Global Cloud Security Software Market Size, Share, Statistics Analysis Report By Component (Solution (Cloud Access Security Broker (CASB), Cloud Detection and Response (CDR), Cloud Infrastructure Entitlement Management (CIEM), Cloud Workload Protection Platform (CWPP), Cloud Security Posture Management (CSPM)), Services (Professional Services, Managed Services), By Deployment (Private, Public, Hybrid), By Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises), By End-use (BFSI, IT & Telecom, Retail & E-commerce, Healthcare, Government, Manufacturing, Aerospace & Defense, Transportation and Logistics, Energy and Utilities, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 136344

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- US Cloud Security Software Market Size

- Component Analysis

- Deployment Analysis

- Enterprise Size Analysis

- End-Use Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Impact of AI on Cloud Security Software Market

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

The Global Cloud Security Software Market size is expected to be worth around USD 183.0 Billion by 2033, from USD 36.8 Billion in 2023, growing at a CAGR of 17.4% during the forecast period from 2024 to 2033. In 2024, North America held a dominant market position, capturing more than a 38.6% share, holding USD 0.1 Billion revenue.

Cloud security software encompasses a suite of technologies, policies, and controls designed to safeguard data, applications, and infrastructure within cloud computing environments. Its primary objective is to protect cloud-based systems from potential threats, ensuring the confidentiality, integrity, and availability of information. This includes measures such as data encryption, identity and access management, and intrusion detection systems.

The global cloud security software market is expanding rapidly due to higher investments from organizations in cloud security solutions to protect sensitive data. Key driving factors for the market include the rise of DeveOps, increasing multi cloud environments, and the integration of AI and ML technologies. The market is further fueled by the growing adoption of remote work, digital transformation, and the need to combat cybersecurity breaches.

For instance, according to Gloroots, 74% of companies plan to make remote work a permanent feature post-pandemic whereas, 91% of remote employees say remote working improves their work-life balance. Additionally, various technological advancements like AI-powered threat detection, DevSecOps practices, and comprehensive security frameworks are creating significant opportunities for the market.

The increasing complexity of cyber risks and the need to protect sensitive data are pushing the organizations to invest in robust cloud security solutions, making it an essential component of modern digital infrastructure. Several factors drive the growth of the cloud security software market. The rapid adoption of cloud services by businesses seeking scalability and cost efficiency has heightened the need for security solutions to protect sensitive data.

Additionally, the increasing sophistication of cyber threats necessitates advanced security measures to safeguard cloud environments. The rising adoption of cloud services has led to a significant increase in demand for cloud security software. Organizations require robust security solutions to protect their data and applications in the cloud, ensuring compliance with regulatory standards and maintaining customer trust.

Based on data from SentinelOne, the average cost of a data breach is a staggering $4.35 million, according to IBM cloud security statistics. Over half (51%) of global organizations are ramping up investments in cloud security, focusing on areas like incident planning, threat detection, and response tools. This comes amid a 13% rise in ransomware attacks over the last five years.

Phishing remains a leading threat, with 51% of organizations reporting it as the most common tactic used by attackers to steal cloud credentials. Impersonation fraud, where scammers pose as trusted individuals, also poses significant risks.

Cloud attacks are on the rise, with 80% of companies seeing an increase in frequency. These attacks include 33% from cloud data breaches, 27% from environment intrusions, 23% involving crypto mining, and 15% tied to failed audits. These incidents lead to revenue losses due to downtime, delays, and operational challenges.

Hackers are increasingly targeting 38% of SaaS applications and cloud-based email servers. Alarmingly, 90% of data breaches involve servers, with cloud-based web application servers being the hardest hit.

The expanding cloud security software market presents numerous opportunities for innovation and growth. As businesses migrate to cloud environments, there is a pressing need for comprehensive security solutions that can address emerging threats and ensure data protection. This demand creates avenues for developing advanced security technologies and services tailored to the evolving cloud landscape.

Technological advancements play a pivotal role in enhancing cloud security software. The integration of artificial intelligence and machine learning enables more effective threat detection and response, while developments in encryption and authentication methods strengthen data protection. These innovations contribute to more robust and resilient cloud security solutions, capable of addressing complex security challenges.

Key Takeaways

- In 2024, the Solution segment emerged as the leader in the Global Cloud Security Software Market, accounting for a substantial 72.9% share. This dominance highlights the growing demand for innovative cloud security solutions to combat increasingly sophisticated cyber threats.

- The Private Cloud segment also held a commanding position, capturing over 54.5% of the market. This reflects the preference of organizations for private cloud environments due to their enhanced control, security, and compliance features.

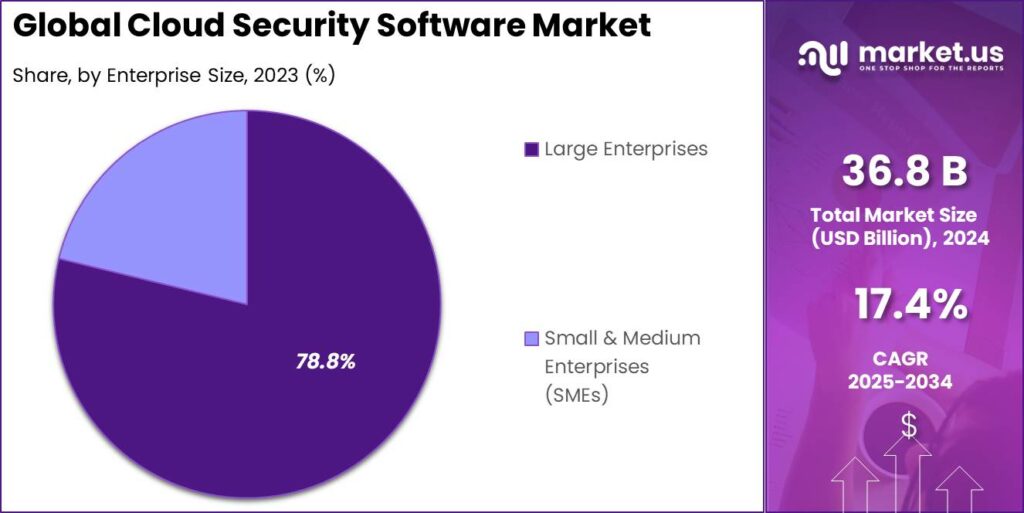

- Among organizational sizes, Large Enterprises were the top adopters, contributing to more than 78.8% of the total market share. Their reliance on robust cloud security solutions is driven by the need to safeguard vast volumes of sensitive data and meet stringent regulatory requirements.

- In terms of industry verticals, the BFSI (Banking, Financial Services, and Insurance) segment held a significant share, accounting for 24.8% of the market. This is attributed to the sector’s increasing adoption of cloud services to optimize operations while prioritizing data security.

- Emerging trends in cloud adoption further underline the industry’s transformation. According to EdgeDelta, 76% of enterprises are now integrating two or more cloud providers, demonstrating a clear shift toward multi-cloud strategies. Additionally, 35% of industries now host over half of their workloads in the cloud, and 29% anticipate migrating their data to cloud platforms soon.

- Security remains a critical concern for businesses. SentinelOne reports a 13% increase in cloud ransomware incidents over the past five years. As a result, 70% of companies identified compliance monitoring as a top priority for addressing cloud security challenges.

- Looking ahead, the cloud-first approach is poised to dominate. By 2025, over 80% of organizations are expected to prioritize cloud adoption, according to NordLayer. This trend underscores the growing reliance on cloud technologies as a cornerstone of modern business operations.

US Cloud Security Software Market Size

The United States is leading the cloud security software market for several reasons, all contributing to its market size projection of $6.4 billion in 2024. A critical factor is the significant investment in cloud infrastructure and security technologies, with the U.S. committing around $29.5 billion to enhance its cloud capabilities, far surpassing other nations.

This financial commitment is underpinned by a robust digital transformation across various sectors. The U.S. market benefits greatly from the presence and proactive strategies of major tech giants such as Microsoft, Amazon Web Services, and Google, all of which are based in the U.S. and lead in cloud innovation and services.

In 2024, North America held a dominant market position in the cloud security software market, capturing more than a 38.6% share, with revenues amounting to USD 0.1 billion. This leading stance can be attributed to several key factors that underscore the region’s robust market dynamics.

Firstly, North America benefits from a highly developed technological infrastructure, which supports widespread adoption and integration of cloud security solutions across various sectors. The region is home to many of the world’s leading technology companies, including prominent cloud service providers and security firms, which innovate and drive advancements in cloud security technologies.

This concentration of tech giants not only fosters innovation but also facilitates the rapid deployment of advanced security solutions across enterprises. Secondly, the regulatory landscape in North America further accelerates the market’s growth. Stringent regulations regarding data protection and privacy, such as the California Consumer Privacy Act (CCPA) and others across the region, mandate businesses to adopt robust security measures.

These regulatory requirements drive the adoption of cloud security software, as businesses strive to comply with legal standards while protecting sensitive data from increasing cyber threats. Additionally, the growing awareness of cybersecurity issues among North American businesses and consumers has led to increased demand for cloud security solutions.

Component Analysis

In 2024, the solution segment dominated the global cloud security software market, accounting for over 72.9% of the market share. This leadership position reflects the increasing complexity of the digital landscape, where businesses face sophisticated cyber threats from highly organized attackers.

The demand for advanced, multi-layered security solutions has grown significantly as companies seek comprehensive protection for their digital assets. The solutions offered under this segment include cutting-edge technologies such as encryption, identity and access management, threat intelligence, data loss prevention, endpoint protection, and security analytics.

These technologies are integrated into unified frameworks that can seamlessly operate within diverse IT ecosystems, providing organizations with robust defenses against ever-evolving cyber threats. As digital environments grow more intricate, businesses are compelled to adopt holistic security strategies.

The solutions segment addresses this need by delivering adaptive and scalable protection mechanisms capable of countering complex hacking techniques. This adaptability ensures that organizations remain resilient against emerging threats, cementing the solutions segment’s position as a critical component in modern cybersecurity strategies.

Deployment Analysis

In 2024, the private cloud segment held a commanding position in the global cloud security software market, capturing 54.5% of the total share. This dominance is attributed to the segment’s superior security and control mechanisms, which appeal to organizations prioritizing the protection of mission-critical applications.

Private cloud environments are designed to provide enhanced data protection, compliance with stringent regulatory standards, and exclusive infrastructure, making them a preferred choice for industries handling sensitive information.

Enterprises are increasingly turning to private cloud solutions due to their ability to maintain robust security protocols while delivering scalability and flexibility. The customizable nature of private cloud infrastructure allows businesses to tailor their systems to specific operational needs, particularly in sectors such as healthcare, finance, and technology.

These industries, which frequently manage confidential data, benefit from the additional control and reliability offered by private cloud platforms. The growing complexity of cyber threats further drives the adoption of private cloud solutions. With cybercrime costs projected to rise to $10.5 trillion by 2025 (Cobalt Labs), organizations are under pressure to invest in advanced security measures that can effectively counteract evolving attack strategies.

Private cloud services address this demand by providing seamless integration with legacy systems, advanced security frameworks, and greater control over data management processes. In the face of escalating digital risks, private cloud platforms have become a cornerstone of modern digital transformation strategies. By offering a balance of enhanced security, operational efficiency, and compliance readiness, these solutions empower organizations to protect their assets while adapting to the fast-changing digital landscape.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing more than a 78.8% share of the Global Cloud Security Software Market. This is attributed to the substantial investments in cloud development and infrastructure.

Their complex digital ecosystems and extensive sensitive data repositories necessitate robust security frameworks to protect critical business assets. The scale of operations in large enterprises demands comprehensive, multi-layered security solutions that address intricate cybersecurity challenges. These organizations operate in highly regulated industries, requiring advanced security protocols that integrate seamlessly with diverse technologies environments and maintain stringent compliance standards.

Moreover, large enterprises possess the financial resources and strategic vision to implement cutting edge cloud security technologies. Their proactive approach to cybersecurity, driven by the potential financial and reputational risks of data breaches, positions them as primary investors in sophisticated cloud security software and services.

End-Use Analysis

In 2023, the BFSI segment held a dominant market position, capturing more than a 24.8% share of the Global Cloud Security Software Market. this is primarily due to its massive volumes of sensitive financial data and critical customer information. Banks and financial institutions manage extensive digital assets that require robust protection against evolving cyber threats.

Stringent regulatory frameworks like GDPR and CCPA compel financial organizations to implement advanced security measures. The increasing adoption of digital banking, mobile services, and cloud computing has exponentially expanded the need for sophisticated cybersecurity solutions to mitigate risks of data breaches and cyber-attacks.

Large financial enterprises are primary targets for cybercriminals, necessitating comprehensive security infrastructure. The sector’s high stakes environment, combined with the growing complexity of digital transactions and the potential financial and reputational damage from security incidents, drives the continuous investment in cutting edge cloud security technologies.

Key Market Segments

By Component

- Solution

- Cloud Access Security Broker (CASB)

- Cloud Detection and Response (CDR)

- Cloud Infrastructure Entitlement Management (CIEM)

- Cloud Workload Protection Platform (CWPP)

- Cloud Security Posture Management (CSPM)

- Services

- Professional Services

- Managed Services

By Deployment

- Private

- Public

- Hybrid

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-use

- BFSI

- IT and Telecom

- Retail & E-commerce

- Healthcare

- Government

- Manufacturing

- Aerospace & Defense

- Transportation and Logistics

- Energy and Utilities

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Adoption of Digital Transformation Practices

The cloud security software market is significantly driven by the widespread adoption of digital transformation practices across various industries. As organizations shift their operations to digital platforms to enhance efficiency, scalability, and customer experience, they increasingly depend on cloud services for data storage and operations.

This shift necessitates robust cloud security measures to protect sensitive information from cyber threats and data breaches. The growing use of digital services through mobile and other devices further accentuates the need for advanced cloud security solutions, ensuring safe user access and data integrity across multiple platforms.

Restraint

Integration Complexities with Legacy Systems

One of the primary challenges facing the cloud security software market is the complexity associated with integrating advanced cloud security solutions with existing legacy IT infrastructure. Many organizations find it difficult to align new cloud security technologies with their old systems, which can hinder the seamless operation and scalability of security measures.

This integration challenge can be particularly daunting for sectors with extensive historical data and entrenched systems, potentially slowing down the adoption of cloud security solutions. The need for specialized IT skills to manage and maintain the integration further complicates this issue, posing a significant barrier to market growth.

Opportunity

Expansion into Emerging Markets

The cloud security software market has a significant opportunity to expand into emerging markets, especially in regions like Asia Pacific, which are witnessing rapid technological advancements and digitalization.

The increasing internet penetration and mobile usage in these areas offer a fertile ground for cloud services adoption, subsequently driving the demand for cloud security solutions. Moreover, as local businesses and startups in these regions grow, their need for secure cloud platforms escalates, providing a lucrative opportunity for cloud security providers to tap into new, expanding markets.

Challenge

Rapidly Evolving Cyber Threats

A major challenge in the cloud security software market is the fast pace at which cyber threats evolve. Cybercriminals continually develop new techniques to exploit vulnerabilities in cloud services, which requires constant vigilance and regular updates to cloud security measures.

This dynamic landscape demands continuous research and development efforts from cloud security providers to stay ahead of threats. Additionally, the growing sophistication of attacks makes it imperative for security solutions to be not only reactive but also proactive, predicting potential security breaches before they occur.

Impact of AI on Cloud Security Software Market

Artificial intelligence (AI) has significantly transformed cloud security software by enhancing threat detection, response times, and overall system resilience. AI-driven solutions can analyze vast amounts of data in real-time, identifying anomalies and potential threats more efficiently than traditional methods. This capability enables organizations to respond to security incidents promptly, reducing potential damage.

However, the integration of AI into cloud security also introduces new challenges. Cybercriminals are leveraging AI to develop more sophisticated attack methods, such as AI-generated phishing emails and adaptive malware, which can evade conventional security measures. This escalation necessitates continuous advancements in AI-driven security solutions to counteract emerging threats.

Moreover, the complexity of AI systems can pose difficulties in understanding and managing security protocols, potentially leading to vulnerabilities if not properly addressed. Ensuring that AI models are transparent and interpretable is crucial for maintaining robust security postures in cloud environments.

Growth Factors

Embracing Digital Transformation and Multi-Cloud Strategies

The cloud security software market is experiencing robust growth, primarily driven by the widespread adoption of digital transformation and the increasing use of multi-cloud strategies by organizations. As businesses continue to digitize their operations and adopt cloud-based technologies, the need for comprehensive cloud security solutions becomes paramount to protect sensitive data and maintain operations integrity.

This trend is further supported by the integration of advanced technologies like artificial intelligence and machine learning, which enhance the effectiveness of cloud security solutions by enabling more sophisticated threat detection and response mechanisms.

The push towards multi-cloud environments allows organizations to leverage the unique benefits of different cloud providers, but it also introduces complex security challenges that require robust solutions to manage data security across diverse platforms.

Emerging Trends

Increased Focus on Cybersecurity and Regulatory Compliance

Emerging trends in the cloud security software market include a heightened focus on cybersecurity measures and compliance with evolving regulatory standards. As cyber threats become more sophisticated, businesses are investing more in cloud security solutions that offer advanced threat detection, data protection, and compliance capabilities.

Regulatory bodies are also updating their guidelines to address the increasing risks associated with cloud computing, which in turn drives demand for compliance-related security features. This trend is evident in sectors such as healthcare, finance, and government, where data sensitivity is high and regulatory compliance is critical.

Additionally, the adoption of technologies such as the Internet of Things (IoT) and the expansion of 5G networks are creating new security vulnerabilities that cloud security solutions are evolving to address, thus shaping the market’s future trajectory.

Business Benefits

Enhancing Efficiency and Reducing Costs

Adopting cloud security solutions offers significant business benefits, including enhanced operational efficiency and cost reduction. By safeguarding data and systems in the cloud, businesses can prevent costly data breaches and downtime, thereby maintaining continuous operations and safeguarding their reputation.

Cloud security solutions also provide scalability and flexibility, allowing businesses to adjust their security settings based on current needs without significant upfront investments. This scalability is particularly beneficial for small to medium-sized enterprises (SMEs) that might not have the resources for extensive in-house security infrastructures but still need to protect their data effectively.

Furthermore, the integration of cloud security solutions with existing IT infrastructures can streamline workflows and reduce the complexity of security management, further reducing operational costs and enhancing overall business agility.

Key Players Analysis

Key players in the cloud security software market are heavily investing in research and development (R&D) to drive growth and improve their internal business operations. This focus on R&D enables them to enhance their product offerings and stay competitive in an increasingly complex market.

Amazon Web Services (AWS) continues to be a dominant player in the cloud security market, with a strong focus on enhancing its services through new acquisitions and product launches. In 2023, AWS strengthened its security offerings with the acquisition of a few key startups that specialize in AI-driven threat detection and network security.

Cisco Systems has been actively improving its cloud security portfolio through both mergers and acquisitions. The company acquired Kenna Security, a leader in vulnerability management, which enabled Cisco to integrate risk-based vulnerability management into its cloud security solutions.

Broadcom Inc. entry into cloud security has been driven by strategic acquisitions, including the purchase of Symantec’s Enterprise Security Business, which significantly expanded its cloud security offerings. This acquisition allowed Broadcom to offer a comprehensive range of products, from endpoint protection to data security.

Top Key Players in the Market

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Broadcom, Inc.

- Trellix

- Check Point Software Technologies Ltd.

- Extreme Networks, Inc.

- Forcepoint

- Fortinet, Inc.

- F5, Inc.

- International Business Machines Corporation

- Proofpoint, Inc.

- Imperva

- Palo Alto Networks, Inc.

- Sophos Ltd.

- Zscaler, Inc.

- Others

Recent Developments

- In February 2024, Uptycs, the leading cloud security platform for large hybrid cloud environments, has launched Upward, its channel-first partner program. The new program would aid Uptycs and its partners bring its cloud-native application protection platform (CNAPP) and services to enterprises seeking to secure their critical workloads, wherever they run.

- In 2024, Amazon Web Services, Inc., Launched AWS Security Incident Response to help organizations manage security events effectively; partnered with Deloitte to deliver ConvergeSECURITY, a cloud-focused security and compliance service.

- In 2023, Cisco Systems, Inc. Acquired Isovalent to strengthen its Security Cloud platform and announced plans to acquire Lightspin for cloud security posture management.

Report Scope

Report Features Description Market Value (2024) USD 36.8 Bn Forecast Revenue (2034) USD 183 Bn CAGR (2025-2034) 17.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution (Cloud Access Security Broker (CASB), Cloud Detection and Response (CDR), Cloud Infrastructure Entitlement Management (CIEM), Cloud Workload Protection Platform (CWPP), Cloud Security Posture Management (CSPM)), Services (Professional Services, Managed Services), By Deployment (Private, Public, Hybrid), By Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises), By End-use (BFSI, IT & Telecom, Retail & E-commerce, Healthcare, Government, Manufacturing, Aerospace & Defense, Transportation and Logistics, Energy and Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services, Inc., Cisco Systems, Inc., Broadcom, Inc., Trellix, Check Point Software Technologies Ltd., Extreme Networks, Inc., Forcepoint, Fortinet, Inc., F5, Inc., International Business Machines Corporation, Proofpoint, Inc., Imperva, Palo Alto Networks, Inc., Sophos Ltd., Zscaler, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cloud Security Software MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Cloud Security Software MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Broadcom, Inc.

- Trellix

- Check Point Software Technologies Ltd.

- Extreme Networks, Inc.

- Forcepoint

- Fortinet, Inc.

- F5, Inc.

- International Business Machines Corporation

- Proofpoint, Inc.

- Imperva

- Palo Alto Networks, Inc.

- Sophos Ltd.

- Zscaler, Inc.

- Others