Global Data Center Infrastructure Management Market Size, Share, Statistics Analysis Report By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Small and Medium Sized Enterprises, Large Enterprises), By Application (Asset Management, Power Monitoring, BI and Analytics, Capacity Management, Environmental Monitoring, Other Applications), By End-Use Industry (IT and Telecommunications, BFSI, Retail, Manufacturing, Healthcare, Government, Other End-Use Industries), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135278

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Component

- By Deployment Mode

- By Enterprise Size

- By Application

- By End-Use Industry

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

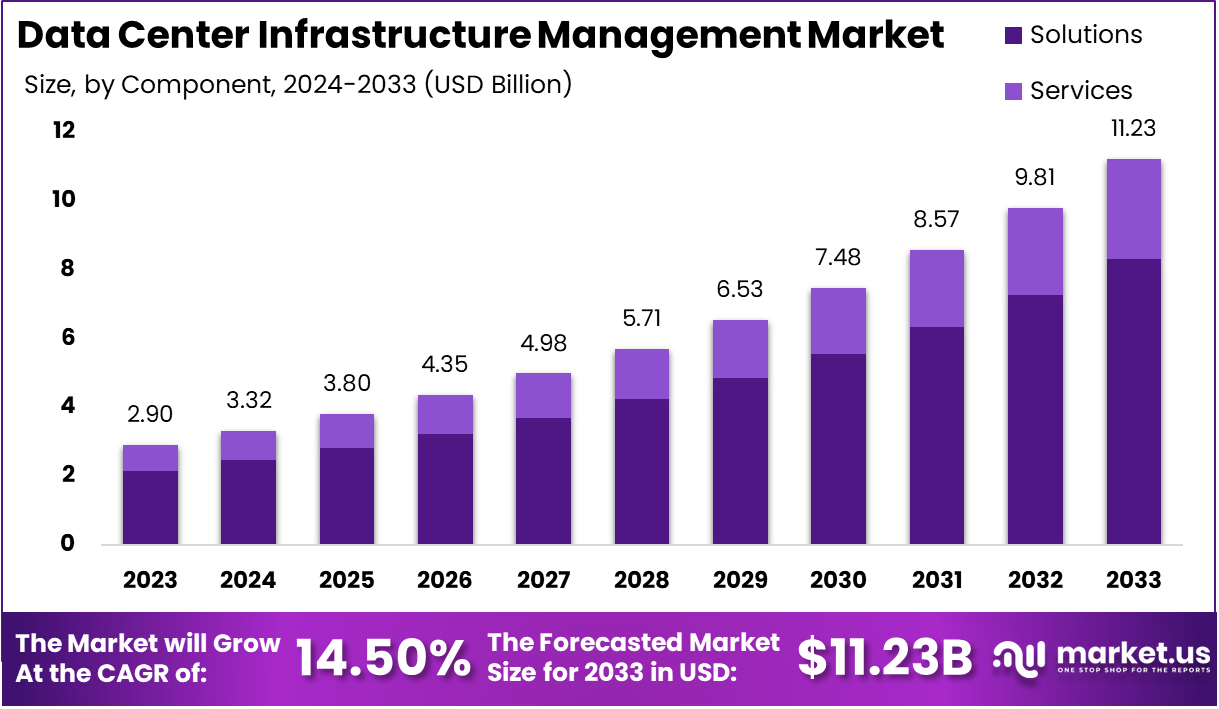

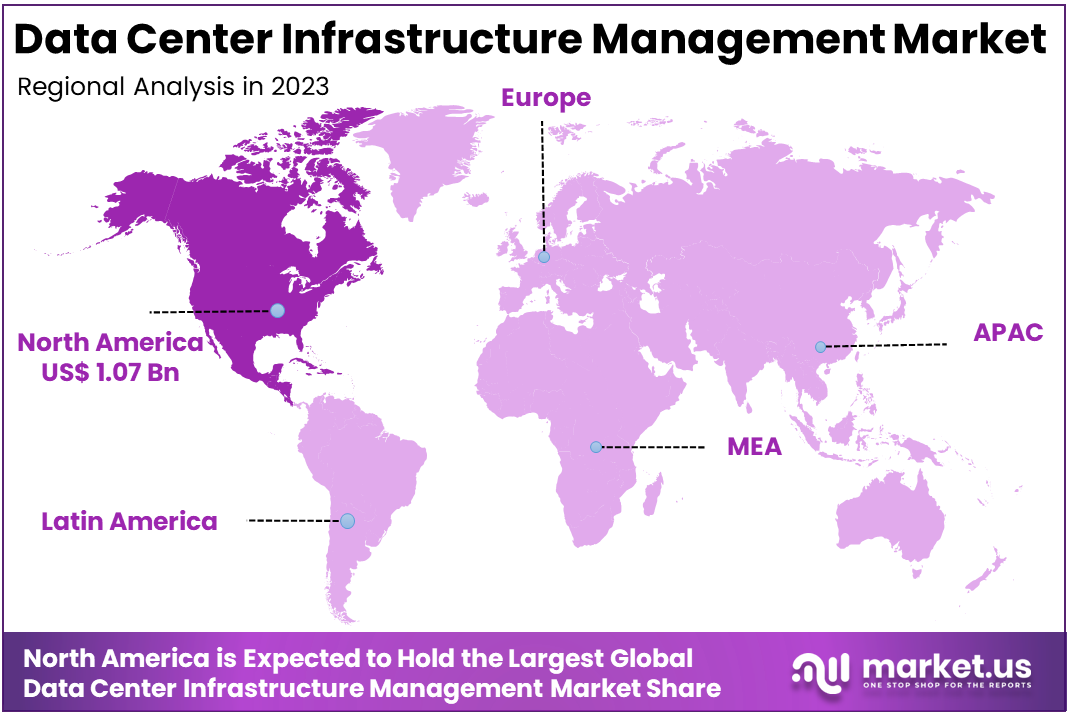

The Global Data Center Infrastructure Management Market is expected to be worth around USD 11.23 Billion By 2033, up from USD 2.9 billion in 2023, growing at a CAGR of 14.50% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 37.2% share and holding USD 1.07 billion in revenue.

Data Center Infrastructure Management (DCIM) refers to the integrated software and hardware solutions used to monitor, manage, and optimize the performance of data centers. It helps organizations ensure the efficient use of resources, improve energy consumption, enhance uptime, and provide real-time visibility into data center operations.

DCIM platforms combine functionalities like asset management, environmental monitoring, energy management, power distribution, and capacity planning into one unified solution. These tools allow data center operators to maintain operational efficiency, reduce costs, and prevent system failures.

With the rise in cloud computing, big data, and Internet of Things (IoT) technologies, DCIM has become a crucial component in modern data centers, enabling businesses to meet increasing demands for scalability, security, and energy efficiency.

The Data Center Infrastructure Management market is expanding rapidly as organizations continue to increase their data center operations to support the growing demand for digital services, cloud computing, and big data analytics.

The market is driven by the need to optimize energy consumption, improve operational efficiency, and ensure high uptime for critical systems. As businesses expand their IT infrastructure to manage vast amounts of data, the demand for DCIM solutions to provide real-time insights and proactive management has surged.

Several factors are driving the growth of the DCIM market. First, the exponential rise in data generation across industries is increasing the complexity of data center operations, making DCIM solutions essential for maintaining efficiency and minimizing downtime.

The shift towards cloud computing, as well as the increasing adoption of IoT and edge computing technologies, has also contributed to the demand for advanced DCIM solutions.

Furthermore, sustainability and energy efficiency regulations are pushing businesses to adopt DCIM tools to optimize power consumption and reduce operational costs. As organizations strive to reduce their carbon footprint, DCIM helps identify areas of inefficiency and enables better management of power distribution and cooling systems.

The demand for DCIM is primarily driven by the increasing complexity of data centers and the need to manage vast amounts of infrastructure, both physical and virtual. The integration of data center operations, including physical asset management, energy monitoring, and predictive maintenance, is becoming critical to ensuring high performance and uptime.

The growing trend of hyper-scale data centers and the adoption of cloud services presents new opportunities for DCIM vendors. Additionally, the rise of edge computing is opening up new market opportunities, as it requires a distributed approach to IT infrastructure management. Companies that can offer integrated and scalable DCIM solutions are well-positioned to capture a significant share of the market.

Technological advancements are playing a key role in the evolution of DCIM. The incorporation of artificial intelligence (AI) and machine learning (ML) algorithms into DCIM platforms is enabling predictive maintenance, helping operators anticipate issues before they arise.

This reduces the likelihood of unplanned downtime and extends the lifespan of data center equipment. Additionally, advancements in sensor technology, data analytics, and automation are helping operators gain deeper insights into the operational performance of their facilities.

These technologies also help optimize energy usage, enabling data centers to operate more sustainably. Furthermore, the integration of cloud-based DCIM solutions is becoming increasingly popular, as it allows for remote monitoring and management of data center operations from anywhere in the world.

In terms of user data, it is estimated that around 70% of organizations currently utilize some form of DCIM solution, with larger enterprises being more likely to adopt these systems due to their complex infrastructure needs.

The enterprise data center segment is particularly noteworthy, accounting for over 32% of the market share in 2024. This segment’s dominance highlights the critical role DCIM plays in managing large-scale data storage and processing requirements. Additionally, user engagement with DCIM tools has increased significantly, with surveys indicating that about 60% of users report improved operational efficiency after implementing DCIM solutions.

North America holds a substantial portion of the market, with over 40% share attributed to its extensive data center infrastructure. Furthermore, user satisfaction rates for DCIM solutions are high, with approximately 75% of users expressing satisfaction with their ability to monitor and manage resources effectively.

Key Takeaways

- Market Value: The global DCIM market was valued at USD 2.9 Billion in 2023 and is projected to reach USD 11.23 Billion by 2033, growing at a CAGR of 14.50%.

- Market Dominance by Solution: The Solution segment accounts for 74.1% of the market share, highlighting the high demand for comprehensive DCIM solutions that combine multiple functionalities such as asset management, energy management, and performance monitoring.

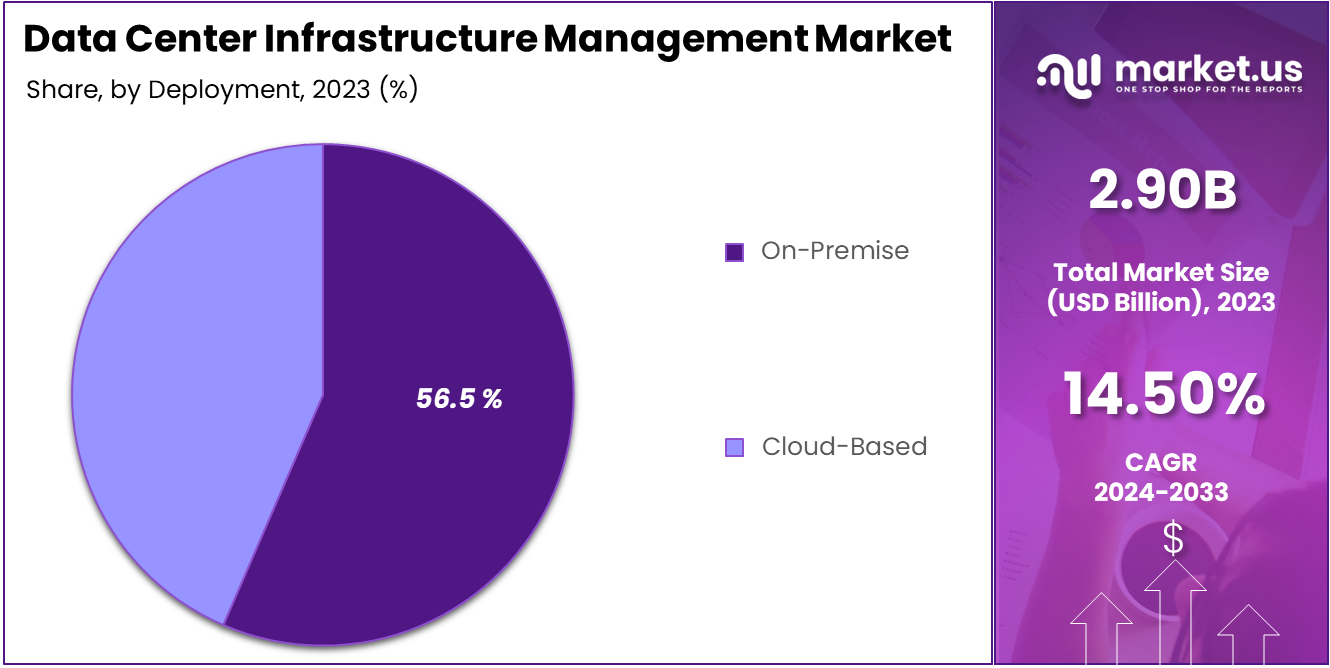

- Deployment Mode: On-premise deployment leads the market with 56.5% share, as many large enterprises prefer to keep their data center management solutions within their infrastructure for security and control.

- Enterprise Size: Large Enterprises dominate the market, holding a 65.9% share, as these organizations typically require advanced DCIM solutions to manage extensive data centers and ensure optimal resource allocation across multiple facilities.

- Application Focus: Asset Management stands out as the leading application in the DCIM market, capturing 34.8% of the market, underscoring the need for businesses to track and manage their physical and virtual assets in real time to ensure seamless data center operations.

- End-Use Industry: The IT and Telecommunications industry represents the largest end-user segment with a 30.5% share, reflecting the sector’s reliance on DCIM solutions to maintain the performance, energy efficiency, and scalability of data centers.

- Regional Insights: North America leads the DCIM market with a 37.2% share, driven by the presence of major data center operators, technology companies, and high adoption rates of cloud services in the region.

By Component

In 2023, the Solution segment held a dominant market position, capturing more than 74.1% of the Data Center Infrastructure Management (DCIM) market share. The primary reason for this dominance is the increasing demand for integrated, all-in-one solutions that provide a comprehensive approach to managing data center operations.

These solutions encompass a variety of functions, such as real-time monitoring, energy management, asset tracking, and optimization of resource usage, which are essential for improving operational efficiency and reducing costs.

Solutions in the DCIM market allow businesses to manage their physical and virtual infrastructure, monitor power consumption, and ensure the reliability of systems in a centralized manner. This helps organizations streamline operations and maintain uptime, which is crucial for businesses that rely heavily on their data centers for critical functions.

The integration of various management tools in a single solution has made it an attractive option for large enterprises looking for comprehensive control over their data center operations. Furthermore, the growing adoption of automation and artificial intelligence (AI) in DCIM solutions is driving demand for advanced solutions that can help businesses predict and prevent potential system failures, optimize resource utilization, and manage large, complex infrastructures.

As data centers become more advanced and essential for business operations, the need for robust, scalable, and integrated solutions continues to increase. This trend is expected to persist, with the solution segment maintaining its leadership in the coming years.

By Deployment Mode

In 2023, the On-Premise segment held a dominant market position in the Data Center Infrastructure Management (DCIM) market, capturing more than 56.5% of the market share. This dominance can be attributed to the increasing preference of large enterprises for control, security, and customization, which on-premise solutions offer.

Many organizations, particularly those in regulated industries such as finance, healthcare, and government, prefer to keep their data and management tools within their infrastructure to ensure compliance with strict data privacy regulations and to mitigate security concerns.

On-premise solutions provide businesses with greater autonomy over their data and IT operations. These solutions enable companies to integrate DCIM tools directly into their existing infrastructure, which is especially beneficial for enterprises with complex, multi-facility operations.

The ability to customize and tailor the solutions according to specific business needs and security protocols makes on-premise solutions more attractive to organizations with specialized requirements or those that need to maintain tight control over their data center operations. Additionally, on-premise solutions often allow for better data throughput and lower latency compared to cloud-based solutions, which is critical for businesses that need real-time access to their data.

Many large enterprises also prefer on-premise deployment for managing sensitive data, given the perceived security risks associated with cloud environments. This preference has contributed to the steady growth of on-premise solutions in the DCIM market, despite the growing interest in cloud-based alternatives.

By Enterprise Size

In 2023, the Large Enterprises segment held a dominant market position in the Data Center Infrastructure Management (DCIM) market, capturing more than 65.9% of the market share. The significant share of large enterprises can be attributed to their vast IT infrastructure needs and the complexity of managing large-scale data centers.

These organizations often operate multiple data centers and have the resources to invest in sophisticated DCIM solutions to ensure optimal management, efficiency, and performance across their facilities. Large enterprises are typically early adopters of advanced technologies and solutions like DCIM, driven by the need for real-time monitoring, predictive maintenance, and enhanced energy efficiency in their large and complex infrastructure.

With a high volume of critical operations running simultaneously, they require robust systems to manage data center capacity, power usage, cooling, and network performance. Additionally, these organizations often have dedicated IT teams capable of managing the technical demands of on-premise DCIM solutions, making them more likely to deploy and benefit from these solutions.

Another key factor driving the dominance of large enterprises in the DCIM market is their need for comprehensive and scalable solutions. These enterprises often operate in multiple regions and have a diverse range of applications and data workloads that need to be managed across various facilities. DCIM solutions provide them with the visibility and control needed to maintain smooth operations, optimize resource utilization, and minimize downtime.

By Application

In 2023, the Asset Management segment held a dominant market position in the Data Center Infrastructure Management (DCIM) market, capturing more than 34.8% of the total share. This leadership can be attributed to the growing need among data center operators to effectively track, manage, and optimize physical assets, such as servers, storage devices, and networking equipment.

Asset management solutions allow organizations to maintain real-time visibility of their equipment, improving operational efficiency and ensuring that assets are utilized optimally. The growing complexity of data centers, with a wide array of hardware and systems to manage, has made asset management a critical function.

With businesses increasingly adopting virtualization and cloud-based infrastructures, the importance of tracking both physical and virtual assets has surged. DCIM solutions that provide detailed insights into asset usage, lifecycle, and location help organizations prevent downtime, extend the life of their hardware, and enhance their overall IT asset management strategy.

Furthermore, these solutions also support regulatory compliance and improve the ability to forecast future capital expenditures. As data centers expand and diversify, particularly with the rise of hyperscale and colocation data centers, asset management becomes an indispensable tool.

Managing a growing number of assets across multiple locations demands a comprehensive and centralized solution. By implementing effective asset management practices, organizations can minimize risks associated with underutilized or misplaced assets, leading to better resource allocation and cost savings.

By End-Use Industry

In 2023, the IT and Telecommunications segment held a dominant market position in the Data Center Infrastructure Management (DCIM) market, capturing more than 30.5% of the total market share. The primary reason for this dominance lies in the rapid growth and expansion of data centers driven by the increasing demand for data storage, cloud computing, and internet services.

The IT and telecommunications sector heavily relies on sophisticated data centers to handle enormous volumes of data, and as the Internet of Things (IoT), 5G networks, and big data analytics continue to evolve, the demand for optimized infrastructure management solutions has soared.

Data centers in the IT and telecommunications sector are integral to supporting both enterprise-level and consumer-level operations. As the number of connected devices increases, data centers must manage vast amounts of data and ensure uptime and performance, which directly impacts their clients and customers.

Efficient asset management, power monitoring, and environmental controls are critical for maintaining service reliability. DCIM solutions enable these data centers to streamline operations, reduce operational costs, and improve energy efficiency, which are key considerations for telecom companies and IT service providers alike.

Moreover, the IT and telecommunications industry’s focus on innovation and scalability makes it a leading adopter of DCIM technologies. As cloud computing and edge data centers become more prominent, companies are investing heavily in infrastructure that can scale quickly while maintaining robust performance and security. DCIM solutions help meet these needs by providing real-time data on asset utilization, ensuring that data centers can efficiently manage their resources and optimize operations at scale.

Key Market Segments

By Component

- Solution

- Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Enterprise Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Application

- Asset Management

- Power Monitoring

- BI and Analytics

- Capacity Management

- Environmental Monitoring

- Other Applications

By End-Use Industry

- IT and Telecommunications

- BFSI

- Retail

- Manufacturing

- Healthcare

- Government

- Other End-Use Industries

Driving Factors

Increasing Demand for Data Center Efficiency

The growing reliance on data across industries is driving the demand for Data Center Infrastructure Management (DCIM) solutions. As businesses, governments, and consumers continue to produce vast amounts of data, data centers are under pressure to handle this volume effectively while maintaining high levels of performance and energy efficiency.

DCIM solutions help manage complex infrastructures by monitoring, controlling, and optimizing key aspects of data center operations such as power consumption, cooling, space utilization, and security. The need for better operational efficiency is a significant growth driver for the DCIM market.

Businesses are increasingly seeking to reduce operational costs and energy consumption, and DCIM plays a key role in achieving these objectives. By providing real-time insights into equipment health and environmental conditions, DCIM solutions allow for predictive maintenance, which helps prevent costly breakdowns and downtime.

For example, data centers can optimize air conditioning systems, improve power distribution, and maximize the usage of available space. These efficiencies are crucial as data centers continue to scale to meet increasing demand for cloud storage, IoT networks, and AI applications.

Moreover, regulatory pressures are pushing data centers to adopt DCIM technologies. Governments around the world are introducing sustainability regulations, requiring companies to reduce their carbon footprint.

DCIM solutions help businesses meet these regulatory requirements by providing detailed analytics that support sustainability goals. This trend is especially significant in regions like North America and Europe, where environmental standards are stricter.

Restraining Factors

High Initial Investment Costs

Despite the evident benefits, the high initial investment required to implement Data Center Infrastructure Management (DCIM) solutions remains a significant restraint for many organizations. While these solutions offer long-term operational savings and efficiencies, the upfront cost of hardware, software, and training can be a deterrent, especially for small- and medium-sized enterprises (SMEs).

In particular, many companies struggle with justifying the capital expenditures required to set up advanced DCIM solutions, especially when the return on investment (ROI) is not immediately apparent. Additionally, the complexity of integrating DCIM systems with existing infrastructure can be a significant challenge.

Most data centers already have legacy systems in place, and adding DCIM solutions requires compatibility and customization efforts. The integration process may require significant upgrades to current hardware and network systems, which can be both costly and time-consuming. For organizations operating with tight budgets, this is often a significant barrier to adoption.

Cost sensitivity is another factor in the restraint of DCIM adoption. In emerging markets, where budgets for technology upgrades are smaller, businesses may be hesitant to invest in advanced data management systems. Even large enterprises, that have the financial resources to deploy DCIM, often prioritize other IT initiatives that provide more immediate returns, such as cybersecurity enhancements or cloud migration.

Growth Opportunities

Expansion of Edge Computing

One of the most significant opportunities in the Data Center Infrastructure Management (DCIM) market is the rapid expansion of edge computing. Edge computing is a distributed computing framework that processes data closer to the source, reducing latency and bandwidth usage.

As the Internet of Things (IoT), 5G technology, and artificial intelligence (AI) continue to grow, the demand for edge computing infrastructure is set to explode. This presents an exciting opportunity for DCIM providers, as edge data centers require robust infrastructure management tools to ensure optimal performance and uptime.

Edge data centers are typically smaller than traditional centralized data centers, and they operate in diverse and often challenging environments. Effective monitoring and optimization of resources are crucial in ensuring that edge data centers run smoothly.

DCIM systems can provide these capabilities by enabling real-time monitoring of power usage, environmental conditions, and network performance at remote locations. Additionally, edge data centers often handle sensitive data, and security is a critical consideration.

DCIM can help ensure that all data centers, including edge locations, comply with data privacy regulations and maintain a high level of security. With the growing trend towards decentralized computing and real-time data processing, businesses are increasingly looking for solutions that provide agility, scalability, and cost efficiency.

DCIM systems offer the ability to optimize operations at both large-scale data centers and small-edge installations. As edge computing continues to gain traction, the DCIM market is poised to capitalize on this opportunity by developing more specialized solutions that cater to edge data center environments.

Challenging Factors

Data Security and Compliance Issues

As data centers become more complex and the volume of data continues to rise, data security and compliance issues have become a growing challenge for organizations implementing Data Center Infrastructure Management (DCIM) solutions. DCIM systems manage critical infrastructure and store vast amounts of sensitive operational data, making them an attractive target for cyberattacks.

Moreover, data centers are often subject to stringent regulations and compliance standards related to data privacy, such as GDPR in Europe, HIPAA in the U.S., and other local data protection laws. Ensuring that DCIM systems are secure, compliant, and able to manage the necessary safeguards is a constant challenge.

Many businesses struggle to keep up with the fast-paced evolution of cybersecurity threats. As data center infrastructures become more interconnected, vulnerabilities increase, making it critical for DCIM solutions to implement robust security measures such as encryption, multi-factor authentication, and real-time threat detection. The implementation of these security measures requires continuous updates and monitoring to stay ahead of emerging threats.

Compliance issues further complicate this challenge. With data centers being subject to various regulatory frameworks, any failure to meet compliance standards can result in severe financial penalties, reputational damage, and legal consequences.

DCIM systems need to integrate compliance tracking and reporting functionalities to ensure that data centers are adhering to regulatory requirements. Additionally, companies must also balance the security of their operations with the need for accessibility and efficiency, which can sometimes be at odds with stringent compliance standards.

Growth Factors

The data center industry continues to expand due to the increasing demand for cloud services, data storage, and high-speed computing. The rise of digital transformation across industries, such as IT, healthcare, and BFSI, is significantly boosting the demand for efficient data center management systems.

As companies scale their operations, they require robust solutions to monitor and optimize data center environments, leading to the growth of Data Center Infrastructure Management (DCIM) solutions. These solutions help organizations ensure maximum uptime, reduce operational costs, and enhance the overall efficiency of their data centers.

The need for energy efficiency and sustainability is another major growth driver. With energy costs rising and growing environmental concerns, organizations are turning to DCIM systems to manage their energy usage more effectively. These systems provide valuable insights into power consumption and help businesses implement green initiatives, such as optimizing cooling systems and reducing carbon footprints.

Emerging Trends

One of the most notable emerging trends is the integration of artificial intelligence (AI) and machine learning (ML) in data center management. AI-driven DCIM solutions are revolutionizing the way data centers are operated by automating routine tasks, predicting potential failures, and offering intelligent recommendations for optimizing performance.

This technology is helping businesses improve their operational efficiency, reduce costs, and enhance their ability to scale quickly. Another trend is the cloud-based DCIM solutions that allow businesses to remotely monitor and manage data center operations.

With businesses increasingly adopting hybrid cloud environments, the ability to access data center management tools from anywhere has become essential for operations. Cloud-based solutions also offer scalability, flexibility, and cost-efficiency, which are crucial for modern data center management.

Business Benefits

By implementing DCIM solutions, businesses can achieve operational excellence, enhanced predictive maintenance, and cost savings. Real-time monitoring of infrastructure components allows businesses to identify potential issues before they escalate, reducing costly downtime.

Additionally, DCIM systems enable capacity planning and resource optimization, ensuring that data centers run at optimal performance levels. Moreover, businesses benefit from the scalability of these solutions, allowing them to easily adapt as their infrastructure needs grow.

In conclusion, as demand for faster, more reliable, and efficient data services rises, DCIM will continue to play a crucial role in optimizing data center operations and achieving business objectives.

Regional Analysis

In 2023, North America held a dominant market position in the Data Center Infrastructure Management (DCIM) market, capturing more than 37.2% of the total share, amounting to USD 1.07 billion in revenue. The region’s leadership can be attributed to its advanced IT infrastructure, the presence of global data center giants, and strong demand for cloud-based services.

With numerous tech-driven industries headquartered in North America, including the United States and Canada, the demand for efficient and scalable data center management solutions is soaring. The growth in cloud computing and the rising use of big data technologies have further pushed the demand for data center efficiency.

North America also leads in terms of technology adoption, with companies in this region rapidly deploying AI-driven and IoT-integrated DCIM solutions. These innovations allow businesses to enhance operational efficiency, reduce energy consumption, and minimize downtime, which are key benefits in a competitive market.

The proliferation of hyperscale data centers in North America is another major factor driving the market. With large enterprises and cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud having significant operations in the region, the demand for sophisticated data center management solutions continues to grow. Furthermore, the region’s well-established IT regulations and emphasis on data security make it an attractive market for DCIM providers.

Strategic investments and acquisitions by key players in the North American market are also contributing to its dominance. With continuous advancements in automation and sustainability practices, North America is expected to maintain a strong growth trajectory, further solidifying its leadership position in the global DCIM market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

ABB Group has been a significant player in the Data Center Infrastructure Management (DCIM) market, particularly through its commitment to sustainable and energy-efficient data center solutions. In recent years, ABB has enhanced its portfolio with key acquisitions, such as the acquisition of GE Industrial Solutions, which has strengthened its position in power management and automation within data centers.

Their “Ability” digital platform, introduced in 2021, integrates IoT technology to optimize energy usage and reduce operational costs in data centers. ABB’s innovations in AI-based monitoring systems and predictive maintenance have enabled businesses to minimize downtime and maximize operational efficiency.

Siemens AG is another major player in the DCIM space, known for its advanced technology solutions aimed at improving data center management efficiency. The company has actively pursued strategic partnerships and acquisitions, including its recent acquisition of Infolink, a provider of cloud-based monitoring solutions.

This move is expected to bolster Siemens’ capabilities in providing end-to-end solutions that combine real-time monitoring, asset management, and energy efficiency optimization. Siemens’ comprehensive “Desigo CC” platform is designed to streamline operations, integrate systems, and provide insights for better decision-making.

Schneider Electric SE has been a leader in providing DCIM solutions that enhance energy efficiency and optimize the performance of data centers. Known for its commitment to sustainability, Schneider Electric has launched several initiatives to support green data centers.

A key development was their launch of EcoStruxure™ for Data Centers, a robust platform that enables organizations to digitally transform their operations through AI-powered automation, real-time monitoring, and predictive analytics. Schneider Electric also expanded its capabilities through strategic partnerships, including collaborations with major cloud service providers.

Top Key Players in the Market

- ABB Group

- Siemens AG

- Schneider Electric SE

- Eaton Corporation PLC

- Vertiv Group Corporation

- Cisco Systems, Inc.

- Dell Inc.

- Hewlett Packard Enterprise (HPE)

- Sunbird Software, Inc.

- FNT GmbH

- Other Key Players

Recent Developments

- In June 2024: Schneider Electric launched its new EcoStruxure™ IT Expert, a cloud-based platform aimed at enhancing the management of data centers. This innovation provides real-time monitoring, predictive maintenance, and energy management, improving operational efficiency and reducing downtime.

- In March 2024: Siemens AG introduced the next generation of its Digital Grid platform, expanding its offering in the data center infrastructure management space. This platform provides real-time data analytics and intelligent automation features, allowing businesses to monitor power distribution, optimize energy efficiency, and ensure uninterrupted service.

Report Scope

Report Features Description Market Value (2023) USD 2.9 Bn Forecast Revenue (2033) USD 11.23 Bn CAGR (2024-2033) 14.50% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Small and Medium Sized Enterprises, Large Enterprises), By Application (Asset Management, Power Monitoring, BI and Analytics, Capacity Management, Environmental Monitoring, Other Applications), By End-Use Industry (IT and Telecommunications, BFSI, Retail, Manufacturing, Healthcare, Government, Other End-Use Industries) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape ABB Group, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, Vertiv Group Corporation, Cisco Systems, Inc., Dell Inc., Hewlett Packard Enterprise (HPE), Sunbird Software, Inc., FNT GmbH, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Center Infrastructure Management MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Data Center Infrastructure Management MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Group

- Siemens AG

- Schneider Electric SE

- Eaton Corporation PLC

- Vertiv Group Corporation

- Cisco Systems, Inc.

- Dell Inc.

- Hewlett Packard Enterprise (HPE)

- Sunbird Software, Inc.

- FNT GmbH

- Other Key Players