Global AI Chip Market By Chipset Type (CPU, GPU, FPGA, ASIC, Others), By Architecture Type (System On Chip (SoC), System in Package, Multi Chip Module, Others), By Function (Training, Inference), By Processing Type (Edge, Cloud), By Vertical (Healthcare, Manufacturing, Automotive, Retail & E-Commerce, Media & Entertainment, Consumer Electronics, BFSI, Others) , By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 115817

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

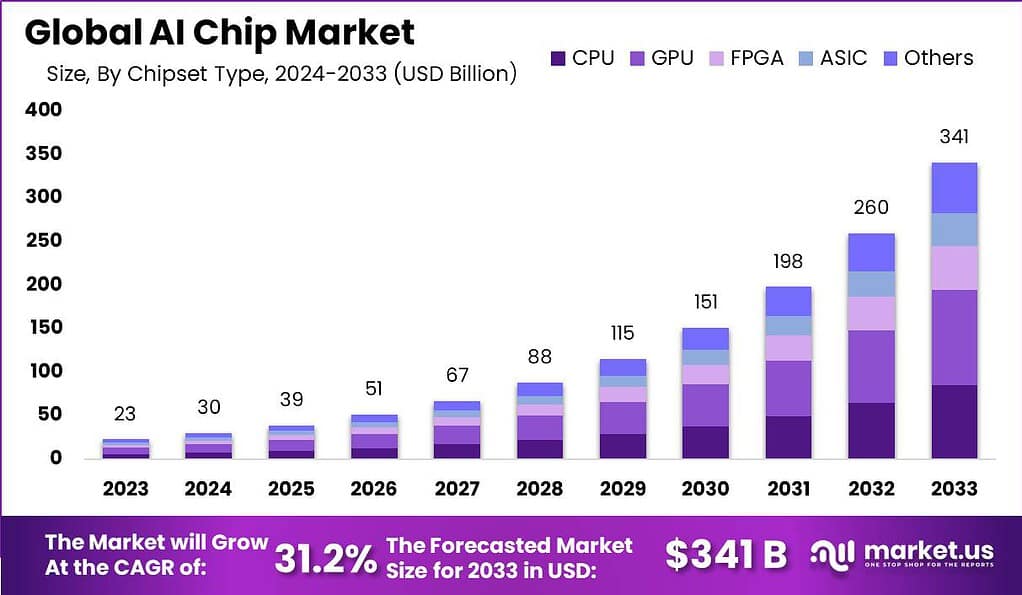

The Global AI Chip Market size is expected to be worth around USD 341 Billion by 2033, from USD 23.0 Billion in 2023, growing at a CAGR of 31.2% during the forecast period from 2024 to 2033.

AI chips, also known as artificial intelligence chips, are specialized semiconductor devices designed to perform complex calculations and tasks required for artificial intelligence applications. These chips are specifically optimized to accelerate AI algorithms and processes, enabling faster and more efficient execution of AI workloads. The AI chip market has experienced significant growth in recent years, driven by the increasing demand for AI-powered technologies across various industries.

The AI chip market has witnessed remarkable expansion due to the rapid advancements in AI technologies and the growing need for AI capabilities in various sectors. With the proliferation of AI applications in areas such as healthcare, finance, automotive, and manufacturing, the demand for AI chips has soared. AI chips enable real-time data processing, pattern recognition, and decision-making, empowering businesses and organizations to extract insights and drive innovation.

In addition to the rise in demand, the AI chip market has seen intense competition among key players. Both established semiconductor manufacturers and emerging startups are investing significantly in AI chip research and development to gain a competitive edge. These companies are striving to develop chips that offer higher performance, lower power consumption, and improved cost-effectiveness, meeting the evolving requirements of AI applications.

Research Findings

According to Deloitte’s predictions, the sales of AI chips in 2024 are projected to reach approximately 11% of the estimated global chip market, which is expected to be worth around US$ 576 billion. This indicates the growing significance of AI chips in the semiconductor industry, as businesses across various sectors increasingly incorporate artificial intelligence into their operations.

Venture funding into AI chip startups is anticipated to exceed $20 billion in 2023, rising from $15 billion in 2022. The upward trend in funding signals the strong investor interest in the potential of AI chips and their applications. The projected funding of over $25 billion in 2024 reflects the continued confidence in the growth and innovation potential of the AI chip market.

NVIDIA has established itself as a dominant force in the AI chip industry, as evidenced by its impressive revenue performance. In the second quarter of 2023, NVIDIA reported revenue of $13.51 billion, representing a remarkable 101% increase compared to the previous year and an 88% surge from the preceding quarter. This growth highlights the market demand for NVIDIA’s AI chips and their widespread adoption across industries.

While NVIDIA currently holds a significant market share of approximately 80%, both large and small businesses are actively seeking alternatives to diversify their AI chip options. Advanced Micro Devices (AMD) stands out as one of the few viable alternatives with successful products in the market. This pursuit of alternative AI chips underscores the need for competition and innovation within the industry.

The adoption of AI accelerators, such as Graphics Processing Units (GPUs) and Field-Programmable Gate Arrays (FPGAs), in data centers is projected to increase significantly. By 2024, it is estimated that over 65% of data centers will have embraced AI accelerators, compared to 45% in 2022. This highlights the growing recognition of the benefits of AI acceleration in data processing and analysis, driving the demand for AI chips in data center infrastructure.

The number of patent applications related to AI chips is expected to grow by 25% in 2023 and 20% in 2024. This indicates the ongoing innovation and research efforts in the field of AI chip development. The increase in patent applications underscores the commitment to advancing AI chip technologies and creating intellectual property to protect and promote further advancements in the industry.

Key Takeaways

- The AI Chip market is estimated to reach a staggering USD 341 billion by 2033, showcasing a robust Compound Annual Growth Rate (CAGR) of 31.2% throughout the forecast period.

- In 2023, the GPU segment held a dominant market position within the AI chip market, capturing more than a 32% share

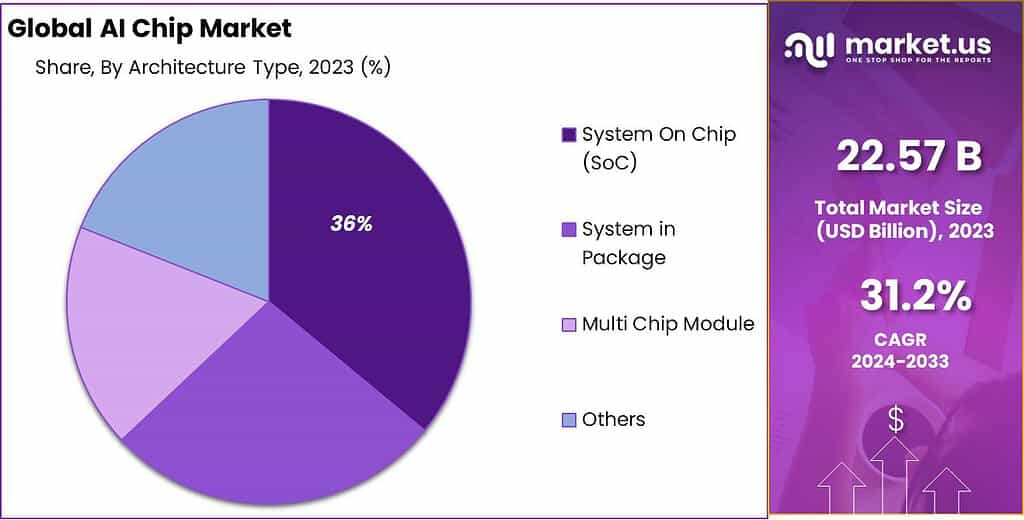

- In 2023, the System On Chip (SoC) segment held a dominant market position in the AI chip market, capturing more than a 36% share.

- In 2023, the Training segment held a dominant market position, capturing more than a 65% share of the AI chip market.

- In 2023, the Edge segment held a dominant market position within the AI chip market, capturing more than a 67% share.

- In 2023, the Consumer Electronics segment held a dominant market position in the AI chip market, capturing more than an 18% share.

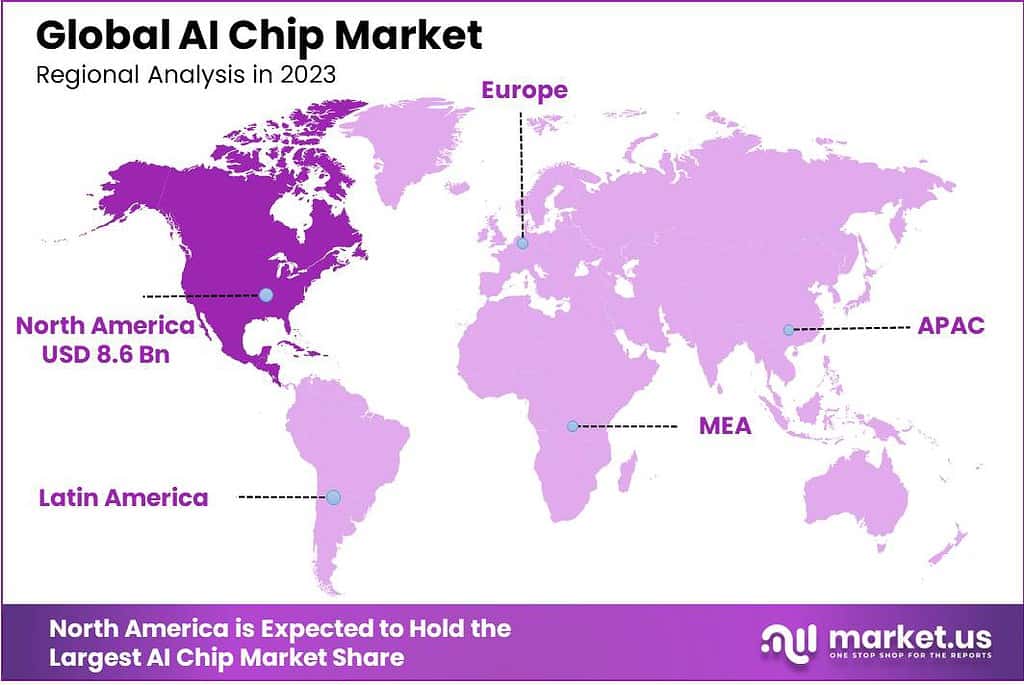

- In 2023, North America held a dominant market position in the AI chip sector, capturing more than a 38% share of the global market.

Chipset Type Analysis

In 2023, the GPU segment held a dominant market position within the AI chip market, capturing more than a 32% share. This leadership can be attributed to the inherent architecture of GPUs, which is exceptionally well-suited for handling the parallel processing requirements of artificial intelligence and machine learning workloads. Unlike traditional CPUs, GPUs are designed with thousands of smaller, more efficient cores capable of managing multiple tasks simultaneously.

This capability makes them ideal for accelerating the computational processes of AI algorithms, thereby significantly reducing the time required for data processing and analysis. The dominance of the GPU segment is further bolstered by its widespread adoption in various high-growth areas, including autonomous vehicles, high-performance computing, and deep learning applications. The demand for GPUs in these sectors is driven by their ability to efficiently process complex computations and large volumes of data, a critical requirement for developing advanced AI models.

Moreover, the continuous advancements in GPU technology, marked by improvements in processing power, energy efficiency, and integration capabilities, have expanded their applicability across a broader range of industries. This technological evolution, coupled with strategic partnerships and collaborations among key industry players, has played a pivotal role in solidifying the GPU segment’s leadership position in the AI chip market.

Architecture Type Analysis

In 2023, the System On Chip (SoC) segment held a dominant market position in the AI chip market, capturing more than a 36% share. This leadership can be attributed to the SoC’s comprehensive integration of various components onto a single chip, which significantly enhances efficiency and reduces power consumption.

SoCs combine the capabilities of the central processing unit (CPU), graphics processing unit (GPU), memory, and sometimes even AI processors, which makes them particularly suited for high-performance applications requiring compact and energy-efficient solutions. The demand for such integrated solutions has seen a marked increase, especially in consumer electronics, automotive, and data centers, where space and power efficiency are critical.

The SoC architecture’s ascendancy is further bolstered by the rapid advancements in semiconductor technology and the growing proliferation of AI and machine learning in various sectors. Manufacturers are continuously innovating to pack more processing power into SoCs while maintaining or reducing their physical size. This has made SoCs an increasingly attractive option for devices ranging from smartphones and tablets to more complex systems like autonomous vehicles and smart home devices.

Additionally, the ability of SoCs to provide high computational power with lower latency is crucial for real-time processing in AI applications, thereby driving their adoption. Moreover, the economic efficiency of SoCs contributes significantly to their leading position in the AI chip market. By integrating all necessary components on a single chip, manufacturers can reduce production costs and complexity, offering more affordable solutions to the end consumer.

Function Analysis

In 2023, the Training segment held a dominant market position, capturing more than a 65% share of the AI chip market. This significant market share can be attributed to the increasing demand for sophisticated AI models that require extensive data training to improve accuracy and efficiency. Training AI models is a computationally intensive task that necessitates powerful AI chips designed specifically for this purpose. These chips are engineered to handle complex algorithms and large datasets, making them indispensable for developing advanced AI applications.

The dominance of the Training segment is further bolstered by the surge in investments from leading tech companies in research and development activities aimed at enhancing AI technologies. These advancements are crucial for training more complex models, including deep learning and neural networks, which are at the heart of innovations in areas such as autonomous vehicles, healthcare diagnostics, and natural language processing. The need for high-performance computing capabilities to manage the training phase efficiently has led to the development of more specialized and powerful chips, thereby fueling the growth of this market segment.

Moreover, the exponential increase in data generation from various sources has necessitated the adoption of AI chips capable of training models to interpret and analyze this data effectively. The ability to process and learn from vast amounts of information in real-time is a critical factor driving the expansion of the Training segment. As industries continue to leverage AI for competitive advantage, the demand for AI chips that can support the intensive requirements of training phase operations is expected to rise, ensuring the continued dominance of the Training segment in the AI chip market.

Processing Type Analysis

In 2023, the Edge segment held a dominant market position within the AI chip market, capturing more than a 67% share. This significant lead can be attributed to the increasing demand for real-time data processing and analytics in various end-user applications, including autonomous vehicles, smart cameras, and IoT devices. Edge computing’s capacity to process data locally, minimizing latency and reducing the need for constant cloud connectivity, has been a critical factor in its predominance.

The surge in deployment of edge computing solutions across industries has directly influenced the demand for AI chips that are capable of performing complex computations at the edge of networks, thereby driving the segment’s growth. Furthermore, the Edge segment’s leadership is bolstered by advancements in AI and machine learning technologies, which require robust computational power at the device level. Manufacturers and developers are continuously innovating to create more efficient, powerful, and energy-saving AI chips suitable for edge computing environments.

The proliferation of smart devices and the escalating need for privacy and data security also contribute to the edge’s appeal, as processing data on-device can significantly mitigate data breach risks compared to cloud-based solutions. Economically, the Edge AI chip segment benefits from economies of scale and a competitive landscape that encourages rapid innovation and cost reduction.

As technology progresses, the cost of AI chips for edge processing is expected to continue decreasing, making advanced AI capabilities accessible to a broader range of products and services. This trend is anticipated to sustain the segment’s growth momentum, further cementing its dominant position in the AI chip market.

Vertical Analysis

In 2023, the Consumer Electronics segment held a dominant market position in the AI chip market, capturing more than an 18% share. This substantial market share can be attributed to the increasing integration of artificial intelligence (AI) technologies in a wide range of consumer electronic products. Devices such as smartphones, smart speakers, wearable technologies, and home automation systems have increasingly incorporated AI chips to enhance user interaction, improve device functionality, and provide a more personalized user experience.

The demand for AI-enabled consumer electronics has been driven by consumers’ growing preference for smart, interconnected devices that offer enhanced convenience, efficiency, and capabilities. The leadership of the Consumer Electronics segment in the AI chip market is further bolstered by the rapid advancements in AI and machine learning technologies, which have enabled more sophisticated and power-efficient AI chips. These technological advancements have facilitated the deployment of complex AI algorithms in consumer devices without significantly impacting battery life or device performance.

Moreover, manufacturers in the consumer electronics industry are continuously innovating and investing in AI to differentiate their products in a highly competitive market. This has led to a proliferation of AI-enabled devices, from high-end to more affordable segments, making AI features accessible to a broader consumer base.

Key Market Segments

By Chipset Type

- CPU

- GPU

- FPGA

- ASIC

- Others

By Architecture Type

- System On Chip (SoC)

- System in Package

- Multi Chip Module

- Others

By Function

- Training

- Inference

By Processing Type

By Vertical

- Healthcare

- Manufacturing

- Automotive

- Retail & E-Commerce

- Media & Entertainment

- Consumer Electronics

- BFSI

- Others

Driver

Rapid Advancements in AI and Machine Learning Technologies

The rapid advancements in artificial intelligence (AI) and machine learning technologies stand as a primary driver for the AI chip market. These technological breakthroughs have significantly enhanced the computational power and efficiency of AI chips, enabling them to process complex algorithms and vast amounts of data at unprecedented speeds.

As AI technologies continue to evolve, the integration of AI chips into various applications, from autonomous vehicles and smart factories to healthcare diagnostics and consumer electronics, is becoming more feasible and cost-effective. This evolution is not only expanding the applicability of AI chips across different sectors but is also driving innovation, leading to the development of smarter, more autonomous, and highly efficient AI systems. The continuous improvement in AI chip technology is instrumental in pushing the boundaries of what is possible with AI, thereby fueling the growth of the global AI chip market.

Restraint

High Costs Associated with AI Chip Development and Integration

One significant restraint facing the AI chip market is the high costs associated with the development and integration of AI chips. The design and fabrication of advanced AI chips require substantial investment in research and development (R&D), specialized materials, and cutting-edge manufacturing processes. Additionally, integrating these chips into applications necessitates extensive testing and optimization to ensure compatibility and performance, further elevating costs.

For small and medium-sized enterprises (SMEs), these high upfront costs can be prohibitive, limiting their ability to adopt AI technologies. This cost barrier not only affects the market expansion by restricting the entry of new players but also slows down the pace of innovation within the industry. Addressing these cost challenges is crucial for enabling broader access to AI technologies and fostering a more competitive and diverse AI chip market.

Opportunity

Surging Demand for AI-based Field Programmable Gate Arrays (FPGAs)

The surging demand for AI-based Field Programmable Gate Arrays (FPGAs) represents a significant opportunity in the AI chip market. FPGAs are uniquely positioned to offer flexibility and efficiency in AI applications, allowing for on-the-fly reprogramming to accommodate various algorithms without the need for hardware modifications.

This adaptability makes FPGAs especially valuable in environments where AI workloads and models frequently change, such as edge computing, data centers, and network infrastructure. The ability of FPGAs to efficiently process AI tasks with lower latency and power consumption compared to traditional CPUs and GPUs is driving their adoption across several industries, including automotive, telecommunications, and healthcare.

Furthermore, the ongoing advancements in FPGA technology and the increasing integration of AI functionalities are expected to further boost their market demand. As organizations continue to seek optimized, flexible, and cost-effective solutions for AI computations, the demand for AI-based FPGAs is poised to grow, presenting lucrative opportunities for manufacturers and developers in the AI chip market.

Challenge

Complexity in AI Chip Design and Manufacturing

A major challenge in the AI chip market is the complexity involved in the design and manufacturing of AI chips. As the demand for more powerful and efficient AI systems grows, the complexity of AI chip architectures increases. Designing chips that are capable of handling advanced AI algorithms requires deep expertise in both semiconductor engineering and AI technology.

Additionally, the manufacturing process for these chips is intricate and requires state-of-the-art fabrication facilities, which are expensive to build and operate. This complexity not only extends the development cycle and increases production costs but also limits the number of players capable of entering the market. Furthermore, as AI technologies rapidly evolve, there is a constant pressure to innovate and upgrade chip designs, adding another layer of challenge for manufacturers in keeping pace with technological advancements.

Regional Analysis

In 2023, North America held a dominant market position in the AI chip sector, capturing more than a 38% share of the global market. This leadership can be attributed to several key factors that have positioned the region at the forefront of the artificial intelligence technology revolution. Firstly, North America is home to a robust ecosystem of tech giants and startups alike, which are pivotal in driving innovation and development within the AI chip industry.

Companies such as NVIDIA, Intel, and AMD, headquartered in this region, have been at the cutting edge of producing specialized processors that significantly enhance AI and machine learning capabilities. Moreover, the region benefits from substantial investments in research and development, supported by both private and public funding, facilitating a rapid advancement in AI technologies. This investment is further bolstered by a strong collaborative link between academia and industry, leading to groundbreaking innovations and the acceleration of AI chip development.

Additionally, North America’s regulatory landscape and policies have been conducive to the growth of AI technologies, encouraging experimentation and the adoption of AI across various sectors including healthcare, automotive, and finance.

The high concentration of technology hubs such as Silicon Valley, combined with a skilled workforce specializing in AI and machine learning, further solidifies North America’s leadership in the global AI chip market. The demand within the region for AI capabilities is driven by the need for data center expansion, increased cloud computing adoption, and the integration of AI into consumer electronics, which in turn fuels the development and adoption of AI chips.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The AI chip market is experiencing transformative growth, driven by the escalating demand for computing power and efficiency in processing vast amounts of data. NVIDIA Corporation, with its acquisition of Mellanox Technologies, continues to lead the market, leveraging synergies between Mellanox’s networking capabilities and NVIDIA’s GPU expertise to enhance data center performance and AI application efficiency.

Intel Corporation remains a formidable competitor, focusing on diversifying its AI chip offerings through its Nervana and Mobileye acquisitions, aiming to strengthen its position in both cloud and edge AI computing. Qualcomm Technologies Inc. is capitalizing on the proliferation of mobile and IoT devices, integrating AI capabilities into its Snapdragon processors to support smart devices and applications.

Similarly, NXP Semiconductors is making significant strides in the automotive and industrial sectors, embedding AI in chips to power autonomous vehicles and smart factories. Micron Technology’s role, though more focused on memory solutions, is pivotal in supporting the infrastructure that AI chips require, enhancing data access speed and efficiency.

Top Market Leaders

- NVIDIA Corporation (Mellanox Technologies)

- Intel Corporation

- Qualcomm Technologies Inc

- NXP Semiconductors

- Micron Technology

- Samsung Electronics Co Ltd,

- Advanced Micro Devices Inc.(Xilinx Inc.)

- Alphabet Inc.

- Apple Inc.

- Huawei Technologies

- MediaTek Inc.

- Other Key Players

Recent Developments

1. NVIDIA Corporation (Mellanox Technologies):

- February 2023: Launched the NVIDIA HGX A100 AI supercomputing platform, offering significant performance improvements for large language models and other AI workloads.

- August 2023: Announced the NVIDIA Grace™ CPU specifically designed for AI and high-performance computing tasks, scheduled for release in 2024.

2. Intel Corporation:

- March 2023: Unveiled the Intel® Ponte Vecchio AI exascale computing chip, targeting scientific simulations and research applications.

- October 2023: Acquired Barefoot Networks, a leader in high-performance Ethernet switching chips, aiming to expand their AI networking solutions.

Report Scope

Report Features Description Market Value (2023) US$ 23 Billion Forecast Revenue (2033) US$ 341 Billion CAGR (2024-2033) 31.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Chipset Type (CPU, GPU, FPGA, ASIC, Others), By Architecture Type (System On Chip (SoC), System in Package, Multi Chip Module, Others), By Function (Training, Inference), By Processing Type (Edge, Cloud), By Vertical (Healthcare, Manufacturing, Automotive, Retail & E-Commerce, Media & Entertainment, Consumer Electronics, BFSI, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape NVIDIA Corporation (Mellanox Technologies), Intel Corporation, Qualcomm Technologies Inc, NXP Semiconductors, Micron Technology, Samsung Electronics Co Ltd,, Advanced Micro Devices Inc.(Xilinx Inc.), Alphabet Inc., Apple Inc., Huawei Technologies, MediaTek Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is an AI Chip?An AI chip, also known as an artificial intelligence chip, is a specialized integrated circuit (IC) designed to perform AI-related tasks such as machine learning, deep learning, and neural network processing.

How big is AI Chip Market?The Global AI Chip Market size is expected to be worth around USD 341 Billion by 2033, from USD 23.0 Billion in 2023, growing at a CAGR of 31.2% during the forecast period from 2024 to 2033.

What are the challenges of using AI Chips?Some challenges of using AI chips include the high cost of development and manufacturing, the need for specialized expertise, and concerns about data privacy and security.

Who are some key players in the AI Chip Market?Some key players in the AI chip market include NVIDIA Corporation (Mellanox Technologies), Intel Corporation, Qualcomm Technologies Inc, NXP Semiconductors, Micron Technology, Samsung Electronics Co Ltd,, Advanced Micro Devices Inc.(Xilinx Inc.), Alphabet Inc., Apple Inc., Huawei Technologies, MediaTek Inc., Other Key Players

What are some key factors driving the growth of the AI Chip Market?Some key factors driving the growth of the AI chip market include increasing demand for AI-related applications across various industries, advancements in AI chip technology, and growing investments in AI research and development.

-

-

- NVIDIA Corporation (Mellanox Technologies)

- Intel Corporation

- Qualcomm Technologies Inc

- NXP Semiconductors

- Micron Technology

- Samsung Electronics Co Ltd,

- Advanced Micro Devices Inc.(Xilinx Inc.)

- Alphabet Inc.

- Apple Inc.

- Huawei Technologies

- MediaTek Inc.

- Other Key Players