Global Dehydrated Vegetable Market Size, Share, Report Analysis By Product Type (Carrot, Onions, Potatoes, Broccoli, Beans, Peas, Cabbage, Mushrooms, Tomatoes, Others), By Form (Powder and Granules, Minced and Chopped, Flakes, Slice and Cubes, Others), By Drying Method (Air Drying, Spray Drying, Freeze Drying, Drum Drying, Vacuum Drying), By End Use (Food Manufacturers, Foodservice, Retail), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Food and Drink Specialty Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156424

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

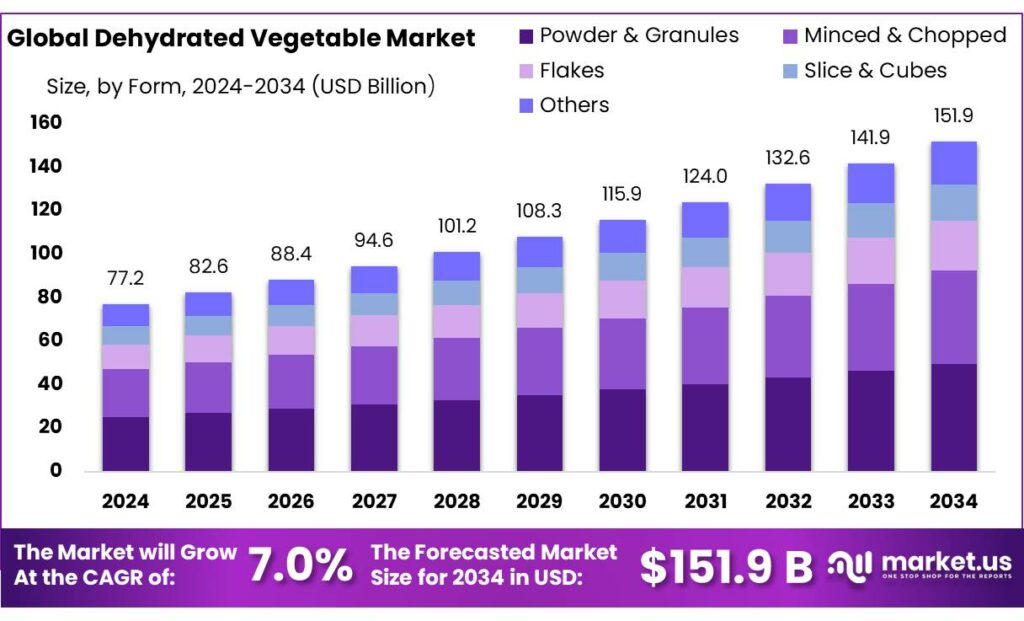

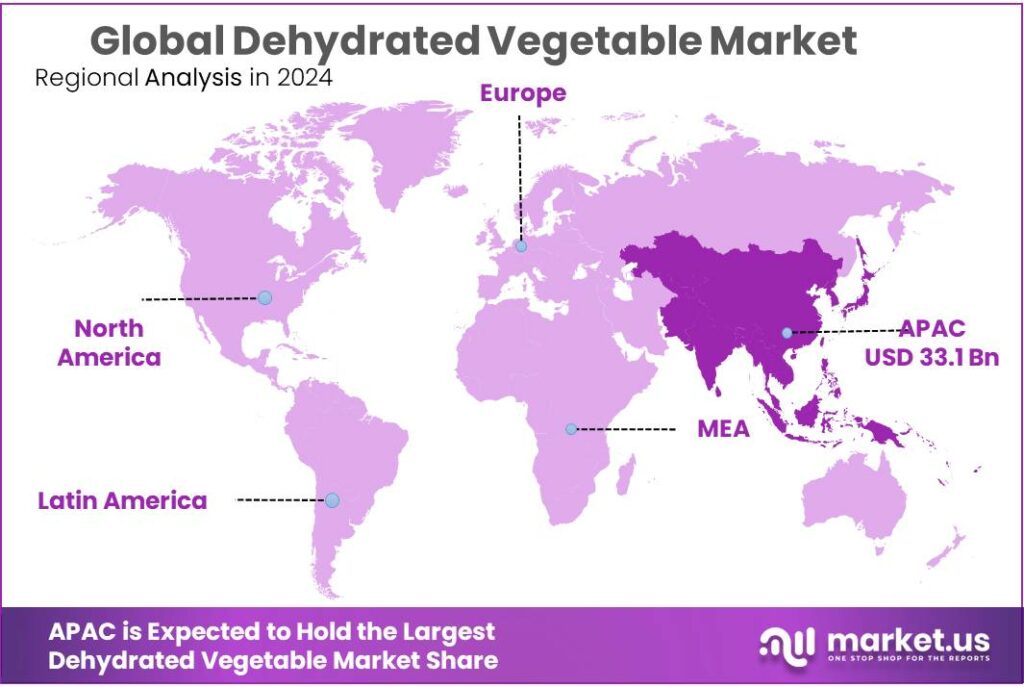

The Global Dehydrated Vegetable Market size is expected to be worth around USD 151.9 Billion by 2034, from USD 77.2 Billion in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 42.90% share, holding USD 33.1 Billion revenue.

The dehydrated vegetable industry in India has emerged as a significant segment within the broader food processing sector, driven by advancements in preservation technologies and a surge in consumer demand for convenient, shelf-stable, and health-conscious food options.

India, being the second-largest producer of vegetables globally, faces challenges related to the perishable nature of its produce. Dehydration offers a viable solution by extending shelf life and reducing transportation costs. Commonly dehydrated vegetables include onions, garlic, tomatoes, carrots, okra, green peas, and spinach.

These products find applications in ready-to-eat meals, soups, snacks, and seasoning blends. India stands as the world’s second-largest producer of vegetables, yet only about 2.2% of its produce undergoes processing, compared to 30% in Brazil and 70% in the USA. This disparity underscores the immense potential for growth in the dehydrated vegetable market.

On the government front, India’s Prime Minister Dhan‑Dhaanya Krishi Yojana, launched in July 2025, allocates ₹24,000 crore annually over six years (2025–26 onward) to enhance crop yields, storage, irrigation, and diversification—benefitting raw material availability for dehydration industries.

Meanwhile, the National Centre for Cold‑chain Development (NCCD) has been instrumental in reducing post‑harvest losses—increasing cold chain penetration and supporting perishable storage and preprocessing logistics; currently only 15% of fruits and vegetables access cold storage, and under 5% are precooled or cold‑chain transported, showing substantial scope for enhancement.

Key Takeaways

- Dehydrated Vegetable Market size is expected to be worth around USD 151.9 Billion by 2034, from USD 77.2 Billion in 2024, growing at a CAGR of 7.0%.

- Onions held a dominant market position, capturing more than a 21.2% share in the Dehydrated Vegetable Market.

- Powder & Granules held a dominant market position, capturing more than a 32.6% share in the Dehydrated Vegetable Market.

- Air Drying held a dominant market position, capturing more than a 38.4% share in the Dehydrated Vegetable Market.

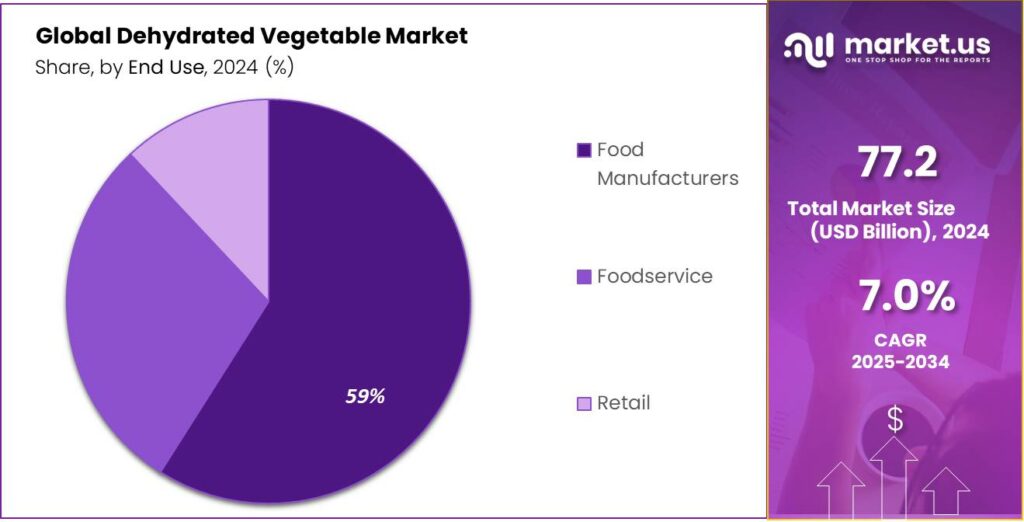

- Food Manufacturers held a dominant market position, capturing more than a 59.7% share in the Dehydrated Vegetable Market.

- Asia-Pacific (APAC) emerged as the dominant region in the Dehydrated Vegetable Market, capturing 42.90% of the global share with a market value of USD 33.1 billion.

By Product Type Analysis

Onions Dominate with 21.2% Share in 2024

In 2024, Onions held a dominant market position, capturing more than a 21.2% share in the Dehydrated Vegetable Market. The strong preference for dehydrated onions comes from their versatile use across food processing, ready-to-eat meals, soups, and spice blends. Consumers and food producers alike rely on them for their long shelf life, consistent flavor, and cost-effectiveness compared to fresh onions. With busy lifestyles increasing the demand for convenience foods, dehydrated onions continue to be an essential ingredient across multiple cuisines.

By 2025, the demand for dehydrated onions is expected to remain robust, supported by the growing global consumption of packaged and instant food products. Their role in reducing waste while offering reliable year-round availability also adds to their market strength. Foodservice chains and household buyers prefer dehydrated onion products like flakes, powders, and granules for easy storage and quick use, reinforcing their high share. This balance of practicality and taste ensures that the onion segment remains the backbone of the dehydrated vegetable market, maintaining its leadership position into the next year.

By Form Analysis

Powder & Granules Lead with 32.6% Share in 2024

In 2024, Powder & Granules held a dominant market position, capturing more than a 32.6% share in the Dehydrated Vegetable Market. Their popularity stems from their versatility and ease of use across multiple industries, especially in instant soups, snacks, seasonings, bakery items, and ready-to-cook meals. Food manufacturers favor this form because it blends smoothly into recipes, offers consistent flavor, and reduces preparation time. For consumers, powders and granules provide both convenience and longer shelf stability compared to fresh produce.

By 2025, the segment is expected to retain its strong lead as demand for packaged and processed foods continues to rise worldwide. With the growing trend toward healthier snacking and the expansion of quick-service restaurants, dehydrated vegetable powders and granules will remain in high demand. Their role in ensuring uniformity of taste, easy storage, and cost efficiency reinforces their widespread adoption across the food processing sector. Overall, the powder and granules form is set to continue driving growth in the dehydrated vegetable market, cementing its leadership in both 2024 and the coming years.

By Drying Method Analysis

Air Drying Dominates with 38.4% Share in 2024

In 2024, Air Drying held a dominant market position, capturing more than a 38.4% share in the Dehydrated Vegetable Market. This method is widely chosen because it preserves the natural taste and texture of vegetables while being cost-effective and scalable for large production. Air-dried vegetables are commonly used in soups, sauces, ready-to-eat meals, and snack formulations, where maintaining flavor integrity is essential. Producers and food processors rely on this technique as it balances efficiency, affordability, and quality.

By 2025, air drying is expected to continue leading the market, supported by the rising global demand for convenient, long-lasting food ingredients. With the food processing industry expanding rapidly, manufacturers prefer air drying for its ability to handle bulk volumes without compromising on shelf stability. Additionally, increasing consumer preference for natural, minimally processed ingredients further strengthens the position of air drying as the most reliable method. As a result, the air drying segment will remain a cornerstone in dehydrated vegetable production, sustaining its leadership role across diverse applications into the next year.

By End Use Analysis

Food Manufacturers Lead with 59.7% Share in 2024

In 2024, Food Manufacturers held a dominant market position, capturing more than a 59.7% share in the Dehydrated Vegetable Market. This dominance reflects the heavy reliance of large-scale food processors on dehydrated vegetables to create soups, sauces, ready meals, instant noodles, and packaged snacks. The ability of dehydrated vegetables to retain flavor, extend shelf life, and reduce storage costs makes them a preferred ingredient for manufacturers aiming for efficiency and consistency in mass production.

By 2025, the demand from food manufacturers is expected to remain strong as the global appetite for convenience foods continues to rise. With changing lifestyles, urbanization, and increased consumption of packaged meals, manufacturers will keep integrating dehydrated vegetables into product lines to balance quality with cost-effectiveness. The wide availability of forms such as flakes, powders, and granules also gives manufacturers flexibility in applications. Overall, the food manufacturers’ segment will remain the backbone of the dehydrated vegetable market, ensuring sustained demand and industry growth into the future.

By Distribution Channel Analysis

Hypermarkets & Supermarkets Dominate with 39.3% Share in 2024

In 2024, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 39.3% share in the Dehydrated Vegetable Market. These retail formats remain the most preferred channel because they offer a wide range of products under one roof, giving consumers easy access to multiple varieties of dehydrated vegetables in different forms such as flakes, powders, and granules. The trust factor of established retail chains, combined with attractive packaging and in-store promotions, has further fueled higher consumer footfall in this segment.

By 2025, hypermarkets and supermarkets are expected to retain their lead as urbanization and busy lifestyles continue to drive reliance on modern retail outlets. Their ability to provide bulk purchase options, consistent product availability, and premium branded varieties ensures they maintain an edge over smaller stores. Additionally, the rising demand for convenient meal solutions encourages retailers to expand their shelf space for dehydrated vegetables. Overall, the hypermarkets and supermarkets segment is set to remain the leading distribution channel, sustaining its influence in shaping consumer buying behavior well into the future.

Key Market Segments

By Product Type

- Carrot

- Onions

- Potatoes

- Broccoli

- Beans

- Peas

- Cabbage

- Mushrooms

- Tomatoes

- Others

By Form

- Powder & Granules

- Minced & Chopped

- Flakes

- Slice & Cubes

- Others

By Drying Method

- Air Drying

- Spray Drying

- Freeze Drying

- Drum Drying

- Vacuum Drying

By End Use

- Food Manufacturers

- Foodservice

- Retail

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Food and Drink Specialty Stores

- Online

- Others

Emerging Trends

Clean Label and Nutritional Transparency in Dehydrated Vegetables

According to the Food Safety and Standards Authority of India (FSSAI), there has been a marked increase in consumer awareness regarding food ingredients and sourcing practices. This awareness has led to a demand for dehydrated vegetables that retain their natural flavors and nutrients without the use of synthetic additives. The FSSAI’s guidelines on food labeling and safety standards have been instrumental in promoting this shift towards cleaner, more transparent food products.

In response to this demand, the Ministry of Food Processing Industries (MoFPI) has initiated several programs aimed at enhancing the quality and safety of food products, including dehydrated vegetables. The Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) Scheme, for instance, provides financial and technical support to small and medium enterprises in the food processing sector.

Furthermore, the National Centre for Cold-chain Development (NCCD) plays a crucial role in improving the infrastructure for the storage and transportation of perishable food items, including vegetables. By enhancing cold chain logistics, the NCCD helps in reducing post-harvest losses and maintaining the quality of vegetables, which is essential for producing high-quality dehydrated products that meet clean label standards.

Drivers

Increasing Health Consciousness and Demand for Convenience

One of the primary drivers propelling the growth of the dehydrated vegetable industry in India is the escalating health consciousness among consumers, coupled with a rising demand for convenient food options. As urban lifestyles become more fast-paced, individuals are increasingly seeking nutritious, ready-to-eat, and shelf-stable food products that align with their health goals and time constraints.

According to the Food Safety and Standards Authority of India (FSSAI), approximately 68% of urban consumers are actively seeking healthier food options, reflecting a significant shift towards health-conscious eating habits. This trend is further supported by the Indian Council of Medical Research, which emphasizes the importance of incorporating a balanced diet rich in fruits and vegetables for maintaining overall health. Dehydrated vegetables offer a practical solution by retaining essential nutrients while providing the convenience of long shelf life and easy storage.

The government’s initiatives also play a crucial role in fostering this growth. The Ministry of Food Processing Industries (MoFPI) has implemented schemes like the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME), which provide financial and technical support to small and medium enterprises in the food processing sector. Such programs encourage the adoption of modern processing techniques, including dehydration, thereby enhancing the availability and quality of dehydrated vegetable products in the market.

Restraints

Supply Chain and Infrastructure Challenges in Dehydrated Vegetable Industry

One of the significant challenges hindering the growth of India’s dehydrated vegetable industry is the underdeveloped supply chain and infrastructure. Despite the country’s status as a leading producer of vegetables, inefficiencies in the supply chain result in substantial post-harvest losses, affecting the availability and quality of raw materials essential for dehydration processes. Studies indicate that inadequate infrastructure, including insufficient cold storage and transportation facilities, contributes to these losses, leading to a mismatch between production and processing capabilities.

The lack of a robust cold chain infrastructure exacerbates the situation, as vegetables are highly perishable and require timely processing to maintain their quality. Without proper storage and transportation facilities, the shelf life of vegetables diminishes, making them unsuitable for dehydration. This not only affects the supply of raw materials but also increases the cost of procurement for processors, thereby impacting the overall economics of the industry.

Recognizing these challenges, the Government of India has initiated several programs to strengthen the supply chain and infrastructure. The National Centre for Cold-chain Development (NCCD) was established to promote the development of cold chain infrastructure across the country. NCCD focuses on creating a seamless cold chain for perishable agricultural produce, which is crucial for the dehydrated vegetable industry. The government’s efforts aim to reduce post-harvest losses and ensure a steady supply of quality raw materials for processing.

Additionally, the Ministry of Food Processing Industries (MoFPI) has launched the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) Scheme, which provides financial, technical, and business support for the upgradation of existing micro food processing enterprises. This scheme encourages the adoption of modern processing technologies, including dehydration, and aims to enhance the competitiveness of small-scale processors.

Opportunity

Export Potential of Dehydrated Vegetables from India

India’s dehydrated vegetable industry is poised for significant growth, driven by the country’s vast agricultural base and increasing global demand for processed food products. In the fiscal year 2023-24, India exported fresh vegetables worth approximately USD 828 million and processed vegetables amounting to USD 1.73 billion, highlighting the substantial export potential of the sector.

The government’s initiatives play a pivotal role in enhancing this export potential. The Pradhan Mantri Kisan SAMPADA Yojana (PMKSY) aims to create modern infrastructure with efficient supply chain management from farm to retail outlet. As of February 28, 2025, the Ministry of Food Processing Industries (MoFPI) has sanctioned 1,608 projects under various components of PMKSY, including Mega Food Parks, Cold Chain projects, and Agro-processing Clusters. These initiatives are designed to reduce wastage, increase processing levels, and enhance exports of processed foods.

Furthermore, the Production Linked Incentive Scheme for Food Processing Industry (PLISFPI), with an outlay of ₹10,900 crore, incentivizes the manufacturing of processed fruits and vegetables. As of February 28, 2025, 171 food processing companies have been approved for assistance under various categories of the PLISFPI scheme, with incentives amounting to ₹1,155.296 crore disbursed.

Regional Insights

Asia-Pacific Leads with 42.90% Share Worth USD 33.1 Billion in 2024

In 2024, Asia-Pacific (APAC) emerged as the dominant region in the Dehydrated Vegetable Market, capturing 42.90% of the global share with a market value of USD 33.1 billion. The region’s leadership stems from its large-scale agricultural base, strong consumption of convenience foods, and the rapid expansion of the food processing industry. Countries such as China, India, and Japan are at the forefront, driven by growing urban populations and rising disposable incomes that encourage demand for packaged and ready-to-eat food products. Dehydrated onions, garlic, and leafy vegetables are particularly popular due to their use in instant noodles, sauces, snacks, and traditional cuisines.

North America, while not the largest region, continues to demonstrate steady growth fueled by health-conscious consumers and the rising adoption of plant-based, shelf-stable ingredients in packaged meals. Europe also contributes significantly, supported by regulatory encouragement for natural food ingredients and strong consumer demand for sustainable sourcing. However, APAC clearly outpaces these regions by combining strong supply-side advantages with surging domestic consumption.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Olam International, a Singapore-based agribusiness giant, plays a leading role in the dehydrated vegetable market through its global supply chains. The company focuses on onions, garlic, and blended vegetable solutions, catering to foodservice and packaged food manufacturers worldwide. In 2024, Olam’s scale and integrated sourcing networks gave it a strong advantage, ensuring quality, safety, and traceability. Its sustainability initiatives and investment in value-added processing reinforce its market position as a trusted supplier to global customers.

Germany-based Symrise AG is well-known for flavors, nutrition, and natural ingredients, with dehydrated vegetables forming a key part of its broad portfolio. In 2024, the company expanded its dehydrated onion and garlic offerings, targeting the growing clean-label and convenience food markets. With operations spanning over 100 countries, Symrise leverages its strong R&D capabilities to blend dehydrated vegetables into seasonings, snacks, and ready meals. Its focus on innovation and sustainable sourcing positions it as a reliable partner in global food solutions.

BC Foods, Inc., headquartered in the U.S., specializes in producing and supplying dehydrated vegetables, herbs, and spices, with onion, garlic, and chili leading its portfolio. In 2024, the company emphasized quality assurance through vertically integrated farming and global processing facilities. Serving clients across North America, Europe, and Asia, BC Foods offers customized ingredient solutions for food manufacturers. Its ability to balance cost efficiency with consistent quality strengthens its competitive edge in meeting rising demand for processed food ingredients.

Top Key Players Outlook

- Olam International

- Symrise AG

- BC Foods, Inc.

- Natural Dehydrated Vegetables Pvt. Ltd

- Real Dehydrated Pvt Ltd

- Green Rootz

- Silva International, Inc

- Van Drunen Farms

- Rosun Groups

- Mevive International Food Ingredients

Recent Industry Developments

In 2024, Natural Dehydrated Vegetables Pvt. Ltd., an Indian company based in Bhavnagar, Gujarat, stands out for its strong focus on processing dehydrated onion and garlic products, with a production capacity exceeding 5,500 MT per year and cold storage of 2,500 MT.

In 2024, Olam Group—the parent of Olam International—generated S$56.2 billion in revenue (about US$41.8 billion) and recorded EBIT rising 9.2% year-on-year, with the Ingredients & Solutions segment (within ofi) delivering a striking 41.8% increase in EBIT—showing how such specialized ingredient lines, which may include hydrolyzed animal protein components, are becoming growth engines.

Report Scope

Report Features Description Market Value (2024) USD 77.2 Bn Forecast Revenue (2034) USD 151.9 Bn CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Carrot, Onions, Potatoes, Broccoli, Beans, Peas, Cabbage, Mushrooms, Tomatoes, Others), By Form (Powder and Granules, Minced and Chopped, Flakes, Slice and Cubes, Others), By Drying Method (Air Drying, Spray Drying, Freeze Drying, Drum Drying, Vacuum Drying), By End Use (Food Manufacturers, Foodservice, Retail), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Food and Drink Specialty Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Olam International, Symrise AG, BC Foods, Inc., Natural Dehydrated Vegetables Pvt. Ltd, Real Dehydrated Pvt Ltd, Green Rootz, Silva International, Inc, Van Drunen Farms, Rosun Groups, Mevive International Food Ingredients Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dehydrated Vegetable MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Dehydrated Vegetable MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Olam International

- Symrise AG

- BC Foods, Inc.

- Natural Dehydrated Vegetables Pvt. Ltd

- Real Dehydrated Pvt Ltd

- Green Rootz

- Silva International, Inc

- Van Drunen Farms

- Rosun Groups

- Mevive International Food Ingredients