Global Robotaxi Market By Level of Autonomy (Level 4, Level 5), By Vehicle Type (Cars, Shuttles and Vans), By Propulsion (Electric, Fuel Cell, Car Rental, Station Based), By Component Type (Camera, Radar, LiDAR, Ultrasonic Sensors), By Application Type (Goods, Passenger), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 73265

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Robotaxi Market size is expected to be worth around USD 450.2 Billion by 2033, from USD 1.7 Billion in 2023, growing at a CAGR of 74.7% during the forecast period from 2024 to 2033.

Robotaxis are self-driving vehicles designed to provide passenger transport services without human drivers. They utilize advanced technologies, including sensors and AI, to navigate roads safely and efficiently. Notably, these vehicles aim to reduce operating costs and improve urban mobility, offering a futuristic approach to transportation.

The robotaxi market focuses on the development, deployment, and management of autonomous ride-hailing services. It involves key players, including technology firms and automotive companies, working to create sustainable and efficient transport solutions. Consequently, this market addresses growing demand for cost-effective and eco-friendly mobility options.

The robotaxi market is experiencing rapid growth, supported by significant investments and regulatory approvals. In November 2024, China’s Pony.ai raised $260 million through an IPO, achieving a valuation of $4.55 billion. Similarly, Baidu’s Apollo vehicles began operations in Hong Kong, reflecting growing global interest in autonomous vehicle technology and market expansion.

In the United States, regulatory support is boosting adoption. For instance, the CPUC authorized Cruise and Waymo in August 2023 to operate commercial passenger services in San Francisco. Moreover, Waymo expanded its service to the public in Los Angeles, covering an 80-square-mile area, highlighting increasing accessibility and consumer acceptance.

Market competitiveness remains high, with established players like Waymo and Baidu driving innovation. However, saturation levels are low, offering ample growth opportunities. Additionally, government policies favoring clean and autonomous vehicles are propelling development, ensuring a sustainable future for the industry while benefiting urban mobility on a local scale.

Broader impacts include reduced congestion and emissions, enhancing urban living standards. Locally, cities like San Francisco and Los Angeles serve as testing grounds, fostering technological advancements. Consequently, the robotaxi market is set for further expansion, driven by innovation, regulation, and increasing consumer demand for efficient transport solutions.

Key Takeaways

- The Robotaxi Market was valued at USD 1.7 billion in 2023 and is anticipated to reach USD 450.2 billion by 2033, exhibiting a CAGR of 74.7%.

- In 2023, Level 5 Autonomy dominated the market, reflecting advancements in fully autonomous vehicle technology.

- In 2023, Cars were the leading vehicle type, indicating their early adoption for passenger transport services.

- In 2023, Electric Propulsion was the dominant propulsion type, driven by the focus on electric vehicle development and environmental policies.

- In 2023, LiDAR led the component type segment, offering superior accuracy in autonomous navigation systems.

- In 2023, the Asia-Pacific (APAC) region held a 39.2% market share, amounting to USD 0.72 billion, supported by strong government initiatives and investments.

Level of Autonomy Analysis

Level 5 dominates with a significant percentage due to advanced technological integration and full automation capabilities.

The Robotaxi market’s Level of Autonomy segment is notably spearheaded by Level 5 autonomy. This category signifies complete automation, requiring no human intervention under any driving conditions.

Level 5 autonomy is a pinnacle of current vehicular technology, promising transformative impacts on mobility and safety, hence its dominance. It integrates sophisticated AI systems capable of complex decision-making processes akin to human reasoning.

Level 4 autonomy, although advanced, still requires some human oversight in specific scenarios. It’s an essential step towards fully autonomous vehicles but is overshadowed by the capabilities of Level 5, which offer a glimpse into the future of fully autonomous transport systems.

Vehicle Type Analysis

Cars dominate with a major market share due to versatility and widespread consumer acceptance.

In the Robotaxi market, the Vehicle Type segment is robustly led by cars. Cars are the primary choice for robotaxis due to their versatility and higher consumer acceptance compared to other vehicle types. They are designed to operate in various environments and can be efficiently integrated with autonomous technologies, making them highly adaptable to urban and suburban settings.

Shuttles and vans also play a crucial role, primarily in specific applications like airport or large campus transport. However, their use is more niche, focusing on capacity rather than versatility, which limits their broader market penetration compared to cars.

Propulsion Analysis

Electric propulsion dominates due to environmental concerns and efficiency in operation.

In the propulsion segment, electric propulsion systems lead the charge in the Robotaxi market. The shift towards sustainability and the reduction of carbon footprints has heavily favored electric vehicles. Electric robotaxis offer significant advantages in terms of operational efficiency and are supported by global initiatives to reduce emissions.

Fuel cell propulsion is emerging, focusing on similar benefits as electric but with some added advantages like faster refueling times. However, infrastructure and technology costs remain challenges. Car rental and station-based models are also essential sub-segments, facilitating the accessibility and usability of robotaxis, but they follow the broader trends set by the primary propulsion technologies.

Component Type Analysis

LiDAR dominates due to its precision and reliability in object detection and navigation.

In the Component Type segment, LiDAR stands out as the most critical component for the Robotaxi market. This technology provides high-resolution, 360-degree images of the taxi’s surroundings, crucial for safe and efficient navigation in complex urban environments. Its precision in detecting and mapping objects ensures the highest levels of safety and operational reliability in robotaxis.

Cameras and radar are also integral, offering necessary visual and detection capabilities that support the primary functions of LiDAR. Ultrasonic sensors provide additional safety through close-range obstacle detection but are secondary to the pivotal role of LiDAR in high-level autonomous operations.

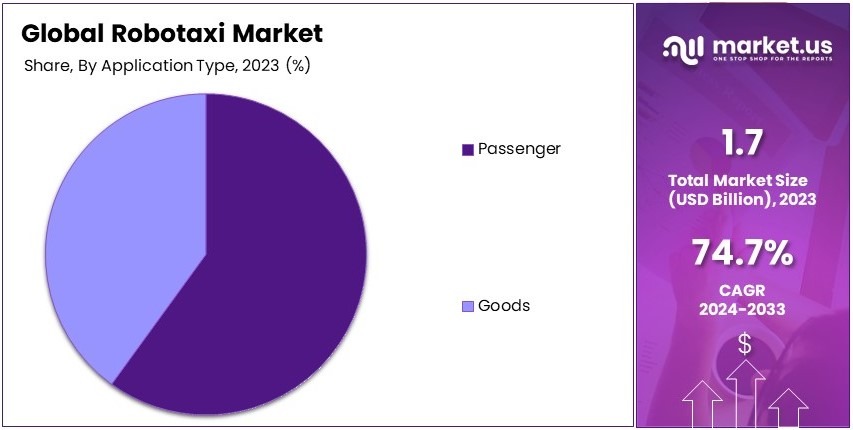

Application Type Analysis

Passenger transport dominates due to high demand for automation in personal mobility.

The Application Type segment is overwhelmingly led by passenger transport. This sub-segment benefits significantly from advancements in autonomy, which promise to transform personal mobility by improving safety and accessibility while reducing costs. The convenience and efficiency of autonomous passenger transport have driven its rapid adoption and market dominance.

Goods transport, while also benefiting from automation, is still developing within the context of robotaxis. It represents a growing market opportunity but has not yet reached the level of impact seen in passenger transport, primarily because current applications are more limited in scope and integration.

Key Market Segments

By Level of Autonomy

- Level 4

- Level 5

By Vehicle Type

- Cars

- Shuttles/Vans

By Propulsion

- Electric

- Fuel Cell

- Car Rental

- Station Based

By Component Type

- Camera

- Radar

- LiDAR

- Ultrasonic Sensors

By Application Type

- Goods

- Passenger

Drivers

Increasing Focus on Reducing Traffic Congestion Drives Market Growth

The Robotaxi market is gaining momentum due to its ability to alleviate urban traffic congestion. With growing urbanization, cities are experiencing heavy traffic, and robotaxis offer an efficient solution by optimizing route planning and reducing vehicle density on roads. These services also minimize travel time, making urban commutes more efficient for users.

Additionally, the adoption of electric and autonomous vehicles is transforming urban mobility. Robotaxis, powered by these technologies, not only reduce emissions but also contribute to cleaner and more sustainable cities. The ability of autonomous vehicles to operate with minimal human intervention aligns perfectly with smart city initiatives aiming to reduce environmental impact.

Moreover, the rising demand for cost-effective mobility solutions is a significant driving factor. Urban dwellers are seeking affordable and flexible transport options, and robotaxis offer a convenient alternative to private vehicle ownership.

Supportive government policies further enhance the market’s potential. Subsidies for autonomous vehicle development, incentives for adopting electric mobility, and investments in infrastructure create a conducive environment for the growth of robotaxi services.

Restraints

High Development Costs and Regulatory Challenges Restraints Market Growth

The Robotaxi market faces significant restraints due to high development and operational costs. The technologies essential for autonomous driving, such as LIDAR systems, AI processors, and high-capacity batteries, are expensive to develop and maintain. These costs make robotaxis a capital-intensive venture, limiting their affordability and scalability.

Regulatory and safety concerns also pose significant barriers. Governments worldwide are implementing strict frameworks to ensure the safety and reliability of autonomous vehicles, which often leads to delays in deployment and increased compliance costs.

Limited infrastructure further hampers the large-scale implementation of robotaxis. The absence of designated lanes, charging stations, and connected networks in many regions restricts their operational efficiency.

Public skepticism toward fully autonomous vehicles adds to these challenges. Many users remain hesitant to trust AI-driven systems, particularly regarding safety in complex traffic scenarios.

Opportunity

Expansion of 5G Networks Provides Opportunities

The expansion of 5G networks is creating exciting opportunities for the Robotaxi market. High-speed connectivity enables real-time data exchange, facilitating precise automotive vehicle-to-everything (V2X) communication and enhancing autonomous vehicle operations. This technological advancement ensures smoother navigation and better adaptability to dynamic traffic conditions.

Rising demand for shared mobility in urban areas also contributes to market growth. As populations in cities expand, shared robotaxi services offer a scalable solution to meet the transportation needs of a growing demographic.

Integration of AI and machine learning in robotaxis provides additional opportunities for market players. These technologies enable predictive maintenance, improved route optimization, and enhanced safety features, which elevate the user experience.

The potential for growth in emerging economies with high population density is another lucrative avenue. These regions offer untapped markets for robotaxi services, provided infrastructure and consumer awareness are developed. Together, these factors create a robust foundation for the expansion of robotaxi services globally.

Challenges

Cybersecurity Risks Challenge Market Growth

Cybersecurity risks present a critical challenge to the Robotaxi market, given its reliance on connected technologies. Autonomous vehicles depend heavily on real-time data exchanges, which makes them vulnerable to hacking and cyberattacks. Securing these networks is essential to maintain trust and ensure the safety of passengers and systems.

Integration challenges with existing transportation networks further complicate the adoption of robotaxis. Many cities operate legacy systems that are not equipped to handle the demands of autonomous technologies, slowing the pace of implementation.

Dependence on high-precision mapping and sensor technologies is another significant challenge. Autonomous vehicles require highly accurate mapping systems to navigate complex urban environments, and discrepancies in data quality can hinder operations.

Additionally, unpredictable road and traffic conditions in developing regions make it difficult for robotaxis to adapt seamlessly. These factors highlight the need for robust strategies and infrastructure investments to overcome these challenges and unlock the full potential of the Robotaxi market.

Growth Factors

Rapid Urbanization and Smart Mobility Adoption Are Growth Factors

Urbanization is a major growth driver for the Robotaxi market as cities expand and populations grow. With urban areas becoming increasingly congested, the demand for smart and efficient mobility solutions has risen. Robotaxis address these challenges by offering convenient, on-demand transportation options, reducing the need for private vehicles.

Another significant factor driving growth is the increasing investment in autonomous vehicle research and development. Companies are heavily investing in technologies such as artificial intelligence, machine learning, and advanced sensor systems to make robotaxis safer and more reliable.

The shift toward subscription-based autonomous fleet services is also accelerating market growth. Consumers are embracing these services for their affordability and convenience, allowing them to access robotaxis without the need for vehicle ownership.

Lastly, growing awareness of eco-friendly transportation alternatives boosts the Robotaxi market. Electric-powered robotaxis reduce carbon footprints, aligning with global efforts to combat climate change. This eco-conscious shift has garnered support from both consumers and policymakers, encouraging faster adoption of robotaxi services.

Emerging Trends

Advancements in LIDAR Technologies Are Latest Trending Factor

Advancements in LIDAR and sensor technologies are driving trends in the Robotaxi market, enhancing navigation and obstacle detection capabilities. These technologies enable robotaxis to operate efficiently in complex urban environments, even in adverse weather conditions.

The focus on sustainable and electric robotaxis is another major trend shaping the industry. Eco-conscious consumers and regulatory mandates are accelerating the shift toward zero-emission autonomous fleets.

Partnerships between automakers and tech firms are also transforming the market landscape. These collaborations leverage expertise in automotive manufacturing and software development, ensuring faster innovation and deployment of robotaxis.

Additionally, pilot programs in cities worldwide are paving the way for broader adoption. These trials allow companies to refine their services and build public trust, setting the stage for a future dominated by smart, autonomous transportation solutions.

Regional Analysis

Asia Pacific Dominates with 39.2% Market Share

Asia Pacific leads the Robotaxi Market with a 39.2% market share, valued at USD 0.72 billion. This leadership stems from rapid technological advancements, large-scale urbanization, and a growing focus on autonomous mobility solutions. Key countries like China, Japan, and South Korea play pivotal roles in shaping the market dynamics.

Key factors driving this dominance include substantial investments in autonomous vehicle technology and supportive government policies. Governments in the region are heavily promoting smart city initiatives, which include the integration of autonomous transportation systems. The presence of major technology firms and automotive manufacturers also accelerates innovation and market adoption.

Regional characteristics, such as densely populated cities and increasing demand for sustainable mobility, significantly influence the Robotaxi Market in Asia Pacific. High urban congestion creates a natural demand for efficient and cost-effective transportation solutions. Additionally, favorable public perception and early adoption of autonomous vehicle testing programs strengthen the region’s competitive edge.

Regional Mentions

- North America: North America holds a strong position, driven by robust investments in R&D and a high concentration of tech companies. Regulatory advancements are also aiding early adoption of autonomous technology.

- Europe: Europe focuses on sustainable mobility and stringent regulations for autonomous vehicle safety. Countries like Germany and France are at the forefront of Robotaxi development and pilot programs.

- Middle East & Africa: The region shows growing interest, with investments in smart city projects and advanced mobility solutions. Robotaxis are being integrated to address urban congestion and reduce emissions.

- Latin America: Latin America is gradually adopting Robotaxi solutions, supported by the need for cost-efficient urban transportation. The focus on modernizing infrastructure is paving the way for future market growth.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Robotaxi Market is dominated by industry pioneers, including Waymo, Cruise Automation, Tesla, and Baidu. These companies leverage cutting-edge technologies and strategic collaborations to maintain leadership in the rapidly evolving market.

Waymo is at the forefront of the industry with its advanced autonomous driving technology. Backed by Alphabet, the company focuses on extensive testing and deployment of robotaxi services in key cities. Waymo’s emphasis on safety and continuous improvement of its AI systems solidifies its position as a market leader.

Cruise Automation, a subsidiary of General Motors, is a key player in autonomous urban mobility. The company specializes in electric, self-driving vehicles optimized for city environments. Cruise benefits from GM’s manufacturing capabilities and significant investments in technology, allowing for rapid scaling of its robotaxi operations.

Tesla is a significant contender, leveraging its electric vehicle expertise and advanced Autopilot system. Tesla’s focus on integrating AI with sustainable energy solutions positions it as a dual innovator in both electrification and autonomy. Its global brand recognition and strong consumer base provide additional market leverage.

Baidu, China’s tech giant, excels in AI and autonomous technologies through its Apollo project. The company collaborates with leading automotive firms to deploy robotaxi services across China. Baidu’s deep understanding of local regulations and infrastructure enables it to capture a significant market share in Asia.

These top companies distinguish themselves through innovation, strong financial backing, and extensive testing and deployment capabilities. Their contributions drive advancements in safety, AI optimization, and scalability within the Robotaxi Market. As the market grows, these players are expected to lead through continuous R&D, strategic partnerships, and adaptation to regional demands, further shaping the future of autonomous mobility solutions.

Top Key Players in the Market

- Waymo

- Cruise Automation

- Autox

- Tesla

- Baidu

- Argo AI

- Pony.Ai

- Easymile

- Didi Chuxing

- Navya

- 2getthere (ZF)

- Local Motors

- Mobileye (Intel)

- Drive.AI (Apple)

- Nissan

- NVIDIA

- Woven Planet (Lyft)

- Aptiv

- ZF Friedrichshafen

- May Mobility

- Optimus Ride

- Yandex

Recent Developments

- WeRide’s Next-Generation Robotaxi Platform: In November 2024, WeRide Inc. unveiled its next-generation GXR Robotaxi platform, integrating over 1,800 days of operational experience. This platform combines WeRide’s proprietary Level 4 autonomous driving systems with an advanced sensor suite and high-performance computing platform.

- Baidu’s Autonomous Vehicle Testing in Hong Kong: In November 2024, Baidu received approval from Hong Kong’s Transport Department to test its Apollo Go autonomous vehicles in the North Lantau area. The trials, involving 10 autonomous vehicles, are scheduled to commence in December 2024 and will run until December 2029.

- Uber’s Expansion into Autonomous Ride-Hailing: Uber is expanding its autonomous vehicle offerings through partnerships with companies like Waymo and Cruise. In early 2025, Uber plans to integrate Waymo’s autonomous vehicles into its platform in Austin and Atlanta, providing riders with autonomous ride-hailing options. Additionally, Uber has partnered with Cruise to introduce autonomous vehicles to its platform in 2025.

Report Scope

Report Features Description Market Value (2023) USD 1.7 Billion Forecast Revenue (2033) USD 450.2 Billion CAGR (2024-2033) 74.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Level of Autonomy (Level 4, Level 5), By Vehicle Type (Cars, Shuttles/Vans), By Propulsion (Electric, Fuel Cell, Car Rental, Station Based), By Component Type (Camera, Radar, LiDAR, Ultrasonic Sensors), By Application Type (Goods, Passenger) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Waymo, Cruise Automation, Autox, Tesla, Baidu, Argo AI, Pony.Ai, Easymile, Didi Chuxing, Navya, 2getthere (ZF), Local Motors, Mobileye (Intel), Drive.AI (Apple), Nissan, NVIDIA, Woven Planet (Lyft), Aptiv, ZF Friedrichshafen, May Mobility, Optimus Ride, Yandex Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Waymo

- Cruise LLC

- Baidu

- AutoX

- Tesla

- Cruise Automation

- Argo AI

- Pony.AI

- Easymile

- Navya