Global Geotechnical Engineering Market By Type (Underground City Space, Engineering, Ground & Foundation Engineering, Slope & Excavation Engineering, and Other Types), By Application (Municipal, Oil & Gas, Bridge & Tunnel, Marine, Mining, Building Construction, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 25302

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

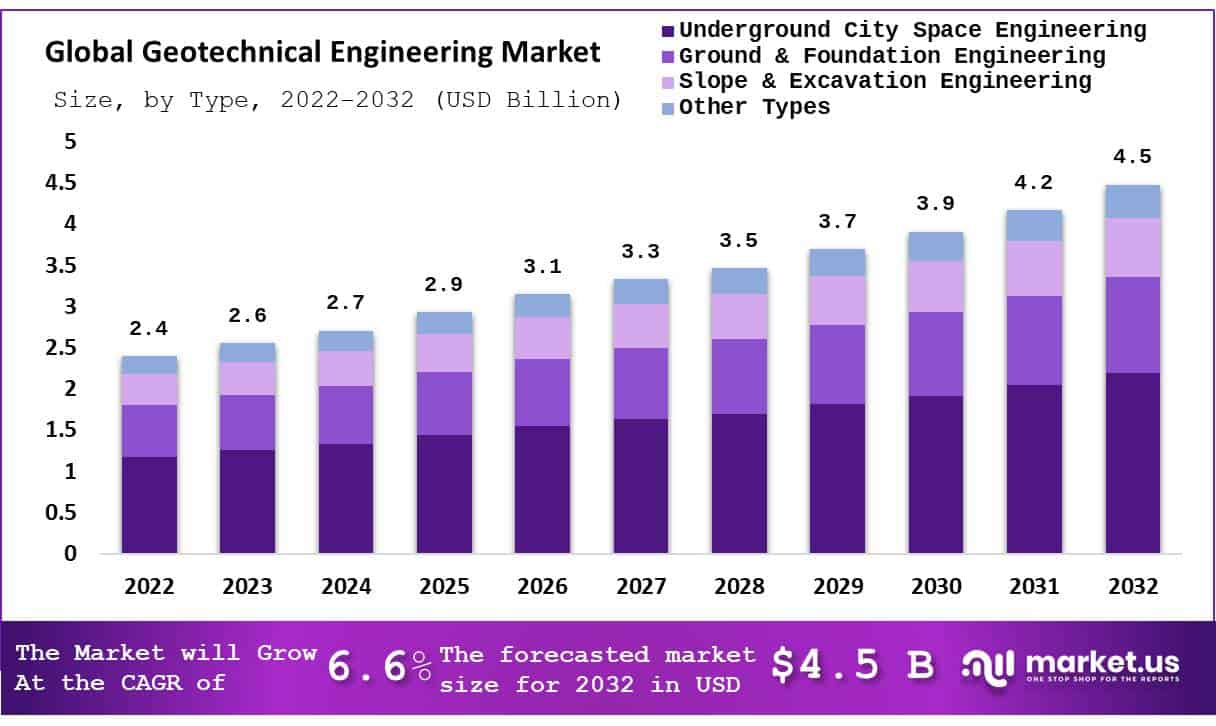

In 2022, the global geotechnical engineering market was valued at USD 2.4 billion and is expected to reach USD 4.5 Billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 6.6%.

Geotechnical engineering refers to the branch of civil engineering that understands the earth’s nature. Also, it studies the mechanical, physical, and chemical properties of the materials found beneath the earth’s upper surface.

Moreover, it allows monitoring and analysis of the condition of the subsoil before the construction of the foundation of any structure. This method helps to detect the stability of the soil of the selected land for construction purposes. Thus, it has become an essential part of any construction process, such as road, bridge, tunnel, canal, and building.

The market growth will be expanding due to factors such as historic restoration and preservation, the increasing adoption of government-backed environmental policies & initiatives, increasing environmental consciousness, and widespread desire to avoid structural breakdowns.

Furthermore, increasing infrastructure improvements, investments in infrastructural developments, continuous growth in urbanization, and growing research & innovation in cold environments will accelerate the growth of the global geotechnical engineering market during the forecast period.

Key Takeaways

Market Developments: The global geotechnical engineering market is experiencing steady expansion with a steady increase in infrastructure project demands. Valued at USD 2.4 billion in 2022 and expected to experience compound annual compound annual growth rates of 6.6% between 2023-2032, this industry sector was valued at an estimated total of USD 4.5 billion by 2032.

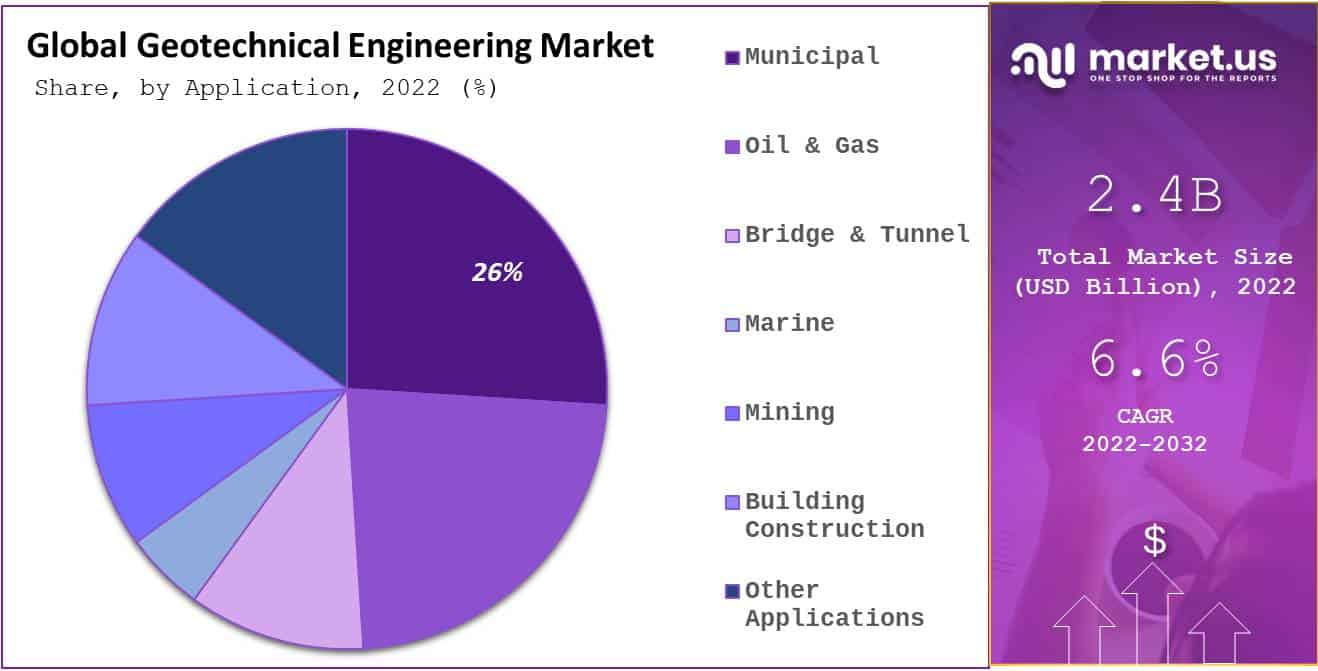

Infrastructure Demands: Geotechnical engineering services have experienced considerable increases due to urbanization, industrialization, and population growth requiring reliable infrastructure projects such as roads, bridges, dams, tunnels, and offshore structures to develop quickly.Type Analysis: Geotechnical engineering involves the use of various products and materials such as geotechnical software, instruments for site investigation, geosynthetics, and ground improvement materials to ensure stability and safety in construction projects. The underground city space held most of the 49% of the market.Application Analysis: Geotechnical engineering finds wide-ranging applications in various sectors such as transportation, energy, construction, and environmental projects. It plays a crucial role in assessing and managing risks related to soil, rocks, and groundwater for safe and sustainable construction. The municipal segment accounted for the dominant share of 26%.Market Drivers: Key drivers of the geotechnical engineering market include urbanization, population growth, increasing infrastructure projects, regulatory requirements for safe construction, and the need for sustainable development.Restraints: Challenges faced by the geotechnical engineering market include project cost overruns, environmental concerns, land acquisition issues, and technical complexities in site characterization.Opportunities: Opportunities for growth in the geotechnical engineering market include investments in research and development for innovative technologies, collaborations for knowledge sharing, and the adoption of sustainable practices for improved project outcomes.Trends: Emerging trends in geotechnical engineering encompass the integration of artificial intelligence, automation in data analysis, emphasis on green and sustainable geotechnical solutions, and a focus on disaster-resilient designs.Regional Analysis: North America Dominated the Global Geotechnical Engineering Market, North America held the largest share of 39% of the overall market, owing to the increasing demand for sustainable constructions due to the rising environmental consciousnessKey Players: Major companies in the geotechnical engineering market are focusing on strategic initiatives such as technological advancements, partnerships, acquisitions, and expanding their service portfolios to maintain a competitive edge and enhance their market presence.Type Analysis

The Underground City Space Segment Accounted for the Largest Share of the Market

The type segment is divided into underground city space, engineering, ground & foundation engineering, slope & excavation engineering, and other types. The underground city space held most of the 49% of the market. It is mainly used to build underground tunnels for water & gas pipeline construction, rail & metro, and other public service facilities.

The requirement for confidential city space service is high because of the increasing demand for rail, metro, and other public service facilities. The ground & foundation were likely to grow significantly during the forecast period. This service is used before municipal activities, defense activities, construction of buildings, and others.

Application Analysis

The municipal Segment Held the Largest Share of the Market

The Segment is divided into municipal, oil & gas, bridge & tunnel, marine, mining, building construction, and other applications. The municipal segment accounted for the dominant share of 26%. The municipal Segment contains the geotechnical services used for airports, power plant construction, government buildings, dam construction, and pipeline construction.

Mining is another segment that contributes to the market’s growth during the forecast period. For solving specific ground engineering problems or to undertake mining project studies, most mining companies are developing in-house geotechnical expertise at corporate and also hiring consultants.

Geotechnical services are also used in understanding the surface of the earth at the river or ocean floors in the marine sector. It involves analyzing the seabed and under-seabed materials to construct offshore structures like anchored floating structures and wind turbines.

Key Market Segments

Based on Type

- Underground City Space Engineering

- Ground & Foundation Engineering

- Slope & Excavation Engineering

- Other Types

Based on Application

- Municipal

- Oil & Gas

- Bridge & Tunnel

- Marine

- Mining

- Building Construction

- Other Applications

Drivers

Increasing Investments in Wind Energy

Across the globe, the power generation industries are shifting towards environment-friendly and cleaner energy resources as there is a rise in environmental protection regulations. Various countries are focusing on developing renewable energy power generation to decrease their dependence on conventional power generation with the help of fossil fuels. Wind energy is the most renewable source of energy.

The geotechnical surveys physically performed the testing or sampling of the seabed characteristics. It assures the developers of the prime placement of offshore wind turbines, substations, and cabling infrastructure.

High Development in the Construction Industry

There has been a remarkable growth in construction activities in industrial, infrastructural, commercial, residential, and other utility sectors in emerging economies. Countries such as Brazil, Thailand, Qatar, Indonesia, China, and India have many projects and widespread, ongoing construction activities. Additionally, different countries such as Thailand, Sri Lanka, and India are promoting their tourism. Thus, the construction of parks, resorts, hotels, and other commercial buildings is growing speedily.

Restraints

High Cost of Geotechnical Services

The cost of geotechnical equipment increases with the repeatability, precision, accuracy, resolution, and range. Advanced complex data acquisition systems, software, and sensors raise the cost of geotechnical solutions. Moreover, the cost of software & hardware used in geotechnical instrumentation and monitoring solutions depends mostly on the complexity of structures. Therefore, the costly geotechnical services will likely hinder the market’s growth.

Opportunities

Increasing Investments in Projects

Geotechnical studies aid in evaluating seabed properties to confirm the proper possible location for cabling, substations, and turbine equipment. Furthermore, in several nations, the construction of wind power facilities was estimated to propel the market’s growth during the forecast period. Furthermore, the increasing investments in several energy and oil & gas projects were estimated to create numerous opportunities for developing the global geotechnical engineering market during the forecast period.

Trends

High Growth in Offshore E&P Activities

The energy demand was increasing continuously across the globe due to industrial developments and increasing population. In 2019, natural gas consumption was augmented by 77 billion cubic meters while global oil consumption increased by 1 million barrels per day; this increased the production of fuel by the companies. Companies are moving towards deeper and remote offshore areas. Thus, the demand for geotechnical services is high in deep-water exploration and production.

Regional Analysis

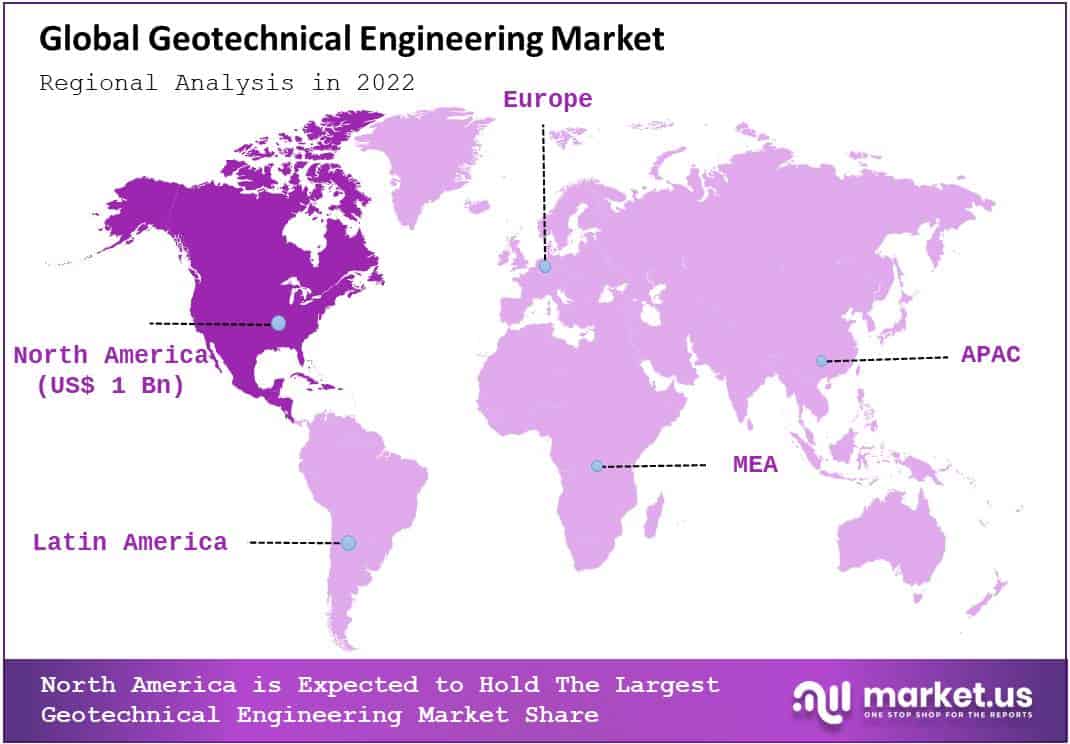

North America Dominated the Global Geotechnical Engineering Market

North America held the largest share of 39% of the overall market, owing to the increasing demand for sustainable constructions due to the rising environmental consciousness. Additionally, the factors contributing to the growth of the market in this region are the availability of abundant natural gas reserves and other oil & gas activities. The numerous infrastructure projects and geotechnical services’ penetration will likely accelerate this region’s market growth.

Furthermore, the Asia Pacific region is estimated to be the highest-growing region during the forecast period owing to the regulatory laws for geotechnical monitoring of sights. Increasing understanding and awareness of geotechnical equipment are a few factors that boost the market growth in this region.

China is estimated to have the majority of share in APAC owing to the vast population in this region. This increases infrastructural investments and the construction of tunnels, bridges, and tunnels. Other factors, such as increasing awareness of sustainable constructions and the rising number of geotechnical projects, contribute to the market growth in this region.

Key Regions and Countries

- North America

-

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- The rest of E.A.

Key Players Analysis

Fugro was Awarded by DOTD

The key players are implementing various strategies to strengthen their position in the geotechnical engineering market. The ideal method by the companies is focusing on a geotechnical service. For instance, the Louisiana Department for Transportation and Development awarded Fugro a 5-year indefinite delivery indefinite quantity contract in August 2020 to facilitate the statewide geotechnical engineering services.

Market Key Players

- AECOM

- Fugro N.V.

- HDR, Inc.

- Gardline Limited

- Stantec Inc.

- Kiewit Corporation

- Bechtel Corporation

- Jacobs Solutions Inc.

- Black & Veatch

- Other Key Players

Recent Developments

- In February 2023- Fugro acquired two platform supply vessels named Topaz Energy and Topaz Endurance to re-purpose the vessels for supporting subsea surveys in the offshore renewable, oil, and gas industries.

- In February 2022- Jacobs declared to enter into a joint venture with Locus Engineering Management and Services Co. W.L.L. It is a Qatar-based entity and an asset management company interested in building oil & gas, infrastructure, maintenance, and engineering.

Report Scope

Report Features Description Report Features Description Market Value (2022) US$ 2.4 Bn Forecast Revenue (2032) US$ 4.5 Bn CAGR (2023-2032) 6.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Underground City Space, Engineering, Ground & Foundation Engineering, Slope & Excavation Engineering, and Other Types; and By Application- Municipal, Oil & Gas, Bridge & Tunnel, Marine, Mining, Building Construction, and Other Applications. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of M.E.A. Competitive Landscape AECOM, Fugro N.V., HDR, Inc., Gardline Limited, Stantec Inc., Kiewit Corporation, Bechtel Corporation, Jacobs Solutions Inc., Black & Veatch, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What exactly is Geotechnical engineering?Geotechnical engineering is a branch of civil engineering that studies the behavior and properties of earth materials such as soil, rock, and groundwater. Geotechnical Engineering is the application of engineering and scientific principles to the construction and maintenance of infrastructure built on the ground or in contact with it.

What is the geotechnical engineering market?The Geotechnical Engineering Market includes services such as site investigation, design and analysis, construction monitoring, and various types of infrastructure including buildings, tunnels, and dams.

What are the main players in the geotechnical engineering market?Geotechnical engineers, government agencies, and construction companies are the major players in the market. Some of the leading companies in this market are AECOM, Fugro N.V., Gardline Limited, Kiewit Corporation, Stantec Inc., Jacobs Solutions Inc. and More

What factors are driving the geotechnical engineering market?The geotechnical engineering market is growing due to several factors including the increasing demand for infrastructure, urbanization, and the need for better disaster resilience. Geotechnical Engineers are also able to improve and innovate their services thanks to technological advancements such as 3D printing and BIM.

Geotechnical Engineering MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Geotechnical Engineering MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- AECOM

- Fugro N.V.

- HDR, Inc.

- Gardline Limited

- Stantec Inc.

- Kiewit Corporation

- Bechtel Corporation

- Jacobs Solutions Inc.

- Black & Veatch

- Other Key Players