Global Duckweed Protein Market Size, Share, Report Analysis By Species (Lemna Minor, Spirodela Polyrhiza, Wolffia Globose, Others), By Category (Fresh, Dried, By Formulation, Powder, Liquid, Paste), By End Use (Food Processing, Animal and Fish Feed, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156314

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

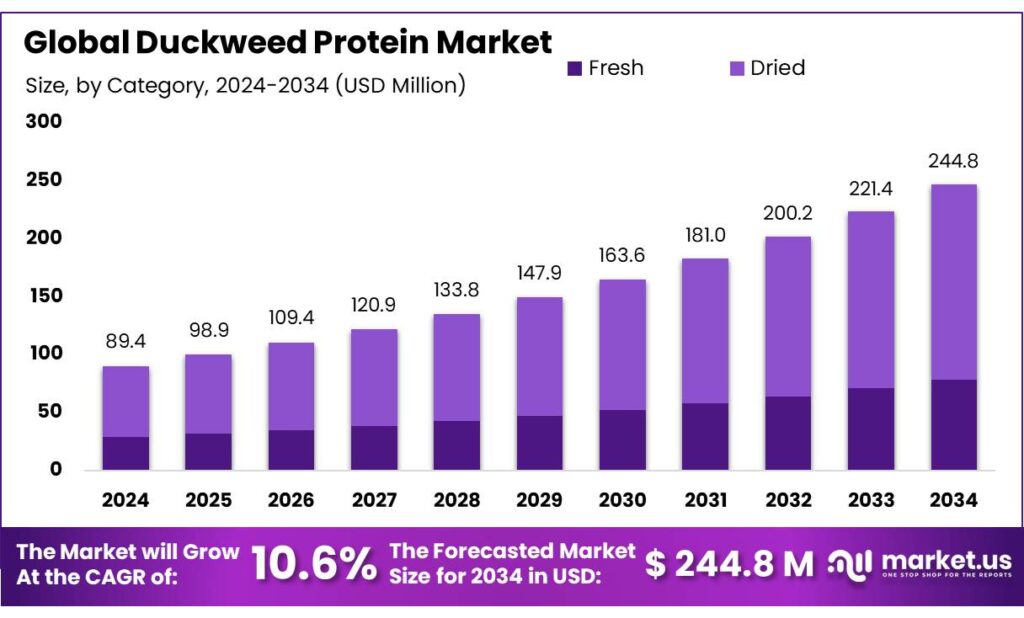

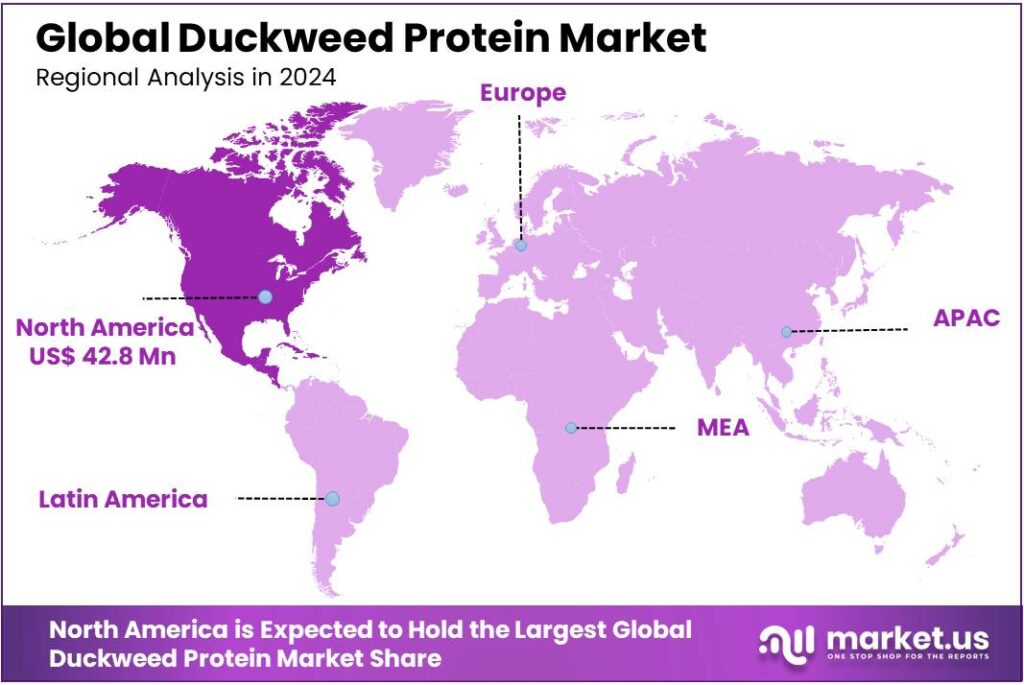

The Global Duckweed Protein Market size is expected to be worth around USD 244.8 Million by 2034, from USD 89.4 Million in 2024, growing at a CAGR of 10.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 47.9% share, holding USD 42.8 Billion revenue.

Duckweed protein, derived from fast‑growing aquatic plants in the family Lemnaceae (notably Lemna minor, Spirodela polyrhiza, Wolffia globosa), boasts exceptional nutritional and production credentials. Certain species can contain up to 40 % protein by dry weight, with Wolffia globosa reaching similar levels and offering rich amino acid and micronutrient profiles including vitamin B12.

Its rapid growth rates—doubling biomass in just a few days—and capability to yield 5–10 times more protein per unit area compared to soybeans underline its efficiency. Spirodela polyrhiza contributes added environmental utility by removing up to 90 % of nitrate and nearly 100 % of phosphate from wastewater while generating biomass suitable for feed or bioethanol. These attributes position duckweed as a high‑quality alternative protein source with strong ecological advantages.

The drive for duckweed protein growth stems from sustainable agriculture policies, nutritional security, and environmental performance. Government research investments, such as DOE’s sequencing effort and other agricultural sustainability initiatives, underscore institutional support. Duckweed can potentially produce up to 30 tonnes of dried biomass per hectare per year under optimal conditions. Nutritionally, its protein content, paired with essential amino acids, aligns with WHO dietary recommendations for high‑quality protein.

Governmental and institutional initiatives, particularly in regions like Asia-Pacific and parts of Europe, support adoption through sustainable agriculture policies, research funding, and standards development—for example, the Asia-Pacific region accounted for 38 % of the global duckweed protein harvesting systems market share in 2024, with government-backed R&D and supportive policy frameworks underpinning that lead.

Additionally, in Europe, the European Food Safety Authority’s recent recognition of Wolffia globosa as a safe vegetable marked a critical regulatory milestone that cleared the way for its broader commercialization, especially in greenhouse cultivation where land use is highly efficient.

Key Takeaways

- Duckweed Protein Market size is expected to be worth around USD 244.8 Million by 2034, from USD 89.4 Million in 2024, growing at a CAGR of 10.6%.

- Lemna Minor held a dominant market position, capturing more than a 49.2% share in the global duckweed protein market.

- Dried held a dominant market position, capturing more than a 69.3% share of the duckweed protein market.

- Powder held a dominant market position, capturing more than a 48.8% share of the duckweed protein market.

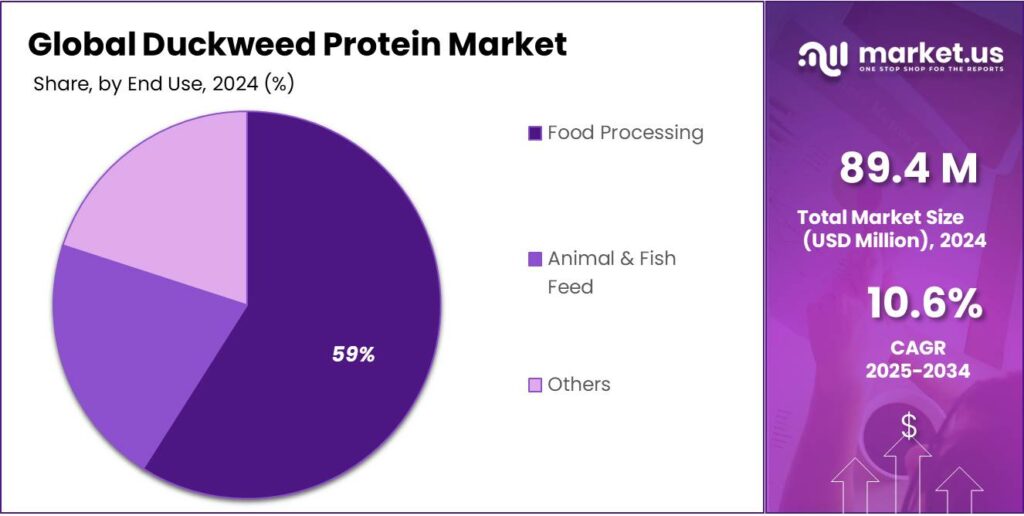

- Animal & Fish Feed held a dominant market position, capturing more than a 59.4% share of the duckweed protein market.

- North America held a dominant position in the global duckweed protein market, capturing 47.9% of the total share, valued at USD 42.8 million.

By Species Analysis

Lemna Minor dominates with 49.2% share in 2024

In 2024, Lemna Minor held a dominant market position, capturing more than a 49.2% share in the global duckweed protein market. This species has been widely recognized for its high protein concentration, often ranging between 35%–45% of its dry weight, making it an efficient source of plant-based protein. Its rapid growth rate and adaptability to various water conditions have also positioned it as the preferred choice among duckweed species for large-scale protein extraction.

The demand for Lemna Minor-based protein has been particularly strong in the food and nutraceutical sectors, where manufacturers are focusing on sustainable and allergen-free protein alternatives. In 2024, producers highlighted Lemna Minor as a cost-effective species for cultivation due to its shorter growth cycle, which allows harvesting every 2–3 days. By 2025, its share is expected to expand further as governments and food industries continue to encourage plant-based proteins for climate-friendly food systems.

By Category Analysis

Dried Duckweed Protein leads with 69.3% share in 2024

In 2024, Dried held a dominant market position, capturing more than a 69.3% share of the duckweed protein market. The dried category has gained strong preference due to its longer shelf life, ease of storage, and suitability for bulk transportation compared to fresh or liquid forms. Food processors and feed manufacturers often choose dried duckweed protein as it retains high nutritional value while being more convenient for blending into powders, supplements, and animal feed.

The dominance of the dried segment in 2024 was also supported by rising demand in regions like Asia and Europe, where dried plant proteins are being increasingly used in health supplements and aquaculture feed. By 2025, this segment is expected to maintain its leadership as investments in sustainable protein continue to expand. The stable form of dried duckweed ensures consistent supply throughout the year, helping industries avoid seasonal dependency.

By Formulation Analysis

Powder Duckweed Protein dominates with 48.8% share in 2024

In 2024, Powder held a dominant market position, capturing more than a 48.8% share of the duckweed protein market. The powdered form has become the most preferred formulation because of its versatility, easy handling, and wide applicability across dietary supplements, functional foods, and animal nutrition. Its fine texture allows manufacturers to incorporate it smoothly into protein shakes, nutrition bars, and health beverages, making it highly attractive to both food companies and consumers seeking plant-based alternatives.

The strong market hold of powdered duckweed protein in 2024 was also influenced by its longer shelf life and ability to retain protein quality even after extended storage. This made it a reliable option for exporters and bulk buyers in regions with high demand for sustainable protein solutions. By 2025, the powdered segment is expected to strengthen its role further as health-conscious consumers and sports nutrition brands continue to invest in clean-label plant proteins.

By End Use Analysis

Animal & Fish Feed leads with 59.4% share in 2024

In 2024, Animal & Fish Feed held a dominant market position, capturing more than a 59.4% share of the duckweed protein market. This dominance is largely due to the species’ exceptional protein profile, which makes it a cost-effective and sustainable alternative to conventional feed ingredients like soybean meal and fishmeal. Duckweed’s fast growth and high amino acid content allow farmers to reduce feed costs while improving the nutritional intake of poultry, livestock, and aquaculture species.

The strong demand for aquaculture feed has been a major driver of this segment, as global fish farming continues to expand rapidly. Duckweed protein powder and dried forms are being widely adopted in feed formulations because they enhance digestibility and promote healthy growth in fish and shrimp. By 2025, the segment is expected to maintain its leadership as feed manufacturers increasingly turn to duckweed to reduce dependency on ocean-sourced fishmeal and meet sustainability commitments.

Key Market Segments

By Species

- Lemna Minor

- Spirodela Polyrhiza

- Wolffia Globose

- Others

By Category

- Fresh

- Dried

By Formulation

- Powder

- Liquid

- Paste

By End Use

- Food Processing

- Animal & Fish Feed

- Others

Emerging Trends

Plant-forward reformulation and pro-protein policies are bringing duckweed protein into mainstream menus

The supply side is aligning with this demand. The European Commission’s medium-term outlook shows strong support for protein crops and forecasts a 42.2% rise in pulses output and a 30% increase in soy production by 2035 versus the 2021–2023 average. Human consumption of pulses in the EU is expected to jump by 61% over the same period. While these figures are not duckweed-specific, they signal a systemwide push to source more protein from plants—opening procurement pathways, processing capacity, and product formats that duckweed suppliers can tap.

Regulation is moving from “if” to “how,” another hallmark of mainstreaming. In 2021, the European Food Safety Authority issued a positive opinion on Wolffia globosa powder (a duckweed species) as a novel food, setting composition and safety guardrails that food companies can follow. EFSA has also evaluated other water-lentil species, broadening the scientific base and signaling that authorities are building comfort with this category. These steps don’t just unlock one market; they provide dossiers and testing frameworks that help regulators elsewhere assess duckweed more quickly.

Sustainability accounting is amplifying the shift. The FAO’s landmark assessment estimated livestock contributes about 14.5% of human-induced greenhouse-gas emissions, an anchor figure used by governments and buyers setting Scope 3 targets. On water, classic Water Footprint work shows beef’s global average footprint near 15,500 liters per kilogram and, per gram of protein, several-fold higher than pulses—numbers that make plant proteins attractive when water stress maps turn red. Duckweed’s ability to grow rapidly in shallow water puts it squarely in that resource-efficient lane.

Drivers

High-protein nutrition with less water and land is pushing duckweed protein into the spotlight

The clearest tailwind is simple: the world needs more protein, but with a smaller resource bill. The UN expects global population to reach around 9.7 billion by 2050, so demand for affordable, nutrient-dense protein will keep rising, especially in fast-growing regions. That pressure is already reframing procurement decisions in food and beverage, where buyers now ask for protein sources that scale without heavy land or water use.

In this context, duckweed stands out for unusually high protein density. Multiple peer-reviewed and open-access syntheses report total protein in duckweed between roughly 20% and 48% of dry weight, depending on species and growing conditions—levels comparable to established plant proteins. That nutritional concentration reduces processing mass per unit of protein and makes closed-loop or indoor cultivation economically interesting for formulators targeting smoothies, soups, snacks, and ready meals.

Momentum is not only environmental; it is also market-led. FAO highlights the rapid expansion of alternative proteins, noting market penetration could rise from about 2% today to 10–22% by 2035, translating to roughly 97 million tonnes a year. That shift creates purchasing channels, co-manufacturing capacity, and ingredient familiarity that duckweed suppliers can ride—especially for blends where neutral flavor and complete amino-acid profiles are valued.

Regulatory signals are turning positive too, which matters for any novel ingredient. In Europe, the food-safety authority (EFSA) issued a positive opinion on Wolffia globosa (often sold as “Mankai”) as a novel food in 2021, and also noted no safety objections for fresh Wolffia arrhiza under the EU novel-food framework. These steps don’t just open one market; they also provide dossiers and toxicology baselines that other regulators examine, reducing uncertainty for global CPG roll-outs.

Restraints

Regulatory uncertainty and safety concerns are slowing wider acceptance of duckweed protein

One of the most important restraining factors for duckweed protein is the lack of harmonized regulations and safety clarity across major food markets. While duckweed is rich in protein, with levels ranging between 20% and 48% of its dry weight, regulators remain cautious about introducing it as a mainstream protein source. This hesitation limits how quickly the ingredient can move from research labs into supermarkets. The European Food Safety Authority (EFSA), for instance, only approved Wolffia globosa as a novel food in 2021 after extensive risk assessments, and other species like Wolffia arrhiza are still under restricted conditions.

Consumer trust is another hurdle. Food safety bodies emphasize that novel proteins must undergo toxicology testing, allergenicity studies, and nutritional profiling before gaining approval. According to the Food and Agriculture Organization (FAO), regulatory and safety uncertainties are among the top barriers for alternative proteins globally. When regulations differ across regions, companies hesitate to invest in large-scale cultivation or processing plants, since approvals in one country may not translate into access elsewhere. This patchwork of rules restricts trade and keeps duckweed protein mostly confined to small-scale or pilot projects rather than international markets.

Governments are aware of this challenge but progress remains uneven. The European Union’s Novel Food Regulation provides a pathway for duckweed protein, but the U.S. Food and Drug Administration (FDA) has yet to establish a clear framework for commercial use. This creates uncertainty for exporters aiming to supply both Western and Asian markets. In contrast, some Asian countries like Thailand have traditionally consumed duckweed (khai-nam) as a local food, but scaling up for export requires formal alignment with international food standards such as Codex Alimentarius. Until such alignment happens, duckweed will remain more of a niche protein rather than a global staple.

Opportunity

Alternative protein demand is creating new growth opportunities for duckweed protein

The world is entering a phase where alternative proteins are no longer just an option, but a necessity. With the global population expected to reach 9.7 billion by 2050, the Food and Agriculture Organization estimates that overall food production will need to increase by 70% to meet demand. Protein is at the heart of this growth, and traditional sources such as meat and soy are heavily resource-intensive. This is where duckweed protein presents an opportunity—its rapid growth, high protein density, and low environmental footprint align perfectly with the shift toward sustainable food systems.

One of the clearest opportunities comes from its efficiency in cultivation. Duckweed doubles its biomass in less than 48 hours, which means that it can produce significantly more protein per hectare compared to soy or pulses. FAO has highlighted the urgent need to adopt crops that minimize land and water use, noting that livestock accounts for 14.5% of global greenhouse gas emissions. By offering a plant protein that grows in shallow water with minimal inputs, duckweed can be positioned as a climate-smart solution, supporting global efforts to reduce emissions while feeding more people.

The health and nutrition sector also offers a major opening. FAO and allied organizations project that alternative proteins could capture 10–22% of the global protein market by 2035, translating to nearly 97 million tonnes annually. Duckweed, with its complete amino acid profile, fits neatly into this transition. It can be used in protein powders, fortified beverages, plant-based meats, and functional foods, serving consumers who are increasingly demanding nutrient-rich, sustainable diets.

Regional Insights

North America leads Duckweed Protein Market with 47.9% share in 2024

In 2024, North America held a dominant position in the global duckweed protein market, capturing 47.9% of the total share, valued at USD 42.8 million. The region’s leadership is driven by strong consumer demand for plant-based and sustainable protein alternatives, supported by an established food innovation ecosystem.

The United States, in particular, has witnessed rapid adoption of duckweed protein in dietary supplements, functional beverages, and sports nutrition products due to growing health awareness and preference for clean-label ingredients. Additionally, Canada has shown notable growth in aquaculture feed applications, where duckweed protein is increasingly being used as a cost-efficient replacement for fishmeal.

Supportive government initiatives and funding in sustainable agriculture and alternative proteins have also bolstered the market in North America. The U.S. Department of Agriculture (USDA) has continued to encourage research and development of novel protein sources, while state-level programs have promoted aquaculture feed diversification using duckweed. Moreover, the region’s advanced supply chain infrastructure has made dried and powdered duckweed protein readily available for food processors, nutraceutical firms, and feed manufacturers.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Barentz Bio Healthife has positioned itself as a strong distributor and innovator in the duckweed protein market, focusing on supplying high-quality plant-based proteins to nutraceutical and food industries. The company leverages its global distribution network to meet growing demand for sustainable proteins. In 2024, Barentz emphasized collaborations with food and beverage companies in North America and Europe, strengthening its portfolio of functional ingredients. Its role lies in bridging producers with manufacturers, ensuring reliable supply and product standardization.

Hinoman, Ltd., an Israel-based company, has been a pioneer in developing duckweed-based protein branded under the commercial name “Mankai.” The firm specializes in controlled cultivation systems that maximize nutritional output while ensuring sustainability. In 2024, Hinoman expanded partnerships with food service chains and beverage companies, making Mankai a recognizable superfood ingredient in global markets. With expertise in biotechnology and precision farming, Hinoman continues to push duckweed protein into mainstream food categories while targeting both Western and Asian consumers.

Lempro Inc. focuses on processing and supplying duckweed protein primarily for feed and food applications. The company has gained attention for its work in refining duckweed into protein concentrates suitable for commercial use. In 2024, Lempro invested in improving its drying and milling technologies to enhance product consistency and efficiency. The company also worked closely with aquaculture and livestock feed producers, where duckweed protein is gaining traction as a cost-effective alternative to traditional soy and fishmeal sources.

Top Key Players Outlook

- Barentz Bio Healthife

- Hinoman, Ltd.

- Lempro Inc.

- Parabel USA Inc.

- Plantible Foods, Inc.

- Seta Organics

Recent Industry Developments

In 2024, Parabel USA Inc., based in Vero Beach, Florida, continued to stand out by producing LENTEIN Complete, a protein ingredient derived from water lentils (duckweed), valued at 40–50% protein with added soluble and insoluble fiber.

In 2024, Lempro Inc. continued to build on its mission to turn duckweed into high‑quality single‑cell protein using its proprietary process, delivering an ingredient often branded as LENTEIN™ Plus Powder. The company’s focus has been on developing a sustainable, green protein that reaches markets where nutrition, energy efficiency, and ecological responsibility matter most

Report Scope

Report Features Description Market Value (2024) USD 89.4 Mn Forecast Revenue (2034) USD 244.8 Mn CAGR (2025-2034) 10.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Species (Lemna Minor, Spirodela Polyrhiza, Wolffia Globose, Others), By Category (Fresh, Dried, By Formulation, Powder, Liquid, Paste), By End Use (Food Processing, Animal and Fish Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Barentz Bio Healthife, Hinoman, Ltd., Lempro Inc., Parabel USA Inc., Plantible Foods, Inc., Seta Organics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Barentz Bio Healthife

- Hinoman, Ltd.

- Lempro Inc.

- Parabel USA Inc.

- Plantible Foods, Inc.

- Seta Organics