Global Animal Disinfectants Market Size, Share, And Business Benefits By Product (Alcohol-based Disinfectant, Iodine-containing Disinfectant, Others), By Application (Poultry Farm, Dairy Farming, Aquaculture, Swine, Equine, Others), By End User (Livestock Farms, Integrated Protein Processors, Veterinary Clinics, Animal Transport and Logistics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157562

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

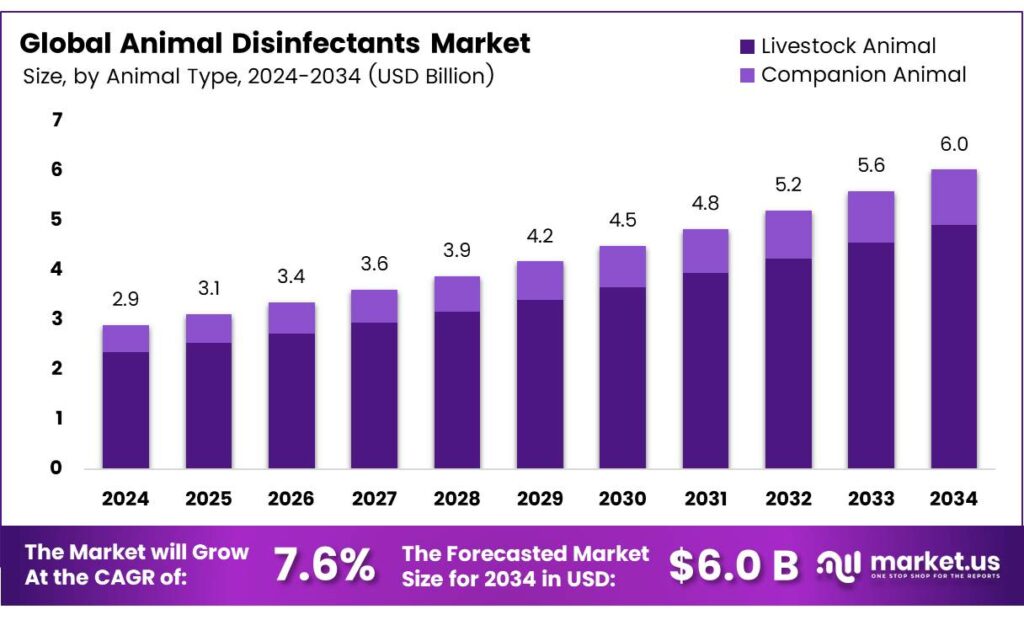

The Global Animal Disinfectants Market size is expected to be worth around USD 6.0 billion by 2034, from USD 2.9 billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034.

Animal disinfectants play a central role in controlling pathogens in farms, veterinary clinics, poultry houses, and aquaculture facilities. The sector has evolved from basic hygiene solutions to more advanced chemical and biological disinfectants tailored for livestock environments. Increasing livestock density in developing economies, coupled with the globalization of meat and dairy trade, has heightened the risk of infectious disease outbreaks such as avian influenza and swine fever, pushing demand for efficient disinfection solutions.

The ongoing search for an ideal disinfectant has highlighted the potential of peroxygen compounds, such as hydrogen peroxide, which, at the right concentrations, can function as sterilants. These compounds act as rapid oxidizers, leading to microbial cell death or inactivation. Historically referred to as oxidized water or peroxymonosulfates, peroxygen products have gained popularity in animal care environments because they are effective, environmentally friendly, and relatively low in toxicity.

Many of these products leave no harmful residues while providing excellent germicidal activity. Their importance became especially evident during the foot-and-mouth disease outbreak in the United Kingdom in 2000, when quick-acting disinfectants were urgently required. Among these, peracetic acid and vapor-phase hydrogen peroxide emerged as strong sterilizing agents due to their fast and powerful germicidal action.

When selecting disinfectants for animal-care facilities, it is essential to verify whether the product has an EPA registration number. This ensures that the disinfectant’s claims are backed by regulatory approval and scientific validation. For example, while household bleach is commonly used in laboratory animal facilities, only a few brands have EPA-registered formulations.

Key Takeaways

- The Global Animal Disinfectants Market is projected to grow from USD 2.9 billion in 2024 to USD 6.0 billion by 2034, at a CAGR of 7.6%.

- Alcohol-based disinfectants held a 19.8% market share in 2024, valued for their broad-spectrum efficacy against bacteria, fungi, and viruses.

- Livestock animals accounted for an 81.5% share of the market in 2024, underscoring their critical role in global food supply chains.

- Liquid disinfectants dominated with a 58.3% share in 2024, favored for ease of use and effective coverage in animal facilities.

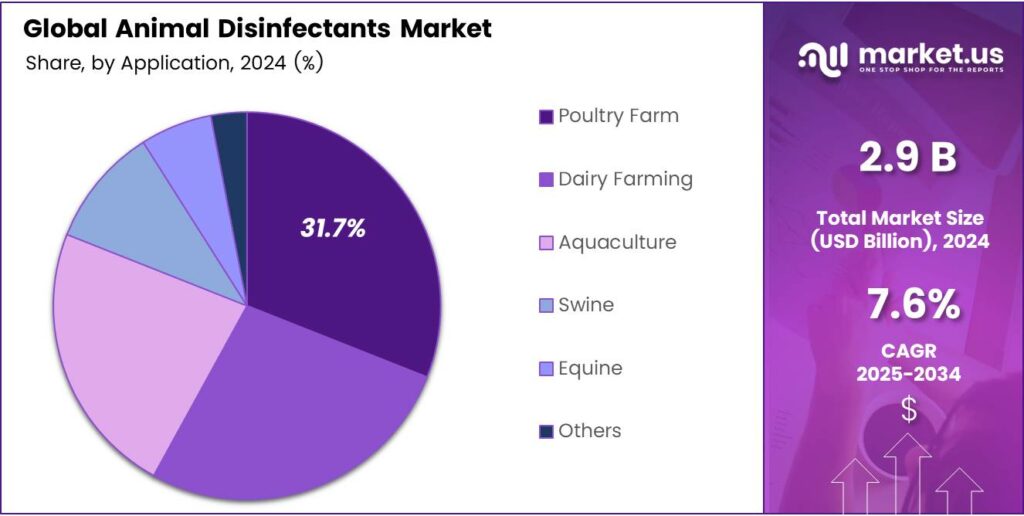

- Poultry farms captured a 31.7% market share in 2024, driven by high disease risks like avian influenza and Salmonella.

- Livestock farms held a 49.0% share in 2024, reflecting the need for hygiene to prevent disease outbreaks in cattle and swine.

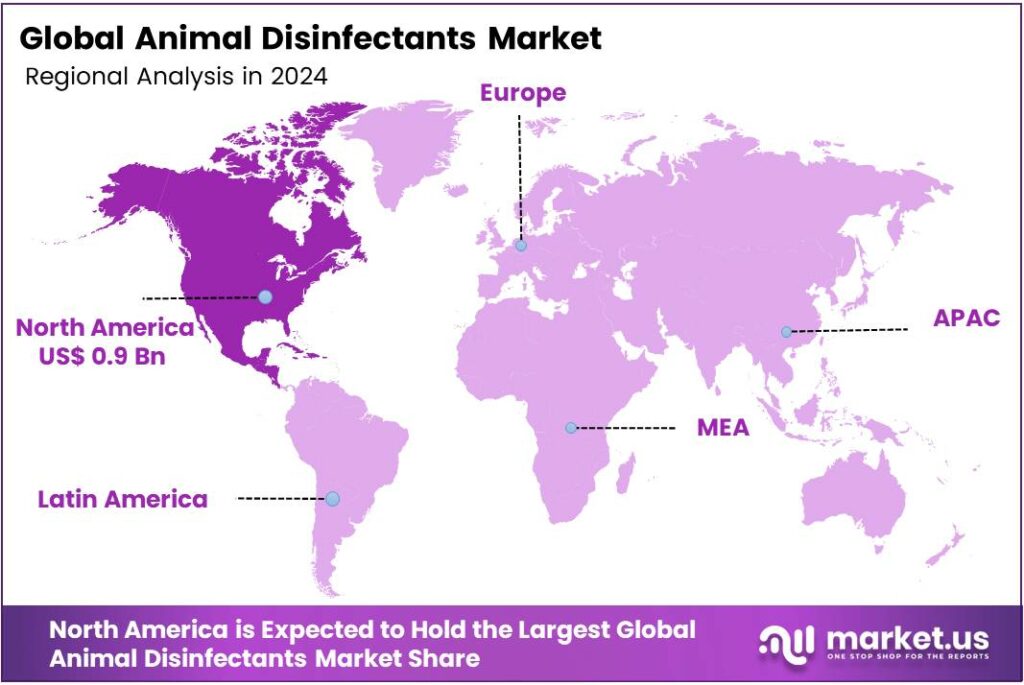

- North America led the market in 2024 with a 32.8% revenue share (USD 0.9 billion), fueled by strict biosecurity and intensive farming practices.

Analyst Viewpoint

The animal disinfectants market is poised for growth as global demand for biosecurity surges. Rising zoonotic disease outbreaks, such as avian influenza, drive the need for effective disinfectants in livestock and pet care. Developing regions like the Asia-Pacific and Latin America offer significant potential due to expanding livestock industries and increasing meat consumption.

Companies innovating in eco-friendly solutions, like biodegradable or lactic acid-based disinfectants, are well-positioned to capture consumer demand for sustainable products. Investing in animal disinfectants comes with challenges. Stringent regulations in North America and Europe require costly compliance with environmental and safety standards, which can strain smaller companies.

Consumer preference is shifting toward natural, non-toxic disinfectants, potentially reducing demand for chemical-based products. High R&D costs for innovative formulations and technologies may deter some players, while counterfeit products in emerging markets threaten brand integrity. Regulatory disparities across regions complicate global strategies, with developed markets enforcing strict rules and developing ones facing infrastructure gaps.

By Product

Alcohol-based Disinfectants Secure 19.8% Market Share

In 2024, Alcohol-based disinfectants held a dominant market position, capturing more than a 19.8% share in the animal disinfectants market. Their effectiveness against a wide range of bacteria, fungi, and viruses has made them a trusted solution for quick and reliable sanitation.

Farmers and animal health operators prefer alcohol-based formulations for their fast action, rapid drying, and ease of use, particularly in cleaning equipment, surfaces, and smaller enclosures where cross-contamination risks are high. The demand for alcohol-based disinfectants is expected to remain strong, supported by increasing awareness of biosecurity practices and the need for dependable hygiene solutions in both livestock and poultry farming.

These disinfectants are especially valued in situations where immediate results are necessary, making them suitable for high-risk environments. Moreover, their compatibility with modern farm management practices and minimal residue after application adds to their appeal.

By Animal Type

Livestock Animal Products Lead with 81.5% Market Share

In 2024, Livestock Animal held a dominant market position, capturing more than an 81.5% share in the animal disinfectants market. This strong presence highlights the critical role of disinfectants in ensuring the health and productivity of livestock, which form the backbone of the global food supply chain.

Farmers and producers are increasingly prioritizing biosecurity measures to prevent outbreaks of diseases such as avian influenza, foot-and-mouth disease, and African swine fever, driving consistent demand for disinfectant products. The rising global consumption of meat, milk, and other animal-derived food products has further supported this dominance, as livestock health directly impacts food safety and quality.

The livestock segment is expected to maintain its lead as large-scale farming operations and integrated poultry and dairy industries expand, especially in regions with high population growth and rising protein intake. The continued push from governments and international organizations to adopt stringent hygiene standards in animal farming is also reinforcing the market’s dependence on livestock-related disinfectants.

By Form

Liquid Form Leads with 58.3% Share

In 2024, Liquid held a dominant market position, capturing more than a 58.3% share in the animal disinfectants market. The preference for liquid disinfectants comes from their ease of application, strong penetration, and wide coverage, making them highly effective in maintaining hygiene across barns, poultry houses, and livestock facilities.

Farmers and producers often choose liquid forms because they can be sprayed, misted, or mixed with water, ensuring flexible use for both large- and small-scale operations. The year 2025 is expected to see continued reliance on liquid disinfectants as biosecurity standards become more stringent worldwide.

Rising concerns over disease outbreaks and cross-contamination in animal farming are driving producers toward convenient and reliable solutions, and liquid formulations provide a quick and efficient method of disinfection. Moreover, their compatibility with modern spraying equipment and automated sanitation systems enhances operational efficiency, which is especially critical for high-volume livestock and poultry farms.

By Application

Poultry Farm Applications Hold 31.7% Share

In 2024, Poultry Farm held a dominant market position, capturing more than a 31.7% share in the animal disinfectants market. The poultry sector has been at the center of disinfectant usage due to its high density of animal populations and the frequent risk of infectious diseases such as avian influenza, Newcastle disease, and Salmonella.

Maintaining strict hygiene in poultry houses, hatcheries, and feed areas has become essential to safeguard bird health and ensure consistent egg and meat production. This growing awareness has made poultry farms one of the largest consumers of disinfectant solutions.

The demand for disinfectants in poultry farming is expected to remain strong as global poultry production expands to meet rising consumer demand for affordable protein. The industry is witnessing stricter government regulations and biosecurity measures, pushing farmers to adopt advanced and regular disinfection practices.

By End User

Livestock Farms Lead with 49.0% Market Share

In 2024, Livestock Farms held a dominant market position, capturing more than a 49.0% share in the animal disinfectants market. The dominance of this segment is driven by the growing need to maintain clean and safe environments for cattle, swine, and other farm animals, where the risk of disease outbreaks is high.

Livestock farms require routine disinfection of housing areas, feeding equipment, and water systems to prevent the spread of infections that can affect both animal productivity and food safety. This has made disinfectants an essential part of daily farm management.

Livestock farms are expected to remain the largest end-user group as global demand for meat and dairy products continues to rise. Governments and industry bodies are also emphasizing strict biosecurity protocols, further encouraging livestock farms to adopt disinfectants as a standard measure for animal health protection.

Key Market Segments

By Product

- Alcohol-based Disinfectant

- Iodine-containing Disinfectant

- Aldehyde Disinfectant

- Peroxide Disinfectant

- Quaternary Ammonium Compounds

- Lactic Acid Disinfectant

- Others

By Animal Type

- Livestock Animal

- Companion Animal

By Form

- Liquid

- Powder

- Foam

- Others

By Application

- Poultry Farm

- Dairy Farming

- Aquaculture

- Swine

- Equine

- Others

By End User

- Livestock Farms

- Integrated Protein Processors

- Veterinary Clinics

- Animal Transport and Logistics

Drivers

The Rising Threat of Animal Diseases and Its Human Cost

A single, overwhelming driver for the increased global focus on animal disinfectants is the devastating economic and ethical impact of infectious disease outbreaks in livestock. This isn’t just about protecting agricultural profits; it’s about safeguarding global food security, preventing immense animal suffering, and protecting the livelihoods of farming families.

The numerical scale of this problem is staggering. The Food and Agriculture Organization of the United Nations (FAO) provides sobering data on the impact of these diseases. For instance, a 2021 report on African Swine Fever illustrates its ruinous effect.

The FAO states that ASF led to the loss of over 7 million pigs in Asia alone during its initial spread, devastating small-scale farmers whose lives and incomes depend on their livestock. Furthermore, the World Organisation for Animal Health (WOAH), an intergovernmental body setting international standards, emphasizes that avian influenza has resulted in the loss of hundreds of millions of birds worldwide in recent years through mortality and control measures.

Restraints

The Challenge of Proper Use and Training for Farmers

The reality for many farmers, especially those with smaller operations or in regions with limited resources, is that these powerful chemicals can be complicated, expensive, and even dangerous to handle. Getting it wrong doesn’t just waste money; it creates a false sense of security, leaving animals vulnerable to outbreaks that could have been prevented.

The proper process is more than just spraying; it involves a strict protocol of thorough cleaning of organic matter like manure and mud first, applying the exact right concentration of chemical, and ensuring the correct contact time on the surface. For a farmer already managing countless tasks, this complexity is a major restraint.

The Food and Agriculture Organization (FAO) of the United Nations has reported that outbreaks of Highly Pathogenic Avian Influenza (HPAI) have led to the loss of hundreds of millions of birds globally since the early 2000s. Many of these outbreaks trace back to breaches in basic biosecurity, a core component of which is disinfection.

Opportunity

Growing Consumer Demand for Ethical and Safe Food

A powerful force pushing the animal disinfectants market forward comes directly from the dinner table. People today are more connected to their food sources than ever before. They want to know that the meat, eggs, and dairy they buy for their families come from farms where animal welfare is a priority and safety is paramount. This isn’t a fleeting trend; it’s a fundamental shift in consumer consciousness.

The push for reducing antibiotics is a key part of this. The World Health Organization (WHO) strongly advocates for reducing the use of antimicrobials in farming to protect their effectiveness for human medicine. They highlight a sobering projection: if nothing changes, antimicrobial resistance could cause up to 10 million deaths per year.

This frightening possibility makes prevention absolutely critical. By using disinfectants to create cleaner and healthier living conditions for animals, farmers can drastically reduce the need to use antibiotics in the first place. This proactive approach is something consumers actively support. It aligns the well-being of the animal with the long-term health of the consumer, creating a powerful demand for robust biosecurity measures from farm to fork.

Trends

The Critical Shift Towards Preventing Zoonotic Diseases

A powerful new factor shaping the future of animal disinfectants is the urgent, global focus on preventing zoonotic diseases—those that jump from animals to humans. The COVID-19 pandemic served as a devastating, real-world lesson for everyone, from government leaders to everyday citizens, on how interconnected human and animal health truly are.

This understanding is driving a massive push towards stronger biosecurity on farms, which are often at the front line of emerging diseases. Disinfectants are now seen as a vital tool in a global early-warning system, a first line of defense to contain pathogens in animal populations before they ever have a chance to evolve and threaten people.

The data on the scale of this threat is compelling. The World Organisation for Animal Health (WOAH) states that a staggering 60% of known infectious diseases in humans are of animal origin, and this figure climbs to 75% for all new and emerging human diseases. These aren’t abstract statistics. They represent real outbreaks that disrupt lives and economies.

Regional Analysis

North America leads with a 32.8% share and a USD 0.9 Billion market value.

In 2024, North America emerged as the leading regional market for animal disinfectants, commanding an estimated 32.8% revenue share of USD 0.9 billion, driven by intensive livestock systems, stringent biosecurity norms, and high compliance across commercial poultry, swine, and dairy operations.

Demand is anchored by routine sanitation protocols in hatcheries, milking parlors, transport vehicles, and rendering facilities, with purchasing concentrated among integrated producers and contract growers who standardize chemistries across multi-site networks. Suppliers benefit from a mature distribution base, veterinary channels, farm co-ops, and specialty distributors supporting steady reorder cycles for quaternary ammonium compounds, iodophors, peroxygen blends, and broad-spectrum virucidal formulations.

Regulatory oversight covering label claims, residue tolerances, and worker safety sustains a preference for proven actives and validated contact times, while periodic disease events (notably avian influenza in poultry belts) keep sanitation spend resilient even when herd/flock margins tighten. Adoption is further reinforced by water quality management and foam/foam gel applications that improve surface coverage in high organic load environments typical of large barns.

The region is poised for mid single-digit growth as producers upgrade to rapid kill, lower corrosivity solutions, invest in precision dosing and automated dispensing, and expand winter disinfection protocols to reduce seasonal pathogen pressure. Canada’s supply chain modernization and cold weather housing bolster per animal usage rates, while Mexico’s scaling poultry and pork segments expand volume pull through vertically integrated complexes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Neogen Corporation specializes in comprehensive food safety and animal healthcare solutions. Its diverse portfolio includes advanced disinfectants effective against a broad spectrum of pathogens, catering to livestock, poultry, and aquaculture. With a strong focus on research and development, Neogen emphasizes innovative, sustainable, and user-friendly products.

Zoetis Inc. delivers a wide array of disinfectants under its hygiene and biosecurity segment. Its products are designed for livestock, poultry, and companion animals, focusing on preventing disease outbreaks and enhancing farm productivity. Leveraging scientific expertise and global commercial reach, Zoetis provides tailored solutions backed by technical support.

The Solvay Group is a key player in advanced chemical materials, offering high-performance disinfectant solutions for the animal health sector. Its product range includes potent, environmentally conscious chemistries, such as peroxygen and halogen-based compounds. Solvay’s expertise lies in developing efficient formulations that meet stringent regulatory standards while ensuring safety and sustainability.

Top Key Players in the Market

- Neogen Corporation

- Zoetis Inc.

- Solvay Group

- Kersia Group

- Steroplast Healthcare Limited

- GEA Group

- PCC Group

- G Sheperdanimal Health

- Sanosil Ag

- Delaval Inc

Recent Developments

- In 2024, Neogen has integrated sustainability into its operations, with a 2024 report highlighting efforts to reduce the environmental impact of its disinfectant production processes. This includes reformulating products to be more biodegradable while maintaining efficacy.

- In 2024, Zoetis introduced digital tools to complement its disinfectant offerings, such as farm management software that integrates biosecurity protocols. These tools help farmers monitor disinfectant application and compliance with health regulations.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Billion Forecast Revenue (2034) USD 6.0 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Alcohol-based Disinfectant, Iodine-containing Disinfectant, Aldehyde Disinfectant, Peroxide Disinfectant, Quaternary Ammonium Compounds, Lactic Acid Disinfectant, Others), By Animal Type (Livestock Animal, Companion Animal), By Form (Liquid, Powder, Foam, Others), By Application (Poultry Farm, Dairy Farming, Aquaculture, Swine, Equine, Others), By End User (Livestock Farms, Integrated Protein Processors, Veterinary Clinics, Animal Transport and Logistics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Neogen Corporation, Zoetis Inc., Solvay Group, Kersia Group, Steroplast Healthcare Limited, GEA Group, PCC Group, G Shepherd Animal Health, Sanosil Ag, Delaval Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Animal Disinfectants MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Animal Disinfectants MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Neogen Corporation

- Zoetis Inc.

- Solvay Group

- Kersia Group

- Steroplast Healthcare Limited

- GEA Group

- PCC Group

- G Sheperdanimal Health

- Sanosil Ag

- Delaval Inc