Global Engineering Plastics Market By Type (Polyamide, Polycarbonate, Acrylonitrile Butadiene Styrene, Polyethylene, Polypropylene, Polyetheretherketone, Fluoropolymer, Polyoxymethylene, Polybutylene Terephthalate, Polymethyl Methacrylate, Polyethylene Terephthalate, Others), By Processing Method (Injection Molding, Extrusion, Blow Molding, Compression Molding, Rotational Molding, Thermoforming, Others), By End-Use (Packaging, Building and Construction, Automotive, Electrical and Electronics, Textiles, Healthcare, Aerospace and Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 135474

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

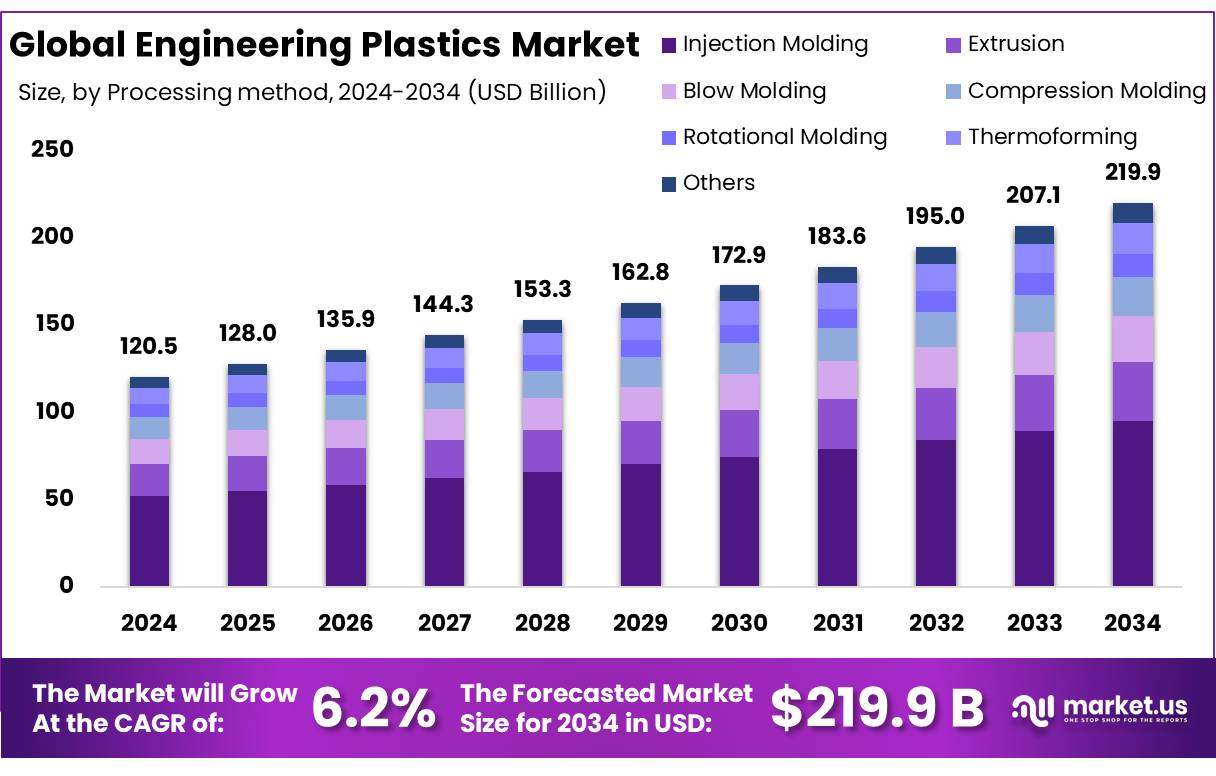

The Global Engineering Plastics Market size is expected to be worth around USD 219.9 billion by 2034, from USD 120.5 billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

Engineering plastics are performance or advanced plastics a class of high-performance polymers specifically developed to offer superior mechanical strength, thermal stability, chemical resistance, and dimensional accuracy compared to conventional commodity plastics. These materials are replacing metals, ceramics, and glass in applications where durability, precision, and weight reduction are critical such as aerospace, packaging, and automotive.

In addition, their ability to be reshaped and reprocessed without compromising performance characteristics significantly enhances their versatility and cost-efficiency in manufacturing processes. This recyclability allows for greater design flexibility, reduced material waste, and lower production costs, making engineering plastics an attractive choice for high-performance applications across various industries.

Additionally, in the automotive sector, they are integral to components such as fuel systems, engine covers, air intake manifolds, and lightweight body parts aimed at improving fuel efficiency. The aerospace industry employs them in high-strength, lightweight structural elements that must endure extreme temperatures and mechanical stress. In electronics, engineering plastics serve as effective insulators and casings for high-performance devices, while in healthcare, their biocompatibility and stabilizability make them suitable for implants, surgical tools, and diagnostic equipment.

Globally, the engineering plastics market is witnessing significant growth, driven by trends such as lightweight in automotive and aerospace, increased miniaturization in electronics, and a shift toward high-performance, sustainable materials. With ongoing innovations and the push for more energy-efficient and environmentally friendly solutions, demand for engineering plastics is expected to rise across both mature and emerging markets. Their ability to meet evolving performance standards while supporting design flexibility and sustainability makes engineering plastics a critical component of modern material science and industrial development.

Key Takeaways

- The global engineering plastics market was valued at USD 120.5 billion in 2024.

- The global engineering plastics market is projected to grow at a CAGR of 6.2 % and is estimated to reach USD 219.9 billion by 2034.

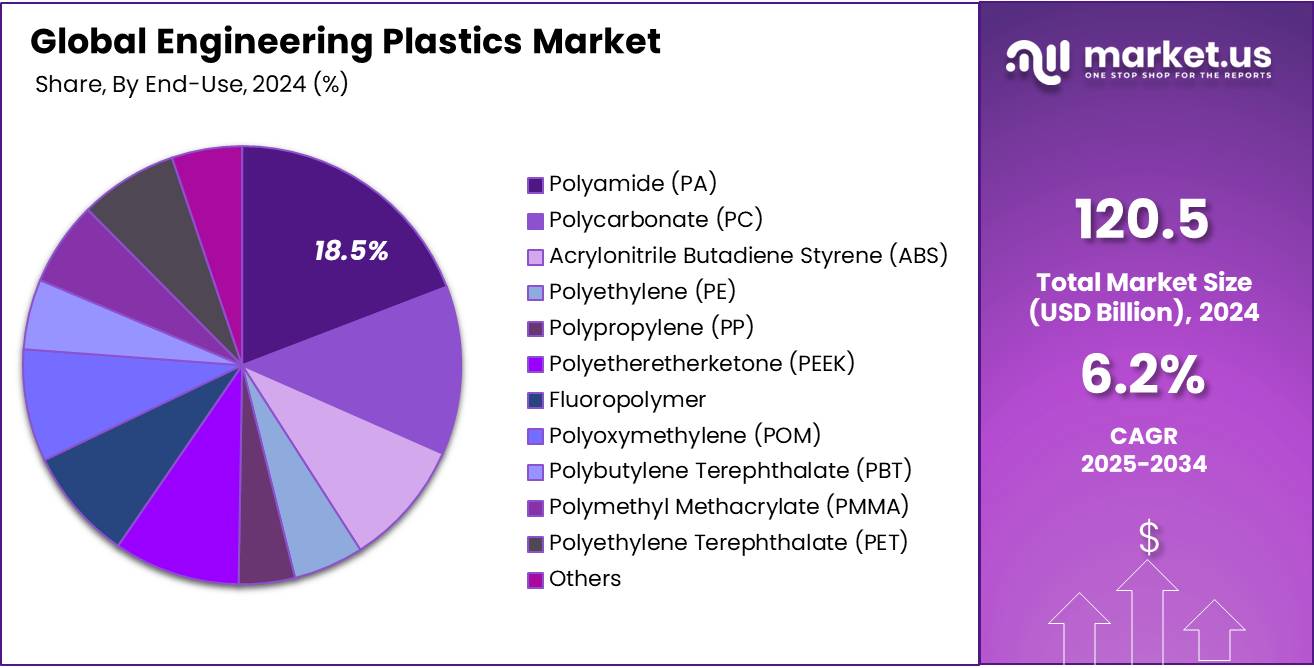

- Among types, Polyamide (PA) accounted for the largest market share of 18.5%.

- Among processing methods, injection molding accounted for the majority of the market share at 43.2%.

- By end-use, packaging accounted for the largest market share of 21.7%.

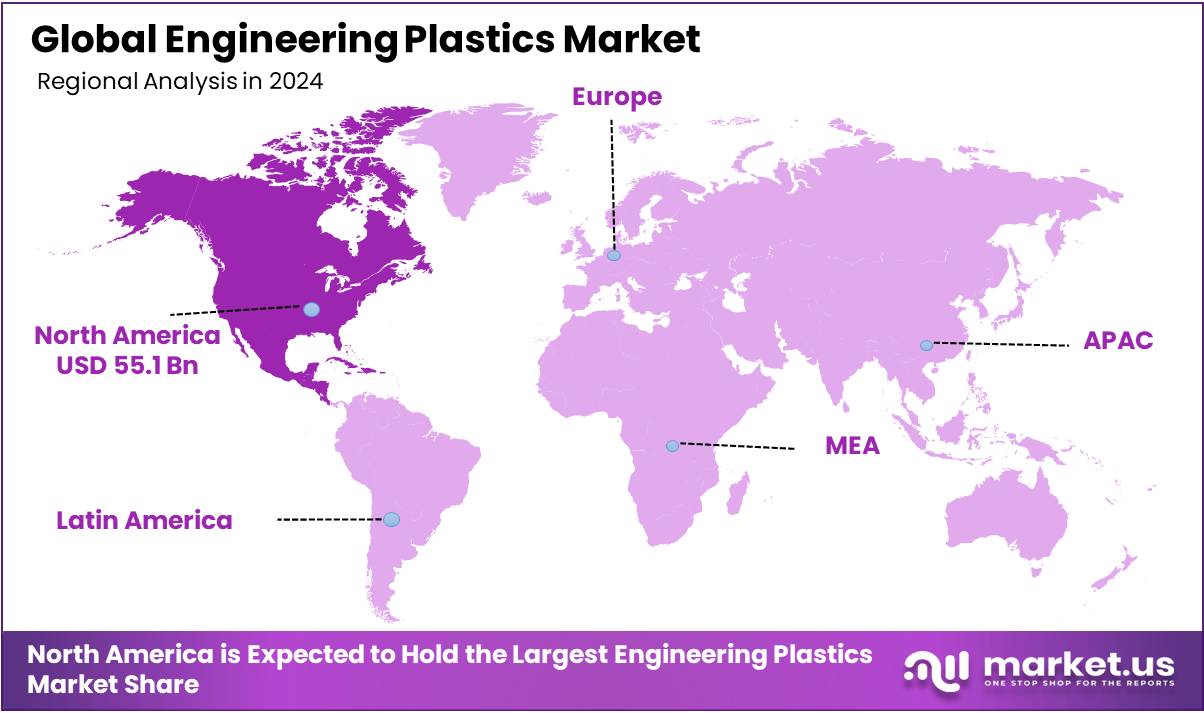

- North America is estimated as the largest market for engineering plastics with a share of 45.8% of the market share.

Type Analysis

Polyamide (PA) Accounted For The Largest Market Share In Engineering Plastics Market in 2024

The engineering plastics market is segmented based on type polyamide, polycarbonate, acrylonitrile butadiene styrene, polyethylene, polypropylene, polyetheretherketone, fluoropolymer, polyoxymethylene, polybutylene terephthalate, polymethyl methacrylate, polyethylene terephthalate, and others. In 2024, the Polyamide (PA) segment held a significant revenue share of 18.5 %. Due to its outstanding mechanical strength, durability, and resistance to chemicals and wear.

Polyamide’s versatility makes it highly suitable for demanding applications in automotive components, electrical and electronic devices, and industrial machinery. Additionally, its lightweight nature helps manufacturers meet growing demands for fuel efficiency and sustainability. These factors combined have driven strong adoption of Polyamide across multiple industries, supporting its dominant market position.

Processing Method Analysis

Injection Molding Dominate the Engineering Plastic Market In 2024

Based on the processing method, the market is further divided into injection molding, extrusion, blow molding, compression molding, rotational molding, thermoforming, and others. The predominance of the Pinot Noir, commanding a substantial 43.2% market share in 2024. Due to its ability to efficiently produce complex, high-precision parts at scale. The method is widely used in industries such as automotive, electronics, and consumer goods, where fast production and consistent quality are essential. Its versatility and cost-effectiveness continue to drive its strong market position.

End-Use Analysis

Packaging Driving The Global Engineering Plastics Market in 2024.

By end-use, the market is categorized into packaging, building & construction, automotive, electrical & electronics, textiles, healthcare, aerospace & defense, and others. The Packaging segment emerging as the dominant user, holding 21.7% of the total market share in 2024. Due to the growing demand for lightweight, durable, and recyclable materials that enhance product safety and shelf life. Additionally, rising consumer awareness and stricter regulations around sustainable packaging have driven increased adoption of engineering plastics in this sector.

Key Market Segments

By Type

- Polyamide (PA)

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyetheretherketone (PEEK)

- Fluoropolymer

- Polyoxymethylene (POM)

- Polybutylene Terephthalate (PBT)

- Polymethyl Methacrylate (PMMA)

- Polyethylene Terephthalate (PET)

- Others

By Processing Method

- Injection Molding

- Extrusion

- Blow Molding

- Compression Molding

- Rotational Molding

- Thermoforming

- Others

By End-Use

- Packaging

- Non-food Contact

- Food Contact

- Building & Construction

- Wall Panels

- Pipes and Fittings

- Windows & Doors

- Insulation Material

- Roofing

- Others

- Automotive

- Interior

- Exterior

- Under the Hood

- Others

- Electrical & Electronics

- Textiles

- Healthcare

- Aerospace & Defense

- Others

Drivers

Increasing Demand For Lightweight Alternatives In Automotive Industries

Engineering plastics have become essential in modern automotive manufacturing due to their lightweight, durable, and high-performance characteristics. Their ability to replace heavier traditional materials like metals has enabled significant reductions in vehicle weight, contributing to better fuel efficiency, lower emissions, and improved overall vehicle dynamics. These materials are now widely used in applications ranging from dashboards and bumpers to engine components and under-the-hood parts, thanks to their strength, thermal resistance, and chemical durability. The shift to precision injection molding with engineering plastics also supports high production efficiency and consistency, meeting the strict standards of the automotive industry.

- According to the U.S. Department of Energy, a 10% reduction in vehicle weight can result in a 6%-8% fuel economy improvement.

- In addition, replacing heavy steel components with materials such as high-strength steel, aluminum, or glass fiber-reinforced polymer composites can decrease component weight by 10-60%.

The increasing global demand for fuel-efficient and environmentally friendly vehicles—especially hybrid and electric models—has accelerated the adoption of engineering plastics. As automotive manufacturers seek solutions to offset the weight of batteries and electric drive systems, lightweight materials such as Acrylonitrile Butadiene Styrene (ABS) and Polycarbonate (PC) are being used more frequently in structural and functional components. These plastics not only support performance and energy efficiency but also enable greater design flexibility and cost-effectiveness in mass production. As a result, engineering plastics are playing a pivotal role in transforming automotive design and supporting the industry’s push toward sustainability and innovation.

- The Vehicle Technologies Office (VTO) is actively supporting efforts to improve the efficiency of advanced internal combustion engines by 25% to 50% in automotive, light truck, and heavy-truck applications, with engineering plastics playing a key role by enabling lightweight, durable components that reduce vehicle weight and boost fuel economy.

- According to the International Energy Association, using lightweight components and high-efficiency engines made possible by advanced materials in just one-quarter of the U.S. vehicle fleet could save over 5 billion gallons of fuel annually by 2030.

- According to the International Organization of Motor Vehicle Manufacturers, 91.8 million vehicles were produced in 2019. The automotive lightweight materials market, which includes engineering plastics, is projected to reach USD 99.3 billion by 2025, growing at a CAGR of 7.3% from USD 69.7 billion in 2020. This highlights the increasing importance of engineering plastics in driving lightweight solutions and improving vehicle efficiency.

Restraints

Growing Stringent Regulation On Plastic Use

The growth of the global engineering plastics market is increasingly being challenged by the rising tide of stringent regulations on plastic waste. Plastic pollution has become a major global concern, now recognized as the third-largest contributor to environmental waste. In response, governments worldwide are enacting strict regulations aimed at curbing plastic use, particularly single-use plastics, and encouraging a shift toward recycling and sustainable material usage.

Policies such as the European Union’s Single-Use Plastics Directive and U.S. state-level Extended Producer Responsibility (EPR) laws are reshaping the operational landscape for plastic producers. These measures, while environmentally necessary, are placing considerable pressure on the plastics industry, particularly those segments serving consumer-facing markets.

- According to internal energy association reports global plastic waste generation currently stands at approximately 1.7 to 1.9 billion metric tons per year, and this figure is projected to rise dramatically to 27 billion metric tons per year by 2050.

- In addition, Asia has been the largest consumer of polymers, producing 30 % of all plastic waste.

- In North America and Asia, people consume approximately 120 kg of plastic-based products per capita. The non-biodegradable nature of plastics complicates their disposal, resulting in substantial environmental challenges across these regions.

Additionally, transitioning to more sustainable or bio-based alternatives often involves high production costs and R&D investments. These financial burdens are especially difficult for small and mid-sized manufacturers to manage, potentially limiting innovation and slowing market expansion. As a result, while demand for lightweight and high-performance materials continues to rise, the tightening regulatory environment is acting as a significant restraint on the global growth trajectory of the engineering plastics market.

- For instance, California’s SB 54 law mandates that by 2032, 100% of packaging must be recyclable or compostable, 65% of single-use plastic packaging must be recycled, and plastic packaging use must be reduced by 25%. Additionally, producers must establish Producer Responsibility Organizations (PROs) to manage recycling efforts and meet these targets. Such stringent regulations create significant financial challenges for manufacturers, particularly in the engineering plastics sector, as they must invest in sustainable materials and compliance measures, increasing production costs.

Opportunity

Rise of Bio-Based Plastics

The growing emphasis on sustainability and eco-friendly products is unlocking significant future opportunities for the global engineering plastics market. Increasing environmental and public health awareness among consumers, along with regulatory pressure from regional governments, is driving a shift away from conventional, petroleum-based polycarbonates.

With support from government sustainability initiatives, major players in the polycarbonate manufacturing sector are increasingly transitioning toward bio-based and environmentally friendly alternatives. These bio-based polycarbonates, derived from renewable sources such as starch, carbohydrates, isosorbide (from sorbitol), and other plant-based materials, are gaining traction due to their versatility, lower environmental impact, and application potential across key industries like automotive, electronics, and packaging.

- According to European Bioplastics, bio-based plastics currently hold a 1-2%, are expected to see significant growth in production capacity, increasing from 2.11 million tons in 2020 to approximately 2.87 million tons by 2025, driving the expansion of bio-based plastics in from automotive, packaging, food to electronics good.

Bio-based engineering plastics represent a new generation of high-performance materials that combine strong mechanical properties, thermal stability, and optical clarity with environmental benefits. As climate concerns and oil dependency grow, technological advancements in industrial biotechnology have renewed interest in sustainable materials.

Governments around the world are supporting this shift through stricter regulations on petrochemical plastics and incentives such as tax breaks and subsidies to encourage the use of bio-based alternatives. This policy environment is accelerating the adoption of bio-based engineering plastics, presenting robust growth opportunities for manufacturers by aligning economic viability with environmental responsibility. As a result, bio-based plastics are emerging as a key growth driver within the global engineering plastics market.

- The Bio Preferred Program, managed by the USDA, promotes bio based plastics products by offering federal purchasing requirements and voluntary labeling. Products with the bio Preferred label encourage adoption by government and private sector buyers focused on sustainability.

Trends

Integration of Smart and Functional Materials

The integration of smart and functional materials is emerging as a transformative trend in the engineering plastics market, redefining the role of plastics across key industries such as automotive, electronics, packaging, and healthcare. Engineering plastics are no longer limited to traditional structural roles; they are now being developed with intelligent features like self-healing capabilities, embedded sensors, and enhanced durability. This evolution is driving innovation in product design and functionality, enabling manufacturers to develop smarter, more adaptive, and more efficient solutions tailored to evolving consumer and industrial demands.

Smart plastics infused with responsive technologies are increasingly being used in applications that require real-time data, performance monitoring, and enhanced user interaction. In packaging, for instance, sensor-integrated plastics can monitor product freshness and environmental conditions, ensuring safety and quality. In healthcare, smart materials are enabling the development of next-generation medical devices that support personalized and continuous patient monitoring.

Meanwhile, the manufacturing sector is leveraging self-monitoring components to improve operational efficiency and minimize maintenance downtime. This fusion of smart technologies with engineering plastics not only broadens material capabilities but also supports sustainability goals through improved resource efficiency and reduced waste. As innovation in this space accelerates, smart and functional materials are poised to play a pivotal role in shaping the future of the global engineering plastics market.

Geopolitical Impact Analysis

Recent trade-tariff wars between major economies such as the U.S. and China have intensified global engineering plastics supply chain disruptions.

Geopolitical factors have a significant impact on the global engineering plastics market, shaping everything from raw material availability to trade flows and production strategies. Tensions between major economies such as the U.S.-China trade conflict have led to tariffs and export restrictions on key materials used in plastic production, driving up costs and disrupting supply chains. Recently anti-dumping duties imposed by China on engineering plastics from the U.S., EU, Japan, and Taiwan have created uncertainty for exporters and manufacturers reliant on cross-border trade.

- For instance, in May 2025, China’s imposition of up to 74.9% anti-dumping duties on POM copolymers from the U.S., EU, Japan, and Taiwan highlights escalating trade-tariff tensions between key regions, directly disrupting global supply chains in the engineering plastics sector.

The imposition of high anti-dumping duties by China on POM copolymer imports from the U.S., EU, Japan, and Taiwan is expected to significantly impact the global engineering plastics market. These duties will likely lead to reduced exports from key producing countries to China, one of the world’s largest consumers of engineering plastics. As a result, global supply chains could become more fragmented, pushing manufacturers to find alternative markets or shift production closer to end-users. This trade barrier may also lead to higher prices and limited availability of POM copolymers in China, affecting industries like automotive, electronics, and medical devices that rely on these materials.

At the same time, countries impacted by these tariffs may face oversupply issues and pricing pressure in their domestic markets. Overall, these geopolitical moves are likely to intensify regionalization in the engineering plastics market, disrupt investment flows, and add uncertainty for global manufacturers and suppliers.

Regional Analysis

North America Held the Largest Share of the Global Engineering Plastics Market

In 2024, North America dominated the global Engineering Plastics market, accounting for 45.8 % of the total market share, driven by strong demand from key end-use industries such as automotive, aerospace, electronics, healthcare, and packaging. The region’s well-established manufacturing infrastructure, coupled with increasing investment in innovation and advanced materials, has positioned North America as a major hub for engineering plastics production and consumption.

The push for lightweight, durable, and high-performance materials in automotive and aerospace sectors specially to meet fuel efficiency and emission reduction targets continues to be a primary growth driver. Additionally, the growing adoption of electric vehicles (EVs), along with advancements in electronics and medical technologies, is creating a surge in demand for engineering plastics with enhanced thermal, electrical, and mechanical properties.

The region is also benefiting from strong regulatory support and incentives for sustainable manufacturing, encouraging the development and adoption of bio-based and recyclable engineering plastics. With ongoing R&D, rising awareness around sustainability, and an increasing focus on high-performance materials, North America is poised to maintain robust growth in its engineering plastics market over the forecast period.

- For instance, DOE projects that by 2030, electric vehicles could make up 50% of new car sales in the U.S. The U.S. rise demand for engineering plastics lightweight material in electric vehicle manufacturing.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the Engineering Plastic market focus on offering high-performing, sustainable products to cater to high-end consumers.

Key players in the global engineering plastic market including BASF SE, Covestro AG, Solvay S.A., Celanese Corporation, and Toray Industries, are continuously investing in research and development to create new grades of engineering plastics tailored for emerging applications such as electric vehicles, 5G infrastructure, and medical devices.

LG Chem’s partnership to optimize supply chains for post-consumer recycled engineering plastics and Borealis AG’s introduction of Stelora, a polymer from renewable resources, highlight this trend. Leading firms continuously diversify their product offerings to address a wide range of industries, including automotive, electronics, healthcare, and construction. These companies are shaping the future of the engineering plastic market through strategic partnerships, research, and innovations.

The Major Players in the Industry

- BASF SE

- Covestro AG

- Solvay S.A.

- Celanese Corporation

- Toray Industries, Inc.

- Dupont

- Teijin Limited

- LG Chem

- Indorama Ventures

- Mitsubishi Chemical Corporation

- Alfa S.A.B. de C.V.

- SABIC

- CHIMEI Corporation

- Dongyue Group Ltd

- Evonik Industries AG

- Lanxess AG

- Other Key Players

Recent Development

- In January 2023- LG Chem began supplying its advanced engineering plastic LUCON® TX5007, featuring carbon nanotube-enhanced conductivity and heat resistance, to Mitsubishi Motors for powder-coated front fenders on models like RVR, Delica D: 5, and Outlander. This lightweight material improves fuel efficiency and meets high automotive quality standards, with LG Chem expanding its carbon nanotube production capacity to support growing demand.

- In January 2025– Toray Industries announced the establishment of a new high-performance plastic compound production site in Guangdong, China, set to begin operations in April 2025. Aimed at serving rising demand in automotive, electronics, and solar industries—especially for new energy vehicles—the facility will also support Toray’s global expansion strategy under its Project AP-G 2025 initiative.

- In June 2024- DuPont announced the acquisition of Donatelle Plastics Incorporated, a medical device contract manufacturer, to expand its healthcare portfolio. This strategic move strengthens DuPont’s capabilities in advanced medical technologies, following its Spectrum acquisition, and enhances its position in high-growth therapeutic markets such as diagnostics and neurostimulation.

Report Scope

Report Features Description Market Value (2024) US$ 120.5 Bn Forecast Revenue (2034) US$ 219.9 Bn CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Polyamide, Polycarbonate, Acrylonitrile Butadiene Styrene, Polyethylene, Polypropylene, Polyetheretherketone, Fluoropolymer, Polyoxymethylene, Polybutylene Terephthalate, Polymethyl Methacrylate, Polyethylene Terephthalate, Others), By Processing Method (Injection Molding, Extrusion, Blow Molding, Compression Molding, Rotational Molding, Thermoforming, Others), By End-Use (Packaging, Building and Construction, Automotive, Electrical and Electronics, Textiles, Healthcare, Aerospace and Defense, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Covestro AG, Solvay S.A., Celanese Corporation, Toray Industries, Inc., Dupont, Teijin Limited, LG Chem, Indorama Ventures, Mitsubishi Chemical Corporation, Alfa S.A.B. de C.V., SABIC, CHIMEI Corporation, Dongyue Group Ltd, Evonik Industries AG, Lanxess AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Engineering Plastics MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Engineering Plastics MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Covestro AG

- Solvay S.A.

- Celanese Corporation

- Toray Industries, Inc.

- Dupont

- Teijin Limited

- LG Chem

- Indorama Ventures

- Mitsubishi Chemical Corporation

- Alfa S.A.B. de C.V.

- SABIC

- CHIMEI Corporation

- Dongyue Group Ltd

- Evonik Industries AG

- Lanxess AG

- Other Key Players