Dental Implant Market By Product Type (Endosteal Implants, Transosteal Implants, and Subperiosteal Implants), By Material (Titanium, Zirconium, and Others), By Design (Tapered Implants, and Parallel Walled Implants), By End-user (Solo Practices, DSO/Group Practices, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 22151

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

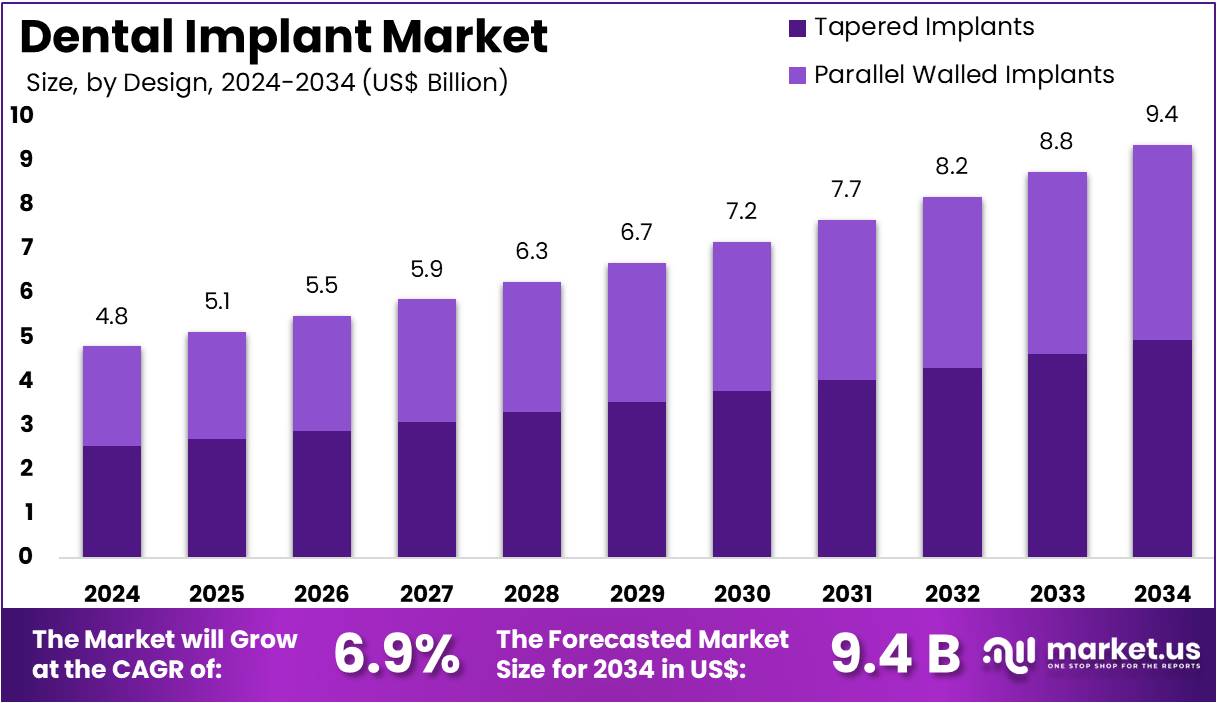

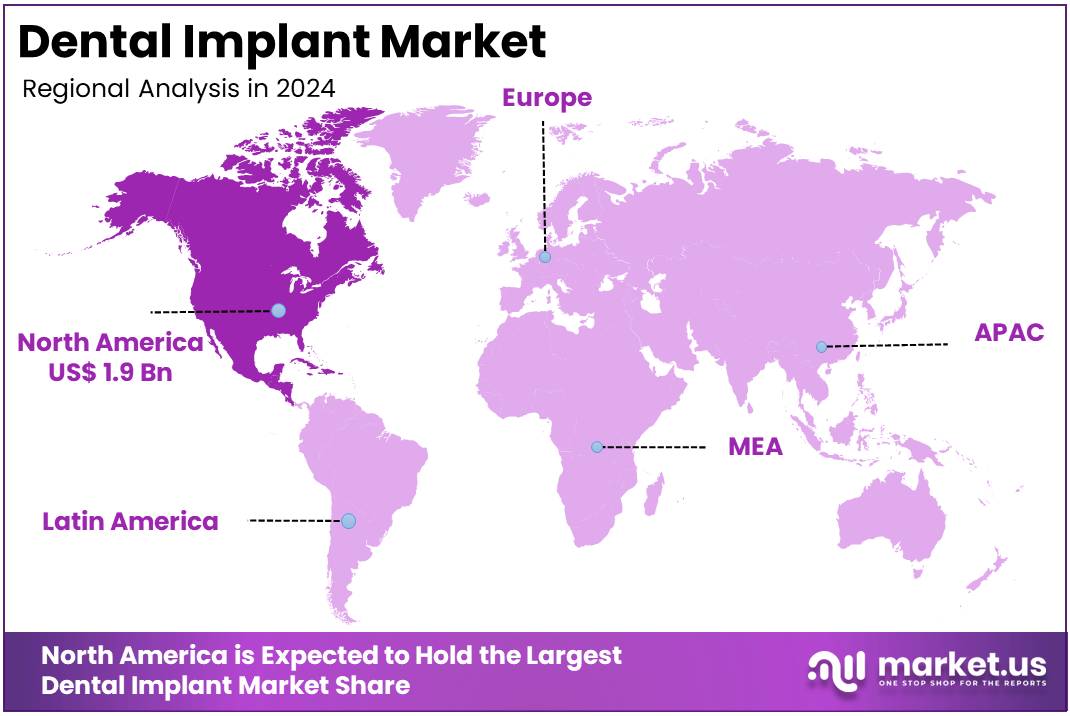

The Dental Implant Market size is expected to be worth around US$ 9.4 billion by 2034 from US$ 4.8 billion in 2024, growing at a CAGR of 6.9% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.9% share and holds US$ 1.9 Billion market value for the year.

Increasing tooth loss due to dental caries, periodontal disease, and trauma is a significant driver for the dental implant market. Globally, oral diseases affect nearly 3.5 billion people, and untreated dental caries in permanent teeth is the most common health condition, according to the World Health Organization (WHO). This widespread problem has led to a growing demand for durable and aesthetic tooth replacement solutions.

Dental implants, which serve as artificial tooth roots, provide a permanent and reliable alternative to traditional dentures and bridges, offering improved functionality, aesthetics, and patient confidence. Their primary applications include single-tooth replacement, multiple-tooth restoration, and full-mouth rehabilitation.

Growing opportunities are emerging from advancements in digital dentistry and material sciences, which are making dental implant procedures more precise and accessible. Technologies such as computer-aided design and manufacturing (CAD/CAM), along with 3D printing, are streamlining treatment planning and the fabrication of custom-fit implants. This has led to a major trend toward biomimetic bone graft substitutes, which are designed to mimic the natural composition and structure of bone.

The January 2023 partnership between Nobel Biocare and Mimetis Biomaterials S.L. to launch creos syntogain, a new biomimetic bone graft substitute, underscores this trend. These innovations are not only enhancing the success rates of implant procedures but also expanding the eligible patient pool by addressing issues like insufficient bone density.

The market is also witnessing a strong trend toward expanding its global presence and adopting minimally invasive techniques. Companies are focusing on international expansion to tap into emerging markets, as exemplified by T-Plus’s launch of its ST implant system in China in May 2023, following an eight-year registration process with the National Medical Products Administration (NMPA).

Concurrently, there is a push for less invasive surgical methods, which reduce patient discomfort and recovery time. Research has shown that minimally invasive techniques can reduce postoperative discomfort by up to 60% compared to traditional methods, further increasing the appeal of dental implants to a wider range of patients seeking efficient and comfortable dental restoration.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.8 billion, with a CAGR of 6.9%, and is expected to reach US$ 9.4 billion by the year 2034.

- The product type segment is divided into endosteal implants, transosteal implants, and subperiosteal implants, with endosteal implants taking the lead in 2023 with a market share of 58.5%.

- Considering material, the market is divided into titanium, zirconium, and others. Among these, titanium held a significant share of 67.4%.

- Furthermore, concerning the design segment, the market is segregated into tapered implants and parallel walled implants. The tapered implants sector stands out as the dominant player, holding the largest revenue share of 52.8% in the market.

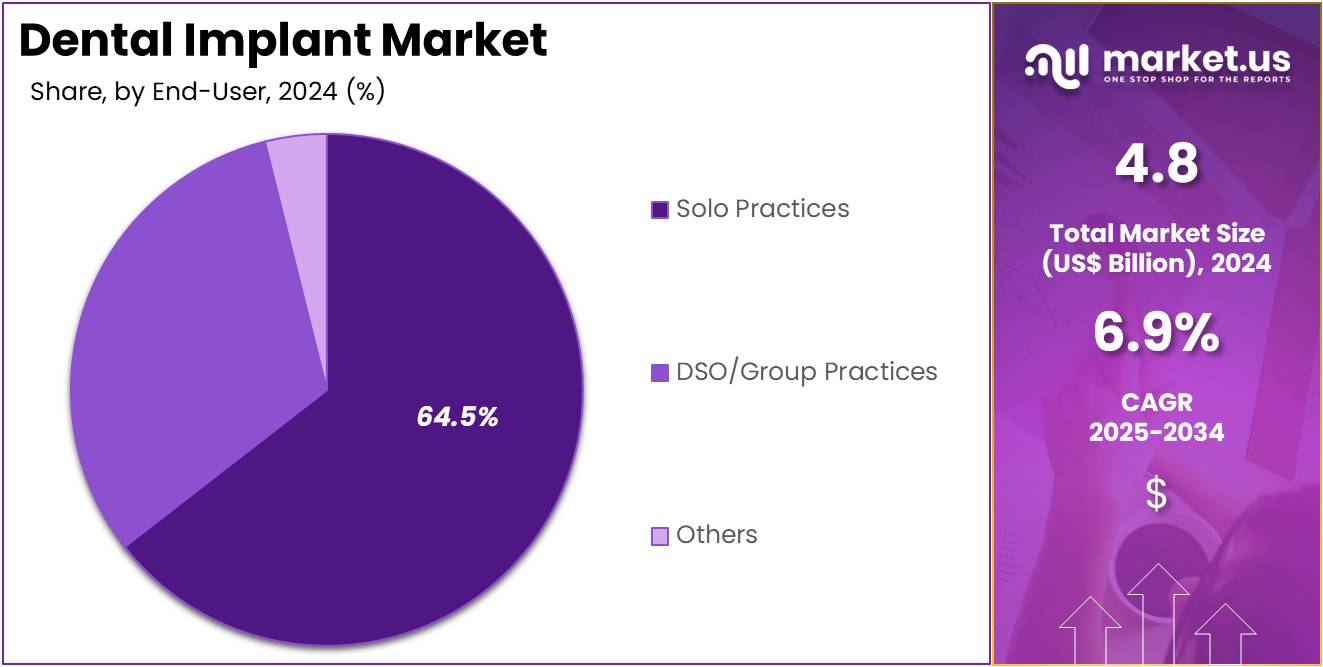

- The end-user segment is segregated into solo practices, DSO/group practices, and others, with the solo practices segment leading the market, holding a revenue share of 64.5%.

- North America led the market by securing a market share of 38.9% in 2023.

Product Type Analysis

In 2024, the Endosteal implants held a dominant market position in the Product Type Segment of Dental Implant Market, and captured more than a 58.5% share. These implants, which are placed directly into the jawbone, are expected to maintain their dominance in the dental implant market due to their high success rates and durability.

Endosteal implants are typically made of titanium, which is known for its biocompatibility and strength. As dental procedures become increasingly advanced and the demand for permanent, high-quality solutions for missing teeth rises, endosteal implants are anticipated to grow.

The development of more precise surgical techniques, as well as improvements in implant surface technology, is expected to enhance the performance and longevity of endosteal implants, further driving their growth. As patients increasingly opt for dental implants over traditional dentures, endosteal implants are projected to remain the preferred choice for many dental professionals.

Material Analysis

In 2024, the Titanium held a dominant market position in the Material Segment of Dental Implant Market, and captured more than a 67.4% share. The growth of titanium in the dental implant market is primarily driven by its superior strength, durability, and biocompatibility.

Titanium implants bond well with the bone, offering a more permanent solution for patients seeking dental restoration. With the increasing preference for permanent and more natural-looking teeth replacement solutions, titanium implants are expected to continue dominating the market.

The material’s resistance to corrosion and the body’s ability to integrate it seamlessly make titanium ideal for use in dental implants. Advances in surface treatment technologies for titanium implants are likely to further boost their growth, making them more appealing to both dentists and patients. Additionally, the rise in dental tourism and the expanding global dental implant market will continue to propel the demand for titanium dental implants.

Design Analysis

In 2024, the Tapered implants held a dominant market position in the Design Segment of Dental Implant Market, and captured more than a 52.8% share. These implants are designed with a conical shape that allows them to adapt more easily to the natural contours of the bone.

Tapered implants are expected to continue their growth due to their ability to provide a secure fit, particularly in cases where bone quality or volume may be compromised. Their unique design makes them suitable for a wide range of clinical situations, including areas with limited bone structure, which is expected to drive their demand.

The increasing prevalence of tooth loss and the growing number of patients opting for implants instead of dentures will contribute to the rise in tapered implant adoption. Moreover, the advancements in surgical techniques and implant designs are expected to improve the overall success rates of tapered implants, further boosting their popularity in the market.

End-User Analysis

In 2024, the Solo practices held a dominant market position in the End-User Segment of Dental Implant Market, and captured more than a 64.5% share. The increasing number of small dental practices and independent practitioners opting for dental implants over traditional solutions is expected to drive this segment’s growth. Solo practices are likely to adopt the latest dental technologies, including implants, to offer a more permanent solution for patients.

The ability of solo practices to provide personalized care and cater to the growing demand for cosmetic dentistry is anticipated to foster the market growth. As dental implant procedures become more affordable and accessible, more patients are expected to seek services from independent dental offices rather than large dental chains. This trend is expected to contribute to the strong growth of the solo practice segment in the dental implant market. Additionally, the increasing awareness about the benefits of dental implants will likely encourage more solo practices to adopt advanced implant technologies.

Key Market Segments

By Product Type

- Endosteal Implants

- Transosteal Implants

- Subperiosteal Implants

By Material

- Titanium

- Zirconium

- Others

By Design

- Tapered Implants

- Parallel Walled Implants

By End-user

- Solo Practices

- DSO/ Group Practices

- Others

Drivers

The rising prevalence of tooth loss and dental disorders is driving the market

The increasing global prevalence of tooth loss and various dental disorders is a primary driver for the dental implant market. As populations age, the incidence of conditions that lead to tooth loss, such as dental caries and periodontal disease, also rises.

Dental implants are widely recognized as the most effective and durable solution for replacing missing teeth, offering a significant improvement in function, aesthetics, and quality of life compared to traditional dentures and bridges. The World Health Organization (WHO) estimated in 2023 that untreated dental caries in permanent teeth is the most common health condition globally.

Furthermore, the global prevalence of complete tooth loss is estimated to be 7% among people aged 20 or older, with this figure rising sharply to 23% for individuals aged 60 or older. This demographic trend, combined with a growing awareness of the benefits of dental implants, fuels a consistent demand for restorative dental procedures. The high number of individuals affected by these conditions ensures a steady patient pool for dental implant procedures, supporting market growth.

Restraints

The high cost and limited insurance coverage are restraining the market

The high cost of dental implant procedures is a significant restraint on market growth, particularly in regions where dental care is not covered by universal healthcare or private insurance plans. The total cost of a single dental implant can be substantial, often ranging from US$3,000 to US$4,800 in the US. This price typically includes the implant itself, the abutment, the crown, and the surgical procedure.

Unlike many medical procedures, dental implants are often considered cosmetic or elective, leading to limited or no coverage from standard dental insurance policies. This places a significant financial burden on patients, many of whom may opt for less expensive and less effective alternatives like bridges or dentures.

The financial barrier is a major reason why many individuals with missing teeth do not seek treatment, despite the long-term benefits of implants. The financial risk of the procedure is also a concern for patients, with the average dental implant failure rate in the US being 6% in 2024. This high cost, coupled with the lack of comprehensive reimbursement, serves as a persistent barrier to wider market adoption.

Opportunities

The growth of dental tourism is creating growth opportunities

The emergence and growth of dental tourism present a significant opportunity for the dental implant market. Dental tourism involves patients traveling to another country to receive dental care, often for procedures that are expensive in their home country.

Countries like Mexico, Costa Rica, and Thailand have become popular destinations due to the availability of high-quality dental care at a fraction of the cost. A dental implant that costs thousands of dollars in a country with a high cost of living may be available for less than a thousand dollars in a dental tourism destination.

According to a 2024 analysis, a single dental implant can cost up to US$ 2,500 in the US, while a similar procedure costs around US$ 900 in countries like Thailand. This cost-saving incentive, combined with the convenience of combining dental work with a vacation, is attracting a growing number of patients. This trend is particularly beneficial for those who do not have adequate insurance coverage for dental implants, thereby expanding the potential patient base beyond domestic borders and creating a new revenue stream for dental providers in these popular destinations.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the restorative dental device market, pushing industry leaders to navigate economic pressures while seeking long-term growth. Rising global inflation is tightening healthcare budgets, forcing clinics to delay the purchase of advanced titanium fixtures for full-mouth rehabilitations.

Economic slowdowns in major regions like North America and Europe limit funding for digital planning tools that improve prosthetic precision. Trade tensions between the U.S. and China, along with supply chain disruptions from Pacific typhoons, are driving up the cost of raw materials needed for biocompatible alloys used in these devices.

Manufacturers are also facing stricter biosecurity regulations amid geopolitical conflicts, delaying certifications for next-generation osseointegrated systems. These challenges are further exacerbated by weaknesses in global logistics, potentially slowing adoption in emerging markets. The rising prevalence of periodontal diseases, affecting over 50% of adults aged 30 and older, according to WHO estimates, increases the demand for reliable restorative solutions. To mitigate these pressures, companies are diversifying suppliers into Southeast Asia and building stronger inventories, helping maintain market resilience and improve clinical outcomes.

U.S. tariffs are reshaping the restorative dental device market by increasing import costs while encouraging domestic innovation and supply chain security. The reciprocal tariff adjustments in September 2025-raising the effective average rate to 17.4%, with some components from China facing tariffs as high as 54%-will increase the cost of precision-machined abutments and surgical kits, reducing profitability for importers such as Straumann. As a result, dental practices are postponing inventory restocking, which contributes to equipment shortages and delays in elective procedures amid patient backlogs.

Retaliatory tariffs from the EU and Mexico further disrupt deliveries of ceramic crowns, widening service disparities for underserved populations. To offset these tariffs, procurement managers are shifting funds from research and development in bioengineered coatings to tariff mitigation, straining hybrid analog-digital workflows. These policies also increase risks in fragmented international networks for sterilization-compatible instruments.

However, tariffs are also stimulating domestic manufacturing, allowing companies to benefit from federal incentives under the BioSecure framework and creating specialized manufacturing jobs. Collaborations with U.S. alloy producers are helping streamline cost-effective, compliant architectures that protect intellectual property. By securing exemptions for critical biomaterials, the sector is turning fiscal challenges into opportunities for self-sufficiency, driving progress in accessible restorative technologies.

Latest Trends

Increased adoption of digital dentistry workflows is a recent trend

A prominent trend in the dental implant market is the increasing adoption of digital dentistry workflows, which are revolutionizing the way implants are planned, placed, and restored. This trend involves the use of advanced technologies such as intraoral scanners, Cone Beam Computed Tomography (CBCT), and Computer-Aided Design and Manufacturing (CAD/CAM). These tools enable a more precise and efficient process, from creating a 3D digital model of the patient’s mouth to designing and milling a custom-fit crown.

The American College of Prosthodontists estimated in January 2024 that nearly 2.3 million implant-supported crowns are produced in the US every year, many of which now utilize these advanced digital techniques. This digital shift not only improves the accuracy and success rate of implant procedures but also significantly reduces the overall treatment time for patients, in some cases allowing for same-day restorations. Furthermore, the use of computer-guided implant placement software minimizes the risk of surgical complications, offering both patients and clinicians greater confidence in the procedure.

Regional Analysis

North America is leading the Dental Implant Market

In 2024, North America held a dominant market position, capturing more than a 38.9% share and holds US$ 1.9 Billion market value for the year. The North America experiencing steady expansion driven by an aging population and increasing awareness of prosthetic solutions for edentulism, which affects millions of adults annually. Dentists increasingly adopted advanced titanium and zirconia implants for their biocompatibility and longevity, enabling minimally invasive placements that reduce recovery times and postoperative complications in outpatient settings.

Regulatory approvals from the FDA for innovative bioactive coatings accelerated market penetration, allowing practitioners to offer customized solutions for patients with compromised bone density. Collaborative research between academic institutions and manufacturers refined digital planning software, enhancing precision in guided surgeries and minimizing revision rates. Rising insurance coverage for restorative procedures under Medicare and private plans incentivized elective treatments, particularly among seniors seeking functional restoration for improved nutrition and speech.

Economic analyses demonstrated favorable return on investment for clinics investing in high-volume implant workflows, attracting venture capital to streamline supply chains. Post-pandemic hygiene protocols further boosted demand, as patients prioritized durable, infection-resistant options over traditional bridges. These factors collectively fortified the region’s leadership in restorative dentistry advancements. According to an investigative report by KFF Health News, more than 3.7 million dental implants were sold in the United States in 2022, reflecting robust procedural volume.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific dental implant sector to expand robustly during the forecast period, as governments address pervasive oral health disparities through subsidized restorative programs in rapidly urbanizing economies. National health authorities in China and India direct funding toward public hospitals, equipping facilities with modern fixtures to accommodate surging caseloads from dietary shifts and tobacco use. Pharmaceutical and device firms collaborate with local innovators to develop affordable, corrosion-resistant variants, anticipating broader adoption in tier-two cities where access remains limited.

Innovation centers in Singapore and Japan pioneer bioengineered surfaces for faster osseointegration, positioning specialists to serve expatriate and tourist demographics efficiently. Regional alliances promote training initiatives for general practitioners, empowering them to perform basic placements and alleviate specialist shortages in rural provinces.

China’s National Health Commission capped dental implantation costs at 6,000 to 9,000 yuan in public hospitals in 2022, enhancing affordability and projected procedure volumes. India’s Ministry of Health and Family Welfare expanded the National Oral Health Programme in 2023, targeting 300 million beneficiaries for preventive and restorative services including implants. Japan’s Ministry of Health, Labour and Welfare allocated ¥50 billion in 2024 to oral rehabilitation technologies, fostering domestic production and equitable distribution.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the dental restoration sector advance growth by introducing innovative titanium and zirconia-based fixtures that enhance osseointegration and reduce treatment times for clinicians. They pursue acquisitions of niche innovators to integrate advanced CAD/CAM technologies, expanding their portfolios for broader procedural compatibility. Companies establish collaborations with dental service organizations and material suppliers to co-develop customized kits, facilitating quicker market entry and regulatory approvals.

Executives direct substantial R&D investments toward digital workflows and AI-assisted planning tools, optimizing precision in esthetic outcomes. They target emerging economies in Asia-Pacific and Latin America, localizing production to comply with regional standards and lower costs. Additionally, they offer bundled training and subscription-based support to deepen practitioner adoption and secure recurring revenue.

Straumann Group, founded in 1954 and headquartered in Basel, Switzerland, leads the global market in implant and regenerative dentistry through precision-engineered solutions. The company develops titanium and ceramic fixtures, along with biomaterials and digital prosthetics, to support esthetic tooth replacement for professionals worldwide.

Straumann commits extensive resources to R&D, pioneering surfaces like SLActive for faster healing and Roxolid for strength in smaller implants. CEO Guillaume Daniellot guides a team across 100 countries, emphasizing innovation and partnerships with the International Team for Implantology. The firm integrates end-to-end workflows, from guided surgery to CAD/CAM restorations, enhancing efficiency for clinics. Straumann sustains its premium positioning by delivering evidence-based tools that prioritize patient confidence and long-term success.

Top Key Players in the Dental Implant Market

- Zimmer Biomet Holdings, Inc

- OSSTEM IMPLANT

- Nobel Biocare Services AG

- Leader Italy

- KYOCERA Medical Corp

- Institut Straumann AG

- DENTSPLY Sirona

- DENTIS

- Bicon, LLC

- Anthogyr SAS

Recent Developments

- In October 2024: Dentsply Sirona and the McGuire Institute (iMc) launched the PrimeTaper EV Implant Registry, an initiative aimed at evaluating the real-world performance of its implants. With over 300 clinicians contributing data on nearly 2,000 implants, the registry reported an impressive 99% survival rate, emphasizing the implant’s reliability and effectiveness in clinical applications.

- In May 2023: Straumann strengthened its position in the dental care market by acquiring GalvoSurge, a Swiss firm specializing in dental implant solutions. This acquisition, which includes the CE-marked GalvoSurge Dental Implant Cleaning System GS 1000, enhances Straumann’s offering in peri-implantitis treatment and broadens its portfolio in dental implant maintenance.

Report Scope

Report Features Description Market Value (2024) US$ 4.8 billion Forecast Revenue (2034) US$ 9.4 billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Endosteal Implants, Transosteal Implants, and Subperiosteal Implants), By Material (Titanium, Zirconium, and Others), By Design (Tapered Implants, and Parallel Walled Implants), By End-user (Solo Practices, DSO/Group Practices, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zimmer Biomet Holdings, Inc, OSSTEM IMPLANT, Nobel Biocare Services AG, Leader Italy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zimmer Biomet Holdings, Inc

- OSSTEM IMPLANT

- Nobel Biocare Services AG

- Leader Italy

- KYOCERA Medical Corp

- Institut Straumann AG

- DENTSPLY Sirona

- DENTIS

- Bicon, LLC

- Anthogyr SAS