France Dehydrated Vegetables Market By Product Type(Potatoes, Carrots, Onions, Broccoli, Beans, Peas, Others), By Form(Minced and Chopped, Powder and Granules, Flakes, Slice and Cubes, Others), By Nature(Conventional, Organic), By Drying Method(Air Drying, Spray Drying, Freeze Drying, Drum Drying, Vacuum Drying), By End Use(Foodservice, Food Manufacturers, Retail, Others), By Distribution Channel(Store-Based Retailing, Hypermarkets/Supermarkets, Convenience Stores, Food and Drink Specialty Stores, Online Retail), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 74624

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

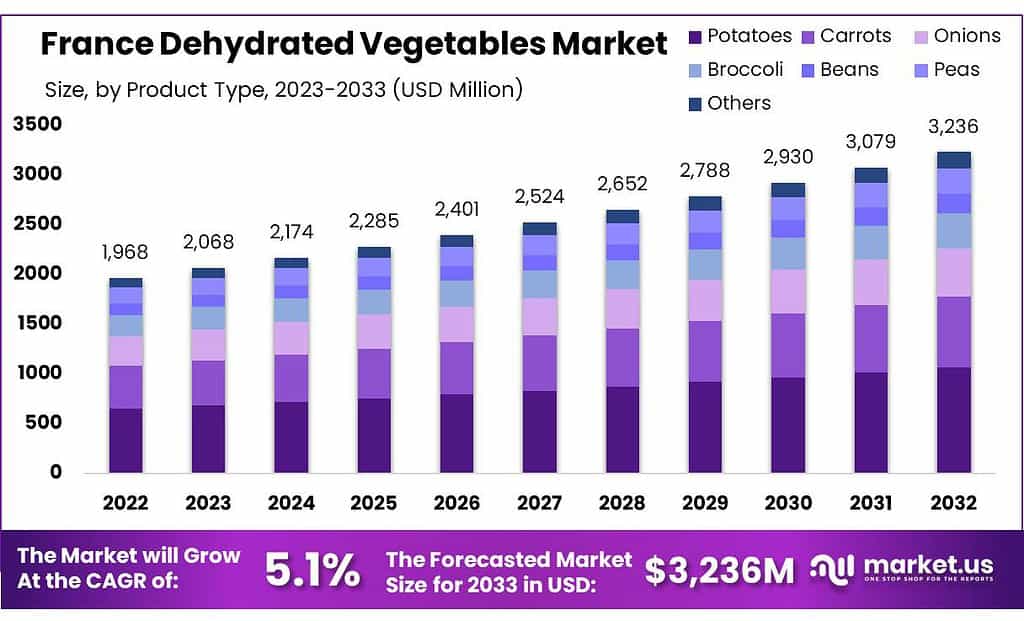

The global France Dehydrated Vegetables Market size is expected to be worth around USD 3236 Million by 2033, from USD 1968 Million in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

The “France Dehydrated Vegetables Market” encompasses a specific segment within the French food industry that focuses on the production, distribution, and sale of dehydrated vegetables. This involves removing most of the moisture from vegetables through drying methods, enhancing their shelf life, and reducing their weight, which benefits storage and transport logistics.

Market research in this area examines the market’s size and segmentation, trends and growth drivers, consumer preferences, supply chain dynamics, competitive environment, and regulatory impacts. This sector is particularly relevant in the context of rising demand for convenient, durable food products and the broader movement towards sustainable food processing practices.

By Product Type

In 2023, Potatoes held a dominant market position, capturing more than a 33.4% share of the France Dehydrated Vegetables Market. This segment benefits from the widespread use of dehydrated potatoes in culinary applications, such as in instant meals and soups, which are favored for their convenience and long shelf life.

Carrots followed, noted for their versatility and nutritional content, making them popular in both household cooking and commercial food products. Their natural sweetness and color appeal to a broad consumer base, driving their adoption in the market.

Onions, essential for flavoring, also formed a significant part of the market. The demand for dehydrated onions is consistent as they are a staple in seasoning mixes and processed foods, offering convenience and enhanced storage properties.

Broccoli, another key segment, is gaining traction due to increasing health consciousness among consumers. Its high nutrient density and application in health-oriented food products make it a growing segment.

Beans and peas, known for their protein content, are consolidating their market presence, particularly in the vegan and vegetarian markets. They are commonly used in a variety of dishes, from traditional stews to innovative snack foods.

By Form

In 2023, Minced & Chopped held a dominant market position, capturing more than a 34.5% share of the France Dehydrated Vegetables Market. This form is favored for its convenience in meal preparation, significantly reducing cooking time and effort.

Powder & Granules also held a substantial segment of the market, appreciated for their ease of storage and ability to blend seamlessly into various dishes. This form is particularly popular in the seasoning and instant food industries, where it enhances flavor without adding bulk.

Flakes followed in market share, commonly used in soups, stews, and ready meals. Their ability to rehydrate quickly makes them ideal for fast-paced cooking environments and home kitchens alike.

Slice & Cubes form captured a notable portion of the market, preferred for their close resemblance to fresh vegetables. They are often used in camping food, emergency supplies, and quick-serve meals, providing a practical yet nutritious food option.

By Nature

In 2023, Conventional dehydrated vegetables held a dominant market position, capturing more than a 56.5% share of the France Dehydrated Vegetables Market. This segment benefits from the established supply chains and lower price points compared to organic options, making it a preferred choice for many large-scale food manufacturers and consumers focused on cost-effectiveness.

Organic dehydrated vegetables, although holding a smaller market share, are experiencing a significant growth trend. This surge is driven by increasing consumer awareness of health and environmental issues, leading to a growing preference for products perceived as safer and more sustainable. As the demand for organic products continues to rise, this segment is expected to capture an increasing share of the market, reflecting broader trends toward organic eating and sustainable agriculture.

By Drying Method

In 2023, Air Drying held a dominant market position, capturing more than a 33.2% share of the France Dehydrated Vegetables Market. This method is favored for its cost-effectiveness and the ability to retain color, flavor, and nutrients effectively, making it a popular choice across various food processing industries.

Spray Drying followed, appreciated for its efficiency in converting pureed vegetables to powder form. This method is integral in producing vegetable powders used in instant mixes, seasonings, and health supplements, due to its fast processing time and ability to achieve fine, consistent particle sizes.

Freeze Drying, known for preserving the highest quality of taste and nutritional content, also captured a significant market share. Although more expensive, this method is preferred for premium products in sectors such as specialty gourmet foods and space meals, where high nutrient retention and rehydration capability are critical.

Drum Drying, while less popular than other methods, remains relevant for its ability to produce flakes and powders at a relatively low cost. This method is commonly utilized in creating ingredients for soups and ready meals.

Vacuum Drying, though holding the smallest share, is gaining interest for its ability to dry vegetables at lower temperatures, thus preserving more sensitive nutrients and compounds. This method is particularly appealing in the health food market, where maximizing nutritional value is a key selling point.

By End Use

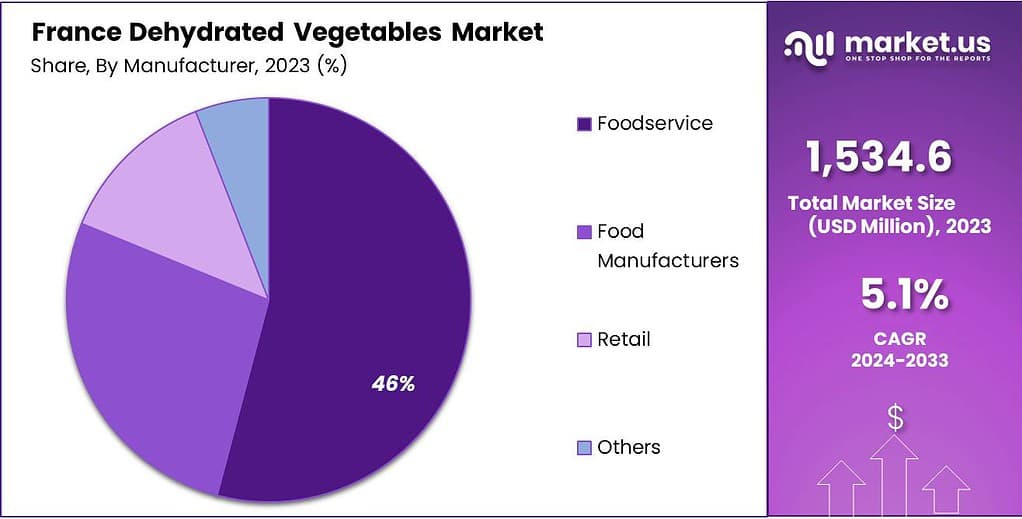

In 2023, Foodservice held a dominant market position, capturing more than a 46.7% share of the France Dehydrated Vegetables Market. This segment benefits from the widespread use of dehydrated vegetables in restaurants, cafeterias, and catering services, where their ease of storage, preparation, and consistent quality are highly valued.

Food Manufacturers constitute another major segment. They integrate dehydrated vegetables into a variety of products such as instant foods, snacks, and seasoning mixes. This usage is driven by the need for longer shelf life and reduced transportation costs, making dehydrated vegetables a cost-effective ingredient.

The Retail segment, which includes supermarkets and online stores, also plays a crucial role in the market. Retailers offer packaged dehydrated vegetables directly to consumers, appealing to those seeking convenient cooking options that retain nutritional value.

By Distribution Channel

In 2023, Store-Based Retailing held a dominant market position, capturing more than a 35.4% share of the France Dehydrated Vegetables Market. This channel is favored for its broad accessibility and the ability for consumers to select products directly, providing immediate availability and a tactile shopping experience.

Hypermarkets/Supermarkets are a critical component of this sector, offering a wide range of dehydrated vegetables under one roof. These outlets are preferred for their convenience and the ability to cater to bulk purchasing needs, making them a primary choice for family shopping.

Convenience Stores, while smaller in scale, provide essential access to dehydrated vegetables in urban and densely populated areas. These stores are key for quick purchases and cater to the needs of consumers looking for immediate and easy-to-prepare food options.

Food & Drink Specialty Stores also play a significant role, especially for consumers seeking gourmet or specialized products. These stores often carry a unique assortment of high-quality or organic dehydrated vegetables that are not commonly found in larger retail formats.

Online Retail has been growing steadily, driven by the increasing consumer preference for shopping from home. This channel offers the convenience of direct delivery and often provides access to a wider variety of products, appealing to a segment of consumers who value ease and variety.

Market Key Segments

By Product Type

- Potatoes

- Carrots

- Onions

- Broccoli

- Beans

- Peas

- Others

By Form

- Minced & Chopped

- Powder & Granules

- Flakes

- Slice & Cubes

- Others

By Nature

- Conventional

- Organic

By Drying Method

- Air Drying

- Spray Drying

- Freeze Drying

- Drum Drying

- Vacuum Drying

By End Use

- Foodservice

- Food Manufacturers

- Retail

- Others

By Distribution Channel

- Store-Based Retailing

- Hypermarkets/Supermarkets

- Convenience Stores

- Food & Drink Specialty Stores

- Online Retail

Drivers

Increasing Demand for Convenient and Long-Lasting Food Products

One of the primary drivers of the France Dehydrated Vegetables Market is the increasing consumer demand for convenient and long-lasting food products. As lifestyles become busier and more demanding, the need for quick and easy meal solutions has grown significantly. Dehydrated vegetables offer an ideal solution as they are both convenient to use and have a long shelf life, reducing the frequency of shopping trips and minimizing food waste.

This trend is particularly evident in urban areas, where fast-paced living and smaller living spaces make it challenging to store fresh produce. Dehydrated vegetables require less storage space and do not need refrigeration, making them highly suitable for urban consumers. Additionally, the shelf stability of dehydrated vegetables appeals to consumers who are looking to maintain a stock of readily available ingredients that can be used at a moment’s notice, thus supporting spontaneous and time-sensitive meal preparation.

Moreover, the rise in consumer awareness regarding the environmental impact of food waste has also played a critical role in driving the market. Dehydrated vegetables, by their extended shelf life, contribute significantly to reducing spoilage and, consequently, food waste. This aligns well with the growing consumer inclination towards more sustainable and waste-reducing food consumption practices.

The convenience factor is further augmented by the ease of preparation that dehydrated vegetables offer. They can be quickly rehydrated and added to dishes, saving time in meal preparation without compromising on nutritional value or taste. This is particularly valued in the food service industry, where speed and efficiency are crucial. Restaurants, cafes, and catering services utilize dehydrated vegetables to streamline kitchen operations and ensure consistency in flavor and quality.

Furthermore, the evolution of online retailing has made dehydrated vegetables more accessible to consumers. The ability to purchase these products online and have them delivered directly to their doorsteps is a convenience that modern consumers value highly. Online platforms also offer a wider variety of dehydrated vegetable products than might be available in local stores, including exotic or less common vegetables, catering to the diverse culinary tastes and dietary preferences of the French population.

Restraints

Perception of Inferior Nutritional Value

A major restraint impacting the growth of the French dehydrated Vegetables Market is the prevalent consumer perception regarding the inferior nutritional value of dehydrated vegetables compared to their fresh counterparts. Many consumers believe that the dehydration process significantly reduces the nutritional content of vegetables, particularly vitamins and minerals that are sensitive to heat and air exposure. This perception can deter health-conscious consumers from choosing dehydrated products, favoring fresh vegetables instead to maximize their dietary benefits.

The dehydration process, depending on the method used (such as air drying, freeze drying, or spray drying), can indeed affect the nutritional profile of vegetables. Heat-sensitive nutrients like vitamin C and some B vitamins are particularly vulnerable to degradation during the drying process. While freeze drying tends to preserve nutrients more effectively than other methods, it is also more expensive, which can lead to higher retail prices for freeze-dried products. This cost factor can further limit the appeal of dehydrated vegetables, especially among consumers who are both health-conscious and budget-aware.

Moreover, the texture and flavor changes that occur during dehydration can also be a turnoff for some consumers. Dehydrated vegetables can have a different mouthfeel and taste compared to fresh vegetables, which can affect consumer acceptance, particularly in a culinary culture as rich and diverse as France’s, where freshness and quality of ingredients are highly prized.

The market also faces challenges from the availability and marketing of alternative convenience products, such as canned or frozen vegetables, which many consumers perceive as being closer to fresh in terms of taste and nutritional value. These alternatives also offer convenience and longer shelf lives, competing directly with dehydrated vegetables.

Efforts to overcome this restraint involve better educational marketing to inform consumers about the technological advancements in the dehydration process that help preserve nutritional content and enhance flavor. Additionally, showcasing the use of dehydrated vegetables in gourmet cooking and premium food products might help change the perception of these products as being of lesser quality. Demonstrating the sustainability benefits, such as reduced food waste and lower transportation emissions, could also align with the growing consumer interest in environmentally friendly consumption practices.

Addressing these nutritional perceptions and competing effectively with alternative convenient food options are critical for the growth and sustainability of the dehydrated vegetable market in France. As consumer preferences evolve, the industry will need to continue innovating and communicating the benefits of dehydrated vegetables to capture a larger share of the market.

Opportunity

Expansion into Organic and Specialized Diet Markets

A significant opportunity for the France Dehydrated Vegetables Market lies in expanding its reach into the organic and specialized diet sectors. As consumers become increasingly health-conscious and aware of the environmental impact of their dietary choices, the demand for organic products continues to rise. Organic dehydrated vegetables, which are produced without synthetic pesticides or fertilizers, offer a compelling product choice for this growing consumer base, who are often willing to pay a premium for foods that align with their health and environmental values.

The specialized diet market, including segments such as vegan, gluten-free, and paleo diets, also presents a lucrative avenue for growth. Dehydrated vegetables are inherently gluten-free and fit well into vegan and paleo dietary patterns, providing a plant-based source of nutrients and flavors without any animal-derived ingredients. By marketing dehydrated vegetables as an essential component for these diets, manufacturers can tap into a niche but rapidly growing market segment.

Furthermore, the convenience of dehydrated vegetables can be a significant draw for consumers who follow strict diet regimens but are pressed for time. These products can drastically reduce meal preparation time while ensuring that dietary guidelines are met. They also offer year-round availability, which can be particularly appealing for consumers looking for seasonal vegetables during off-season periods.

Innovation in packaging and product presentation can further enhance the appeal of dehydrated vegetables in these markets. For instance, offering portion-controlled, single-use packages could appeal to small households or those specifically looking for quick meal additions without the commitment to large quantities. Additionally, integrating dehydrated vegetables into meal kits and other modern food service solutions can provide practical and innovative uses for these products, making them more attractive to a broader audience.

Lastly, developing stronger branding and clearer communication around the nutritional retention and ecological benefits of dehydrated vegetables can help mitigate some of the existing barriers in consumer perception. Emphasizing the use of advanced drying technologies that preserve more nutrients and the sustainability benefits of reduced food waste and lower transport emissions can align the product with the values of a conscientious consumer base.

Trends

Increasing Integration of Dehydrated Vegetables in Snack Foods

A major trend in the French dehydrated Vegetables Market is the increasing integration of dehydrated vegetables into snack foods. As consumers seek healthier snacking options, manufacturers are innovating by using dehydrated vegetables to create nutritious and convenient snacks. This trend is driven by the growing awareness of healthy eating habits and the desire for on-the-go food options that do not compromise nutritional value.

Dehydrated vegetables are ideal for snacks because they offer a concentrated source of flavors and nutrients with a longer shelf life than fresh vegetables. They can be enjoyed as standalone snacks, similar to chips, or incorporated into bars, mixes, and other snack forms. The versatility of dehydrated vegetables allows for a wide range of flavors and textures, catering to a variety of consumer preferences and dietary restrictions.

Furthermore, the appeal of vegetable-based snacks extends beyond traditional consumers to include a significant portion of the health-conscious demographic, such as fitness enthusiasts and those following specific dietary guidelines like vegan or low-calorie diets. These snacks not only provide essential nutrients but also align with the global shift towards plant-based diets, further broadening their market appeal.

Innovative packaging solutions have also contributed to the trend, with resealable and portable packaging making it easier for consumers to carry these snacks without compromising on freshness or convenience. Marketing strategies that highlight the absence of artificial flavors, colors, and preservatives enhance the appeal of these snacks to health-aware consumers, emphasizing the ‘clean eating’ aspect of dehydrated vegetable products.

Manufacturers are also exploring combinations of various dehydrated vegetables to create multigrain and multi-vegetable snacks that are rich in fibers and antioxidants. The use of exotic and diverse vegetables can introduce new tastes and textures, making the snacks more exciting and appealing to a broader audience.

This trend towards healthier snack options is likely to continue growing, as it responds to the demand for products that fit into a healthy lifestyle while providing convenience and flavor. The France Dehydrated Vegetables Market stands to benefit significantly from this movement, with potential for increased production and innovation leading to broader consumer acceptance and higher market penetration. This alignment with consumer trends offers a promising pathway for expansion and diversification within the snack food sector.

Key Players Analysis

In the competitive landscape of the dehydrated vegetables market, several key players hold significant sway. Olam International, renowned for its global presence in agribusiness and food ingredients, stands out with its diverse range of dehydrated vegetable offerings sourced from various regions.

Market Key Players

- Chaucer Foods Ltd

- Alfalfa

- Paula Ingredients

- Elchais Holdings B.V.

- Juste Bio

- Naturz Organics

- Agropole

Recent Developments

March 2023, Chaucer Foods Ltd expanded its product portfolio with new varieties of dehydrated vegetables, catering to the growing trend of plant-based diets.

Report Scope

Report Features Description Market Value (2023) USD 1968 Mn Forecast Revenue (2033) USD 3236 Mn CAGR (2023-2033) 5.1% Base Year for Estimation 2022 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Potatoes, Carrots, Onions, Broccoli, Beans, Peas, Others), By Form(Minced and Chopped, Powder and Granules, Flakes, Slice and Cubes, Others), By Nature(Conventional, Organic), By Drying Method(Air Drying, Spray Drying, Freeze Drying, Drum Drying, Vacuum Drying), By End Use(Foodservice, Food Manufacturers, Retail, Others), By Distribution Channel(Store-Based Retailing, Hypermarkets/Supermarkets, Convenience Stores, Food and Drink Specialty Stores, Online Retail) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Chaucer Foods Ltd, Alfalfa, Paula Ingredients, Elchais Holdings B.V., Juste Bio, Naturz Organics, Agropole Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  France Dehydrated Vegetables MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

France Dehydrated Vegetables MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Chaucer Foods Ltd

- Alfalfa

- Paula Ingredients

- Elchais Holdings B.V.

- Juste Bio

- Naturz Organics

- Agropole