Natural Growth Avenue

One of the most promising growth opportunities in the beauty drinks market lies in the rapid rise of plant-based and vegan formulations. As more people choose cruelty-free, environmentally friendly, and plant-powered lifestyles, there’s a strong demand for beauty products — including drinks — that match these values. Beauty from within is no longer just about glowing skin; it’s about doing so ethically and sustainably.

According to the Food and Agriculture Organization (FAO), the global consumption of plant-based ingredients has increased by nearly 20% between 2015 and 2023, largely due to health concerns and sustainability goals. People are becoming more aware of what goes into their bodies, and that extends to collagen-based drinks too. Traditional collagen is sourced from animals or fish, but now, plant-derived alternatives like silica from bamboo, seaweed extracts, and fermented ingredients are entering the scene.

This isn’t just a niche. In fact, a 2022 report by the European Commission on Sustainable Food Systems emphasized the importance of promoting plant-based innovation for better planetary health. Beauty drink brands aligning with these values — offering vegan, non-GMO, and eco-conscious options — are more likely to earn long-term loyalty, especially from Gen Z and Millennial consumers who prioritize ethical consumption.

Government efforts are also adding fuel. For example, the EU’s Green Deal and the United Nations’ Sustainable Development Goals both encourage plant-based transitions in consumer goods, including food and wellness. These global initiatives make it easier for brands to source and promote plant-based ingredients in a regulated, transparent way.

Regional Insights

Europe dominates the Beauty Drinks Market with 41.7% share, valued at USD 1 billion in 2024.

In 2024, Europe emerged as the leading region in the global Beauty Drinks Market, capturing over 41.7% of the total share and generating revenue of approximately USD 1 billion. This strong market position is supported by the region’s mature beauty and wellness industry, combined with a high consumer inclination towards functional beverages offering health and aesthetic benefits.

Countries like Germany, the UK, France, and Italy are driving demand, with consumers increasingly opting for beauty drinks enriched with collagen, vitamins, and natural plant extracts to maintain skin health and combat aging. The rising popularity of clean-label and sustainably sourced ingredients further boosts the segment, as European buyers place significant importance on product safety, quality, and transparency.

The presence of advanced nutraceutical manufacturing facilities and strict regulatory frameworks such as those by the European Food Safety Authority (EFSA) has also played a key role in promoting trust and market growth. According to the European Commission, functional food and beverage segments, including nutraceutical beverages, have shown steady growth rates due to increasing preventive healthcare trends across the region.

In 2025, Europe is expected to maintain its dominant position as manufacturers continue to innovate with sugar-free and vegan formulations, catering to the rising demand among health-conscious and environmentally aware consumers. With strong retail networks and e-commerce penetration, the region is set to remain a focal point for premium beauty drink sales.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Groupon Inc., primarily recognized as a global e-commerce marketplace, has entered the wellness space by offering beauty drink products through partnered health and beauty merchants. While not a manufacturer, Groupon facilitates the promotion and sales of collagen-infused and antioxidant-rich beauty beverages via its deals platform. It plays a growing role in consumer accessibility, offering discounts on trending wellness products and thereby increasing awareness and trial of beauty drinks in the North American and European markets.

Juice Generation is a U.S.-based wellness brand known for its cold-pressed juices and superfood-based functional beverages. It has expanded into the beauty drinks space with offerings that feature ingredients like hyaluronic acid, biotin, and marine collagen. Popular among health-conscious urban consumers, its beauty drink range promotes glowing skin and hydration. Juice Generation combines clean ingredients with eco-conscious packaging, distributing its products through juice bars, direct-to-consumer channels, and wellness collaborations with lifestyle influencers and beauty brands.

Hangzhou Nutrition Biotechnology Co., Ltd., based in China, specializes in producing functional nutrition products including collagen and vitamin-enriched beauty drinks. The company focuses on bioactive ingredients that support anti-aging and skin rejuvenation. Its offerings cater to both domestic and international markets, with a growing footprint in Asia-Pacific. Through continuous innovation and strict quality control, the company has positioned itself as a key supplier to private labels and wellness brands looking for high-performance beauty-from-within solutions.

Top Key Players Outlook

- AMC Grupo Alimentación Fresco y Zumos SA

- Hangzhou Nutrition Biotechnology Co., Ltd.

- Juice Generation

- Groupon Inc.

- Asterism Healthcare Plus Inc.

- Sappe Public Company Limited

- Kino Biotech

- Shiseido Co. Ltd

- Vital Proteins LLC

- Kordel’s La Beauté

Recent Industry Developments

In 2024 AMC Grupo Alimentación Fresco y Zumos SA, reported revenue of approximately €747 million and processed over 250,000 tons of fruit and vegetables annually, reflecting its scale in the natural beverage sector.

In 2024 Hangzhou Nutrition Biotechnology Co., Ltd., the firm produced fish collagen powder at an annual capacity of approximately 2,000 tons, processed through a 20,000 m² standardized workshop that can output RMB 300 million in products per year.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Bn Forecast Revenue (2034) USD 6.7 Bn CAGR (2025-2034) 10.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural Drinks, Artificial Drinks), By Ingredients (Vitamins and Minerals, Protein and Peptides, Antioxidants, Co-Enzymes, Others), By Function (Anti-Aging, Detoxication, Radiance, Vitality, Others), By Distribution Channel (Grocery Retailers, Beauty Specialty Stores, Drug Stores and Pharmacies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AMC Grupo Alimentación Fresco y Zumos SA, Hangzhou Nutrition Biotechnology Co., Ltd., Juice Generation, Groupon Inc., Asterism Healthcare Plus Inc., Sappe Public Company Limited, Kino Biotech, Shiseido Co. Ltd, Vital Proteins LLC, Kordel’s La Beauté Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AMC Grupo Alimentación Fresco y Zumos SA

- Hangzhou Nutrition Biotechnology Co., Ltd.

- Juice Generation

- Groupon Inc.

- Asterism Healthcare Plus Inc.

- Sappe Public Company Limited

- Kino Biotech

- Shiseido Co. Ltd

- Vital Proteins LLC

- Kordel's La Beauté