Global Freeze-dried Food Market By Product Type (Fruits, Vegetables, Meat and Poultry, Seafood, Dairy Products, Other Product Types), By Form (Whole, Cuts and Flakes, Powdered), By End Use (Food Service, Retail), By Distribution Channel (B2B, B2C), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145567

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

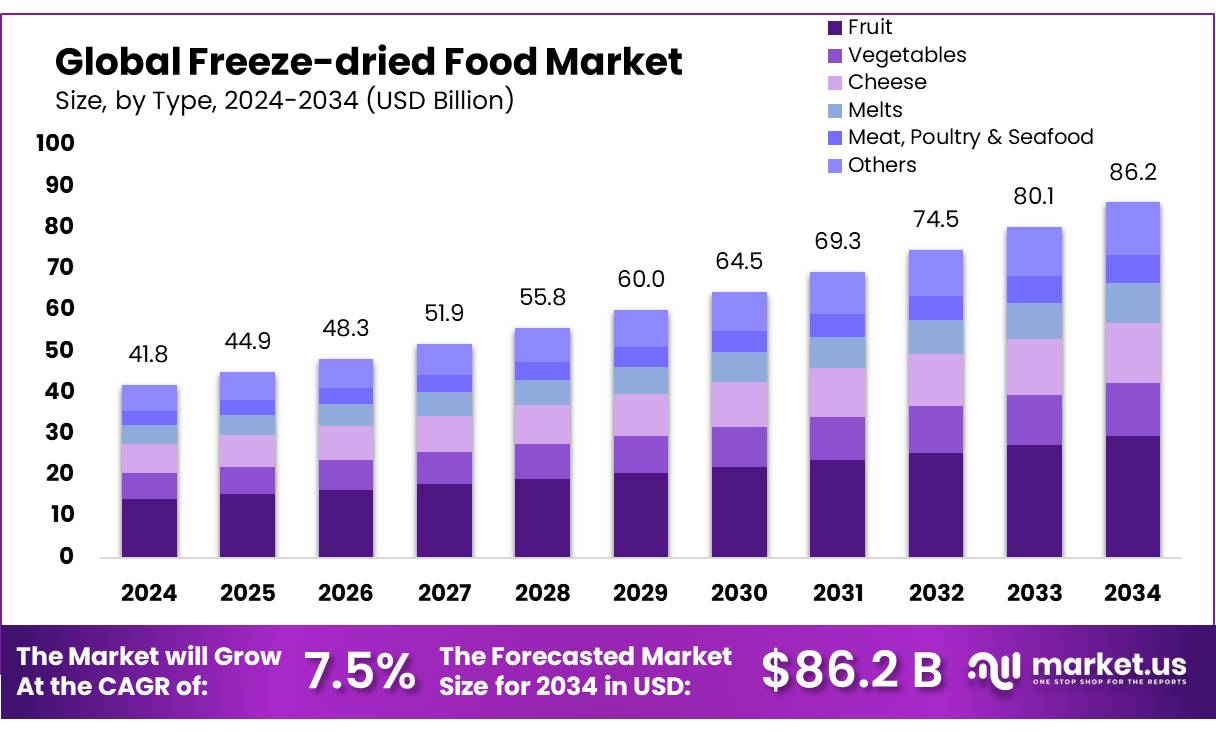

The Global Freeze-dried Food Market size is expected to be worth around USD 86.2 Bn by 2034, from USD 41.8 Bn in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034.

Freeze-dried food, also known as lyophilization or cryodesiccation, involves a dehydration process typically used to preserve perishable materials, enhancing the shelf life of products without compromising nutritional value. This process is widely used in various sectors such as space missions, pharmaceuticals, and the food and beverage industry. The global interest in freeze-dried foods has been growing due to the expanding demand for durable yet nutritious food options among consumers leading a fast-paced lifestyle.

The freeze-dried food is promising, backed by significant technological advancements and increasing investments in food processing technology. Key players in the food sector, like Nestlé and Unilever, report a substantial portion of their R&D investments directed towards improving freeze-drying techniques. For instance, Nestlé allocated approximately $2.1 billion towards R&D in 2020, a portion of which specifically targeted enhancements in freeze-drying processes to optimize texture and nutritional content in their range of products.

Driving factors for the market include the rising demand for preserved food with extended shelf life and minimal loss of flavor and nutritional quality. The trend towards convenience foods among the global populace, particularly in urban areas where time is a premium, is also a significant driver. The market is further bolstered by the increasing prevalence of outdoor activities like camping and hiking, where lightweight, easy-to-carry food options are preferred. According to a report from the Department of Agriculture, the U.S. saw a 5% increase in camping activities in 2021, which indirectly boosts the demand for freeze-dried food products.

Government initiatives across various regions have also supported the freeze-dried food industry. In the European Union, for example, food preservation technologies including freeze-drying have been encouraged through funding and subsidies under the Common Agricultural Policy (CAP), which allocated €4 billion in 2020 to support food innovation and sustainability projects. This funding aims to improve food processing techniques and promote the sustainability of food resources.

Future growth opportunities in the freeze-dried food industry look robust, driven by an increase in strategic partnerships and technological innovations. Companies are increasingly collaborating with biotechnological firms to enhance the efficiency of the freeze-drying process and develop better preservation solutions that could further penetrate health-conscious consumer segments.

Key Takeaways

- Freeze-dried Food Market size is expected to be worth around USD 86.2 Bn by 2034, from USD 41.8 Bn in 2024, growing at a CAGR of 7.5%.

- Fruit segment held a dominant position in the freeze-dried food market, capturing more than a 34.20% share.

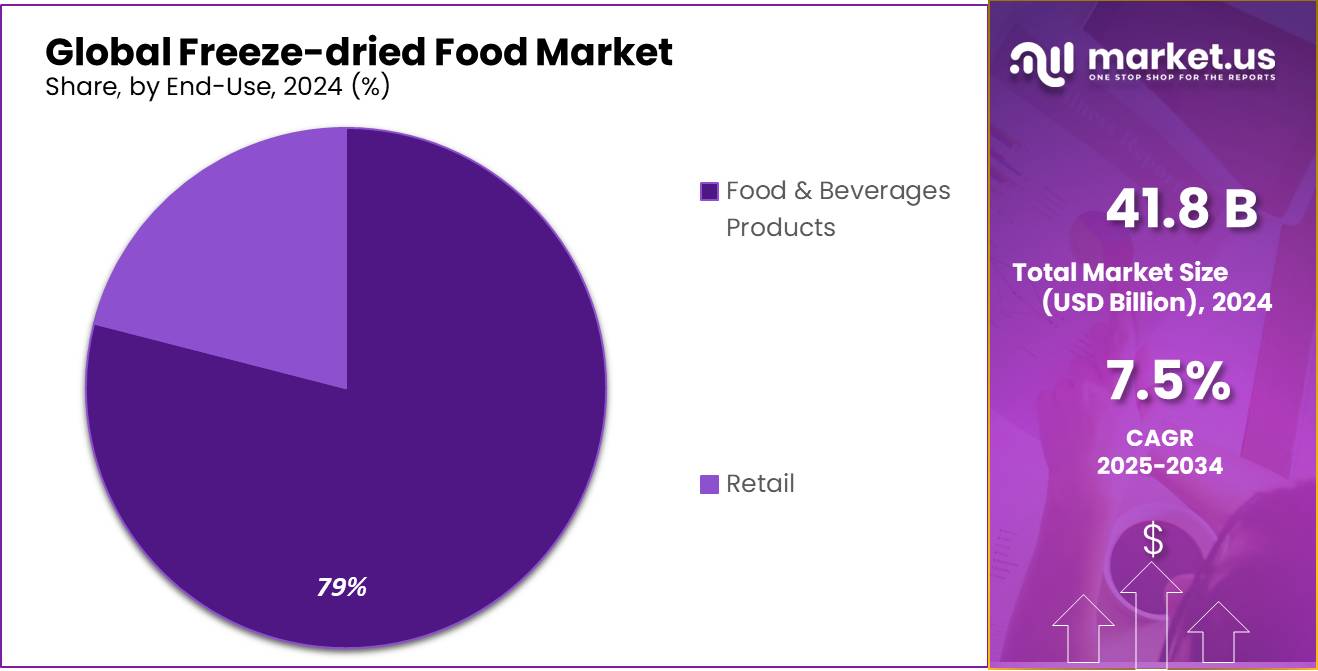

- Food Service Products in the freeze-dried food market held a dominant market position, capturing more than a 79.20% share.

- Business-to-Business (B2B) distribution channel for freeze-dried food secured a dominant market position, capturing more than a 59.20% share.

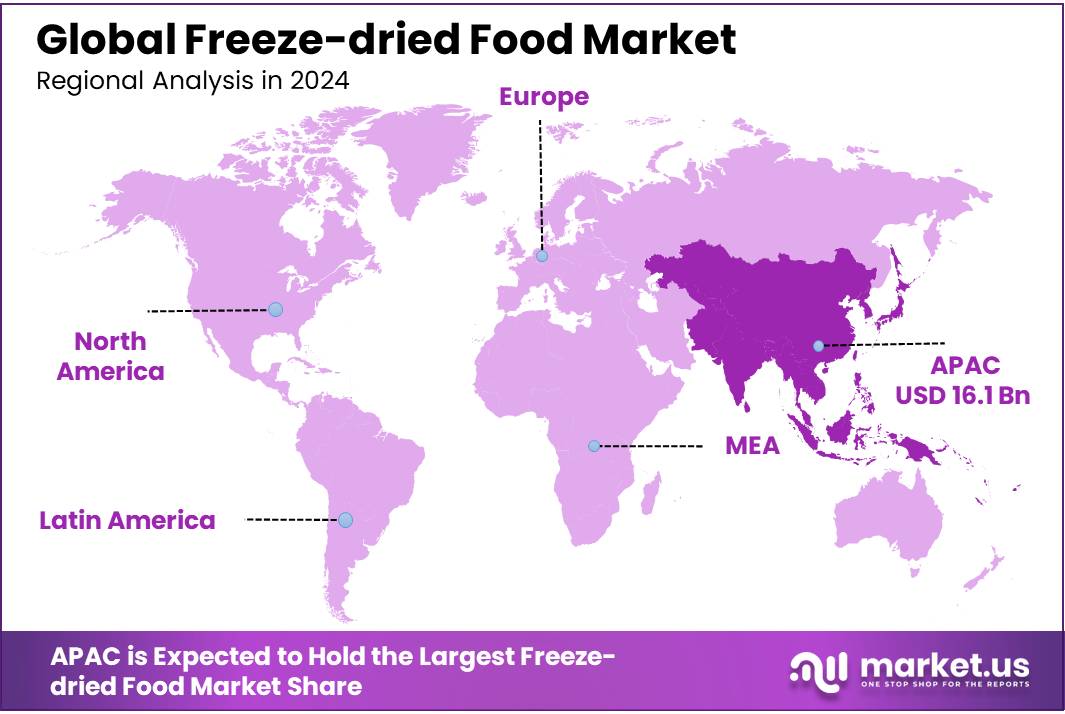

- Asia-Pacific (APAC) region holds a commanding position in the freeze-dried food market, capturing a substantial 39.30% share, which translates to approximately USD 16.1 billion in revenue.

By Product Type

Fruit Segment Commands Over a Third of the Market with a 34.20% Share in 2024

In 2024, the Fruit segment held a dominant position in the freeze-dried food market, capturing more than a 34.20% share. This significant market share reflects the growing consumer preference for nutritious and convenient snack options. Freeze-dried fruits, known for retaining much of the nutritional value and flavor of fresh fruit, have become increasingly popular among health-conscious consumers.

The demand is particularly strong in regions with a rising awareness of health and wellness, driving the consumption of fruits in a more stable and convenient form. This segment benefits from the shift towards healthier dietary patterns and the demand for longer-lasting, preservative-free food options. The popularity of freeze-dried fruits is expected to maintain a robust growth trajectory, as they offer both the nutritional benefits of fresh produce and the convenience of a snack that can be stored and transported easily.

By Form

The whole form segment holds a leading share in the global freeze-dried food market, driven by its superior product integrity, consumer preference for minimally processed foods, and versatility across multiple application channels. This form preserves the original shape, texture, and nutritional profile of the food item, making it particularly appealing in segments where visual appeal and freshness perception are critical, such as in retail snack packs, emergency food supplies, and premium packaged meals.

Consumers are increasingly drawn to whole freeze-dried fruits, vegetables, and meat products as healthy, ready-to-eat options that require no rehydration or cooking, particularly in on-the-go snacking and outdoor consumption scenarios. The surge in demand for clean-label and additive-free snacks has further fueled this preference, with whole freeze-dried products perceived as closer to fresh alternatives due to their minimal processing and natural appearance.

By End Use

Food Service Products Command a Major Share with 79.20% in 2024

In 2024, Food Service Products in the freeze-dried food market held a dominant market position, capturing more than a 79.20% share. This substantial market share underscores the integral role that freeze-dried products play in the food and beverage industry. These products are highly favored for their long shelf life, ease of storage, and retention of nutritional qualities and flavors, which are critical factors in the food processing and retail sectors.

The ability to preserve the color, texture, and aroma of the original products makes freeze-dried foods particularly appealing in the production of snacks, ready meals, and beverages. Their convenience and quality continue to drive their adoption in new culinary applications and product innovations, making them a staple in both commercial and home kitchens.

By Distribution Channel

B2B Distribution Leads in Freeze-dried Food with a 59.20% Market Share in 2024

In 2024, the Business-to-Business (B2B) distribution channel for freeze-dried food secured a dominant market position, capturing more than a 59.20% share. This dominance is reflective of the extensive use of freeze-dried foods in various sectors that require bulk purchasing, such as catering, food service, and food manufacturing.

B2B channels are crucial for delivering large volumes of freeze-dried products that are used as ingredients in ready meals, dietary supplements, and emergency rations. The strength of the B2B segment lies in its ability to efficiently manage supply chains and meet the large-scale demands of businesses, ensuring a steady flow of freeze-dried products into various commercial applications. This distribution model continues to be favored for its economic scale and logistical advantages, supporting the sustained growth of the freeze-dried food industry.

Key Market Segments

By Product Type

- Fruits

- Strawberry

- Raspberry

- Pineapple

- Apple

- Mango

- Others

- Vegetables

- Pea

- Corn

- Carrot

- Potato

- Mushroom

- Others

- Meat & Poultry, Seafood

- Pork

- Chicken

- Beef

- Fish

- Others

- Dairy Products

- Cheese

- Yogurt

- Milk

- Others

- Other Product Types

By Form

- Whole

- Cuts & Flakes

- Powdered

By End Use

- Food Service

- Retail

By Distribution Channel

- B2B

- B2C

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Drivers

Rising Demand for Long Shelf Life and Nutrient Retention in Food Drives Freeze-Dried Market Growth

One of the primary driving factors for the freeze-dried food market is the increased consumer demand for products that offer extended shelf life while maintaining nutritional integrity. This trend is especially prevalent in the context of global food security concerns and the growing consumer awareness regarding food waste.

Governments and food organizations have been highlighting the benefits of food preservation technologies. For instance, the U.S. Department of Agriculture (USDA) promotes the use of advanced drying technologies like freeze-drying for disaster preparedness. According to USDA data, freeze-dried foods can retain up to 97% of their original nutrients, making them a superior option for both emergency food supplies and everyday use.

The appeal of freeze-dried foods is also evident in the hiking and camping communities, where lightweight, nutritious, and easy-to-prepare foods are essential. Outdoor recreation organizations have noted a significant uptick in outdoor activities post-2020, which correlates with increased demand for convenient food options like freeze-dried meals. The National Park Service reported a record-breaking 327 million visits in 2020, reflecting a broader trend towards outdoor lifestyles and by extension, a rising demand for suitable food products.

Moreover, government initiatives further bolster the market. For example, the European Commission has funded research into food drying technologies as part of its Horizon 2020 program, aiming to innovate and improve food processing methods across the EU. Such initiatives underscore the importance of freeze-drying in food technology advancements and sustainability efforts.

Restraints

High Cost of Production Limits Freeze-Dried Food Market Expansion

A significant restraining factor in the freeze-dried food market is the high cost associated with the freeze-drying process. This technology requires substantial energy consumption and sophisticated equipment, which can be a major barrier for new entrants and smaller players in the food industry.

The energy-intensive nature of freeze-drying, where foods must first be frozen and then dried under a vacuum, leads to higher production costs compared to other drying methods. For instance, the Food and Agriculture Organization (FAO) notes that freeze-drying uses about 1.2 times more energy than conventional air drying. This higher energy requirement translates directly into greater operational costs, which can restrict the affordability and widespread adoption of freeze-dried products, particularly in price-sensitive markets.

Additionally, the initial investment in freeze-drying equipment is considerable. Setting up a commercial freeze-drying facility can cost anywhere from $10,000 for a small unit to over $500,000 for large-scale operations, as per industry reports from leading equipment manufacturers. This high capital expenditure can deter small to medium-sized enterprises from entering the freeze-dried food market.

Governments and industry bodies recognize these challenges and have been exploring ways to make this technology more accessible and cost-effective. For example, the U.S. Department of Energy has been funding projects aimed at improving the energy efficiency of food processing technologies, including freeze-drying. These initiatives are crucial for reducing operational costs and promoting wider adoption of freeze-drying technologies across various sectors of the food industry.

Opportunity

Expanding Markets in Asia-Pacific Region Present Growth Opportunities for Freeze-Dried Foods

One of the most promising growth opportunities for the freeze-dried food industry lies in the expanding markets of the Asia-Pacific region. This region is experiencing rapid urbanization and an increasing middle-class population, factors that drive the demand for convenient and high-quality food products.

The Asia-Pacific region has shown a remarkable increase in disposable incomes, leading to a shift in consumer preferences towards premium food products. According to the Asian Development Bank, the middle-class population in Asia is projected to reach 3.5 billion by 2030, accounting for over 60% of the region’s total population. This demographic shift is expected to significantly boost the demand for freeze-dried foods, which are perceived as high-quality and convenient.

Furthermore, the increasing health consciousness among consumers in this region has heightened the demand for nutritious and safe food options. Freeze-dried foods, known for their ability to preserve nutrients and flavors without additives, are particularly appealing.

Government health initiatives across Asia emphasize the importance of nutritious diets, which further supports the market for freeze-dried products. For instance, Japan’s Ministry of Health, Labour, and Welfare actively promotes dietary guidelines that favor the consumption of fruits and vegetables, potentially increasing the appeal of freeze-dried fruit products.

Additionally, the region’s growing focus on emergency preparedness—spurred by frequent natural disasters like typhoons and earthquakes—has led to increased investment in sustainable food storage solutions. Freeze-dried foods, with their long shelf life and ease of preparation, are ideal for inclusion in emergency food supplies, a factor that governments and NGOs in the region are keen to capitalize on.

Trends

Incorporation of Superfoods into Freeze-Dried Products

A notable trend in the freeze-dried food market is the incorporation of superfoods into freeze-dried products, capitalizing on the growing consumer interest in health and wellness. Superfoods, which include items like acai berries, chia seeds, and kale, are favored for their high nutrient density and health benefits. Freeze-drying these foods preserves their nutritional content and makes them convenient for consumers seeking healthy eating options without the hassle of perishable produce.

The trend is supported by increasing consumer awareness about the benefits of superfoods, driven by health and wellness campaigns from various health organizations worldwide. For example, the World Health Organization (WHO) has been actively promoting the consumption of nutrient-rich foods as part of a balanced diet to combat non-communicable diseases. This has encouraged food manufacturers to explore innovative ways to incorporate healthy options into their product lines, making superfoods more accessible to the general public.

The appeal of freeze-dried superfoods is also tied to the global rise in veganism and plant-based diets. Data from the Food and Agriculture Organization (FAO) suggest that there has been a significant shift towards plant-based diets, particularly in Western countries, where the market for vegan products is expected to grow by 10% annually. Freeze-dried superfoods fit well into this dietary trend, offering a shelf-stable, nutrient-rich option that aligns with the ethical and health motivations of vegan consumers.

Additionally, many governments have begun to support agricultural practices that are sustainable and conducive to producing superfoods. For instance, the United States Department of Agriculture (USDA) offers grants and funding opportunities for organic farming, which includes many superfood crops. This governmental backing helps ensure a steady supply of high-quality ingredients for freeze-drying.

Regional Analysis

The Asia-Pacific (APAC) region holds a commanding position in the freeze-dried food market, capturing a substantial 39.30% share, which translates to approximately USD 16.1 billion in revenue. This dominance is driven by several factors that cater to the unique demands and dynamics of this diverse market.

Rapid urbanization and an increasing middle-class population have significantly contributed to the surge in demand for freeze-dried foods in APAC. Countries like China, Japan, and India are leading this trend, where busy lifestyles are common and there’s a growing preference for convenient, healthy, and long-lasting food options.

Health trends play a crucial role as well. The region has seen a rise in consumer awareness regarding nutritional intake and diet management, particularly in more developed parts such as South Korea and Australia. This awareness is bolstered by government health initiatives promoting balanced diets, which favor the inclusion of freeze-dried products known for retaining most of the nutrients found in their fresh counterparts.

Moreover, the APAC region is highly prone to natural disasters like earthquakes and typhoons, leading to a robust demand for emergency food supplies, where freeze-dried foods are ideal due to their long shelf life and ease of preparation. This functional benefit supports sustained growth in the freeze-dried food sector across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Asahi Group Holdings, a prominent player in the beverage and food industry, has diversified its portfolio to include freeze-dried products, catering to the rising demand for convenient and healthy food options. Known for its innovation in preservation technologies, Asahi leverages advanced freeze-drying techniques to maintain the nutritional integrity and flavor of its offerings, appealing to health-conscious consumers globally.

Associated British Foods plc is a global food, ingredients, and retail group which includes freeze-dried products as part of its diverse food portfolio. The company focuses on leveraging its extensive distribution network to deliver high-quality, durable food products, meeting the needs of consumers looking for convenience without sacrificing taste or nutritional value.

European Freeze Dry specializes in the production of freeze-dried foods, providing a wide range of products from fruits and vegetables to fully cooked meals. Their commitment to quality and extensive product customization options make them a leader in the freeze-dried food sector, serving both individual consumers and large-scale commercial clients across Europe.

Top Key Players in the Market

- Asahi Group Holdings, Ltd.

- Nestlé S.A.

- Ajinomoto Co. Inc.

- Harmony House Foods Inc.

- Lyofood Sp. z o.o.

- European Freeze Dry

- OFD Foods LLC

- Steele Brands (Crispy Green Inc.)

- Katadyn Products Inc.

- AMG-Group

- Harmony House Foods, Inc.

- Crispy Green

- Backpacker’s Pantry

- Chaucer Foods

- Hindustan Unilever Limited

- Döhler GmbH

Recent Developments

In 2024, Paradise Fruits made significant strides in the freeze-dried food sector, enhancing its position as a key player in the industry. The company, part of the larger Jahncke group and with a longstanding history dating back to 1883, has continued to innovate in the production of freeze-dried fruits, fruit preparations, yogurts, and other granulated products.

Asahi has been instrumental in driving market growth during this period, with the freeze-dried food sector expanding notably under its influence. The company’s commitment to enhancing and expanding its product offerings in this area is evident from its active participation in industry growth trends, including the proliferation of organized retail which has been a critical driver for the sector.

Report Scope

Report Features Description Market Value (2024) USD 41.8 Bn Forecast Revenue (2034) USD 86.2 Bn CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fruits, Vegetables, Meat and Poultry, Seafood, Dairy Products, Other Product Types), By Form (Whole, Cuts and Flakes, Powdered), By End Use (Food Service, Retail), By Distribution Channel (B2B, B2C) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Asahi Group Holdings, Ltd., Nestlé S.A., Ajinomoto Co. Inc., Harmony House Foods Inc., Lyofood Sp. z o.o., European Freeze Dry, OFD Foods LLC, Steele Brands (Crispy Green Inc.), Katadyn Products Inc., AMG-Group, Harmony House Foods, Inc., Crispy Green, Backpacker’s Pantry, Chaucer Foods, Hindustan Unilever Limited, Döhler GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Asahi Group Holdings, Ltd.

- Nestlé S.A.

- Ajinomoto Co. Inc.

- Harmony House Foods Inc.

- Lyofood Sp. z o.o.

- European Freeze Dry

- OFD Foods LLC

- Steele Brands (Crispy Green Inc.)

- Katadyn Products Inc.

- AMG-Group

- Harmony House Foods, Inc.

- Crispy Green

- Backpacker's Pantry

- Chaucer Foods

- Hindustan Unilever Limited

- Döhler GmbH