Global Gynecological Devices Market By Product Type (Surgical Devices, Diagnostic Imaging Devices (Ultrasound and Mammography), Endometrial Ablation Devices (Hydrothermal, Radiofrequency, Balloon, and Others), Fluid Management Systems, and Portable Tools), By End-use (Hospital & Clinics, Diagnostic Centers, and Ambulatory Surgery Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 130141

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

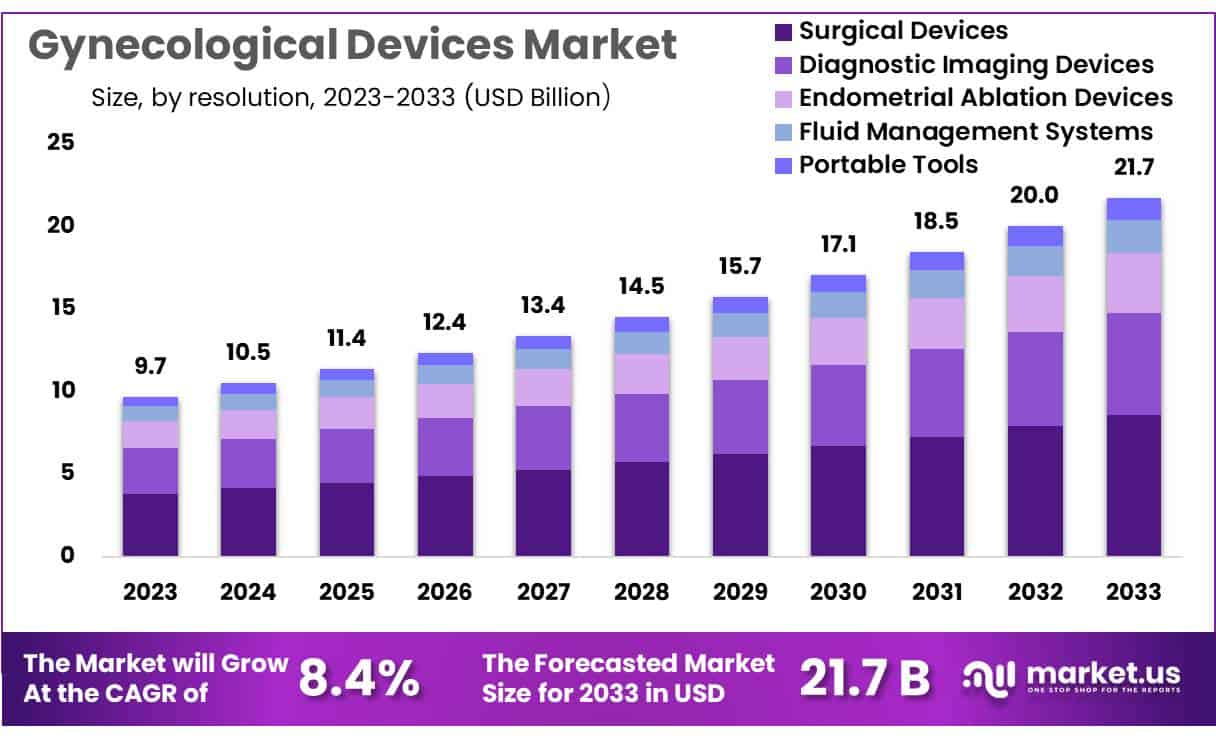

Global Gynecological Devices Market size is expected to be worth around USD 21.7 billion by 2033 from USD 9.7 billion in 2023, growing at a CAGR of 8.4% during the forecast period 2024 to 2033.

Growing awareness of women’s health issues drives significant demand for gynecological devices, particularly in areas such as diagnostics, surgical procedures, and fertility treatments. These devices include ultrasound systems, minimally invasive surgical instruments, and robotic-assisted surgical systems, all of which enhance clinical outcomes for a variety of conditions, including polycystic ovary syndrome (PCOS).

With a global prevalence of approximately 5% to 9%, PCOS has garnered increased attention, prompting healthcare providers to invest in advanced technologies for diagnosis and treatment. Recent advancements in robotic-assisted surgery have revolutionized gynecological procedures, enabling greater precision and reduced recovery times.

In July 2021, the introduction of the Hugo Robotic-Assisted Surgery (RAS) system by Medtronic Plc marked a milestone as the first gynecological procedure using this technology was successfully performed in Panama. This trend reflects a broader shift toward innovative, minimally invasive solutions that improve patient experiences and outcomes.

Furthermore, the growing focus on preventive healthcare and routine screenings provides ample opportunities for market expansion, as more women seek regular gynecological care.

Key Takeaways

- Market Size: Gynecological Devices Market size is expected to be worth around USD 21.7 billion by 2033 from USD 9.7 billion in 2023.

- Market Growth: The market growing at a CAGR of 8.4% during the forecast period 2024 to 2033.

- Product Type Analysis: The surgical devices segment led in 2023, claiming a market share of 39.4%.

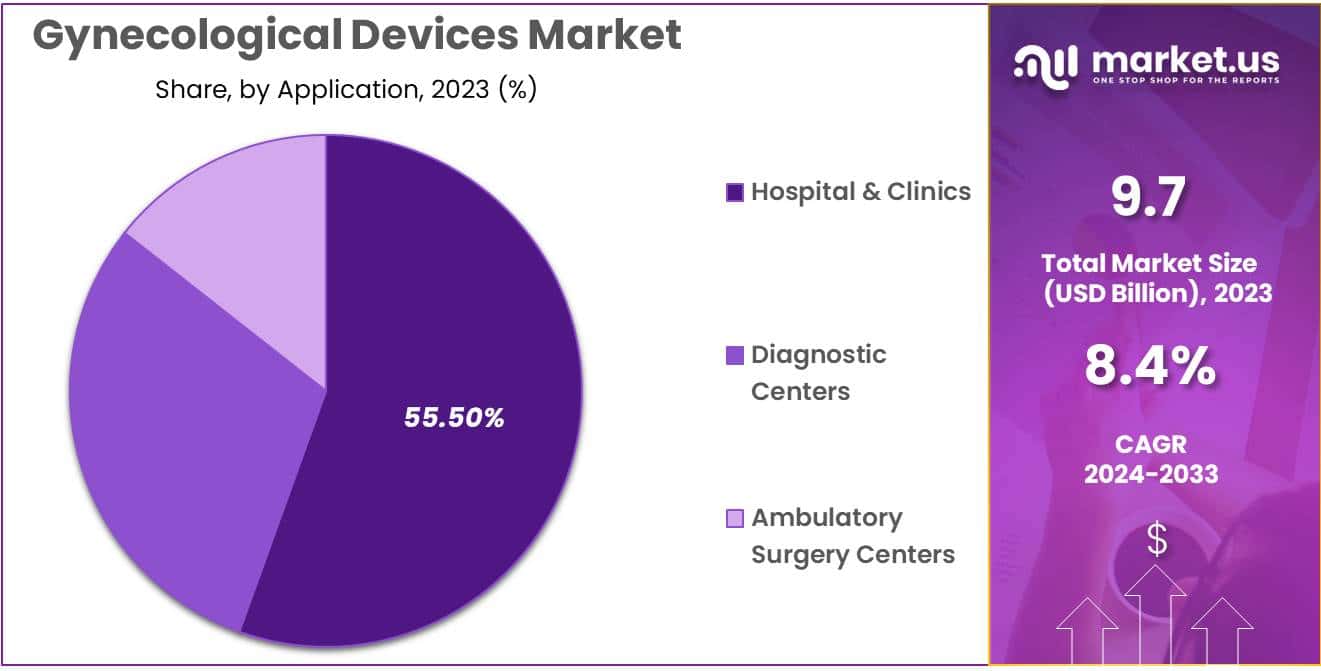

- Application Analysis: In 2023, The hospital & clinics held a significant share of 55.5%.

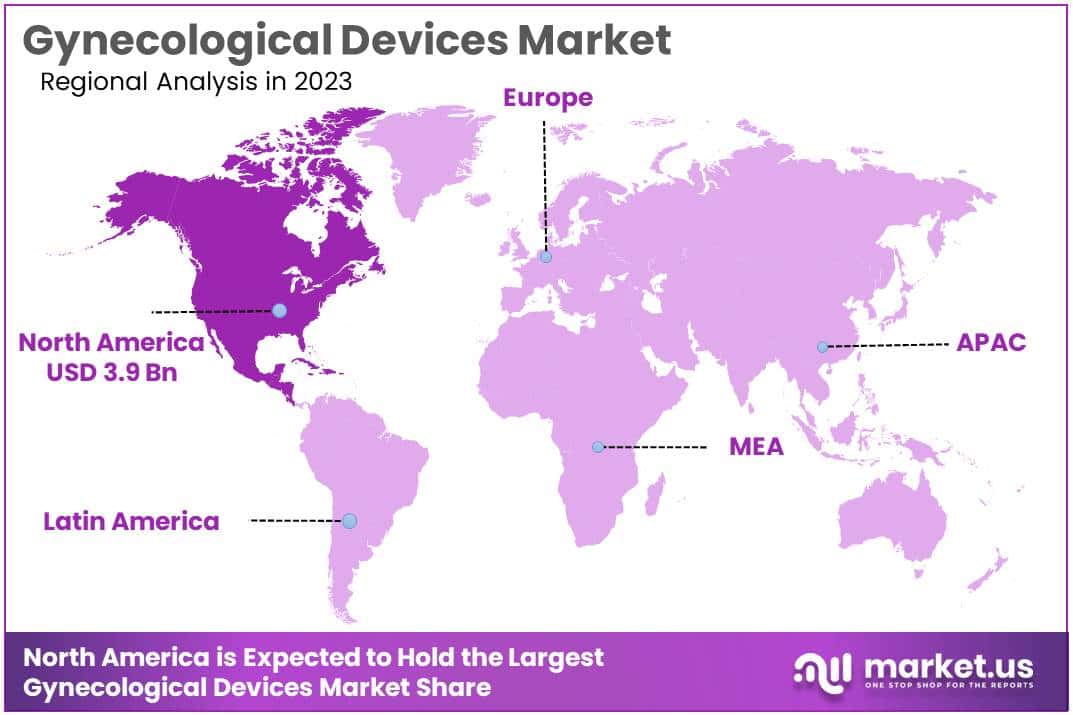

- Regional Analysis: In 2023, North America dominated the market with the highest revenue share of 39.7%.

- Technological Advancements: Innovations in minimally invasive surgical techniques are enhancing patient recovery times and supporting higher adoption rates.

- Drivers: The demand for personalized treatment options and improved healthcare accessibility is a primary market growth driver.

By Product Type Analysis

The surgical devices segment led in 2023, claiming a market share of 39.4% owing to the increasing prevalence of gynecological disorders and the rising demand for minimally invasive surgical procedures. The advancement in surgical techniques and technologies has enhanced the efficiency and safety of gynecological surgeries, making them more appealing to both patients and healthcare providers. Innovations such as robotic-assisted surgery and laparoscopic techniques are anticipated to propel this segment forward, as they offer reduced recovery times and lower complication rates.

Additionally, the growing awareness of women’s health issues and the importance of regular screenings are likely to boost the utilization of surgical instruments in procedures like hysterectomies and fibroid removals. The expansion of outpatient surgical centers is projected to further support this growth by increasing access to surgical care, thus creating a larger market for specialized surgical tools and devices.

By End-use Analysis

The hospital & clinics held a significant share of 55.5%. The rising incidence of gynecological conditions, coupled with the increasing number of women seeking preventive care and treatment, drives demand within this segment. Hospitals and clinics are likely to invest in advanced diagnostic and therapeutic equipment to improve patient outcomes and streamline workflow processes.

Furthermore, the emphasis on integrated healthcare solutions and multidisciplinary approaches in women’s health is anticipated to enhance collaboration among healthcare providers, thereby increasing the utilization of gynecological devices. The ongoing shift towards value-based care models is expected to incentivize these facilities to adopt innovative technologies that promote better patient care while reducing costs.

Consequently, hospitals and clinics are likely to remain at the forefront of the gynecological devices market, leading the way in providing essential healthcare services to women.

Key Market Segments

By Product Type

- Surgical Devices

- Diagnostic Imaging Devices

- Ultrasound

- Mammography

- Endometrial Ablation Devices

- Hydrothermal

- Radiofrequency

- Balloon

- Others

- Fluid Management Systems

- Portable Tools

By End-use

- Hospital & Clinics

- Diagnostic Centers

- Ambulatory Surgery Centers

Drivers

Surge in Hysterectomy Procedures

Increasing numbers of hysterectomy procedures significantly drive the gynecological devices market. According to the Office on Women’s Health (OWH), approximately 500,000 women in the U.S. choose to undergo this surgery annually, making it the second-most common surgical procedure among females. The rise in conditions such as fibroids, endometriosis, and abnormal bleeding contributes to this trend, leading healthcare providers to recommend surgical intervention.

As the demand for effective and minimally invasive treatment options grows, manufacturers of related devices are expanding their product lines to cater to this need. Innovative solutions, such as advanced surgical instruments and enhanced imaging technologies, are expected to play a crucial role in improving surgical outcomes. This increase in hysterectomy procedures, driven by both medical necessity and patient preference, is projected to bolster market growth for gynecological devices.

Restraints

Lack of Awareness

High levels of lack of awareness about gynecological health impede the growth of the market for related devices. Many women remain uninformed about available treatment options and the importance of regular gynecological check-ups. This gap in knowledge can lead to delayed diagnoses and missed opportunities for timely intervention, ultimately limiting the adoption of new technologies and devices.

Additionally, cultural stigma surrounding women’s health issues often hampers open discussions and education efforts, further contributing to this restraint. Healthcare providers may also struggle to engage patients effectively due to these awareness barriers. This lack of awareness is expected to hinder the overall market potential, as many women may not pursue necessary treatments or inquire about advanced surgical options.

Opportunities

Growing Technological Advancements

Rising technological advancements offer significant opportunities for the gynecological devices market. Continuous innovation in medical technology enhances the effectiveness and safety of surgical procedures, attracting more patients to seek treatment. For instance, in January 2022, The Women’s Hospital at Jackson Memorial, alongside HCA Florida Healthcare’s Kendall Regional Medical Center and AdventHealth Celebration, began utilizing the Hominis Surgical System.

This robotic surgical technology, developed by Memic Innovative Surgery, streamlines gynecological procedures, enhancing precision and reducing recovery times. As healthcare providers increasingly adopt robotic-assisted techniques and minimally invasive options, the demand for advanced gynecological instruments is anticipated to rise. These advancements are expected to foster significant growth opportunities in the market, as manufacturers invest in innovative solutions to meet evolving patient and clinician needs.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly affect the market for reproductive health technologies. Economic fluctuations often lead to changes in healthcare spending, impacting the availability and affordability of essential devices. High inflation rates and rising costs of raw materials may constrain manufacturers’ profit margins and impede research and development efforts. Geopolitical instability, such as trade tensions and conflicts, can disrupt supply chains and increase lead times for product delivery.

Conversely, governments’ increasing emphasis on women’s health initiatives and the introduction of supportive policies foster growth opportunities. Additionally, the shift toward personalized healthcare encourages innovation and drives demand for advanced technologies. Overall, while challenges exist, the focus on enhancing women’s health and expanding access to reproductive health services presents a positive outlook for the market.

Latest Trends

Impact of Mergers and Acquisitions on the Gynecological Devices Market

Rising trends in mergers and acquisitions are anticipated to stimulate growth in the gynecological devices market. Companies actively pursue strategic partnerships to enhance their product offerings and expand their market reach. Such consolidation efforts enable businesses to leverage complementary technologies and share resources, ultimately fostering innovation.

For instance, in October 2021, Hologic, Inc. finalized its acquisition of Bolder Surgical, a U.S.-based company specializing in surgical devices. This acquisition included a range of laparoscopic tools, such as Bolder’s CoolSeal, the JustRight 5 mm stapler, and the JustRight 3 mm vessel sealer.

These strategic moves likely enhance Hologic’s capabilities in minimally invasive surgery and solidify its competitive position in the industry. As companies continue to merge and acquire, the market is expected to witness accelerated advancements and a broader range of offerings.

Regional Analysis

North America is leading the Gynecological Devices Market

North America dominated the market with the highest revenue share of 39.7% owing to various factors that underscore the increasing importance of women’s health. The rise in awareness and early diagnosis of gynecological conditions, alongside an aging population, has amplified the demand for advanced diagnostic and therapeutic solutions. Increased investment in healthcare infrastructure and technology has also contributed to market expansion, facilitating the adoption of innovative devices.

Notably, in March 2022, Endoluxe, a California-based company, launched the Endoluxe eVS, a high-definition wireless endoscopic camera integrated with TowerTech. This device, designed for use in gynecological procedures as well as urology, ENT, orthopedics, and general surgery, exemplifies the technological advancements that have enhanced surgical capabilities.

Furthermore, the growing emphasis on minimally invasive procedures has propelled the demand for sophisticated surgical instruments, reinforcing the trend toward enhanced patient care. Overall, these dynamics have fostered a thriving environment for gynecological devices in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

In the Asia Pacific region, the gynecological devices market is expected to experience robust growth during the forecast period. The increasing prevalence of gynecological disorders, coupled with rising awareness about women’s health, is anticipated to drive demand for various medical devices. Significant investments in healthcare infrastructure across countries like India and China contribute to the expansion of the market, facilitating access to advanced technologies.

In September 2022, Olympus Corporation, a prominent manufacturer in optical and digital precision technology, introduced the VISERA ELITE III, a state-of-the-art surgical visualization platform tailored to meet healthcare professionals’ needs during endoscopic procedures across multiple disciplines, including gynecology.

This launch demonstrates the commitment to enhancing surgical precision and outcomes, which is projected to further stimulate market growth. Additionally, government initiatives aimed at improving healthcare access and outcomes for women are likely to bolster the adoption of innovative devices in the region, leading to sustained market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the Gynecological Devices market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the gynecological devices market prioritize innovation and product differentiation to capture a larger share of the industry.

They invest significantly in research and development to create advanced solutions that address unmet medical needs, such as minimally invasive surgical instruments and improved diagnostic tools. Establishing strategic partnerships with healthcare providers and academic institutions enhances their credibility and facilitates the adoption of new technologies.

Companies actively pursue mergers and acquisitions to expand their product portfolios and enhance their competitive positioning. Additionally, they focus on entering emerging markets, capitalizing on the increasing demand for women’s health solutions in those regions.

Top Key Players

- Stryker Corporation

- Richard Wolf GmbH

- Olympus Corporation

- Medtronic plc

- MedGyn Product Inc.

- Hologic Inc.

- Cooper Surgical Inc.

- Boston Scientific Corporation

Recent Developments

- In July 2022, GE Healthcare, a prominent innovator in medical technology, pharmaceutical diagnostics, and digital solutions, introduced its latest ultrasound system, the Voluson Expert 22. This state-of-the-art device enhances GE Healthcare’s renowned Women’s Health portfolio by employing graphic-based beam former technology, which delivers superior image quality and increased flexibility in imaging capabilities. The introduction of advanced ultrasound technology is expected to drive growth in the gynecological devices market by improving diagnostic accuracy and expanding the range of available imaging options.

- In June 2022, UroViu Corp launched the Hystero-V, a single-use hysteroscope designed for compatibility with UroViu’s Always Ready endoscopy platform. This 12-Fr, semi-rigid hysteroscope features a hydrophilic coating that facilitates gentle insertion and enhances visualization for effective intra-uterine examinations. The introduction of innovative single-use hysteroscopes like the Hystero-V is anticipated to contribute to the growth of the gynecological devices market by increasing accessibility and improving patient outcomes through enhanced examination techniques.

Report Scope

Report Features Description Market Value (2023) USD 9.7 billion Forecast Revenue (2033) USD 21.7 billion CAGR (2024-2033) 8.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Surgical Devices, Diagnostic Imaging Devices (Ultrasound and Mammography), Endometrial Ablation Devices (Hydrothermal, Radiofrequency, Balloon, and Others), Fluid Management Systems, and Portable Tools), By End-use (Hospital & Clinics, Diagnostic Centers, and Ambulatory Surgery Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Stryker Corporation, Richard Wolf GmbH, Olympus Corporation, Medtronic plc, MedGyn Product Inc., Hologic Inc., Cooper Surgical Inc., and Boston Scientific Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Gynecological Devices MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Gynecological Devices MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Stryker Corporation

- Richard Wolf GmbH

- Olympus Corporation

- Medtronic plc

- MedGyn Product Inc.

- Hologic Inc.

- Cooper Surgical Inc.

- Boston Scientific Corporation