Global Diabetic Retinopathy Market Analysis By Type (Non-Proliferative Diabetic Retinopathy (NPDR), Proliferative Diabetic Retinopathy (PDR)), By Treatment (Anti-VEGF Injections, Corticosteroids, Laser Treatment, Surgery), By End User (Hospitals & Clinics, Ophthalmology Centers, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145648

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

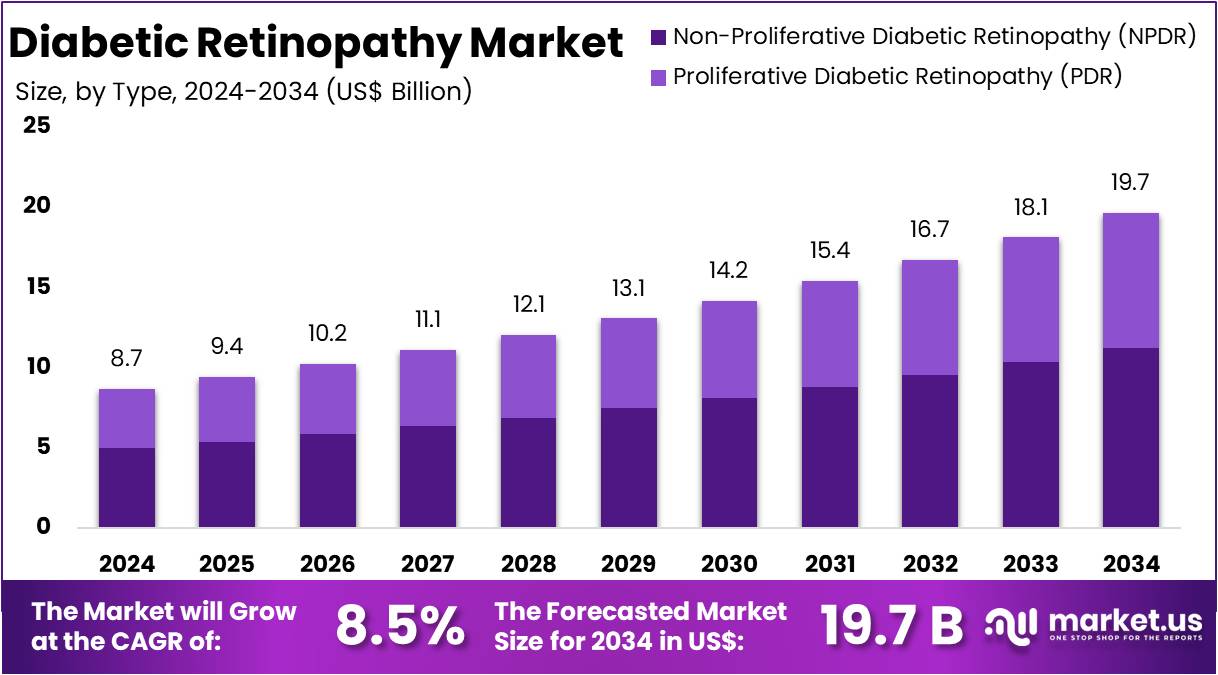

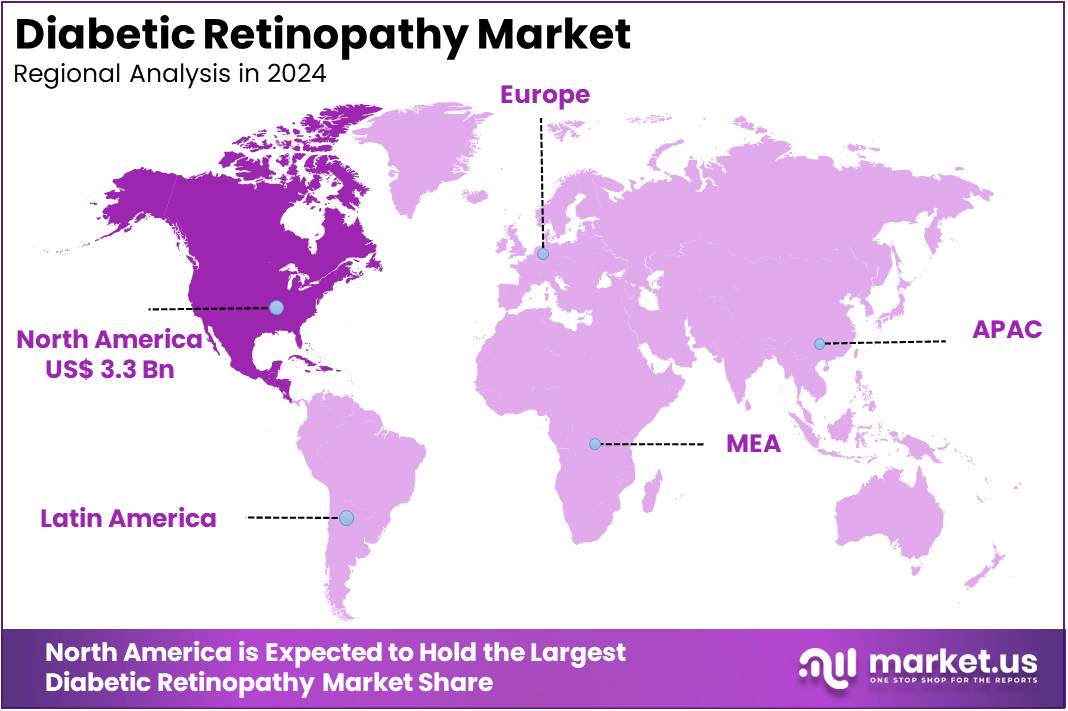

The Global Diabetic Retinopathy Market Size is expected to be worth around US$ 19.7 Billion by 2034, from US$ 8.7 Billion in 2024, growing at a CAGR of 8.5% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38.2% share and holds US$ 3.3 Billion market value for the year.

Diabetic retinopathy (DR) is a serious eye condition caused by long-term high blood sugar levels. It damages the blood vessels in the retina, which is responsible for converting light into signals for the brain. As the condition progresses, it can lead to blurred vision, dark spots, and in severe cases, blindness. According to the World Health Organization (WHO), the number of individuals affected by DR is expected to rise from 146 million in 2014 to 180.6 million by 2030.

The condition develops in stages, starting with mild nonproliferative retinopathy, where small areas of swelling in the blood vessels appear. It progresses through moderate and severe nonproliferative stages, which involve a lack of oxygen and blood supply to the retina. The final stage, proliferative diabetic retinopathy, is marked by the growth of new, abnormal blood vessels in the retina, leading to severe complications.

DR is common among individuals with diabetes, with the prevalence increasing over time. A study by the Wisconsin Epidemiologic Study of Diabetic Retinopathy revealed that after 20 years of diabetes, 99% of type 1 diabetics and 60% of type 2 diabetics will have some degree of retinopathy. This highlights the critical role of disease duration in DR development. Early detection through regular eye exams is crucial, as many patients may not notice symptoms until the condition has advanced.

According to a meta-analysis, about 103 million people globally suffer from diabetic retinopathy, with projections indicating this number will grow to 161 million by 2045. In 2020, DR was responsible for blindness in 1.07 million individuals and visual impairment in 3.28 million. For instance, in the United States, 9.6 million people (26.4% of diabetics) had DR in 2021, and 1.84 million of them experienced vision-threatening DR.

Advancements in screening and diagnosis have significantly improved early detection rates. Studies have shown that AI-driven systems are proving highly effective in detecting DR, with sensitivity and specificity rates between 85.7% and 97.5%. For example, AI-powered screening systems, such as AEYE Health’s AEYE-DS, are being widely adopted, and the technology recently received FDA approval in 2024. This system enables rapid, accurate retinal assessments, streamlining the screening process.

The growing incidence of diabetes and the aging global population are key drivers behind the increase in DR cases. The WHO predicts that the number of people aged 60 and older will rise from 962 million in 2017 to 1.4 billion by 2030. This demographic shift will contribute to a greater burden of diabetes and associated complications like DR. Furthermore, lifestyle changes, such as poor diet and lack of exercise, are also increasing diabetes rates, further escalating the need for efficient DR management.

Key Takeaways

- The global diabetic retinopathy market is projected to reach US$ 19.7 billion by 2034, up from US$ 8.7 billion in 2024, growing at a CAGR of 8.5%.

- In 2024, Non-Proliferative Diabetic Retinopathy (NPDR) dominated the Type Segment, securing over 57.2% of the market share.

- Anti-VEGF injections led the Treatment Segment in 2024, commanding more than 38.5% of the market share.

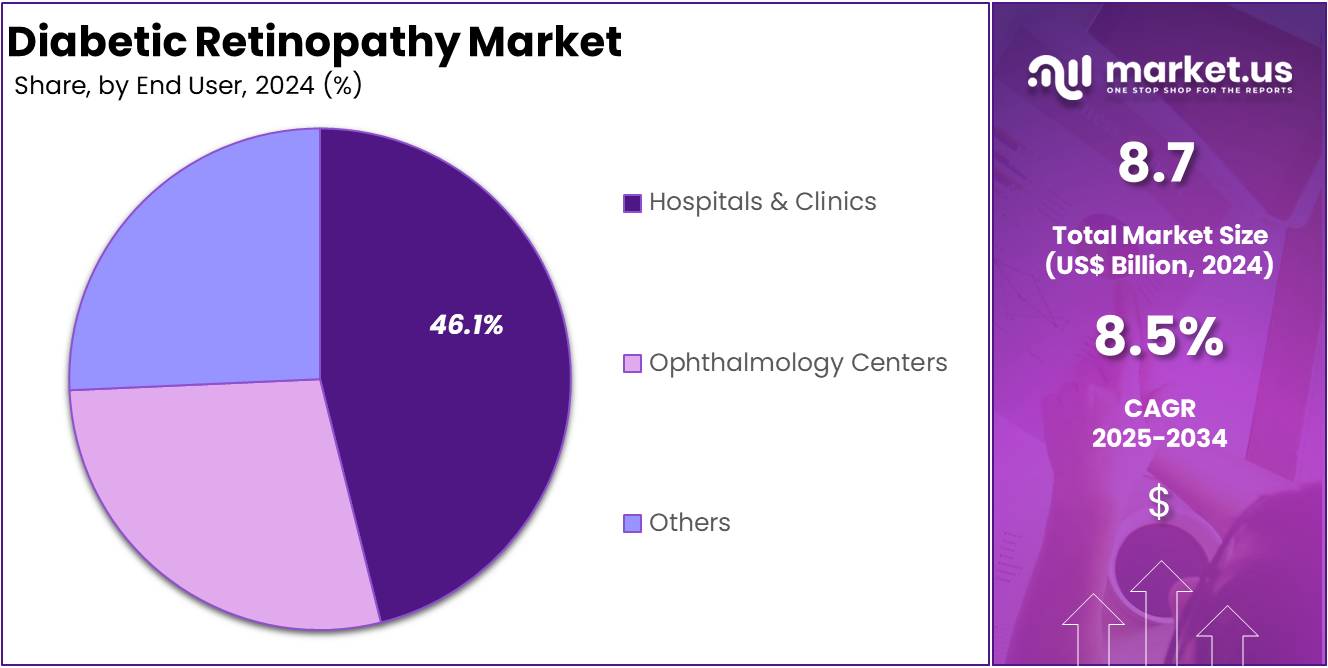

- Hospitals & Clinics dominated the End-User Segment of diabetic retinopathy in 2024, accounting for over 46.1% of the market share.

- North America maintained a strong market position in 2024, capturing over 38.2% of the market share, equivalent to a market value of US$ 3.3 billion.

Type Analysis

In 2024, Non-Proliferative Diabetic Retinopathy (NPDR) held a dominant market position in the Type Segment of Diabetic Retinopathy, capturing more than a 57.2% share. According to industry observations, this dominance can be linked to the higher incidence of NPDR in patients with both Type 1 and Type 2 diabetes. NPDR often represents the early stage of the disease. This increases the chances of diagnosis during routine eye exams, especially in individuals undergoing regular diabetic care and monitoring.

Experts have noted that technological advancements in diagnostic tools have supported this trend. Tools such as fundus photography and optical coherence tomography (OCT) are widely used. These allow early detection and help reduce the risk of progression to severe stages. Standardized screening programs in primary care settings also play a major role. With rising awareness of diabetes-related eye issues, patients are encouraged to undergo regular eye check-ups, resulting in more NPDR cases being identified early.

On the other hand, Proliferative Diabetic Retinopathy (PDR) accounts for a smaller market share. It is considered a more advanced and less common form of the disease. PDR involves abnormal blood vessel growth in the retina, often leading to severe vision problems. Although less prevalent, PDR demands complex treatments such as laser surgery and intravitreal injections. These advanced therapies are becoming more accessible, which may support steady growth of the PDR segment. However, NPDR is expected to maintain its lead due to early-stage diagnosis and preventive care.

Treatment Analysis

In 2024, Anti-VEGF Injections held a dominant market position in the Treatment Segment of Diabetic Retinopathy, capturing more than a 38.5% share. These injections are widely used due to their high success rate in reducing macular edema and improving vision. Healthcare professionals prefer them for their minimally invasive nature and fewer side effects. Their growing acceptance in clinical guidelines has also supported this trend. Continuous innovation in drug formulation and delivery further strengthens their market position.

Corticosteroids followed as another key treatment option in the diabetic retinopathy segment. These drugs are mainly prescribed when anti-VEGF therapy does not provide desired results. However, their usage is often limited by risks such as elevated eye pressure and cataract formation. The demand for corticosteroids is likely to rise slowly due to advancements in long-acting implants. Despite their therapeutic value, safety concerns continue to restrict their broader use in diabetic eye care.

Laser treatment remains a conventional method used in managing diabetic retinopathy. It is mainly recommended for advanced cases or when pharmacological options are ineffective. However, its usage has declined with the growing popularity of injectable therapies. Surgical options, such as vitrectomy, are also used but only in severe cases. High costs and longer recovery times have restricted their demand. Nevertheless, improvements in surgical technology may encourage limited growth in this segment over the forecast period.

End User Analysis

In 2024, Hospitals & Clinics held a dominant market position in the End User Segment of Diabetic Retinopathy, capturing more than a 46.1% share. This dominance was largely due to higher patient visits and better access to diagnostic tools. Hospitals and clinics also had more skilled professionals and stronger infrastructure. These settings often offered faster and more reliable treatment. As a result, they became the first choice for patients seeking diabetic retinopathy care.

Ophthalmology Centers were the second-largest contributors to the market. Their growth was driven by the increasing demand for specialized eye care. These centers focused exclusively on ophthalmic conditions and offered quicker services. Many patients preferred these centers for their advanced technology and targeted treatments. The rise in awareness about diabetic eye diseases further supported this segment’s growth. As accessibility improved, more patients began choosing these specialized centers over general healthcare facilities.

The Others segment, which includes diagnostic labs and ambulatory surgical centers, had a smaller market share. However, its growth potential remained strong due to rising awareness in rural and semi-urban areas. Mobile screening units and outreach programs supported this expansion. These facilities provided basic eye care services at lower costs. Although they lacked advanced infrastructure, they played a vital role in early detection. Over time, this segment is expected to grow as healthcare access continues to improve.

Key Market Segments

By Type

- Non-Proliferative Diabetic Retinopathy (NPDR)

- Proliferative Diabetic Retinopathy (PDR)

By Treatment

- Anti-VEGF Injections

- Corticosteroids

- Laser Treatment

- Surgery

By End User

- Hospitals & Clinics

- Ophthalmology Centers

- Others

Drivers

Increasing Prevalence of Diabetes

The global rise in diabetes cases is a key driver for the diabetic retinopathy market. Diabetes, a chronic condition, affects millions of people worldwide. As the prevalence of diabetes grows, the risk of developing diabetic retinopathy also increases. This creates a higher demand for diagnostic tools and treatments aimed at managing and preventing the condition.

The growing number of diabetes cases directly correlates with an uptick in diabetic retinopathy cases. As diabetes becomes more common, healthcare providers and patients face increased pressure to address potential eye complications. This trend contributes significantly to market growth, expanding opportunities for product development.

Healthcare systems and organizations are adapting to the increase in diabetic retinopathy cases. New diagnostic technologies and treatments are emerging to meet the rising demand. The focus is on providing effective solutions to prevent vision loss associated with the condition. As a result, the market for diabetic retinopathy diagnostics and treatments is expected to continue expanding.

Restraints

High Treatment Costs

The high treatment costs associated with diabetic retinopathy pose a significant restraint to market growth. Advanced therapies, such as intravitreal injections and laser surgeries, are expensive. These therapies are crucial in managing the disease effectively and preventing vision loss. However, their high costs can limit accessibility, especially in low-income regions. This makes it difficult for patients to afford the necessary care, reducing the number of individuals seeking treatment.

In low-income regions, healthcare systems often lack the resources to provide expensive treatments. The financial burden of these therapies is a barrier to timely intervention, resulting in worsened outcomes. Many patients in these regions may opt for less effective, low-cost alternatives, or may not seek treatment at all. This contributes to the rising burden of diabetic retinopathy globally, especially in developing countries.

Furthermore, limited access to these advanced treatments reduces the overall market potential in these areas. As the need for effective diabetic retinopathy care continues to grow, the inability to provide these services limits market growth. Governments and healthcare providers must address cost-related issues to improve treatment access. This will help overcome financial barriers and expand the market for diabetic retinopathy treatments.

Opportunities

Rising Demand for Early Diagnostic Solutions

The growing demand for early diagnostic solutions is shaping a significant market opportunity. Innovations in healthcare, such as AI-based diagnostic tools and retinal imaging technologies, are becoming increasingly important. These solutions enable quicker and more accurate detection of various health conditions, including eye diseases and neurological disorders. As the technology matures, it is expected to play a key role in transforming healthcare diagnostics, improving overall patient outcomes.

AI-based diagnostic tools offer a highly effective approach for early disease detection. These systems use machine learning algorithms to analyze medical data and identify potential issues. The integration of AI enhances diagnostic accuracy and speed, which is crucial for preventing the progression of illnesses. This is particularly beneficial in sectors such as oncology, cardiology, and ophthalmology, where early detection significantly improves patient prognosis.

Retinal imaging technologies also provide promising opportunities in early diagnostics. These non-invasive tools can detect conditions like diabetic retinopathy, glaucoma, and age-related macular degeneration. As these technologies evolve, they will contribute to reducing healthcare costs by preventing the need for more expensive treatments down the line. The growing prevalence of chronic diseases further supports the need for such advanced diagnostic methods, ensuring continued market growth in the sector.

Trends

Shift Toward Minimally Invasive Procedures and Targeted Therapies

There is an increasing shift toward minimally invasive procedures in healthcare. These procedures offer significant advantages over traditional methods. They typically result in smaller incisions, reduced recovery times, and less postoperative pain. As a result, both patients and healthcare providers are showing greater interest in these approaches. The adoption of minimally invasive techniques can lead to faster recovery and lower overall healthcare costs, making them a preferred choice for various treatments.

Targeted therapies, such as gene therapy, are also gaining traction. These treatments aim to address specific genetic issues, offering more precise and personalized care. By focusing on the root cause of the condition, targeted therapies can improve treatment outcomes. This approach minimizes the side effects often associated with traditional treatments, such as chemotherapy. As a result, patients experience better quality of life during treatment, further driving the popularity of these advanced therapies.

Drug-eluting implants are another example of targeted treatments. These implants slowly release medication directly to the treatment site, enhancing the effectiveness of the therapy. By focusing the medication at the target area, drug-eluting implants reduce systemic exposure, minimizing side effects. This innovation provides a less invasive, more effective option for conditions like coronary artery disease. As healthcare evolves, such targeted solutions are becoming increasingly important for both patients and healthcare providers seeking more efficient treatment options.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 38.2% share and holds US$ 3.3 billion market value for the year. This growth is mainly due to the high number of diabetic patients in the region. Diabetes is one of the leading health concerns in the United States and Canada. The rise in diagnosed cases increases the risk of diabetic retinopathy. As a result, the demand for early detection and treatment solutions continues to grow steadily.

Advanced healthcare infrastructure also supports this regional dominance. North America offers easy access to diagnostic tools and specialized care. Regular eye exams and early treatment have become more common. Anti-VEGF therapies and laser procedures are widely used across hospitals and clinics. In addition, public health programs promote awareness about eye complications from diabetes. These efforts improve early intervention and patient outcomes, which further contribute to the market expansion in the region.

Strong government support and insurance coverage enhance access to treatment. Many health plans cover diabetic eye care, reducing patient costs. This makes treatments more affordable and accessible. Major pharmaceutical companies in the region invest in research and development. Their innovations bring new treatment options to the market. Together, these factors ensure North America remains a key market for diabetic retinopathy care.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The diabetic retinopathy market is characterized by the presence of several global and regional players focusing on product innovation, strategic collaborations, and expanding geographic presence to strengthen their market position. The market is moderately consolidated, with a few major players holding significant market shares. Key companies are emphasizing research and development (R&D) initiatives to introduce advanced therapeutic and diagnostic solutions aimed at early detection and effective treatment of diabetic retinopathy.

Novartis AG is a leading player in the diabetic retinopathy market with its ophthalmic drugs Beovu® (brolucizumab) and Lucentis® (ranibizumab), co-developed with Genentech. The company invests heavily in next-generation anti-VEGF therapies and aims to expand access in emerging markets. Strategic partnerships and a strong R&D pipeline support its position as a key innovator in retinal disease management. Novartis continues to drive growth through innovation and expanding its market reach, ensuring sustained leadership in the field.

Bayer AG maintains a strong market presence through its anti-VEGF treatment Eylea® (aflibercept), co-developed with Regeneron Pharmaceuticals. Bayer’s focus on ophthalmology research and global distribution has allowed it to secure a substantial share of the diabetic retinopathy therapeutics segment. Additionally, the company works on life-cycle management and label expansions of existing drugs, ensuring a robust market footprint. Its continuous commitment to advancing treatments strengthens its leadership in diabetic retinopathy care and enhances long-term growth prospects.

F. Hoffmann-La Roche Ltd is a dominant force in ophthalmology, particularly through its key product, Lucentis®. Roche’s acquisition of Spark Therapeutics and its commitment to personalized healthcare have bolstered its capabilities in gene therapy and molecular diagnostics. The company’s innovation pipeline includes advanced biologics and sustained drug delivery systems. These developments are expected to reshape treatment paradigms for diabetic retinopathy, solidifying Roche’s role as a leader in retinal disease management and expanding its influence in emerging therapeutic areas.

Other prominent players contributing to the diabetic retinopathy market include Alimera Sciences, AbbVie Inc., ThromboGenics NV, and Quantel Medical. These companies are involved in the development of corticosteroid-based implants, laser treatment systems, and novel therapeutic approaches. Strategic acquisitions, regional market expansions, and increased R&D expenditure are some of the key initiatives observed among these players to strengthen their market presence.

Market Key Players

- Novartis AG

- Bayer AG

- Hoffmann-La Roche Ltd

- Regeneron Pharmaceuticals Inc.

- Carl Zeiss

- Optos

- Genentech Inc.

- AbbVie

- Eli Lilly and Company

- Viatris

- AstraZeneca

- Bausch Health Companies Inc.

Recent Developments

- In January 2023: Harrow finalized the acquisition of exclusive U.S. commercial rights to five branded ophthalmic products from Novartis. The deal, valued at $130 million upfront with additional milestone payments, includes a transition period during which Novartis will continue selling the products in the U.S. and transfer net profits to Harrow. Novartis retains rights to these products outside the U.S. This acquisition positions Harrow as a leader in the U.S. ophthalmic pharmaceuticals market, while providing patients with more treatment options.

- In November 2023: The Committee for Medicinal Products for Human Use (CHMP) of the EMA recommended aflibercept 8 mg for approval in Europe. This recommendation supports extended treatment intervals for nAMD and DME, based on successful outcomes from the PULSAR and PHOTON trials. The final decision from the European Commission is expected soon.

Report Scope

Report Features Description Market Value (2024) US$ 8.7 Billion Forecast Revenue (2034) US$ 19.7 Billion CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Non-Proliferative Diabetic Retinopathy (NPDR), Proliferative Diabetic Retinopathy (PDR)), By Treatment (Anti-VEGF Injections, Corticosteroids, Laser Treatment, Surgery), By End User (Hospitals & Clinics, Ophthalmology Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Novartis AG, Bayer AG, Hoffmann-La Roche Ltd, Regeneron Pharmaceuticals Inc., Carl Zeiss, Optos, Genentech Inc., AbbVie, Eli Lilly and Company, Viatris, AstraZeneca, Bausch Health Companies Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Diabetic Retinopathy MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Diabetic Retinopathy MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Novartis AG

- Bayer AG

- Hoffmann-La Roche Ltd

- Regeneron Pharmaceuticals Inc.

- Carl Zeiss

- Optos

- Genentech Inc.

- AbbVie

- Eli Lilly and Company

- Viatris

- AstraZeneca

- Bausch Health Companies Inc.