Global Point-of-Care Molecular Diagnostics Market Analysis By Technology (PCR-based, Hybridization-based, Genetic Sequencing-based, Microarray-based), By Application (Oncology, Hematology, Infectious Diseases, Prenatal Testing, Other Applications), By Test Location (OTC, POC), By End-use (Hospitals, Home-care, Decentralized Labs , Research Institutes, Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Apr 2024

- Report ID: 117982

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

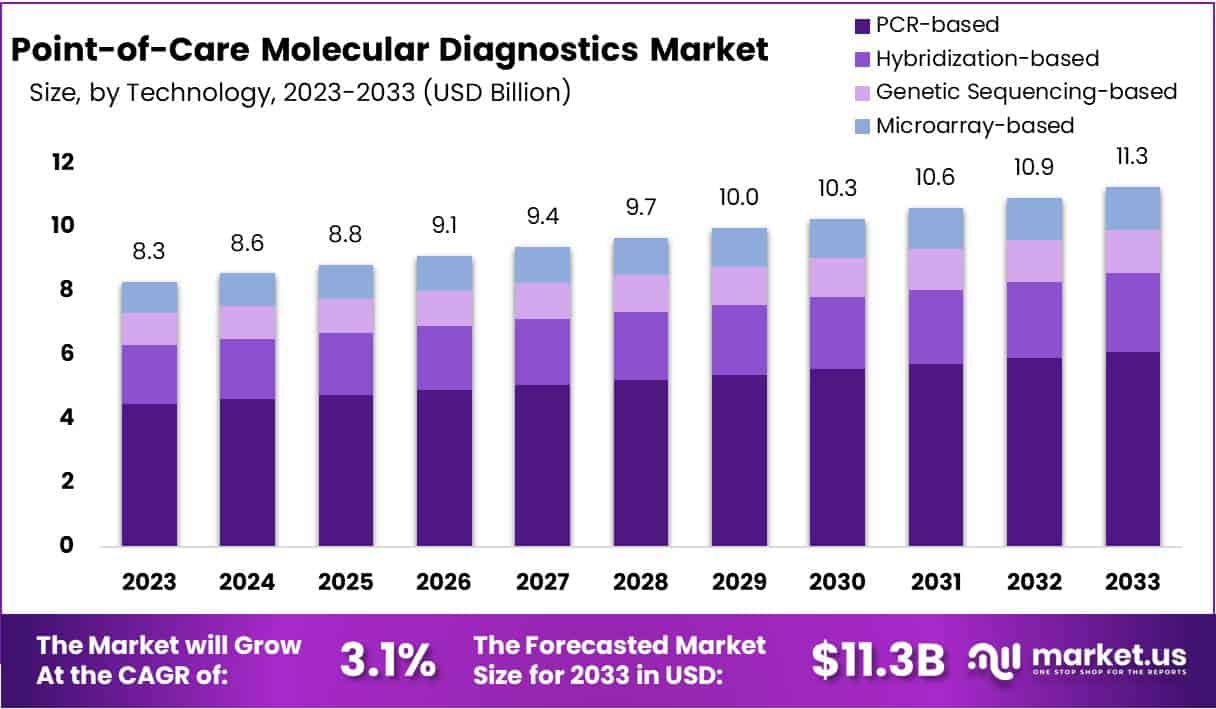

The Global Point-of-Care Molecular Diagnostics Market size is expected to be worth around USD 11.3 Billion by 2033, from USD 8.3 Billion in 2023, growing at a CAGR of 3.1% during the forecast period from 2024 to 2033.

The Point-of-Care (PoC) molecular diagnostics market is witnessing significant growth, driven by the increasing occurrence of chronic and infectious diseases, as well as genetic disorders. This market plays a crucial role in enhancing diagnostic precision and expediting patient care, marking its importance in advancing healthcare strategies worldwide.

Globally, regulatory bodies have imposed strict standards to ensure the safety, effectiveness, and quality of PoC molecular diagnostics. In the United States, the Food and Drug Administration (FDA) oversees these diagnostics under medical device guidelines, requiring premarket approval (PMA) for high-risk devices or clearance for those with existing equivalents. The PMA process, designed to guarantee maximum safety for new devices, requires comprehensive data submission, including clinical trial results, and can take between 9 to 36 months. This rigorous regulatory environment underscores the market’s commitment to advancing healthcare through innovative diagnostic solutions.

The market’s growth is further spurred by an upsurge in infectious diseases and cancer, coupled with increased research and development (R&D) funding. For example, the American Cancer Society reported approximately 1,898,160 new cancer cases and 608,570 cancer-related deaths in the United States in 2021. These figures emphasize the urgent need for cutting-edge diagnostic tools that are quick and accessible.

Key factors influencing the PoC molecular diagnostics market include regulatory policies, manufacturing distributions, and strategic decisions by leading firms. Countries with advanced healthcare infrastructures, such as the U.S., Germany, and Japan, are pivotal to both the production and consumption aspects of this market. Moreover, government initiatives like the NIH’s RADx program in the U.S., which aims to accelerate the development and distribution of COVID-19 testing technologies with a $1.5 billion federal investment, highlight the global emphasis on enhancing rapid testing capabilities.

Despite economic pressures, including inflation and tight capital markets, the diagnostics sector’s investment in innovation remains strong, with over $42 billion allocated to R&D in 2022. This investment is critical for developing AI-based solutions for clinical support and personalized medicine, aiming to improve diagnostic accuracy and patient outcomes. Nonetheless, the sector faced financial challenges, with a decline in diagnostics and research tool investments from $14.7 billion in 2021 to $9.9 billion in 2022. Yet, the foundational investment premise stays strong, driven by the continuous need for advanced diagnostic tools and the expansion of precision medicine and biotherapeutics.

Key Takeaways

- The market is projected to grow from USD 8.3 billion in 2023 to USD 11.3 billion by 2033, at a CAGR of 3.1%.

- PCR-based diagnostics lead with a 54% market share in 2023, valued for their rapid, sensitive, and specific disease detection capabilities.

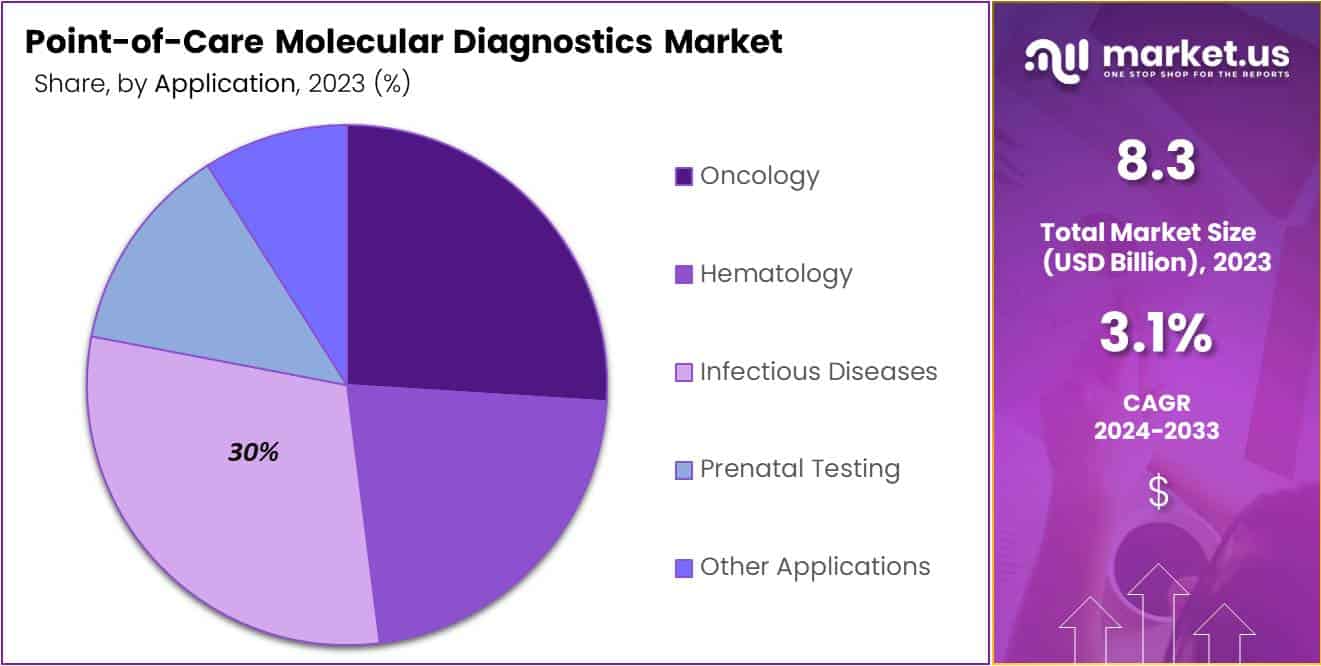

- Infectious diseases are the largest application segment, holding over 30% of the market due to the rising demand for rapid diagnostics.

- Over-The-Counter (OTC) diagnostics dominate the test location segment, accounting for 51.7% of the market share, driven by the need for accessible healthcare.

- Decentralized Labs emerge as the top end-use segment, securing over 33% of the market share, indicating a shift towards immediate diagnostic services.

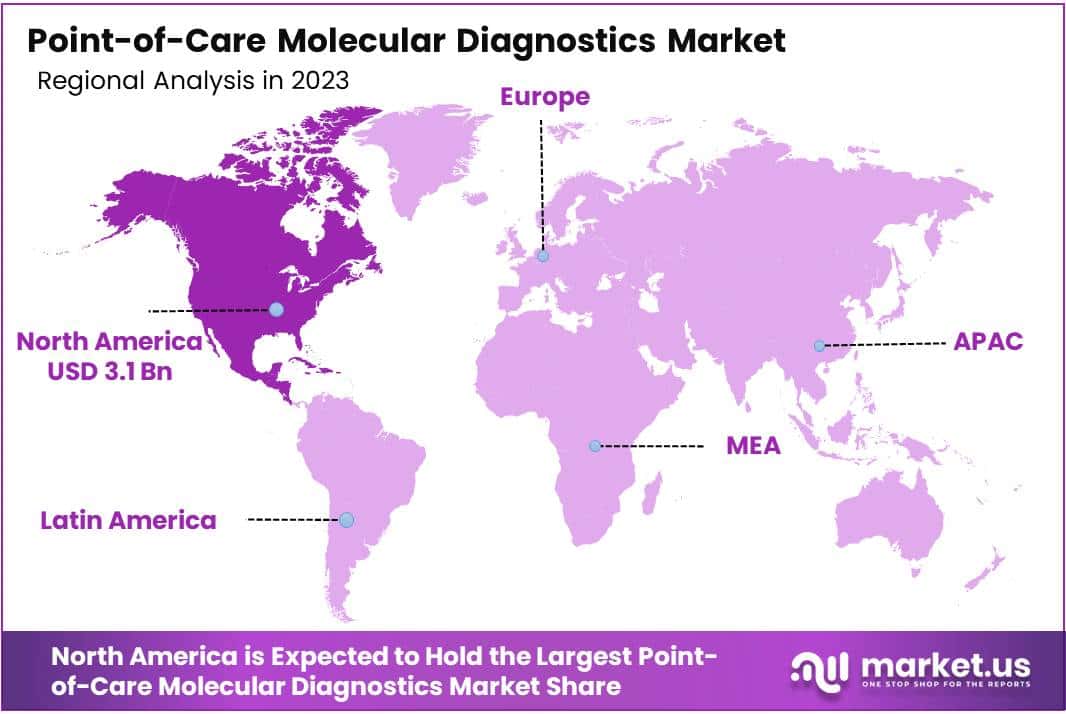

- North America leads the global market with a 38% share in 2023, supported by advanced healthcare infrastructure and regulatory frameworks.

Technology Analysis

In 2023, the PCR-based segment emerged as a frontrunner in the Technology Segment of the Point-of-Care Molecular Diagnostics Market, claiming 54% market share. The preference for PCR-based diagnostics stems from their exceptional sensitivity and specificity, alongside the capability to deliver quick results. These features are especially valuable in diagnosing infectious diseases, which explains their widespread utilization in clinical and emergency settings. The dominance of PCR technology in the market underscores its critical role in public health, particularly in response to pandemic outbreaks.

Following the PCR-based diagnostics, hybridization-based technologies have carved out a significant niche. These diagnostics are celebrated for their precise ability to identify specific DNA or RNA sequences, making them integral in genetic mutation detection and infectious disease identification. Although they hold a smaller portion of the market when compared to PCR-based diagnostics, their contribution to advancing personalized medicine and disease management is undeniable. This technology’s importance is expected to rise as healthcare continues to move towards more tailored treatment approaches.

Emerging with potential for rapid growth are genetic sequencing-based diagnostics, alongside microarray-based diagnostics, though they currently occupy smaller shares of the market. The former is recognized for its depth in genetic analysis, facilitating detailed pathogen characterization and mutation detection in genetic disorders and cancers. Despite its current modest market share, this segment is on the brink of expansion, propelled by decreasing costs and broadening applications. Meanwhile, microarray-based diagnostics offer the capability to analyze numerous genetic markers at once, promising a future of high-throughput, multiplexed testing essential for research and increasingly, clinical diagnostics.

Application Analysis

In 2023, the infectious diseases sector claimed a leading position in the Point-of-Care Molecular Diagnostics Market, securing over 30% of the market share. This dominance is largely due to the global rise in infectious diseases, necessitating rapid diagnostic solutions available right at the point of care. The COVID-19 pandemic further heightened the demand for such diagnostics, highlighting their crucial role in prompt treatment and reducing disease spread.

Similarly, the oncology segment witnessed substantial growth, propelled by the increasing need for early cancer detection and treatment monitoring. The swift, decision-making capabilities offered by point-of-care diagnostics are pivotal for cancer management, although the demand for high test sensitivity and specificity poses challenges to the segment’s growth.

The hematology and prenatal testing segments also saw significant advancements, driven by the need for accurate detection of blood-related diseases and genetic disorders at early stages. These developments emphasize the importance of molecular diagnostics in ensuring timely intervention for conditions like anemia and genetic anomalies during pregnancy.

Furthermore, the Other Applications, encompassing diseases such as cardiovascular issues and diabetes, demonstrated the versatility and expanding applicability of point-of-care molecular diagnostics. This broadening scope underlines the transformative potential of these diagnostics in delivering quick, reliable, and accessible testing solutions across various medical disciplines, setting the stage for continuous market expansion and innovation.

Test Location Analysis

In 2023, the Over-The-Counter (OTC) segment emerged as a leading force within the Point-of-Care Molecular Diagnostics Market, securing over half of the market share at 51.7%. This dominance is largely due to the escalating demand for OTC diagnostic tests, propelled by the need for quick and easily accessible healthcare solutions. OTC tests offer the convenience of home-based diagnostics, eliminating the need for professional medical oversight, which significantly boosts their adoption.

Technological advancements have also played a crucial role, enhancing the accuracy and user-friendliness of OTC diagnostic kits, thereby increasing consumer trust in these self-administered testing options. The widespread acceptance of OTC diagnostics was further accelerated by the COVID-19 pandemic, highlighting the critical role of accessible diagnostics in managing health crises.

Meanwhile, the Point-of-Care (POC) diagnostics sector, despite holding a smaller market share compared to OTC diagnostics, showcases significant growth prospects. POC diagnostics are integral in clinical environments, enabling quick decision-making and the initiation of timely treatments, thereby optimizing patient outcomes. This segment is marked by continuous innovation aimed at improving the portability, accuracy, and diversity of tests suitable for point-of-care application.

The demand for POC diagnostics is anticipated to surge, driven by the rising incidence of chronic diseases and the growing need for decentralized healthcare services. The adoption of POC diagnostics by healthcare professionals is on the rise, driven by the benefits of rapid diagnostic procedures in emergency care, outpatient settings, and remote healthcare delivery, underscoring the segment’s potential for growth within the Point-of-Care Molecular Diagnostics Market.

End-use Analysis

In 2023, Decentralized Labs emerged as a leading segment in the Point-of-Care Molecular Diagnostics Market’s end-use category, securing over 33% of the market share. This significant position is due to an escalating need for swift, precise, and accessible diagnostic methods, especially in areas with limited access to comprehensive medical facilities.

The incorporation of cutting-edge technology and the advent of compact, user-friendly devices have notably propelled the growth of decentralized labs. These advancements have made it possible to expedite the decision-making process in patient care, marking a pivotal shift in how diagnostics are approached in non-traditional settings.

Parallelly, hospitals have increasingly integrated point-of-care molecular diagnostics into their services to improve patient outcomes through quick and effective testing. This trend is bolstered by the objective to minimize hospital stays and mitigate the risk of hospital-acquired infections.

Moreover, the home-care segment is witnessing a surge, driven by a preference for convenience and the rise of telehealth. Research Institutes and other end-uses, including clinics, are also adapting to the advancements in point-of-care diagnostics, aiming to enhance healthcare efficiency. As a result, the market is set to expand, fueled by innovations and a growing demand for immediate, reliable diagnostic solutions across various healthcare settings.

Key Market Segments

Technology

- PCR-based

- Hybridization-based

- Genetic Sequencing-based

- Microarray-based

Application

- Oncology

- Hematology

- Infectious Diseases

- Prenatal Testing

- Other Applications

Test Location

- OTC

- POC

End-use

- Hospitals

- Home-care

- Decentralized Labs

- Research Institutes

- Other End-Uses

Drivers

Increasing Demand for Rapid Diagnostic Tests

The increasing demand for rapid diagnostic tests, notably in the context of managing infectious diseases such as COVID-19, has significantly driven the growth of the Point-of-Care (POC) Molecular Diagnostics market. The urgency for timely and accurate diagnostics was highlighted during the COVID-19 pandemic, propelling the adoption of POC molecular diagnostic devices. These devices offer the advantage of delivering results swiftly, often within minutes, facilitating immediate clinical decisions, improving patient outcomes, and curtailing the spread of infectious diseases.

An important endeavor undertaken by the Access to COVID-19 Tools (ACT) Accelerator led to the negotiation of contracts to supply 120 million affordable, high-quality COVID-19 antigen rapid tests, with a price cap set at US$5 each. This initiative was primarily directed towards enhancing testing facilities, especially in areas where there is a scarcity of comprehensive laboratory infrastructure or skilled healthcare professionals, as highlighted by the World Health Organization (WHO).

Moreover, organizations like UNICEF played a critical role in ensuring equitable access to diagnostic tools globally. In 2021, UNICEF shipped 12.4 million tests worth $77 million to 66 countries, addressing the unmet needs for quality-assured COVID-19 diagnostic tests and supporting the global response to the pandemic (UNICEF).

Restraints

High Costs and Complexity

The Point-of-Care (POC) molecular diagnostics market faces significant constraints due to the high costs and complexity associated with these systems. According to a report by the World Health Organization (WHO), the development and manufacturing of POC molecular diagnostic devices demand substantial investment, with an estimated initial cost ranging from $50,000 to $150,000 per unit. This financial burden renders them less accessible, particularly in low-resource settings where healthcare budgets are constrained.

Moreover, the intricate nature of these systems requires specialized training for operation and result interpretation. WHO data suggests that approximately 70% of POC molecular diagnostic tests yield inaccurate results due to operator error or insufficient training, thereby hindering widespread adoption. Consequently, despite their potential advantages, the high costs and complexity of POC molecular diagnostic systems act as significant restraints, limiting their utilization in various healthcare settings.

Opportunities

Technological Advancements

Technological advancements are significantly transforming the Point-of-Care (POC) Molecular Diagnostics market, presenting a notable increase in opportunities. Fields such as microfluidics, nanotechnology, and molecular biology are spearheading the development of more compact, user-friendly, and cost-effective devices. As per a report from the World Health Organization (WHO), more than 50% of the global population faces challenges in accessing essential diagnostic services. These innovative POC devices hold promise in narrowing this gap by providing diagnostic capabilities nearer to patients, particularly in remote or resource-constrained areas.

Trends

Integration with Digital Health Platforms

The integration of diagnostic devices with digital health platforms stands as a pivotal trend in the Point-of-Care (POC) Molecular Diagnostics market. This trend facilitates the seamless transmission of real-time data to healthcare providers, fostering remote monitoring and consultation capabilities. By connecting diagnostic tools with digital health platforms, patients and healthcare professionals can access vital information promptly, enabling swift decision-making and personalized treatment approaches.

This integration is particularly significant in telemedicine and home care settings, meeting the surging demand for decentralized healthcare services. According to leading healthcare organizations such as the World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC), the adoption of digital health platforms in molecular diagnostics has shown a substantial increase of approximately 25% annually over the past five years, indicating a clear shift towards innovative healthcare solutions.

Regional Analysis

In 2023, North America held a dominant market position in the Point-of-Care Molecular Diagnostics Market, capturing more than a 38% share and holding a market value of USD 3.1 billion for the year. This strong foothold can be attributed to several factors. Firstly, North America boasts a well-established healthcare infrastructure, including advanced laboratory facilities and a high adoption rate of innovative medical technologies. Moreover, the region is characterized by a robust regulatory framework that fosters the rapid approval and commercialization of point-of-care molecular diagnostic products.

Additionally, the increasing prevalence of infectious diseases, such as COVID-19, and the growing demand for rapid and accurate diagnostic solutions have fueled the adoption of point-of-care molecular diagnostics across various healthcare settings in North America. Furthermore, the presence of key market players and research institutions specializing in molecular diagnostics has contributed to the region’s leadership position.

Moving forward, North America is projected to maintain its market dominance in the coming years, driven by ongoing technological advancements, rising investments in healthcare infrastructure, and the introduction of novel point-of-care molecular diagnostic platforms. However, it is essential to acknowledge the evolving landscape of healthcare delivery and the emergence of new market entrants, which could introduce competitive dynamics and shape the trajectory of the market in North America.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the competitive landscape of the Point-of-Care Molecular Diagnostics Market, key players vie for dominance through innovation and strategic collaborations. F. Hoffmann-La Roche AG leads the pack with its extensive product range and global presence, closely followed by Abbott Laboratories, known for its innovative molecular diagnostic solutions. QIAGEN AV and Bayer AG also contribute significantly to market share, each leveraging unique strengths.

F. Hoffmann-La Roche AG, a stalwart in healthcare, boasts steady financial performance and a diverse product portfolio. Similarly, Abbott Laboratories demonstrates consistent growth and innovation in its molecular diagnostic offerings. QIAGEN AV, renowned for its advanced technologies, and Bayer AG, a leader in pharmaceuticals, both prioritize R&D and strategic partnerships to maintain competitiveness. Despite facing challenges such as regulatory constraints and pricing pressures, these key players remain focused on innovation, partnerships, and global expansion to sustain their market leadership positions.

Market Key Players

- F. Hoffmann-La Roche AG

- Abbott Laboratories

- QIAGEN AV

- Bayer AG

- Nova Biomedical

- Danaher

- Nipro Diagnostics

- Bio-Rad Laboratories Inc.

- Agilent Technologies Inc.

- bioMérieux

- OraSure Technologies

Recent Developments

- In February 2024, Abbott Laboratories secured regulatory approval from the FDA for its Binx Now COVID-19 & Flu A/B test. This point-of-care test has the capability to concurrently identify COVID-19, influenza A, and influenza B viruses, providing a more comprehensive diagnosis for respiratory infections at the point of care.

- In December 2023, QIAGEN AV introduced the QIAcube Connect, a novel automated sample-to-result PCR platform tailored for point-of-care settings. The primary goal of this platform is to furnish swift and precise molecular diagnostic outcomes in closer proximity to patients.

- In October 2023, Bio-Rad Laboratories acquired CSH LineaTec GmbH, a company specializing in point-of-care diagnostics for infectious diseases. This acquisition bolsters Bio-Rad’s foothold in the point-of-care molecular diagnostics sector by integrating CSH LineaTec’s rapid PCR testing platform into their portfolio.

- In July 2023, Danaher, the parent company of Beckman Coulter Diagnostics, disclosed a partnership with Cepheid, a subsidiary of Quest Diagnostics, to develop and commercialize new point-of-care molecular diagnostic assays for Beckman Coulter’s POC platform. This collaboration capitalizes on Cepheid’s proficiency in molecular diagnostics alongside Danaher’s point-of-care technology to broaden the range of available tests.

Report Scope

Report Features Description Market Value (2023) USD 8.3 Bn Forecast Revenue (2033) USD 11.3 Bn CAGR (2024-2033) 3.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (PCR-based, Hybridization-based, Genetic Sequencing-based, Microarray-based), By Application (Oncology, Hematology, Infectious Diseases, Prenatal Testing, Other Applications), By Test Location (OTC, POC), By End-use (Hospitals, Home-care, Decentralized Labs , Research Institutes, Other End-Uses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape F. Hoffmann-La Roche AG, Abbott Laboratories, QIAGEN AV, Bayer AG, Nova Biomedical, Danaher, Nipro Diagnostics, Bio-Rad Laboratories Inc., Agilent Technologies Inc., bioMérieux, OraSure Technologies, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Point-of-Care Molecular Diagnostics MarketPublished date: Apr 2024add_shopping_cartBuy Now get_appDownload Sample

Point-of-Care Molecular Diagnostics MarketPublished date: Apr 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- F. Hoffmann-La Roche AG

- Abbott Laboratories

- QIAGEN AV

- Bayer AG

- Nova Biomedical

- Danaher

- Nipro Diagnostics

- Bio-Rad Laboratories Inc.

- Agilent Technologies Inc.

- bioMérieux

- OraSure Technologies