Global Virtual Tour Software Market By Component (Software Solutions, Services), Deployment Mode (On-Premises, Cloud-Based), By Type (360 Virtual Tour, 3D Virtual Tour, Virtual Reality Tour), By Industry Vertical (Travel and Tourism, Education, Hospitality, Retail and E-commerce, Automobile, Museums & Galleries, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 111978

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

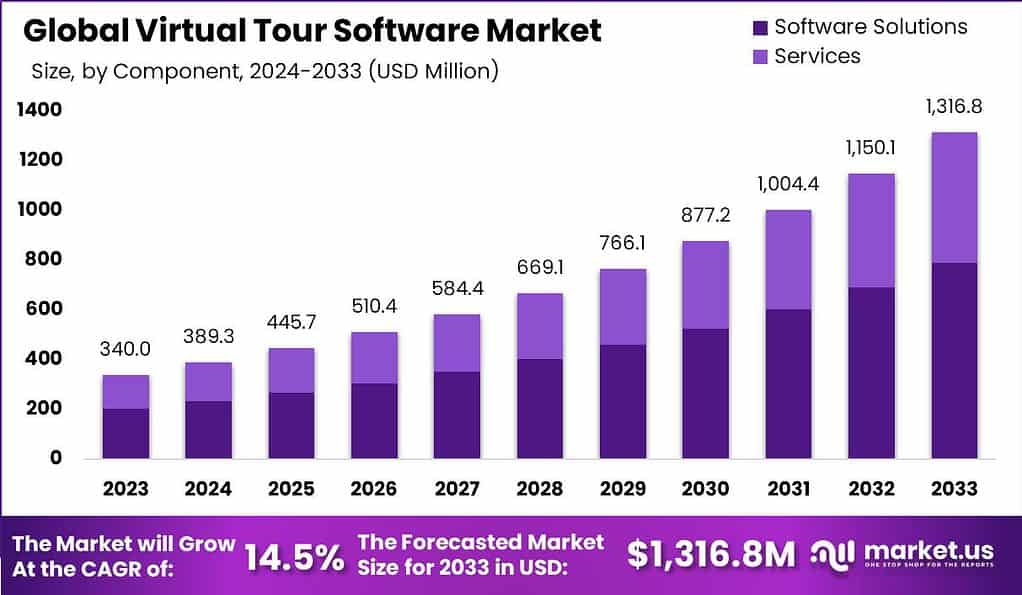

The Global Virtual Tour Software Market is projected to be worth USD 340 Million in 2023. The market is likely to reach USD 1,316.8 Million by 2033. It is further expected to surge at a CAGR of 14.5% during the forecast period 2024 to 2033.

Virtual tour software allows users to create interactive 360-degree virtual tours. This software is used to take panoramic photos and stitch them together to create an immersive virtual experience. Users can embed hotspots, add audio, text, and other multimedia elements. The virtual tours created can be published online or accessed through virtual reality headsets.

The Virtual Tour Software Market refers to the industry that offers virtual tour software solutions and services to cater to the growing demand for immersive and interactive virtual experiences. The market has witnessed significant growth due to the increasing adoption of virtual tours as a powerful marketing and visualization tool across different sectors. The market offers a wide range of virtual tour software solutions, including standalone software applications, cloud-based platforms, and software development kits (SDKs) for integration into existing applications.

Key Takeaways

- Market Size and Growth: The Virtual Tour Software Market is expected to be worth USD 1,316.8 Million by 2033. It is projected to achieve a steady CAGR of 14.5% during the forecast period from 2024 to 2033.

- Component Analysis: In 2023, the Software Solutions segment held a dominant market position, capturing over 60% market share.

- Deployment Mode: In 2023, Cloud-Based deployment held a dominant market share of more than 65%.

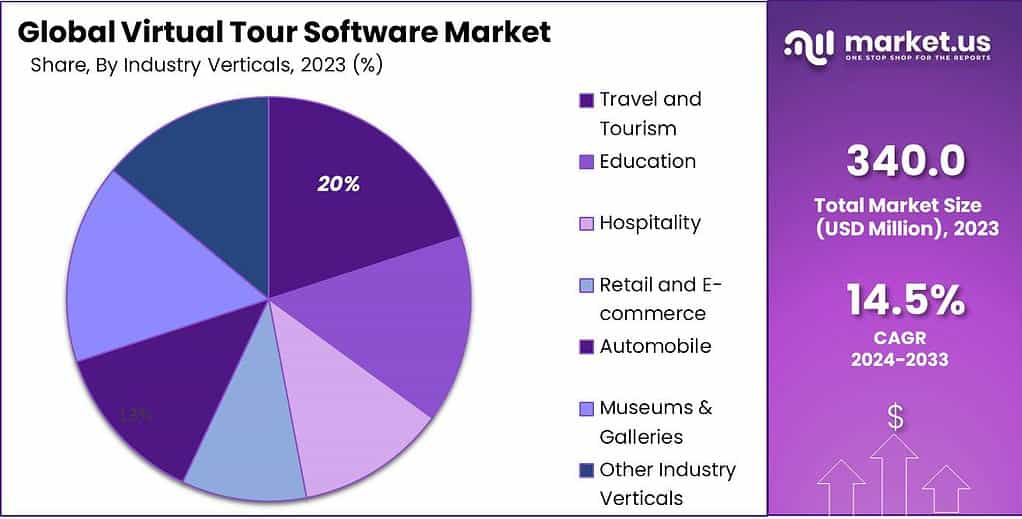

- Industry Verticals: Travel and Tourism led the market with more than 20% market share in 2023.

- Regional Analysis: North America dominated the market with a 38.6% market share, driven by rapid technological adoption.

- Key Players: Prominent companies in the Virtual Tour Software Market include Matterport Inc., Roundme Limited, Kuula, and Pano2VR, among others.

- Market Trends: Integration with booking and reservation systems is a key trend.

- Growth Opportunities: Integration with Augmented Reality (AR) and mobile compatibility are growth opportunities.

- Challenges: Maintaining quality and realism in virtual tours can be challenging.

Component Analysis

In 2023, the Software Solutions segment held a dominant market position in the Virtual Tour Software Market, capturing more than a 60% share. This segment includes the various software applications, platforms, and tools that enable the creation, editing, and customization of virtual tours. The high market share can be attributed to the increasing adoption of virtual tour software by businesses and individuals for marketing, sales, and visualization purposes.

The software solutions offer features such as 360-degree image integration, interactive hotspots, multimedia content embedding, and customization options, allowing users to create immersive and engaging virtual experiences. The demand for software solutions is driven by industries like real estate, tourism, hospitality, and education, which leverage virtual tours to showcase properties, attractions, and facilities to potential customers.

The Services segment in the Virtual Tour Software Market also captured a significant share, accounting for more than a 40% market share in 2023. This segment comprises various professional services offered by virtual tour software providers, including consulting, implementation, training, and support services. These services assist businesses and individuals in effectively utilizing virtual tour software, ensuring smooth implementation, and providing ongoing technical support.

Service providers work closely with clients to understand their specific requirements, customize virtual tours, and provide guidance on best practices for creating captivating virtual experiences. The growing demand for services is driven by the need for expertise, technical assistance, and seamless integration of virtual tour software into existing workflows. The services segment is expected to witness growth as businesses increasingly recognize the value of professional support to maximize the benefits of virtual tour software.

Overall, the Virtual Tour Software Market is characterized by a strong presence of software solutions, contributing to more than 60% market share, and supported by a growing demand for services, accounting for over 40% market share. This segmentation highlights the importance of both software solutions and services in meeting the diverse needs of businesses and individuals looking to leverage virtual tours for marketing, sales, and interactive visualization purposes.

Deployment Mode Analysis

In 2023, the Cloud-Based segment held a dominant market position in the Virtual Tour Software Market, capturing more than a 65% share. Cloud-based deployment refers to the delivery of virtual tour software through cloud computing infrastructure, allowing users to access and utilize the software over the internet. The high market share of the cloud-based segment can be attributed to the numerous advantages it offers, including scalability, flexibility, cost-effectiveness, and ease of access from any device with an internet connection.

Cloud-based virtual tour software eliminates the need for on-premises infrastructure and provides seamless updates and maintenance, making it an attractive choice for businesses and individuals. The growing adoption of cloud-based solutions in various industries, such as real estate, tourism, and education, is driving the dominance of this segment in the market.

The On-Premises segment in the Virtual Tour Software Market captured a significant share, accounting for more than a 35% market share in 2023. On-premises deployment refers to the installation and utilization of virtual tour software on local infrastructure within an organization’s premises. This segment caters to businesses and individuals who prefer to have complete control over their virtual tour software and data, ensuring compliance with security and privacy requirements.

On-premises deployment offers a higher level of customization, data control, and integration with existing systems, making it suitable for organizations with specific IT policies or regulatory constraints. The on-premises segment is driven by industries that require strict control over their data, such as government agencies, healthcare organizations, and large enterprises.

Type Analysis

In 2023, the Virtual Tour Software Market was distinctly categorized into three types: 360 Virtual Tours, 3D Virtual Tours, and Virtual Reality Tours. The 360 Virtual Tour segment held a dominant market position, capturing more than a 45% share. This segment’s popularity stems from its widespread application in industries like real estate, tourism, and education, where users can experience panoramic views of locations or products with a simple interface. The ease of creating and viewing 360 tours has contributed to their dominant market share.

Following closely, the 3D Virtual Tour segment accounted for more than a 30% share. These tours offer a more immersive and detailed experience, allowing users to explore spaces with a realistic perspective. The growing demand for high-quality, interactive virtual experiences in sectors such as interior design and architecture has bolstered the market share of 3D Virtual Tours.

Lastly, the Virtual Reality Tour segment, while smaller, still captured a significant 25% of the market. These tours offer the most immersive experience, allowing users to step into a virtual world using VR headsets. The segment’s share is reflective of the niche but growing interest in fully immersive virtual experiences, particularly in gaming, education, and specialized training.

Industry Vertical

In 2023, the Travel and Tourism segment held a dominant market position in the Virtual Tour Software Market, capturing more than a 20% share. The travel and tourism industry has recognized the value of virtual tours in showcasing destinations, accommodations, and attractions to potential travelers. Virtual tour software provides an immersive and interactive experience, allowing users to explore various travel destinations virtually and make informed decisions. The segment’s growth can be attributed to the increased adoption of virtual tours by travel agencies, hotels, resorts, and tourist destinations to enhance their marketing efforts and engage with customers.

The Education segment accounted for a 15% market share in 2023. Virtual tour software has revolutionized the education sector by enabling virtual field trips, campus tours, and interactive learning experiences. Educational institutions, such as schools, colleges, and universities, are leveraging virtual tours to provide students with a realistic and engaging way to explore campuses, museums, historical sites, and other educational resources. The segment’s growth is fueled by the increasing demand for remote learning solutions and the integration of virtual tours into digital learning platforms.

The Hospitality segment captured a 10% market share in 2023. Hotels, resorts, and accommodations are utilizing virtual tour software to showcase their facilities, rooms, and amenities to potential guests. Virtual tours offer a visually appealing and interactive way to provide a virtual walkthrough of the property, giving guests a preview of their experience and increasing booking conversions. The segment’s growth is driven by the hospitality industry’s focus on enhancing the customer experience and differentiating themselves in a competitive market.

The Retail and E-commerce segment accounted for an 18% market share in 2023. Retailers and e-commerce businesses are incorporating virtual tours into their online platforms to create a virtual shopping experience. Virtual tours allow customers to explore stores, browse products, and make purchases from the comfort of their homes. This segment’s growth is attributed to the increasing demand for immersive and personalized online shopping experiences.

The Automobile segment held an 8% market share in 2023. Virtual tour software is utilized by automotive manufacturers and dealerships to showcase vehicles, provide virtual test drives, and highlight features and specifications. Virtual tours enable potential buyers to explore different car models, interiors, and exteriors, enhancing the decision-making process for customers.

The Museums & Galleries segment captured a 12% market share in 2023. Museums, art galleries, and cultural institutions are leveraging virtual tour software to offer virtual exhibitions and tours. Virtual tours enable people from anywhere in the world to explore artworks, artifacts, and exhibitions, thereby expanding access to cultural experiences.

Other Industry Verticals accounted for a 17% market share in 2023. This segment includes various industries, such as healthcare, real estate, event management, and architecture, which are adopting virtual tour software for their specific needs. These industries utilize virtual tours to showcase properties, visualize event setups, provide virtual healthcare visits, and present architectural designs.

Overall, the Virtual Tour Software Market is segmented across various industry verticals, with the Travel and Tourism segment leading the market. The market’s growth is driven by the recognition of virtual tours as a valuable tool for marketing, engagement, and visualization across a wide range of industries.

Note: Actual Numbers Might Vary In Final Report

Driving Factors

- Enhanced Customer Experience: Virtual tour software allows travel and tourism businesses to offer immersive and interactive experiences to potential travelers. By providing virtual tours of destinations, accommodations, and attractions, companies can engage customers and provide a preview of what they can expect, enhancing their overall experience.

- Increased Accessibility: Virtual tours eliminate geographical barriers and enable travelers to explore destinations remotely. This accessibility is particularly beneficial for travelers who may have limitations or constraints that prevent them from physically visiting certain locations.

- Time and Cost Savings: Virtual tours save time and costs for both travelers and businesses. Instead of physically visiting multiple destinations, travelers can use virtual tours to narrow down their options and make more informed decisions. For businesses, virtual tours reduce the need for extensive in-person visits and allow them to showcase their offerings to a broader audience.

- Marketing and Sales Advantage: Virtual tours provide a competitive edge for travel and tourism businesses. By offering immersive digital experiences, companies can differentiate themselves from competitors, attract more customers, and increase booking conversions.

- Adaptation to Changing Consumer Behavior: The rise of technology and digital platforms has changed consumer behavior, including how travelers research and make travel-related decisions. Virtual tours cater to these changing preferences by providing a visually engaging and interactive way to explore destinations, accommodations, and attractions.

Restraining Factors

- Limited Physical Interaction: Virtual tours may not capture the same level of physical interaction and sensory experiences that travelers can enjoy during an actual visit. This limitation may deter some travelers looking for an authentic and hands-on experience.

- Technology Requirements: Virtual tours rely on technology infrastructure, such as high-quality cameras, software, and internet connectivity. Some travel and tourism businesses, especially smaller ones with limited resources, may face challenges in adopting and implementing virtual tour technology.

- Internet Access and Bandwidth: Access to stable internet connections and sufficient bandwidth is essential for a seamless virtual tour experience. In areas with limited internet infrastructure or unreliable connectivity, the effectiveness of virtual tours may be hindered.

- Content Creation and Maintenance: Creating and maintaining high-quality virtual tour content requires time, effort, and expertise. Businesses need to invest in capturing and updating virtual tour assets regularly to ensure accuracy and relevance.

- Privacy and Security Concerns: Virtual tour software may involve the collection and storage of personal data, raising privacy and security concerns. Businesses must address these concerns and adhere to data protection regulations to build trust with customers.

- Adoption Barriers: Some travelers may still prefer traditional methods of travel planning and booking, and the adoption of virtual tours may require additional education and marketing efforts to convince them of the benefits and value provided.

Growth Opportunities

- Integration of Augmented Reality (AR): Augmented reality technology can enhance virtual tours by overlaying digital information onto the real-world environment. Integrating AR features into virtual tour software can provide a more interactive and immersive experience for travelers.

- Mobile Compatibility: With the increasing use of smartphones and mobile devices, optimizing virtual tour software for mobile platforms presents a significant growth opportunity. Mobile compatibility allows travelers to access virtual tours on-the-go, enhancing convenience and accessibility.

- Personalization and Customization: Offering personalized and customized virtual tour experiences can cater to the unique preferences and interests of individual travelers. Advanced virtual tour software that allows users to customize their tour routes, focus on specific areas of interest, or receive personalized recommendations can enhance the user experience.

- Collaboration with Travel Agencies and Online Travel Platforms: Partnering with travel agencies and online travel platforms can expand the reach of virtual tour software. Integration of virtual tours into travel booking websites and platforms can provide a comprehensive and engaging travel planning experience for customers.

- Cross-Industry Collaboration: Collaborating with other industries, such as accommodation providers, transportation companies, and attractions, can create integrated virtual tour experiences. This collaboration can offer travelers a seamless end-to-end virtual tour journey, enhancing convenience and satisfaction.

- Localization and Multilingual Support: Providing virtual tours in multiple languages and localizing content for specific target markets can open up opportunities to attract international travelers and cater to diverse customer needs.

Challenges

- Quality and Realism: Maintaining high-quality visuals, realistic representations, and accurate information in virtual tours can be challenging. Businesses need to ensure that virtual tours accurately reflect the actual experience to meet customer expectations.

- Technology Advancements: Virtual tour software requires continuous technological advancements to provide better user experiences. Staying up-to-date with emerging technologies, such as high-resolution imaging, virtual reality, and 3D modeling, can be a challenge for businesses.

- User Engagement and Interactivity: Keeping users engaged throughout the virtual tour Continuing from the previous point.

- User Engagement and Interactivity: Keeping users engaged throughout the virtual tour experience can be a challenge. Businesses need to incorporate interactive elements, such as clickable hotspots, guided narratives, and gamification, to enhance user engagement and make the virtual tour more immersive.

- Content Differentiation: With the increasing adoption of virtual tour software in the travel and tourism industry, creating unique and differentiated content becomes crucial. Businesses need to find innovative ways to stand out and offer compelling virtual tour experiences that go beyond standard offerings.

- Scalability and Infrastructure: As the demand for virtual tours grows, businesses may face challenges related to scalability and infrastructure. Ensuring that virtual tour software can handle increased traffic and deliver a seamless experience to a large number of users simultaneously is essential.

- User Education and Adoption: Despite the growing popularity of virtual tours, there may still be a need for user education and awareness. Some travelers may be unfamiliar with virtual tour technology or hesitant to embrace it. Educating users about the benefits and ease of use of virtual tour software can help drive adoption.

Key Market Trend

- Integration with Booking and Reservation Systems: A key market trend is the integration of virtual tour software with booking and reservation systems. By combining virtual tours with the booking process, travel and tourism businesses can provide a seamless customer journey from exploration to reservation, enhancing conversion rates and overall customer satisfaction.

- Social Media Integration and Sharing: Virtual tour software is increasingly being integrated with social media platforms, allowing users to share their virtual tour experiences with friends and followers. This trend leverages the power of social media to amplify the reach and impact of virtual tours, potentially attracting new customers and generating user-generated content.

- Collaborative Virtual Tours: Collaborative virtual tours enable multiple users to explore destinations together in real-time, regardless of their physical location. This trend facilitates group experiences, interactive discussions, and shared exploration, making virtual tours a social and interactive activity.

- Immersive Technologies: Virtual tour software is evolving to incorporate immersive technologies such as virtual reality (VR) and 360-degree videos. These technologies provide a more immersive and realistic experience, allowing travelers to feel as if they are physically present in the destination they are exploring.

- Data Analytics and Personalization: Virtual tour software is leveraging data analytics to gain insights into user preferences and behaviors. This data is then used to personalize virtual tour experiences, offering tailored recommendations and content based on individual preferences, travel history, and demographics.

- Integration with Artificial Intelligence (AI): AI-powered features are being integrated into virtual tour software to enhance user experiences. AI can provide intelligent recommendations, voice-guided tours, and real-time translations, making virtual tours more interactive, informative, and user-friendly.

Key Market Segments

Component

- Software Solutions

- Services

Deployment Mode

- On-Premises

- Cloud-Based

Type

- 360 Virtual Tour Software

- 3D Virtual Tour Software

- Virtual Reality Tour

Industry Vertical

- Travel and Tourism

- Education

- Hospitality

- Retail and E-commerce

- Automobile

- Museums & Galleries

- Other Industry Verticals

Regional Analysis

The North America held a dominant market position, capturing more than a 38.6% share. This dominance is largely due to the region’s rapid technological adoption and the presence of key market players. The demand for Virtual Tour Software in North America was valued at US$ 131.2 Million in 2023 and is anticipated to grow significantly in the forecast period.

Industries such as real estate, tourism, and education in the U.S. and Canada have been quick to implement virtual tour technologies, driving substantial market growth. Moreover, the region’s robust IT infrastructure supports the development and smooth operation of advanced virtual tour solutions.Europe has also shown significant market presence, with countries like the UK, Germany, and France leading in adoption. The market’s growth is driven by the region’s strong focus on tourism and cultural heritage, where virtual tours offer an innovative way to experience landmarks and properties. Additionally, Europe’s stringent data protection laws ensure that virtual tour software providers prioritize security and privacy, making the solutions attractive to more cautious users.

The APAC region is witnessing rapid growth due to increasing internet penetration and smartphone usage. Countries like China, Japan, and India are seeing a surge in virtual tour adoption across sectors such as real estate and education. The region’s large population and growing tech-savvy middle class present a vast potential customer base for virtual tour software.

Latin America’s market is emerging, with countries like Brazil and Mexico leading the way. The region’s growth is bolstered by increasing digital transformation in various sectors and a growing interest in innovative marketing strategies. However, the market faces challenges like varying internet quality and economic disparity, which could affect adoption rates.

The MEA region, while still nascent in terms of market share, shows promising growth potential. The Gulf countries, in particular, are investing in smart city projects and tourism, which could significantly boost the adoption of virtual tour technologies. However, the region’s diverse economic and technological landscape means market growth could be uneven, with wealthier countries adopting faster than others.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Virtual Tour Software Market is characterized by a diverse range of key players, each contributing to the industry’s growth and innovation. These players vary from established technology giants to specialized companies focusing exclusively on virtual tour solutions. Prominent companies in the market engage in collaborative initiatives to bolster their offerings.

Top 14 Companies Profiled in the Virtual Tour Software Market Report

- Matterport Inc.

- Roundme Limited

- Kuula

- Pano2VR

- SeekBeak

- 360 Imagery

- Exsight 360

- Invision Studio Inc.

- Blue Raven Studios

- Klapty

- Starts360

- Eye Revolution Ltd

- RealTourVision

- Concept 3D Inc.

Recent Developments

- In 2023, Metaverse Mania: Meta (formerly Facebook) announces plans to integrate virtual tours into its Horizon Worlds platform, pushing the boundaries of immersive experiences.

- In 2023, Matterport is a leading 3D capture technology company, acquires Envolta, expanding its reach in the virtual tour market.

- In June 2022, Concept3D, Inc. revealed a collaboration with Pathify, a higher education engagement hub. This partnership aims to provide virtual campus tours through advanced virtual mapping.

- In April 2022, Mass Interact, headquartered in Washington, joined forces with Full Measure Education to deliver virtual tour solutions, enhancing the experience of campus visits. The partnership’s objectives include improving student enrollment and retention by offering tailored virtual experiences and more.

Report Scope

Report Features Description Market Value (2023) USD 340 Mn Forecast Revenue (2033) USD 1,316.8 Mn CAGR (2023-2032) 14.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software Solutions, Services), Deployment Mode (On-Premises, Cloud-Based), By Type (360 Virtual Tour, 3D Virtual Tour, Virtual Reality Tour), By Industry Vertical (Travel and Tourism, Education, Hospitality, Retail and E-commerce, Automobile, Museums & Galleries, Other Industry Verticals) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Matterport Inc., Roundme Limited, Kuula, Pano2VR, SeekBeak, 360 Imagery, Exsight 360, Invision Studio Inc., Blue Raven Studios, Klapty, Starts360, Eye Revolution Ltd, RealTourVision, Concept 3D Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Virtual Tour Software Market?The Virtual Tour Software Market refers to the industry that offers solutions for creating and presenting immersive virtual tours across various sectors.

How big is Virtual Tour Software Market?The Global Virtual Tour Software Market is projected to be worth USD 340 Million in 2023. The market is likely to reach USD 1,316.8 Million by 2033. It is further expected to surge at a CAGR of 14.5% during the forecast period 2024 to 2033.

What industries benefit from Virtual Tour Software?Virtual Tour Software caters to a range of industries, including real estate, tourism, hospitality, education, and entertainment, providing a versatile platform for immersive visualization.

What are the key features of Virtual Tour Software?Key features include 360-degree panoramic imaging, interactive elements, multimedia integration, hotspot functionality for additional information, and the ability to navigate through different areas.

Who are the top players in the virtual tour market?Some of key players are Matterport Inc., Roundme Limited, Kuula, Pano2VR, SeekBeak, 360 Imagery, Exsight 360, Invision Studio Inc., Blue Raven Studios, Klapty, Starts360, Eye Revolution Ltd, RealTourVision, Concept 3D Inc., Other Key Players

Which is the leading deployment segment in the market?The cloud segment is likely to lead the market. Virtual Tour Software MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample

Virtual Tour Software MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Matterport Inc.

- Roundme Limited

- Kuula

- Pano2VR

- SeekBeak

- 360 Imagery

- Exsight 360

- Invision Studio Inc.

- Blue Raven Studios

- Klapty

- Starts360

- Eye Revolution Ltd

- RealTourVision

- Concept 3D Inc.