Global Distillers Dried Grains With Solubles (DDGS) Market Size, Share, And Industry Analysis Report By Type (Corn, Wheat, Rice, Amino Acids, Blended Grains, Others), By Animal Type (Poultry, Dairy Cattle, Beef Cattle, Swine, Aquaculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176800

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

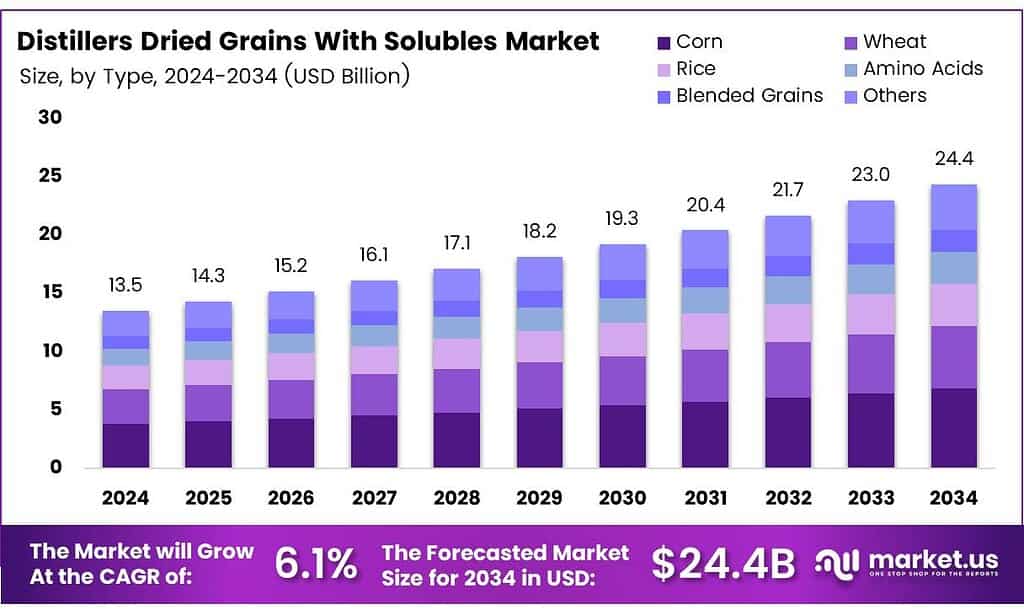

The Global Distillers Dried Grains With Solubles (DDGS) Market size is expected to be worth around USD 24.4 billion by 2034, from USD 13.5 billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

Distillers Dried Grains With Solubles (DDGS) Market represents a steadily expanding segment within the global animal nutrition industry. It emerges as a high-value co-product of ethanol and alcohol production, offering feed manufacturers a cost-effective protein alternative. As demand for sustainable feed inputs increases, DDGS continues to gain relevance among poultry, cattle, and aquaculture producers.

The market advances as producers prioritise low-cost, functional feed ingredients that support stronger feed conversion ratios. DDGS supports this shift by offering favourable nutrient density, dependable availability, and competitive pricing. Its suitability for diverse livestock segments encourages feed integrators to adopt DDGS more consistently across structured nutritional programs.

- Toward the nutritional front, DDGS continues attracting buyers due to its strong composition. DDGS feed contains 28% crude protein, 13 MJ/kg DM energy, 90% dry matter, 5.5% crude fibre, 9% crude fat, 4.5% ash, 30% NDF, and 0.18% calcium, supporting balanced livestock nutrition. Recommendations suggest it should not exceed 20% of the total ration.

Additionally, industry insights indicate that distillers’ grains—derived after extracting starch for alcohol—retain essential proteins, fats, vitamins, and minerals. Plants may produce DDGS with 38–40% protein, depending on processing. Rice-based DDGS also emerges as a valuable by-product of alcohol manufacturing, further expanding market possibilities in diversified grain economies.

Furthermore, growth accelerates through expanding biofuel production across major economies, creating a reliable supply chain for DDGS output. Governments promoting renewable energy indirectly strengthen DDGS availability, making the market more resilient. As ethanol plants scale operations, the volume of DDGS entering the feed sector proportionally increases, enhancing long-term stability.

Key Takeaways

- The Global DDGS Market is projected to reach USD 24.4 billion by 2034, rising from USD 13.5 billion in 2024, at a CAGR of 6.1% from 2025 to 2034.

- Corn DDGS leads the market by type with a dominant share of 67.9%.

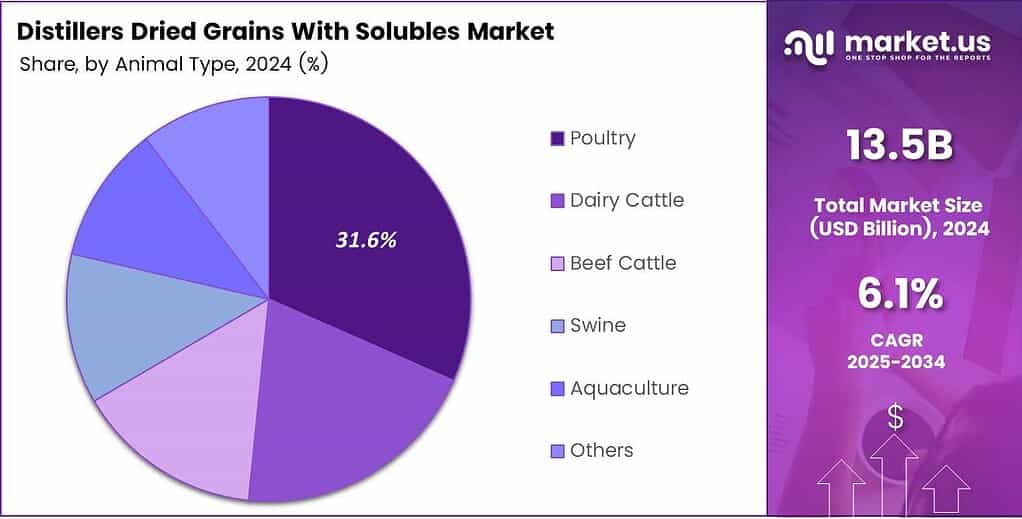

- Poultry remains the top-consuming animal segment with a 31.6% market share.

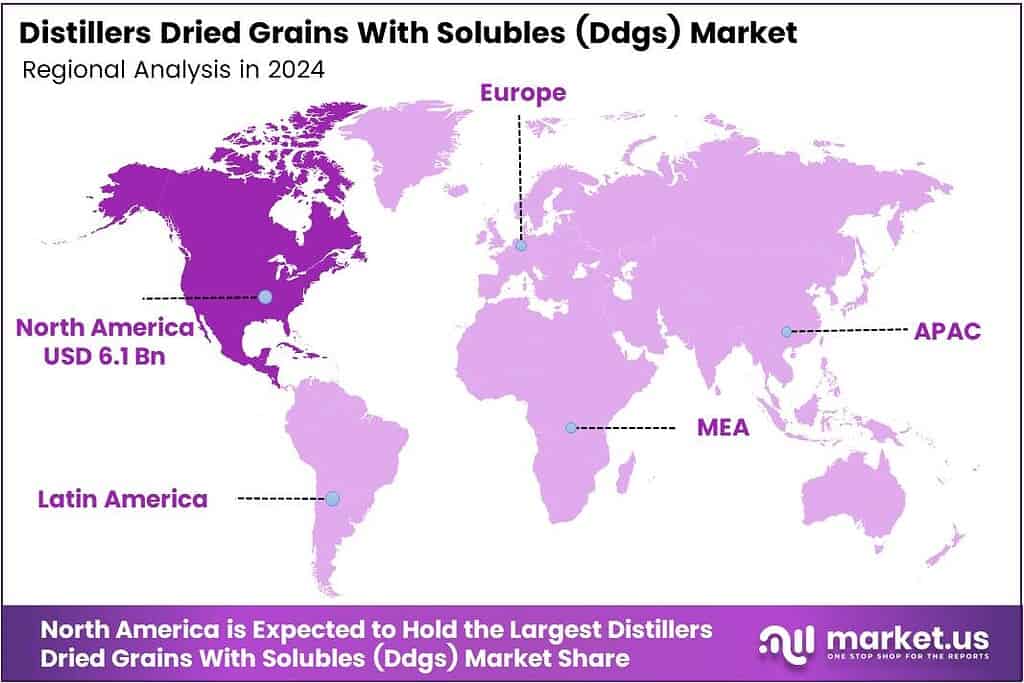

- North America dominates globally with a 45.8% share, valued at USD 6.1 billion.

By Type Analysis

Corn dominates with 67.9% due to its high nutritional density and strong adoption in global feed formulations.

In 2025, Corn held a dominant market position in the By Type Analysis segment of the Distillers Dried Grains With Solubles (DDGS) Market, with a 67.9% share. Its consistent nutrient profile and large-scale ethanol production continue to support widespread usage. Moreover, feed manufacturers prefer corn-based DDGS for predictable supply and quality stability.

Wheat DDGS continued gaining traction as producers sought alternatives for regions lacking corn availability. Its balanced amino acid profile supports poultry and swine nutrition. Additionally, its growing use in European feed markets improved accessibility. Manufacturers also expanded processing capacity, enabling greater supply efficiency and diversification in feed applications.

Rice DDGS expanded gradually across Asian countries where rice-based ethanol production is increasing. Its lighter fiber content appeals to aquaculture and poultry nutritionists. Furthermore, rising ethanol units in Southeast Asia boosted availability. Feed producers also explored blending rice DDGS with conventional ingredients to reduce overall ration costs and improve feed digestibility.

Amino Acids–based DDGS gained attention due to enhanced protein enrichment. This category appeals to precision feeding systems that require better nutrient density. Additionally, producers use fermentation-based improvements, enabling more consistent amino acid release. Such value-added formulations help meet rising demand for performance-oriented livestock nutrition.

Blended Grains DDGS addressed the need for flexible feed ingredient options. These blends combine multiple grain sources to stabilize nutrient variability. Feed manufacturers choose blended DDGS to improve diet uniformity. Their gradual adoption reflects growing interest in cost-effective and nutritionally balanced feed alternatives for diverse livestock categories worldwide.

By Animal Type Analysis

Poultry dominates with 31.6% due to rising commercial feed demand and strong inclusion acceptance.

In 2025, Poultry held a dominant market position in the By Animal Type Analysis segment of the Distillers Dried Grains With Solubles (DDGS) Market, with a 31.6% share. Poultry producers increasingly adopted DDGS for cost savings and amino-acid value. Its digestibility and energy contribution also improved feed efficiency across broilers and layers.

Dairy Cattle use of DDGS expanded steadily as farmers utilized its high-fat and protein profile to enhance milk yield potential. Dairy nutritionists increasingly recommend controlled inclusion levels to support rumen function. Additionally, competitive pricing encouraged producers to incorporate DDGS into balanced rations for improved productivity.

Beef Cattle applications benefited from DDGS’s energy-rich and fiber-balanced structure. Feedlots preferred DDGS to maintain weight gain targets while controlling ration costs. Its consistent nutrient delivery made it a reliable supplement. Wider use across North and South American beef production strengthened overall segment growth in 2025.

Swine operations incorporated DDGS for its amino acids and metabolizable energy value. Producers used it as a partial corn and soybean meal substitute. Improved digestibility research helped optimize swine diets. As feed prices fluctuated, DDGS supported cost-effective nutrition strategies across various growth stages.

Aquaculture leveraged DDGS as an alternative plant-protein source. Fish and shrimp feed formulators tested DDGS for cost savings and sustainable protein replacement. While inclusion levels remained lower than in livestock, ongoing trials encouraged gradual uptake. Expanding aquafeed production in Asia supported additional segment usage.

Key Market Segments

By Type

- Corn

- Wheat

- Rice

- Amino Acids

- Blended Grains

- Others

By Animal Type

- Poultry

- Dairy Cattle

- Beef Cattle

- Swine

- Aquaculture

- Others

Emerging Trends

Growing Shift Toward Sustainable and Low-Carbon Feed Ingredients

Sustainability is becoming a major trend influencing the DDGS market. Feed manufacturers and livestock producers are increasingly choosing ingredients that reduce environmental impact and improve resource efficiency. DDGS supports sustainability goals because it is produced from the leftover material of bioethanol processing, helping reduce waste.

- There is also a noticeable trend toward adopting circular economy practices in the feed sector. Using DDGS helps producers lower their carbon footprint, making it attractive in regions focusing on green agriculture. In December 2025, U.S. dry mills produced 1.95 million tons of DDGS, which was 11% higher than the prior month and 4% above the same month a year earlier.

Additionally, digitalization in feed quality testing is gaining traction. New tools help track nutrient consistency in DDGS, improving buyer confidence. As technology helps stabilize quality perception, the market benefits from higher acceptance across poultry, swine, dairy, and aquafeed segments.

Drivers

Rising Dependence on High-Protein Livestock Feed Drives Market Growth

The Distillers Dried Grains With Solubles (DDGS) market is growing mainly because livestock producers are looking for affordable and nutrient-rich feed ingredients. DDGS provides a strong protein profile, making it a reliable option for poultry, cattle, and swine farmers who want cost efficiency without compromising on feed value. As feed prices fluctuate globally, DDGS becomes a preferred alternative.

- In addition, ethanol production continues to rise in major regions, increasing the availability of DDGS as a by-product. This steady supply supports long-term market stability. Brazil’s DDG/DDGS production rose to 4.2 million tons in 2024/25, up from 1.2 million tons, showing how quickly supply can grow when ethanol grinding rises.

The demand for sustainable feed options also fuels the growth of the DDGS market. Farmers increasingly choose ingredients that minimize waste and improve resource efficiency. Since DDGS is derived from grain-based ethanol processing, it fits well into circular agricultural systems, adding to its appeal across global feed industries.

Restraints

Quality Variations in DDGS Limit Wider Adoption

One of the key restraints in the DDGS market is the inconsistency in product quality across different producers. Variations in color, nutrient concentration, and moisture levels make buyers cautious, especially when feeding poultry and young livestock that require consistent nutrition. This lack of standardization creates hesitancy among feed formulators.

- Behind this opportunity is the steady expansion of corn ethanol processing, which naturally produces DDGS. Brazil’s corn ethanol production grew from 400 million liters to 7.5 billion liters, while the volume of corn processed rose from 950,000 tons to 17 million tons.

Transportation and storage challenges also add pressure to the market. DDGS is hygroscopic, meaning it can absorb moisture quickly, resulting in spoilage or nutrient loss during transit. These issues raise handling costs and reduce its usability in humid regions.

Growth Factors

Expanding Use of DDGS in Aquaculture Unlocks New Potential

The aquaculture sector is becoming an attractive growth avenue for DDGS producers. With the rising cost of traditional fishmeal, feed manufacturers are actively seeking alternative protein sources, and DDGS fits well due to its favorable nutritional profile. Its amino acids, energy levels, and fiber content support steady growth in various fish species.

- Developing countries are rapidly scaling up their aquaculture production, creating fresh demand for affordable feed ingredients. Brazil exported 791,000 tons of DDGS to 21 countries in 2024, worth USD 118 million, and the Brazilian government and corn industry have been actively opening new markets.

Moreover, advancements in feed formulation technology now allow producers to enhance the digestibility of DDGS for aquatic species. Enzyme supplementation and fermentation improvements are expanding its usability. This shift positions DDGS as a competitive ingredient in a fast-growing global protein market.

Regional Analysis

North America Dominates the Distillers Dried Grains With Solubles (DDGS) Market with a Market Share of 45.8%, Valued at USD 6.1 Billion

North America leads the global DDGS market due to its strong ethanol production capacity, consistent grain availability, and widespread adoption of high-protein feed ingredients. The region’s large livestock and poultry industries further support its dominance, with DDGS widely integrated into feed formulations. With a market share of 45.8% and a valuation of USD 6.1 billion.

Europe shows steady growth in the DDGS market, driven by rising demand for sustainable feed ingredients and increasing regulatory support for circular bioeconomy practices. The livestock sector, particularly dairy and swine, is adopting DDGS to enhance feed efficiency while reducing reliance on traditional protein sources. Additionally, regional emphasis on reducing carbon emissions strengthens the demand for biofuel by-products, contributing to the region’s expanding DDGS utilization.

Asia Pacific is emerging as one of the fastest-growing regions, supported by rising meat consumption, expanding livestock populations, and heavy feed imports from global producers. Countries like China, Vietnam, and India are increasing DDGS adoption due to its favorable nutrient profile and cost benefits. The region’s growing aquaculture industry also strengthens demand, with processors opting for DDGS as a stable energy and protein source in feed formulations.

The Middle East & Africa region is gradually increasing its DDGS usage, driven by growing livestock production needs and efforts to reduce dependence on expensive feed imports. Governments are investing in modernizing feed supply chains, which is supporting market penetration. Although still developing, MEA’s market shows long-term potential due to rising consumption of poultry and dairy products across GCC and African nations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Top Key Players in the Market

- Archer Daniels Midland Company

- POET LLC

- CropEnergies AG

- Cargill Incorporated

- Green Plains Inc.

- Valero Energy Corporation

- The Andersons, Inc.

- Globus Spirits Limited

- Nugen Feeds and Foods Private Limited

- The Scoular Company

Recent Developments

In 2025, the global DDGS market continues to evolve as producers focus on expanding bioethanol output, optimizing co-product value, and strengthening supply security. Leading players adopt capacity expansions, technology upgrades, and strategic distribution improvements to meet rising demand from livestock, poultry, and aquaculture sectors.

Archer Daniels Midland Company maintains a strong foothold in the DDGS market by leveraging its expansive ethanol production network and advanced grain-handling infrastructure. The company continues to enhance export flows through optimized logistics, supporting rising demand from Asia-Pacific and Latin America.

POET LLC strengthens its market position through continuous innovation in bioprocessing technologies, enabling higher DDGS yield and improved nutrient consistency. Its integrated production facilities allow the company to respond quickly to feed-demand fluctuations across domestic and global markets.

CropEnergies AG plays a vital role in the European DDGS landscape, supported by robust ethanol production capacity and sustainability-driven operations. Its focus on low-carbon biofuel output aligns with growing preference for environmentally responsible feed ingredients across the EU livestock industries.

Cargill Incorporated leverages its global supply-chain strength and diversified agricultural operations to expand DDGS penetration across emerging feed markets. The company strategically integrates sourcing, processing, and distribution capabilities, ensuring consistent product availability despite raw-material volatility.

Report Scope

Report Features Description Market Value (2024) USD 13.5 Billion Forecast Revenue (2034) USD 24.4 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Corn, Wheat, Rice, Amino Acids, Blended Grains, Others), By Animal Type (Poultry, Dairy Cattle, Beef Cattle, Swine, Aquaculture, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Archer Daniels Midland Company, POET LLC, CropEnergies AG, Cargill Incorporated, Green Plains Inc., Valero Energy Corporation, The Andersons, Inc., Globus Spirits Limited, Nugen Feeds and Foods Private Limited, The Scoular Company Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Distillers Dried Grains With Solubles (DDGS) MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Distillers Dried Grains With Solubles (DDGS) MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer Daniels Midland Company

- POET LLC

- CropEnergies AG

- Cargill Incorporated

- Green Plains Inc.

- Valero Energy Corporation

- The Andersons, Inc.

- Globus Spirits Limited

- Nugen Feeds and Foods Private Limited

- The Scoular Company