Global Cancer-focused Genetic Testing Service Market By Test Type (DNA, Chromosome and Biochemical), By Cancer Type (Breast Cancer, Lung Cancer, Colorectal Cancer and Others), By Service Provider (Hospitals, Diagnostic Laboratories, Specialty Clinics and Specialized Cancer Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171220

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

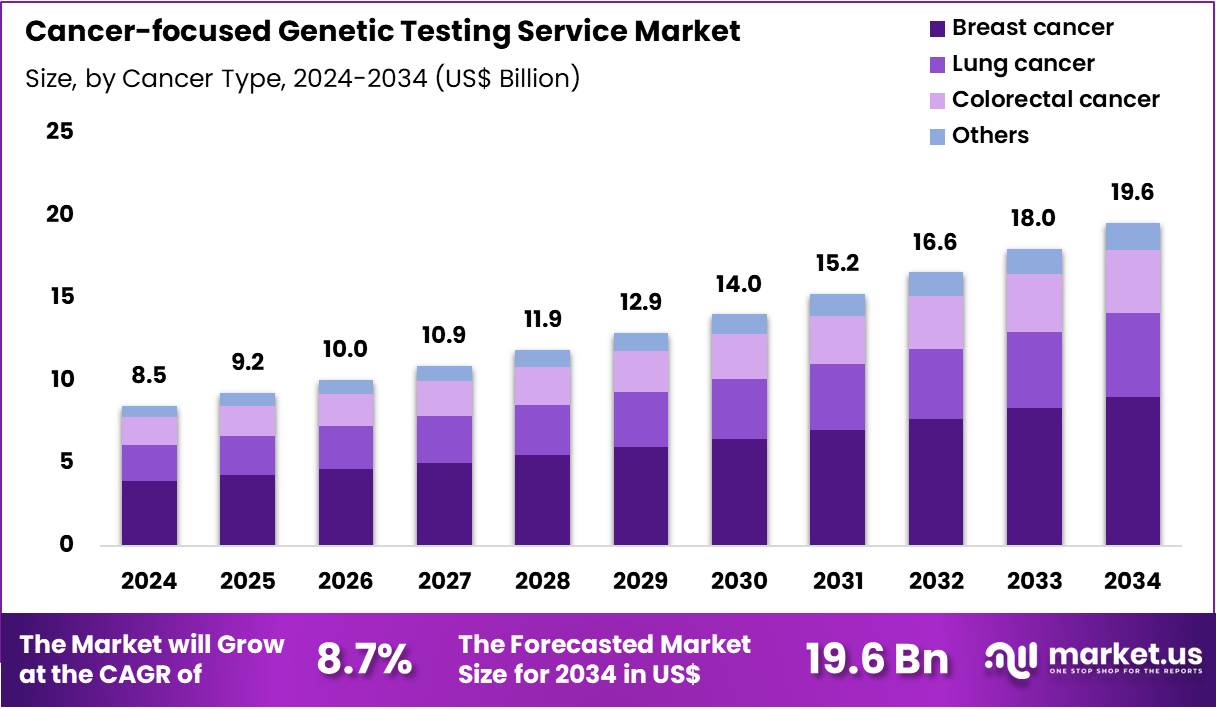

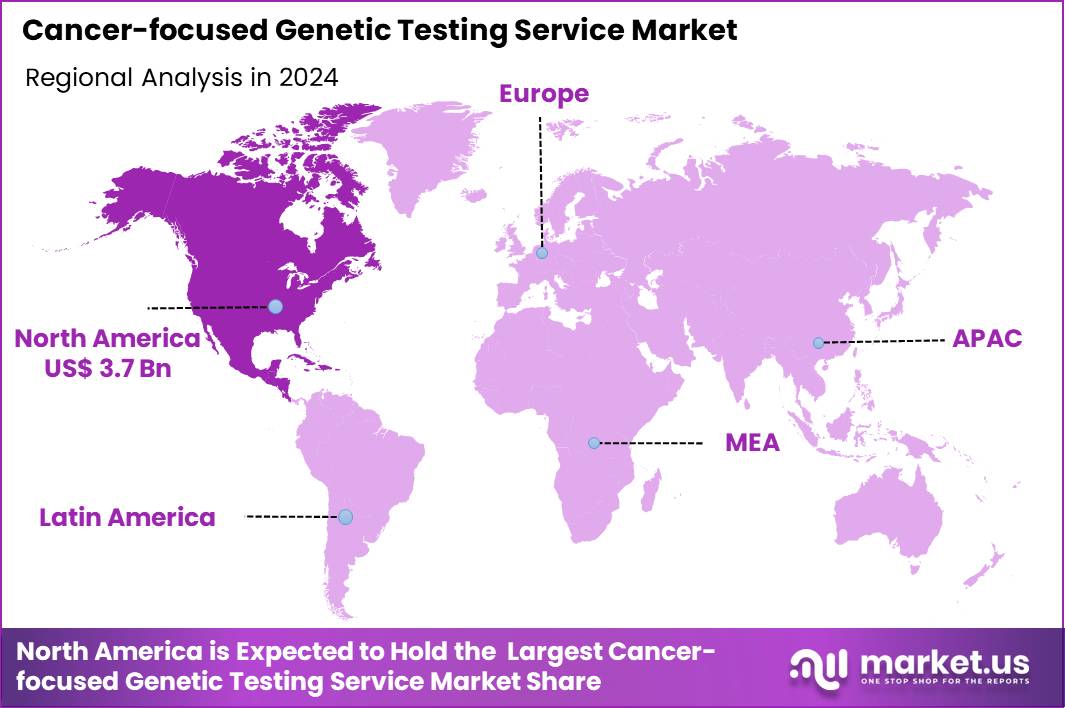

The Global Cancer-focused Genetic Testing Service Market size is expected to be worth around US$ 19.6 Billion by 2034 from US$ 8.5 Billion in 2024, growing at a CAGR of 8.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.1% share with a revenue of US$ 3.7 Billion.

Increasing demand for precision oncology therapies propels the Cancer-focused Genetic Testing Service market, as oncologists integrate comprehensive genomic profiling to match patients with targeted inhibitors and immunotherapies effectively. Service providers offer next-generation sequencing panels that analyze hundreds of actionable genes from tumor tissue or circulating DNA, delivering variant reports within days.

These services enable hereditary risk assessment for BRCA1/2 mutations in breast cancer families, somatic variant detection in lung adenocarcinoma for EGFR inhibitor eligibility, colorectal tumor profiling for microsatellite instability to guide checkpoint blockade, and pancreatic cancer screening via multi-gene panels for familial syndromes.

Technological upgrades in analysis pipelines create opportunities for enhanced sensitivity in low-frequency mutations, broadening applicability in early-stage diagnostics. In January 2024, QIAGEN Digital Insights rolled out an upgraded next-generation sequencing analysis approach that sharpens somatic mutation detection in cancer, boosting speed and precision to refine personalized workflows and elevate treatment decisions. This refinement underscores the market’s commitment to actionable insights that transform patient care trajectories.

Growing adoption of liquid biopsy technologies accelerates the Cancer-focused Genetic Testing Service market, as clinicians favor non-invasive monitoring to track tumor evolution and therapy resistance without repeated biopsies. Laboratories deploy plasma-based assays that quantify circulating tumor DNA for minimal residual disease detection, enabling dynamic adjustments in treatment regimens.

Applications encompass prostate cancer surveillance through AR variant tracking during androgen deprivation therapy, ovarian cancer response evaluation via CA-125 correlated genomic shifts, bladder tumor recurrence monitoring with FGFR alterations, and lymphoma subtyping for BTK inhibitor selection. Emerging opportunities include integration with wearable devices for real-time biomarker correlation, fostering proactive intervention strategies.

Myriad Genetics advanced this capability in February 2024 by acquiring Precise Tumor and Precise Liquid from Intermountain Precision Genomics, expanding liquid biopsy offerings to enhance non-invasive profiling across solid tumors. Such expansions solidify the market’s role in longitudinal care and drive efficiency in resource-constrained oncology practices.

Rising focus on multi-cancer early detection panels invigorates the Cancer-focused Genetic Testing Service market, as providers develop broad-spectrum assays that screen for shared oncogenic drivers across tumor types to facilitate incidental findings during routine checkups. Innovators curate pan-cancer gene sets that identify TP53, KRAS, and PIK3CA hotspots from blood samples, supporting population-level risk stratification.

These services apply in executive health programs for executive-level germline screening, post-treatment surveillance in melanoma for BRAF reactivation, integrative oncology for endometrial cancer via Lynch syndrome panels, and research cohorts evaluating polygenic risk scores in diverse cancers. Artificial intelligence enhancements create opportunities for predictive modeling that anticipates metastasis patterns and optimizes surveillance intervals.

Foundation Medicine launched hereditary germline tests like FoundationOne Germline in February 2025, partnering with Fulgent Genetics to identify inherited mutations in high-risk individuals and advance familial cancer prevention. This initiative propels the market toward preventive genomics and underscores its potential in reshaping early intervention paradigms.

Key Takeaways

- In 2024, the market generated a revenue of US$ 8.5 Billion, with a CAGR of 8.7%, and is expected to reach US$ 19.6 Billion by the year 2034.

- The test type segment is divided into DNA, chromosome and biochemical, with DNA taking the lead in 2023 with a market share of 52.8%.

- Considering cancer type, the market is divided into breast cancer, lung cancer, colorectal cancer and others. Among these, breast cancer held a significant share of 46.2%.

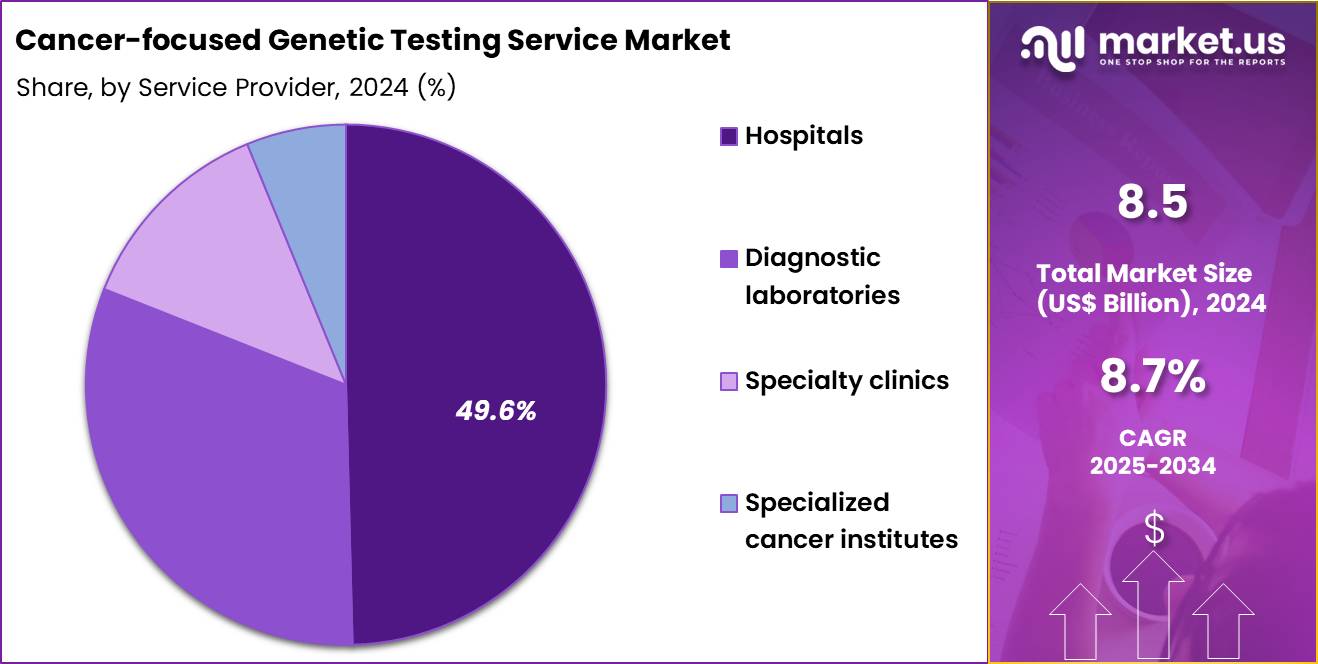

- Furthermore, concerning the service provider segment, the market is segregated into hospitals, diagnostic laboratories, specialty clinics and specialized cancer institutes. The hospitals sector stands out as the dominant player, holding the largest revenue share of 49.6% in the market.

- North America led the market by securing a market share of 43.1% in 2024.

Test Type Analysis

DNA testing, holding 52.8%, is expected to dominate because identifying hereditary mutations such as BRCA1, BRCA2, and other oncogenes remains essential for cancer risk prediction and early detection. Growing consumer awareness about preventive oncology encourages more individuals to seek DNA-based genetic evaluations before symptoms emerge. Advancements in sequencing technologies improve mutation identification accuracy and reduce overall testing costs, boosting accessibility.

Healthcare professionals increasingly recommend genetic risk assessments to guide personalized surveillance and therapeutic decisions. Expanding direct-to-consumer testing adoption also strengthens market growth. These factors keep DNA testing anticipated to remain the leading test type in cancer-focused genetic services.

Cancer Type Analysis

Breast cancer, holding 46.2%, is projected to dominate because hereditary breast cancer syndromes represent one of the most well-recognized applications of genetic screening. Early risk identification supports preventive strategies, including risk-reducing medication and enhanced imaging surveillance, driving testing volume among high-risk women.

Clinical guidelines increasingly integrate genetic evaluations for newly diagnosed breast cancer patients to guide treatment and assess familial risk. Public health efforts emphasize awareness of inherited breast cancer, strengthening demand for targeted screening. As variant classification improves, genetic data provide clearer insight into therapeutic responses and prognosis. These drivers keep breast cancer expected to remain the most tested indication in this market.

Service Provider Analysis

Hospitals, holding 49.6%, are anticipated to remain dominant because oncology care pathways often begin in hospital settings where genetic counselors and specialists oversee risk assessment and treatment planning. Hospitals integrate molecular diagnostics into patient workflows to guide precision therapies, including targeted and immunotherapies. Patients prefer hospital-based genetic testing due to direct access to multidisciplinary clinicians who interpret results and provide next-step care.

Increasing investments in cancer centers within hospital systems expand testing capabilities. Growing cancer incidence and hospital-led screening initiatives continue increasing the number of patients receiving genetic evaluation. These factors keep hospitals expected to maintain leadership among service providers in the cancer-focused genetic testing service market.

Key Market Segments

By Test Type

- DNA

- Chromosome

- Biochemical

By Cancer Type

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Others

By Service Provider

- Hospitals

- Diagnostic Laboratories

- Specialty Clinics

- Specialized Cancer Institutes

Drivers

Rising global cancer incidence is driving the market

The continuous upward trajectory in cancer diagnoses globally has intensified the demand for specialized genetic testing services to facilitate early intervention and personalized treatment strategies. This surge necessitates comprehensive genomic profiling to identify hereditary risks and somatic mutations guiding therapeutic decisions. Healthcare systems are increasingly prioritizing these services to align with evidence-based guidelines for high-risk populations.

The integration of genetic testing into standard oncology workflows enhances prognostic accuracy and supports targeted therapies. As cancer becomes a leading cause of mortality, public health policies emphasize scalable diagnostic platforms to manage burgeoning caseloads. Collaborative research consortia are leveraging genetic data to refine risk models, accelerating service adoption.

The economic rationale for proactive testing lies in its potential to reduce long-term treatment expenditures through precision approaches. Educational outreach to clinicians bolsters referral patterns, embedding genetic services within routine care pathways. Technological maturation in sequencing affordability further incentivizes widespread implementation. In summary, this driver catalyzes innovation and investment in cancer-focused genetic testing infrastructures.

Restraints

Limited uptake among eligible populations is restraining the market

Despite advancements, the proportion of individuals accessing cancer genetic testing remains suboptimal, curtailing the full realization of its preventive potential. Barriers such as affordability and geographic disparities disproportionately affect underserved communities, leading to inequities in service utilization. Complex consent processes and counseling requirements add administrative hurdles, deterring both providers and patients.

Variability in insurance coverage creates financial unpredictability, with many facing substantial deductibles for comprehensive panels. Awareness gaps among primary care physicians result in inconsistent recommendations, fragmenting referral networks. Ethical concerns over data privacy and incidental findings erode trust, contributing to hesitancy.

In 2024, only 23.4% of U.S. adults reported undergoing genetic testing for cancer risk, according to the National Cancer Institute’s Health Information National Trends Survey 7. This low penetration rate underscores systemic inefficiencies in outreach and integration. Longitudinal follow-up challenges post-testing further complicate sustained engagement. Collectively, these restraints impede equitable expansion and optimization of genetic testing services.

Opportunities

Expansion of national genomic cohorts is creating growth opportunities

Large-scale genomic initiatives provide foundational datasets for validating novel biomarkers, spurring development of refined cancer genetic testing protocols. These cohorts enable real-world evidence generation, informing regulatory pathways and reimbursement models for emerging assays. By aggregating diverse genetic profiles, they facilitate algorithm improvements for variant interpretation, enhancing clinical utility. Partnerships between research institutions and service providers accelerate translation from bench to bedside applications.

The inclusivity of such programs addresses representation gaps, yielding insights tailored to varied ancestries. Resource allocation toward data harmonization unlocks multiplexing opportunities for multi-cancer screening. Integration with electronic health records streamlines workflows, promoting seamless incorporation into care delivery. As these cohorts mature, they underpin pharmacogenomic advancements, optimizing therapy selection. International alignments amplify scalability, fostering cross-border validations. Overall, this opportunity landscape positions genetic testing as a cornerstone of proactive oncology paradigms.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends fuel the cancer-focused genetic testing service market as expanding healthcare investments and rising cancer incidence rates compel providers to offer advanced genomic panels for risk assessment and targeted therapies. Leading companies actively develop comprehensive sequencing services and companion diagnostics, leveraging the momentum from precision medicine initiatives to serve more patients in oncology clinics worldwide.

Persistent inflation and fluctuating economic conditions, however, constrain reimbursement policies and patient affordability, prompting healthcare systems to limit elective testing and prioritize essential services in volatile environments. Geopolitical tensions, including U.S.-China trade disputes and regional conflicts, frequently disrupt global supply chains for sequencing reagents and bioinformatics tools, leading to delays and higher operational uncertainties for service providers.

Current U.S. tariffs impose broad duties on imported medical devices and diagnostic components, elevating costs for genetic testing kits and straining profitability for importers dependent on overseas manufacturing. These tariffs provoke retaliatory actions in international markets that hinder U.S. exports of innovative testing services and complicate collaborative research efforts. Nevertheless, the policies encourage substantial investments in domestic labs and localized technology development, creating more secure ecosystems that will enhance accessibility and drive long-term market innovation.

Latest Trends

FDA approvals of companion diagnostics for tumor mutations is a recent trend

In 2025, the U.S. Food and Drug Administration authorized the Oncomine Dx Express Test as a companion diagnostic for detecting HER2 and EGFR mutations in non-small cell lung cancer tumors, enabling eligibility for targeted therapies like zongertinib and sunvozertinib. This approval, issued during July to September 2025, exemplifies the regulatory push toward integrated genetic profiling in treatment selection.

Concurrently, the Guardant360 CDx assay received clearance for identifying ESR1 mutations in breast cancer, supporting access to imlunestrant for hormone receptor-positive cases. These developments prioritize liquid biopsy modalities for minimally invasive monitoring. By streamlining mutation detection, they reduce dependency on tissue biopsies, broadening applicability in metastatic settings. The trend reflects heightened emphasis on actionable genomics amid evolving therapeutic landscapes.

Early implementations demonstrate improved turnaround times, aiding rapid decision-making in oncology clinics. Such endorsements validate next-generation sequencing platforms for routine use. This progression enhances precision in subtype stratification, mitigating overtreatment risks. Ultimately, the 2025 authorizations herald a standardized era for mutation-driven diagnostics in cancer management.

Regional Analysis

North America is leading the Cancer-focused Genetic Testing Service Market

In 2024, North America captured a 43.1% share of the global cancer-focused genetic testing service market, propelled by escalating demands for precision oncology and robust healthcare infrastructure. Clinicians increasingly integrate next-generation sequencing into routine workflows, enabling tailored treatment strategies that target hereditary mutations in high-risk families. Federal initiatives, such as those from the National Cancer Institute, fund expansive genomic research cohorts, accelerating the validation of biomarkers for early detection across diverse populations.

Pharmaceutical innovators collaborate with diagnostic laboratories to develop companion tests for immunotherapies, enhancing therapeutic efficacy while minimizing adverse effects. Heightened consumer awareness, amplified through public education drives, motivates proactive germline testing among individuals with familial histories of breast or colorectal cancers. Telemedicine expansions facilitate remote sample collection and counseling, broadening access in rural and underserved communities.

Venture capital inflows support startups pioneering liquid biopsy technologies, which offer non-invasive monitoring of tumor evolution. These synergistic factors underscore a strategic pivot toward preventive genomics, fortifying resilience against rising oncological burdens. The Centers for Disease Control and Prevention reported 1,851,238 new cancer cases in the United States in 2022, illustrating the critical role of advanced diagnostics in managing this caseload.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders project substantial advancement in the cancer-focused genetic testing sector across Asia Pacific over the forecast period, as governments intensify investments in molecular diagnostics to combat surging incidences. Health ministries in countries like Japan and South Korea deploy national screening programs that incorporate polygenic risk scores, empowering physicians to stratify patient vulnerabilities for prostate and ovarian malignancies.

Local biotech firms engineer affordable CRISPR-based assays, customizing panels for prevalent ethnic variants that influence drug metabolism in South Asian cohorts. International consortia equip urban hospitals with high-throughput sequencers, streamlining workflows for pharmacogenomic guidance in chemotherapy regimens. Community outreach teams educate migrant laborers on hereditary syndromes, fostering uptake of at-home kits that detect Lynch-associated colorectal risks.

Academic partnerships accelerate data-sharing platforms, refining algorithms for variant interpretation amid heterogeneous genetic landscapes. Regulatory bodies streamline approvals for AI-enhanced reporting tools, ensuring scalability in resource-constrained settings. These proactive measures solidify the region’s trajectory, equipping healthcare systems to preemptively address oncogenic threats. The World Health Organization’s GLOBOCAN database records 9,826,539 new cancer cases in Asia in 2022, compelling urgent scaling of genetic services.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading providers in cancer-focused genetic diagnostics expand their offerings by covering a wider range of hereditary and somatic mutation panels, enabling clinicians to match patients with targeted therapies and risk-management programs. They strengthen channel penetration by partnering with oncology networks, genomic counseling services, and payors so more patients access reimbursed testing.

They advance digital capabilities through integrated reporting dashboards and decision-support tools that help oncologists interpret complex genomic profiles efficiently. They drive brand trust through evidence-backed clinical validation studies and guideline alignment that reinforce the test’s role in precision-oncology workflows.

Commercial teams accelerate recurring demand by embedding their solutions into long-term survivorship and family-risk management pathways. One major player, Invitae Corporation, supports broad oncology testing needs with a comprehensive portfolio of hereditary-cancer and tumor-profiling services, leverages strong clinician partnerships and centralized laboratory infrastructure, and positions itself as an essential genomic partner for health systems advancing personalized cancer care.

Top Key Players

- NeoGenomics Laboratories, Inc.

- Illumina, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- Myriad Genetics, Inc.

Recent Developments

- On December 5, 2025, Natera announced the acquisition of Foresight Diagnostics in a deal worth up to US$450 million, including US$275 million paid at closing. By integrating Foresight’s highly sensitive PhasED-Seq™ technology, Natera plans to further enhance its Signatera™ platform for minimal residual disease testing. This strengthens Natera’s position in the rapidly expanding field of MRD monitoring for solid tumors and lymphoma, a major growth area within advanced cancer genetic testing services.

- In January 2024, the European Commission authorized Roche’s Tecentriq SC, the first subcutaneous form of a PD-(L)1 immunotherapy available for multiple tumor types in the EU. This approval enables cancer patients to receive treatment through a quicker and less invasive injection method, improving comfort and access while supporting a shift toward more patient-friendly immunotherapy options.

Report Scope

Report Features Description Market Value (2024) US$ 8.5 Billion Forecast Revenue (2034) US$ 19.6 Billion CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (DNA, Chromosome and Biochemical), By Cancer Type (Breast Cancer, Lung Cancer, Colorectal Cancer and Others), By Service Provider (Hospitals, Diagnostic Laboratories, Specialty Clinics and Specialized Cancer Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NeoGenomics Laboratories, Inc., Illumina, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific, Inc., QIAGEN N.V., Bio-Rad Laboratories, Inc., Myriad Genetics, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cancer-focused Genetic Testing Service MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Cancer-focused Genetic Testing Service MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NeoGenomics Laboratories, Inc.

- Illumina, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- Myriad Genetics, Inc.