Core Clinical Molecular Diagnostics Market By Product Type (Reagents, Software & Services, and Instruments), By Application (Infectious Diseases, Genetic Disorders, Cancer Screening, and Others), By Technique (PCR, Nucleic Acid Sequencing, Fluorescence in situ Hybridization (FISH), and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147120

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

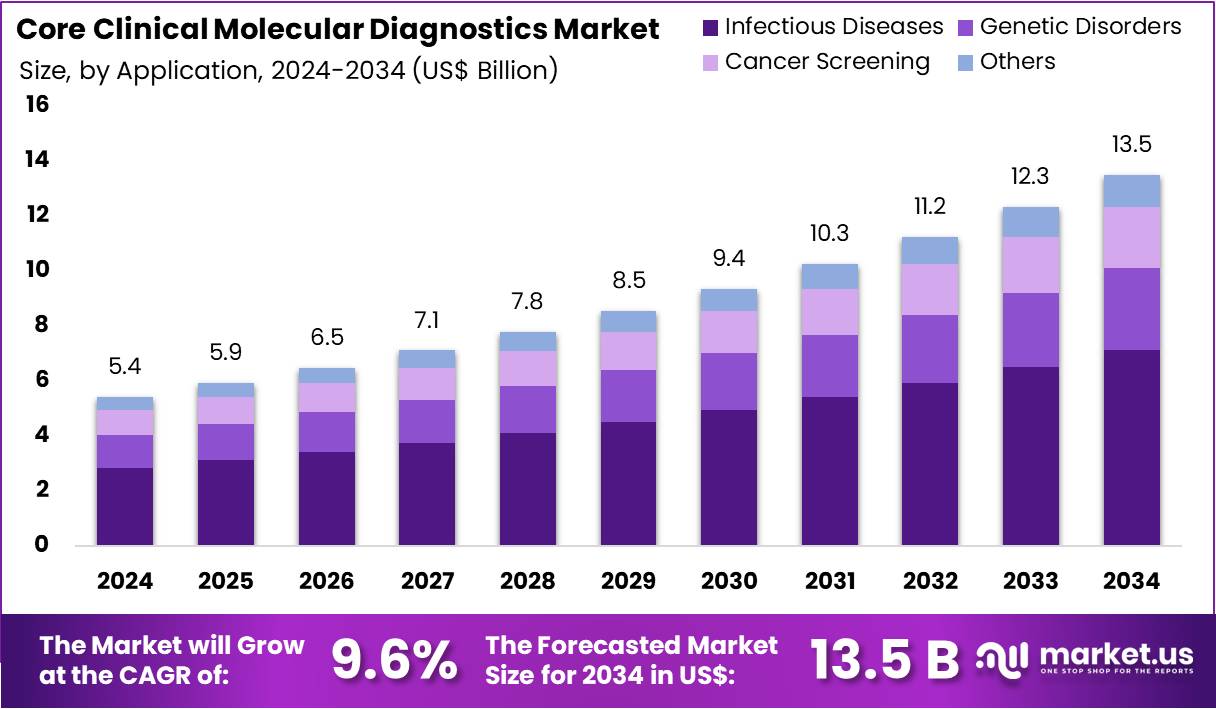

The Core Clinical Molecular Diagnostics Market Size is expected to be worth around US$ 13.5 billion by 2034 from US$ 5.4 billion in 2024, growing at a CAGR of 9.6% during the forecast period 2025 to 2034.

Increasing demand for accurate, rapid, and non-invasive diagnostic solutions drives the growth of the core clinical molecular diagnostics market. This market focuses on the application of molecular biology techniques to diagnose diseases at the genetic and molecular levels, offering high precision in the detection of a variety of conditions, including infectious diseases, cancers, and genetic disorders.

Core clinical molecular diagnostics play a critical role in improving patient outcomes by enabling early detection, personalized treatment plans, and the monitoring of disease progression. The market sees a rise in demand for point-of-care diagnostics and home testing solutions, particularly as healthcare systems seek to reduce costs and improve accessibility.

In May 2023, the Biomedical Advanced Research and Development Authority (BARDA), part of the US Department of Health, committed US$ 53.7 million in funding to Aptitude Medical to support the development of innovative molecular diagnostic tools for home and point-of-care use. This funding highlights the growing investment in technologies that streamline diagnostic processes and increase their accessibility.

As advancements in molecular technologies continue, the market will likely see further innovations in diagnostic tools, creating more opportunities for improving clinical decision-making and patient care.

Key Takeaways

- In 2023, the market for Core Clinical Molecular Diagnostics generated a revenue of US$ 5.4 billion, with a CAGR of 9.6%, and is expected to reach US$ 13.5 billion by the year 2033.

- The product type segment is divided into reagents, software & services, and instruments, with reagents taking the lead in 2023 with a market share of 58.5%.

- Considering application, the market is divided into infectious diseases, genetic disorders, cancer screening, and others. Among these, infectious diseases held a significant share of 52.7%.

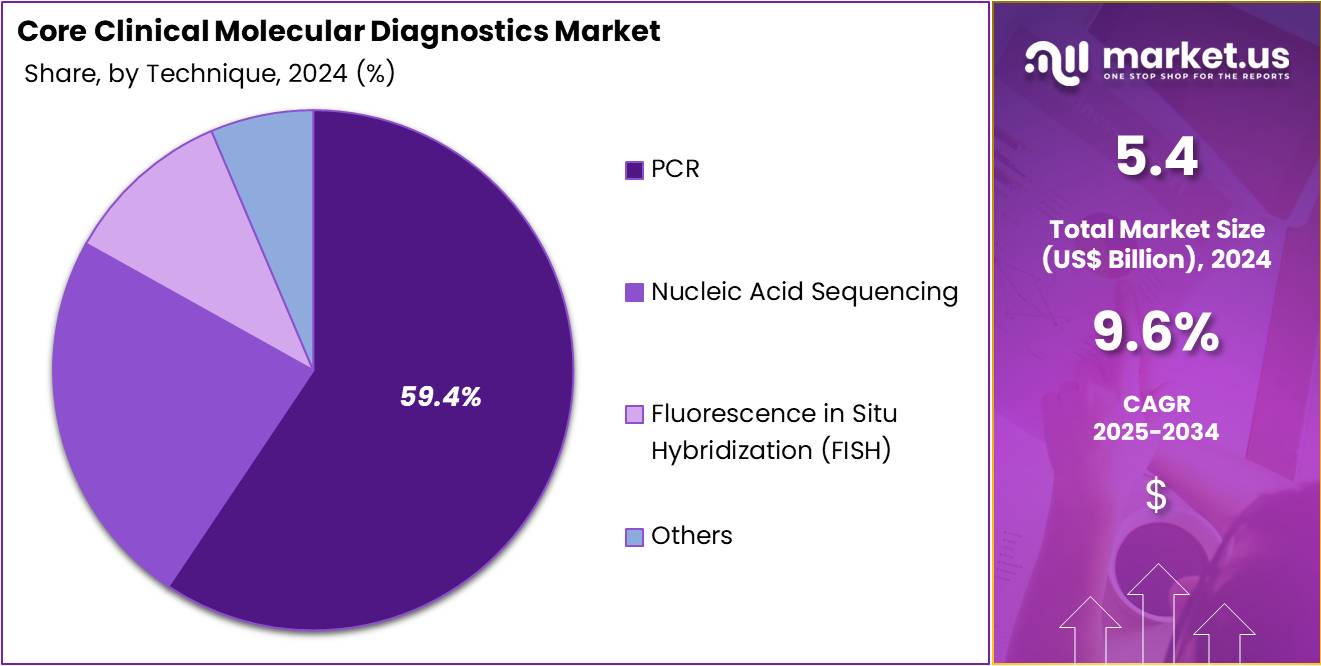

- Furthermore, concerning the technique segment, the market is segregated into PCR, nucleic acid sequencing, fluorescence in situ hybridization (fish), and others. The PCR sector stands out as the dominant player, holding the largest revenue share of 59.4% in the Core Clinical Molecular Diagnostics market.

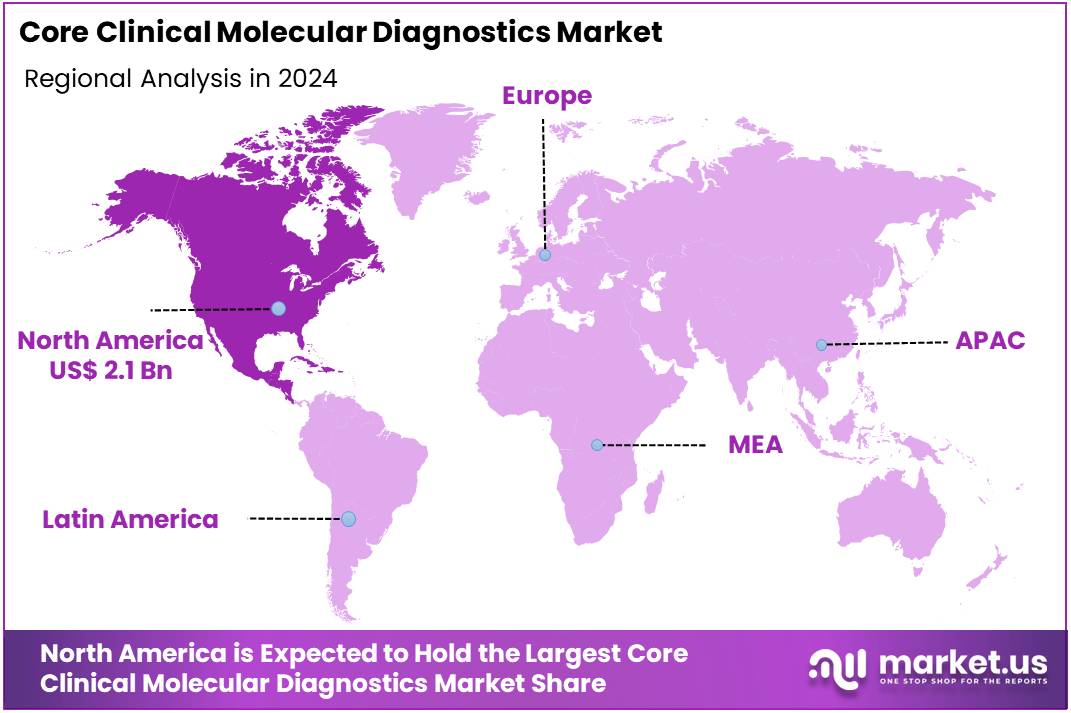

- North America led the market by securing a market share of 38.8% in 2023.

Product Type Analysis

The reagents segment led in 2023, claiming a market share of 58.5% owing to the increasing demand for accurate diagnostic tools in healthcare settings. As molecular diagnostic technologies advance, the need for high-quality reagents to enable precise testing of genetic disorders, infections, and cancers is anticipated to rise.

The growing prevalence of chronic diseases and the need for personalized medicine are projected to further drive the demand for reagents in the diagnostic process. Additionally, innovations in reagent development, such as the creation of multiplex assays, are expected to contribute to the segment’s expansion, providing more efficient and effective diagnostic solutions for a variety of conditions.

Application Analysis

The infectious diseases held a significant share of 52.7% as the global burden of infectious diseases increases, especially with the rise of emerging infectious pathogens. The need for fast, accurate, and reliable diagnostics to detect infectious agents such as viruses, bacteria, and fungi is expected to propel this segment.

Advances in molecular diagnostic technologies, including PCR and next-generation sequencing, are likely to improve the speed and accuracy of infectious disease diagnosis, allowing for better patient management and treatment. Additionally, increasing global healthcare investments and improved disease surveillance systems are expected to further boost the demand for molecular diagnostics in infectious disease management.

Technique Analysis

The PCR segment had a tremendous growth rate, with a revenue share of 59.4% owing to its well-established role in the detection of genetic material from pathogens, cancer cells, and genetic disorders. PCR’s ability to provide highly sensitive and specific results is expected to continue driving its adoption in clinical diagnostics.

With the ongoing development of more advanced and automated PCR systems, the technology is likely to become even more efficient and accessible, fueling demand across both developed and emerging markets. Moreover, the growth of personalized medicine and the increasing emphasis on early disease detection, particularly in oncology and infectious diseases, are projected to enhance the use of PCR as a key diagnostic tool in the healthcare industry.

Key Market Segments

By Product Type

- Reagents

- Software & Services

- Instruments

By Application

- Infectious Diseases

- Genetic Disorders

- Cancer Screening

- Others

By Technique

- PCR

- Nucleic acid sequencing

- Fluorescence in situ Hybridization (FISH)

- Others

Drivers

Technological Advancements are driving the market

Significant technological advancements are strongly driving the core clinical molecular diagnostics market, enhancing test performance and expanding the range of detectable analytes. Innovations in PCR-based methods, microarray technology, and the increasing integration of next-generation sequencing in clinical labs are enabling more sensitive, specific, and comprehensive diagnostic testing. These improvements facilitate earlier disease detection, more accurate prognosis, and better treatment selection across various medical disciplines, including infectious diseases, oncology, and genetic disorders.

For instance, the US Food and Drug Administration (FDA) approved numerous new molecular diagnostic tests in recent years; the FDA’s database indicates over 30 original Premarket Approval (PMA) applications for molecular diagnostic devices were approved in 2023 alone, demonstrating a consistent pace of innovation bringing new diagnostic capabilities to market during the 2022-2024 period. This continuous flow of advanced diagnostic tools expands the clinical utility and adoption of molecular testing.

Restraints

High Development Costs and Regulatory Pathways are restraining the market

Despite the drive for innovation, the core clinical molecular diagnostics market faces restraints primarily due to the high costs associated with developing and validating new tests and navigating complex regulatory pathways. Bringing a novel molecular diagnostic assay from research to market requires substantial investment in R&D, clinical trials, and manufacturing scale-up.

The stringent requirements set by regulatory bodies like the FDA for demonstrating analytical and clinical validity add significant time and expense to the development process, potentially delaying patient access to new diagnostics. For example, Roche Diagnostics, a major player in the field, reported R&D expenses of CHF 4.7 billion (approximately US$5.2 billion) for its Diagnostics division in 2023, highlighting the substantial financial commitment required for ongoing test development and innovation in this complex market. These high barriers to entry and ongoing development costs can limit the number of new tests reaching the market and potentially impact test affordability.

Opportunities

Growing Adoption of Precision Medicine is creating growth opportunities

The increasing global adoption of precision medicine approaches presents a significant growth opportunity for the core clinical molecular diagnostics market. Precision medicine relies heavily on molecular information to tailor treatments to individual patients based on their genetic makeup, tumor characteristics, or pathogen strains. This paradigm shift drives demand for molecular diagnostic tests that can identify specific biomarkers, gene mutations, or infectious disease subtypes crucial for guiding therapeutic decisions.

The development and approval of molecular companion diagnostics, specifically linked to targeted therapies, exemplifies this trend. The FDA’s database shows a growing number of approvals for molecular companion diagnostic devices; the FDA issued several such approvals in 2023, indicating the expanding role of molecular testing in selecting appropriate therapies and driving the market for tests integrated into personalized healthcare strategies.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the core clinical molecular diagnostics market, creating both challenges and potential areas of growth. Global economic conditions, such as inflation and shifts in healthcare spending priorities, can impact laboratory budgets, potentially affecting their capacity to invest in new molecular diagnostic instruments or the volume of tests they can run. Disruptions to global supply chains, often exacerbated by geopolitical tensions, can lead to increased costs and delays in acquiring essential reagents, components, and instruments needed for testing.

For example, the average inflation rate in the US was 4.1% in 2023, impacting operational costs for diagnostic laboratories and companies. However, during periods of heightened health security concerns or public health crises, governments often prioritize investment in diagnostic infrastructure; the US Centers for Disease Control and Prevention (CDC) budget for Infectious Diseases and Vaccinations in FY2023 exceeded US$4 billion, demonstrating continued government commitment to areas heavily reliant on molecular diagnostics, which can provide market stability and opportunities despite broader economic headwinds.

Current US tariff policies introduce complexities for the core clinical molecular diagnostics market, affecting manufacturing costs and the flow of goods. Tariffs on certain laboratory instruments, reagents, or components imported from specific countries can increase the cost of production for diagnostic companies or raise the purchase price for laboratories within the US, potentially impacting test affordability or limiting investment in new platforms. These trade barriers can also complicate the logistics of sourcing materials and distributing finished products internationally, creating inefficiencies and potential delays in the supply chain.

For instance, according to US Census Bureau data, the US imported medical goods, including diagnostic reagents and test kits, valued at billions of US dollars from various global regions in 2023, highlighting the scale of trade potentially subject to tariff considerations. While tariffs can present challenges through increased costs and supply chain disruptions, they may also incentivize domestic manufacturing or sourcing within the US, potentially fostering local industry growth and enhancing supply chain resilience in the long term, ultimately supporting market robustness.

Trends

Shift Towards Syndromic Testing and Decentralization is a recent trend

A notable recent trend in the core clinical molecular diagnostics market is the shift towards syndromic testing and decentralization of testing capabilities. Syndromic panels allow for the simultaneous detection of multiple pathogens causing similar symptoms from a single patient sample, providing faster and more comprehensive diagnoses for infectious diseases.

Concurrently, there is an increasing focus on developing and deploying molecular diagnostic platforms closer to the patient in point-of-care settings, reducing turnaround times and improving patient management. The need for rapid identification during respiratory seasons has accelerated this trend.

For instance, the FDA issued numerous Emergency Use Authorizations (EUAs) for multiplex molecular diagnostic panels capable of detecting multiple respiratory pathogens during the 2022-2023 flu and RSV season, reflecting the growing importance and adoption of these expanded, rapid testing capabilities outside of traditional central laboratories.

Regional Analysis

North America is leading the Core Clinical Molecular Diagnostics Market

North America dominated the market with the highest revenue share of 38.8% owing to several key factors. A significant driver was the sustained increase in demand for infectious disease testing. According to provisional data from the Centers for Disease Control and Prevention (CDC), the number of reported tuberculosis cases in the US saw an 8% increase from 9,622 in 2023 to 10,347 in 2024. This rise underscores the ongoing need for accurate and rapid molecular diagnostic tools for infectious agent identification.

Furthermore, the continuous advancements in diagnostic technologies and their subsequent regulatory approvals by the US Food and Drug Administration (FDA) have broadened the availability of sophisticated molecular tests. While a specific comprehensive list of all molecular diagnostic approvals for 2024 is extensive, the FDA’s continuous authorization of new medical devices and diagnostic tests, including those related to blood management and analysis, as highlighted in their 2024 analysis of drug approvals, indicates a supportive regulatory environment for market expansion.

Additionally, the Centers for Medicare & Medicaid Services (CMS) regularly updates its coding and reimbursement policies for molecular diagnostic tests, as seen in their quarterly updates to the MolDX: Molecular Diagnostic Tests (MDT) billing and coding article in 2024. These updates, including the addition and deletion of specific CPT codes for molecular tests, reflect the evolving landscape of clinical molecular diagnostics and influence market accessibility.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing healthcare expenditure across many countries in the region. The OECD’s “Health at a Glance: Asia/Pacific 2024” report highlights the diverse healthcare landscapes and the ongoing efforts towards achieving universal health coverage, suggesting a greater allocation of resources towards diagnostics.

The region’s rapidly aging population, as indicated in the United Nations Economic and Social Commission for Asia and the Pacific’s “Asia-Pacific Report on Population Ageing 2022,” is also projected to drive demand for advanced diagnostic solutions for age-related diseases and overall health management.

Moreover, the high prevalence of infectious diseases in the Asia Pacific, as noted in the World Health Organization’s 2024 report on tuberculosis, where the South-East Asia region accounted for over 45% of the global TB incidence in 2023, will likely necessitate the widespread adoption of sensitive molecular diagnostic tests for timely and effective disease management.

Furthermore, various government initiatives across the Asia Pacific aimed at improving healthcare infrastructure and promoting early disease detection are anticipated to bolster the market. For instance, increased funding for research and development in molecular diagnostics and public health efforts for disease surveillance, as mentioned by market reports, are expected to contribute significantly to the market’s expansion in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the core clinical molecular diagnostics market drive growth through strategic investments in research and development, expanding their product portfolios, and enhancing global distribution networks. They focus on developing advanced diagnostic platforms, reagents, and bioinformatics tools to improve the accuracy, efficiency, and scalability of molecular testing.

Collaborations with academic institutions, research organizations, and healthcare providers facilitate the integration of new technologies and broaden market access. Additionally, targeting emerging markets with increasing healthcare infrastructure and rising disease prevalence presents significant growth opportunities.

Thermo Fisher Scientific, headquartered in Waltham, Massachusetts, is a global leader in laboratory instruments, reagents, and consumables. The company offers a comprehensive range of molecular diagnostic products, including PCR and sequencing-based assays, to support clinical applications.

In the first quarter of 2025, Thermo Fisher reported revenues of $10.36 billion, surpassing analysts’ expectations, driven by steady demand for its tools and services used in clinical research and therapy development . The company operates in over 50 countries, serving customers in academia, healthcare, and industry sectors, and continues to expand its presence through strategic acquisitions and product innovations.

Top Key Players in the Core Clinical Molecular Diagnostics Market

- Quest Diagnostics

- Qiagen

- Myriad Genetics

- CORE Diagnostics

- Bio-Rad Laboratories

- Biomerieux

- Roche Diagnostics

- CORE Diagnostics

Recent Developments

- In July 2024, Roche Diagnostics unveiled its latest advancements in diagnostic systems, which includes a cutting-edge mass spectrometry solution. This breakthrough was presented at the 2024 ADLM Scientific Meeting and Clinical Lab Expo held in Chicago.

- In May 2023, CORE Diagnostics expanded its operations by launching a new satellite laboratory in East Delhi, India. This expansion is part of the company’s initiative to enhance testing capacity and address the rising demand for accurate diagnostic services in the area.

Report Scope

Report Features Description Market Value (2024) US$ 5.4 billion Forecast Revenue (2034) US$ 13.5 billion CAGR (2025-2034) 9.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents, Software & Services, and Instruments), By Application (Infectious Diseases, Genetic Disorders, Cancer Screening, and Others), By Technique (PCR, Nucleic Acid Sequencing, Fluorescence in situ Hybridization (FISH), and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Quest Diagnostics, Qiagen, Myriad Genetics, CORE Diagnostics, Bio-Rad Laboratories, Biomerieux, Roche Diagnostics, and CORE Diagnostics. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Core Clinical Molecular Diagnostics MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Core Clinical Molecular Diagnostics MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Quest Diagnostics

- Qiagen

- Myriad Genetics

- CORE Diagnostics

- Bio-Rad Laboratories

- Biomerieux

- Roche Diagnostics

- CORE Diagnostics