The US Bakery, Batter and Breader Premixes Market By Product Type (Complete Mix, Dough-Base Mix, Dough Concentrates, Batter and Breader), By Application (Meat, Pork, Chicken, Seafood, Vegetables, Onion rings, Other vegetables, Others), By End-use (Full-Service Restaurants (FSRs), Quick Service Restaurants (QSRs), Others), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Platforms, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 76082

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

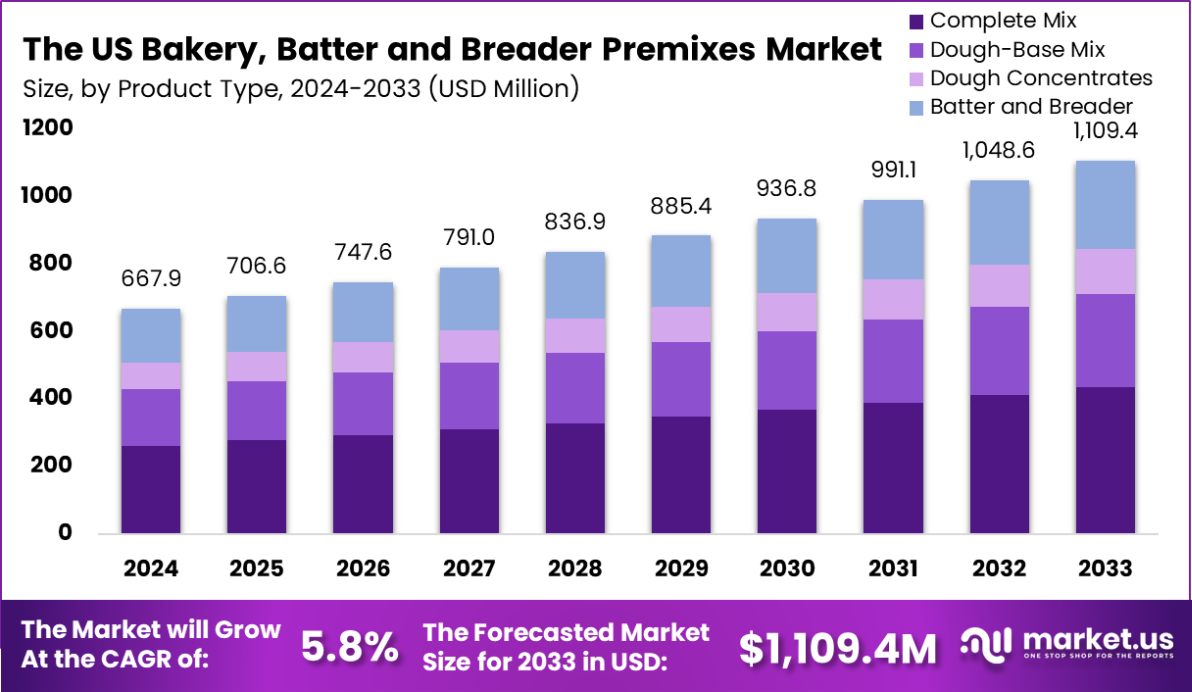

The US Bakery, Batter, and Breader Premixes Market is expected to be worth around USD 1,109.4 Million by 2033, up from USD 667.9 Million in 2023, and grow at a CAGR of 5.8% from 2024 to 2033.

US Bakery, Batter, and Breader Premixes are pre-formulated dry mixtures used in baking, battering, and breading processes. They simplify production, ensuring consistency in texture and flavor for baked goods, fried foods, and snacks. These premixes often contain ingredients like flour, starch, leavening agents, and seasonings.

The US market for these premixes is expanding due to increased demand for convenience foods, rising consumer preference for ready-to-cook products, and innovations in clean-label ingredients. The trend towards healthier, gluten-free products, and organic options also drives market growth.

The demand for quick meal solutions, changing consumer preferences towards healthier foods, and advancements in food technology contribute to the steady growth of this market. Increased consumption of ready-to-eat snacks and baked goods fuels demand, particularly in the food service industry. As consumers shift towards healthier options, there is an opportunity for companies to innovate with organic, gluten-free, and non-GMO products.

The U.S. Bakery, Batter, and Breader Premixes Market is undergoing significant evolution, driven by shifting consumer preferences and augmented by substantial financial support mechanisms. As dietary trends lean towards healthier and more convenient eating options, the demand for bakery premixes, which promise both ease of use and consistent quality, has seen a notable uptick.

This trend is well-supported by economic data which reveals that in 2015, an average U.S. consumer unit allocated $4,015 towards food purchases at home, underscoring a robust domestic focus on food consumption that bakes into the market’s potential for growth.

Further bolstering this sector are several governmental and private funding initiatives aimed at revitalizing and supporting the bakery industry. Key among these is the Restaurant Revitalization Fund, providing up to $10 million per business in forgivable funds, a crucial lifeline for bakeries adapting to post-pandemic market conditions.

Additionally, the USDA’s Business Builder Grants inject $124 million into small and midsized farm and food businesses, including those in the bakery chain, facilitating enhancements from farm to table.

Moreover, tailored financial solutions such as those offered by peakbusinessvaluation, with up to $5 million in financing for bakery infrastructure, underscore the accessible capital that can drive technological and operational advancements in this space.

Notably, innovative projects like the $600,000 grant awarded to VitaminSea for developing seaweed bread highlight the market’s openness to novel products that align with contemporary health and wellness trends. Collectively, these dynamics weave a promising tapestry for sustained growth and innovation within the U.S. bakery, batter, and breeder premixes market.

Key Takeaways

- The US Bakery, Batter, and Breader Premixes Market is expected to be worth around USD 1,109.4 Million by 2033, up from USD 667.9 Million in 2023, and grow at a CAGR of 5.8% from 2024 to 2033.

- In the US Bakery, Batter, and Breader Premixes Market, Complete Mix holds 39.3%.

- Meat applications account for 28.4% of the market’s demand for various products.

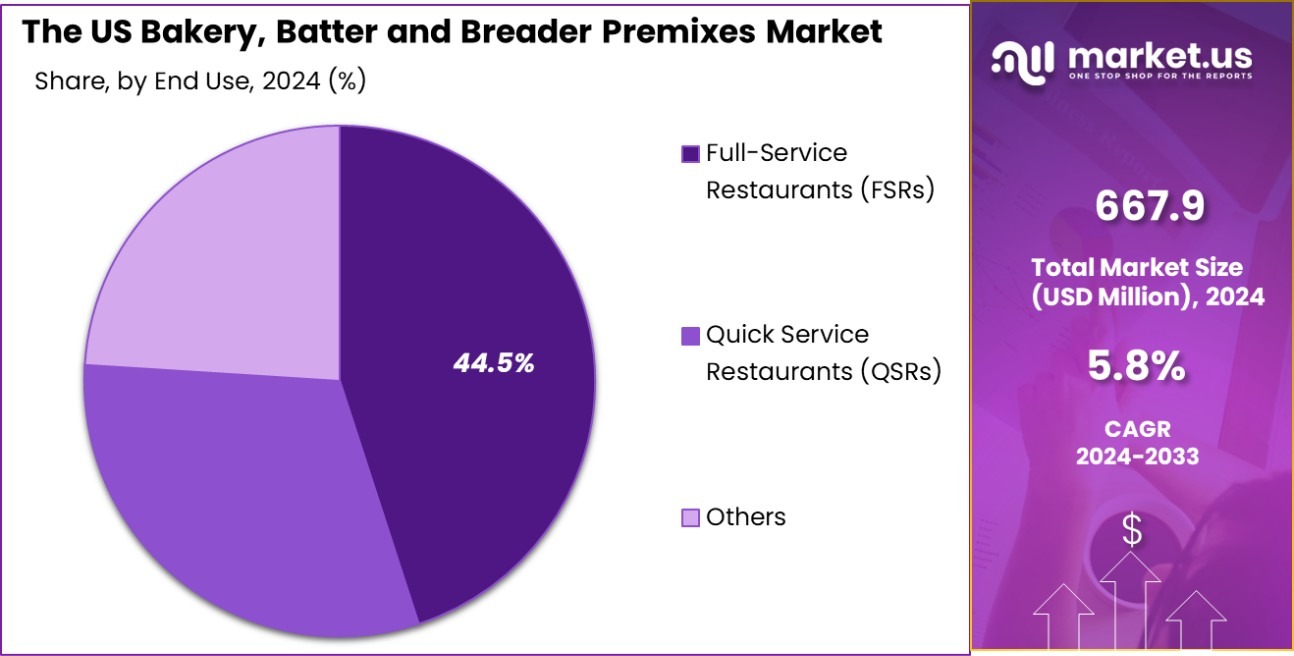

- Full-Service Restaurants (FSRs) dominate end-use, representing 44.5% of the market.

- Supermarkets and hypermarkets are key, distributing 33.4% of these premixes nationally.

By Product Type Analysis

Complete Mix dominates the U.S. Bakery, Batter and Breader Premixes Market with a 39.3% share.

In 2024, Complete Mix held a dominant market position in the “By Product Type” segment of the US Bakery, Batter, and Breader Premixes Market, with a 39.3% share. Following closely were Dough-Base Mix, Dough Concentrates, and Batter and breader products.

Each of these segments catered to specific needs within the bakery products and batter industry, emphasizing the diversification and specialization of the market.

Dough-Base Mix captured 24.7% of the market, appreciated for its convenience and consistency, which are crucial for commercial baking operations seeking to maintain quality while minimizing labor costs.

Dough Concentrates, with a market share of 21.0%, were favored for their ability to provide customizable options for bakers aiming to differentiate their products but still benefit from the ease of premixed ingredients. Lastly, Batter and Breader products accounted for 15.0% of the market, essential for the preparation of coated foods, reflecting a steady demand in both retail and food service sectors.

This segmentation highlights a robust market with varied consumer preferences and technological advancements driving growth. Manufacturers have focused on innovating within each category to cater to health trends, efficiency demands, and flavor enhancements, thereby ensuring they meet the broad spectrum of consumer and commercial needs in the US market.

By Application Meat Analysis

Meat applications claim 28.4% of the U.S. Bakery, Batter, and Breader Premixes Market sector.

In 2024, Meat held a dominant market position in the “By Application” segment of the US Bakery, Batter, and Breader Premixes Market, with a 28.4% share. This was followed by other significant categories including Pork, Chicken, Seafood, Vegetables, Onion Rings, and Other Vegetables, each catering to diverse culinary needs and preferences.

Pork and Chicken were prominent segments, capturing 18.5% and 22.3% of the market, respectively. These segments benefited from the widespread consumption of pork and chicken products in various culinary traditions across the US, which consistently demand high-quality, flavorful coatings to enhance the final product.

Seafood, with a 12.6% market share, showed robust demand, influenced by a growing consumer preference for seafood dishes that require specialized batter mixes for optimal texture and taste.

The Vegetable segment, including Onion Rings and Other Vegetables, collectively held a 18.2% share, driven by the increasing trend towards vegetarian and vegan diets as well as the rise in snack culture, which favors breaded and battered vegetables as a popular choice.

This segment underscores the versatility and adaptability of batter and bread premixes to meet evolving dietary trends and consumer tastes in the US market.

By End-use Analysis

Full-Service Restaurants (FSRs) are the leading end-users, capturing 44.5% of the market.

In 2024, Full-Service Restaurants (FSRs) held a dominant market position in the “By End-use” segment of the US Bakery, Batter, and Breader Premixes Market, with a 44.5% share. This was closely followed by Quick Service Restaurants (QSRs), which also play a significant role in the industry.

The prominent market share of FSRs can be attributed to their extensive use of a variety of bakery, batter, and breeder premixes to offer diverse and sophisticated menu options that cater to diners seeking a sit-down meal experience with high-quality, freshly prepared food. The preference in FSRs for premium, customizable options that require complex and specific premixes has driven their leading position in the market.

On the other hand, QSRs, capturing a market share of 55.5%, focus on the speed of service and consistency across numerous locations, relying heavily on premixes that allow for quick preparation and uniform quality. The demand in QSRs highlights the importance of efficiency and the ability to meet the fast-paced demands of consumers, making them a significant sector within the market.

Together, these segments underscore the diverse applications and critical role of premix solutions in enhancing operational efficiency and culinary quality in the restaurant industry.

By Distribution Channel Analysis

Supermarkets and hypermarkets are key, holding a 33.4% share in distribution channels for the market.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the “By Distribution Channel” segment of the US Bakery, Batter, and Breader Premixes Market, with a 33.4% share. This was followed by Specialty Stores, Convenience Stores, and Online Platforms, each channel catering uniquely to consumer purchasing behaviors.

Supermarkets and Hypermarkets have remained preferred shopping destinations due to their wide product range and the convenience of accessing various bakery, batter, and breeder premixes under one roof. These outlets cater to consumers looking for immediate purchases and those preferring to physically evaluate options before buying.

Specialty Stores, accounting for 24.6% of the market, attract customers seeking premium and niche products, often offering specialized items not commonly found in larger retail formats. Convenience Stores, with a 21.5% share, cater to impulse buys and the need for quick shopping trips, essential for consumers needing last-minute ingredients.

Online Platforms are rapidly gaining market share, currently holding 20.5%. This growth is driven by the increasing consumer preference for e-commerce, which offers the convenience of home delivery, easy comparisons, and often competitive pricing, reflecting a significant shift in consumer shopping habits. This segment demonstrates the evolving dynamics of retail and the growing importance of digital channels in the food industry.

Key Market Segments

By Product Type

- Complete Mix

- Dough-Base Mix

- Dough Concentrates

- Batter and Breader

By Application

- Meat

- Pork

- Chicken

- Seafood

- Vegetables

- Onion rings

- Other vegetables

- Others

By End-use

- Full-Service Restaurants (FSRs)

- Quick Service Restaurants (QSRs)

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Platforms

- Others

Driving Factors

Increasing Demand for Convenience and Ready-to-Eat Products

The U.S. market for bakery, batter, and broader premixes is significantly driven by the growing consumer preference for convenience foods. Ready-to-eat and easy-to-prepare food products are becoming increasingly popular among Americans who have busy lifestyles and little time for traditional cooking.

This trend has led to a rise in demand for premix products that simplify the baking process and reduce preparation time, making them a popular choice in households across the country.

Rising Popularity of Gluten-Free and Organic Options

Health consciousness among American consumers has led to a surge in demand for gluten-free and organic bakery products. This shift is driving the bakery, batter, and breader premixes market as manufacturers develop and market products that cater to these specific dietary needs.

These products not only appeal to health-conscious consumers but also to those with dietary restrictions, such as celiac disease, further expanding the market base.

Innovations in Flavors and Ingredients

The U.S. market is witnessing substantial growth due to innovations in flavors and ingredients in bakery products. Consumers are increasingly looking for new and exotic flavors, which has encouraged manufacturers to experiment with unique combinations of ingredients and flavors in their premixes.

This innovation not only rejuvenates consumer interest but also helps brands differentiate their products in a competitive market, thereby attracting a broader demographic.

Restraining Factors

High Competition from Fresh and Artisanal Bakery Products

The U.S. market for bakery, batter, and breeder premixes faces significant competition from fresh and artisanal bakery products. Many consumers prefer fresh, locally-made products over premixed or mass-produced options, perceiving them as higher quality and more authentic.

This preference can limit the growth of the premix market as artisanal and fresh bakeries continue to hold a substantial market share, especially in urban and upscale markets where consumer demand for artisanal products is particularly strong.

Concerns Over Processed Foods and Additives

Increasing health awareness among consumers has led to skepticism regarding processed foods, which often include various additives and preservatives. This sentiment affects the bakery, batter, and breader premixes market, as these products are perceived to be less healthy compared to homemade or fresh alternatives.

The presence of artificial ingredients and preservatives in premixes can deter health-conscious consumers, posing a challenge to market growth.

Volatility in Raw Material Prices

The cost of raw materials such as flour, eggs, and sugar can fluctuate due to various factors like climate change, agricultural policies, and global supply chains. This volatility affects the stability of production costs for bakery, batter, and breader premixes.

When raw material costs increase, manufacturers may face challenges in maintaining consistent pricing, potentially leading to decreased consumer purchases if prices are passed on to them. This uncertainty can restrain the market’s growth and profitability

Growth Opportunity

Expansion into Vegan and Plant-Based Product Offerings

There’s a notable rise in veganism and plant-based diets among U.S. consumers, creating an opportunity for the bakery, batter, and breader premixes market to expand its product range. By introducing vegan-friendly versions of popular premixes, manufacturers can cater to this growing demographic.

These products can be marketed not only as vegan but also as environmentally friendly and healthy, appealing to a broad range of consumers interested in sustainable and ethical eating habits.

Incorporation of Ethnic and Exotic Flavors

The increasing cultural diversity in the U.S. and the growing interest in global cuisines present a significant opportunity for innovation in the bakery, batter, and breader premixes market. By integrating ethnic and exotic flavors into their products, manufacturers can attract consumers looking for new and unique taste experiences.

This approach can differentiate products in a crowded market and capture the attention of adventurous eaters eager to explore different culinary traditions through convenient premix options.

Leveraging E-commerce and Direct-to-Consumer Sales

The shift towards online shopping, accelerated by the COVID-19 pandemic, offers a robust growth opportunity for premix manufacturers. Developing a strong e-commerce presence and direct-to-consumer sales channels can help brands reach a wider audience, provide better consumer experiences, and increase brand loyalty.

This strategy allows for direct feedback and customer data collection, enabling brands to quickly adapt to changing consumer preferences and enhance their product offerings effectively.

Latest Trends

Increasing Use of Natural and Organic Ingredients

Consumers are becoming more health-conscious, leading to a trend towards natural and organic ingredients in bakery products. This shift is influencing the bakery, batter, and breader premixes market as manufacturers are now incorporating organic grains, natural sweeteners, and non-GMO ingredients to meet consumer demands.

These changes not only help attract health-focused customers but also align with the broader consumer preference for transparency and clean labels in food products.

Customization and Personalization in Bakery Products

There is a growing trend towards customization and personalization in the food industry, including bakery items. Consumers are looking for products that can be tailored to their dietary needs and taste preferences.

Manufacturers of bakery, batter, and breader premixes are responding by offering customizable options that allow consumers to add or omit ingredients based on their requirements. This trend is enhancing consumer engagement and satisfaction by providing unique, personalized baking experiences at home.

Technological Advancements in Food Processing

Technological advancements are revolutionizing the bakery, batter, and breader premixes market. Innovations in food processing technologies are enabling manufacturers to improve the consistency and quality of their products while maintaining efficiency and reducing waste.

These technologies also help extend the shelf life of products without compromising taste or nutritional value, making premixes more appealing to both retailers and consumers. This trend is expected to continue driving the market forward, as technology helps meet the growing demand for high-quality, convenient food solutions.

Key Players Analysis

In 2023, the U.S. Bakery, Batter, and Breader Premixes market remains a dynamic landscape with key players like ADM, Cargill, Kerry Group, and others strategically positioning themselves to capitalize on emerging consumer trends and technological advancements.

Companies such as ADM and Cargill are leveraging their vast supply chains and expertise in agronomy to ensure the availability of high-quality raw materials, focusing on sustainability and traceability, which are increasingly important to today’s consumers.

Kerry Group continues to innovate in the realm of taste and nutrition, integrating exotic and ethnic flavors into their premixes, which aligns with the growing consumer desire for diverse culinary experiences. Similarly, Honeyville and Newly Weds Foods have been adept at tailoring their offerings to include gluten-free and organic options, meeting the demand for health-centric products without compromising on taste.

Companies like Upper Crust Enterprise and The Langlois Company are focusing on niche markets, providing specialized products that cater to specific consumer preferences and dietary needs. This approach not only helps in maintaining a loyal customer base but also in standing out in a crowded market.

Innovation remains a key driver, with firms like Ingredion and McCormick & Company investing in new processing technologies to improve product quality and shelf life. The focus on e-commerce and direct-to-consumer sales models is also prominent, allowing companies to build direct relationships with consumers and gather valuable data to further refine their products.

Overall, the ability of these key players to adapt to fast-evolving market conditions, embrace technological advancements, and respond to consumer preferences will determine their success in the increasingly competitive U.S. Bakery, Batter, and Breader Premixes market.

Top Key Players in the Market

- ADM

- Cargil

- Kerry Group Plc (Kerry Foodservice)

- Honeyville, Inc.

- Newly Weds Foods, Inc.

- Upper Crust Enterprise, Inc.

- The Langlois Company

- POPLA International Inc.

- Ingredion

- McCormick & Company, Inc.

- Bunge Limited

- House-Autry Mills

- Newly Weds Food

Recent Developments

- In 2024, ADM anticipates increased volumes and margin improvements, yet faces rising operational costs. Targeting an adjusted EPS between $5.25 and $6.25, the company focuses on sustainable, innovative practices to boost consumer health through nutritious products.

- In 2023, Newly Weds Foods, Inc. improved its bakery, batter, and breader premixes in the US, focusing on creating superior taste, texture, and appearance through innovative, customized formulations that address varying food processing needs and conditions.

Report Scope

Report Features Description Market Value (2023) USD 667.9 Million Forecast Revenue (2033) USD 1,109.4 Million CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Complete Mix, Dough-Base Mix, Dough Concentrates, Batter and Breader), By Application (Meat, Pork, Chicken, Seafood, Vegetables, Onion rings, Other vegetables, Others), By End-use (Full-Service Restaurants (FSRs), Quick Service Restaurants (QSRs), Others), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Platforms, Others) Competitive Landscape ADM, Cargil, Kerry Group Plc (Kerry Foodservice), Honeyville, Inc., Newly Weds Foods, Inc., Upper Crust Enterprise, Inc., The Langlois Company, POPLA International Inc., Ingredion , McCormick & Company, Inc. , Bunge Limited, House-Autry Mills, Newly Weds Food Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  The US Bakery, Batter and Breader Premixes MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

The US Bakery, Batter and Breader Premixes MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- Cargil

- Kerry Group Plc (Kerry Foodservice)

- Honeyville, Inc.

- Newly Weds Foods, Inc.

- Upper Crust Enterprise, Inc.

- The Langlois Company

- POPLA International Inc.

- Ingredion

- McCormick & Company, Inc.

- Bunge Limited

- House-Autry Mills

- Newly Weds Food