Multiomics Market By Product & Service (Products (Reagents & Consumables, Instruments & Platforms and Software & Analysis Tools) and Services), by Type (Bulk Multiomics and Single-cell Multiomics), By Platforms (Genomics, Proteomics, Transcriptomics, Metabolomics, Lipidomics, Microbiomics, Epigenomics, and Others), By Application (Cell Biology, Oncology, Neurology, and Immunology), By End Use (Academic and Research Institutes, Pharmaceutical & Biotechnology Companies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141823

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product & Service Analysis

- Type Analysis

- Platforms Analysis

- Application Analysis

- End-use Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Trends

- Regional Analysis

- Key Players Analysis

- Top Key Players in the Multiomics Market

- Recent Developments

- Report Scope

Report Overview

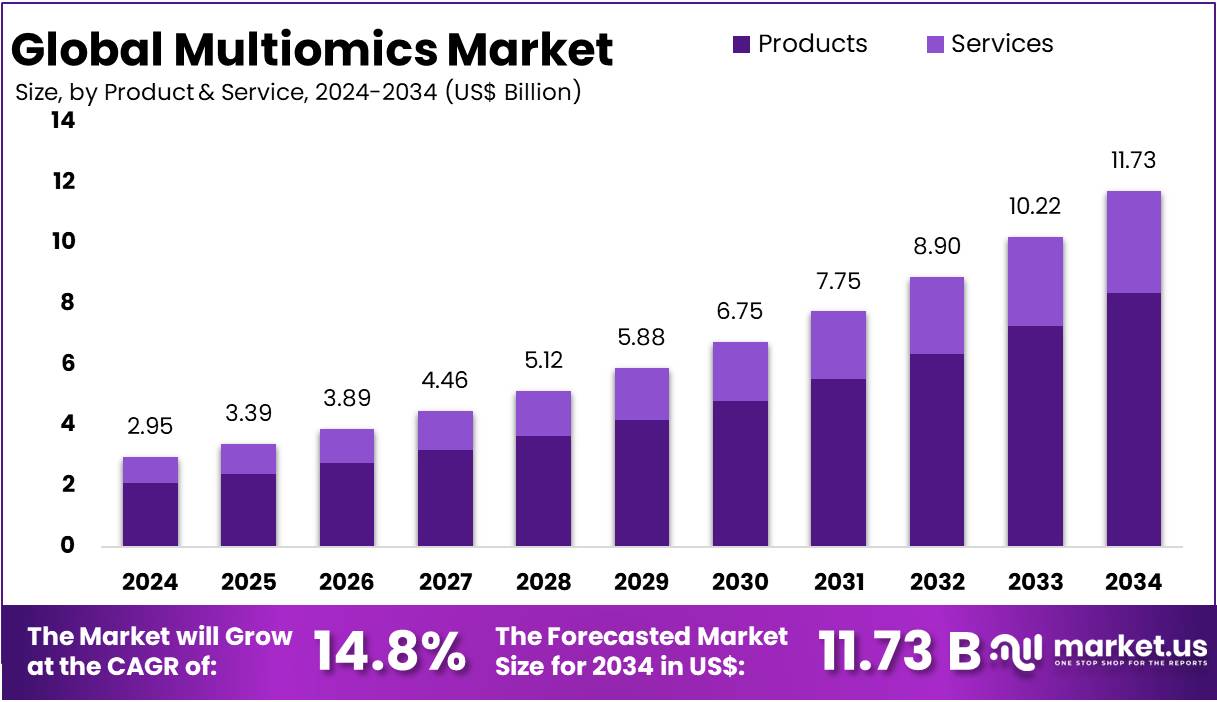

The Multiomics Market Size is expected to be worth around US$ 11.73 billion by 2034 from US$ 2.95 billion in 2024, growing at a CAGR of 14.8% during the forecast period 2025 to 2034.

Multiomics refers to the integration and analysis of multiple omics technologies (such as genomics, proteomics, metabolomics, transcriptomics, and others) to study biological systems at different molecular levels. By combining data from various omics fields, researchers can gain more comprehensive insights into disease mechanisms, personalized medicine, drug discovery, and other areas of life sciences. Multiomics helps uncover complex biological interactions that single-omics technologies cannot provide, enabling a holistic approach to understanding health and disease.

The multiomics market is expanding rapidly due to the growing demand for personalized medicine, advancements in high-throughput technologies, and the need for more precise diagnostics and treatments. Key sectors benefiting from multiomics include healthcare, pharmaceuticals, agriculture, and environmental science. The market is driven by innovations in genomics and proteomics, supported by major companies offering cutting-edge tools and platforms for data analysis and integration. As multiomics becomes more accessible and cost-effective, its applications are likely to increase across various industries.

Key Takeaways

- In 2024, the market for Multiomics generated a revenue of US$ 95 billion, with a CAGR of 14.8%, and is expected to reach US$ 11.73 billion by the year 2033.

- The product and services segment is divided into Products (Reagents & Consumables, Instruments & Platforms and Software & Analysis Tools) and Services, with products taking the lead in 2023 with a market share of 71.20%.

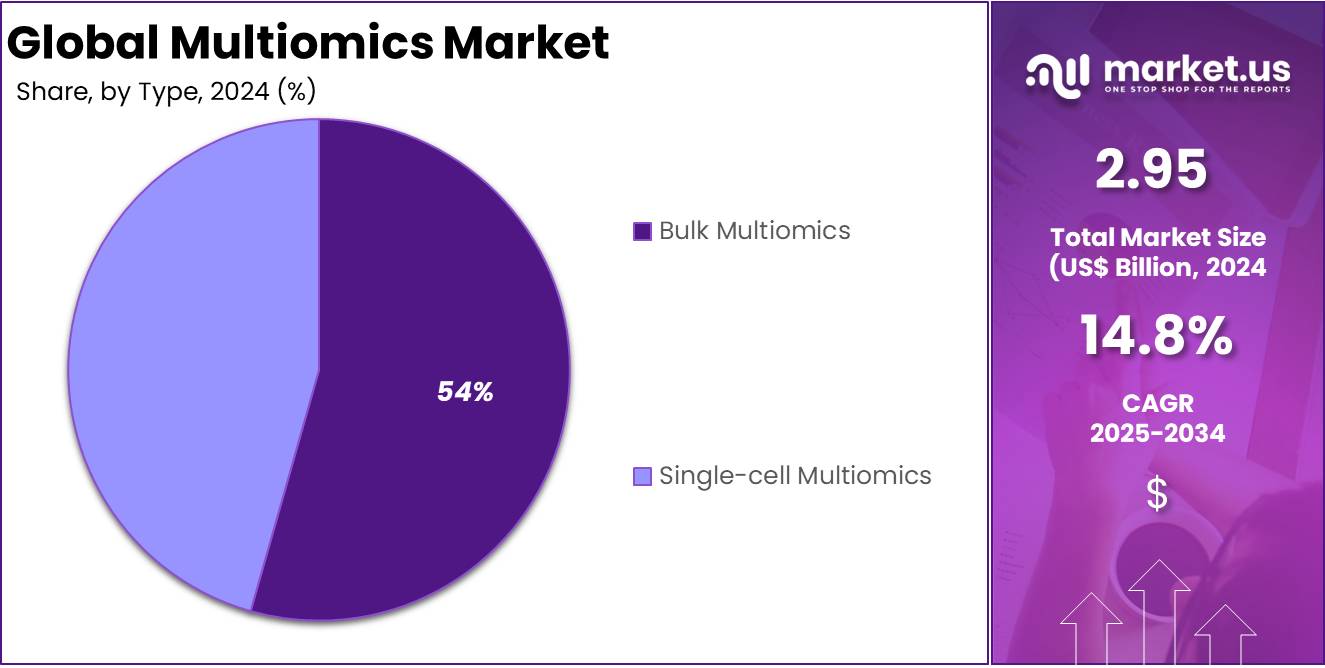

- By Type, the market is bifurcated into Bulk Multiomics and Single-cell Multiomics, with Bulk Multiomics leading the market with 54.4% of market share.

- Furthermore, concerning the platform segment, the market is segregated into Genomics, Proteomics, Transcriptomics, Metabolomics, Lipidomics, Microbiomics, Epigenomics, and Others. The Genomics sector stands out as the dominant player, holding the largest revenue share of 27.9% in the Multiomics market.

- By Application, the market is classified into Cell Biology, Oncology, Neurology, and Immunology with Oncology leading the market with 47.7% market share.

- Considering end user segment, the market is bifurcated into Academic and Research Institutes, Pharmaceutical & Biotechnology Companies, and Others. Pharmaceutical & Biotechnology Companies dominated the market with 45.2% market share.

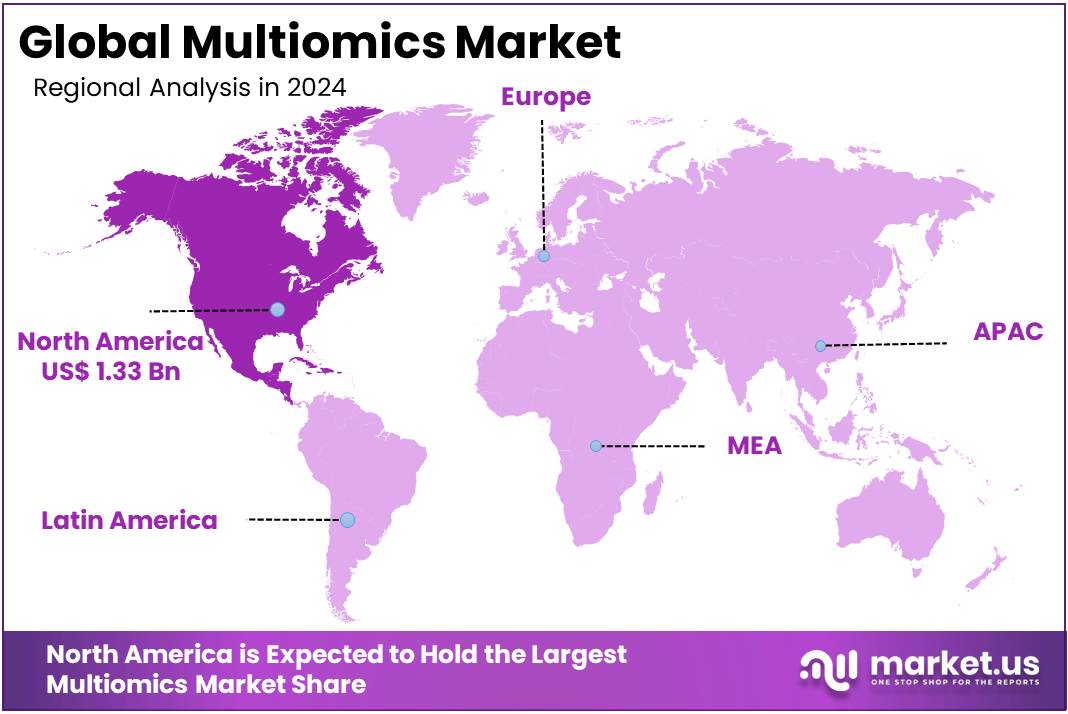

- North America led the market by securing a market share of 45.0% in 2023.

Product & Service Analysis

The Products segment leads the market with 71.20% market share with the Reagents & Consumables segment dominating, primarily driven by the essential role of reagents in sample preparation, sequencing, and analysis across genomics, proteomics, and metabolomics. Reagents are critical for data accuracy and reliability, making them the most frequently used products in multiomics research. The Instruments & Platforms segment follows closely, with next-generation sequencing (NGS) and mass spectrometry being integral to multiomics studies.

These platforms enable the high-throughput analysis required for large-scale, complex data generation in genomics, proteomics, and metabolomics. In February 2025, Illumina, Inc. has introduced a range of innovative advancements, positioning itself as the leader in offering the industry’s most extensive portfolio of omics solutions and sequencing applications.

These solutions, which cover genomics, spatial transcriptomics, single-cell analysis, CRISPR technologies, epigenetics, and data analytics software, will empower researchers to uncover groundbreaking insights into the underlying causes of diseases. Software & Analysis Tools are increasingly important as multiomics data sets grow in complexity. However, this segment is growing at a slower pace compared to reagents and instruments, as advanced software solutions are crucial for data integration and interpretation.

Type Analysis

the Bulk Multiomics segment dominates with 54.4% market share, primarily due to its broader applicability and established use in large-scale research studies. Bulk multiomics involves analyzing samples at a population level, providing valuable insights into overall trends and mechanisms in disease research, drug development, and agriculture. This approach is widely used in clinical studies, biomarker discovery, and personalized medicine, making it the leading segment.

The Single-cell Multiomics segment is experiencing rapid growth, driven by its ability to provide detailed insights into the heterogeneity of individual cells, which is particularly valuable in cancer research, immunology, and neuroscience. In June 2024, Mission Bio, a pioneer in single-cell multi-omics solutions for precision medicine, has today unveiled the Tapestri Single-cell Multiple Myeloma Multiomics Solution. This innovative product suite aims to revolutionize multiple myeloma (MM) research and therapeutic development by delivering in-depth clonal and subclonal insights into disease evolution and biology at the single-cell level, surpassing the capabilities of traditional bulk methodologies.

Platforms Analysis

The Genomics platform dominated the market covering 27.9% share, driven by its foundational role in understanding genetic information and its widespread use in research, diagnostics, and personalized medicine. Genomic technologies such as next-generation sequencing (NGS) are extensively applied across various industries, making genomics the largest segment in multiomics. Proteomics follows closely, as it plays a critical role in understanding protein functions, interactions, and expressions, which are essential for drug discovery, biomarker identification, and disease research.

Technologies like mass spectrometry are heavily used for proteomics, making it a significant contributor to the market. In January 2025, NVIDIA unveiled new partnerships aimed at revolutionizing the $10 trillion healthcare and life sciences sector by speeding up drug discovery, advancing genomic research, and driving the development of cutting-edge healthcare services using agentic and generative AI.

Application Analysis

Oncology dominated the market with a 47.7% share, driven by the crucial role of multiomics in cancer research. This approach helps in understanding cancer biology, identifying biomarkers, and advancing personalized cancer therapies. Multiomics enables deeper insights into genetic, proteomic, and metabolic changes that contribute to tumorigenesis. As a result, oncology remains the largest and fastest-growing segment. In September 2022, Freenome launched the Sanderson Study, using its multiomics platform and real-world data to detect multiple cancers and enhance risk prediction models for high-risk populations.

Immunology is another key segment benefiting from multiomics technologies. These approaches help researchers study immune system behavior, autoimmune diseases, and responses to immunotherapy. Multiomics allows a better understanding of immune cell interactions, leading to improved treatments. The integration of genomics, proteomics, and metabolomics supports the development of targeted therapies. Researchers can now identify specific biomarkers linked to immune disorders, leading to more effective treatments. As a result, immunology continues to grow, driven by advancements in precision medicine and personalized healthcare.

End-use Analysis

Pharmaceutical and biotechnology companies dominated the multiomics market as the primary end-users, holding a 45.2% market share. These companies use multiomics technologies in drug discovery, biomarker identification, and personalized medicine. By integrating genomic, transcriptomic, proteomic, and metabolomic data, they gain deeper insights into disease mechanisms. This approach helps identify potential therapeutic targets and optimize drug formulations. The extensive use of multiomics accelerates research and development, improving precision medicine strategies and enhancing patient care through targeted therapies.

Multiomics technologies play a crucial role in advancing drug development and clinical trials. Pharmaceutical and biotechnology firms utilize these technologies to analyze patient responses to treatments. By examining multiple biological data layers, they develop predictive models for disease progression and drug efficacy. This data-driven approach reduces trial failures and enhances regulatory approvals. The integration of multiomics in clinical research leads to innovative treatment solutions, improving drug safety and effectiveness. As a result, companies continue to invest in multiomics to drive medical advancements.

Key Market Segments

By Product & Service

- Products

- Reagents & Consumables

- Instruments & Platforms

- Software & Analysis Tools

- Services

By Type

- Bulk Multiomics

- Single-cell Multiomics

By Platforms

- Genomics

- Proteomics

- Transcriptomics

- Metabolomics

- Lipidomics

- Microbiomics

- Epigenomics

- Others

By Application

- Cell Biology

- Oncology

- Neurology

- Immunology

By End-use

- Academic and Research Institutes

- Pharmaceutical & Biotechnology Companies

- Others

Drivers

Technological Innovations in Multiomics

Technological advancements are a key driver of the multiomics market. Innovations in sequencing technologies, such as next-generation sequencing (NGS), and advancements in mass spectrometry, bioinformatics, and artificial intelligence (AI) have significantly enhanced the ability to analyze complex biological data. These technologies enable the integration of genomics, transcriptomics, proteomics, and metabolomics, providing a comprehensive understanding of biological systems.

The development of high-throughput platforms and cloud-based data storage solutions has further accelerated research and applications in multiomics. These innovations are driving demand across academic research, pharmaceutical development, and clinical diagnostics, as they offer deeper insights into disease mechanisms, biomarker discovery, and drug development.

In February 2025, Illumina, Inc. introduced a set of groundbreaking innovations, positioning itself with the industry’s most extensive portfolio of omics solutions and sequencing applications. These solutions, covering genomics, spatial transcriptomics, single-cell analysis, CRISPR technologies, epigenetics, and data analytics software, will empower researchers to uncover transformative insights into the underlying causes of disease.

Restraints

Data Integration and Interpretation Challenges

One of the major restraints in the multiomics market is the difficulty in integrating and interpreting vast amounts of heterogeneous data. Multiomics generates massive datasets from diverse sources, requiring sophisticated tools and expertise for analysis. The lack of standardized protocols and interoperable platforms complicates data integration, leading to potential inaccuracies or incomplete insights.

Additionally, the complexity of biological systems makes it challenging to derive meaningful conclusions from multiomics data. These challenges increase the time and cost of research, limiting the adoption of multiomics technologies, particularly among smaller organizations or those with limited computational resources.

Opportunities

Potential Application in Personalized Medicine

The multiomics market holds significant opportunities in personalized medicine, where tailored treatments are developed based on an individual’s genetic, molecular, and environmental profile. Multiomics approaches enable the identification of biomarkers, disease subtypes, and therapeutic targets, facilitating precision diagnostics and treatment strategies.

For example, integrating genomic and proteomic data can help predict drug responses and adverse effects, improving patient outcomes. The growing emphasis on personalized healthcare, coupled with increasing investments in precision medicine, is expected to drive the adoption of multiomics technologies. This application has the potential to revolutionize healthcare by enabling more effective, patient-specific therapies.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the multiomics market by shaping investment, research funding, and market access. Economic downturns or financial instability may lead to reduced funding for research initiatives, limiting the development and adoption of multiomics technologies. Conversely, strong economic growth can drive investments in healthcare, biotechnology, and personalized medicine, boosting market demand for multiomics tools and services.

Geopolitical factors, such as trade policies, international collaborations, and tensions, can affect the availability of resources, talent, and partnerships. Trade restrictions or sanctions may disrupt the global supply chain for multiomics technologies, particularly for companies reliant on specialized equipment or reagents. On the other hand, favorable geopolitical conditions can promote cross-border collaborations and accelerate the commercialization of multiomics innovations. Ultimately, market dynamics are closely tied to these broader external factors, which can either facilitate or hinder growth depending on the prevailing economic and geopolitical climate.

Trends

Integration of AI and Machine Learning

The integration of AI and machine learning (ML) is rapidly transforming the multiomics market by enhancing data analysis, interpretation, and predictive modeling. Multiomics involves the integration of genomic, proteomic, metabolomic, and other omics data, which often results in complex, high-dimensional datasets. AI and ML algorithms can efficiently analyze and uncover patterns within this vast data, enabling researchers to make more accurate predictions and identify potential biomarkers or therapeutic targets.

AI-driven platforms also improve data integration across different omics layers, enhancing the understanding of disease mechanisms and personalized medicine. Machine learning models can identify hidden relationships between genetic variations and clinical outcomes, optimizing treatment strategies. Furthermore, AI facilitates the automation of routine tasks, such as data preprocessing and quality control, reducing time and human error. This technology is advancing the multiomics market by accelerating discoveries, improving clinical decision-making, and driving innovation in precision medicine.

Regional Analysis

North America is leading the Multiomics Market

The North American multiomics market is one of the largest and fastest-growing globally with 45.0% market share, driven by technological advancements, strong healthcare infrastructure, and significant investments in research and development. The U.S., in particular, is a hub for multiomics innovations, with major biotech companies like Thermo Fisher Scientific, Illumina, and Agilent Technologies leading the charge in providing multiomics tools and solutions.

For example, Illumina’s next-generation sequencing (NGS) technologies enable high-throughput genomic analysis, which is integrated with proteomics and metabolomics for comprehensive data analysis in research and clinical settings. Similarly, companies like Labcorp and Bio-Rad are expanding their multiomics offerings, focusing on personalized medicine, biomarker discovery, and disease profiling.

Government funding through initiatives such as the National Institutes of Health (NIH) and private-sector collaborations further support the market’s growth. North America is also seeing increased adoption of AI and machine learning to analyze complex multiomics datasets, enhancing precision medicine capabilities. For instance, The National Institutes of Health (NIH) is launching the Multi-Omics for Health and Disease Consortium, with an initial funding of about $11 billion for its first year. The consortium’s goal is to enhance the generation and analysis of multi-omic data to further human health research.

Over the next five years, the consortium is expected to receive a total of $50.3 billion, contingent on the availability of funds. The initiative is jointly funded by the National Human Genome Research Institute (NHGRI), the National Cancer Institute (NCI), and the National Institute of Environmental Health Sciences (NIEHS).

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

BD (Becton, Dickinson and Company) provides advanced flow cytometry and cell sorting technologies for multiomics research. These tools help analyze proteomics and genomics data at a high-throughput level. BD’s instruments play a crucial role in single-cell analysis, supporting personalized medicine. Thermo Fisher Scientific offers a broad range of multiomics platforms, including sequencing and mass spectrometry systems. These technologies allow researchers to integrate genomic, proteomic, and metabolomic data. Their solutions enhance biomarker discovery, disease research, and clinical diagnostics, advancing precision medicine.

Illumina is a leader in next-generation sequencing (NGS), which is essential for genomic insights in multiomics studies. Their sequencing technologies integrate with other omics layers, supporting advancements in disease research. Illumina’s solutions play a key role in precision medicine, enabling deeper biological analysis. Other key players include Danaher, PerkinElmer, Shimadzu, Bruker, QIAGEN, Agilent Technologies, BGI, Bio-Rad, Sage Science, and Pacific Biosciences. These companies develop innovative tools for multiomics applications, improving research in genomics, proteomics, and metabolomics.

Top Key Players in the Multiomics Market

- BD

- Thermo Fisher Scientific Inc.

- Illumina, Inc

- Danaher

- PerkinElmer Inc.

- Shimadzu Corporation

- Bruker

- QIAGEN

- Agilent Technologies, Inc.

- BGI

- Bio-Rad Laboratories, Inc.

- Sage Science Inc.

- Pacific Biosciences

- Other Prominent Players

Recent Developments

- In January 2025, PacBio, renowned for its high-quality, long-read sequencing solutions, has significantly contributed to a groundbreaking study soon to be featured in Nature Genetics. This study, titled “Synchronized Long-Read Genome, Methylome, Epigenome, and Transcriptome for Resolving a Mendelian Condition,” showcases how researchers utilized PacBio’s advanced sequencing technologies. Techniques like Fiber-seq and Kinnex (previously known as MAS-seq) were instrumental in deciphering the genetic and molecular basis of a rare and intricate Mendelian disorder.

- In January 2025, Quantum-Si Incorporated, also known as The Protein Sequencing Company, is set to partake in the Festival of Genomics UK. This event will take place from January 29–30, 2025, at ExCeL London. Richard Broadhead, Ph.D., will present the company’s latest innovations in Next-Generation Protein Sequencing, highlighting its potential to revolutionize proteomics and multiomics research.

- In January 2025, Enhanc3D Genomics, a pioneer in 3D genomics technology, introduced a comprehensive suite of integrated multi-omics solutions aimed at boosting the efficacy and precision of drug discovery. The company’s 3D Multi-omic platform employs its proprietary Promoter Capture Hi-C technology to create detailed, genome-wide regulatory maps applicable to various cell types and states. This method is essential for understanding the interactions between promoters and regulatory regions, thus offering profound insights into the regulatory mechanisms of cells.

Report Scope

Report Features Description Market Value (2024) US$ 2.95 billion Forecast Revenue (2034) US$ 11.73 billion CAGR (2025-2034) 14.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product & Service (Products (Reagents & Consumables, Instruments & Platforms and Software & Analysis Tools) and Services), by Type (Bulk Multiomics and Single-cell Multiomics), By Platforms (Genomics, Proteomics, Transcriptomics, Metabolomics, Lipidomics, Microbiomics, Epigenomics, and Others), By Application (Cell Biology, Oncology, Neurology, and Immunology), By End Use (Academic and Research Institutes, Pharmaceutical & Biotechnology Companies, and Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BD, Thermo Fisher Scientific Inc., Illumina, Inc, Danaher, PerkinElmer Inc., Shimadzu Corporation, Bruker, QIAGEN, Agilent Technologies, Inc., BGI, Bio-Rad Laboratories, Inc., Sage Science Inc., Pacific Biosciences, and Other Prominent Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BD

- Thermo Fisher Scientific Inc.

- Illumina, Inc

- Danaher

- PerkinElmer Inc.

- Shimadzu Corporation

- Bruker

- QIAGEN

- Agilent Technologies, Inc.

- BGI

- Bio-Rad Laboratories, Inc.

- Sage Science Inc.

- Pacific Biosciences

- Other Prominent Players