Global Aluminium Fluoride Market Size, Share Analysis Report By Type (Anhydrous, Dry, Wet), By Grade (Industrial Grade, Metallurgical Grade, High Purity Grade), By Application (Aluminum Production, Ceramics, Glass Manufacturing, Chemical Intermediates, Others), By End-Use (Automotive, Construction, Aerospace, Electronic, Chemicals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 151926

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

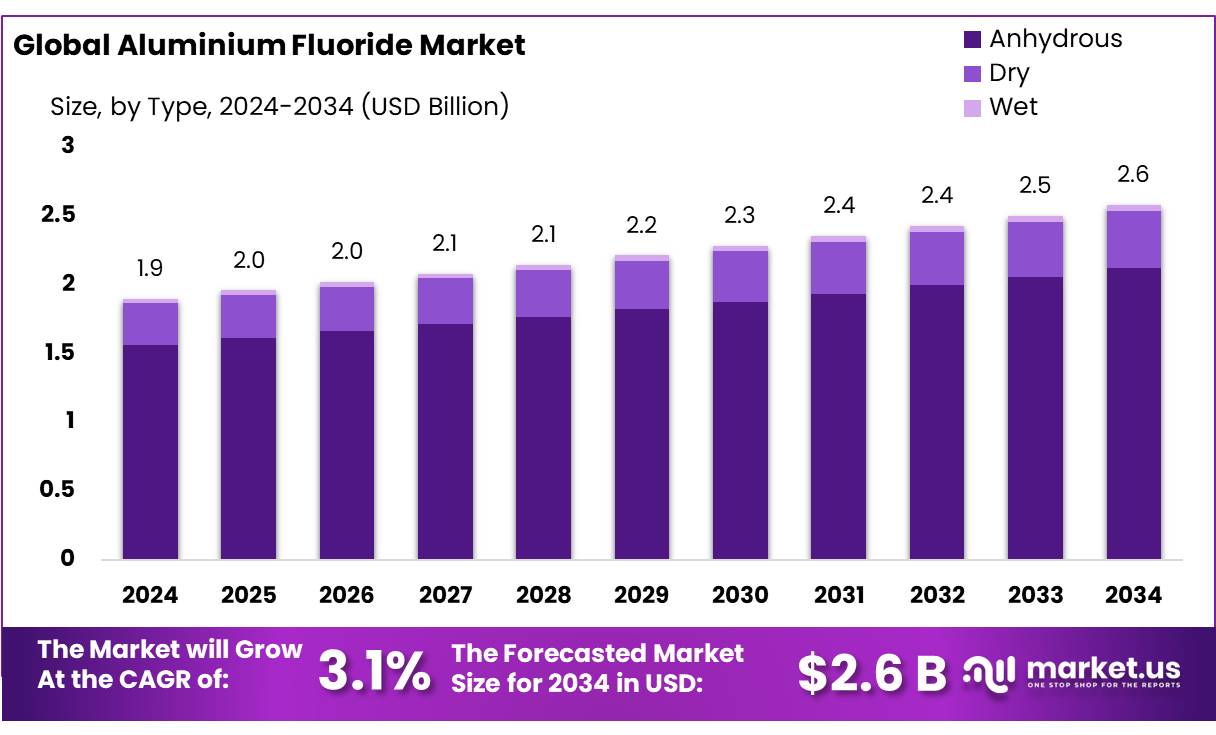

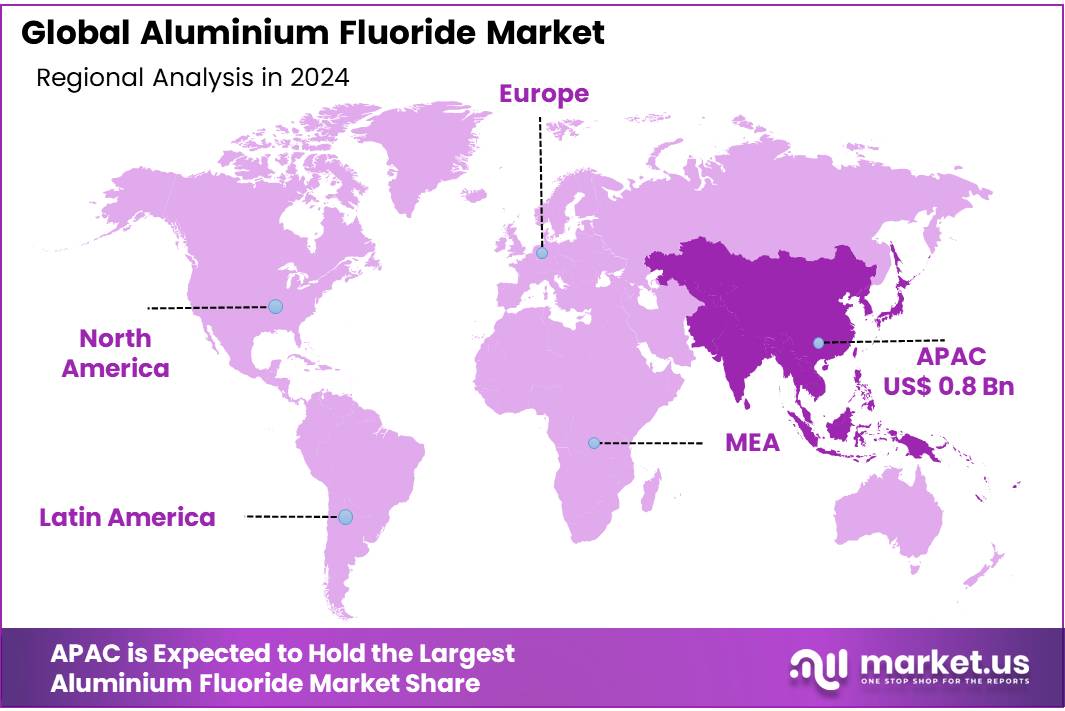

The Global Aluminium Fluoride Market size is expected to be worth around USD 2.6 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 3.1% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 45.7% share, holding USD 0.8 billion revenue.

Aluminium fluoride (AlF₃) is a white, granular compound integral to aluminium production and other industrial applications. As a key flux in electrolytic aluminium smelting, it lowers the melting point of alumina and enhances electrolyte conductivity. It also finds use in specialty glass, ceramics, pharmaceuticals, optical coatings, and fermentation control. The substance is produced primarily by reacting alumina with hydrogen fluoride at high temperatures

According to the International Aluminium Institute, global aluminium production reached approximately 60 million tonnes in 2023, a notable increase from previous years, which translates into a higher demand for aluminium fluoride. The production of aluminium fluoride is also significantly impacted by the price of aluminium, as it is closely tied to the economics of aluminium smelting.

Government policy and trade the Indian government reduced import duties on aluminium fluoride from 7.5% to 2.5% to alleviate cost pressures on domestic producers, where AlF contributes approximately 1.5% to aluminium production cost. Similar initiatives include reductions in duties on coal tar pitch. These measures support smelter expansion and increase AlF consumption.

Driving factors for the aluminium fluoride market include the growth of the aluminium industry, particularly in emerging markets. Countries like China, India, and Brazil have seen rapid industrialization, driving demand for aluminium-based products. The Chinese government, for instance, has implemented initiatives to increase aluminium production capacity and energy efficiency in the smelting process, which further accelerates the need for aluminium fluoride.

China alone accounts for over 50% of global aluminium fluoride consumption, with its aluminium production capacity reaching 40 million tonnes annually as of 2023. Similarly, government policies promoting infrastructure development, such as India’s National Infrastructure Pipeline (NIP), are expected to further fuel the demand for aluminium products and, consequently, aluminium fluoride.

Key Takeaways

- Aluminium Fluoride Market size is expected to be worth around USD 2.6 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 3.1%.

- Anhydrous Aluminium Fluoride held a dominant market position, capturing more than a 82.3% share of the total aluminium fluoride market.

- Industrial Grade Aluminium Fluoride held a dominant market position, capturing more than a 67.2% share of the global aluminium fluoride market.

- Aluminum Production held a dominant market position, capturing more than a 78.7% share of the overall aluminium fluoride market.

- Automotive held a dominant market position, capturing more than a 34.9% share in the global aluminium fluoride market.

- Asia-Pacific (APAC) region held a dominant position in the global aluminium fluoride market, capturing approximately 45.7% of the total market share, which translated to a valuation of around USD 0.8 billion.

By Type Analysis

Anhydrous Aluminium Fluoride dominates with 82.3% in 2024 due to its critical role in aluminium smelting.

In 2024, Anhydrous Aluminium Fluoride held a dominant market position, capturing more than a 82.3% share of the total aluminium fluoride market. This strong lead is primarily due to its essential application in the Hall-Héroult process for aluminium production, where it helps lower the melting point of alumina and improves electrolyte conductivity.

Industries across major aluminium-producing countries—including China, India, Russia, and the Gulf nations—have heavily depended on this compound to boost smelting efficiency and reduce energy costs. With aluminium demand continuing to rise globally, especially from construction, transportation, and packaging sectors, the consumption of anhydrous aluminium fluoride has followed suit.

By Grade Analysis

Industrial Grade Aluminium Fluoride leads with 67.2% in 2024, driven by its heavy use in aluminium smelting processes.

In 2024, Industrial Grade Aluminium Fluoride held a dominant market position, capturing more than a 67.2% share of the global aluminium fluoride market. This segment’s leadership is strongly supported by its wide-scale application in aluminium production, where it serves as a crucial additive in reducing the melting point of alumina during the smelting process. Aluminium producers across regions such as Asia-Pacific, the Middle East, and North America rely on industrial grade formulations due to their optimal balance of purity, performance, and cost.

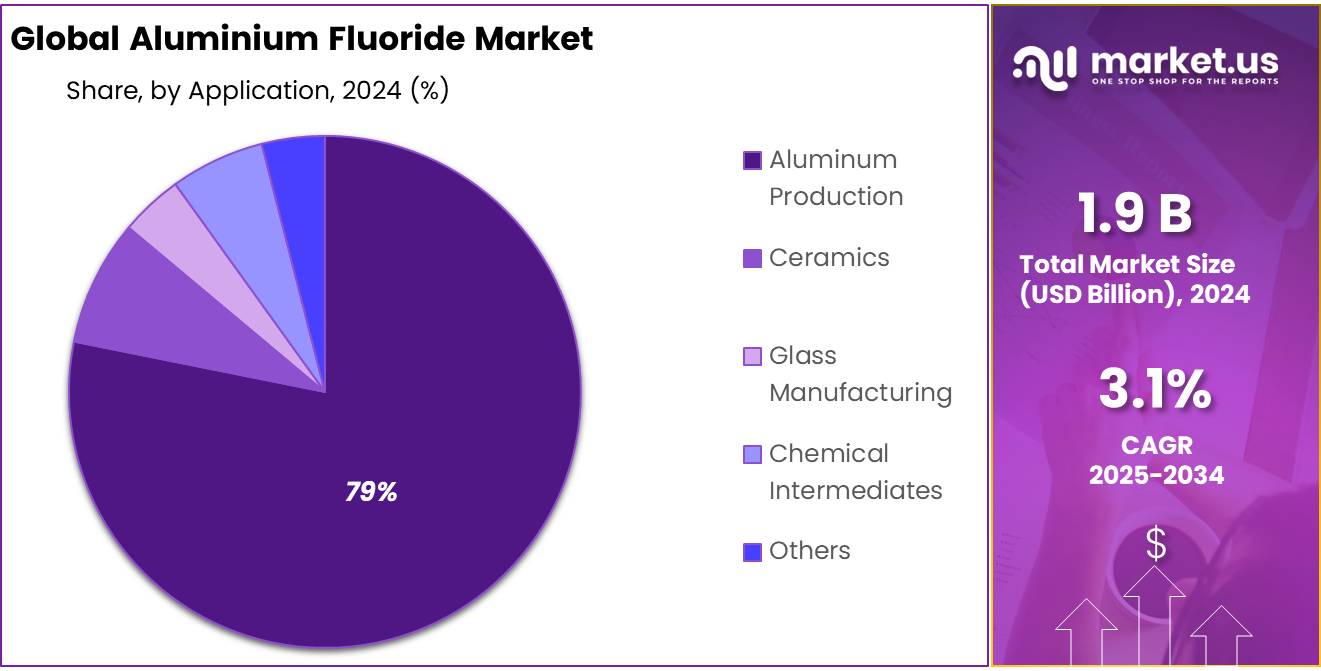

By Application Analysis

Aluminum Production dominates with 78.7% share in 2024, driven by its essential role in smelting operations.

In 2024, Aluminum Production held a dominant market position, capturing more than a 78.7% share of the overall aluminium fluoride market. This strong lead is directly linked to the compound’s primary use in the electrolytic production of aluminium, where it acts as a flux to lower the melting point of alumina and enhance electrical efficiency in the smelting process. The growing global demand for aluminium—used extensively in industries such as construction, automotive, aerospace, and packaging—has significantly boosted the requirement for aluminium fluoride in this application.

By End-Use Analysis

Automotive leads with 34.9% share in 2024, supported by rising demand for lightweight aluminium components.

In 2024, Automotive held a dominant market position, capturing more than a 34.9% share in the global aluminium fluoride market by end-use. This leadership is mainly driven by the growing use of aluminium in vehicle manufacturing, particularly in electric and hybrid cars where reducing vehicle weight is critical for improving battery efficiency and range. Aluminium fluoride plays an indirect yet essential role in this process by enabling the cost-effective production of primary aluminium through smelting.

Key Market Segments

By Type

- Anhydrous

- Dry

- Wet

By Grade

- Industrial Grade

- Metallurgical Grade

- High Purity Grade

By Application

- Aluminum Production

- Ceramics

- Glass Manufacturing

- Chemical Intermediates

- Others

By End-Use

- Automotive

- Construction

- Aerospace

- Electronic

- Chemicals

- Others

Emerging Trends

Surge in Demand for High-Purity Aluminium Fluoride

High-purity aluminium fluoride (AlF3) is essential in modern aluminium smelting, particularly in the production of lightweight aluminium alloys used in sectors like electric vehicles (EVs), aerospace, and renewable energy infrastructure. These industries require aluminium with minimal impurities to ensure optimal performance and energy efficiency.

Governments are also supporting this trend through initiatives that promote sustainable and energy-efficient manufacturing. Policies encouraging the use of advanced materials and technologies are fostering an environment conducive to the growth of high-purity aluminium fluoride.

Drivers

Increasing Demand for Aluminium in Key Industries

The growing demand for aluminium in key sectors such as transportation, packaging, and construction is a major driving factor for the Aluminium Fluoride market. Aluminium is known for its lightweight, strength, and durability, making it essential for industries looking to improve efficiency and reduce costs.

For example, the global automotive industry is shifting towards lighter vehicles to meet fuel efficiency standards, driving up aluminium consumption. According to the International Aluminium Institute, global aluminium demand is expected to grow by 5.7% per year, reaching 94 million tonnes by 2025. This directly impacts the aluminium smelting process, where Aluminium Fluoride plays a key role in improving the efficiency of electrolysis.

In addition to transportation, the packaging industry is also increasing its reliance on aluminium due to its recyclability and growing consumer preference for sustainable packaging solutions. The Aluminium Association reports that over 75% of aluminium ever produced is still in use, highlighting its growing importance in sustainable packaging. This trend is expected to continue, with the global aluminium packaging market projected to grow by 3.5% annually from 2023 to 2028, further boosting the demand for Aluminium Fluoride.

Restraints

Environmental Concerns and Regulatory Pressures

One of the major restraining factors for the Aluminium Fluoride market is the growing environmental concerns associated with its production and use. Aluminium Fluoride is essential in the aluminium smelting process, but its production can result in harmful emissions and waste products, such as greenhouse gases and acidic waste, which have been under increasing scrutiny. As industries worldwide focus on reducing their environmental footprint, stricter regulations are being implemented that directly affect the production and consumption of Aluminium Fluoride.

In Europe, the European Commission’s regulations under the REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) initiative are enforcing stricter limits on chemicals and materials used in industrial processes. For instance, Aluminium Fluoride is classified as a substance of concern due to its potential environmental impact, leading to a more rigorous approval process for new plants and facilities. These regulations aim to curb emissions and minimize environmental harm, making the process of producing Aluminium Fluoride more challenging and costly for manufacturers.

Furthermore, environmental groups and government agencies are pushing for cleaner production methods, which could increase operational costs for smelters. For example, the aluminium industry in the U.S. has been under pressure to adopt more energy-efficient and environmentally friendly technologies. The U.S. Environmental Protection Agency (EPA) has been working on regulating emissions from aluminium plants, which could raise operational costs and impact the demand for Aluminium Fluoride.

Opportunity

Expansion in the Electric Vehicle (EV) Industry

One of the significant growth opportunities for the Aluminium Fluoride market lies in the rising demand for electric vehicles (EVs). Aluminium is increasingly used in the production of EVs due to its lightweight properties, which enhance fuel efficiency and range. As the global shift towards greener transportation accelerates, the need for aluminium, and consequently for Aluminium Fluoride in the aluminium smelting process, is expected to grow significantly.

The International Energy Agency (IEA) reported that global electric car sales exceeded 10 million in 2022, marking a 55% increase from the previous year. This surge in electric vehicle production directly drives demand for aluminium in vehicle manufacturing. Aluminium is used extensively in the body, chassis, and battery components of EVs, and as more automakers adopt aluminium-intensive designs, Aluminium Fluoride’s role in aluminium production becomes even more critical.

Governments worldwide are supporting this shift with various initiatives, further creating opportunities for growth. For instance, the U.S. government’s recent efforts to provide tax credits for electric vehicles and the European Union’s Green Deal, which includes a plan to increase the share of EVs in new car sales to 30% by 2030, are expected to significantly boost aluminium demand. These policies not only promote EV adoption but also increase the need for aluminium, which in turn increases the requirement for Aluminium Fluoride in aluminium smelting operations.

Regional Insights

Asia-Pacific Leads the Aluminium Fluoride Market with 45.7% Share in 2024

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global aluminium fluoride market, capturing approximately 45.7% of the total market share, which translated to a valuation of around USD 0.8 billion.

This strong regional presence is largely attributed to the high concentration of aluminium smelters across countries such as China, India, Australia, and the Gulf nations, which drive substantial demand for aluminium fluoride as a critical additive in the electrolytic production of aluminium.

China, being the world’s largest aluminium producer, plays a central role in shaping APAC’s market dynamics. The country alone accounts for more than 55% of global aluminium production, generating significant downstream demand for aluminium fluoride to support its large-scale smelting operations.

India, another key contributor in the region, is experiencing rising aluminium demand due to expanding infrastructure projects, growth in electric vehicle production, and increased industrialisation. According to the Ministry of Mines (India), aluminium production in India reached nearly 4 million tonnes in FY2023–24, further amplifying the need for aluminium fluoride.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AB Lifosa is a leading producer of aluminium fluoride, specializing in the manufacture and supply of various grades of aluminium fluoride for the aluminium smelting industry. The company is known for its high-quality products, which are essential in the production of aluminium. AB Lifosa has a strong presence in the global market, with a focus on innovation and sustainable practices to meet the growing demands of the aluminium industry.

Alcore is a prominent player in the aluminium fluoride market, providing high-purity aluminium fluoride for the production of aluminium. The company focuses on delivering high-quality products and services to its clients in the aluminium industry. Alcore’s commitment to research and development ensures that its offerings meet the evolving needs of the market, with a particular emphasis on environmentally sustainable production methods and customer satisfaction.

Alufluoride Limited is a major supplier of aluminium fluoride and has established a significant footprint in the global market. The company produces high-purity aluminium fluoride to cater to the aluminium smelting and other related industries. Alufluoride is known for its focus on continuous improvement in its manufacturing processes and its efforts to meet the stringent demands of the aluminium industry, positioning itself as a leader in the market.

Top Key Players Outlook

- AB Lifosa

- Alcore

- Alufluoride Limited

- Belfert

- Do-Fluoride Chemicals Co., Ltd.

- Fluorsid S.p.A.

- Gulf Fluor

- Hunan Nonferrous Metals Corporation Limited

- Industries Chimiques du Fluor

- PT Petrokimia Gresik

- Rio Tinto

- SPIC

- Tanfac Industries Ltd

Recent Industry Developments

In 2024 AB Lifosa, produced approximately 21,000 tonnes of aluminium fluoride annually, representing a significant segment of its diversified chemical portfolio.

In 2024, Albemarle reported total revenues of USD 5.4 billion, with 36% of net sales generated from China—an important region for aluminium smelting operations.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Bn Forecast Revenue (2034) USD 2.6 Bn CAGR (2025-2034) 3.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Anhydrous, Dry, Wet), By Grade (Industrial Grade, Metallurgical Grade, High Purity Grade), By Application (Aluminum Production, Ceramics, Glass Manufacturing, Chemical Intermediates, Others), By End-Use (Automotive, Construction, Aerospace, Electronic, Chemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AB Lifosa, Alcore, Alufluoride Limited, Belfert, Do-Fluoride Chemicals Co., Ltd., Fluorsid S.p.A., Gulf Fluor, Hunan Nonferrous Metals Corporation Limited, Industries Chimiques du Fluor, PT Petrokimia Gresik, Rio Tinto, SPIC, Tanfac Industries Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AB Lifosa

- Alcore

- Alufluoride Limited

- Belfert

- Do-Fluoride Chemicals Co., Ltd.

- Fluorsid S.p.A.

- Gulf Fluor

- Hunan Nonferrous Metals Corporation Limited

- Industries Chimiques du Fluor

- PT Petrokimia Gresik

- Rio Tinto

- SPIC

- Tanfac Industries Ltd