Global Oil & Gas Separation Equipment Market By Material Type (Two-Phase Separators, Three-Phase Separators, Scrubber,Other Types), By Application (Onshore, Offshore, Refineries, Other Application) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jan 2024

- Report ID: 78771

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

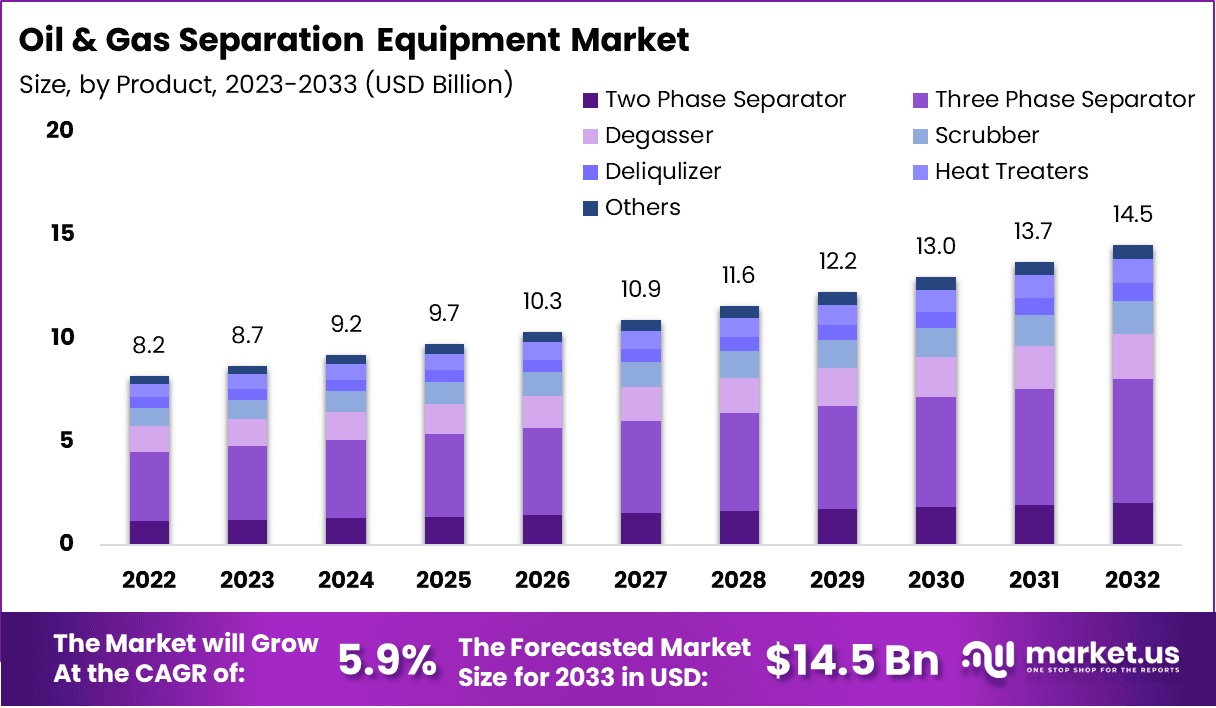

The Global Oil and Gas Separation Equipment Market size is expected to be worth around USD 14.5 Billion by 2033, From USD 8.2 Billion by 2023, growing at a CAGR of 3.80% during the forecast period from 2024 to 2033.

Oil and Gas Separation Equipment plays a vital role in the upstream oil and gas production process, facilitating the efficient separation of hydrocarbons, water, and other impurities from crude oil and natural gas. This equipment includes separators, scrubbers, and coalescers designed to enhance the separation efficiency, ensuring the production of high-quality hydrocarbons.

By employing various separation technologies such as gravity settling, centrifugation, and filtration, these equipment components contribute to the optimization of downstream processes, compliance with environmental standards, and the overall operational efficiency of oil and gas facilities.

The continuous evolution of separation technologies further enhances the performance and environmental sustainability of oil and gas production. Oil and Gas Separation Equipment ensures the extraction of valuable hydrocarbons by removing contaminants and water during the production phase.

This equipment’s precision and reliability are critical for maximizing resource recovery, minimizing environmental impact, and meeting stringent industry regulations. Advanced separation technologies continue to drive innovation in this sector, optimizing efficiency and sustainability in oil and gas operations.

Key Takeaways

- Market Growth: The Oil and Gas Separation Equipment Market anticipates substantial growth, with the market value poised to increase from USD 8.2 billion in 2023 to USD 14.5 billion in 2033, reflecting a commendable Compound Annual Growth Rate (CAGR) of 5.9%.

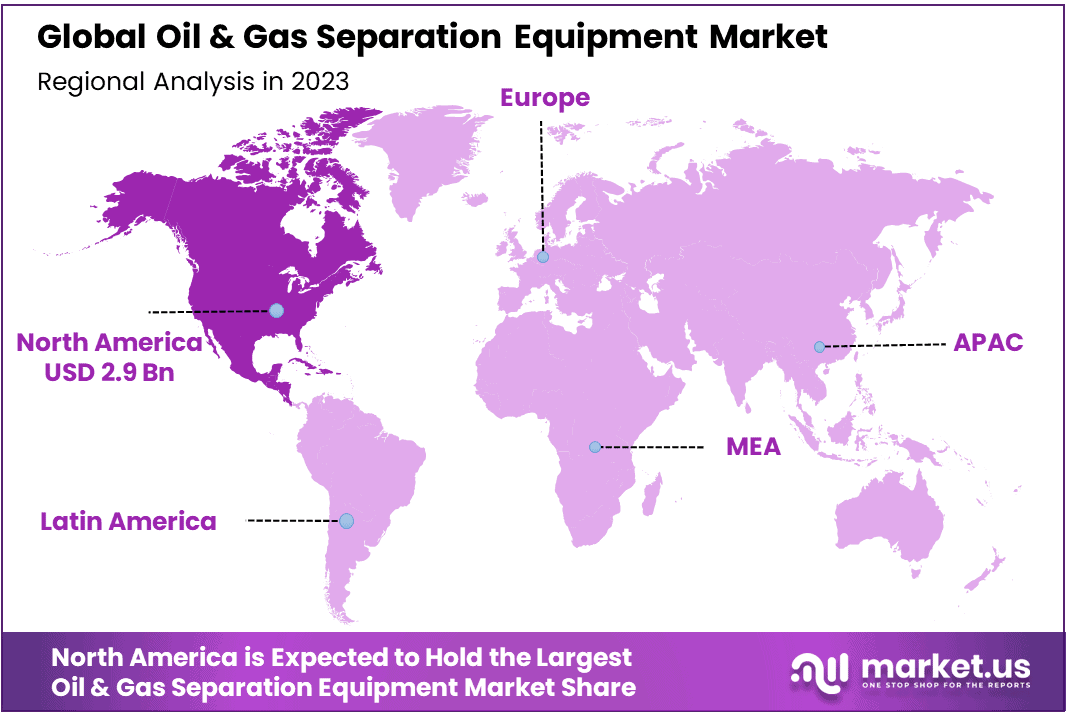

- Regional Dominance: North America emerges as the dominant region, commanding a significant 35.4% share. This signifies a robust market presence and heightened demand for oil and gas separation equipment in the North American energy landscape.

- Segmentation Insights:

- Product Dominance: Three Phase Separator stands out as the dominating product, holding a notable 41.3% share. This emphasizes the critical role of three-phase separators in efficiently separating oil, gas, and water in upstream oil and gas processes.

Market Dynamics:

- Steady Market Expansion: The market displays a steady growth trajectory, driven by the continuous demand for effective separation equipment in the oil and gas industry.

- North America’s Significance: The dominance of North America underscores the region’s strategic importance in the global oil and gas sector, with a focus on efficient separation processes.

Industry Analysis:

- Enduring Market Demand: The consistent CAGR reflects enduring demand for oil and gas separation equipment, crucial for optimizing production processes and meeting stringent industry standards.

- Three-Phase Separator Focus: The prominence of three-phase separators indicates their pivotal role in managing the complex mix of oil, gas, and water in upstream operations.

This analysis underscores the Oil and Gas Separation Equipment Market’s substantial growth prospects, driven by the continuous need for efficient separation solutions in the energy sector.

The steady CAGR and North America’s dominance highlight a resilient market with sustained relevance in the evolving landscape of oil and gas production.

Driving Factors

The combination of high oil and gas production and increased E&P in the deep sea and ultra-deep sea, as well as high yields from non-conventional hydrocarbon resources such as tight gas, shale, and CBM, has led to an increase in oil and gas production.

Due to the unique nature of oil and gas fields, special separation techniques and equipment are required. Standardization of separation levels has been a result of growing environmental concerns and increasing government regulations to ensure that oil in water is at the optimum level for pipeline grades. This has led to an increase in demand for oil and gas separation equipment.

For several purposes, stringent regulations on disposal and reuse have required onsite processing. Increasing TDS levels in the produced water could have serious environmental impacts. Oil & Gas producers are now more responsible for properly treating formation fluids before disposing of or reusing them. This will be a key driver of market growth during the forecast period.

Restraining Factors

The Oil and Gas Separation Equipment market faces certain restraining factors that impact its growth trajectory. The capital-intensive nature and high initial investment for procuring and installing sophisticated separation equipment can hinder widespread adoption, especially for smaller players.

Additionally, the industry’s sensitivity to fluctuations in oil prices and global economic conditions can lead to reduced capital spending on new equipment. Regulatory complexities and evolving environmental standards may necessitate constant updates to comply, adding operational challenges.

Overcoming these obstacles requires strategic investment planning, technological innovations, and industry collaboration to address both economic and regulatory constraints in the Oil and Gas Separation Equipment market.

Growth Opportunities

The Oil and Gas Separation Equipment market presents promising growth opportunities driven by several factors. The increasing global demand for energy and the exploration of new oil and gas reserves in challenging environments create a continuous need for advanced separation technologies.

As environmental regulations become more stringent, there is a growing market for equipment that ensures efficient removal of pollutants. Moreover, the adoption of digitalization and smart technologies in separation equipment offers opportunities for enhanced monitoring, control, and predictive maintenance.

Continued investments in research and development to improve separation efficiency and sustainability contribute to the industry’s growth outlook, presenting avenues for innovation and market expansion.

Trending Factors

The Oil and Gas Separation Equipment market is undergoing transformative trends that are shaping the industry’s landscape. A notable shift is the integration of digitalization and IoT technologies, enabling real-time monitoring and predictive maintenance for enhanced operational control.

Environmental sustainability takes center stage, driving the adoption of equipment that aligns with stringent regulations, emphasizing reduced emissions and environmental impact. The exploration of challenging environments, including deep-sea and unconventional resources, demands advanced separation solutions.

Additionally, a growing preference for modular and compact designs, coupled with the integration of advanced materials, highlights the industry’s pursuit of efficiency, adaptability, and durability in oil and gas separation processes.

Type Analysis

The three-phase separator was the most popular product segment, accounting for more than 41.3% of total demand. The three-phase separator offers advantages over two-phase separators in terms of liquid sealing and optimum pressure. Due to increased production from associated oil and gas wells, three-phase separators will be in high demand.

Over the forecast period, product demand will rise due to surging oil production from shale play and coal bed methane areas. Asia Pacific will be the region with the highest three-phase separators growth rate over the forecast period, growing at a CAGR of 5.6% between 2024 and 2033. The market will be driven by rising oil & gas production, especially in China and Vietnam over the forecast period.

The demand for two-phase separators is expected to grow at an average rate over the foreseen period. These separators can be found in oil fields to separate well fluids into liquid and gas.

Over the forecast period, the scrubber will experience rapid growth in demand. Scrubber is used upstream of gas treatment equipment that uses dry desiccants and mechanical equipment like compressors. To protect downstream equipment from failure or damage, it removes liquid droplets from the gas stream.

It can also be used downstream for condensed liquids. Market expansion will be positively affected by stringent government regulations regarding flare gas quality and high suspended matter content in pipeline fluids.

Кеу Маrkеt Ѕеgmеntѕ

By Type:

- Two Phase Separator

- Three Phase Separator

- Degasser

- Scrubber

- Deliqulizer

- Heat Treaters

- Others

By Application:

- Onshore

- Offshore

- Refineries

- Other Application

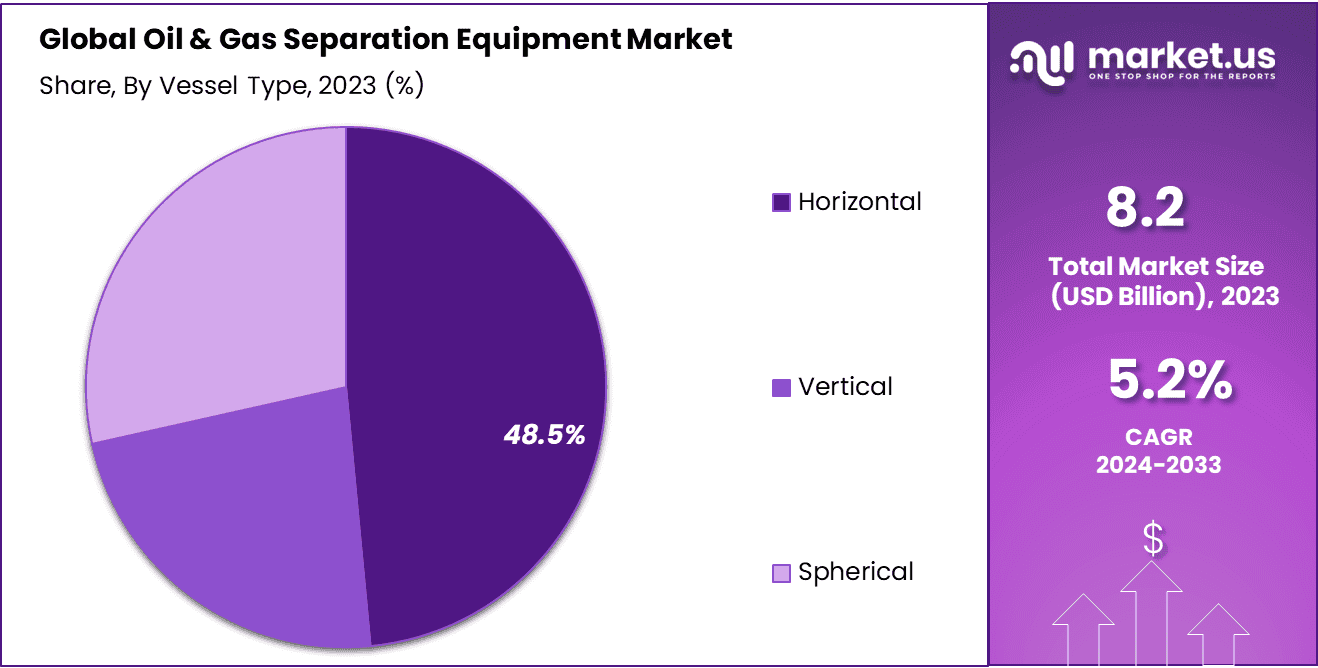

By Vessel Type:

- Horizontal

- Vertical

- Spherical

Regional Analysis

North America was the dominant market in the global oil & gas industry in 2023 with a market share of 45%. It is expected to continue its dominance over the next few years. The North American oil and gas industry is characterized by the high capitalization of assets both onshore and offshore reserves.

Over the forecast period, equipment demand is expected to rise due to rising shale play and coal bed methane output. Market growth is expected to be fueled by increased offshore E&P and new explorations at Baken oilfields.

North America’s two-phase separators market has a high growth rate due to increased oil production. The region’s shale play growth is expected to increase two-phase separator demand during the forecast period. North America will continue to be the largest two-phase separator marketplace over the forecast period due to its high capitalization and continuing E&P in conventional resources.

Asia Pacific is expected to see the greatest growth due to E&P activities in India, China, Taiwan, Malaysia, and Vietnam. These activities will boost product demand over seven years. Market penetration in these areas will be driven by government initiatives to sustainably exploit hydrocarbon resources, including financial aid in the form of FDI and tax incentives in China and India. Over the forecast period, large unexplored hydrocarbon resources and the discovery of shale in China will fuel the oil and gas separation equipment market.

Europe will see moderate growth rates due to the stringent regulatory environment in the region concerning air quality and the quality of processed streams. Norway, Russia, and the UK are the main centers of oil and gas production. Due to rising demand for processing equipment, especially in oil-rich countries like Venezuela, Brazil, and Argentina, Latin America is expected to experience significant growth over this forecast period.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The industry is somewhat fragmented, with a few small-scale and local players. Major companies are expanding their product lines and investing heavily in R&D to develop multi-functional equipment that can handle a wide range of fluids. This will increase their industry preference and thus increase their market share shortly.

Кеу Маrkеt Рlауеrѕ іnсludеd іn thе rероrt:

- Honeywell

- Alpha Laval

- ACS Manufacturing

- Fenix Process Technologies Pvt. Ltd.

- Worthington

- HAT International

- Amacs

- Doyle Dryers LLC

- Valerus

- BNF Engineering Pte Ltd.

- eProcess Technologies

- Burgess-Manning, Inc.

- Godrej Process Equipment

- CAT Technologies

- ATLAS Oil & Gas Process Systems Inc.

Recent Developments

- In 2023, Chevron finalized a $53 billion all-stock acquisition of Hess, expanding its resource base in offshore Guyana and the Bakken Shale. This strategic move strengthened Chevron’s asset portfolio with substantial new reserves.

- In April 2024, SLB reached an agreement to acquire ChampionX Corporation (NASDAQ: CHX) in an all-stock transaction. The deal received unanimous approval from ChampionX’s board of directors and is expected to enhance SLB’s technology and service capabilities.

- In 2025, Phillips 66 (NYSE: PSX) announced a definitive agreement to acquire EPIC Y-Grade GP, LLC and EPIC Y-Grade, LP for $2.2 billion in cash. The acquisition includes extensive natural gas liquids pipelines, fractionation facilities, and distribution systems, positioning Phillips 66 for increased midstream growth.

- In 2024, Harbour Energy successfully completed its acquisition of Wintershall Dea’s upstream asset portfolio. With an effective date of June 30, 2023, this transaction significantly increases Harbour Energy’s operational footprint.

- In October 2024, SM Energy Company (NYSE: SM) closed its Uinta Basin acquisition, securing an 80% interest in XCL Resources’ oil and gas assets. The acquisition includes additional adjacent assets, strengthening SM Energy’s position in the region.

- In 2024, ConocoPhillips (NYSE: COP) completed its acquisition of Marathon Oil Corporation (NYSE: MRO). This transaction enhances ConocoPhillips’ portfolio with high-quality, low-cost supply inventory adjacent to its U.S. unconventional operations. The company anticipates over $1 billion in annual synergies within the next year.

- In 2024, Equinor and Shell agreed to merge their UK offshore oil and gas assets, forming Equinor UK Ltd. The new entity will be the largest independent oil and gas producer in the UK North Sea, leveraging both companies’ expertise to enhance production efficiency.

Report Scope

Report Features Description Market Value (2023) USD 335.5 Million Forecast Revenue (2032) USD 487.20 Million CAGR (2023-2032) 3.80% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Two Phase Separator, Three Phase Separator, Degasser, Scrubber, Deliqulizer, Heat Treaters, Others), By Vessel Type(Horizontal, Vertical, Spherical) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa. Competitive Landscape Honeywell, Alpha Laval, ACS Manufacturing, Fenix Process Technologies Pvt. Ltd., Worthington, HAT International, Amacs, Doyle Dryers LLC, Valerus, BNF Engineering Pte Ltd., eProcess Technologies, Burgess-Manning, Inc., Godrej Process Equipment, CAT Technologies, ATLAS Oil & Gas Process Systems Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User license (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Oil and Gas Separation Equipment Market Size in the 2023?The Global Oil and Gas Separation Equipment Market size was USD 8.2 Billion by 2023, growing at a CAGR of 3.80%.

What is the Oil and Gas Separation Equipment Market Estimated CAGR During the Forecast Period?The Global Oil and Gas Separation Equipment Market size is expected to grow at a CAGR of 3.80% during the forecast period from 2024 to 2033.

What is the Oil and Gas Separation Equipment Market Estimated Size During the Forecast Period?The Global Oil and Gas Separation Equipment Market size is expected to be worth around USD 14.5 Billion during the forecast period from 2024 to 2033.

Oil and Gas Separation Equipment MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Oil and Gas Separation Equipment MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

Кеу Маrkеt Рlауеrѕ іnсludеd іn thе rероrt:

- Honeywell

- Alpha Laval

- ACS Manufacturing

- Fenix Process Technologies Pvt. Ltd.

- Worthington

- HAT International

- Amacs

- Doyle Dryers LLC

- Valerus

- BNF Engineering Pte Ltd.

- eProcess Technologies

- Burgess-Manning, Inc.

- Godrej Process Equipment

- CAT Technologies

- ATLAS Oil & Gas Process Systems Inc.