AI Powered Retina Image Analysis Market By Type of Technology (Machine Learning (ML), Deep Learning (DL), Natural Language Processing (NLP)), By Disease Type (Diabetic Retinopathy (DR), Age-related Macular Degeneration (AMD), Glaucoma, Retinal Vein Occlusion (RVO), Retinopathy of Prematurity (ROP) and Others), By Application (Clinical Diagnosis, Early Detection & Screening, Treatment Planning, Monitoring & Follow-up, and Telemedicine & Remote Screening), By Deployment Mode (On-premises, and Cloud), By End-User (Hospitals & Clinics, Diagnostic Centers, Research & Academia, Telemedicine Providers, and Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136105

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Type of Technology Analysis

- Disease Type Analysis

- Application Analysis

- Deployment Mode Analysis

- End User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

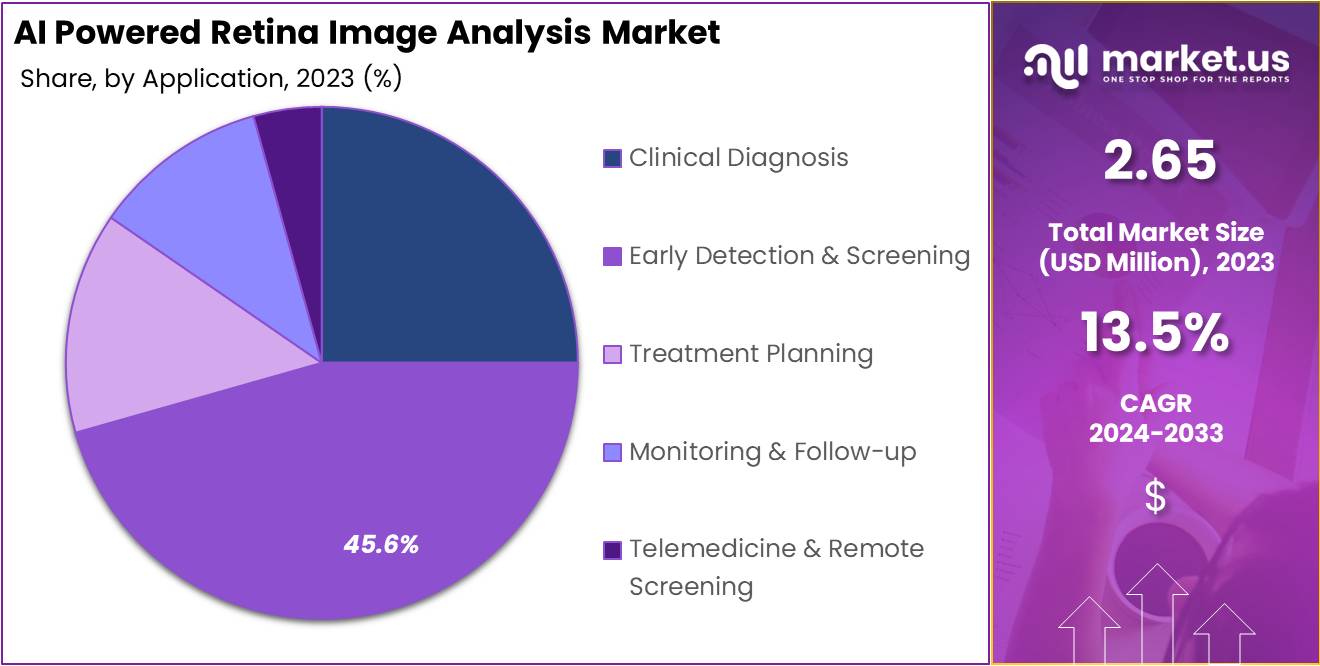

The Global AI Powered Retina Image Analysis Market Size is expected to be worth around US$ 9.4 Billion by 2033, from US$ 2.65 Billion in 2023, growing at a CAGR of 13.5% during the forecast period from 2024 to 2033.

The AI-powered retina image analysis industry is revolutionizing the field of ophthalmology by leveraging artificial intelligence (AI) technologies to improve the diagnosis, treatment, and management of various retinal diseases. This industry uses advanced machine learning (ML) and deep learning (DL) algorithms to analyze retinal images such as fundus photographs, optical coherence tomography (OCT) scans, and fluorescein angiography, enabling faster, more accurate, and cost-effective diagnoses.

AI-powered tools offer several advantages, including increased diagnostic accuracy, automated image analysis, and early disease detection, which are critical for managing chronic retinal conditions. The technology also facilitates telemedicine, enabling remote screenings and improving access to care, particularly in underserved regions. With increasing investment in healthcare AI startups and advancements in computational power, the AI retina image analysis industry is expected to grow rapidly, contributing to better patient outcomes and a reduction in the global burden of vision-related diseases.

Key Takeaways

- In 2023, the market for AI Powered Retina Image Analysis generated a revenue of US$ 2.65 billion, with a CAGR of 13.5%, and is expected to reach US$ 9.41 billion by the year 2033.

- The product type segment is divided into Machine Learning (ML), Deep Learning (DL) and Natural Language Processing (NLP), with ML taking the lead in 2023 with a market share of 37.7%.

- Considering active Disease Type, the market is divided into Diabetic Retinopathy (DR), Age-related Macular Degeneration (AMD), Glaucoma, Retinal Vein Occlusion (RVO), Retinopathy of Prematurity (ROP) and Others. Among these, Diabetic Retinopathy (DR) agents held a significant share of 39.4%. Diabetic Retinopathy (DR) association with diabetes and increasing incidence rates is the primary reason for the segment’s dominance.

- Furthermore, concerning the application, the market is segregated into Clinical Diagnosis, Early Detection & Screening, Treatment Planning, Monitoring & Follow-up, and Telemedicine & Remote Screening. The Early Detection & Screening stands out as the dominant segment, holding the largest revenue share of 45.6% in the AI Powered Retina Image Analysis market.

- By End-User, the market is classified into Hospitals & Clinics, Diagnostic Centers, Research & Academia, Telemedicine Providers, and Others. Hospitals & Clinics held a major share of 35.0%

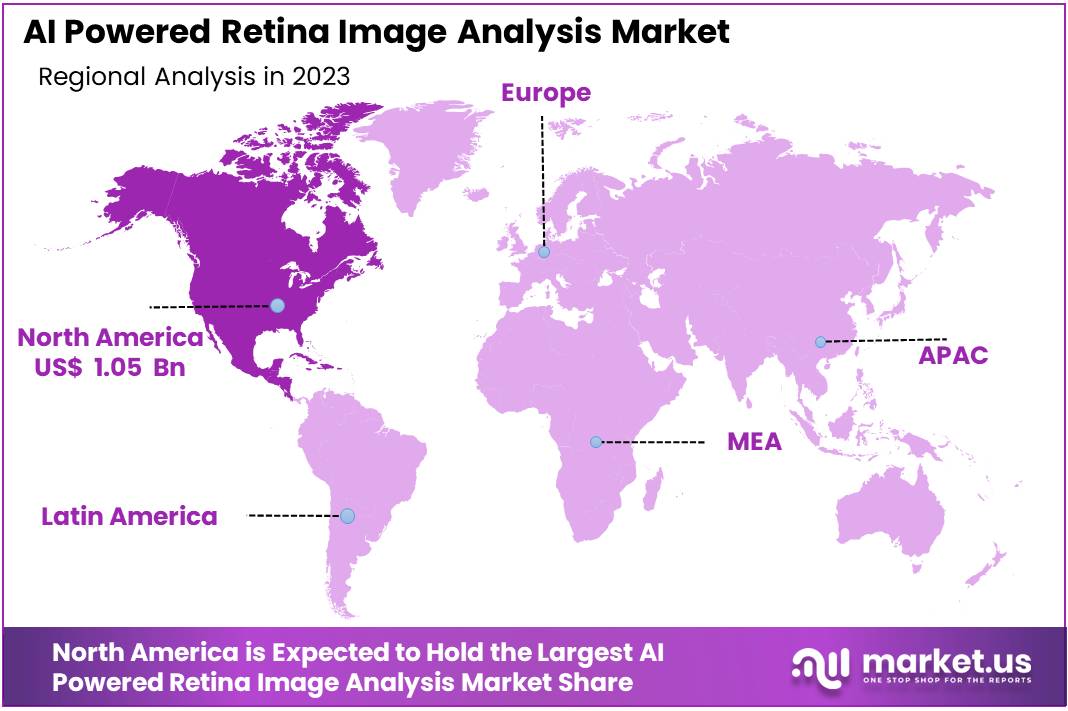

- North America led the market by securing a market share of 48.9% in 2023.

Type of Technology Analysis

The AI-powered retina image analysis market relies on three key technologies: Machine Learning (ML), Deep Learning (DL), and Natural Language Processing (NLP). Machine Learning (ML) is essential for analyzing retinal images and diagnosing conditions like diabetic retinopathy and macular degeneration. ML is the dominating segment which held share of 37.7% in 2023.

ML models learn from data, improving diagnostic accuracy over time and enabling automated screening, particularly in underserved areas. Deep Learning (DL), a subset of ML, uses neural networks like Convolutional Neural Networks (CNNs) to process and analyze complex retinal images. Natural Language Processing (NLP) complements these image analysis technologies by processing unstructured text data, such as patient reports and medical histories.

These technologies collectively drive the market’s growth by enabling faster, more accurate, and comprehensive retinal disease diagnosis.

Disease Type Analysis

The AI-powered retina image analysis market is segmented by disease type, including Diabetic Retinopathy (DR), Age-related Macular Degeneration (AMD), Glaucoma, Retinal Vein Occlusion (RVO), Retinopathy of Prematurity (ROP), and Others. Diabetic Retinopathy (DR) held largest share of 39.4% and is the dominant segment, driven by the increasing prevalence of diabetes globally.

AI systems are highly effective at detecting DR in its early stages, enabling timely intervention to prevent vision loss. For instance, in 2021, approximately 9.6 billion people in the U.S. were estimated to have DR, representing 26.4% of those with diabetes. Among these, about 1.84 billion individuals had vision-threatening diabetic retinopathy (VTDR), which constitutes 5.1% of those with diabetes.

Application Analysis

Early Detection & Screening is the dominant segment with 45.6% market share, driven by the growing need for quick and accurate identification of retinal diseases like diabetic retinopathy and macular degeneration. AI’s ability to analyse retinal images in real-time enhances the efficiency of large-scale screening programs, especially in regions with limited access to specialists.

Clinical Diagnosis is another key application, with AI assisting ophthalmologists in diagnosing complex retinal conditions through more precise and automated image analysis. AI-powered tools provide decision support, improving diagnostic accuracy and reducing human error.

Deployment Mode Analysis

Cloud deployment is the dominant segment with a 59.3% of share, driven by its scalability, flexibility, and cost-effectiveness. Cloud-based solutions enable real-time access to AI-powered tools and retinal image analysis from any location, facilitating remote diagnostics and telemedicine.

Cloud platforms also allow for seamless integration with existing healthcare IT infrastructure and the storage of large volumes of imaging data, which is crucial for training AI models and ensuring long-term patient data accessibility. Additionally, cloud-based solutions reduce the need for on-site infrastructure, offering lower upfront costs and enabling continuous software updates and improvements.

End User Analysis

Hospitals & Clinics are the dominant segment with 35.0% market share, driven by the high demand for AI-driven diagnostic tools to enhance clinical decision-making. These healthcare facilities utilize AI for early detection, screening, and monitoring of retinal diseases, improving patient outcomes and increasing operational efficiency.

Hospitals and clinics have access to advanced imaging equipment and a high volume of patients, making them the primary adopters of AI-powered retina analysis solutions.

Key Market Segments

By Type of Technology

- Machine Learning (ML)

- Deep Learning (DL)

- Natural Language Processing (NLP)

By Disease Type

- Diabetic Retinopathy (DR)

- Age-related Macular Degeneration (AMD)

- Glaucoma

- Retinal Vein Occlusion (RVO)

- Retinopathy of Prematurity (ROP)

- Others

By Application

- Clinical Diagnosis

- Early Detection & Screening

- Treatment Planning

- Monitoring & Follow-up

- Telemedicine & Remote Screening

By Deployment Mode

- On-premises

- Cloud

By End-User

- Hospitals & Clinics

- Diagnostic Centers

- Research & Academia

- Telemedicine Providers

- Others

Drivers

Growing Prevalence of Retinal Diseases

The growing prevalence of retinal diseases, such as diabetic retinopathy (DR), age-related macular degeneration (AMD), glaucoma, and retinal vein occlusion (RVO), is a significant driver for AI-powered retina image analysis. The rise in chronic conditions like diabetes and hypertension, combined with the aging population, has contributed to a surge in the incidence of retinal disorders. Diabetic retinopathy alone is one of the leading causes of blindness globally. Early detection is crucial to preventing vision loss and managing disease progression effectively. AI-based solutions enable faster and more accurate diagnoses by analyzing fundus photographs, OCT scans, and other retinal images.

These AI tools can identify subtle signs of disease that may be missed by the human eye, particularly in early stages, when intervention is most effective. As the global burden of these diseases increases, AI solutions will play a critical role in improving patient outcomes and reducing the overall healthcare burden. As per the statistics by a study done by SLACK Incorporated in January 2021, out of the 3,086,791 eyes examined, following were identified:

- 490,881 (15.9%) had dry age-related macular degeneration (AMD)

- 294,041 (9.5%) had wet age-related macular degeneration (AMD)

- 270,703 (8.8%) had diabetic macular edema (DME)

- 254,690 (8.3%) had diabetic retinopathy (DR) without DME

- 73,617 (2.4%) had branch retinal vein occlusion (BRVO)

- 50,670 (1.6%) had central retinal vein occlusion (CRVO)

Restraints

Data Privacy and Security Concerns

Data privacy and security remain key challenges in the adoption of AI-powered retina image analysis tools. These AI systems rely on large datasets of sensitive patient information, such as retinal images and medical histories, which are subject to strict data protection regulations like HIPAA in the U.S. and GDPR in Europe. The collection, transmission, and storage of personal health data raise significant concerns about the risk of data breaches, unauthorized access, and cyberattacks.

Furthermore, the deployment of cloud-based AI platforms, while offering scalability and real-time analysis, introduces additional vulnerabilities related to data storage and sharing. To overcome these concerns, it is essential for developers and healthcare providers to implement robust security protocols, such as encryption, multi-factor authentication, and secure cloud infrastructures. As regulations evolve and technology improves, securing sensitive healthcare data will be critical to ensuring widespread adoption and public trust in AI-powered medical tools.

Opportunities

Advancements in AI and Machine Learning

Recent advancements in artificial intelligence (AI) and machine learning (ML) have transformed the field of retinal image analysis, providing powerful tools for diagnosing eye diseases with unprecedented accuracy. Deep learning algorithms, particularly convolutional neural networks (CNNs), have shown exceptional performance in analyzing retinal images, identifying patterns, and detecting diseases such as diabetic retinopathy (DR), age-related macular degeneration (AMD), and glaucoma.

These algorithms can process vast amounts of data, learning from labelled datasets to improve their diagnostic abilities over time. Moreover, reinforcement learning and other AI techniques have advanced AI’s ability to predict disease progression, providing clinicians with decision support for treatment planning. The increased computational power and availability of large medical datasets have contributed to AI models’ ability to perform accurate and real-time image analysis, reducing diagnostic errors. As AI continues to evolve, these innovations will improve early detection, treatment precision, and overall patient outcomes in ophthalmology.

Impact of Macroeconomic / Geopolitical Factors

The AI-powered retina image analysis market is influenced by several macroeconomic and geopolitical factors that can impact both demand and supply dynamics. Macroeconomic factors, such as global economic conditions, can affect healthcare spending. In regions with economic downturns, healthcare budgets may be constrained, limiting investments in advanced technologies like AI in ophthalmology.

Conversely, economic growth in emerging markets can boost healthcare infrastructure spending, providing opportunities for AI-powered solutions to expand into new regions, particularly in Asia-Pacific, where rising healthcare investments and an aging population are prominent drivers. Geopolitical factors also play a critical role.

Political stability, regulatory frameworks, and trade agreements significantly influence market growth. For instance, in regions like Europe and North America, well-established regulations and supportive government policies (e.g., FDA approval in the U.S.) encourage the adoption of AI in healthcare. However, political instability in certain countries or regions could delay or disrupt market entry and the rollout of AI-powered diagnostic tools.

Moreover, global trade tensions and supply chain disruptions can impact the availability of hardware, software, and skilled personnel needed for AI development and deployment. Conversely, international collaborations and partnerships can facilitate the sharing of resources, expertise, and technologies, accelerating AI adoption globally. Geopolitical tensions and economic fluctuations will continue to shape the pace and accessibility of AI-powered retinal image analysis tools.

Trends

Integration with Telemedicine Platforms

In July 2023, the Icahn School of Medicine at Mount Sinai inaugurated the Center for Ophthalmic Artificial Intelligence and Human Health. This center, the first of its kind in New York and among the first in the United States, marks a significant advancement in AI applications in ophthalmology. It positions the Mount Sinai Health System at the forefront of integrating cutting-edge innovations and technologies in patient care.

AI-powered retina image analysis integrated with telemedicine platforms is an emerging trend poised to transform eye care delivery, especially in underserved areas. Telemedicine allows remote consultations, enabling patients to receive diagnoses and treatment recommendations without visiting healthcare facilities. This integration significantly enhances the accessibility and efficiency of retinal screenings at the point of care, such as rural clinics or via smartphone-based imaging devices.

AI algorithms excel in analyzing retinal images in real-time, providing swift diagnostic outcomes. This capability reduces the workload on ophthalmologists and addresses the prevalent shortage of trained professionals in this field. By automating the initial screening and diagnosis processes, AI supports the early detection of conditions like diabetic retinopathy and macular degeneration, critical for preventing severe outcomes.

Moreover, telemedicine supported by AI facilitates ongoing follow-up care and continuous monitoring of patients. This approach not only improves long-term health outcomes but also contributes to reducing overall healthcare costs. As telemedicine continues to expand, AI’s role in enhancing access to quality eye care becomes increasingly pivotal, offering a sustainable solution for global health challenges.

Regional Analysis

North America is leading the AI Powered Retina Image Analysis Market

In July 2024, North America held a significant 48.9% share of the AI-powered retina image analysis market. This dominance is supported by a robust healthcare infrastructure, high healthcare expenditure, and a strong adoption rate of AI technologies in medical diagnostics. The United States and Canada are at the forefront, integrating artificial intelligence in ophthalmology, bolstered by government initiatives and substantial healthcare technology investments.

Key industry players, including giants like Google and IBM, along with innovative startups such as RetiSpec Inc., drive the market forward. In July 2024, RetiSpec Inc. successfully secured US$10M in Series A financing, aiming to commercialize its AI-driven diagnostic technology for early Alzheimer’s detection. This influx of capital underscores the dynamic growth and potential within the sector.

The region’s aging population and increasing prevalence of retinal diseases like diabetic retinopathy and age-related macular degeneration boost the demand for AI-powered diagnostic tools. Enhanced by favorable regulatory conditions, including FDA approvals, North America is well-positioned to advance the use of AI in clinical settings, reinforcing its market leadership.

The expansion of telemedicine and remote diagnostics further augments the market landscape, especially in underserved areas. With easy access to advanced imaging devices and a conducive regulatory environment, North America is poised to sustain its dominant market share. Continued innovation and deeper healthcare integration are expected to propel the market’s growth, ensuring ongoing leadership in AI-powered retina image analysis.

The Europe region is expected to experience the highest CAGR during the forecast period

Europe is the second-largest region which held 26.8% share for the AI powered retina image analysis market, with countries like Germany, the United Kingdom, and France leading the way. The AI-powered retina image analysis market in Europe is experiencing significant growth, driven by an aging population, high healthcare standards, and increasing adoption of digital health technologies.

Countries like Germany, the UK, and France are at the forefront of incorporating AI in ophthalmology, supported by favorable regulatory frameworks (e.g., CE marking) and extensive healthcare infrastructure. Europe’s well-established healthcare systems encourage the integration of advanced diagnostic tools, making AI-powered retina image analysis a valuable tool for early detection and management of conditions like diabetic retinopathy, age-related macular degeneration (AMD), and glaucoma.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The AI Powered Retina Image Analysis Market is characterized by intense competition among key players such as Google Health (DeepMind), IBM Watson Health, Aidoc, and Retina.ai. Other notable companies include Eyenuk, Zebra Medical Vision, VivoSight, and Topcon Healthcare. These organizations prioritize innovation, regulatory compliance, and building consumer trust to secure a larger market share. Their efforts are directed towards enhancing technology and expanding application areas in healthcare.

Google Health, through its DeepMind division, stands out with substantial financial and technological resources. This allows it to lead in AI research and healthcare applications. Google’s extensive infrastructure and research capabilities enable it to invest in advanced AI technologies and conduct large-scale clinical studies. This strategic advantage positions Google as a frontrunner in the market.

In October 2024, Google announced a significant initiative by licensing its AI model for detecting diabetic retinopathy to partners in Thailand and India. These countries, which face a critical shortage of eye specialists, will benefit from Google’s AI solutions. The technology aims to mitigate preventable blindness caused by diabetic retinopathy, demonstrating Google’s commitment to global health improvements through AI.

Nearly a decade prior, Google Research teams collaborated with Aravind Eye Hospital in India and Rajavithi Hospital in Thailand. This partnership explored the potential of AI to enhance the detection and treatment of diabetic retinopathy. Through these collaborations, Google has established a strong foothold in applying AI to solve real-world health issues, particularly in regions lacking sufficient medical infrastructure.

Top Key Players in the AI Powered Retina Image Analysis Market

- Google Health (DeepMind)

- IBM Watson Health

- Aidoc

- ai

- Eyenuk

- Zebra Medical Vision

- VivoSight

- Topcon Healthcare

- Canon Medical Systems

- Heidelberg Engineering

- Bionode Health

- Pixyl

- IDx Technologies

- Ophthalmos AI

- Optos

- Other players

Recent Developments

- In May 2024: Notal Vision achieved a significant milestone when the FDA granted De Novo authorization for its SCANLY Home OCT device. This patient-operated tool is designed to monitor wet age-related macular degeneration (nvAMD). Recognized as a Breakthrough Device, the SCANLY Home OCT empowers patients by enhancing personalized care for those suffering from nvAMD.

- In October 2023: Canadian company DIAGNOS Inc. launched an advanced screening program in collaboration with Canada’s leading specialist in diabetes and endocrinology. Utilizing the FLAIRE AI platform, DIAGNOS aims to revolutionize the diagnosis and monitoring of retinal conditions, focusing particularly on patients with diabetes and hypertension.

- In December 2022: RetinAI Medical AG introduced its Discovery CORE™ software, integrating AI for retinal fluid and layer segmentation. This new tool accelerates the analysis of medical and imaging datasets, fostering real-time collaboration among clinical and academic researchers. Discovery CORE is designed to enhance efficiency and innovation in medical research.

Report Scope

Report Features Description Market Value (2023) US$ 2.65 billion Forecast Revenue (2033) US$ 9.41 billion CAGR (2024-2033) 13.5% Base Year for Estimation 2023 Historic Period 2019-2033 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type of Technology (Machine Learning (ML), Deep Learning (DL), Natural Language Processing (NLP)), By Disease Type (Diabetic Retinopathy (DR), Age-related Macular Degeneration (AMD), Glaucoma, Retinal Vein Occlusion (RVO), Retinopathy of Prematurity (ROP) and Others), By Application (Clinical Diagnosis, Early Detection & Screening, Treatment Planning, Monitoring & Follow-up, and Telemedicine & Remote Screening), By Deployment Mode (On-premises, and Cloud), By End-User (Hospitals & Clinics, Diagnostic Centers, Research & Academia, Telemedicine Providers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google Health (DeepMind), IBM Watson Health, Aidoc, Retina.ai, Eyenuk, Zebra Medical Vision, VivoSight, Topcon Healthcare, Canon Medical Systems, Heidelberg Engineering, Bionode Health, Pixyl, IDx Technologies, Ophthalmos AI, and Optos. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Powered Retina Image Analysis MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

AI Powered Retina Image Analysis MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Google Health (DeepMind)

- IBM Watson Health

- Aidoc

- ai

- Eyenuk

- Zebra Medical Vision

- VivoSight

- Topcon Healthcare

- Canon Medical Systems

- Heidelberg Engineering

- Bionode Health

- Pixyl

- IDx Technologies

- Ophthalmos AI

- Optos

- Other players