Global Dental Turbines Market By Speed (High and Low) By End-Use (Dental offices and Hospitals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 64160

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

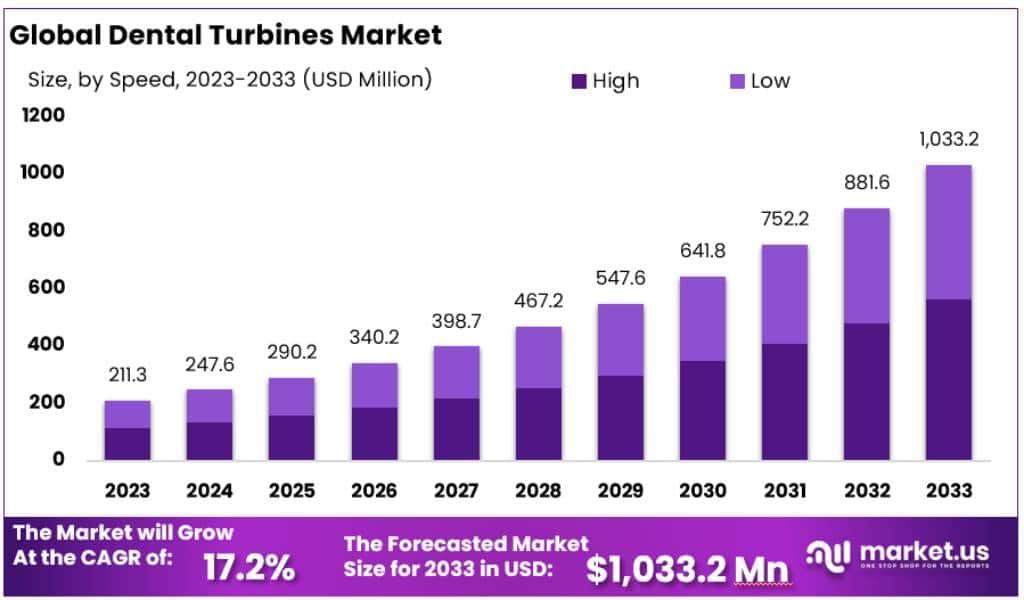

The Global Dental Turbines Market size is expected to be worth around USD 1033.2 Million by 2033, from USD 211.3 Million in 2023, growing at a CAGR of 17.2% during the forecast period from 2024 to 2033.

A dental turbine is a rotating instrument that works with compressed air and can rotate at very high speeds of around 400,000 rpm. It is an ideal tool for abrading or cutting tooth enamel and materials used in fixed prostheses.

This market growth is due to an increasing demand not only for cosmetic dentistry but also for other procedures like restorative and orthodontics. This market is also driven largely by technological advances in dental turbine handpieces and growing awareness about dental health.

Key Takeaways

- The Dental Turbines Market is projected to reach approximately USD 1033.2 Million by the year 2033.

- In 2023, the market was valued at USD 211.3 Million.

- This growth represents a remarkable Compound Annual Growth Rate (CAGR) of 17.2% between 2024 and 2033.

- Dental turbines are rotating instruments that operate using compressed air and can rotate at speeds of up to 400,000 rpm.

- High-speed turbine handpieces accounted for over 54.4% of the dental turbine market in 2023.

- Hospitals accounted for more than 52.3% of the market share in 2023, driven by extensive healthcare infrastructure.

- Oral diseases like tooth decay and periodontal diseases are widespread, affecting about 10% of the global population.

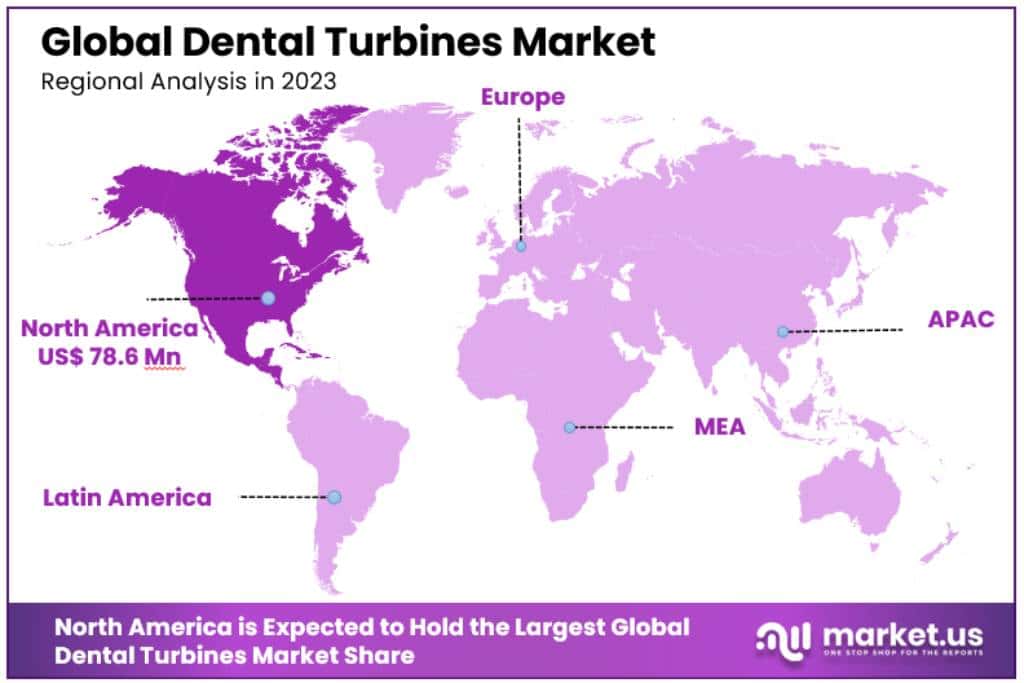

- North America leads the global market, holding a commanding 37.2% market share in 2023, driven by advanced healthcare infrastructure and rising awareness of oral health.

Speed Analysis

In 2023, the high-speed turbine handpiece segment held a dominant market position, capturing more than a 54.4% share of the dental turbines market. This substantial market share can be primarily attributed to the widespread adoption of high-speed handpieces among dental professionals. High-speed handpieces are essential in a variety of dental procedures, notably due to their efficiency and precision in cutting dental hard tissues. According to industry insights, an average dental practice typically requires a minimum of three high-speed handpieces per operation. This demand underscores the segment’s robust growth trajectory.

The high-speed turbine handpiece’s prominence is further reinforced by its extensive use in regions like Canada and Puerto Rico, as highlighted in research published in the Journal of Prosthodontics. The versatility and effectiveness of these handpieces in complex dental procedures contribute significantly to their market dominance.

Conversely, the low-speed turbine handpiece segment, while holding a smaller market share, is anticipated to experience considerable growth over the forecast period. These handpieces are crucial in a range of dental treatments, including caries removal, cavity preparation, and the application of crowns and veneers. The diversity in their application underpins the segment’s potential growth. Market analysis indicates a steady demand for at least two low-speed handpieces per operation in a standard dental practice, suggesting a growing market presence.

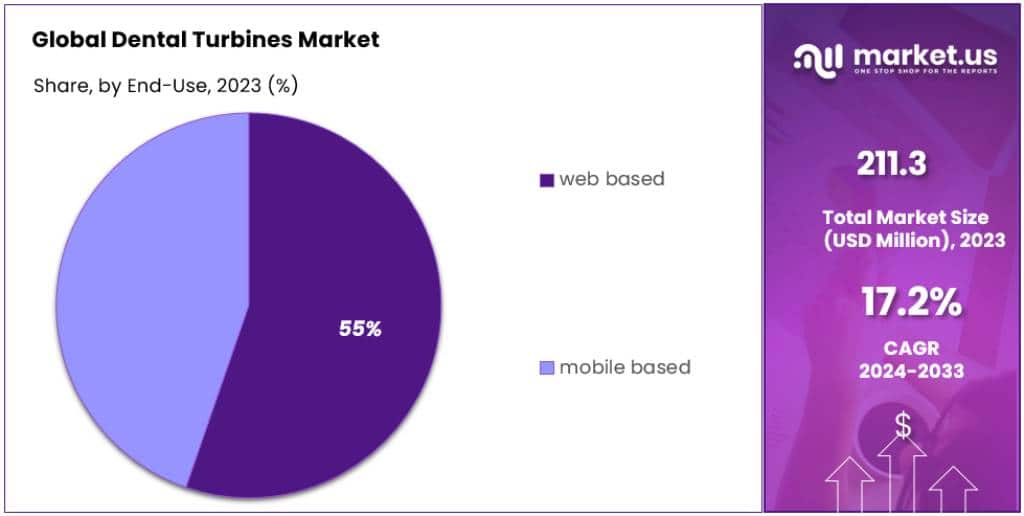

End-Use Analysis

In 2023, hospitals held a dominant market position in the dental turbines market, capturing more than a 52.3% share. This significant market presence is largely due to the expansive healthcare infrastructure in various countries, especially those developing. Hospitals have become key locations for comprehensive dental care, leveraging advanced dental equipment like turbines for a range of procedures. The growth in this segment is further supported by partnerships between hospitals and dental schools, enhancing the quality and scope of dental services offered.

The dental offices segment, while holding a smaller share of the market, remains vital. Dental offices are typically the first point of contact for routine dental care and minor procedures. Despite facing challenges such as financial strains during the COVID-19 pandemic and the need to postpone elective procedures, dental offices continue to be a critical part of the dental care ecosystem. They cater primarily to non-emergency dental services, which form a substantial portion of dental care needs.

Кеу Маrkеt Ѕеgmеntѕ

By Speed

- High Speed

- Low Speed

By End-Use

- Dental Offices

- Hospitals

Drivers

- Growing Demand for Aesthetic Dental Procedures: There’s an increasing trend for aesthetic dental procedures such as teeth whitening, gum contouring, and dental implants. These services are gaining popularity in both developed and developing countries. For instance, the American Academy of Cosmetic Dentistry reported that 99.7% of adults view a smile as an important social asset, and 74.0% believe an unattractive smile can hinder career success.

- Rising Prevalence of Dental Diseases: Oral diseases pose a significant health and economic burden globally. Reports by the National Library of Medicine indicate that conditions like tooth decay and periodontal diseases are widespread. The World Health Organization noted in March 2020 that gum diseases affect 10% of the global population.

- Technological Advancements: Innovations in dental turbines, such as electric handpieces and automatic torque control, are enhancing efficiency in dental procedures. The integration of technology like the Internet of Things in dental equipment is also a key driver.

Restraints

- High Costs and Alternative Methods: The expense associated with dental turbine procedures and devices, coupled with the availability of alternatives like laser technology, poses challenges. For example, the Health Policy and Standards Department in Dubai highlights the increasing use of laser devices in various dental specialties as an alternative to dental turbines.

Opportunities

- Post-COVID Recovery of Dental Practices: As dental clinics rebound from the pandemic’s impact, the demand for dental turbines is expected to rise. The American Dental Association’s guidelines in March 2020, which focused on urgent care, led to a temporary decline in demand. However, with the gradual recovery, the market is witnessing an upswing.

- Increased Healthcare Infrastructure: The expansion of healthcare infrastructure, especially in developing countries, offers a significant opportunity for the growth of the dental turbine market.

Challenges

- Pandemic-Induced Economic Strain: The COVID-19 pandemic has created economic challenges for the dental sector. The shift in focus to emergency services and the postponement of elective procedures has led to financial strains, especially for dental practices specializing in non-emergency services.

Trends

- Dominance of High-Speed Dental Turbines: High-speed dental turbines, known for their efficiency in reducing procedural time, are increasingly preferred by dentists. The Global Burden of Disease Study by the WHO in March 2022 reported that 3.5 billion people are affected by oral diseases, driving the demand for efficient dental procedures.

- Inorganic Growth Strategies by Key Players: Mergers and acquisitions are shaping the market. For instance, in October 2021, Vista Apex acquired Palisades Dental LLC., indicating a strategic move to enhance product offerings and market presence.

Regional Analysis

The Dental Turbines Market in North America is leading globally, holding a commanding 37.2% market share, valued at USD 78.6 million in 2023. This dominance is largely attributed to the region’s advanced healthcare infrastructure, skilled dental professionals, and a high level of oral health awareness. The United States, in particular, plays a significant role in this market, driven by factors such as an increasing burden of dental diseases, a growing elderly population, rising demand for cosmetic dentistry, and the adoption of CAD/CAM technologies.

New product launches, rising investments, and strategic initiatives by key market players are further propelling the market growth in North America. The heightened awareness of oral health hygiene among North Americans, as evidenced by the Canadian Dental Association’s 2021 report showing that 85.7% of Canadians visit a dentist within two years, underpins this trend. Additionally, the American Dental Association’s June 2021 data reveals that 85% of Americans are highly concerned about their dental health, which is expected to increase the demand for cosmetic dentistry and, consequently, dental turbines in the region.

On the other hand, the Asia Pacific region is poised for significant growth in the dental turbine market. This growth is driven by factors such as increasing dental conditions, affordable treatment costs, a surge in demand for advanced dental tools, and a growing focus on dental aesthetics and oral well-being. The region’s large population base and evolving healthcare infrastructure offer a substantial market opportunity for dental turbines.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The Dental Turbine market is a moderately competitive arena with a mix of global and regional companies. A handful of major players hold significant portions of the market share. The widespread issue of tooth decay, alongside a growing interest in aesthetic dental procedures in both developed and emerging nations, as well as advancements in dental turbine technology, are key factors attracting new companies to this field.

This market is quite diverse, with a multitude of both local and international firms. The COVID-19 pandemic has had a notable impact on the sales of these companies. For example, Dentsply Sirona, a leading player in the market, experienced significant disruptions in its operations in China, Japan, Taiwan, Korea, and Italy around March 2020, mainly due to supply chain and demand issues. The company anticipated a drop in sales of about USD 60 to 70 million in the first quarter of 2020.

Key players in this market include well-known names like Dentsply Sirona, Inc., Nakanishi Inc., and W&H Group. Others like BA International, Bien Air, The Yoshida Dental Mfg. Co., Ltd., A-dec, Inc., Guilin Woodpecker Medical Instrument Co., Ltd., and Danaher Corporation also have a significant presence. These companies, along with other key players, are central to the dynamics of the Dental Turbine market.

Маrkеt Кеу Рlауеrѕ

- Dentsply Sirona, Inc.

- Nakanishi Inc.

- W&H Group

- BA International

- Bien Air

- The Yoshida Dental Mfg. Co., Ltd.

- A-dec, Inc.

- Guilin Woodpecker Medical Instrument Co., Ltd.

- Danaher Corporation

- Other Key Players

Recent Developments

- November 2023: Nakanishi Inc. unveils its latest generation of air turbine handpieces featuring improved cutting efficiency and reduced vibration.

- November 2023: W&H Group acquires dental implant manufacturer Straumann Group, expanding its portfolio and market reach.

- November 2023: European Union updates regulations on medical device sterilization, impacting manufacturers of dental turbines.

- October 2023: Bien-Air Dental launches Nova, a new electric handpiece dental turbine offering high torque and low noise levels.

- October 2023: Dentsply Sirona announces partnership with AI company DeepScribe to develop AI-powered solutions for dental practices.

- October 2023: US Food and Drug Administration (FDA) approves new dental turbine with improved safety features.

Report Scope

Report Features Description Market Value (2023) USD 211.3 Million Forecast Revenue (2033) USD 1033.2 Million CAGR (2023-2032) 17.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Speed (High and Low) By End-use (Dental Offices and Hospitals) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Dentsply Sirona, Inc. | Nakanishi Inc. | W&H Group | BA International | Bien Air | The Yoshida Dental Mfg. Co., Ltd. | A-dec, Inc. | Guilin Woodpecker Medical Instrument Co., Ltd. | Danaher Corporation | Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the CAGR for the Dental Turbines market?A: The Dental Turbines market is expected to grow at a CAGR of 17.2% during 2023-2033.

Q: What are the segments covered in the Dental Turbines market report?A: Market.US has segmented the Dental Turbines market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Speed, market has been segmented into High, Low. By End-Use, the market has been further divided into Dental offices, Hospitals.

Q: Who are the key players in the Dental Turbines market?A. Dentsply Sirona, Inc. | Nakanishi Inc. | W&H Group | BA International | Bien Air | The Yoshida Dental Mfg. Co., Ltd. | A-dec, Inc. | Guilin Woodpecker Medical Instrument Co., Ltd. | Danaher Corporation | Other Key Players

Q: What is the Dental Turbines market size in 2023?A: The Dental Turbines market size is projected to generate revenues of approx. USD 211.3 Million (2023-2033).

-

-

- DentalEZ

- Dentsply Sirona, Inc.

- Nakanishi Inc.

- &H Group

- BA International

- Bien Air

- The Yoshida Dental Mfg. Co., Ltd

- A-dec, Inc.

- Guilin Woodpecker Medical Instrument Co., Ltd.

- Danaher Corporation

- Other Key Players