Global Bone Broth Market Size, Share, And Business Benefits By Product Type (Beef, Chicken, Pork, Turkey, Others), By Product Form (Powdered, Liquid), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others), By End-User (HoReCa, Household), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146727

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

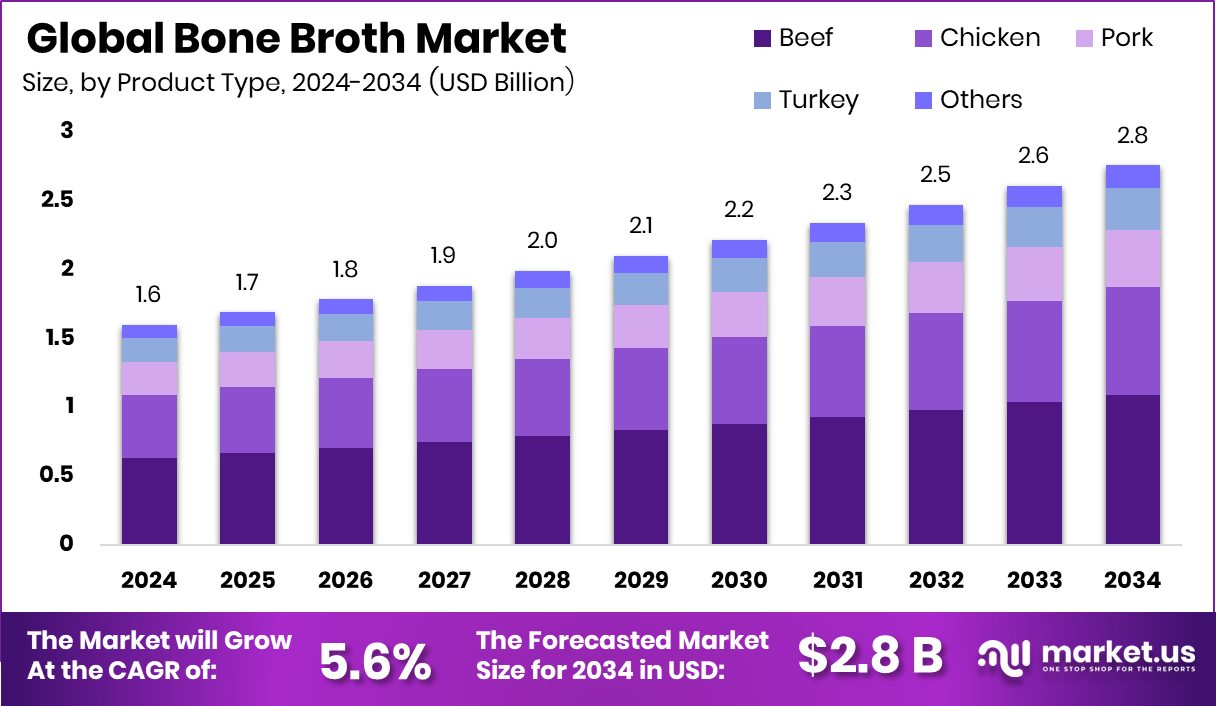

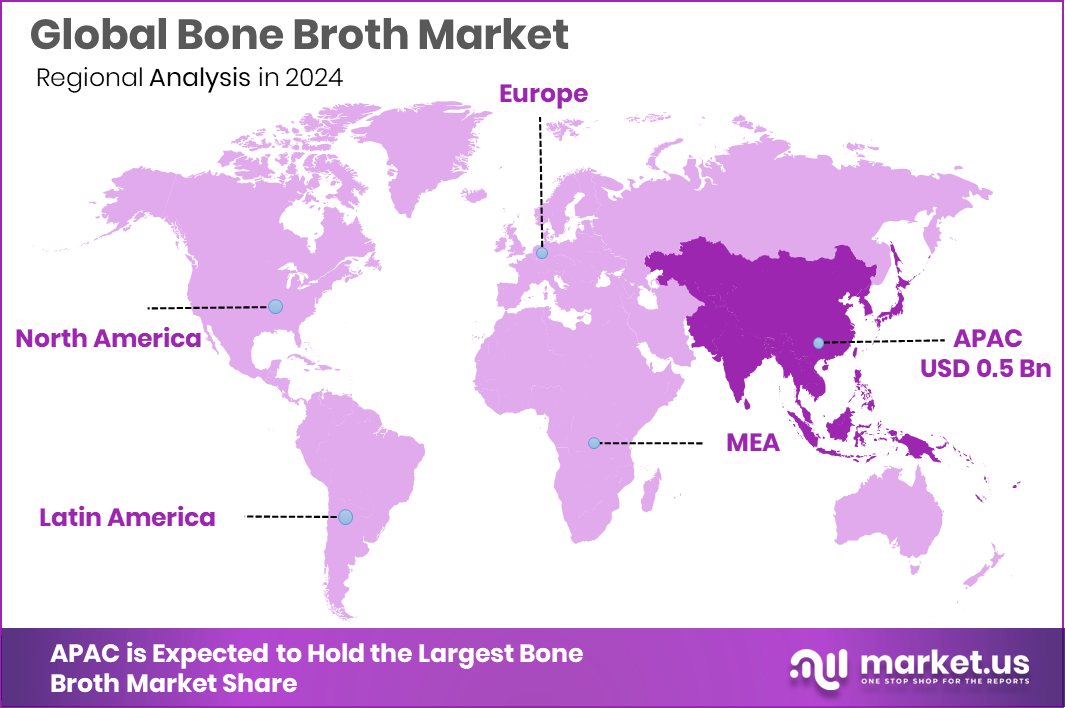

Global Bone Broth Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.6 billion in 2024, and grow at a CAGR of 5.6% from 2025 to 2034. Bone Broth Market saw 34.8% Asia-Pacific dominance, worth around USD 0.5 Bn.

Bone broth, a nutrient-rich liquid derived from simmering animal bones and connective tissues, has gained significant traction globally due to its health benefits, including high protein content, collagen, and essential minerals. Its popularity is fueled by the rising consumer demand for natural, functional foods that support gut health, joint function, and overall wellness.

In India, the bone broth industry is still in its nascent stages but shows promising potential. The country’s vast livestock resources and a growing health-conscious population provide a fertile ground for the development of this sector. The Indian food processing industry, projected to reach $535 billion by 2025-26, offers substantial opportunities for bone broth producers to integrate into the value chain.

The bone broth market is influenced by several driving factors. The surge in health-conscious consumers seeking functional foods has led to increased consumption of bone broth, known for its rich nutritional profile. Additionally, the popularity of diets such as paleo and ketogenic, which emphasize high-protein and low-carbohydrate intake, has further propelled the demand for bone broth products.

Looking ahead, the bone broth market presents several growth opportunities. The development of innovative flavors and formulations can attract a diverse consumer demographic. Furthermore, leveraging digital marketing strategies to educate consumers about the health benefits of bone broth can drive market penetration.

Key Takeaways

- Global Bone Broth Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.6 billion in 2024, and grow at a CAGR of 5.6% from 2025 to 2034.

- In 2024, beef-based bone broth led the product type segment, accounting for 39.6% market share.

- The powdered form of bone broth was most preferred in 2024, holding a 62.3% share globally.

- Supermarkets and hypermarkets dominated distribution channels in 2024, with a significant 43.7% share of sales.

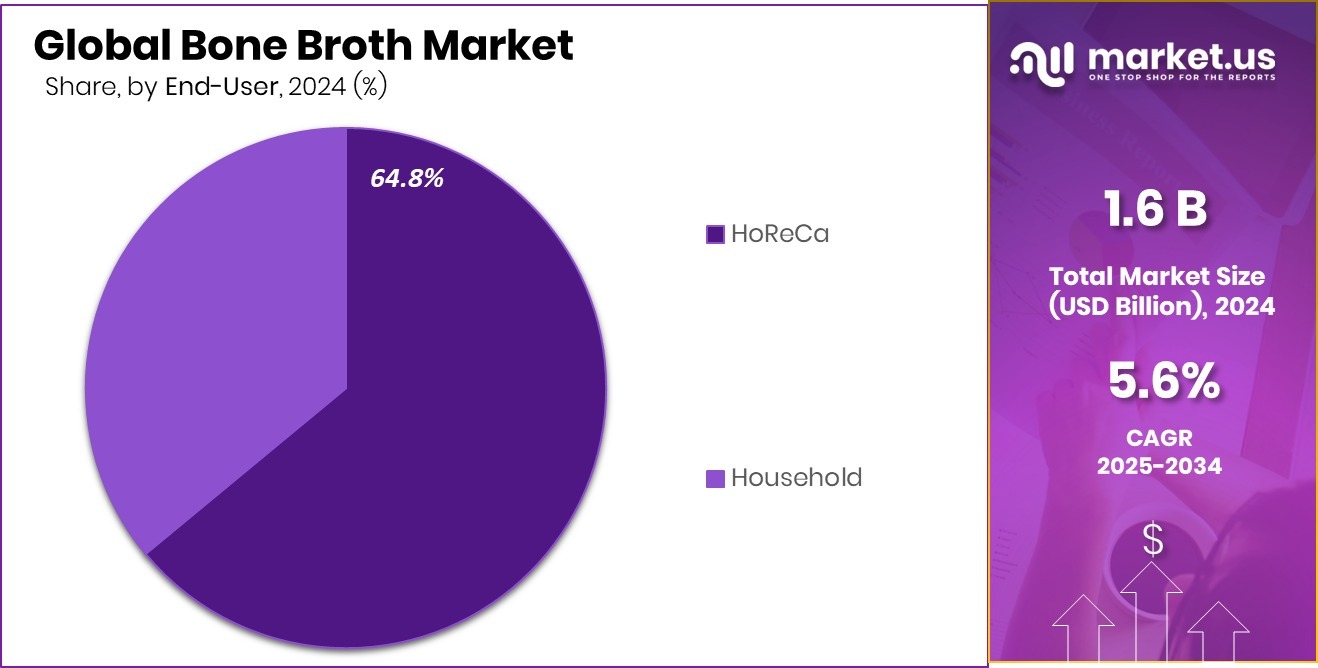

- The HoReCa sector remained the primary end-user in 2024, commanding a dominant 64.8% market share.

- In 2024, Asia-Pacific reached USD 0.5 Bn, holding 34.8% Bone Broth Market share.

By Product Type Analysis

In 2024, beef held a 39.6% share in product type.

In 2024, Beef held a dominant market position in the By Product Type segment of the Bone Broth Market, with a 39.6% share. This reflects the strong consumer preference for beef-based broth due to its rich flavor profile, higher collagen content, and perceived health benefits.

The demand is especially strong in North America and Europe, where beef bone broth is commonly consumed as a functional beverage or used as a base in soups, stews, and health-oriented food products. This dominance also links closely with the rise in ketogenic and paleo dietary patterns, where beef bone broth is a favored supplement for protein and gut health. Additionally, foodservice sectors and HoReCa players are increasingly integrating beef bone broth into their premium offerings to meet rising wellness trends.

The 39.6% market share highlights not just the popularity of beef over chicken or other variants but also the growing inclination toward nutrient-dense options among health-conscious consumers. As this trend continues, the beef segment is expected to maintain its leading position, backed by innovations in packaging, extended shelf life, and expanded retail availability across supermarkets and specialty health stores.

By Product Form Analysis

Powdered bone broth dominated the form segment with 62.3% market share.

In 2024, Powdered held a dominant market position in the By Product Form segment of the Bone Broth Market, with a 62.3% share. This substantial market share reflects the increasing consumer demand for convenient, easy-to-store, and long-lasting bone broth formats. Powdered bone broth products are widely favored for their portability, extended shelf life, and versatility in applications, ranging from dietary supplements to instant beverages and cooking ingredients.

The growth in health and wellness trends, especially among fitness-conscious consumers and working professionals, has accelerated the uptake of powdered forms due to their ease of use in daily routines. Additionally, powdered bone broth aligns well with e-commerce sales models and direct-to-consumer nutrition brands, which have seen notable traction post-pandemic. The 62.3% share also signals the success of packaging innovations and single-serve sachets, which cater to on-the-go lifestyles.

Manufacturers are increasingly focusing on flavor enhancement and clean-label claims to meet evolving consumer expectations. Given these factors, powdered bone broth continues to dominate over liquid or frozen alternatives, offering both manufacturers and consumers a balance between health benefits and convenience.

By Distribution Channel Analysis

Supermarkets and hypermarkets led distribution with a 43.7% market contribution.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Bone Broth Market, with a 43.7% share. This strong foothold is driven by the extensive availability of bone broth products across major retail chains and the convenience of in-store shopping for consumers.

Supermarkets and hypermarkets offer a broad product range, competitive pricing, and trusted brand presence, which encourages bulk purchasing and repeat sales. The 43.7% market share reflects consumers’ preference to physically evaluate packaging, read nutritional labels, and compare options directly, especially for health-based products like bone broth.

This channel also benefits from in-store promotions, shelf placement strategies, and visibility in wellness aisles, boosting sales further. Additionally, supermarkets serve as key distribution hubs for powdered and beef-based broths, which dominate the product landscape. As demand for functional foods continues to rise, large-format retailers are expanding shelf space for bone broth varieties, including organic, grass-fed, and high-protein formulations.

By End-User Analysis

HoReCa accounted for 64.8% in the end-user segment in 2024.

In 2024, HoReCa held a dominant market position in the By End-User segment of the Bone Broth Market, with a 64.8% share. This dominance is largely driven by the strong demand from hotels, restaurants, and catering services that incorporate bone broth into a variety of culinary offerings.

Chefs and foodservice professionals increasingly use beef and powdered bone broth as foundational ingredients for soups, sauces, gravies, and gourmet dishes, due to their rich flavor and nutritional density.

The 64.8% market share underlines the strategic role HoReCa plays in driving bulk procurement and consistent usage of bone broth, especially in premium dining and health-focused establishments. Powdered forms, in particular, have gained traction in commercial kitchens for their ease of storage, quick reconstitution, and cost-efficiency.

With consumer preferences shifting toward natural and protein-rich menu options, foodservice providers are leveraging bone broth as a healthy, traditional, and functional addition to their offerings. The segment’s strength also stems from increasing partnerships between bone broth manufacturers and institutional buyers who demand large-scale, high-quality, and customizable solutions.

Key Market Segments

By Product Type

- Beef

- Chicken

- Pork

- Turkey

- Others

By Product Form

- Powdered

- Liquid

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

By End-User

- HoReCa

- Household

Driving Factors

Rising Health Awareness Boosting Bone Broth Consumption

One of the biggest reasons behind the growth of the bone broth market is the increasing awareness about health and nutrition among people. Bone broth is rich in collagen, amino acids, calcium, and other minerals, making it a preferred choice for those seeking joint health, gut support, and immunity improvement.

Consumers today are shifting toward natural and functional foods, especially post-COVID, as they look for ways to boost overall wellness. Bone broth fits perfectly into this lifestyle trend due to its clean-label, low-carb, and high-protein profile.

Additionally, fitness communities and wellness influencers on social media have helped promote bone broth as a daily superfood, driving up its demand across various age groups and markets.

Restraining Factors

High Production Costs Limit Bone Broth Accessibility

One major challenge facing the bone broth market is its high production cost, which makes it more expensive for consumers. Producing bone broth requires high-quality ingredients like organic bones and vegetables, which are costly.

Additionally, the slow cooking process needed to extract nutrients consumes a lot of energy and time, further increasing expenses. These factors lead to higher retail prices, making bone broth less affordable for many people.

In regions where consumers are price-sensitive, such as parts of Asia and Africa, this can significantly limit market growth. To make bone broth more accessible, producers need to find ways to reduce costs without compromising quality, such as optimizing production processes or sourcing more affordable ingredients.

Growth Opportunity

Expanding Plant-Based Bone Broth Alternatives for Vegans

A major growth opportunity in the bone broth market lies in developing plant-based alternatives. As more consumers adopt vegetarian and vegan lifestyles for health, ethical, or environmental reasons, the demand for meat-free wellness products is growing fast.

Traditional bone broth is animal-based, which excludes a significant portion of this market. Companies are now experimenting with plant-based versions using mushrooms, seaweed, miso, and other umami-rich ingredients that mimic the taste and nutritional benefits of traditional broth.

These products appeal to both vegan consumers and those with dietary restrictions. By introducing innovative, clean-label, and functional plant-based broths, brands can tap into new customer segments and expand their presence in health food stores, online platforms, and global markets.

Latest Trends

Innovative Packaging and Flavors Driving Market Growth

A significant trend in the bone broth market is the introduction of innovative packaging and diverse flavors to cater to evolving consumer preferences. Manufacturers are developing ready-to-drink bone broths and powdered mixes that offer convenience for busy lifestyles. These products are available in various flavors, enhancing their appeal to a broader audience.

Additionally, the use of sustainable and user-friendly packaging solutions is gaining traction, aligning with environmental concerns and consumer demand for eco-friendly products. This combination of convenience, taste variety, and sustainability is making bone broth products more accessible and attractive, thereby driving market growth.

Regional Analysis

Asia-Pacific led the Bone Broth Market with 34.8% share, valued at USD 0.5 Bn.

In 2024, Asia-Pacific held a dominant position in the Bone Broth Market, accounting for 34.8% of the global share and reaching a market value of USD 0.5 billion. This leadership can be attributed to growing consumer awareness about traditional nutritional practices, rising demand for protein-rich diets, and expanding urban middle-class populations adopting functional foods.

North America followed as a significant region, driven by the popularity of paleo, keto, and clean-label diets. Consumers in this region are inclined toward natural wellness products, supporting steady demand for bone broth in both liquid and powdered forms. Europe also showed consistent growth, particularly due to increased retail shelf availability and rising interest in immune-boosting products.

In Latin America and the Middle East & Africa, the market remained niche but displayed emerging traction as bone broth awareness spread across health-conscious consumer groups. While overall market presence in these regions is currently smaller, growing e-commerce channels and regional health trends suggest potential for future expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global bone broth market experienced significant contributions from key players, notably Campbell Soup Company, Bonafide Provisions, and Del Monte Foods Inc., each leveraging their unique strengths to cater to evolving consumer preferences.

Campbell Soup Company, a longstanding leader in the soup and broth sector, reported stable organic net sales and double-digit adjusted EBIT and EPS growth in its third-quarter fiscal 2024 results. The company’s strategic integration of Sovos Brands has already begun to yield incremental growth, enhancing its product portfolio and market reach. This move aligns with Campbell’s commitment to innovation and meeting the demands of health-conscious consumers seeking convenient, nutritious options.

Bonafide Provisions continues to set itself apart by emphasizing quality and transparency. As the first company to introduce real bone broth to the market, Bonafide maintains its reputation by using simple, wholesome ingredients without gums, fillers, or seed oils. Their products, crafted from grass-fed bones and slow-simmered for over 18 hours, cater to consumers adhering to paleo and keto diets.

Del Monte Foods Inc. has demonstrated robust performance through its Kitchen Basics brand, which grew approximately three times faster than the overall broth and stock category in FY2024. This growth reflects Del Monte’s strategic focus on high-margin, health-oriented products. By expanding its portfolio with offerings like Joyba bubble tea and enhancing its presence in the foodservice sector, Del Monte continues to adapt to shifting consumer trends and preferences.

Top Key Players in the Market

- Campbell Soup Company

- Bonafide Provisions

- Del Monte Foods Inc.

- Pacific Foods

- Essentia Protein Solutions

- Bare Bones Broth Co.

- Ancient Brands, LLC.

- FOND BONE BROTH LLC.

- LonoLife

- Erie Bone Broth

Recent Developments

- In April 2025, Pacific Foods introduced a new Organic Chicken Bone Broth infused with ginger, turmeric, and black pepper. This slow-simmered broth is made from organic chicken bones, vegetables, and spices, offering 8 grams of protein per serving. It’s available at Whole Foods Market and on Amazon.

- In March 2024, Campbell Soup Company acquired Sovos Brands, enhancing its premium offerings, including bone broth products under the Pacific Foods brand. This strategic move strengthens Campbell’s position in the bone broth market by expanding its portfolio with high-quality, organic options.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 2.8 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Beef, Chicken, Pork, Turkey, Others), By Product Form (Powdered, Liquid), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others), By End-User (HoReCa, Household) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Campbell Soup Company, Bonafide Provisions, Del Monte Foods Inc., Pacific Foods, Essentia Protein Solutions, Bare Bones Broth Co., Ancient Brands, LLC., FOND BONE BROTH LLC., LonoLife, Erie Bone Broth Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Campbell Soup Company

- Bonafide Provisions

- Del Monte Foods Inc.

- Pacific Foods

- Essentia Protein Solutions

- Bare Bones Broth Co.

- Ancient Brands, LLC.

- FOND BONE BROTH LLC.

- LonoLife

- Erie Bone Broth