Global Bitter Blocker Market Size, Share, And Industry Analysis Report By Product Type (Natural Bitter Blockers, Synthetic Bitter Blockers, Others), By Application (Food and Beverage, Pharmaceuticals, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176450

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

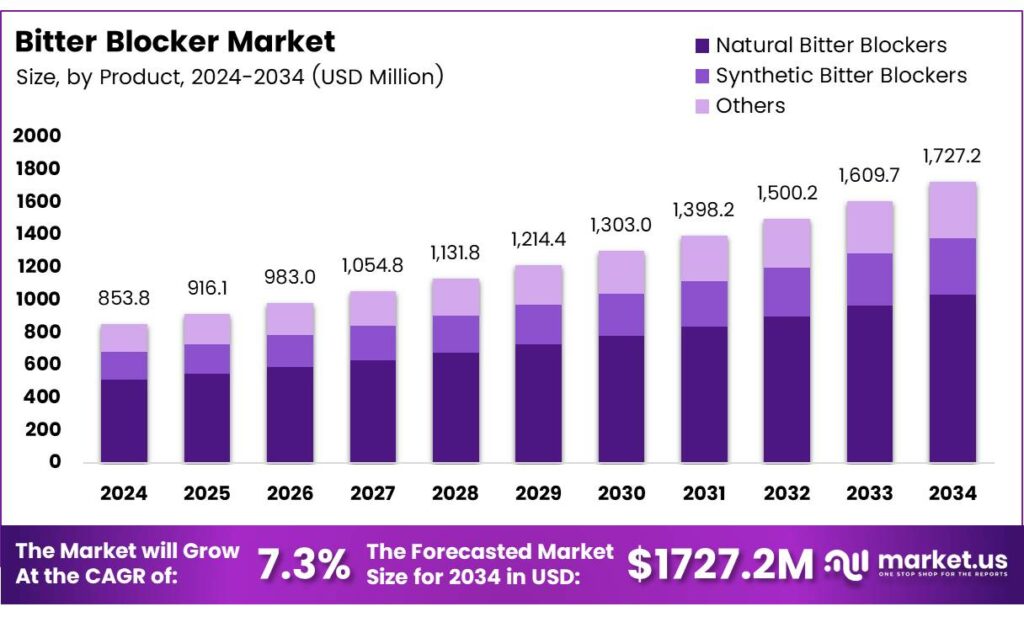

The Global Bitter Blocker Market size is expected to be worth around USD 1727.2 million by 2034, from USD 853.8 million in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034.

The Bitter Blocker Market focuses on technologies and ingredients that reduce unpleasant taste in foods, beverages, nutraceuticals, and pharmaceuticals. It helps manufacturers improve flavor acceptance, especially in health-focused products where bitter compounds are common. As a functional ingredient segment, it continues to evolve with cleaner formulations, sensory science advances, and growing consumer demand for better taste experiences.

The market gains traction through opportunities in plant-based foods, protein shakes, OTC medicines, and herbal extracts categories, typically linked with strong bitterness. Governments increasingly support research on food-grade additives, ensuring safer taste-modulating compounds. Clearer regulatory pathways across the U.S. and Europe also encourage technology developers to commercialize novel bitter blockers with clean-label positioning.

- Bitter blockers such as eriodictyol-8-C-P-glucoside, homoeriodictyol 4′-O-glucoside, and homoeriodictyol 7-O-glucoside can reduce bitterness by at least 50%, with enhanced reductions reaching 60% and even 80%. Compositions may contain at least 100 mg/L of bitter tastants while still achieving significant taste reduction. The same source notes that these blockers are effective at concentrations between 10 ppm and 200 ppm, reinforcing their value in precision flavor formulations.

Regulatory oversight strengthens confidence in these technologies, enabling broader applications in beverages, gummies, syrups, and oral care. As innovation accelerates, companies focus on natural bitter blockers to align with consumer preferences. This transition improves product acceptability and supports long-term market expansion across global food and nutraceutical supply chains.

Key Takeaways

- The Global Bitter Blocker Market reached USD 853.8 million in 2024 and is projected to hit USD 1727.2 million by 2034 at a 7.3% CAGR.

- Natural Bitter Blockers dominate the product type segment with a 54.3% market share.

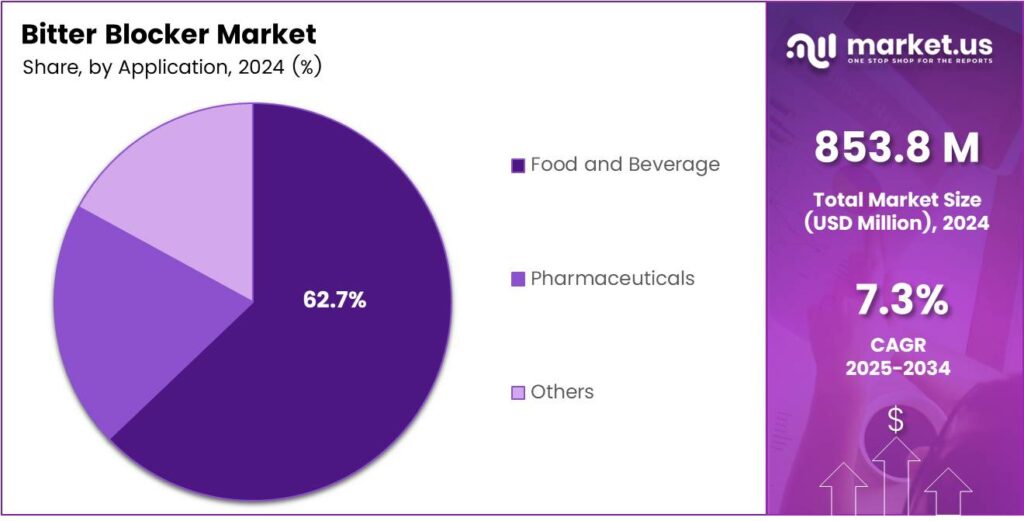

- The Food and Beverage segment leads with a 62.7% share in 2025.

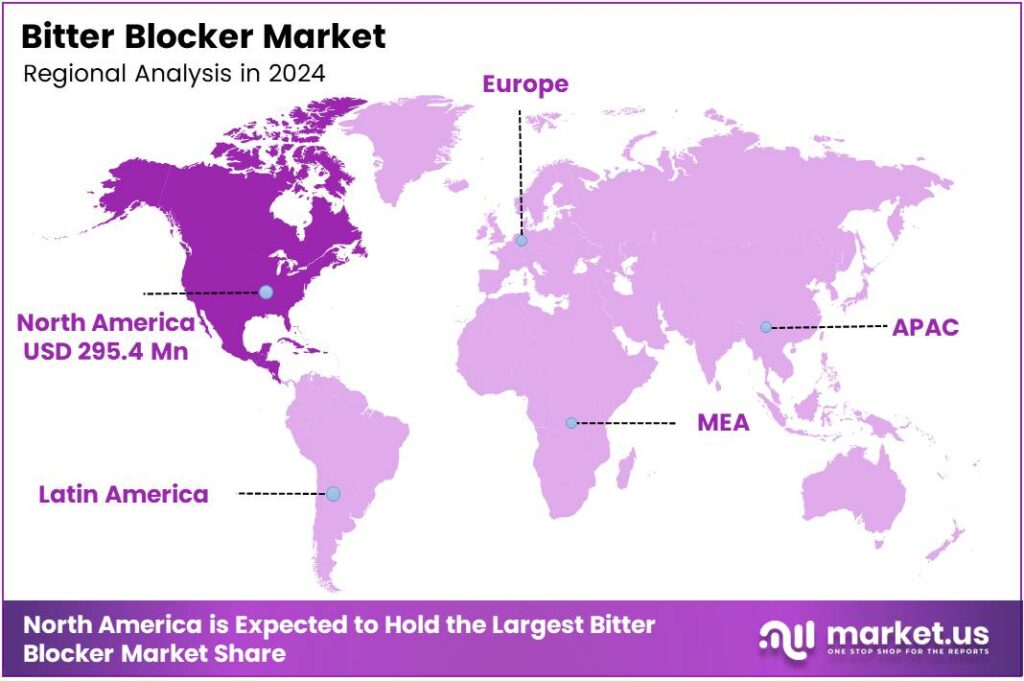

- North America is the leading region with a 34.6% share, valued at USD 295.4 million.

By Product Type Analysis

Natural Bitter Blockers dominate with 54.3% due to their clean-label appeal and higher adoption in food and beverage formulations.

In 2025, Natural Bitter Blockers held a dominant market position in the By Product Type segment of the Bitter Blocker Market, with a 54.3% share. Their rise is driven by growing demand for natural taste-modulating ingredients. These solutions help brands reduce bitterness in plant proteins, nutraceutical drinks, and fortified foods while supporting clean-label claims.

Synthetic Bitter Blockers continue to support industries that need stronger or more targeted bitterness-reducing effects. These compounds are widely used in pharmaceutical formulations where active ingredients naturally carry unpleasant taste profiles. They also help improve patient compliance, especially in pediatric and geriatric medications requiring efficient taste-masking solutions.

Others include emerging botanical blends and hybrid formulations designed for applications where conventional blockers underperform. These options are increasingly explored in customized beverage bases, sports nutrition mixes, and experimental flavor systems. Their flexibility allows manufacturers to fine-tune mouthfeel and deliver balanced taste experiences aligned with evolving consumer preferences.

By Application Analysis

Food and Beverage segment leads with 62.7% due to higher use of taste-masking in functional and fortified products.

In 2025, Food and Beverage held a dominant market position in the By Application segment of the Bitter Blocker Market, with a 62.7% share. Growing consumption of plant-based proteins, zero-sugar drinks, and nutritionally fortified products increases the need for bitterness-reducing additives. These solutions help brands maintain enjoyable flavor while retaining nutritional value.

Pharmaceuticals continue to rely heavily on bitter blockers to improve the palatability of oral medicines. Many active pharmaceutical ingredients exhibit strong bitterness, prompting formulators to use blockers in syrups, chewables, and dissolvable tablets. Improving taste helps enhance treatment adherence across pediatric and senior populations, supporting broader healthcare goals.

Others include applications in nutraceuticals, dietary supplements, and personal care formulations. These categories benefit from bitterness-modulating compounds to refine the consumer sensory experience. As supplement formats diversify—gummies, drink mixes, and liquid concentrates—manufacturers utilize bitter blockers to create smoother flavor profiles and encourage consistent daily use.

Key Market Segments

By Product Type

- Natural Bitter Blockers

- Synthetic Bitter Blockers

- Others

By Application

- Food and Beverage

- Pharmaceuticals

- Others

Emerging Trends

Growing Shift Toward Natural Bitter Blocker Ingredients Trends Upward

A major trend in the Bitter Blocker Market is the rising preference for natural and plant-derived bitter blockers. Companies are moving away from synthetic compounds and adopting clean-label solutions extracted from fruits, herbs, and botanicals. This aligns with consumer expectations for transparency and natural formulation.

- In the U.S., the Good Food Institute and Plant Based Foods Association reported the plant-based retail market was worth $8.1 billion in 2024. They also noted that unit sales fell 5% and dollar sales fell 4%, which is a loud signal that taste and texture still need work, not just price cuts.

The integration of bitter blockers in sugar-reduced and zero-sugar products. As brands increase their use of stevia, monk fruit, and other natural sweeteners, bitter blockers become essential in balancing the taste profile. This trend is strong in beverages, confectionery, and nutrition supplements.

Drivers

Rising Demand for Better-Tasting Functional Foods Drives Market Growth

The Bitter Blocker Market is growing because more people want functional foods and beverages that taste better without added sugar. As companies add vitamins, minerals, and plant ingredients to products, bitterness becomes a common issue. Bitter blockers help solve this challenge, allowing brands to maintain natural ingredients while improving flavor. This creates a strong push for adoption in nutrition bars, fortified drinks, and plant-based supplements.

- The UK Soft Drinks Industry Levy was associated with a 34.3% reduction in total sugar sales from soft drinks, dropping from 135,391 tonnes to 89,019 tonnes. Over the same period, the sales-weighted average sugar content of levy-eligible soft drinks fell from 3.8 g/100 mL to 2.1 g/100 mL.

The rising use of plant proteins, especially in dairy alternatives, sports nutrition, and vegan snacks. Many plant proteins have an aftertaste that consumers dislike, making bitter blockers essential for cleaner flavor profiles. Manufacturers are increasingly choosing natural bitter-blocking compounds to meet clean-label expectations.

Restraints

High Formulation Complexity Restrains Bitter Blocker Market Expansion

One major restraint for the Bitter Blocker Market is the complexity involved in formulating products across different applications. Bitter blockers must work in harmony with various ingredients, pH levels, and processing conditions, making it difficult for manufacturers to achieve consistent results. This increases development time and costs, slowing adoption for smaller brands.

- Food and pharmaceutical companies must evaluate safety, dosage limits, and ingredient interactions on their own, which requires additional testing. A FEMA-hosted review paper notes that the FEMA Expert Panel has determined that over 2,700 flavoring ingredients have met the criteria for GRAS status under conditions of intended use.

Cost sensitivity also affects the market, as high-quality bitter blockers can be expensive for mass-market food and beverage categories. Many companies hesitate to invest in these ingredients unless the product strongly depends on taste improvement.

Growth Factors

Expanding Use in Plant-Based Foods Creates Strong Growth Opportunities

The shift toward plant-based foods presents one of the strongest opportunities in the Bitter Blocker Market. As demand for vegan proteins, dairy alternatives, and plant-based supplements grows, companies require solutions to mask bitterness and enhance overall taste. Bitter blockers allow brands to differentiate themselves through better sensory experiences.

Emerging markets also offer large growth potential as food and beverage manufacturers modernize product lines. Increasing urbanization and rising disposable income are encouraging consumers to explore fortified foods, creating a need for taste optimization technologies.

Another significant opportunity lies in sugar reduction initiatives. With global governments pushing for lower sugar consumption, companies are using alternative sweeteners—many of which have bitter notes. Bitter blockers help balance these flavors, supporting healthier product development.

Regional Analysis

North America Dominates the Bitter Blocker Market with a Market Share of 34.6%, Valued at USD 295.4 Million

North America leads the global Bitter Blocker Market due to strong adoption of taste-modifying ingredients in food, beverages, and nutraceuticals. The region’s market share of 34.6% reflects its advanced flavor innovation ecosystem and high investment in product reformulation. With a valuation of USD 295.4 million, the demand is further supported by the rising consumption of fortified and functional foods.

Europe represents a mature market driven by stringent food quality regulations and increased consumer preference for improved taste in low-sugar and plant-based products. The region benefits from strong research activity and growing industry alignment with clean-label expectations. Demand is consistently supported by widespread adoption in bakery, dairy, and specialty nutrition categories.

Asia Pacific is one of the fastest-growing regions, propelled by rapid urbanization, rising middle-class consumption, and expanding processed food production. Countries like China, India, and Japan are witnessing higher use of bitterness-masking ingredients in beverages and nutraceuticals. Increased investment in flavor innovation and growing health-focused product launches further accelerate market growth.

The U.S. remains the core contributor within North America, driven by continuous innovation in food technology and expanding applications in dietary supplements. High consumer demand for reduced-sugar and plant-based alternatives boosts the need for effective bitterness-modifying solutions. The country’s advanced R&D capabilities and supportive regulatory environment further enhance adoption across multiple industries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADM is well-positioned in 2025 to win where bitter blocking meets scale: high-volume beverage, dairy alternatives, and value nutrition. Its edge is the ability to combine masking systems with sweeteners, fibers, and proteins into “one-bag” solutions that simplify reformulation for big manufacturers.

BASF brings a formulation-first mindset that matters as clean-label pressure rises and sweeteners diversify. In 2025, the company’s strength is translating flavor-modulation chemistry into stable performance across processing stresses like heat, pH shifts, and shelf-life—areas where bitterness often reappears after pilot success.

Blue California stands out for niche agility, especially in natural taste modulation for functional foods and supplements. As more brands use botanicals, minerals, and high-intensity sweeteners, Blue California’s opportunity is to help them keep “natural” positioning while smoothing off-notes without over-sweetening or heavy masking.

Cargill, Inc. is likely to focus on practical, cost-aware bitterness management tied to sugar reduction and plant-based growth. In 2025, its advantage is broad applications support—matching bitter blockers with sweetener systems and textures—so customers can hit taste targets while staying within tight labeling, sourcing, and margin constraints.

Top Key Players in the Market

- ADM

- BASF

- Blue California

- Cargill, Inc.

- Döhler

- dsm-firmenich

- Givaudan SA

- Kerry Group plc

- Symrise AG

- Tate and Lyle PLC

- Sensient Technologies Corporation

Recent Developments

- In 2025, ADM offers taste modification and modulation solutions focused on mitigating off-tastes such as bitterness, metallic notes, and lingering sweetness in high-intensity sweeteners. These solutions help replicate sugar’s functionality, including mouthfeel and texture, while masking undesirable profiles in products like beverages and nutrition bars.

- In 2025, BASF provides Smart Release Solutions for taste masking in formulations, which may incorporate bitterness blocking agents to mask bitter tastes or their perception on the tongue. Examples include adenosine as a bitter blocker, aimed at improving palatability in pharmaceutical or food applications.

Report Scope

Report Features Description Market Value (2024) USD 853.8 Million Forecast Revenue (2034) USD 1727.2 Million CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Natural Bitter Blockers, Synthetic Bitter Blockers, Others), By Application (Food and Beverage, Pharmaceuticals, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ADM, BASF, Blue California, Cargill, Inc., Döhler, DSM-Firmenich, Givaudan SA, Kerry Group plc, Symrise AG, Tate and Lyle PLC, Sensient Technologies Corporation Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- ADM

- BASF

- Blue California

- Cargill, Inc.

- Döhler

- dsm-firmenich

- Givaudan SA

- Kerry Group plc

- Symrise AG

- Tate and Lyle PLC

- Sensient Technologies Corporation