Global Electric Vehicle Market Report By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers, Three-Wheelers), By Propulsion Type (Battery Electric Vehicles, Plug-in Hybrid Electric Vehicles, Fuel Cell Electric Vehicles), By Drive Type (Front-Wheel Drive, Rear-Wheel Drive, All-Wheel Drive), By Vehicle Speed (Less Than 100 MPH, 100 MPH to 125 MPH, Above 125 MPH), By Vehicle Class, By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 131664

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Major Recent Investments and Funding

- Sustainability and Environment Impact

- Government Investments and Policies

- Vehicle Type Analysis

- Propulsion Type Analysis

- Drive Type Analysis

- Vehicle Speed Analysis

- Vehicle Class Analysis

- End-Use Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Opportunities

- Challenges

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

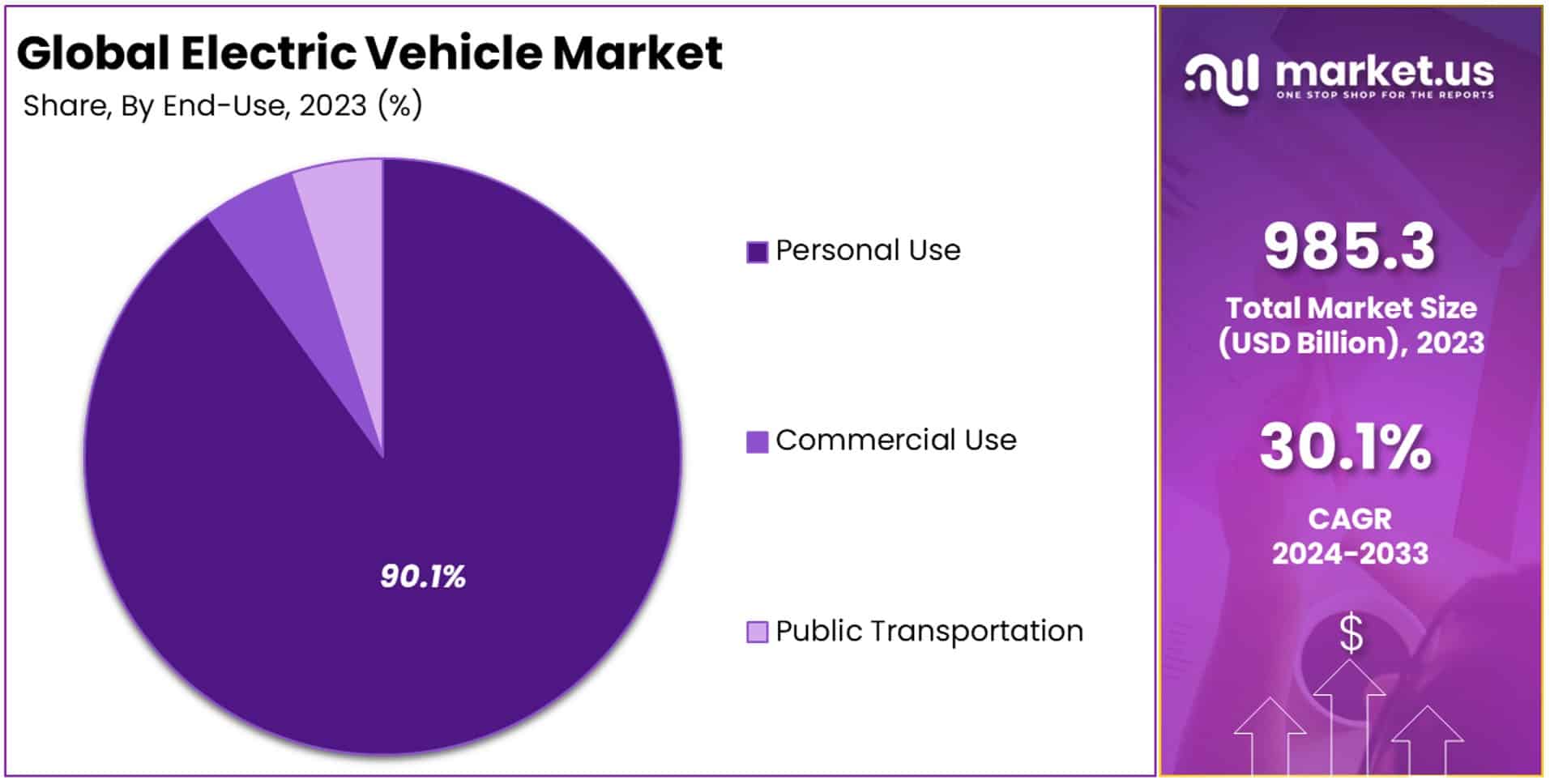

The Global Electric Vehicle Market size is expected to be worth around USD 13,688.0 Billion by 2033, from USD 985.3 Billion in 2023, growing at a CAGR of 30.1% during the forecast period from 2024 to 2033.

Electric Vehicles (EVs) are vehicles powered by electric motors, using energy stored in rechargeable batteries. These vehicles do not rely on traditional fuel sources like gasoline or diesel. They produce zero tailpipe emissions, making them environmentally friendly. Advancements in battery technology have improved EV efficiency, driving global adoption.

The Electric Vehicle Market involves the production, sales, and adoption of electric vehicles globally. It covers passenger cars, commercial vehicles, and two-wheelers. Driven by government incentives, rising environmental concerns, and advancements in technology, this market shows significant growth potential.

The global electric vehicle (EV) market saw strong growth in 2023, with approximately 14 million EVs sold globally, representing a 35% increase from the previous year, according to the International Energy Agency (IEA).

This brought the total number of EVs to over 40 million worldwide. EVs accounted for 18% of all new vehicle sales in 2023, with significant adoption in China, where 35% of new vehicle sales were EVs, followed by Europe with 3.2 million EVs and the United States with 1.4 million EVs.

The EV industry remains highly competitive, with major automakers like Honda, Hyundai, and Kia committing significant investments. Honda’s $40 billion investment aims to introduce 30 new battery electric vehicle (BEV) models by 2030, including a $500 million manufacturing facility in Guangzhou, China.

Similarly, Hyundai and Kia are investing $16.2 billion to launch 17 new EV models by 2030, supported by a $5.5 billion production plant in Georgia, U.S., set to start operations in 2024. These initiatives highlight increasing competitiveness among leading automakers striving to expand their EV portfolios.

Additionally, the European Union’s Fit for 55 initiative, targeting CO₂ emissions reductions, has driven substantial private investments in EV production, creating further growth opportunities.

Despite the positive outlook, the EV market in some regions is approaching early saturation, particularly in developed markets like China and parts of Europe, where EV adoption rates are already high. Various subsidies and tax rebates in key markets, including China, the European Union, and the United States, have played a significant role in boosting demand.

This trend implies that future growth may shift toward emerging markets, where penetration remains relatively low. Market competitiveness is expected to increase further as new entrants, including both traditional automakers and start-ups, introduce innovative models and technologies. Companies will likely focus on battery efficiency, longer driving ranges, and cost reduction to gain a competitive edge.

Key Takeaways

- The Electric Vehicle Market was valued at USD 985.3 billion in 2023, and is expected to reach USD 13,688 billion by 2033, with a CAGR of 30.1%.

- Passenger Cars dominated the vehicle type segment with 82.6%, driven by increasing consumer demand for personal electric vehicles.

- Battery Electric Vehicles (BEVs) led the propulsion segment with 84.2% due to their zero-emission capabilities and rising infrastructure development.

- Front-wheel Drive (FWD) was the leading drive type with 53.1%, attributed to its efficiency and lower manufacturing costs.

- The 100MPH-125MPH vehicle speed segment held 68.5% share, reflecting the demand for moderate-speed EVs suitable for urban use.

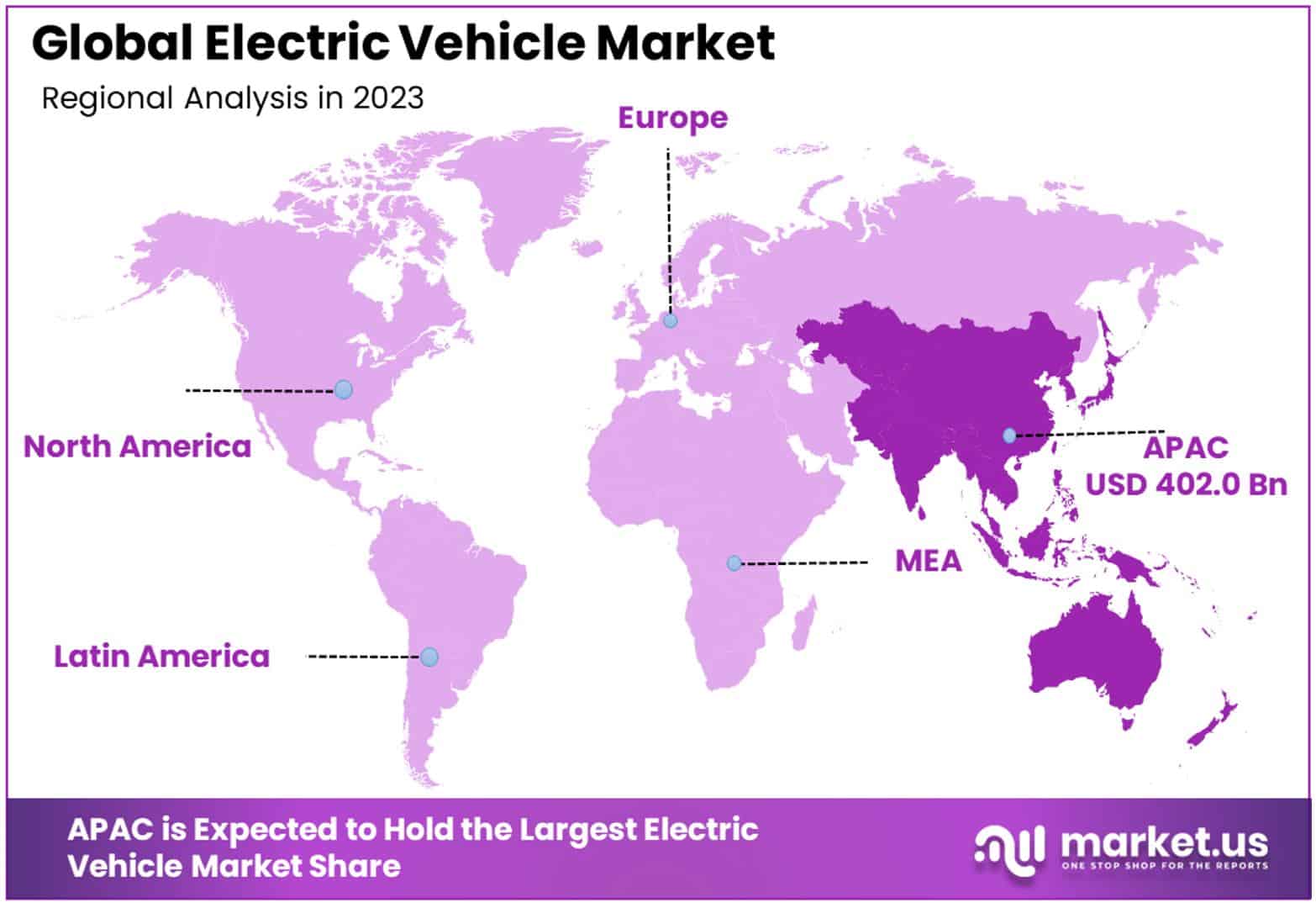

- In 2023, Asia-Pacific (APAC) led the regional market with 40.8% share, driven by government incentives and high EV adoption rates.

Major Recent Investments and Funding

- In October 2024, Indonesia launched a $1.2 billion joint venture with Contemporary Amperex Technology Co Ltd (CATL) from China to establish a global electric vehicle (EV) hub. The partnership, involving the Indonesia Battery Corporation and CATL’s subsidiary, CBL International Development, aims to develop a battery production capacity of up to 15 gigawatts annually in Karawang, West Java.

- Meanwhile, Hanon Systems announced a $155 million investment to establish North America’s first high-displacement e-compressor manufacturing facility in Woodbridge, Ontario. This plant aims to strengthen Ontario’s EV supply chain and meet growing demand for electric vehicle components in Canada and the U.S.

- Toyota Motor committed an additional $500 million in October 2024 to Joby Aviation to support certification and commercial production of electric air taxis. This funding follows a prior investment of $394 million and aligns with Toyota’s strategy to advance sustainable urban air mobility.

- Electrovaya, in October 2024, secured C$2 million ($1.45 million) from the Government of Canada, facilitated by the Federal Economic Development Agency for Southern Ontario. The funding will enhance its Mississauga, Ontario facility with automation, AI integration, and increased production capacity.

- In October 2024, Arizona received $205 million in federal funding to develop EV infrastructure over the next three years, focusing on highways and underserved communities. This initiative follows a threefold increase in EV adoption over the past 18 months, supported by expanding access to charging stations.

Sustainability and Environment Impact

- As per IEA, in 2023, the global electric vehicle (EV) fleet consumed approximately 130 TWh of electricity, equivalent to Norway’s total electricity demand for the same period. On a global scale, EVs represented about 0.5% of the world’s total final electricity consumption, with this figure rising to around 1% in both China and Europe.

- According to the U.S. Alternative Fuels Data Center, EVs emit approximately 2,727 pounds of CO₂ annually, a stark contrast to the 12,594 pounds produced by gasoline-powered vehicles. This reduction translates to a substantial decrease in greenhouse gases, supporting global climate objectives to reduce emissions by 700 million metric tons of CO₂ by 2030.

- Global strategies, including the European Union’s new battery regulations, require recycled content in EV batteries by 2024, ensuring that materials like lithium and cobalt are reused, thereby improving supply chain resilience.

- Ford, for instance, has committed to a 60% reduction in lifetime CO₂ emissions for its EVs compared to similar internal combustion vehicles. Ford achieved a 35.4% reduction in direct and energy-related emissions (Scopes 1 and 2) since 2017 and expanded its use of renewable electricity to over 60% in facilities globally.

- EVs offer significant cost savings over their lifetimes. For instance, EV owners in the U.S. can save between $6,000 to $12,000 on fuel and maintenance costs compared to conventional vehicle owners, with fuel savings largely due to the higher efficiency of electric motors.

Government Investments and Policies

- In the United States, the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law provide incentives such as tax credits of up to $7,500 for eligible EVs, along with conditions on local content to boost U.S.-based battery and vehicle production. Since these policies took effect, the U.S. has seen EV registrations rise by over 40%, with projections to double market share to 20% by 2030.

- Europe has advanced its zero-emission vehicle (ZEV) agenda through the Fit for 55 package, targeting a 100% reduction in CO₂ emissions from new cars and vans by 2035. In 2023, these policies drove European EV sales to nearly 3.2 million units, with EVs accounting for 25% of total car sales in France, the UK, and the Netherlands.

- China, the largest EV market, continues to lead with robust policies, including subsidies, local incentives, and supportive regulations for new energy vehicles (NEVs). In 2023, China exceeded its target, capturing over 60% of global EV sales. Regional policies in areas like Chongqing and Jilin focus on achieving ambitious production goals, targeting annual outputs of over 1 million NEVs by 2025.

- The Indian government approved the PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) scheme, allocating ₹10,900 crore ($1.3 billion) over two years to boost EV adoption. The plan includes 22,100 fast chargers for e-4Ws, 1,800 for e-buses, and 48,400 for e-2Ws/3Ws, focusing on cities with high EV penetration and key highways, with ₹2,000 crore designated for infrastructure.

Vehicle Type Analysis

Sedans dominate with 82.6% due to their widespread acceptance as a versatile and efficient form of passenger transport.

The electric vehicle market is significantly segmented, with passenger cars emerging as the dominant segment. Within this category, sedans hold the largest share due to their blend of affordability, performance, and lower environmental impact compared to internal combustion vehicles.

Sedans and Hatchbacks, traditionally favored for their affordability and practicality, continue to contribute to the growth by appealing to middle-income groups in urban and suburban areas. SUVs/MUVs have seen an increase in demand owing to their versatility and the shift towards family-oriented, eco-friendly vehicles.

Sports Cars, though a smaller sub-segment, are increasingly being marketed as high-performance, zero-emission vehicles, tapping into the luxury goods market. Luxury Vehicles remain significant for their role in showcasing cutting-edge technology and driving the high-end market’s adoption of EVs.

Commercial Vehicles, encompassing Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs), along with Buses and Trucks, are integral to the commercial sector’s gradual transition towards sustainable solutions. The growth in this sub-segment is spurred by regulatory support for greener public transport and logistics solutions.

Two-Wheelers, including Electric Scooters and Motorcycles, are essential in regions where affordability and agility are crucial, especially in densely populated cities. These models serve as an entry point into the EV market, particularly in developing economies.

Three-Wheelers, such as Electric Rickshaws and Electric Cargo Vehicles, are pivotal in transforming last-mile connectivity and are instrumental in reducing the carbon footprint within urban setups.

Propulsion Type Analysis

Battery Electric Vehicles (BEVs) dominate with 84.2% due to their zero-emission nature and decreasing battery costs.

BEVs have taken a commanding lead in the electric vehicle propulsion type segment. This dominance is driven by the global push for zero-emission transportation solutions and the significant decrease in battery costs over recent years, coupled with improvements in battery density and EV charging infrastructure.

BEVs offer a cleaner alternative to internal combustion engines by eliminating tailpipe emissions, which is a critical factor in urban areas facing strict emission regulations.

The other key sub-segments, Plug-in Hybrid Electric Vehicles (PHEVs) and Fuel Cell Electric Vehicles (FCEVs), though smaller, play crucial roles in the market. PHEVs provide a practical solution for consumers not ready to transition fully to battery electric, offering a combination of electric propulsion with a conventional engine for extended range.

FCEVs, although limited by infrastructure, are anticipated to grow, especially in commercial applications due to their fast refueling and long-range capabilities.

Drive Type Analysis

Front-Wheel Drive (FWD) dominates with 53.1% due to its cost-effectiveness and simplicity in design.

In the drive type segment of the electric vehicle market, FWD configurations prevail primarily due to their simplicity and lower manufacturing costs. This layout is inherently more compact, freeing up space for other components like larger batteries.

FWD vehicles also benefit from improved traction control in adverse weather conditions, making them a popular choice among consumers in colder climates.

Rear-Wheel Drive (RWD) and Intelligent All-Wheel Drive (AWD) systems also hold significant positions in the market. RWD vehicles are typically favored for their driving dynamics and better weight distribution, which is particularly advantageous in performance-oriented electric vehicles.

AWD systems, offering superior power distribution and handling, are increasingly being adopted in higher-end EV models that prioritize safety and performance in varied driving conditions.

Vehicle Speed Analysis

The 100MPH to 125MPH range dominates with 68.5% due to the optimal balance between speed and efficiency.

Vehicle speed capabilities play a crucial role in consumer choice within the electric vehicle market. The 100MPH to 125MPH speed range is the most popular, striking an ideal balance between operational efficiency and the speed requirements of the average consumer.

This speed bracket caters well to both urban commuters and long-distance travelers, offering sufficient velocity without compromising the vehicle’s range and battery efficiency.

Segments with speeds less than 100 MPH cater primarily to urban users who prioritize efficiency over speed, while vehicles capable of exceeding 125 MPH are generally positioned in the premium segment, targeting enthusiasts and performance seekers.

These higher-speed vehicles demonstrate the advancements in electric powertrain technologies that challenge traditional perceptions of electric vehicle performance.

Vehicle Class Analysis

Low-price Electric Vehicle dominates with 48.7% due to growing consumer demand for affordable, sustainable transportation solutions.

The electric vehicle market sees a diverse array of classes, with economy or low-price vehicles currently taking the lead. The increasing demand for affordable electric vehicles is fueled by a broader consumer base seeking to reduce carbon footprints without compromising on mobility.

This segment’s growth is supported by governmental incentives, falling battery prices, and an expanding public charging infrastructure.

Mid-range and luxury classes also reflect significant market segments. Mid-range electric vehicles offer enhanced features and better performance than economy models, capturing the interest of a more tech-savvy market segment.

Luxury electric vehicles continue to rise in popularity as they combine prestige, advanced technology, and sustainability, appealing to affluent buyers looking to make environmentally friendly choices without sacrificing luxury and comfort.

End-Use Analysis

Personal use dominates with 90.1% due to the high adaptability and convenience of electric vehicles for individual and family use.

The end-use application segment of the electric vehicle market is predominantly led by personal use, which encompasses daily commuting and family travel. The convenience of owning an electric vehicle, coupled with increasing environmental awareness, has propelled this segment. Personal electric vehicles have become more appealing with competitive pricing, improved range, and a robust charging network.

Commercial use and public transportation, although smaller segments, are vital to the growth of the electric vehicle market. Commercial electric vehicles are increasingly adopted by businesses aiming to reduce operational costs and carbon footprints.

Electric public transportation solutions, such as buses and shuttles, are growing as cities worldwide strive to meet sustainability goals and improve urban air quality. These segments are critical for the widespread adoption of electric vehicles as they provide substantial opportunities for market expansion and technological advancements.

Key Market Segments

By Vehicle Type

- Passenger Cars

- Sedans

- Hatchbacks

- SUVs/MUVs

- Sports Cars

- Luxury Vehicles

- Commercial Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Buses

- Trucks

- Two-Wheelers

- Scooters

- Motorcycles

- Three-Wheelers

- Electric Rickshaws

- Electric Cargo Vehicles

By Propulsion Type

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

By Drive Type

- Front-Wheel Drive (FWD)

- Rear-Wheel Drive (RWD)

- All-Wheel Drive (AWD)

By Vehicle Speed

- Less Than 100 MPH

- 100 MPH to 125 MPH

- Above 125 MPH

By Vehicle Class

- Economy Class

- Mid-Range Class

- Luxury Class

By End-Use Application

- Personal Use

- Commercial Use

- Public Transportation

Drivers

Growing Urbanization and Smart Cities Driving Electric Vehicle Market Growth

The electric vehicle (EV) market is experiencing significant growth, driven by multiple influential factors. Urbanization and the development of smart cities are creating a favorable infrastructure for EVs, supported by the expansion of charging stations and intelligent traffic systems.

Concurrently, supportive regulatory policies, including tax incentives and manufacturing mandates, are lowering barriers to adoption and spurring technological advancements. These technological improvements are evident in battery efficiency and energy density, which enhance the driving range and overall performance of EVs, making them more appealing to consumers.

Additionally, a surge in consumer demand for cleaner and smarter transportation options, fueled by increasing environmental awareness, is shifting preferences away from traditional combustion engines towards more sustainable electric alternatives.

Restraints

High Initial Purchase Cost Restrain Market Growth

The growth of the electric vehicle (EV) market, while promising, is hampered by several critical factors. High initial purchase costs remain a significant barrier, deterring potential buyers who find EVs more expensive upfront compared to traditional combustion engine vehicles.

Moreover, the limited charging infrastructure in many regions adds a layer of inconvenience, discouraging widespread adoption. Consumers in areas with sparse charging stations face practical challenges, which diminish the attractiveness of EVs as a viable daily transportation option.

Additionally, the EV market’s heavy dependence on the import of key materials, such as rare earth elements used in batteries, introduces vulnerability to supply chain disruptions and price volatility. This reliance on imports can lead to increased costs and further contribute to the high initial purchase price of EVs.

Growth Opportunities

Development of Ultra-fast Charging Provide Opportunities

The development of ultra-fast charging solutions stands as a pivotal breakthrough, drastically reducing charging times and addressing one of the primary concerns of potential EV buyers: lengthy charging periods.

Battery-as-a-Service (BaaS) models further enrich the EV landscape by offering a novel approach to battery management and ownership. This model allows consumers to lease the battery, the most expensive component of EVs, rather than purchasing it with the vehicle.

Additionally, the electrification of public transport represents a significant growth area within the EV market. As cities globally push for greener, more sustainable public transportation solutions, electric buses and trains are becoming increasingly prevalent.

Finally, the growth of Vehicle-to-Grid (V2G) technology presents an exciting frontier. V2G systems allow EVs to interact with the power grid to accept or return electricity. Beyond merely serving as transportation, EVs can thus function as mobile energy sources, contributing to grid stability and renewable energy integration.

Challenges

Competition and Regulatory Hurdles Challenge Market Growth

A primary hurdle is the persistent competition from conventional vehicles, which continue to dominate the market due to their lower initial cost and the extensive existing infrastructure supporting them.

Additionally, the introduction and adoption of new EV technologies often encounter long approval processes. These regulatory challenges not only delay market entry but also add to the development costs, complicating the financial viability of innovative EV solutions.

Cybersecurity risks in connected EVs present another complex challenge. As vehicles become more integrated with digital technologies, they become more vulnerable to hacking and other cyber threats.

Moreover, the EV sector’s heavy dependence on rare earth elements for battery production introduces a layer of geopolitical and supply chain risk. These materials are not only scarce but also predominantly controlled by a few countries, leading to potential volatility in prices and availability.

Emerging Trends

Investment and Innovations Are Latest Trending Factors

Increased investment in EV startups is leading the charge, funneling capital into innovative technologies and business models that promise to revolutionize the automotive landscape.

Transitioning to Lithium-Iron-Phosphate (LFP) batteries represents another significant trend, offering a more cost-effective and safer alternative to traditional lithium-ion battery compositions. LFP batteries provide longer life spans and improved thermal stability.

Furthermore, the expansion of subscription-based EV ownership models is redefining how consumers approach vehicle ownership. These models provide flexibility and lower upfront costs, appealing to younger demographics and those reluctant to commit to a traditional purchase.

Lastly, the development of swappable battery technology is emerging as a game-changer, significantly reducing downtime for charging and addressing one of the most substantial hurdles in EV adoption—range anxiety.

Regional Analysis

APAC Dominates with 40.8% Market Share

APAC leads the Electric Vehicle Market with a 40.8% share, amounting to USD 402.0 billion. This dominance is driven by aggressive government policies promoting electric mobility, high consumer demand in countries like China and India, and major investments in EV infrastructure and battery technologies.

China’s EV sales have surged, with over 10 million units sold in 2023, accounting for over 60% of new car sales, according to the International Energy Agency (IEA). The country’s charging infrastructure has grown rapidly, reaching 5.2 million publicly accessible chargers, supported by government incentives and green energy initiatives.

Moreover, India’s EV market has advanced through the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme. The IEA reports a 70% year-over-year increase in EV registrations in 2023, totaling around 80,000 units, which represents about 2% of total car sales.

Indonesia has seen over a 200% rise in battery charging station installations, primarily in Jakarta and Bali, fueled by fiscal incentives aimed at reducing EV costs and promoting market growth, as noted by the Institute for Essential Services Reform (IESR).

APAC is expected to maintain its leadership as demand for clean energy and sustainable transport rises. Ongoing investments in charging infrastructure, policy support, and manufacturing capacity will continue to drive market growth.

Regional Mentions:

- North America: North America holds a solid position in the EV market, driven by a growing focus on clean energy and government incentives. The region’s market is fueled by strong consumer awareness, advanced infrastructure, and active participation of key automakers in EV manufacturing.

- Europe: Europe has a robust EV market due to stringent emissions regulations and strong governmental support. The region is characterized by high EV adoption rates in countries like Norway, Germany, and the Netherlands, supported by advanced charging infrastructure and incentives.

- Middle East & Africa: This region is gradually expanding its EV market, with initiatives focused on sustainable transport solutions. Investments are geared towards improving charging infrastructure, particularly in countries like the UAE and South Africa, to support growing demand.

- Latin America: Latin America’s EV market is developing as governments emphasize cleaner transportation. Key markets include Brazil and Mexico, where policies and incentives aim to boost EV adoption, although infrastructure remains a challenge for faster growth.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Electric Vehicle (EV) Market is led by prominent companies, each contributing significantly to industry growth. The top four players—Tesla, Inc., BYD Company Limited, Volkswagen Group, and General Motors (GM)—account for a major share of the market, driven by strong production capacities, global outreach, and consistent technological advancements.

Tesla, Inc. holds a dominant position, renowned for its innovation in battery technology and autonomous driving. The company leverages its strong brand presence and wide EV portfolio to maintain leadership, focusing on mass production and global expansion, particularly in North America, Europe, and China. Its strategic investments in Gigafactories enable cost-effective production, enhancing competitiveness.

BYD Company Limited, based in China, is a major player in the global EV market. It benefits from vertical integration across battery manufacturing and EV production, allowing cost advantages. The company targets both passenger and commercial EV segments, supported by robust domestic demand and favorable government policies in China, its key market.

Volkswagen Group has established itself as a leading EV manufacturer in Europe and beyond. The company has invested heavily in the development of EV platforms and charging infrastructure. It focuses on transitioning its legacy brands toward electrification, aiming for broad market penetration across Europe, China, and the U.S. Strategic partnerships and collaborations further support its growth.

General Motors (GM) emphasizes EV development, particularly in the North American market. The company aims to expand its EV lineup through increased production capacities, including the Ultium battery platform. GM’s plans are supported by government incentives and initiatives promoting electric mobility, helping to strengthen its market position.

These companies collectively drive the global EV market through innovation, large-scale production, and strategic regional expansion. Their focus remains on affordability, technology, and sustainability to meet growing consumer demand.

Top Key Players in the Market

- Tesla, Inc.

- BYD Company Limited

- Volkswagen Group

- General Motors (GM)

- BMW Group

- NIO Inc.

- Li Auto Inc.

- Hyundai Motor Company

- Ford Motor Company

- Stellantis N.V.

- Mercedes-Benz Group AG

- Renault Group

- Toyota Motor Corporation

- Honda Motor Company

- Lucid Group, Inc.

Recent Developments

- Stellantis and Factorial Energy: In October 2024, Stellantis announced plans to deploy a demonstration fleet of Dodge Charger Daytonas featuring semi-solid-state batteries by 2026. This collaboration with U.S. startup Factorial Energy aims to enhance EV performance through increased energy density and reduced weight, potentially extending the driving range by up to 50%.

- Jaguar Land Rover (JLR): In October 2024, JLR expanded its global innovation network by launching an Open Innovation Hub in Bangalore, India. The hub aims to collaborate with startups focusing on AI, big data, and IoT to drive the development of advanced solutions for future JLR vehicles.

- Vajram Electric and Varcas Automobiles: In October 2024, Vajram Electric Ltd, a subsidiary of eBikeGo, acquired a 40% stake in Varcas Automobiles Pvt Ltd, an electric vehicle manufacturer based in Hyderabad. This strategic partnership seeks to boost production capacity and address the increasing demand for electric two-wheelers, particularly in Tier-2 and Tier-3 cities across India.

Report Scope

Report Features Description Market Value (2023) USD 985.3 Billion Forecast Revenue (2033) USD 13,688 Billion CAGR (2024-2033) 30.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Passenger Cars: Sedans, Hatchbacks, SUVs/MUVs, Sports Cars, Luxury Vehicles; Commercial Vehicles: Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Buses, Trucks; Two-Wheelers: Scooters, Motorcycles; Three-Wheelers: Electric Rickshaws, Electric Cargo Vehicles), By Propulsion Type (Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Fuel Cell Electric Vehicles (FCEVs)), By Drive Type (Front-Wheel Drive (FWD), Rear-Wheel Drive (RWD), All-Wheel Drive (AWD)), By Vehicle Speed (Less Than 100 MPH, 100 MPH to 125 MPH, Above 125 MPH), By Vehicle Class (Economy Class, Mid-Range Class, Luxury Class), By End-Use Application (Personal Use, Commercial Use, Public Transportation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tesla, Inc., BYD Company Limited, Volkswagen Group, General Motors (GM), BMW Group, NIO Inc., Li Auto Inc., Hyundai Motor Company, Ford Motor Company, Stellantis N.V., Mercedes-Benz Group AG, Renault Group, Toyota Motor Corporation, Honda Motor Company, Lucid Group, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tesla, Inc.

- BYD Company Limited

- Volkswagen Group

- General Motors (GM)

- BMW Group

- NIO Inc.

- Li Auto Inc.

- Hyundai Motor Company

- Ford Motor Company

- Stellantis N.V.

- Mercedes-Benz Group AG

- Renault Group

- Toyota Motor Corporation

- Honda Motor Company

- Lucid Group, Inc.