Global Biomedical Textiles Market By Fiber Type(Non-biodegradable Fiber, Biodegradable Fiber) By Fabric Type (Non-Woven, Woven, Other Fiber Types) By Application(Implantable, Non-implantable, Others) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 12061

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

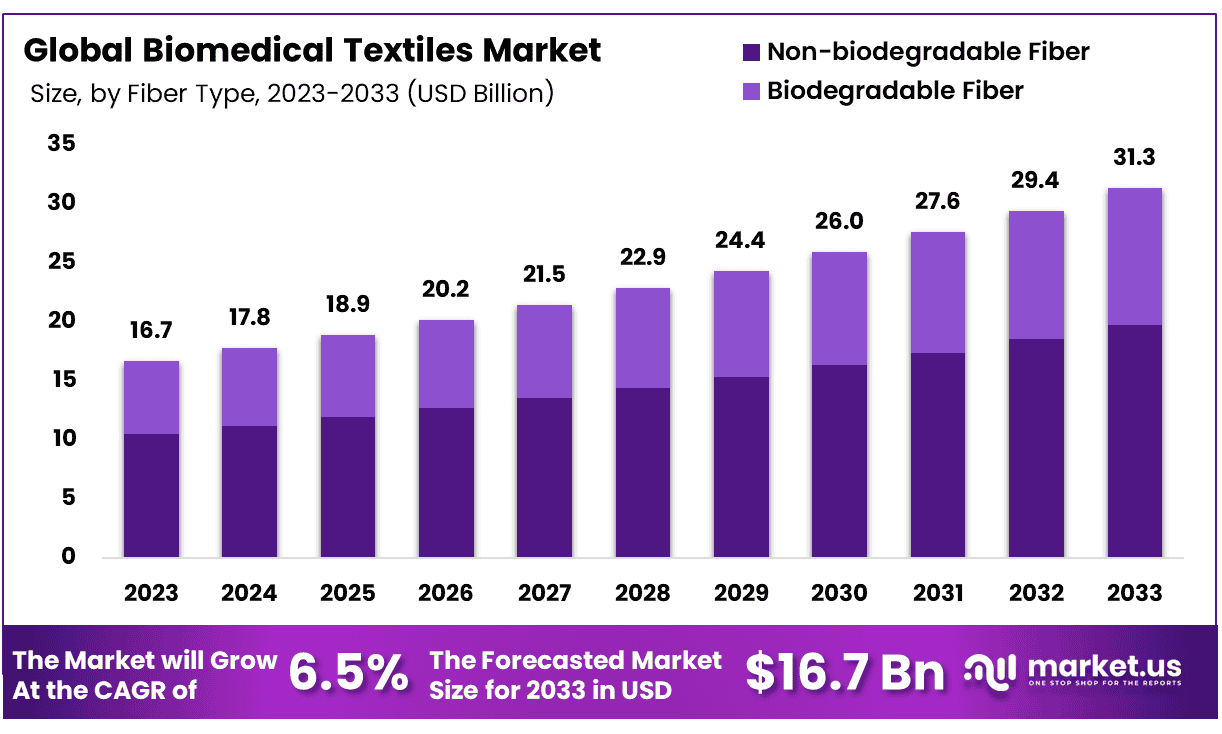

The Global Biomedical Textile Market size is expected to be worth around USD 31.3 Billion by 2033 from USD 16.7 Billion in 2023, growing at a CAGR of 6.5% during the forecast period from 2024 to 2033.

Market.us provides an expansive overview of the global biomedical textile market by categorizing it by fiber type, fabric type, and application. Fiber types covered include Biodegradable and Non-biodegradable with Biodegradable anticipated as the fastest-growing segment across all fiber types. Biomedical textiles can further be divided by fabric type into Non-Woven, Woven and Others segments – Non-Woven predicted to lead revenue gains over 2024-2033.

This Report offers an in-depth analysis of market trends, drivers, restraints, opportunities, etc. Along with qualitative information, this report includes the quantitative analysis of various segments in terms of market share, growth, opportunity analysis, market value, etc. for the forecast years. The global biomedical textiles market is segmented on the basis of type, application, and geography.

Biomedical textiles are fabrics, materials, and devices that are used in healthcare to improve patient care. This growth is driven by rising awareness about the benefits of using biomedical textiles in healthcare, increasing demand for comfortable and therapeutic garments, and increasing focus on reducing infection rates.

This growth is driven by the increasing demand for medical devices and garments, as well as the growing awareness about the importance of textile innovation in healthcare. In addition, the increasing popularity of natural fibers and advanced printing techniques is expected to boost market growth.

Key Takeaways

- Market Size & Growth: Biomedical Textile Market size is expected to be worth around USD 31.3 Billion by 2033 from USD 16.7 Billion in 2023, growing at a CAGR of 6.5%

- Fiber Type Analysis: Non-biodegradable Fiber dominates, holding 63% of market share.

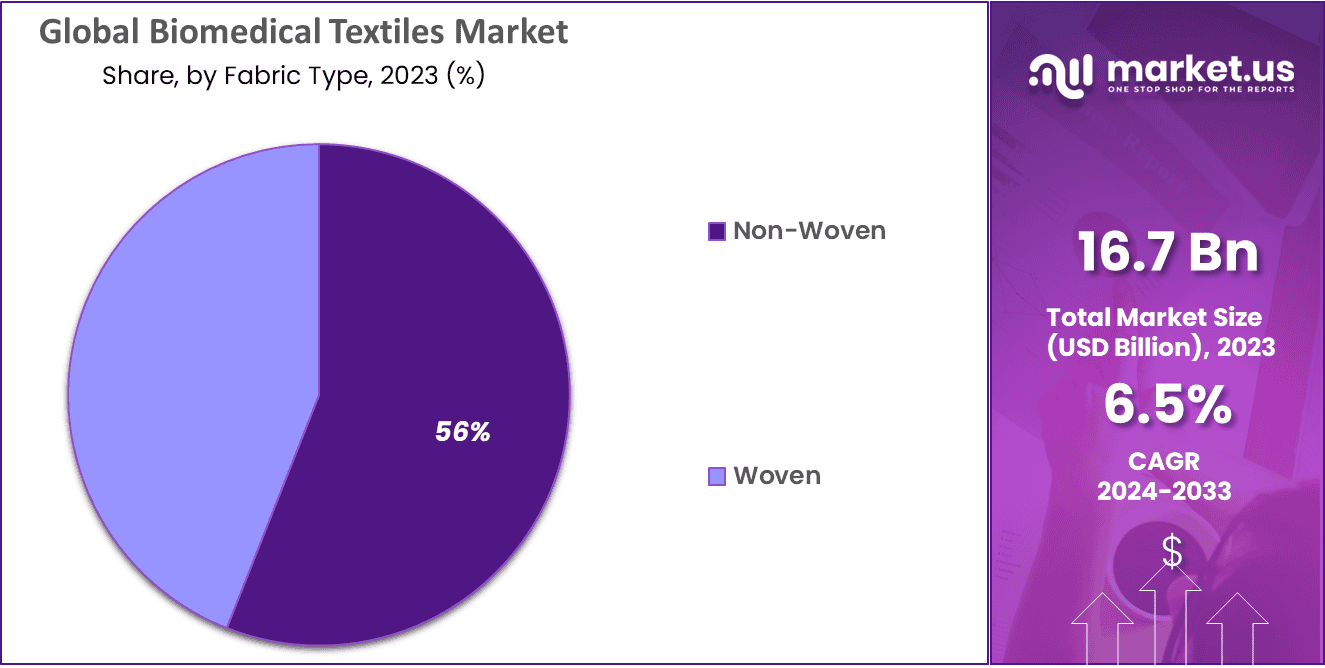

- Fabric Type Analysis: Non-Woven Fibers claim over 56% market share.

- Application Analysis: Implantable applications lead this category with 36% market share.

- Regional Analysis: North America holds an impressive 38% market share and generated USD 6.3 billion in biomedical textiles revenues in 2023

- Comprehensive Competition Insights: Competitive landscape covers company profiles, finances, R&D, global presence, and strategic focuses.

- Strategic Industry Emphasis: Market players concentrate on R&D, global expansion, and innovative product launches, shaping the competitive landscape.

Fiber Type Analysis

Biomedical textiles market undergoes an in-depth segmentation analysis, revealing a dominating position for fiber type textiles. Non-biodegradable Fiber dominates, holding 63% of market share and showing its high preference in multiple biomedical applications. Non-biodegradable materials’ dominance in medical textiles is due to their inherent properties of durability and stability, making them invaluable. Conversely, Biodegradable Fiber represents an emerging trend toward eco-friendly and sustainable options within biomedical science.

Market trends indicate a strong preference for non-biodegradable fibers, reflecting industry priorities. This segmentation analysis offers valuable insights into the intricacies shaping biomedical textiles markets by showing the balance between conventional and eco-conscious material choices.

Fabric Type Analysis

As part of an in-depth segmentation analysis of biomedical textiles market, Fiber Type category presents an eye-opening picture. Non-Woven Fibers claim over 56% market share – reflecting their widespread usage across biomedical applications as non-woven textiles have proven their versatility, cost-efficiency and ease of production to meet various medical needs.

As evidenced by this data, its application looms large within biomedical textile market segmentation analysis. Woven and Other Fiber Types make up the remaining market share in biomedical textiles, providing additional options in biomedical textiles landscape. Woven textiles provide strength and durability, while Other Fiber Types bring flexibility and innovation.

This segmentation analysis captures the industry’s nuanced preferences and the changing landscape of biomedical textiles. Non-Woven fibers stand out for their adaptability across a range of medical applications from surgical gowns to wound dressings; Woven and Other Fiber Types demonstrate market diversity that caters for specific requirements within biomedical textiles; whilst Woven and Other Fiber Types show how open this market remains to varied materials suited for particular requirements in biomedical textiles.

As technology and materials science advance this analysis provides invaluable insights into shaping dynamics that impacting biomedical textile market dynamics.

Application Analysis

As part of its segmentation analysis of biomedical textiles market, the Application category shows remarkable dynamics. Implantable applications lead this category with 36% market share – showing their prevalence in implantable medical devices and surgical procedures as well as tissue engineering processes. Implantable textiles play a significant role in improving medical outcomes from surgical implants to tissue engineering procedures.

Non-Implantable applications account for the remaining share, and represent an array of uses other than direct implantation. This encompasses wound dressings, bandages and medical textiles used in non-invasive procedures.

This segmentation analysis unveils the delicate balance of biomedical textiles market, revealing their varied roles across implantable and non-implantable medical applications. Implantable applications demonstrate precision and reliability required by implants; non-Implantable ones demonstrate biomedical textiles’ adaptability for various medical scenarios. As healthcare advances, this segmentation analysis offers insight into biomedical textiles’ evolving landscape – contributing towards innovation and improvement of healthcare practices.

Key Market Segments

Fiber Type

- Non-biodegradable Fiber

- Biodegradable Fiber

Fabric Type

- Non-Woven

- Woven

- Other Fiber Types

Application

- Implantable

- Non-implantable

- Others

Drivers

Biomedical Textile Market Boom

The biomedical textiles market is experiencing an upward spike in demand driven by an increased need for advanced wound care products. Biomedical textiles play a vital role in wound management as they offer effective wound healing, reduced infection risks and enhanced patient comfort. With increasing prevalence of chronic wounds such as diabetic ulcers and pressure sores driving increased need for innovative textiles with healing properties, manufacturers are investing heavily in creating biomedical textiles with enhanced functionality, durability and biocompatibility to meet ever changing healthcare needs.

Technological Advancements in Implantable Textiles

Integration of advanced technologies into biomedical textiles has proven an integral component of market expansion. Innovations in materials science and textile engineering have resulted in implantable textiles with unique properties like biodegradability, flexibility and compatibility with human bodies – perfect for medical applications such as vascular grafts, hernia repair or orthopedic implants. Furthermore, more recently we are witnessing smart textiles which respond dynamically to physiological changes, offering new avenues for personalized healthcare solutions.

Trends

Increased Focus on Sustainable and Eco-Friendly Textiles

One notable trend in biomedical textiles market is an increased emphasis on sustainability and eco-friendliness. As environmental issues gain prominence, manufacturers are turning their attention towards using eco-friendly biodegradable and compostable materials in biomedical textile production – this trend aligns with broader changes towards more sustainable healthcare practices; companies invest heavily in research and development of textiles which not only meet performance requirements of medical applications but also reduce environmental impacts associated with product disposal.

Adopting Nanotechnology into Biomedical Textiles

Nanotechnology has quickly become a cutting-edge trend in biomedical textiles. Nanomaterials are being employed to give textiles specific properties such as antimicrobial activity, enhanced drug delivery and increased mechanical strength. Nanofiber-based textiles in particular have seen tremendous interest due to their large surface area applications in wound dressings and tissue engineering applications. Nanotech promises to revolutionize both design and performance for biomedical textiles while offering novel solutions to healthcare challenges.

Restraint

Stringent Regulatory Requirements

One of the key challenges facing biomedical textiles market is navigating an intricate regulatory environment for medical devices and textiles. Approval for biomedical textiles typically requires rigorous testing against safety and efficacy standards set by regulatory bodies; compliance can extend product development timelines significantly while increasing development costs, placing manufacturers under additional strain to meet all necessary quality and safety standards, thus slowing their market expansion potential.

Initial Costs of Biomedical Textile Products

Initial costs associated with producing high-quality biomedical textile products can act as a roadblock to market expansion. Producing advanced textiles with specific functions typically requires significant investments in research, technology and specialized manufacturing processes – often leaving small and medium-sized enterprises struggling to enter this capital-intensive industry unable to enter with premium priced products as budget constraints prevent adoption & hamper growth potential of biomedical textile products for healthcare use & thus limit growth of the market overall.

Opportunities

Biomedical Textile Market Opportunities from an Aging Population and Chronic Disease Prevalence Trend

The ever-increasing global aging population and increasing chronic disease prevalence create tremendous opportunities for biomedical textiles market players. Elderly individuals often require healthcare interventions such as surgeries or wound care where biomedical textiles play a key role.

Furthermore, growing incidences of chronic conditions like diabetes or cardiovascular diseases drives demand for advanced medical textiles such as vascular grafts or implantable devices that cater to specific demographic and health trends; thus creating potential opportunities that allow companies to capitalize on demographic and health trends by developing tailored textiles specifically tailored for specific demographic and health trends of an aging and ailing population.

Regenerative Medicine Offers Opportunities for Biomedical Textiles

Regenerative medicine presents an exciting opportunity for biomedical textiles. Textiles have increasingly become scaffolds in tissue engineering and regenerative therapy applications. Biomedical textiles provide the foundation for cell growth and tissue regeneration, making them integral parts of regenerative medicine solutions.

Innovation opportunities exist within the textile market to develop textiles tailored for regenerative medicine applications, including skin grafts, bone regeneration, and organ transplants. By working together textile manufacturers and biotechnology firms can lead to breakthrough products addressing unmet needs in this area of medicine.

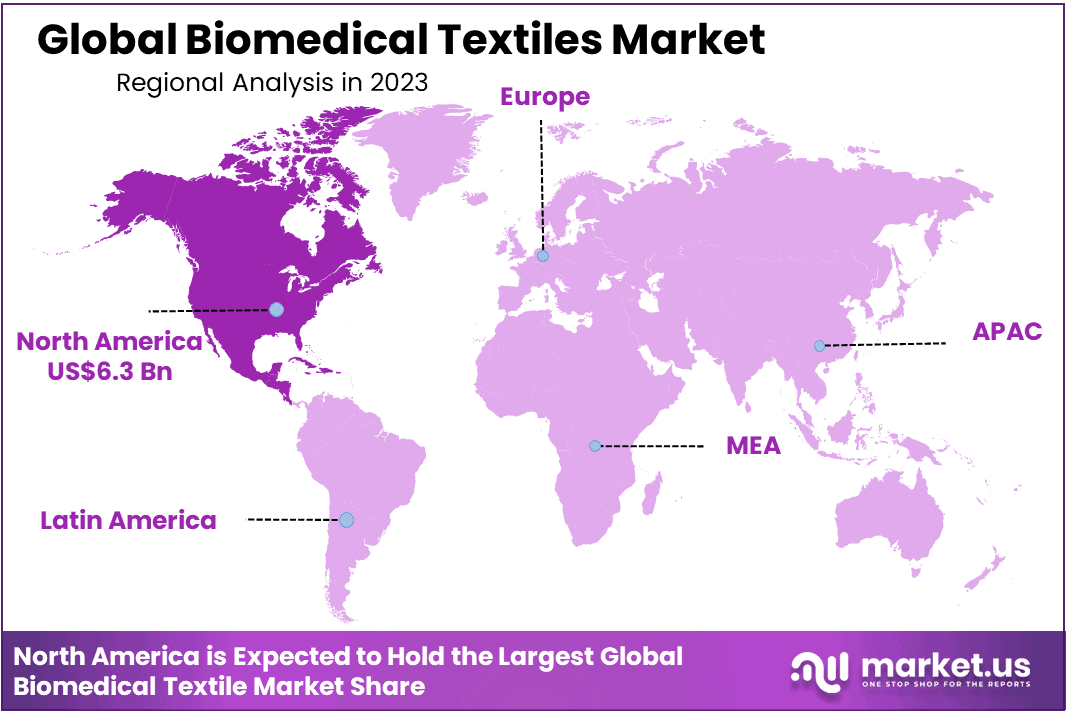

Regional Analysis

North America holds an impressive 38% market share and generated USD 6.3 billion in biomedical textiles revenues in 2023. This dominance is projected to last into the forecast period due to significant healthcare expenditure and advances in healthcare product technologies; as well as robust healthcare infrastructure and technological advances that support North America’s position within this industry sector.

Asia-Pacific is projected to experience the highest compound annual growth rate during this forecast period. This forecast can be explained by multiple factors, including availability of skilled labor at more economical costs, elevated disposable income levels and easy accessibility of raw materials in this geographical area. All these favorable factors help position Asia-Pacific as an expanding biomedical textiles market that could experience substantial expansion over time.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

The competitive panorama within the biomedical textiles market provides thorough insights into each participant. This includes an in-depth exploration of company profiles, financial positions, revenue generation, market potential, research and development investments, global presence production sites facilities production capacities inherent strengths weaknesses product launches product scope application dominance etc centered around each strategic focus within biomedical textiles market enterprises.

All information relevant only pertains to businesses operating within this niche market and their focus. It is vital that this data applies only specifically for this business sector.

Market Key Players

- Poly-Med Incorporated

- Medline Industries Inc.

- Atex Technologies Inc.

- DSM

- Cortland Biomedical

- Swicofil AG

- Bally Ribbon Mills, Inc.

- Elkem ASA

- 3M

- Integra LifeSciences Corporation

Recent Developments

- (February 2024): Poly-Med Incorporated launched BioWeave, a bioresorbable textile designed for surgical applications. This innovative product aims to enhance tissue integration and healing, providing a more efficient solution for surgical implants and wound care.

- (March 2024): Medline Industries Inc. acquired HealthTex Solutions, a leading provider of medical textiles. This strategic acquisition aims to expand Medline’s product portfolio and enhance its market presence in the biomedical textiles sector.

- (April 2024): Atex Technologies Inc. introduced SurgiMesh, a high-strength, antimicrobial textile designed for use in hernia repair surgeries. This product aims to reduce infection rates and improve patient outcomes by combining durability with antimicrobial properties.

- (January 2024): DSM merged with BioFabric Technologies to form DSM BioMed, a new entity focused on innovative biomedical textile solutions. This merger aims to leverage both companies’ expertise to develop advanced materials for medical applications.

- (June 2024): Cortland Biomedical acquired FiberTech Medical, enhancing its capabilities in producing high-performance biomedical textiles. This acquisition aims to broaden Cortland Biomedical’s product offerings and improve its market position.

- (May 2024): Swicofil AG launched MedFiber, a line of biocompatible fibers designed for use in various medical devices and implants. This new product aims to provide enhanced performance and safety in medical applications.

- (March 2024): Bally Ribbon Mills, Inc. introduced BioStrap, a biomedical textile designed for orthopedic supports and braces. This product aims to offer improved strength and flexibility, enhancing patient comfort and support during recovery.

Report Scope

Report Features Description Market Value (2023) USD 31.3 Billion Forecast Revenue (2033) USD 16.7 Billion CAGR (2024-2033) 6.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Fiber Type-(Non-biodegradable Fiber, Biodegradable Fiber);Fabric Type-(Non-Woven, Woven, Other Fiber Types, Application-(Implantable, Non-implantable, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Poly-Med Incorporated, Medline Industries Inc., Atex Technologies Inc., DSM, Cortland Biomedical, Swicofil AG, Bally Ribbon Mills, Inc., Elkem ASA, 3M, Integra LifeSciences Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Biomedical Textiles Market?The biomedical textiles market involves the production and utilization of textiles in medical applications, ranging from wound care to implantable devices.

How big is the Biomedical Textiles Market?The global Biomedical Textiles Market size was estimated at USD 16.7 Billion in 2023 and is expected to reach USD 31.3 Billion in 2033.

What is the Biomedical Textiles Market growth?The global Biomedical Textiles Market is expected to grow at a compound annual growth rate of 6.5%. From 2023 To 2033

What Drives Growth in Asia-Pacific for Biomedical Textiles?Asia-Pacific is projected for high growth, fueled by cost-effective skilled labor, increasing disposable income, and easy access to raw materials.

What Insights Does the Competitive Landscape Provide?The competitive landscape offers details on company profiles, finances, research investments, global presence, and strategic focuses within the biomedical textiles market.

What Strategic Emphases do Market Players Prioritize?Market players focus on research and development, global expansion, and innovative product launches, shaping the competitive dynamics of the biomedical textiles industry.

Biomedical Textiles MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Biomedical Textiles MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Poly-Med Incorporated

- Medline Industries Inc.

- Atex Technologies Inc.

- DSM

- Cortland Biomedical

- Swicofil AG

- Bally Ribbon Mills, Inc.

- Elkem ASA

- 3M

- Integra LifeSciences Corporation