Global Virtual Desktop Infrastructure Market Size, Share, Statistics Analysis Report By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Retail, Healthcare, Manufacturing, Government, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134432

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

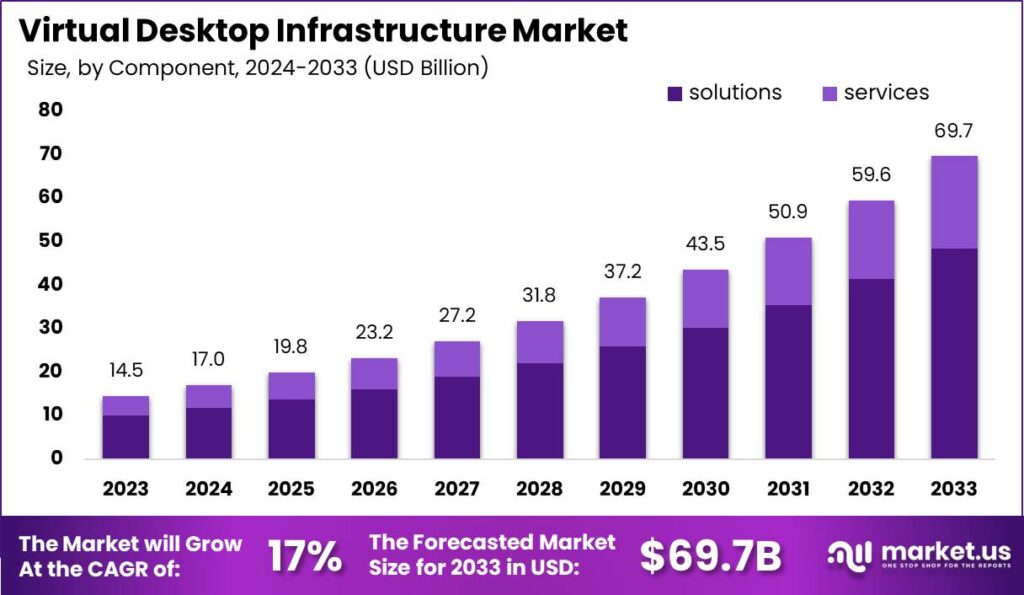

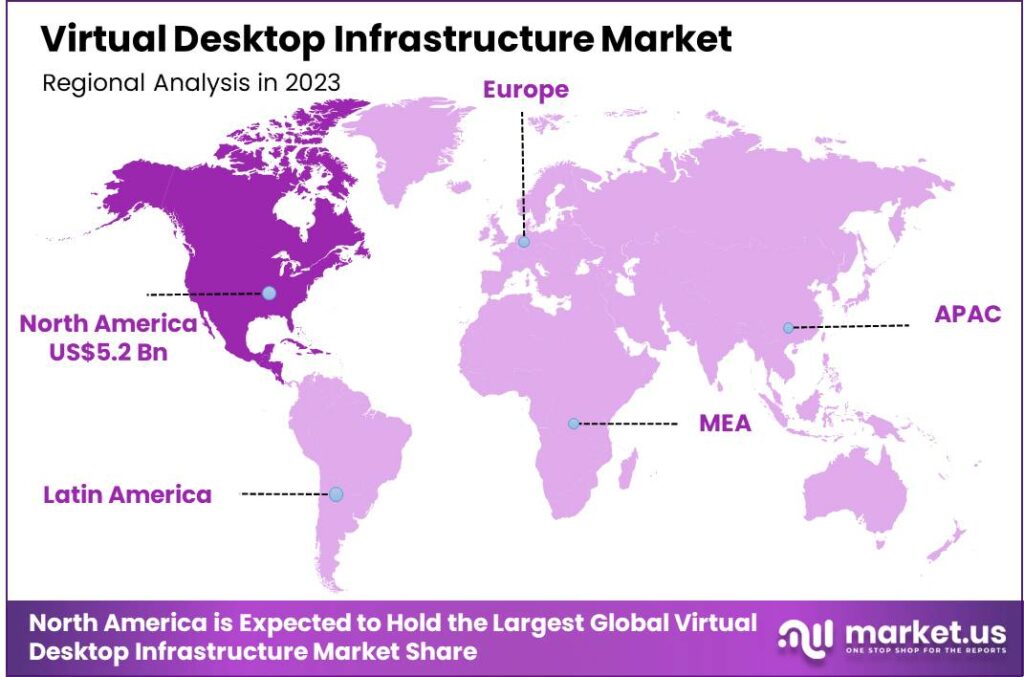

The Global Virtual Desktop Infrastructure Market size is expected to be worth around USD 69.7 Billion By 2033, from USD 14.5 Billion in 2023, growing at a CAGR of 17.00% during the forecast period from 2024 to 2033. In 2023, North America dominated the Virtual Desktop Infrastructure (VDI) market, holding over 36.1% of the market share and generating approximately USD 5.2 billion in revenue.

Virtual Desktop Infrastructure (VDI) is a technological framework that allows users to access and operate a desktop environment from a remote server. Essentially, VDI detaches the physical location of a desktop from its computational execution. This means that all the software, applications, and data typically found on a personal computer are hosted on a centralized server, managed and maintained by IT professionals.

The VDI market is experiencing significant growth, driven by the increasing need for remote work solutions and cost-effective IT management strategies. As businesses continue to adopt flexible working conditions, the demand for robust, scalable virtual desktop solutions is surging. This demand is further bolstered by continuous improvements in cloud computing technologies, which enhance the scalability and efficiency of VDI systems.

These advancements also include better security measures and more seamless user experiences, even on less powerful client devices. The integration of AI and machine learning for predictive analytics and automated issue resolution is setting new benchmarks in how VDI environments operate and are managed. Several key factors are propelling the VDI market forward.

The shift towards remote and hybrid work models has made VDI indispensable for many organizations, offering a way to maintain rigorous security and compliance standards while providing flexible access to corporate resources. VDI also reduces the need for physical hardware upgrades, as the heavy lifting is done server-side, which can significantly cut down IT costs.

Moreover, the ability to centrally manage desktop environments simplifies IT operations, including updates, security patches, and troubleshooting, further driving down operational expenses. The market for VDI is ripe with opportunities, especially in sectors like healthcare, education, and finance, where data security and regulatory compliance are paramount.

The healthcare sector, for example, can benefit from VDI by securing patient data and providing healthcare professionals with the flexibility to access medical applications and patient records securely from any location. Additionally, the educational sector is leveraging VDI to provide students and faculty with access to educational tools and resources irrespective of their physical location. This adaptability is crucial for facilitating remote learning and can also cater to the needs of remote faculty and administrative operations.

For instance, In February 2024, Cisco and NVIDIA took a significant step to support organizations by simplifying the deployment and management of secure AI infrastructure. These industry leaders have successfully rolled out data center environments tailored for a hybrid workforce. Their innovative approach focuses on enhancing user experience through AI-powered conferencing, adaptable workspaces, and robust virtual desktop infrastructure.

Technological innovations are continuously shaping the VDI market. The advent of cloud-based VDI solutions, such as Desktop-as-a-Service (DaaS), is making virtual desktops more accessible and affordable. These solutions reduce the need for organizations to invest in their own IT infrastructure by outsourcing desktop management to cloud service providers.

Based on data from llcbuddy, research by Capgemini has shown a notable trend: about 63% of organizations have seen their productivity increase by integrating virtualization technologies to support remote work flexibility. This approach not only boosts efficiency but also contributes to environmental sustainability by prolonging device lifecycles by up to 2 years. This reduces the frequency of IT purchases significantly.

For businesses that require basic Virtual Desktop Infrastructure (VDI), costs are quite manageable, starting at $60/month per user, provided there’s a minimum setup of three users. However, for sectors that demand high computing power, VDI expenses begin at $90/month per user, and this figure doesn’t include additional licensing fees. It’s important to note that VDI might not be the most economical option for smaller organizations needing fewer than 100 virtual desktops.

VDI systems are hosted on secure virtual machines (VMs), enabling users to access a variety of operating systems remotely, which enhances security and flexibility. Looking at broader market trends, spending on Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) is expected to surpass $180 billion in 2023. This indicates a strong and growing reliance on cloud services in the corporate sector.

Advances in virtualization technologies and the introduction of hyper-converged infrastructure have also enhanced the performance and scalability of VDI solutions, enabling businesses to deploy and manage virtual desktops more efficiently and at scale. Overall, the VDI market is expanding as more organizations recognize the benefits of a flexible, secure, and cost-efficient desktop delivery model. The continuous technological advancements and the shifting work paradigms are likely to keep the demand for VDI solutions strong in the coming years.

Key Takeaways

- The Global Virtual Desktop Infrastructure (VDI) Market is projected to reach USD 69.7 billion by 2033, growing from USD 14.5 billion in 2023, with a CAGR of 17.00% from 2024 to 2033.

- In 2023, the Solution segment dominated the VDI market, capturing over 69.5% of the market share.

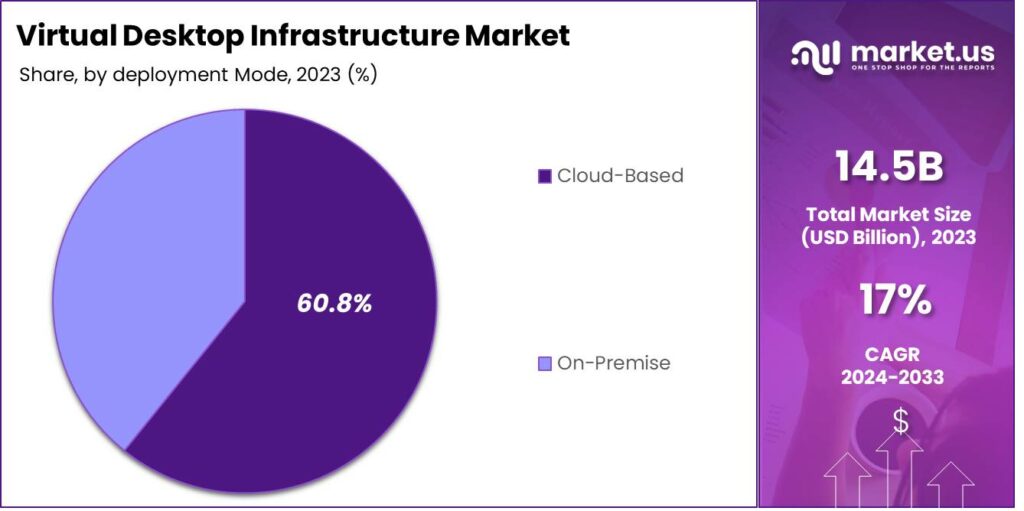

- The Cloud-Based segment held a dominant position in 2023, capturing more than 60.8% of the VDI market share.

- In 2023, Large Enterprises held a dominant market position, accounting for more than 64.0% of the VDI market share, driven by their significant resource capabilities, robust IT infrastructures, and complex operational needs.

- The IT and Telecommunications segment captured over 21.3% of the VDI market in 2023.

- North America held a dominant position in the VDI market in 2023, capturing over 36.1% of the market share, with approximately USD 5.2 billion in revenue.

Component Analysis

In 2023, the solutions segment of the Virtual Desktop Infrastructure (VDI) market held a dominant position, capturing more than 69.5% of the market share. This significant market presence can primarily be attributed to the increasing adoption of cloud-based solutions and the rising demand for enhanced security and operational efficiency in IT operations.

The shift towards digital workspaces that allow for seamless remote access and management has further fueled the growth of VDI solutions. The deployment of VDI solutions is predominantly driven by the need for organizations to enable a flexible and scalable remote working environment. This need has been amplified by the global shift towards hybrid work models, where businesses seek robust frameworks to support remote access while ensuring data security and system integrity.

VDI solutions, particularly those based on cloud deployment, offer the advantages of lower upfront costs and reduced operational expenses, which are attractive to businesses aiming to optimize their IT spend. Furthermore, technological advancements such as the integration of Artificial Intelligence (AI) and machine learning for enhancing the digital employee experience have contributed to the robustness of VDI solutions.

Companies like VMware and Amazon have been at the forefront, introducing innovations that not only streamline management processes but also enhance security protocols, making these solutions more appealing to enterprises across various sectors. Moreover, the growth trajectory of the VDI solutions segment is supported by its widespread application across diverse industries including IT and telecom, healthcare, and education, where there is a high demand for efficient, scalable, and secure access to resources and applications.

Deployment Mode Analysis

In 2023, the Cloud-Based segment of the Virtual Desktop Infrastructure (VDI) market held a dominant position, capturing more than 60.8% of the market share. This prominence is largely driven by the growing preference for scalable, cost-effective IT solutions that enhance operational agility and enable remote workforces.

Cloud-based VDI solutions offer enterprises the flexibility to scale resources up or down based on real-time needs, significantly reducing the need for large upfront capital investments in hardware and ongoing maintenance costs. The adoption of cloud-based VDI is further bolstered by its inherent advantages in terms of disaster recovery and data security.

As cyber threats become more sophisticated, cloud VDI providers continuously update their infrastructure to defend against potential breaches, offering a level of security that can be challenging for individual organizations to achieve on their own. This aspect is particularly appealing to sectors such as financial services, healthcare, and public entities, where data integrity and availability are crucial.

Moreover, the integration of advanced technologies such as AI and machine learning in cloud VDI environments has improved the user experience by optimizing resource allocation, reducing latency, and providing more personalized virtual desktop environments. Providers like Amazon Web Services and Microsoft have been pivotal in advancing these capabilities, which has led to broader market acceptance and increased deployment of cloud-based VDI solutions across various industries.

Overall, the sustained growth of the cloud-based VDI segment is expected to continue, fueled by ongoing technological advancements and the increasing global shift towards digital and remote work environments. As businesses seek more agile and secure IT solutions, cloud-based VDI stands out as a pivotal technology that meets these evolving needs.

Organization Size Analysis

In 2023, the Large Enterprises segment held a dominant position in the Virtual Desktop Infrastructure (VDI) market, capturing more than 64% of the market share. This substantial share is attributed to the extensive IT infrastructure and resources that large enterprises possess, enabling them to implement robust VDI solutions to address their complex operational needs.

The scalability and flexibility of VDI technology have become essential tools for large-scale organizations to streamline operations, ensure data security, and enhance workforce productivity in hybrid work environments. Large enterprises often manage vast amounts of sensitive data across multiple locations, necessitating a secure and centralized IT architecture.

VDI solutions provide these organizations with the ability to centralize desktop management, reducing the risks associated with endpoint vulnerabilities and ensuring compliance with stringent regulatory requirements. Industries such as banking, finance, healthcare, and IT services have particularly driven the demand for VDI, as secure and seamless access to resources is critical to their operations.

Furthermore, the financial capacity of large enterprises to invest in cutting-edge technologies has accelerated the adoption of advanced VDI solutions, including those that leverage artificial intelligence and machine learning for enhanced user experience and operational efficiency. Companies such as VMware, Citrix, and Microsoft have been pivotal in delivering enterprise-grade VDI platforms that cater to the specific needs of large organizations, including integration with existing IT ecosystems and support for diverse workloads.

The ability to support global operations and enable remote working at scale has solidified the position of large enterprises as the leading adopters of VDI solutions. As these organizations continue to prioritize digital transformation and the establishment of resilient IT frameworks, the Large Enterprises segment is expected to maintain its dominance in the VDI market over the coming years.

Industry Vertical Analysis

In 2023, the IT and Telecommunications segment held a dominant market position in the Virtual Desktop Infrastructure (VDI) market, capturing more than 21.3% of the market share. This leadership is largely due to the critical role that VDI plays in supporting the complex and data-intensive operations typical of this industry.

As IT and telecommunications companies continue to manage large-scale networks and substantial data traffic, the need for reliable, scalable, and secure IT infrastructure is paramount. VDI solutions address these requirements by providing centralized control over desktop environments, enhancing security, and reducing system downtime.

The increasing pressure on IT and telecommunications companies to ensure continuous service availability also drives the adoption of VDI. By utilizing VDI, these companies can deploy and manage their IT resources more efficiently, ensuring that systems are consistently updated and maintained without disrupting user access. This is crucial for maintaining the high service levels required in this competitive sector.

Moreover, the ongoing digital transformation initiatives within the industry, characterized by the shift towards cloud technologies and the integration of IoT devices, have further fueled the growth of the VDI market in this segment. The ability of VDI to provide remote access to a secure and robust digital workspace aligns well with the telecommuting trends and the distributed workforce model increasingly adopted by IT and telecommunications firms.

As the sector continues to evolve with advancements in technology and shifts in regulatory landscapes, the demand for sophisticated VDI solutions is expected to grow. This ensures not only operational resilience but also a strategic advantage in a rapidly changing digital environment. Thus, the IT and Telecommunications segment’s substantial market share in the VDI market is a reflection of both its current needs and its strategic positioning for future growth.

Key Market Segments

By Component

- Solution

- Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Industry Vertical

- IT and Telecommunications

- BFSI

- Retail

- Healthcare

- Manufacturing

- Government

- Other Industry Verticals

Driver

Increasing Demand for Remote Work Solutions

The growing demand for remote work has been one of the main drivers for Virtual Desktop Infrastructure (VDI) adoption. As businesses worldwide shift to flexible work models, employees need secure, accessible, and centralized access to company resources. VDI provides an ideal solution by hosting desktops and applications on centralized servers, allowing employees to access their work environments from anywhere, on any device, without compromising security.

Remote work has become a standard for many organizations due to its cost-effectiveness and ability to maintain business continuity during uncertain times like the COVID-19 pandemic. VDI allows organizations to maintain control over data security, as all sensitive data is stored in a central location, reducing the risk of data breaches or loss through remote endpoints. This driver is particularly relevant as the workforce becomes increasingly dispersed and businesses recognize the need for effective, scalable IT solutions.

Restraint

High Initial Investment and Complexity

While Virtual Desktop Infrastructure offers numerous advantages, its implementation can be costly and complex, especially for small to medium-sized enterprises (SMEs). The initial capital investment in hardware, software licenses, and infrastructure setup can be a significant barrier to entry. Additionally, maintaining a VDI environment often requires specialized IT expertise and ongoing support, further adding to costs.

Moreover, VDI setup and ongoing management can be complex. Companies must plan for network configuration, user provisioning, security policies, and performance monitoring. As a result, businesses may face delays in deployment and need more time and resources to optimize the infrastructure. These challenges make it harder for smaller companies to compete with larger enterprises who can afford more extensive VDI infrastructure.

Opportunity

Enhanced Security and Centralized Data Management

One of the key opportunities presented by VDI is the potential for enhanced security. With VDI, critical business applications and data are stored and managed centrally on a secure server, rather than on individual devices. This reduces the risk of data breaches, loss, or theft because sensitive information doesn’t reside on employees’ local machines, which are more prone to cyberattacks or theft.

Furthermore, businesses can deploy strict access controls, encryption, and multi-factor authentication for users accessing the virtual desktops. These layers of security reduce the attack surface, making VDI an attractive option for industries with strict data compliance requirements, such as finance, healthcare, and government. Additionally, centralized data management makes it easier for IT teams to implement security patches, updates, and backups across all users, ensuring that critical systems remain secure and up-to-date.

Challenge

User Experience and Performance Issues

Despite the many benefits, one of the biggest challenges businesses face when implementing VDI is ensuring a smooth user experience. Since VDI relies on transmitting desktop environments over a network, factors like network bandwidth, latency, and server performance can significantly affect the user experience. Users may experience slower response times, lags, or poor-quality graphics if the infrastructure isn’t properly optimized.

Performance is particularly important for organizations with high-end computing needs, such as graphic design or video editing companies. These industries rely on quick processing power and high-resolution displays, which can be difficult to deliver via a virtual desktop setup.

Emerging Trends

One of the emerging trends is the growing adoption of Cloud-based VDI solutions. Instead of relying on on-premises hardware, companies are increasingly turning to cloud platforms like AWS, Azure, and Google Cloud for hosting virtual desktops. This shift reduces the need for expensive hardware investments and simplifies IT management.

Another notable trend is the integration of AI and machine learning to optimize VDI performance. AI-powered tools are being used to predict and resolve potential issues before they affect users, such as network bottlenecks or resource shortages. Additionally, AI is being used to personalize the virtual desktop experience, adapting to users’ behaviors and preferences to enhance productivity.

Fot instance, In August 2023, Workspot unveiled its latest innovation: Workspot Trends™. This feature marks a significant stride in data-driven decision-making, enabling businesses to fine-tune their performance like never before. By offering real-time insights into user interactions, Workspot helps companies optimize their cloud environments effectively. This development not only enhances user experience but also boosts overall operational efficiency, empowering businesses to thrive in today’s multi-cloud landscape.

Furthermore, hybrid VDI is becoming more popular, combining on-premises infrastructure with cloud resources. Hybrid VDI allows businesses to maintain control over sensitive data while taking advantage of the scalability and flexibility of the cloud.

Business Benefits

Virtual Desktop Infrastructure (VDI) offers numerous business benefits, starting with improved security. With VDI, data is stored on centralized servers instead of local devices, reducing the risk of data loss from device theft or malfunction. Moreover, businesses can implement uniform security policies across all virtual desktops, such as regular updates, data encryption, and strong access controls.

Enhanced productivity and flexibility are also key advantages. Employees can access their virtual desktops from virtually any device, whether they are using a laptop, tablet, or smartphone. This flexibility allows workers to stay productive even when working remotely or traveling.

Simplified IT management is a major benefit of VDI. IT administrators can manage all virtual desktops from a central location, streamlining updates, patches, and troubleshooting. This centralization not only saves time but also reduces the complexity of managing a large number of diverse devices.

Regional Analysis

In 2023, North America held a dominant market position in the Virtual Desktop Infrastructure (VDI) market, capturing more than a 36.1% share, with a revenue of approximately USD 5.2 billion. This market leadership is primarily driven by the rapid adoption of advanced IT solutions by businesses across the region, particularly in the United States and Canada.

North America is home to many large enterprises, technology-driven organizations, and leading cloud service providers that have embraced VDI to optimize their IT infrastructure. The region’s strong digital transformation initiatives, coupled with a highly developed technology ecosystem, have significantly contributed to its commanding position in the global VDI market.

North America leads in VDI adoption due to its early embrace of cloud computing and virtualization. With a high concentration of data centers and advanced cloud platforms, the region has widely deployed cloud-based VDI solutions. These solutions help businesses reduce hardware costs, scale IT resources, and support remote and hybrid workforces. The COVID-19 pandemic further accelerated the demand for secure, flexible desktop solutions to manage distributed teams.

North America’s strong IT infrastructure and presence of leading VDI providers like VMware, Citrix, and Microsoft have boosted its market share. These companies offer scalable, secure solutions suited for industries such as finance, healthcare, and technology. The region’s focus on data security, privacy, and compliance, along with its strong regulatory environment, has further driven the adoption of VDI solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the rapidly growing Virtual Desktop Infrastructure (VDI) market, key players are constantly innovating and refining their offerings to meet the diverse needs of businesses.

Microsoft Corporation is a major force in the VDI market, largely due to its comprehensive suite of cloud-based and on-premise solutions.Microsoft has captured a significant share by offering businesses a seamless, scalable solution that integrates directly with other Microsoft services like Office 365, Microsoft Teams, and SharePoint.

IBM Corporation has also established a prominent position in the VDI market through its robust enterprise solutions, including IBM Cloud and Watson-powered technologies. IBM’s VDI offerings cater primarily to large enterprises looking for customizable, secure, and scalable virtual desktop solutions.

Cisco Systems, Inc. is another leader in the VDI market, known for its networking and communication technologies. Cisco’s Virtual Desktop Infrastructure solutions integrate seamlessly with its broader networking products, providing businesses with secure, reliable, and high-performance virtual desktop environments.

Top Key Players in the Market

- Microsoft Corporation

- IBM Corporation

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- Broadcom Inc.

- Hewlett Packard Enterprise (HPE)

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Parallels International GmbH

- NComputing

- Other Key Players

Top Opportunities Awaiting for Players

As businesses continue to embrace hybrid and remote work models, VDI offers an efficient way to provide secure access to desktop environments, applications, and data from anywhere. This presents several exciting opportunities for market players to capitalize on in the coming years.

- Growth in Remote and Hybrid Work Solutions: The shift to remote and hybrid work environments is one of the biggest drivers for the VDI market.Providers can expand their VDI offerings to cater to small and mid-sized businesses (SMBs) that are increasingly adopting remote work practices but may have limited resources to invest in traditional IT infrastructure.

- Rising Demand for Cloud-Based VDI Solutions: Cloud-based VDI solutions offer a more flexible, cost-effective alternative to on-premise solutions. Companies that offer cloud-native VDI platforms have an edge in attracting businesses looking for agile solutions. Partnerships with cloud service providers like AWS, Microsoft Azure, and Google Cloud can help accelerate market penetration.

- Increased Focus on Security and Data Privacy: VDI offers enhanced security features, such as centralized data management and secure access, reducing the risk of data breaches. VDI vendors can differentiate themselves by incorporating advanced security features like multi-factor authentication, endpoint security integration, and zero-trust architectures. This would address the growing need for robust cybersecurity solutions.

- Integration with Emerging Technologies: VDI vendors can integrate AI and machine learning to improve performance and adapt to the evolving needs of users. Moreover, optimizing solutions for 5G networks will ensure that VDI delivers superior speed and reliability, especially for users in remote or underserved regions.

- Expansion into Vertical-Specific Solutions: Industries such as healthcare, education, retail, and manufacturing have specific needs when it comes to virtual desktops. Developing industry-specific VDI solutions can help vendors cater to the unique demands of these sectors.

Recent Developments

- In October 2024, CrowdStrike has partnered with Omnissa, a leading digital work platform company, to introduce real-time threat detection and automated remediation for both Virtual Desktop Infrastructure (VDI) and physical desktop environments. This collaboration is designed to enhance the digital work experience and drive greater productivity for customers.

- In May 2024, as a leader in Desktop as a Service, Dizzion has officially launched Dizzion DaaS on IBM Cloud Virtual Private Cloud (VPC). For the first time, the company is offering self-service, managed, and hosted virtual desktop and application solutions through its next-generation Frame DaaS platform on IBM Cloud VPC.

Report Scope

Report Features Description Market Value (2023) USD 14.5 Bn Forecast Revenue (2033) USD 69.7 Bn CAGR (2024-2033) 17% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Retail, Healthcare, Manufacturing, Government, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, IBM Corporation, Cisco Systems, Inc., Citrix Systems, Inc., Broadcom Inc., Hewlett Packard Enterprise (HPE), Fujitsu Limited, Huawei Technologies Co., Ltd., Parallels International GmbH, NComputing, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Virtual Desktop Infrastructure MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Virtual Desktop Infrastructure MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- IBM Corporation

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- Broadcom Inc.

- Hewlett Packard Enterprise (HPE)

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Parallels International GmbH

- NComputing

- Other Key Players