Global Aluminium Caps and Closures Market Size, Share, And Business Benefits By Product Type (Roll-On-Pilfer-Proof, Easy open ends, Non-refillable closures, Others), By Material Type (Pure Aluminum, Aluminum Alloys), By Size (Size from 17mm to 53mm, Height from 6mm to 12mm), By End-use (Beverage, Pharmaceutical, Food, Home and personal care, Others), By Distribution channel (Direct Sales, Distributors, Retailers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: January 2025

- Report ID: 137113

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of Aluminium Caps and Closures

- By Product Type Analysis

- By Material Type Analysis

- By Size Analysis

- By End-Use Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

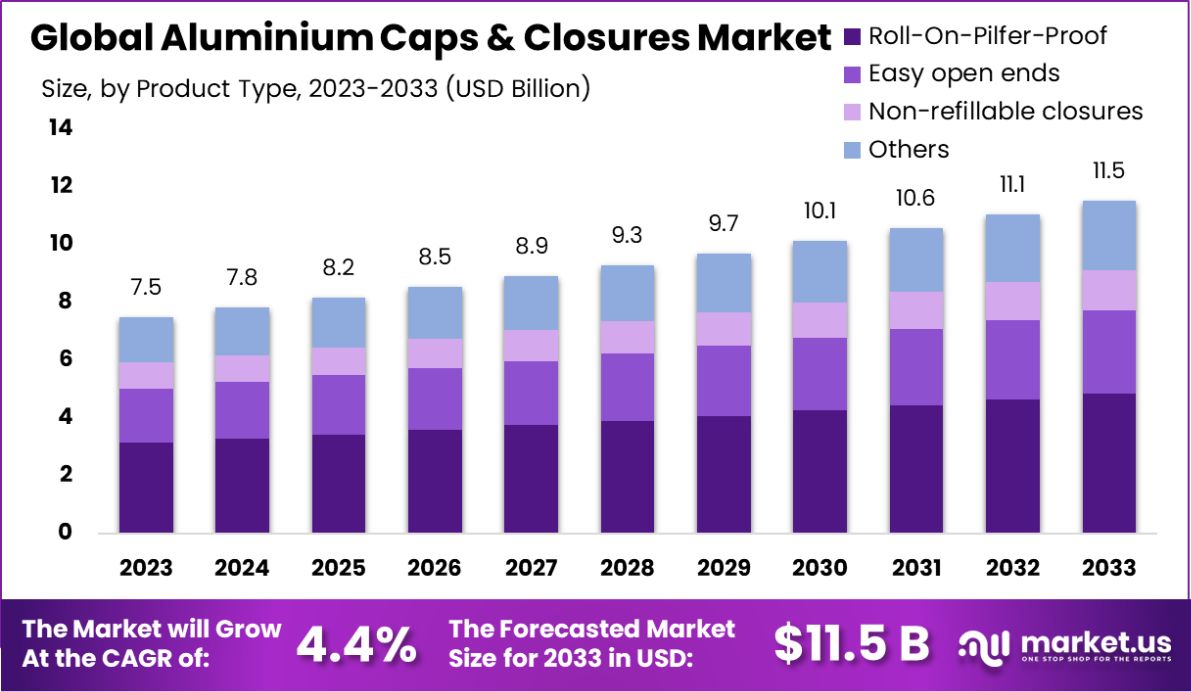

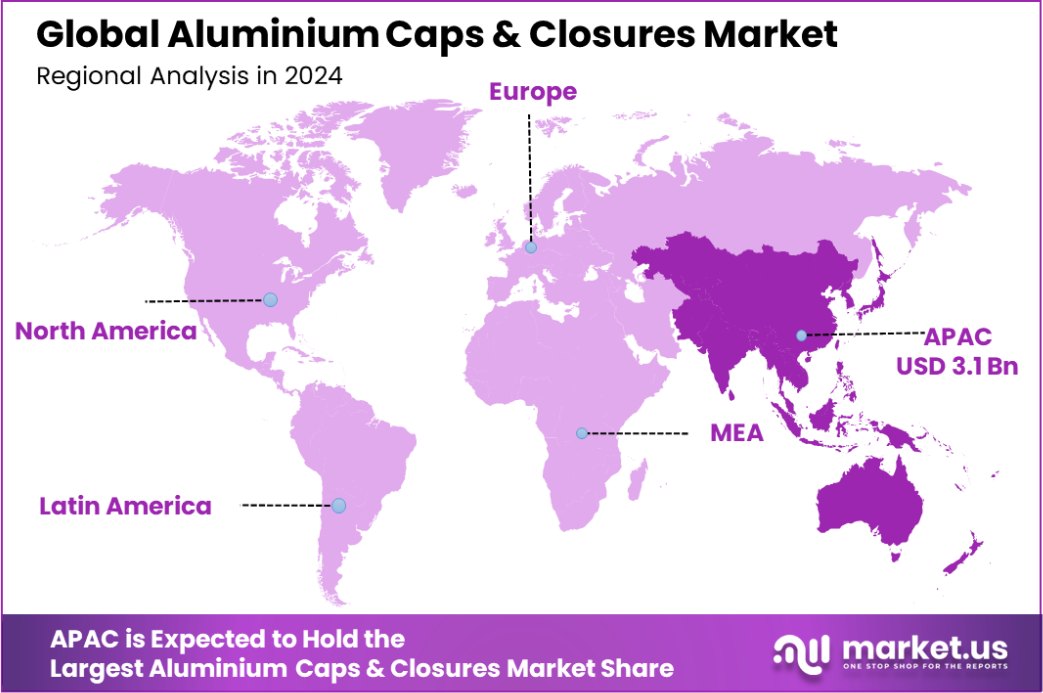

The Global Aluminium Caps and Closures Market is expected to be worth around USD 11.5 Billion by 2033, up from USD 7.5 Billion in 2023, and grow at a CAGR of 4.4% from 2024 to 2033. The Asia-Pacific aluminium caps and closures market holds 43.6%, valued at USD 3.1 billion.

Aluminium caps and closures are integral components in packaging, offering benefits such as durability, lightweight properties, and excellent barrier protection. These attributes make them indispensable in industries like food and beverage, pharmaceuticals, and cosmetics.

In India, the aluminium industry has witnessed significant growth. The Ministry of Mines reports that the country’s aluminium production capacity reached approximately 4.1 million tonnes in the fiscal year 2018-19, with major contributions from both the public and private sectors.

Several factors drive the demand for aluminium caps and closures. The food and beverage sector’s expansion, coupled with increasing consumer preference for convenient and safe packaging, has bolstered the need for reliable sealing solutions. Additionally, the pharmaceutical industry’s stringent requirements for contamination-free packaging further amplify this demand.

A notable trend in the aluminium caps and closures market is the emphasis on sustainability. Aluminium’s recyclability aligns with global environmental initiatives, promoting its use over less eco-friendly alternatives. The European Commission highlights that aluminium recycling saves up to 95% of the energy required for primary production, underscoring its environmental benefits.

The future of the aluminium caps and closures market appears promising. The Indian government’s initiatives, such as the “Housing for All by 2022” scheme, are expected to boost demand for household products, including aluminium utensils and related items. This, in turn, is likely to drive the growth of the aluminium industry, creating opportunities for manufacturers to expand their product lines and cater to the evolving market needs.

The aluminium caps and closures market is poised for sustained growth, driven by increasing demand for sustainable and recyclable packaging solutions across industries such as food and beverages, pharmaceuticals, and personal care. Aluminium’s high recyclability aligns with evolving consumer preferences for eco-friendly packaging, a trend further supported by regulatory initiatives and public funding aimed at bolstering recycling infrastructure.

According to the U.S. Environmental Protection Agency (EPA), the Solid Waste Infrastructure for Recycling (SWIFR) program allocated $58 million in September 2024 for community recycling projects, with an additional $20 million specifically directed toward Tribal and Intertribal Consortia.

Moreover, the Infrastructure Investment and Jobs Act earmarks $275 million for SWIFR grants between FY 2022 and 2026, providing $55 million annually. The EPA also received $5 million in FY 2024 to implement the SWIFR program. Such investments reinforce a circular economy model, amplifying demand for aluminium closures as a sustainable packaging choice.

Key Takeaways

- The Global Aluminium Caps and Closures Market is expected to be worth around USD 11.5 Billion by 2033, up from USD 7.5 Billion in 2023, and grow at a CAGR of 4.4% from 2024 to 2033.

- Roll-on-pilfer-proof aluminum caps and closures hold a 41.1% share, dominating the product segment significantly.

- Pure aluminum leads the material type category with a commanding 68.1% market share.

- Aluminum caps ranging from 17mm to 53mm comprise 72.1%, catering to versatile packaging needs.

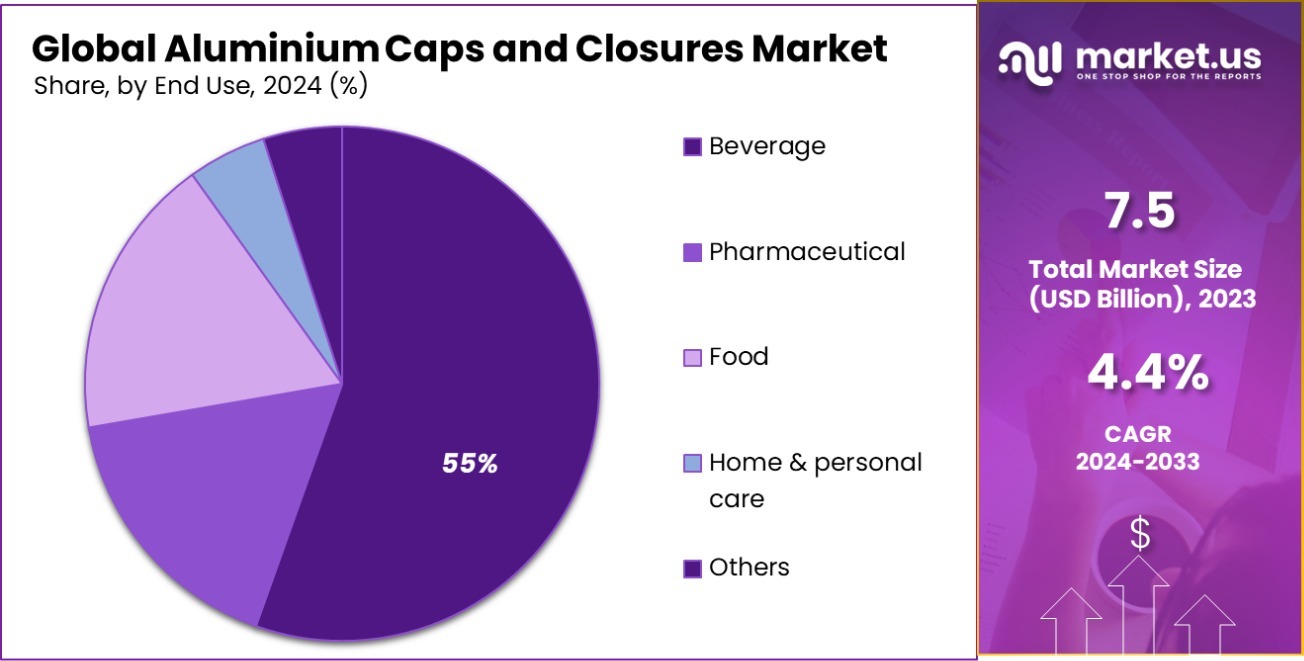

- Beverages remain the leading end-use category, accounting for 56.1% of aluminum caps and closures demand.

- Direct sales channel captures 47.3%, streamlining aluminum caps and closing supply to key industry stakeholders.

- The Asia-Pacific aluminium caps and closures market accounts for 43.6%, valued at USD 3.1 billion.

Business Benefits of Aluminium Caps and Closures

Aluminium caps and closures are gaining traction in the global packaging industry due to their numerous business benefits, supported by data from government and industry sources.

According to reports from the U.S. Environmental Protection Agency (EPA) and the European Aluminium Association, aluminium packaging offers a high recycling rate, exceeding 70% globally, reducing production costs and ensuring sustainability. This aligns with government directives promoting circular economies and environmental responsibility.

Aluminium caps are lightweight, which minimizes transportation costs and carbon emissions. Their excellent barrier properties extend shelf life, preserving product quality by protecting against moisture, oxygen, and contaminants. This is particularly vital for sectors such as food, beverage, and pharmaceuticals. For businesses, this means reduced product wastage and enhanced customer satisfaction.

Additionally, aluminium closures are tamper-evident, meeting stringent safety standards mandated by regulatory bodies. This enhances consumer trust and compliance with government safety guidelines. They are also versatile, compatible with various packaging formats, offering businesses flexibility in design and branding.

Government-backed initiatives to reduce single-use plastics further drive the demand for aluminium closures, as they are seen as a viable alternative. For businesses, adopting aluminium caps and closures aligns with sustainability goals, regulatory compliance, and cost efficiency, fostering long-term growth.

By Product Type Analysis

Roll-on-pilfer-proof caps dominate the aluminum closures market globally.

In 2023, the Aluminium Caps and Closures Market was led by Roll-On-Pilfer-Proof (ROPP) caps, which captured a dominant 41.1% market share in the By Product Type segment. These caps are favored for their tamper-evidence and cost-effectiveness, making them highly preferred in industries requiring secure packaging solutions, such as beverages and pharmaceuticals.

Following ROPP, Easy Open Ends accounted for a significant portion of the market. These closures are designed for consumer convenience, allowing easy access to canned products without the need for additional tools. Their adoption has been driven by the growing demand for user-friendly packaging in the food and beverage sector. Non-refillable closures also held a notable position in the market.

These are primarily used to prevent product tampering and ensure product integrity, especially in the spirits and pharmaceutical industries. The use of non-refillable closures is encouraged by regulatory standards aiming to enhance consumer safety and product authenticity.

Together, these segments illustrate a diverse and evolving landscape within the Aluminium Caps and Closures Market, reflecting ongoing shifts toward safety, convenience, and sustainability in packaging.

By Material Type Analysis

Pure aluminum holds the largest share in this industry segment.

In 2023, Pure Aluminum held a dominant market position in the By Material Type segment of the Aluminium Caps and Closures Market, capturing a 68.1% share. This material is highly favored for its exceptional corrosion resistance, lightweight nature, and complete recyclability, making it a preferred choice across various industries including food, beverages, and pharmaceuticals.

Following Pure Aluminum, Aluminum Alloys also made a significant impact in the market. These alloys are engineered to include elements such as magnesium, silicon, and zinc, which enhance the mechanical properties and durability of aluminum.

Aluminum Alloys are particularly valued in applications requiring robust, yet lightweight caps and closures, such as in automotive fluids and agrochemicals. Their usage reflects industry trends focusing on enhancing the strength and versatility of packaging solutions while maintaining the lightweight characteristic of aluminum.

Together, Pure Aluminum and Aluminum Alloys represent key components of the Aluminium Caps and Closures Market, each serving distinct market needs and applications. Their combined attributes of durability, lightness, and sustainability continue to drive their adoption in a market increasingly focused on efficient and environmentally friendly packaging solutions.

By Size Analysis

Closures sized between 17mm and 53mm cater to most demand.

In 2023, sizes from 17mm to 53mm held a dominant market position in the By Size segment of the Aluminium Caps and Closures Market, commanding a 72.1% share. This range is particularly popular due to its versatility across various bottleneck specifications and its suitability for a wide array of products, from beverages and food to pharmaceuticals and personal care items.

The dominance of this size range is attributable to its ability to provide a secure seal, essential for preserving the integrity and extending the shelf life of contained products.

Following closely, the Height from 6mm to 12mm segment also plays a crucial role in the market. This height range is optimal for ensuring tight fit and efficient sealing capabilities, which are paramount in preventing leaks and contamination. It is especially preferred in industries where the safety and purity of the contents are a priority, such as in the medical and cosmetic sectors.

Together, the specified sizes and heights in the Aluminium Caps and Closures Market illustrate a focused demand for customization and precision in packaging solutions. These dimensions support the industry’s need for functional, reliable, and consumer-friendly closures, reinforcing the trend toward more secure and practical packaging options.

By End-Use Analysis

Beverage applications drive over half of aluminum caps’ market share.

In 2023, the Beverage sector held a dominant market position in the By End-Use segment of the Aluminium Caps and Closures Market, with a commanding 56.1% share. This segment benefits significantly from the use of aluminium caps and closures, which provide effective tamper evidence, maintain beverage integrity, and offer a high degree of recyclability.

The preference for aluminum in beverages, ranging from carbonated drinks to alcoholic beverages and juices, is driven by the need for lightweight, durable, and cost-effective sealing solutions.

Following the Beverage sector, the Pharmaceutical industry also relies heavily on aluminium caps and closures to ensure product safety and compliance with stringent packaging regulations. These closures provide effective barriers against contamination and extend the shelf life of medicinal products.

The Food sector, also makes extensive use of aluminium closures, especially in processed and ready-to-eat food items, leveraging the material’s ability to prevent spoilage and maintain freshness.

Lastly, the Home and Personal Care industry utilizes aluminium caps and closures for their aesthetic appeal and functional benefits, such as providing a premium look while ensuring the longevity of the products.

Together, these segments underscore the critical role of aluminium caps and closures in diverse industries, each emphasizing different aspects of functionality and design tailored to specific market needs.

By Distribution Channel Analysis

Direct sales account for nearly half of all product transactions.

In 2023, Direct Sales held a dominant market position in the By Distribution Channel segment of the Aluminium Caps and Closures Market, with a 47.3% share. This channel’s leading status can be attributed to its ability to facilitate direct interaction between manufacturers and large-volume buyers like beverage companies, food producers, and pharmaceutical firms.

Direct sales enable manufacturers to tailor their offerings to specific customer requirements, ensuring precise specifications are met and enhancing customer satisfaction through personalized service.

Following Direct Sales, Distributors also played a crucial role in the market, acting as intermediaries that add value through logistical support, market penetration, and localized customer service. Distributors help expand the reach of aluminium cap and closure manufacturers, particularly in geographically dispersed markets where direct sales are less viable.

Retailers, though holding a smaller share compared to the other channels, are instrumental in reaching small businesses and end-users who require lower volumes of caps and closures. Retailers provide accessibility to a diverse customer base, offering ready availability and convenience.

Together, these distribution channels support the aluminium caps and closures industry by connecting manufacturers with a broad spectrum of customers, each channel catering to different segments of the market based on volume needs and purchasing preferences.

Key Market Segments

By Product Type

- Roll-On-Pilfer-Proof

- Easy open ends

- Non-refillable closures

- Others

By Material Type

- Pure Aluminum

- Aluminum Alloys

By Size

- Size from 17mm to 53mm

- Height from 6mm to 12mm

By End-use

- Beverage

- Pharmaceutical

- Food

- Home and personal care

- Others

By Distribution channel

- Direct Sales

- Distributors

- Retailers

Driving Factors

Increased Demand for Sustainable Packaging Solutions

The Aluminium Caps and Closures Market is significantly driven by the increasing demand for eco-friendly packaging solutions. Aluminium, being highly recyclable and durable, offers an attractive option for companies aiming to reduce their environmental footprint.

As consumers become more environmentally conscious, the preference for sustainable materials in packaging continues to rise, boosting the adoption of aluminium caps and closures across various industries, including food, beverage, and pharmaceuticals.

Growth in Beverage Industry Requirements

Aluminium caps and closures have seen a surge in demand paralleling the growth of the beverage industry. These closures are essential for ensuring product integrity, extending shelf life, and providing tamper evidence in beverages ranging from soft drinks to alcoholic drinks.

As the beverage sector expands, driven by changing consumer preferences and the introduction of new products, the need for reliable and cost-effective aluminium closures continues to escalate, further propelling market growth.

Technological Advancements in Closure Solutions

Technological innovations in the production and design of aluminium caps and closures have been a key factor driving market growth. Advances such as improved sealing techniques and the development of customizable closure designs enhance product appeal and functionality.

These innovations not only improve the efficiency of production processes but also meet the evolving needs of end-users in terms of convenience, safety, and product differentiation, significantly influencing market dynamics.

Restraining Factors

Competition from Alternative Closure Materials

One of the major restraining factors for the Aluminium Caps and Closures Market is the competition from alternative materials like plastics and composites. These materials often offer cost advantages and versatility in terms of design and functionality.

Plastics, in particular, are lightweight and can be engineered to mimic various textures and appearances, which can be more appealing in consumer-driven markets such as cosmetics and personal care products. This competition can limit the growth of aluminium closures in segments where cost and aesthetic versatility are prioritized over sustainability.

Fluctuating Raw Material Prices

The volatility of aluminium prices poses a significant challenge to the stability of the Aluminium Caps and Closures Market. Fluctuating raw material costs can lead to inconsistent pricing of finished products, complicating budgeting and financial planning for manufacturers.

This unpredictability can deter potential customers, particularly small and medium enterprises, from committing to aluminium closures, opting instead for more economically stable alternatives. The impact of these fluctuations is felt across the supply chain, affecting profitability and operational efficiency.

Regulatory and Environmental Compliance Costs

Compliance with stringent environmental and safety regulations can also restrain market growth for aluminium caps and closures. The production process for aluminium involves significant energy consumption and can lead to environmental degradation if not managed properly.

Adhering to regulations aimed at reducing environmental impact often requires substantial investments in cleaner technologies and practices. These additional costs can be prohibitive for manufacturers, especially in regions with strict environmental controls, potentially limiting market expansion and innovation in the aluminium caps and closures sector.

Growth Opportunity

Expansion into Emerging Markets with Rising Consumer Goods Demand

The Aluminium Caps and Closures Market has significant growth opportunities in emerging markets, where rising incomes and changing lifestyles are increasing the demand for consumer goods, including beverages and pharmaceuticals.

These markets present a fertile ground for expansion as the increasing consumer base demands higher quality and more secure packaging. By entering these regions, manufacturers can leverage lower operational costs and potentially less stringent regulatory environments to increase their market share and profitability.

Innovations in Product Design and Functionality

Innovative product designs that enhance functionality and consumer appeal present a major growth opportunity for the Aluminium Caps and Closures Market. By developing closures that are easier to open, resealable, or offer enhanced tamper-evidence, manufacturers can cater to the growing consumer demand for convenience and safety.

Additionally, incorporating smart technologies such as QR codes and NFC (Near Field Communication) tags can add value to products, enabling brand owners to engage more effectively with end-users and track products through supply chains.

Integration of Sustainable Practices in Production

There is a growing trend towards sustainability within the packaging industry, which represents a substantial opportunity for growth in the Aluminium Caps and Closures Market. By investing in sustainable production practices, such as using recycled materials and reducing energy consumption, manufacturers can not only reduce their environmental impact but also attract customers who are increasingly prioritizing eco-friendly products.

Additionally, such practices can lead to cost savings in the long term through efficiencies and compliance with global environmental standards, enhancing brand reputation and customer loyalty.

Latest Trends

Rising Preference for Eco-Friendly Packaging Solutions

A significant trend in the Aluminium Caps and Closures Market is the increasing consumer and regulatory push towards more sustainable packaging options. Aluminium, being highly recyclable, is gaining favor over less sustainable materials like single-use plastics.

This shift is not only driven by consumer awareness but also by stricter environmental regulations globally. Manufacturers are responding by investing in new recycling technologies and designing products that better facilitate the circular economy, enhancing their appeal to environmentally conscious consumers and businesses.

Adoption of Smart Packaging Technologies

Smart packaging technologies are becoming increasingly popular in the Aluminium Caps and Closures Market. Features such as QR codes, RFID tags, and sensors are being integrated into aluminium closures to provide added functionalities like track and trace, product authentication, and consumer engagement.

These technologies enable brands to enhance the consumer experience by offering interactive content, detailed product information, and personalized communication, thereby increasing brand loyalty and product security.

Shift Towards Customization and Personalization

There is a growing trend towards the customization and personalization of aluminium caps and closures to meet specific customer needs and preferences. Manufacturers are offering a wider range of colors, shapes, and printing options to cater to diverse markets and help brands stand out on shelves.

This trend is particularly evident in sectors such as beverages and cosmetics, where packaging differentiation is a key competitive strategy. Such customization allows brands to align more closely with consumer identities and preferences, further driving consumer interest and sales.

Regional Analysis

The Asia-Pacific region holds 43.6% of the aluminum caps and closures market, valued at USD 3.1 billion.

The Aluminium Caps and Closures Market exhibits diverse regional dynamics, with Asia-Pacific leading the charge, accounting for 43.6% of the market share and valued at USD 3.1 billion. This dominance is attributed to rapid industrialization, expanding consumer goods sectors, and significant investments in food and beverage, pharmaceutical, and personal care industries in countries like China, India, and Japan.

North America also represents a substantial market segment, driven by stringent food safety and drug regulations that necessitate reliable sealing solutions. The demand in Europe is bolstered by a strong emphasis on sustainable packaging solutions and high consumer awareness regarding environmental issues, which fuels the adoption of recyclable aluminium closures.

Conversely, Latin America and the Middle East & Africa, though smaller in market size, are experiencing growth due to increasing urbanization and the gradual expansion of manufacturing capabilities. These regions are seeing rising demand in the beverage sector and a growing focus on quality packaging in the pharmaceutical and cosmetic industries.

Each region’s unique economic and regulatory landscapes shape their respective market characteristics, with Asia-Pacific currently leading in both market share and growth potential within the global Aluminium Caps and Closures Market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global aluminium caps and closures market in 2023 is characterized by strong competition among major players, each leveraging distinct strategies to capture market share. Leading companies such as Crown Holdings, Inc., Silgan Holdings, and Amcor continue to dominate with extensive global reach, innovative technologies, and large-scale production capabilities.

Guala Closure and Herti JSC are key players in the European market, focusing on high-quality, customizable closure solutions. These companies have managed to build strong customer relationships by offering tailored solutions for a wide range of industries, including beverages, pharmaceuticals, and cosmetics.

Smaller but significant players like Alcopack, Torrent Closures, and Cap & Seal Pvt Ltd are gaining traction by targeting emerging markets in Asia and Africa. These companies focus on offering cost-effective, high-quality products while establishing robust distribution networks.

Companies such as Federfin Tech S.R.L, DYZDN Metal Packaging, and Shangyu Sanyou Electro-Chemical Aluminium Products are driving innovation in closure design and manufacturing techniques, with an emphasis on enhancing product functionality and durability.

Meanwhile, Indian players like Alupac-India, Alutop, and Manaksia Limited are capitalizing on the growing demand for aluminium closures in the domestic market, while expanding their footprint internationally.

Top Key Players in the Market

- Crown Holdings, Inc.

- Silgan Holdings.

- Amcor

- Guala Closure

- Alcopack

- Herti JSC

- Torrent Closures

- Cap & Seal Pvt Ltd

- Federfin Tech S.R.L

- Osias Berk

- ITC Packaging

- DYZDN Metal Packaging

- Shangyu Sanyou Electro-Chemical Aluminium Products

- Alameda Packaging

- EMA Pharmaceuticals

- Alupac-India

- Alutop

- Helicap Closures

- Manaksia Limited

Recent Developments

- In 2024, Crown Holdings, Inc. enhanced aluminum caps and closures with innovative tamper-evident designs and sustainability-focused solutions. Increased North American shipments of beverage and food cans boosted sales to $3,074 million, reflecting strong market demand and product advancements.

- In 2023, Silgan Holdings, a global leader in rigid packaging, specializes in aluminum caps and closures for food and beverages. With $6 billion in sales, they emphasized sustainability and innovation, advancing eco-friendly, endlessly recyclable packaging solutions for consumer goods.

Report Scope

Report Features Description Market Value (2023) USD 7.5 Billion Forecast Revenue (2033) USD 11.5 Billion CAGR (2024-2033) 4.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Roll-On-Pilfer-Proof, Easy open ends, Non-refillable closures, Others), By Material Type (Pure Aluminum, Aluminum Alloys), By Size (Size from 17mm to 53mm, Height from 6mm to 12mm), By End-use (Beverage, Pharmaceutical, Food, Home and personal care, Others), By Distribution channel (Direct Sales, Distributors, Retailers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Crown Holdings, Inc., Silgan Holdings., Amcor, Guala Closure, Alcopack, Herti JSC, Torrent Closures, Cap & Seal Pvt Ltd, Federfin Tech S.R.L, Osias Berk, ITC Packaging, DYZDN Metal Packaging, Shangyu Sanyou Electro-Chemical Aluminium Products, Alameda Packaging, EMA Pharmaceuticals, Alupac-India, Alutop, Helicap Closures, Manaksia Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aluminium Caps and Closures MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Aluminium Caps and Closures MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Crown Holdings, Inc.

- Silgan Holdings.

- Amcor

- Guala Closure

- Alcopack

- Herti JSC

- Torrent Closures

- Cap & Seal Pvt Ltd

- Federfin Tech S.R.L

- Osias Berk

- ITC Packaging

- DYZDN Metal Packaging

- Shangyu Sanyou Electro-Chemical Aluminium Products

- Alameda Packaging

- EMA Pharmaceuticals

- Alupac-India

- Alutop

- Helicap Closures

- Manaksia Limited