PCR Molecular Diagnostics Market By Product Type (Instrument, Software, and Reagents & Consumables), By Application (Oncology Testing, Infectious Disease Testing, Others), By End-user (Hospitals & Clinics, Diagnostics Laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 140083

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

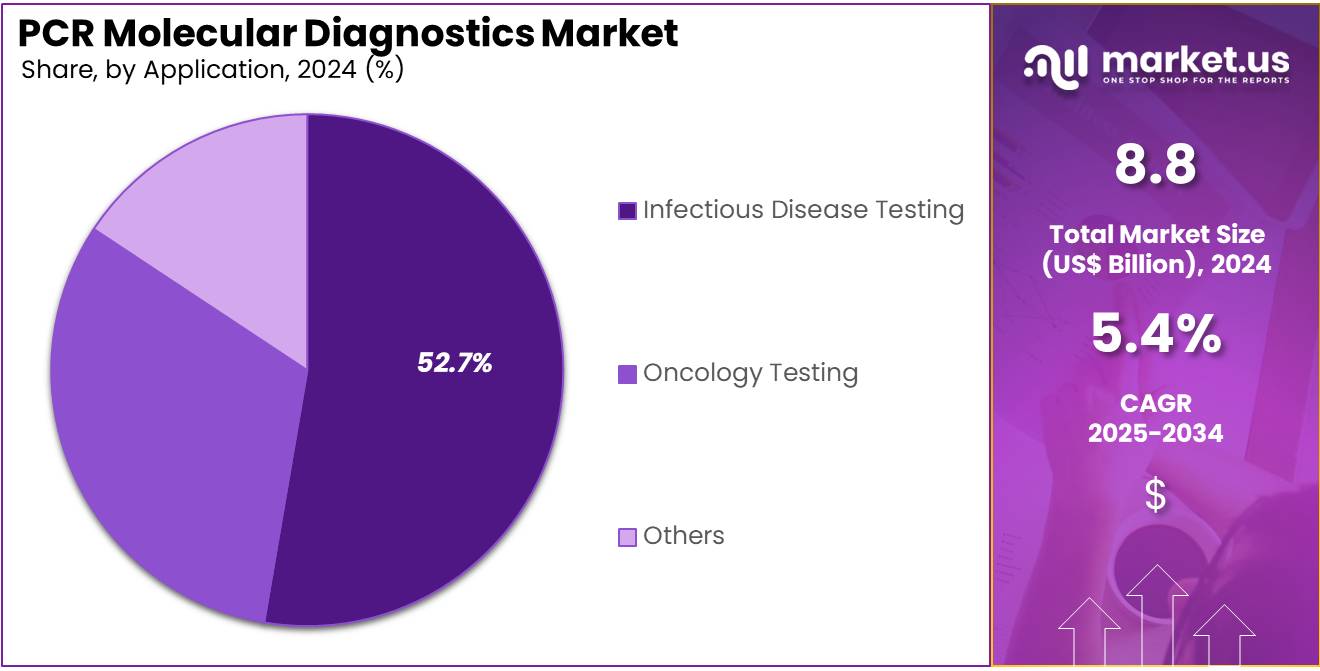

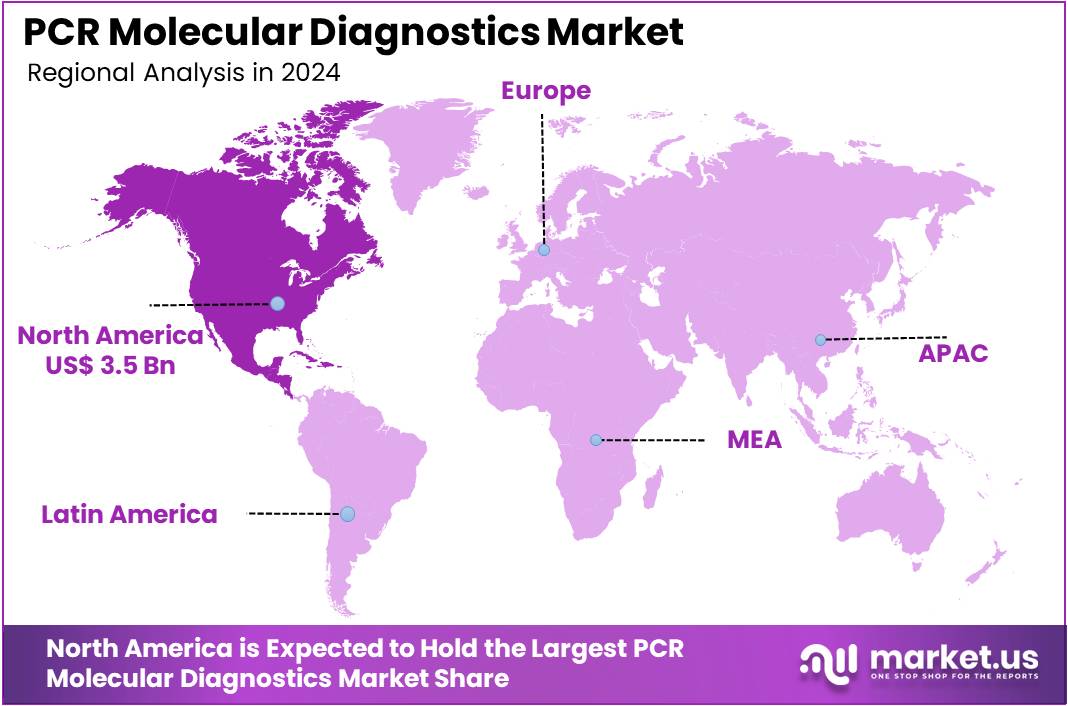

The PCR Molecular Diagnostics Market Size is expected to be worth around US$ 14.9 billion by 2034 from US$ 8.8 billion in 2024, growing at a CAGR of 5.4% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.8% share and holds US$ 3.5 Billion market value for the year.

Growing demand for rapid and precise diagnostic solutions has driven advancements in PCR molecular diagnostics. Healthcare providers use PCR technology to detect infectious diseases, genetic disorders, and cancer biomarkers with high accuracy. In April 2024, Australian-based Speed Pty Ltd. launched an advanced qPCR test capable of detecting 14 respiratory viruses simultaneously, offering fast results at a competitive price.

Innovations in quantitative and digital PCR have improved multiplexing, reduced turnaround times, and expanded point-of-care applications. Artificial intelligence and cloud-based platforms enhance data analysis, streamlining clinical decision-making. Pharmaceutical companies rely on PCR for biomarker discovery, drug development, and personalized medicine.

Expanding applications in food safety, veterinary diagnostics, and environmental monitoring create new growth opportunities. Miniaturization and automation of PCR systems have made testing more accessible in decentralized settings. Companies invest in cost-effective and portable PCR solutions to improve efficiency and affordability. As demand for early disease detection rises, PCR molecular diagnostics will continue evolving to meet healthcare and research needs.

Key Takeaways

- In 2024, the market for PCR Molecular Diagnostics generated a revenue of US$ 8.8 billion, with a CAGR of 5.4%, and is expected to reach US$ 14.9 billion by the year 2034.

- The product type segment is divided into instrument, software, and reagents & consumables, with reagents & consumables taking the lead in 2024 with a market share of 46.8%.

- Considering application, the market is divided into oncology testing, infectious disease testing, others. Among these, infectious disease testing held a significant share of 52.7%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, diagnostics laboratories, and others. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 54.3% in the PCR Molecular Diagnostics market.

- North America led the market by securing a market share of 39.8% in 2024.

Product Type Analysis

The reagents & consumables segment led in 2024, claiming a market share of 46.8% owing to as demand for molecular diagnostics continues to rise. Reagents and consumables, such as primers, enzymes, and buffers, play an essential role in the accuracy and efficiency of PCR tests. The growth of this segment is likely to be driven by the increasing volume of diagnostic tests, particularly for infectious diseases and genetic testing, as healthcare providers demand more cost-effective and reliable testing solutions.

Additionally, advancements in PCR technology and the need for rapid testing are projected to increase the demand for specialized reagents and consumables. As a result, manufacturers are anticipated to focus on improving product quality and availability to cater to a broader market.

Application Analysis

The infectious disease testing held a significant share of 52.7% due to the increasing prevalence of infectious diseases worldwide. PCR technology provides accurate, fast, and sensitive detection of pathogens, making it a preferred method for diagnosing conditions such as COVID-19, tuberculosis, and other infectious diseases.

The growth of this segment is expected to be fueled by the increasing demand for early diagnosis, effective treatment, and the need for efficient outbreak monitoring. Governments and healthcare organizations are anticipated to further invest in PCR testing infrastructure, supporting the expansion of this market segment and addressing the rising global burden of infectious diseases.

End-user Analysis

The hospitals & clinics segment had a tremendous growth rate, with a revenue share of 54.3% as healthcare facilities continue to prioritize accurate and timely diagnostic tools. Hospitals and clinics are expected to increase their use of PCR-based diagnostics to improve patient outcomes, especially in infectious disease management, oncology, and genetic testing.

The growing emphasis on personalized medicine and early disease detection is anticipated to drive the adoption of PCR molecular diagnostics in clinical settings. Additionally, healthcare institutions are likely to invest in advanced diagnostic technologies to meet the rising demand for rapid, point-of-care testing, further accelerating the growth of the hospitals & clinics segment.

Key Market Segments

By Product Type

- Instrument

- Software

- Reagents & Consumables

By Application

- Oncology Testing

- Infectious Disease Testing

- Others

By End-user

- Hospitals & Clinics

- Diagnostics Laboratories

- Others

Drivers

Growing Prevalence of Cancer Driving the PCR Molecular Diagnostics Market

Rising cancer cases are anticipated to drive demand for PCR molecular diagnostics as healthcare providers prioritize early detection and precision medicine. The World Health Organization highlighted a concerning rise in cancer cases across Asia, reporting 9.84 million new diagnoses in 2022. Projections suggest a significant surge, with cases expected to reach 16.2 million by 2045, representing a 64.5% increase.

This rising disease burden underscores the necessity for advanced diagnostic technologies to enhance early detection and treatment efficacy. PCR-based molecular diagnostics provide high sensitivity in detecting cancer-associated genetic mutations, aiding in personalized therapy selection. The integration of liquid biopsy techniques with real-time PCR is improving non-invasive cancer detection and monitoring.

Pharmaceutical companies and research institutions are expanding collaborations to develop advanced PCR assays for targeted oncology applications. Governments and healthcare organizations are increasing funding to promote cancer screening initiatives using PCR-based technologies. The expansion of PCR diagnostics into low-resource settings is improving global access to accurate and timely cancer diagnosis.

The rapid turnaround time of PCR tests enables oncologists to make informed treatment decisions faster, improving patient outcomes. Next-generation PCR advancements, such as digital PCR, are providing greater precision in quantifying cancer biomarkers. The shift toward companion diagnostics in precision oncology is driving demand for PCR-based testing solutions. The growing adoption of automation in PCR molecular diagnostics is enhancing efficiency and reducing errors in clinical laboratories.

Restraints

High Cost of PCR Molecular Diagnostics Equipment and Testing

Increasing concerns over the affordability of PCR molecular diagnostics are anticipated to limit market expansion, particularly in low- and middle-income countries. The initial cost of acquiring high-end PCR instruments can be prohibitively expensive for small healthcare facilities. Routine PCR tests, particularly those used in oncology, require expensive reagents and consumables, increasing operational costs.

Many healthcare systems face reimbursement challenges, limiting patient access to PCR-based diagnostics. The need for specialized laboratory infrastructure and trained professionals to operate PCR systems adds to implementation difficulties. Strict regulatory approvals for new PCR tests can delay product launches and increase compliance costs.

Some cancer diagnostics rely on alternative molecular testing techniques, such as next-generation sequencing (NGS), which may reduce reliance on PCR-based solutions. In regions with limited healthcare funding, hospitals and clinics may prioritize cost-effective screening methods over advanced PCR testing.

Opportunities

Rise in Innovation as an Opportunity for the PCR Molecular Diagnostics Market

Growing technological advancements are anticipated to create new opportunities in the PCR molecular diagnostics sector by enhancing test accuracy, speed, and accessibility. In May 2024, MolBio Diagnostics, an Indian company, introduced its Truelab Real-Time quantitative micro PCR system, showcasing advancements in point-of-care diagnostics. The company is currently in the process of obtaining WHO prequalification for its hepatitis C PCR tests, reinforcing its commitment to global public health initiatives.

Additionally, MolBio is expanding its efforts in preventive diagnostics, with a strong focus on cervical cancer screening through HPV testing. The introduction of portable and handheld PCR devices is improving diagnostic access in remote and resource-limited regions. AI-driven PCR software solutions are enhancing data interpretation and reducing the risk of human error in clinical diagnostics.

Innovations in multiplex PCR technology are enabling simultaneous detection of multiple cancer biomarkers in a single test. The rise of cloud-based platforms for PCR data management is streamlining workflows and improving collaboration in research and clinical applications. Increased investments in precision medicine are fostering demand for PCR assays tailored to individual cancer profiles. The development of rapid, cost-effective PCR techniques is driving market growth by making molecular diagnostics more accessible to a wider patient population.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have a profound influence on the PCR molecular diagnostics market. On the positive side, increased healthcare investments and a heightened focus on improving public health infrastructure, especially after the COVID-19 pandemic, drive significant demand for PCR-based diagnostic tools. The rise of chronic diseases, infectious outbreaks, and global healthcare awareness contributes to market growth, especially in regions like Asia-Pacific and Latin America.

However, economic downturns and reduced healthcare budgets can limit spending on expensive diagnostic technologies, particularly in lower-income regions. Geopolitical factors, such as trade restrictions or regulatory changes, may disrupt the global supply chain, delaying the availability of essential PCR diagnostic kits and increasing costs. Despite these challenges, the growing adoption of personalized medicine, the need for rapid diagnostics, and continued advancements in PCR technology ensure long-term growth prospects for the market.

Trends

Advancements in Localized Disease Detection Driving the PCR Molecular Diagnostics Market

Rising advancements in localized disease detection are driving the PCR molecular diagnostics market. High demand for faster, more accurate, and region-specific diagnostic solutions pushes the development of technologies that enable quick detection of emerging diseases. Localized detection methods reduce reliance on centralized laboratories and enable more efficient and timely responses to public health emergencies.

These technologies are expected to enhance diagnostic capabilities, particularly in rural and underserved areas, improving access to healthcare. The rise in global travel and the increasing need for rapid infectious disease screening contribute to the growing adoption of PCR-based diagnostics. Increasing integration of PCR with mobile health platforms also supports its reach, ensuring that diagnostic capabilities are more accessible and affordable.

In August 2024, India witnessed the launch of the ErbaMDx MonkeyPox RT-PCR Kit, marking a significant advancement in localized disease detection. This diagnostic tool is expected to enhance early detection and containment efforts in response to emerging infectious diseases. As localized disease detection technologies continue to evolve, the market for PCR molecular diagnostics is anticipated to experience further expansion.

Regional Analysis

North America is leading the PCR Molecular Diagnostics Market

North America dominated the market with the highest revenue share of 39.8% owing to advancements in high-throughput testing and increasing demand for rapid, accurate disease detection. Roche Diagnostics’ launch of its first high-throughput respiratory test for Cobas analyzers in September 2024 significantly enhanced diagnostic capabilities by enabling the simultaneous detection of 12 viruses, including influenza A and B, RSV, and COVID-19.

The growing prevalence of respiratory infections and the need for streamlined workflows in clinical laboratories fueled the adoption of advanced PCR-based testing. Rising investment in research and development, particularly in infectious disease diagnostics and oncology, further supported market expansion. The widespread implementation of automation and AI-driven data analysis improved test efficiency and reduced turnaround times, making molecular diagnostics more accessible to healthcare providers.

Additionally, increasing government funding for public health initiatives and the expansion of precision medicine programs contributed to greater adoption of PCR-based solutions. The presence of leading biotech and pharmaceutical companies in the U.S. and Canada further strengthened innovation and market growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising healthcare investments and advancements in syndromic testing platforms. The introduction of Japan’s QIAstat-D syndromic testing system in April 2024 marked a major breakthrough in rapid pathogen detection, allowing identification of over 20 respiratory infections from a single sample.

Expanding healthcare infrastructure in countries like China, India, and South Korea is expected to enhance accessibility to advanced diagnostic tools. Increasing cases of infectious diseases and growing awareness of early disease detection are likely to drive market demand. Government initiatives supporting the adoption of next-generation molecular testing platforms are anticipated to accelerate growth.

Collaborations between regional healthcare providers and global diagnostic firms are projected to improve test affordability and availability. The rising adoption of AI-integrated diagnostic solutions is expected to enhance efficiency and accuracy, further strengthening the market’s expansion across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the PCR molecular diagnostics market focus on developing high-speed and multiplex testing solutions to enhance disease detection accuracy. Companies invest in research and development to integrate automation, real-time data analysis, and portable PCR systems for rapid and precise diagnostics.

Strategic collaborations with healthcare providers and research institutions help expand test accessibility and drive adoption in clinical and point-of-care settings. Geographic expansion into regions with increasing demand for infectious disease diagnostics supports further market growth.

Many players also emphasize cost-effective and user-friendly platforms to improve efficiency in laboratory and field applications. Roche Diagnostics is a leading company in this market, offering advanced PCR-based diagnostic solutions such as the cobas systems, which provide high-throughput and real-time testing capabilities.

The company focuses on continuous innovation and strong partnerships with healthcare institutions to enhance molecular diagnostic accuracy. Roche Diagnostics’ commitment to technological advancements and global expansion solidifies its position as a key player in the industry.

Top Key Players in the PCR Molecular Diagnostics Market

- Sysmex Corporation

- Siemens Healthineers AG

- QIAGEN

- Grifols

- Danaher

- BIOMERIEUX

- BD

- Abbott

Recent Developments

- In February 2024, Bruker announced the acquisition of ELITechGroup through a Share Purchase Agreement. This move strengthens Bruker’s position in the molecular diagnostics sector, expanding its portfolio with ELITechGroup’s expertise in specialized and mainstream PCR assays.

- In February 2023, Huwel Lifesciences unveiled a compact RT-PCR device capable of detecting multiple viral infections, including respiratory diseases and sexually transmitted infections, within 30 minutes. Designed for ease of use in clinics and corporate healthcare settings, the device delivers lab-quality results without the need for extensive technical training or specialized infrastructure.

Report Scope

Report Features Description Market Value (2024) US$ 8.8 billion Forecast Revenue (2034) US$ 14.9 billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Instrument, Software, and Reagents & Consumables), By Application (Oncology Testing, Infectious Disease Testing, Others), By End-user (Hospitals & Clinics, Diagnostics Laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sysmex Corporation, Siemens Healthineers AG, QIAGEN, Grifols, Danaher, BIOMERIEUX, BD, and Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  PCR Molecular Diagnostics MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

PCR Molecular Diagnostics MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sysmex Corporation

- Siemens Healthineers AG

- QIAGEN

- Grifols

- Danaher

- BIOMERIEUX

- BD

- Abbott