Global Medical Device Outsourcing Market By Service (Contract Manufacturing (Accessories Manufacturing, Assembly Manufacturing, Component Manufacturing, and Device Manufacturing), Quality Assurance, Design and Development Services (Machining, Molding, Designing & Engineering, and Packaging), Maintenance Services, Regulatory Affairs Services (Regulatory Writing and Publishing, Clinical Trials Applications & Product Registrations, Legal Representation, and Other), and Others), By Application (Cardiology, General and Plastic Surgery, Diagnostic Imaging, Drug Delivery, IVD, and Others), By Class (Class I, Class II, and Class III), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 102327

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

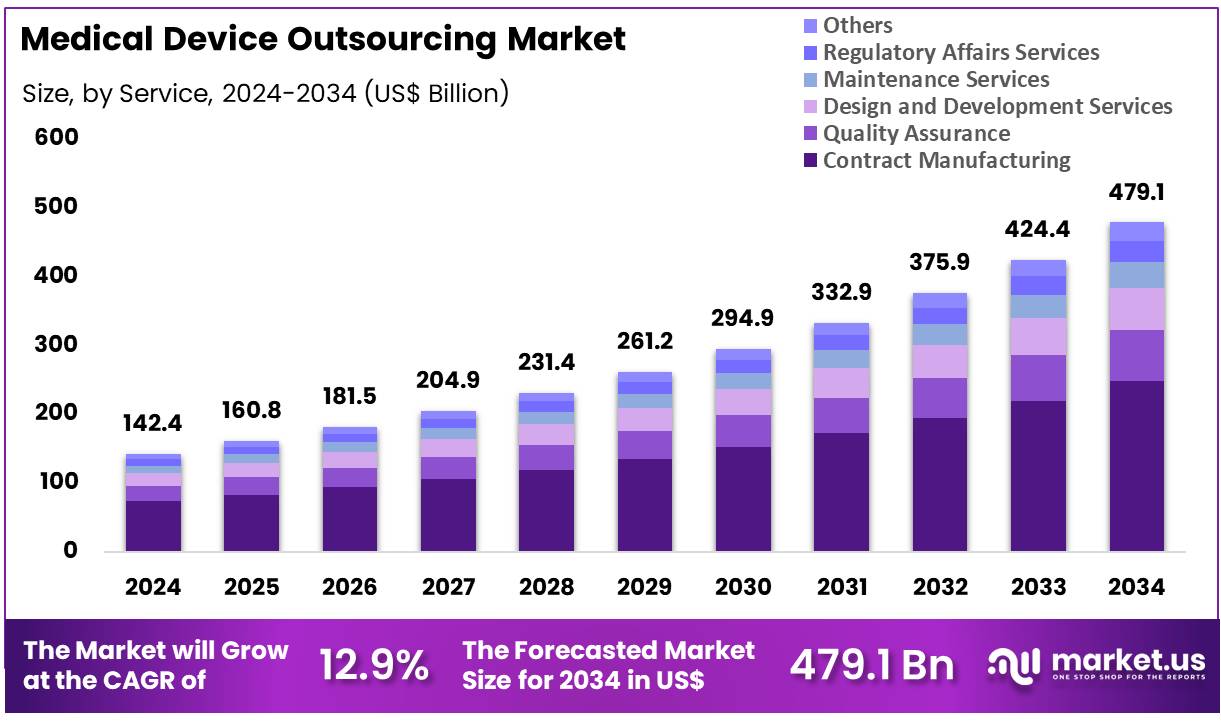

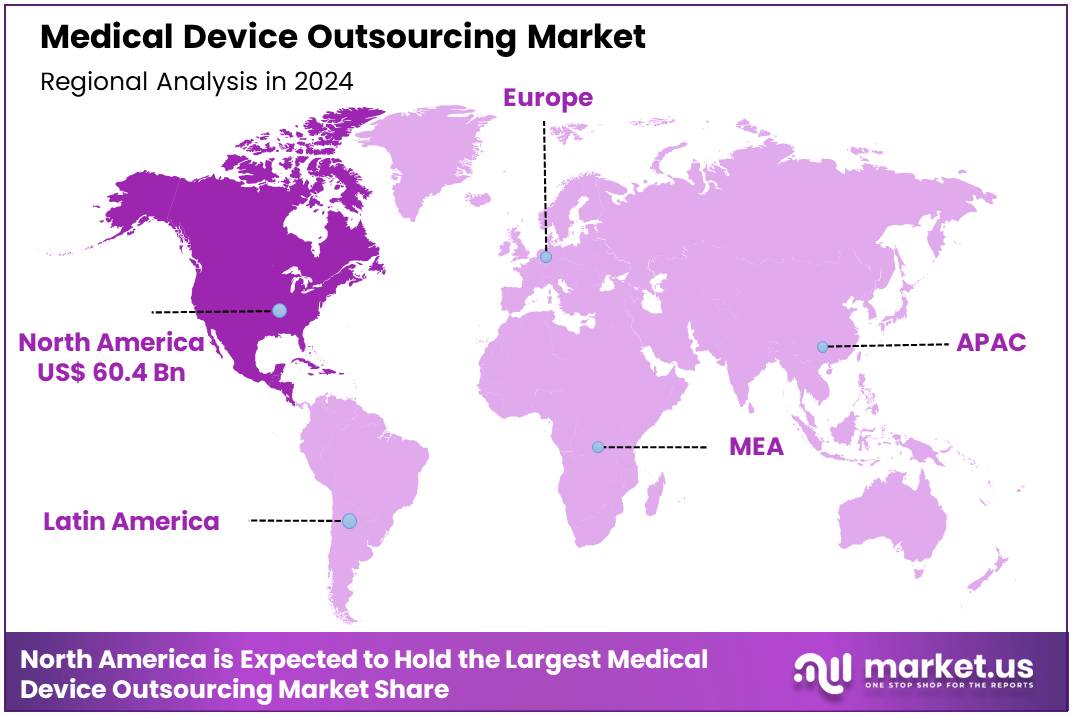

Global Medical Device Outsourcing Market size is expected to be worth around US$ 479.1 Billion by 2034 from US$ 142.4 Billion in 2024, growing at a CAGR of 12.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.4% share with a revenue of US$ 60.4 Billion.

Increasing regulatory complexities and the escalating costs of in-house manufacturing are major drivers for the medical device outsourcing market. Original Equipment Manufacturers (OEMs) are seeking to streamline operations and reduce overhead by leveraging the specialized expertise of third-party partners for a wide range of services, including design, manufacturing, and regulatory support.

Outsourcing allows companies to avoid significant capital investments in facilities and equipment, enabling them to focus on core competencies like product innovation and marketing. The U.S. Food and Drug Administration (FDA), for instance, has introduced increasingly stringent guidelines for device approval, making it more cost-effective for companies to partner with firms that specialize in navigating complex regulatory landscapes.

Growing strategic partnerships and a focus on end-to-end solutions are key trends shaping the market. Medical device firms are moving away from transactional relationships with multiple vendors and instead pursuing long-term collaborations with full-service outsourcing partners. These partnerships provide seamless integration across the entire product lifecycle, from initial concept to final packaging and distribution.

A prime example of this trend is the multiyear supply and services agreement announced in January 2023 between Avantor, Inc. and Catalent, Inc., where Avantor will serve as Catalent’s main supplier for manufacturing materials, clinical and laboratory products, and related services to strengthen and expand their ongoing partnership. This type of collaboration reduces complexity and improves supply chain resilience.

Rising demand for advanced and innovative devices is creating significant opportunities for market expansion. The shift towards non-invasive and home-based healthcare technologies, such as wearable monitors and remote diagnostic tools, is driving the need for specialized manufacturing capabilities. Outsourcing partners with expertise in miniaturization, robotics, and advanced materials can help OEMs accelerate the development of these complex devices.

In September 2022, North American Science Associates, LLC (NAMSA) entered into an outsourcing agreement with InspireMD, Inc. to support and accelerate the development and commercialization of medical devices. This collaboration demonstrates how outsourcing is critical for bringing cutting-edge technologies to market quickly and efficiently, ensuring companies can stay competitive in a rapidly evolving industry.

Key Takeaways

- In 2024, the market generated a revenue of US$ 142.4 billion, with a CAGR of 12.9%, and is expected to reach US$ 479.1 billion by the year 2034.

- The service segment is categorized into contract manufacturing, quality assurance, design and development services, maintenance services, regulatory affairs services, and others, with contract manufacturing leading the market in 2023, accounting for 51.7% of the market share.

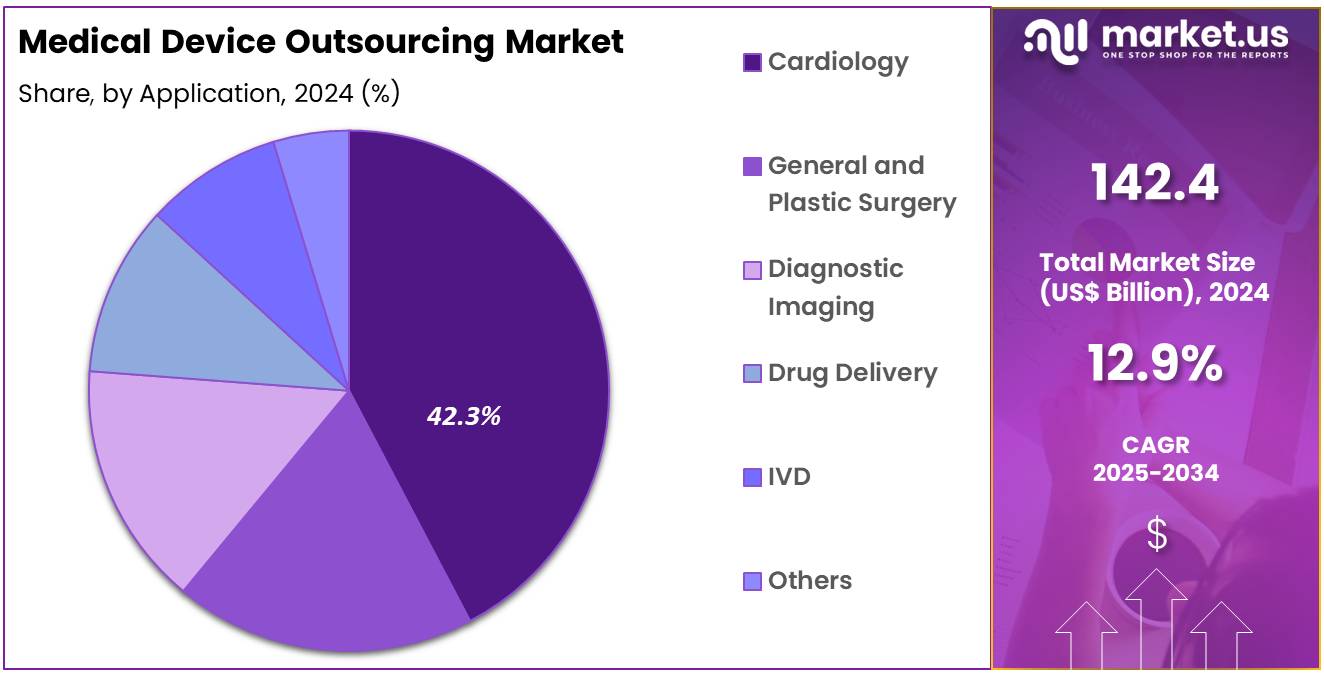

- In terms of application, the market is divided into cardiology, general and plastic surgery, diagnostic imaging, drug delivery, IVD, and other categories. Among these, cardiology captured the largest share, holding 42.3% of the market.

- Regarding the class segment, the market is divided into class I, class II, and class III devices. The class II segment dominates, representing the largest revenue share with 49.4% in the market.

- North America led the market by securing a market share of 42.4% in 2023.

Service Analysis

Contract manufacturing holds 51.7% of the service segment in the medical device outsourcing market. Its growth is projected to continue as medical device companies increasingly focus on core R&D and regulatory compliance while outsourcing production. The rising demand for cost-effective and scalable manufacturing solutions is anticipated to drive adoption. Outsourcing reduces capital investment for device manufacturers while offering access to specialized expertise in component assembly, molding, and device finishing.

Increasing complexity in medical devices, including integrated electronics and sophisticated drug delivery systems, is likely to encourage companies to rely on contract manufacturing. Regulatory pressures on quality and compliance make outsourced production attractive, as specialized manufacturers maintain stringent quality systems. The trend toward global supply chain diversification is expected to further support market growth. Contract manufacturing also enables faster time-to-market for innovative devices, which is projected to accelerate adoption in both emerging and developed regions.

Application Analysis

Cardiology applications account for 42.3% of the market and are expected to experience significant growth. Cardiovascular diseases remain the leading cause of mortality worldwide, driving demand for innovative devices such as stents, pacemakers, and implantable monitors. Outsourcing the production of these devices is likely to reduce costs and improve manufacturing efficiency. Increasing prevalence of lifestyle-related cardiovascular conditions and growing patient awareness is projected to support demand.

Manufacturers are expected to focus on precision, high-quality production to meet stringent regulatory standards. Cardiology device outsourcing also benefits from advanced material requirements, such as biocompatible metals and polymers, which specialized manufacturers can handle effectively. Collaborations between hospitals, cardiologists, and medical device developers are likely to further promote outsourcing. The demand for minimally invasive devices and remote monitoring tools is anticipated to expand production needs, which contract manufacturers are projected to fulfill efficiently.

Class Analysis

Class II medical devices hold 49.4% of the class segment and are expected to grow steadily due to moderate risk classification and widespread clinical use. These devices, including infusion pumps, diagnostic imaging equipment, and surgical instruments, require controlled manufacturing environments and strict regulatory compliance. Outsourcing production of Class II devices allows companies to scale operations while ensuring adherence to FDA and international standards.

Increasing adoption of technologically advanced Class II devices in hospitals and clinics is likely to boost market demand. Manufacturers are anticipated to leverage contract services for rapid prototyping, quality assurance, and regulatory submissions. The need for consistent performance, precision, and safety in Class II devices supports a strong reliance on specialized outsourcing providers. Additionally, growing healthcare infrastructure and investments in modern medical facilities globally are expected to drive production requirements. Outsourcing enables faster delivery, cost optimization, and flexibility, making Class II devices a dominant segment in the market.

Key Market Segments

By Service

- Contract Manufacturing

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

- Quality Assurance

- Design and Development Services

- Machining

- Molding

- Designing & Engineering

- Packaging

- Maintenance Services

- Regulatory Affairs Services

- Clinical Trials Applications And Product Registrations

- Regulatory Writing And Publishing

- Legal Representation

- Other

- Others

By Application

- Cardiology

- General and Plastic Surgery

- Diagnostic Imaging

- Drug Delivery

- IVD

- Others

By Class

- Class I

- Class II

- Class III

Drivers

The rising demand for advanced and complex devices is driving the market.

The medical device outsourcing market is experiencing significant growth, primarily fueled by the escalating demand for highly complex and technologically advanced medical devices. Original equipment manufacturers (OEMs) are increasingly recognizing the strategic necessity of partnering with specialized contract manufacturers to manage the intricate and costly development process.

Outsourcing allows OEMs to leverage the expertise of third parties for everything from design and engineering to manufacturing and quality assurance, thereby accelerating product development cycles and reducing overhead. This partnership model is particularly crucial for sophisticated devices, such as those in the fields of robotics, diagnostics, and cardiology. This trend is clearly supported by a review of official data.

The US Food and Drug Administration (FDA)’s annual report for 2024 shows a continued increase in the number of high-risk medical device approvals, particularly those for complex systems like the TriClip G4 System and Vercise DBS Systems, with over 30 new devices making it to market in the first half of the year alone. The complexity of these devices makes outsourcing a key operational strategy for OEMs seeking to maintain a competitive edge.

Restraints

Intellectual property and data security concerns are restraining the market.

A significant restraint on the market is the pervasive and increasing risk associated with intellectual property (IP) protection and data security. When a medical device company outsources a part of its operations, it must share sensitive proprietary information, including design specifications, formulas, and patient data, with a third-party partner. This exposure creates a substantial risk of data breaches, theft of trade secrets, or the unauthorized use of patented technology.

Any breach of this trust can result in severe financial losses, irreparable damage to a company’s reputation, and long-term legal ramifications. The US Department of Health and Human Services (HHS) Office for Civil Rights provides clear evidence of this vulnerability.

In 2023, the agency’s data showed 725 reported data breaches of 500 or more records, impacting over 134 million individuals. A significant portion of these breaches occurred at business associates, highlighting the elevated risk of entrusting sensitive data to third-party vendors and serving as a major headwind for the outsourcing market.

Opportunities

The expansion of specialized services is creating growth opportunities.

A key growth opportunity in the medical device outsourcing market lies in the increasing demand for highly specialized, niche services that go beyond traditional manufacturing. OEMs are now seeking partners who can provide end-to-end solutions, including product design, regulatory compliance consulting, and post-market surveillance. This trend is particularly evident in the rapidly evolving sectors of robotic surgery and connected health.

Specialized contract manufacturers with a deep understanding of these complex fields can offer a compelling value proposition. The US Patent and Trademark Office (USPTO)’s public search database for 2024 shows a remarkable increase in patent grants related to robotic surgery and AI-enabled medical devices, with multiple new patents issued for systems like the Microbot Medical Liberty system. This surge in innovation creates a lucrative market for outsourcing firms that possess the unique technical capabilities and regulatory expertise required to bring these cutting-edge products to market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors and geopolitical volatility significantly shape the market for outsourced medical device services. Persistent global inflation drives up the cost of raw materials like plastics and metals, forcing companies to increase prices or accept lower margins. Geopolitical tensions, such as trade disputes or regional conflicts, can disrupt intricate supply chains, leading to material shortages and production delays. This volatility exposes the inherent risks of a globally dispersed manufacturing model, compelling companies to rethink their sourcing strategies.

The current landscape of US tariffs on imported goods and components presents an additional layer of challenge, directly increasing the cost of production and potentially making US-based products less competitive. However, these challenges also create a positive ripple effect. They motivate companies to diversify their manufacturing footprint and near-shore operations to more stable, geographically proximate regions, ultimately building a more resilient and less vulnerable supply chain.

In a parallel development, these same tariffs can encourage foreign outsourcing partners to relocate or expand their operations to the US, which stimulates domestic job growth and innovation. This creates a more robust local supply base, ultimately strengthening the US medical device ecosystem.

Latest Trends

The integration of automation and smart manufacturing is a recent trend.

A defining trend in 2024 is the accelerated integration of automation, robotics, and smart manufacturing technologies into the outsourcing process. These advancements are transforming traditional contract manufacturing by enhancing precision, increasing efficiency, and reducing human error. Outsourcing partners are investing in automated assembly lines, robotic quality control systems, and data analytics platforms to optimize production and ensure the highest standards of quality. This shift toward a more technology-driven approach provides a significant competitive advantage.

The International Federation of Robotics (IFR)’s World Robotics Report 2024 revealed that the total operational stock of industrial robots in the US reached 381,964 in 2023, representing a 12% increase from the previous year. While this number includes all industries, the medical device sector is a key driver of this trend, as companies seek to leverage automation to meet stringent regulatory requirements and reduce long-term operational costs.

Regional Analysis

North America is leading the Medical Device Outsourcing Market

The North American medical device outsourcing market held a significant 42.4% share of the global market in 2024. This leadership is a direct result of the region’s robust medical technology ecosystem, a strategic focus by original equipment manufacturers (OEMs) on their core competencies, and a complex and evolving regulatory landscape. The US is a major hub of innovation, with a consistent and high volume of new product development and approvals.

For instance, the US Food and Drug Administration (FDA) granted 167 breakthrough device designations in 2023, a notable increase from 135 in 2022. This high rate of innovation and regulatory activity creates a substantial need for specialized expertise in product design, development, and compliance, which is a core service provided by outsourcing partners. By leveraging these specialized firms, medical device companies can accelerate time to market, manage costs, and focus on their primary mission of bringing innovative products to patients.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific medical device outsourcing market is anticipated to experience robust growth during the forecast period. This is largely a result of a rapidly expanding healthcare sector, growing domestic medical device manufacturing, and increasing foreign direct investment in the region. Many multinational corporations are looking to establish a manufacturing presence in Asia to capitalize on lower labor costs and burgeoning local markets. The market’s growth is also supported by recent regulatory changes in countries like India, which are intended to streamline the approval process for new medical devices.

For example, in 2024, the Indian government launched a new scheme with a total outlay of Rs. 500 crore (approximately US$60 million) to strengthen the medical device industry by supporting local manufacturing and infrastructure. Similarly, China’s total expenditure on research and development (R&D) exceeded 3.6 trillion yuan (approximately US$496 billion) in 2024, demonstrating its commitment to becoming a leader in medical technology. This type of government-led initiative is likely to encourage both domestic and international companies to expand their operations, thereby increasing the demand for outsourcing partners.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the medical device outsourcing market are driving growth by strategically expanding their technological capabilities, particularly in areas like AI-driven data analytics and remote patient monitoring devices. They are also actively engaged in mergers and acquisitions and forming strategic partnerships to offer a more comprehensive suite of services, from design and engineering to regulatory compliance and post-market support. Companies further focus on expanding their global manufacturing footprints to meet the growing demand in emerging markets and provide cost-effective solutions. This combination of innovation and strategic business development is crucial for maintaining a competitive edge.

Jabil Inc., a leading manufacturing solutions provider, has solidified its position in this sector through its dedicated healthcare division. The company’s business model is centered on providing comprehensive, end-to-end services that support the entire product lifecycle, from initial concept and design to large-scale manufacturing and supply chain management.

Jabil’s strategy involves leveraging its global scale and deep expertise in advanced manufacturing technologies to help medical device original equipment manufacturers (OEMs) navigate complex regulatory environments and accelerate their time to market. The company’s focus on vertical integration and innovation makes it a key partner for many of the world’s largest medical technology companies.

Top Key Players

- WuXiAppTec

- SGS SA

- PAREXEL International Corporation

- Pace Analytical Services, Inc

- North American Science Associates, LLC

- Medical Device Testing Services

- Mandala International

- Laboratory Corporation of America Holdings

- Intertek Group plc

- Global Regulatory Partners

- Freyr

- Euro fins Scientific

- Charles River Laboratories

Recent Developments

- In March 2025, Flex, a major contract manufacturer, announced the opening of a new Product Introduction (NPI) center near Boston, Massachusetts. This facility is designed to support medical device customers with end-to-end product development, from prototyping to production transfer. The center is specifically aimed at customers in sectors such as surgical robotics and diagnostics. This development highlights the trend of outsourcing firms moving beyond simple manufacturing to provide more comprehensive, value-added services. By offering a dedicated NPI center, Flex is helping medical device companies accelerate their time-to-market and streamline the development process, which is a significant driver of growth in the medical device outsourcing market.

- In January, 2025, WuXi AppTec announced it has agreed to sell its U.S. medical device testing operations to NAMSA, including facilities in Minnesota and Georgia. This move allows WuXi to maintain its focus on its integrated CRDMO platform while NAMSA expands its MedTech services.

- In January 2025, Arterex, a global medical device contract manufacturer, announced the successful completion of its acquisition of Phoenix S.r.l. The acquisition of Phoenix, a European medical device developer and manufacturer, is a significant development as it expands Arterex’s global footprint and manufacturing capabilities, particularly in the European market. This move allows Arterex to offer a more comprehensive suite of services to its customers and solidifies its position as a key player in the outsourcing space. This type of strategic acquisition is a common growth strategy in the market, allowing companies to quickly expand their geographical reach and service offerings.

Report Scope

Report Features Description Market Value (2024) US$ 142.4 Billion Forecast Revenue (2034) US$ 479.1 Billion CAGR (2025-2034) 12.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Medical Device Outsourcing Market By Service (Contract Manufacturing (Accessories Manufacturing, Assembly Manufacturing, Component Manufacturing, and Device Manufacturing), Quality Assurance, Design and Development Services (Machining, Molding, Designing & Engineering, and Packaging), Maintenance Services, Regulatory Affairs Services (Regulatory Writing and Publishing, Clinical Trials Applications & Product Registrations, Legal Representation, and Other), and Others), By Application (Cardiology, General and Plastic Surgery, Diagnostic Imaging, Drug Delivery, IVD, and Others), By Class (Class I, Class II, and Class III) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape WuXiAppTec, SGS SA, PAREXEL International Corporation, Pace Analytical Services, Inc, North American Science Associates, LLC, Medical Device Testing Services, Mandala International, Laboratory Corporation of America Holdings, Intertek Group plc, Global Regulatory Partners, Freyr, Euro fins Scientific, Charles River Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medical Device Outsourcing MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Medical Device Outsourcing MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- WuXiAppTec

- SGS SA

- PAREXEL International Corporation

- Pace Analytical Services, Inc

- North American Science Associates, LLC

- Medical Device Testing Services

- Mandala International

- Laboratory Corporation of America Holdings

- Intertek Group plc

- Global Regulatory Partners

- Freyr

- Euro fins Scientific

- Charles River Laboratories