Global Convenience Food Market Size, Share Analysis Report By Type (Ready-To-Eat, Raw Food, Canned Food, Frozen Food, Ready-To-Cook, Others), By Product (Meat/poultry Products, Cereal-based Products, Vegetable-based Products, Others), By Distribution Channel (Supermarkets/Hypermarkets, Departmental Stores, Mom and Pop Shops, Convenience Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145974

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

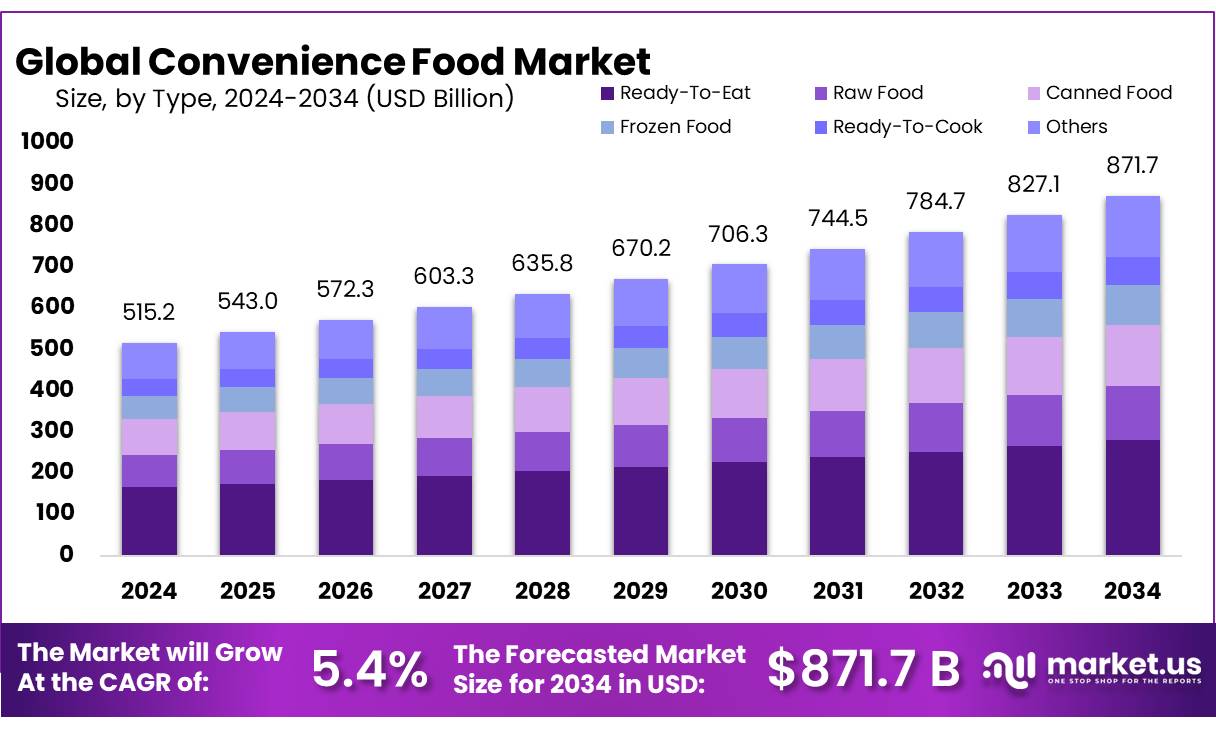

The Global Convenience Food Market size is expected to be worth around USD 871.7 Bn by 2034, from USD 515.2 Bn in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

The convenience food market has become an integral part of the food industry, adapting to the fast-paced lifestyle of the global population. This sector comprises a range of products, including ready-to-eat meals, frozen foods, and snacks that require minimal preparation, offering a practical solution for consumers seeking quick and easy meal options.

One of the primary driving factors behind the growth of the convenience food market is the significant shift in consumer behavior towards time-saving products. As work hours extend and commuting times increase, many individuals find less time to prepare home-cooked meals. According to data from the U.S. Department of Agriculture, the average time spent on meal preparation and cleanup per day has decreased significantly over the past decade, underscoring the growing reliance on convenience foods.

These outlets are favored for their wide range of product offerings and accessibility, making them preferred shopping destinations for busy consumers. Government initiatives also support this trend, with regulations and labeling requirements that ensure the safety and nutritional value of pre-packaged foods, thereby boosting consumer confidence.

The health and wellness trend presents both a challenge and an opportunity in the convenience food sector. Consumers are increasingly looking for healthier options in the convenience segment, prompting manufacturers to innovate and offer products that not only save time but also provide nutritional benefits. This shift is reflected in the introduction of convenience foods with reduced sodium, fewer preservatives, and enhanced vitamin content.

Key Takeaways

- Convenience Food Market size is expected to be worth around USD 871.7 Bn by 2034, from USD 515.2 Bn in 2024, growing at a CAGR of 5.4%.

- Convenience food sector witnessed Ready-To-Eat (RTE) products securing a prominent market position, boasting a significant share of 32.2%.

- Meat/poultry products solidified their role as cornerstone offerings within the convenience food market, capturing a robust share of 32.4%.

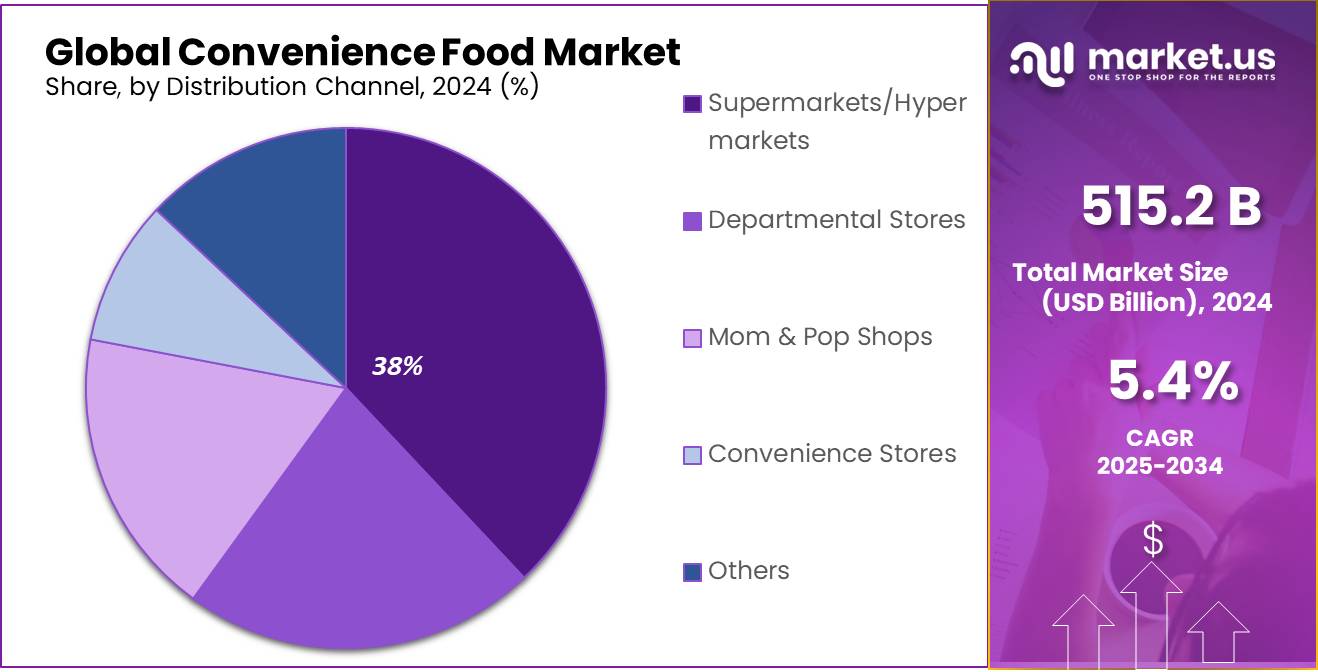

- Supermarkets/hypermarkets continued to dominate the distribution channels for convenience foods, securing a substantial market share of 38.4%.

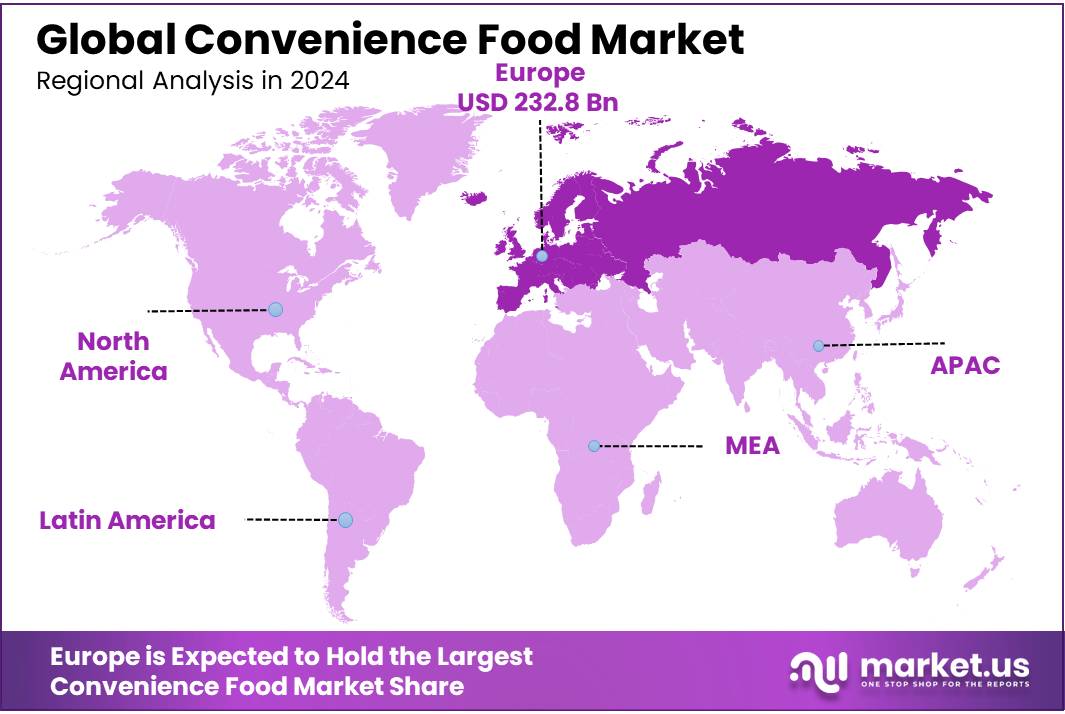

- Europe held a dominant position in the global convenience food market, capturing 45.2% of the total share, valued at approximately USD 232.8 billion.

Analysts’ Viewpoint

From an investment perspective, the convenience food market presents significant opportunities underscored by robust consumer demand and ongoing industry innovation. A critical driver is the unyielding pace of modern lifestyles, which has bolstered the demand for fast, convenient meal solutions. As families become busier, the allure of ready-to-eat and easy-to-prepare food options continues to grow, thus expanding the market.

However, potential investors should consider the volatility of raw material costs and the regulatory environment, which can impact profitability. Changes in global trade policies and fluctuations in agricultural commodity prices can affect production costs, influencing market pricing and margins.

Consumer preferences are rapidly evolving, with a notable shift towards healthier and more sustainable choices. This consumer insight requires companies to innovate continuously, incorporating organic ingredients, reducing additives, and improving nutritional content. Technological impacts, including advancements in food preservation, smarter packaging, and logistics, also play a crucial role in shaping the sector. These technologies help maintain food quality and extend shelf life, enhancing consumer appeal.

The regulatory environment presents both a risk and an opportunity. Stringent food safety regulations ensure higher standards of production, which can increase operational costs but also boost consumer trust in convenience food products. Moreover, regulations around labeling and the use of certain ingredients can affect product offerings, requiring constant adaptation by companies within this space.

By Type

Ready-To-Eat Foods Lead the Convenience Food Market with a 32.2% Share

In 2024, the convenience food sector witnessed Ready-To-Eat (RTE) products securing a prominent market position, boasting a significant share of 32.2%. This category’s dominance is largely attributed to the growing consumer demand for quick and easy meal solutions amidst fast-paced lifestyles. RTE foods have become a staple in many households due to their accessibility and minimal preparation time, catering to the needs of busy consumers seeking both convenience and quality.

As the trend towards more time-efficient meal options continues to rise, RTE foods are expected to maintain their strong hold in the market, reflecting the ongoing shift in consumer eating habits towards more convenient dining solutions.

By Product

Meat/Poultry Products Command a 32.4% Share in the Convenience Food Market

In 2024, meat/poultry products solidified their role as cornerstone offerings within the convenience food market, capturing a robust share of 32.4%. This segment’s strong performance is primarily driven by consumers’ continuing preference for protein-rich, flavorful, and easy-to-prepare meal options. As lifestyles get busier, the demand for meat and poultry products that offer a quick yet satisfying meal solution has seen significant growth. These products cater effectively to the need for nourishing and convenient eating options, aligning with the modern consumer’s desire for both speed and nutritional value in their daily diet. This trend is expected to persist, reinforcing meat and poultry products’ essential position in the evolving landscape of convenience foods.

By Distribution Channel

Supermarkets/Hypermarkets Lead with a 38.4% Stake in Convenience Food Sales

In 2024, supermarkets/hypermarkets continued to dominate the distribution channels for convenience foods, securing a substantial market share of 38.4%. This prominence is attributed to their ability to offer a wide variety of products under one roof, coupled with the convenience of location and extended shopping hours. These factors make supermarkets and hypermarkets the go-to spots for consumers looking to quickly pick up a range of ready-to-eat and easy-to-prepare food items. The trend towards one-stop shopping experiences, where customers can access a broad selection of convenience foods alongside their regular grocery purchases, significantly contributes to the ongoing success of supermarkets/hypermarkets in this market segment.

Key Market Segments

By Type

- Ready-To-Eat

- Raw Food

- Canned Food

- Frozen Food

- Ready-To-Cook

- Others

By Product

- Meat/poultry Products

- Cereal-based Products

- Vegetable-based Products

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Departmental Stores

- Mom & Pop Shops

- Convenience Stores

- Others

Drivers

Urbanization and Changing Lifestyle Patterns Propel Convenience Food Market Growth

A major driving factor for the burgeoning convenience food market is the rapid pace of urbanization coupled with significant changes in lifestyle patterns. As cities grow and lifestyles become increasingly hectic, more individuals are opting for convenient meal solutions that fit their busy schedules. According to the United Nations, approximately 68% of the world’s population is projected to live in urban areas by 2050, up from 55% in 2018. This urban migration is directly correlated with a rise in dual-income households where time is at a premium, and convenience becomes a necessity in daily meal preparation.

Government initiatives also play a pivotal role in shaping this trend. For instance, food safety regulations enforced by the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) ensure that convenience foods meet stringent safety standards, thereby enhancing consumer trust and fostering market growth. These regulatory bodies emphasize the importance of labeling, nutritional information, and the absence of harmful additives, which encourages manufacturers to invest in higher quality production processes.

Furthermore, the evolution of dietary preferences towards healthier and more diverse food options has led manufacturers to innovate continuously. They are now expanding their product lines to include organic and natural ingredients, catering to the health-conscious consumer without compromising on convenience. This shift not only meets consumer demand but also aligns with governmental dietary guidelines promoting healthier eating habits among populations.

Restraints

Health Concerns and Nutritional Skepticism Slow Convenience Food Market Growth

A significant restraint affecting the growth of the convenience food market is the growing health concerns among consumers regarding processed foods. The perception that convenience foods are less healthy than home-cooked meals poses a considerable challenge to the industry. This concern is especially prevalent among health-conscious consumers who prioritize dietary quality and nutritional content in their eating habits.

Government health organizations, such as the World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC), have published studies and guidelines that highlight the risks associated with high intake of processed foods. These risks often include high levels of sodium, sugars, and fats, which can contribute to various health issues such as obesity, heart disease, and diabetes. For instance, the WHO has recommended reducing intake of free sugars to less than 10% of total energy intake, a guideline that challenges many products within the convenience food sector.

In response, some governments have initiated labeling requirements that force manufacturers to clearly indicate the presence of high sugar, salt, and fat content. These initiatives aim to increase consumer awareness and encourage healthier choices. However, they also lead to increased scrutiny and sometimes reduced sales for convenience food products perceived as unhealthy.

Despite these challenges, the convenience food industry has opportunities for growth by innovating and reformulating products to meet health standards. By reducing harmful additives and enhancing the nutritional value of their products, companies can mitigate the impact of these health concerns and align better with consumer demands for healthier eating options.

Opportunity

Plant-Based Innovations: A Thriving Opportunity in the Convenience Food Market

One significant growth opportunity within the convenience food market is the expanding interest in plant-based products. As consumer preferences shift towards more sustainable and healthier dietary choices, the demand for plant-based convenience foods is surging. This trend is not only driven by vegetarians and vegans but also by a broader base of consumers who are adopting “flexitarian” diets, which emphasize plant-based meals without completely eliminating meat.

This shift is supported by nutritional guidelines from various government health organizations, which advocate for increased consumption of fruits, vegetables, and whole grains. For example, the Dietary Guidelines for Americans recommend filling half your plate with fruits and vegetables as part of a healthy eating pattern. This guideline encourages the inclusion of more plant-based foods in the average diet, providing a direct avenue for growth in the convenience food sector.

The market’s response has been enthusiastic, with an influx of new product developments that cater to this demand. These include ready-to-eat salads, vegetable-packed sandwiches, and plant-based ready meals that offer convenience without compromising on health. The innovation extends to meat substitutes, where products made from soy, peas, and other plant proteins are designed to mimic traditional meat products, providing familiar tastes in a healthier and more sustainable form.

As these plant-based alternatives become more mainstream, their presence in supermarkets and online grocery platforms is expanding, making them accessible to a wider audience. This availability aligns with the increasing consumer preference for foods that support a healthier lifestyle and environmental sustainability.

Trends

The Rise of Global Flavors: A Trend Shaping the Convenience Food Market

A notable trend in the convenience food market is the growing consumer interest in global cuisines, which is reshaping product offerings and expanding the market’s reach. As people become more adventurous with their food choices, driven by travel experiences and cultural exchange, the demand for ethnic and international flavors has surged. This trend is not just confined to major cities but is spreading across various demographics and regions, indicating a broad and growing appeal.

This shift towards global flavors is supported by data suggesting that consumers are increasingly seeking authentic and diverse food experiences that are easily accessible. For instance, a report from the U.S. Department of Agriculture highlights that over the last decade, there has been a significant increase in the import of spices and seasonings, a testament to the expanding palate of the American consumer. These culinary adventures are now being catered to by convenience food manufacturers who are incorporating bold flavors from Asia, Latin America, and the Middle East into their product lines.

From ready-to-eat meal kits featuring Thai spices to Mexican-style frozen entrees and Mediterranean-inspired snack options, the variety is vast and growing. The convenience factor combined with a taste of international cuisine provides a compelling product proposition for today’s busy, yet flavor-seeking, consumer.

Moreover, government initiatives promoting multiculturalism and global trade can facilitate the availability of diverse food ingredients, which further supports the growth of this trend in the convenience food sector. By embracing these global flavors, manufacturers can not only meet consumer demand but also differentiate their offerings in a competitive market.

Regional Analysis

In 2024, Europe held a dominant position in the global convenience food market, capturing 45.2% of the total share, valued at approximately USD 232.8 billion. The region’s dominance is driven by evolving consumer lifestyles, growing urbanization, and the increasing preference for time-saving meal solutions among working professionals and single households.

Countries like Germany, the United Kingdom, and France are key contributors to this growth, with strong demand for ready meals, frozen snacks, and processed dairy products. The market in Europe is further propelled by the rising penetration of premium and organic convenience food offerings that cater to health-conscious consumers. A noticeable trend is the surge in plant-based ready-to-eat meals, especially among younger demographics and flexitarians, reflecting a shift towards sustainability and wellness.

Retail chains and e-commerce platforms have also contributed to market expansion, offering wider access and attractive promotions on packaged food products. The increasing number of dual-income households in urban centers has further cemented the need for quick-meal options, making convenience food a staple in daily diets. Technological advancements in food processing, packaging, and shelf-life extension have also supported the region’s ability to meet high food safety and quality standards.

Additionally, government regulations promoting transparent labeling and clean-label ingredients have encouraged manufacturers to reformulate products to meet growing consumer expectations. Overall, Europe remains a vital growth hub, both in terms of value and innovation, positioning it as a leading region in the global convenience food market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ajinomoto Foods North America is renowned for its extensive range of flavor-enhanced products, including frozen foods and seasonings that cater to the global palate. Leveraging advanced food technologies and a deep understanding of umami, Ajinomoto continues to innovate within the convenience food sector, focusing on taste, health, and nutritional value to meet diverse consumer needs.

ADM is a global leader in food processing and ingredients, with a significant footprint in the convenience food market through their vast array of products that include snacks, beverage additives, and prepackaged meals. The company is committed to sustainable and responsible sourcing, which resonates well with today’s environmentally conscious consumers.

Bakkavor Group plc Specializing in fresh prepared foods, Bakkavor Group plc is a key player in the convenience food industry, particularly known for its ready meals, salads, and desserts. With a focus on freshness and flavor, Bakkavor is dedicated to delivering high-quality products that align with the modern consumer’s desire for quick and nutritious food options.

Grupo Bimbo As one of the largest bakery companies in the world, Grupo Bimbo operates an extensive distribution network that ensures a wide reach for its array of bakery products, including breads, cookies, and snacks. The company’s commitment to sustainability and nutrition is evident in its operations and product development, positioning it well within the competitive convenience food market.

Top Key Players

- Ajinomoto Foods N.A.

- Archer-Daniels-Midland Company (ADM)

- Bakkavor Group plc

- EUROPASTRY S.A.

- Grupo Bimbo

- Imperial brands plc.

- JBS S.A.

- Lantmännen Unibake

- Mars Incorporated

- McCain Foods Limited

- Mondelez International Inc.

- MTR Foods Pvt. Ltd.

- Nestlé S.A.

- PepsiCo Inc.

- The Coca-Cola Company

- Tyson Foods Inc.

- Vandemoortele N.V.

- W.H. Group

- Wilmar International Ltd.

Recent Developments

ADM’s operations, which encompass a broad range of food ingredients and products from oils and flours to specialty proteins, cater directly to the evolving demands of the global convenience food sector. They are particularly recognized for their innovation in creating sustainable and nutritious food solutions that meet the taste and health preferences of modern consumers.

Grupo Bimbo’s approach to market expansion involves tailoring products to local tastes while maintaining high quality and nutritional standards, making it a beloved brand in numerous households worldwide.

Report Scope

Report Features Description Market Value (2024) USD 515.2 Bn Forecast Revenue (2034) USD 871.7 Bn CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ready-To-Eat, Raw Food, Canned Food, Frozen Food, Ready-To-Cook, Others), By Product (Meat/poultry Products, Cereal-based Products, Vegetable-based Products, Others), By Distribution Channel (Supermarkets/Hypermarkets, Departmental Stores, Mom and Pop Shops, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ajinomoto Foods N.A., Archer-Daniels-Midland Company (ADM), Bakkavor Group plc, EUROPASTRY S.A., Grupo Bimbo, Imperial brands plc., JBS S.A., Lantmännen Unibake, Mars Incorporated, McCain Foods Limited, Mondelez International Inc., MTR Foods Pvt. Ltd., Nestlé S.A., PepsiCo Inc., The Coca-Cola Company, Tyson Foods Inc., Vandemoortele N.V., W.H. Group, Wilmar International Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ajinomoto Foods N.A.

- Archer-Daniels-Midland Company (ADM)

- Bakkavor Group plc

- EUROPASTRY S.A.

- Grupo Bimbo

- Imperial brands plc.

- JBS S.A.

- Lantmännen Unibake

- Mars Incorporated

- McCain Foods Limited

- Mondelez International Inc.

- MTR Foods Pvt. Ltd.

- Nestlé S.A.

- PepsiCo Inc.

- The Coca-Cola Company

- Tyson Foods Inc.

- Vandemoortele N.V.

- W.H. Group

- Wilmar International Ltd.