Wound Debridement Market By Product Type (Gels, Ultrasonic Devices, Surgical Devices, Ointments & Creams, Medical Gauzes, and Others), By Method (Autolytic, Surgical, Mechanical, Enzymatic, and Others), By Application (Pressure Ulcers, Venous Leg Ulcers, Diabetic Foot Ulcers, Burn Wounds, and Others), By End-user (Hospitals, Homecare, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145240

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

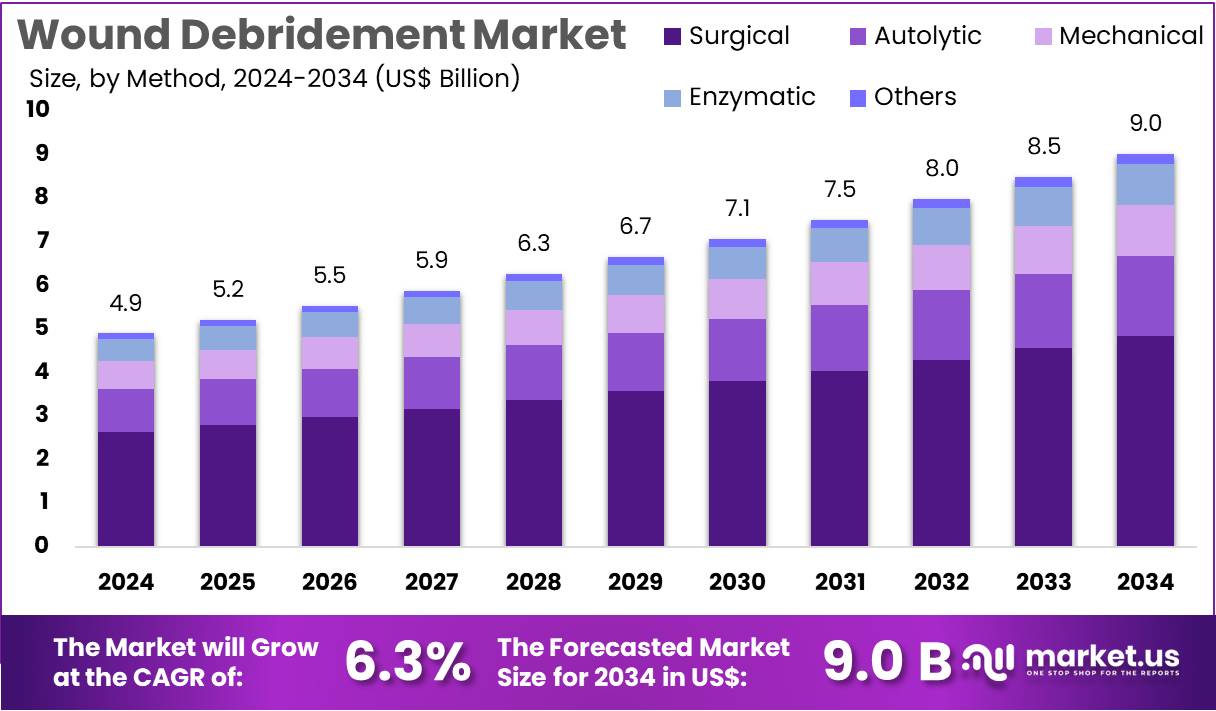

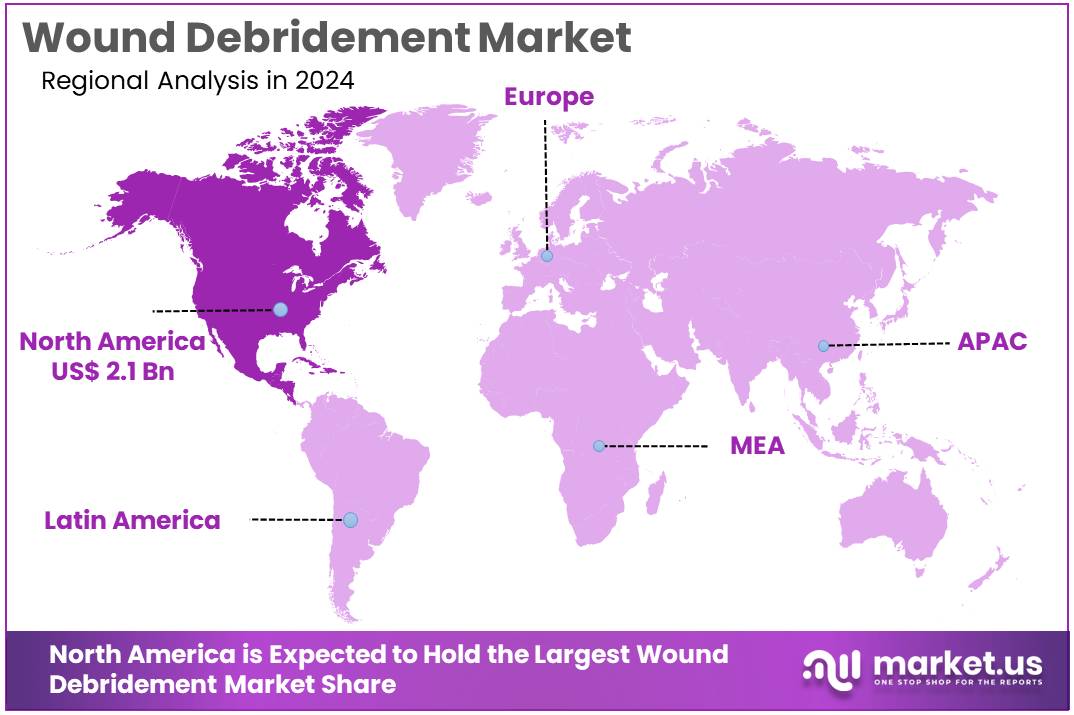

The Global Wound Debridement Market Size is expected to be worth around US$ 9 Billion by 2034, from US$ 4.9 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 43.1% share and holds US$ 2.1 Billion market value for the year.

Increasing cases of chronic wounds and diabetic ulcers are driving the growth of the wound debridement market. Effective wound management is crucial in preventing infection and promoting faster healing, and debridement plays a significant role in this process.

Rising awareness about advanced wound care, including the benefits of debridement in improving recovery times, fuels market demand. Technological advancements in wound debridement products, such as enzymatic debridement agents, hydrogels, and mechanical devices, are creating new opportunities for more efficient treatment options.

Healthcare professionals continue to prioritize minimally invasive methods to reduce pain, risk of infection, and recovery time, enhancing the overall patient experience. The growing adoption of advanced wound care products is driven by the aging population, as older individuals often suffer from chronic conditions that result in slower wound healing.

In September 2022, MiMedx Group, Inc. introduced AMNIOEFFECT, a human tissue allograft composed of three layers that helps improve wound healing. This innovation highlights the ongoing trend of using biologically active materials to enhance tissue regeneration and healing processes, further expanding the wound debridement market.

Key Takeaways

- In 2024, the market for wound debridement generated a revenue of US$ 4.9 billion, with a CAGR of 6.3%, and is expected to reach US$ 9.0 billion by the year 2033.

- The product type segment is divided into gels, ultrasonic devices, surgical devices, ointments & creams, medical gauzes, and others, with medical gauzes taking the lead in 2024 with a market share of 51.8%.

- Considering method, the market is divided into autolytic, surgical, mechanical, enzymatic, and others. Among these, surgical held a significant share of 53.7%.

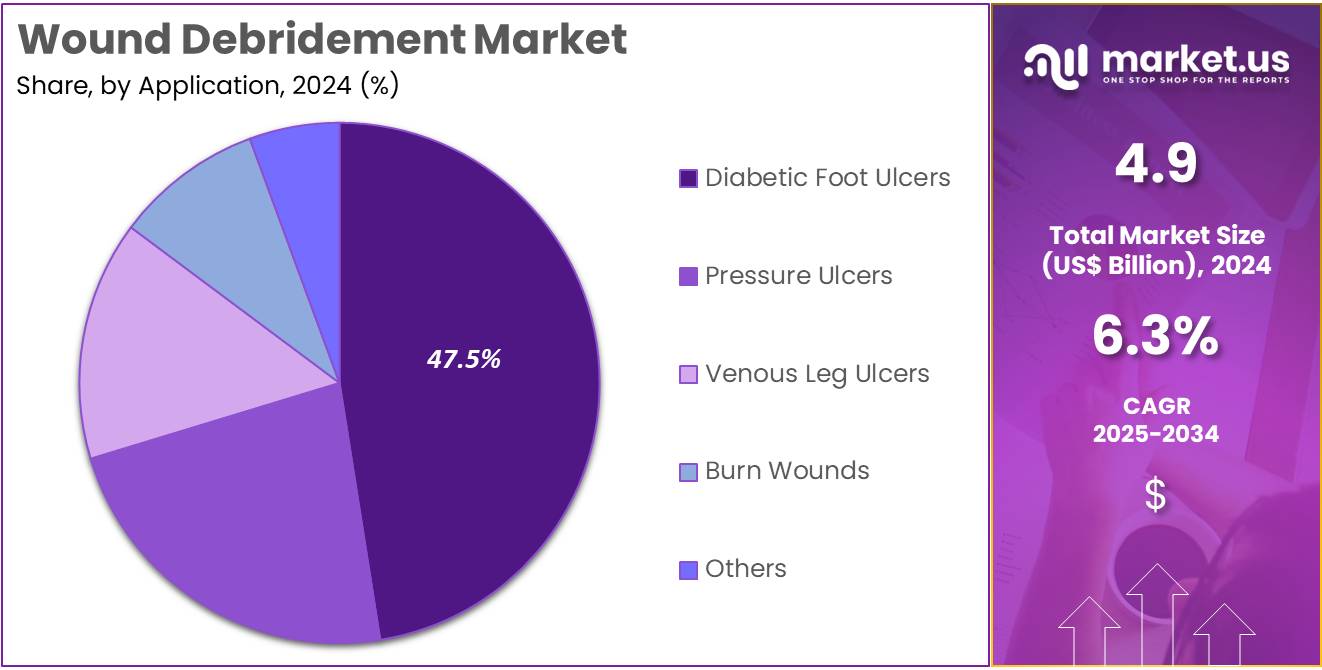

- Furthermore, concerning the application segment, the market is segregated into pressure ulcers, venous leg ulcers, diabetic foot ulcers, burn wounds, and others. The diabetic foot ulcers sector stands out as the dominant player, holding the largest revenue share of 47.5% in the wound debridement market.

- The end-user segment is segregated into hospitals, homecare, and others, with the hospitals segment leading the market, holding a revenue share of 59.4%.

- North America led the market by securing a market share of 43.1% in 2024.

Product Type Analysis

The medical gauzes segment led in 2024, claiming a market share of 51.8% owing to the increasing demand for effective wound care solutions. Medical gauzes are commonly used to promote wound healing by providing an ideal environment for tissue regeneration. They are frequently used for wound dressings and are particularly effective in removing necrotic tissue during debridement.

With the rise in chronic wounds, including diabetic foot ulcers and venous leg ulcers, medical gauzes are anticipated to become a preferred choice for wound care due to their versatility and ease of use. Additionally, the adoption of advanced medical gauze formulations designed to enhance healing is likely to further propel market growth.

Method Analysis

The surgical held a significant share of 53.7% as more patients seek efficient and precise wound cleaning methods. Surgical debridement offers advantages such as the ability to remove large amounts of necrotic tissue in a single procedure, making it suitable for severe wounds. As the prevalence of conditions requiring wound debridement, such as diabetes and vascular diseases, increases, demand for surgical debridement methods is expected to rise.

Technological advancements, such as minimally invasive techniques, are projected to drive further adoption of surgical debridement. The segment’s growth is also supported by an increasing number of surgical procedures and the preference for effective, long-term wound care.

Application Analysis

The diabetic foot ulcers segment had a tremendous growth rate, with a revenue share of 47.5% owing to the rising incidence of diabetes worldwide. Diabetic foot ulcers are one of the most common and debilitating complications of diabetes, requiring frequent debridement to promote healing and prevent infection. With the growing diabetic population, more individuals are likely to require wound debridement solutions.

The development of advanced wound care products, including debriding agents and dressings tailored to diabetic foot ulcers, is expected to drive this segment. Additionally, healthcare providers are placing increased focus on preventing complications related to diabetic foot ulcers, which is anticipated to further boost demand for debridement products.

End-User Analysis

The hospitals segment grew at a substantial rate, generating a revenue portion of 59.4% as hospitals are the primary settings for the treatment of complex and chronic wounds. Hospitals offer specialized care that is required for managing severe wounds, such as diabetic foot ulcers, pressure ulcers, and surgical wounds.

The increasing number of surgical procedures and the rising prevalence of chronic diseases requiring wound care are expected to drive demand for wound debridement solutions in hospitals. Additionally, advancements in wound care technologies, as well as improved healthcare infrastructure, are likely to contribute to the segment’s expansion as hospitals invest in better wound care management systems.

Key Market Segments

By Product Type

- Gels

- Ultrasonic Devices

- Surgical Devices

- Ointments & Creams

- Medical Gauzes

- Others

By Method

- Autolytic

- Surgical

- Mechanical

- Enzymatic

- Others

By Application

- Pressure Ulcers

- Venous Leg Ulcers

- Diabetic Foot Ulcers

- Burn Wounds

- Others

By End-user

- Hospitals

- Homecare

- Others

Drivers

Rising Prevalence of Chronic Wounds is Driving the Market

The increasing incidence of diabetes and vascular diseases is fueling demand for advanced debridement solutions. According to the American Diabetes Association, over 37 million Americans had diabetes in 2023, and a significant portion develops chronic foot ulcers that require debridement. Hospitalizations for chronic wounds have also increased in recent years, with Medicare spending a considerable amount annually on wound care.

Major manufacturers like Smith & Nephew and Molnlycke have expanded their enzymatic and hydrosurgical debridement product lines, reporting strong growth in advanced wound management. The growing diabetic population directly correlates with an increased need for debridement procedures. Aging populations in developed countries like Japan and those in Europe are further contributing to the growing demand for wound care solutions, particularly for age-related wounds.

Restraints

High Treatment Costs and Reimbursement Challenges are Restraining the Market

The expense of advanced debridement systems and inconsistent insurance coverage limit market growth. Enzymatic debridement treatments can cost between US$ 350 and US$ 800 per session, with Medicare typically reimbursing only 60-75% of the cost in many regions. In emerging markets, out-of-pocket expenses significantly restrict access to these treatments, with only a small percentage of wound care centers equipped with advanced debridement technologies.

Private insurers have increased claim rejections for biologic debridement agents, adding another financial barrier for patients and healthcare providers alike. These challenges continue to impede market expansion, particularly in regions with limited healthcare resources.

Opportunities

Adoption of Telemedicine for Wound Monitoring is Creating Growth Opportunities

Remote wound assessment platforms are creating new demand for at-home debridement solutions. Healthcare providers reported a significant increase in virtual wound consultations during 2023. Medical manufacturers are now integrating digital apps with disposable debridement products, achieving significant sales growth.

Recent policy changes have expanded insurance coverage for tele-wound care, particularly benefiting rural areas where many patients lack access to specialists. This combination of digital health innovation and physical debridement products is opening new opportunities across the care continuum, improving accessibility and convenience for patients in underserved areas.

Impact of Macroeconomic / Geopolitical Factors

Economic conditions and international trade policies significantly influence the debridement sector. Inflation has driven up the cost of raw materials, leading manufacturers to increase prices, though healthcare facilities have continued to prioritize essential wound care purchases. Trade tensions have caused supply chain disruptions, delaying key components and increasing costs.

However, government funding initiatives are supporting innovation, with investments in medical technology development helping to alleviate some of these challenges. Currency fluctuations have made imported biological agents more expensive in some markets, but local production expansions are expected to reduce costs. Despite financial pressures in developed markets, global demand for advanced wound care solutions is steadily growing through technological innovation and adoption in emerging markets, ensuring long-term industry expansion.

Latest Trends

Biosurgical Debridement Agents are a Recent Trend

Enzyme-based and biological debridement products are gaining popularity over traditional methods. Clinical studies demonstrate that these advanced agents reduce healing time compared to conventional approaches. Sales of FDA-approved enzymatic debridement treatments saw substantial growth in 2023 following expanded indications.

Healthcare systems worldwide are increasing investments in biological debridement research, with many governments allocating funds for innovative therapies like maggot therapy. This shift toward biologically active, precise solutions is significantly evolving wound care practices, offering better outcomes for patients and more targeted treatment options.

Regional Analysis

North America is leading the Wound Debridement Market

North America dominated the market with the highest revenue share of 43.1% owing to rising chronic wound cases, technological advancements, and greater focus on wound care management. The Centers for Disease Control and Prevention (CDC) reports that diabetes-related foot ulcers now affect 15% of diabetic patients, up from 13% in 2022. The American Hospital Association documented a 12% increase in hospital-acquired pressure injuries between 2022 and 2023, driving demand for effective debridement solutions.

In 2023, the US Food and Drug Administration (FDA) approved five new enzymatic debridement agents, broadening treatment alternatives. Medicare data indicates a 9% rise in reimbursement claims for debridement procedures, reflecting growing clinical utilization. The Veterans Health Administration committed US$350 million to chronic wound management programs in 2024, further stimulating market development. These factors collectively contribute to the sector’s robust expansion across healthcare facilities and home care settings.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing diabetes prevalence, healthcare infrastructure improvements, and government-led wound care initiatives. India’s Ministry of Health and Family Welfare recorded a 22% surge in diabetic foot ulcer cases from 2022 to 2023. China’s National Health Commission implemented updated wound care protocols in 2023, promoting advanced debridement methods. Japan’s aging population has led to a 17% increase in chronic wound incidents according to health ministry data.

Australia’s Department of Health allocated US$ 120 million for wound care research in 2024, with significant focus on innovative debridement approaches. South Korea’s health insurance system reported 14% more reimbursements for wound care procedures in 2023, indicating rising clinical adoption. These regional developments suggest continued expansion of debridement technologies and services across Asia Pacific healthcare systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the wound debridement market focus on technological innovation, strategic partnerships, and expanding their global presence to drive growth. They invest in developing advanced products, such as specialized debridement devices, enzymatic treatments, and dressings, to enhance healing outcomes and minimize complications.

Companies also collaborate with healthcare providers and research institutions to improve product development and increase adoption. Additionally, targeting emerging markets with increasing healthcare needs and infrastructure presents significant opportunities for growth. By prioritizing regulatory compliance and offering personalized solutions, they strengthen their market position.

Smith & Nephew, headquartered in Watford, England, is a leading manufacturer in the medical sector specializing in advanced wound management, including debridement devices. The company offers a wide range of wound debridement products designed to improve patient care and support faster healing processes. With a strong global presence, Smith & Nephew continues to expand its influence in the wound debridement market through strategic acquisitions, innovations, and partnerships with healthcare providers.

Top Key Players in the Wound Debridement Market

- Smith & Nephew

- Molnlycke Health Care AB

- Medline Industries

- Lohmann & Rauscher

- Integra LifeSciences

- ConvaTec Group

- Braun SE

- 3M

Recent Developments

- In January 2023, Convatec Group (UK) unveiled ConvaFoam, a versatile wound dressing designed to cater to a wide variety of wounds throughout the entire healing process. Its goal is to offer a straightforward and effective solution for skin protection and wound management, making it an essential product for healthcare professionals in diverse clinical settings.

- In April 2021, 3M Company launched its Spunlace Extended Wear Adhesive Tape on Liner, model 4576, which boasts an impressive wear time of up to 21 days. Designed to improve patient compliance, this product offers significant health and economic advantages by reducing the need for frequent dressing changes.

Report Scope

Report Features Description Market Value (2024) US$ 4.9 billion Forecast Revenue (2034) US$ 9.0 billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Gels, Ultrasonic Devices, Surgical Devices, Ointments & Creams, Medical Gauzes, and Others), By Method (Autolytic, Surgical, Mechanical, Enzymatic, and Others), By Application (Pressure Ulcers, Venous Leg Ulcers, Diabetic Foot Ulcers, Burn Wounds, and Others), By End-user (Hospitals, Homecare, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Smith & Nephew, Molnlycke Health Care AB, Medline Industries, Lohmann & Rauscher, Integra LifeSciences, ConvaTec Group, B. Braun SE, and 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Smith & Nephew

- Molnlycke Health Care AB

- Medline Industries

- Lohmann & Rauscher

- Integra LifeSciences

- ConvaTec Group

- Braun SE

- 3M