Global Bio-Lactase Enzyme Market Size, Share, And Industry Analysis Report By Product Type (Liquid Bio-Lactase, Powder Bio-Lactase, Capsule and Tablets), By Source (Microbial, Fungal, Yeast), By Application (Food and Beverage, Pharmaceuticals, Dietary Supplements, Animal Feed), By Distribution Channel (Supermarkets and Hypermarkets, Online Stores, Specialty Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169777

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

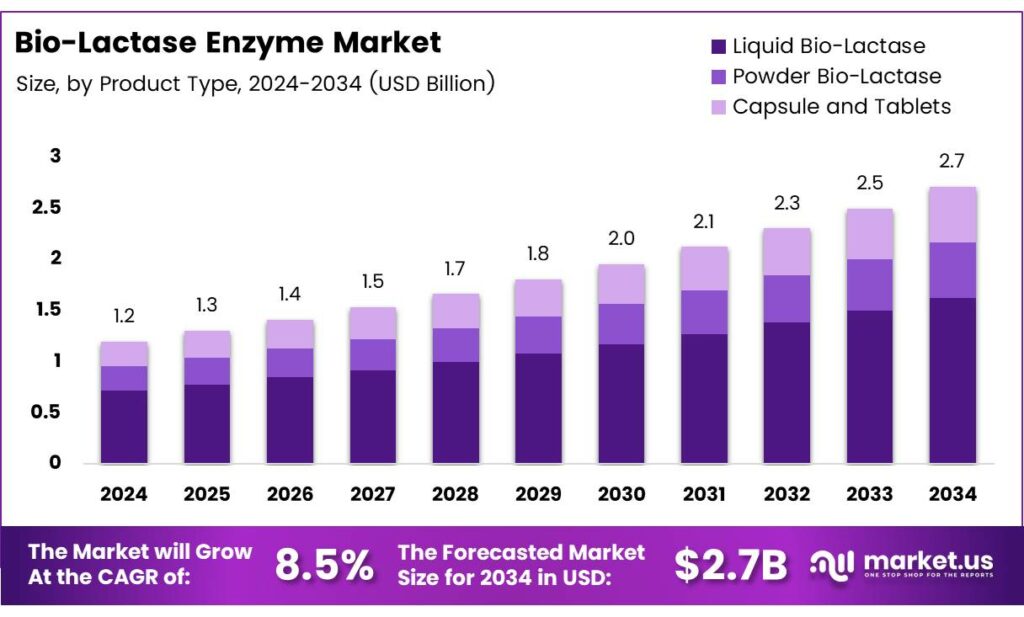

The Global Bio-Lactase Enzyme Market size is expected to be worth around USD 2.7 billion by 2034, from USD 1.2 billion in 2024, growing at a CAGR of 8.5% during the forecast period from 2025 to 2034.

The Bio-Lactase Enzyme represents a naturally derived biocatalyst that supports lactose digestion by converting lactose into simpler sugars. Importantly, it directly addresses lactose intolerance challenges while improving dairy sweetness, digestibility, and product flexibility. Bio-lactase increasingly influences dairy processing innovation and functional nutrition strategies worldwide.

The Bio-Lactase Enzyme Market reflects the commercial ecosystem surrounding production, formulation, and application across food, beverage, and nutraceutical industries. Driven by clean-label preferences and digestive health awareness, the market enables manufacturers to reduce lactose content while maintaining taste quality. Consequently, bio-lactase adoption strengthens value creation across fermented dairy and specialized nutrition products.

- Enzymatic performance continues to improve with advanced microbial strains. Volumetric enzymatic activity reached 33 U/mL, with an enzyme yield of 357 U/g, compared to only 10.4 U/mL from K. marxianus ATCC 16045 grown in lactose medium, highlighting production efficiency gains.

NIH and FAO nutritional studies, lactose hydrolysis increases sweetness perception because glucose and galactose provide nearly 70% sweetness of sucrose, compared to lactose at 20%. Furthermore, lactase deficiency affects nearly 75% of African Americans and 100% of Chinese adults, reinforcing sustained demand for bio-lactase solutions.

Rising lactose intolerance prevalence and diversification of dairy alternatives remain primary drivers. Governments and food regulators continue encouraging reduced sugar formulations and digestive-friendly ingredients. Therefore, bio-lactase investment aligns with sugar-reduction policies, functional food expansion, and sustainable enzyme manufacturing supported by biotechnology incentives across developed and emerging economies.

Key Takeaways

- The Global Bio-Lactase Enzyme Market is projected to grow from USD 1.2 billion in 2024 to USD 2.7 billion by 2034, registering a CAGR of 8.5%.

- Liquid Bio-Lactase leads the product type segment with a dominant market share of 48.2% due to ease of use and faster solubility.

- Microbial Bio-Lactase dominates by source, accounting for 56.8% of the total market because of high yield and industrial scalability.

- Food and Beverage is the largest application segment, holding a market share of 48.9% driven by the rising demand for lactose-free dairy products.

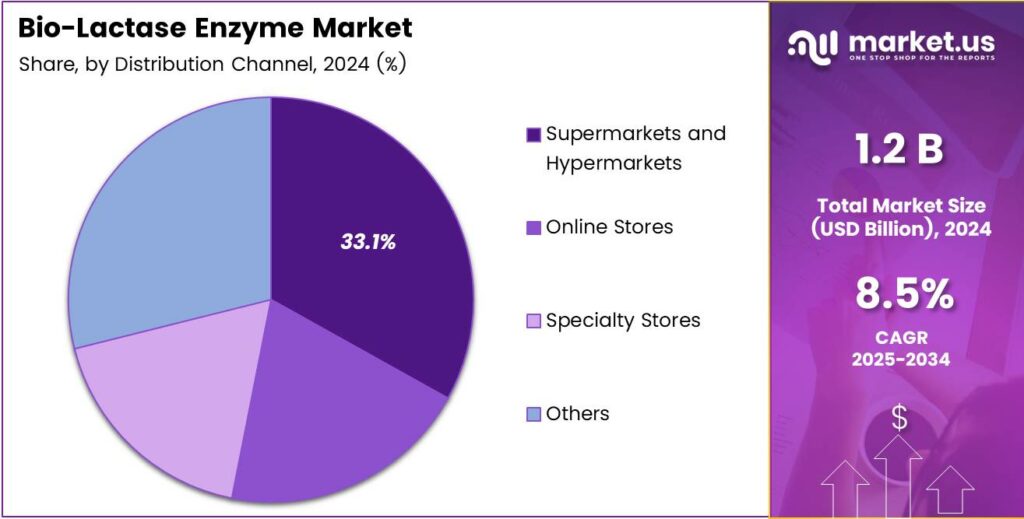

- Supermarkets and Hypermarkets represent the leading distribution channel with a share of 33.1%, supported by strong retail accessibility.

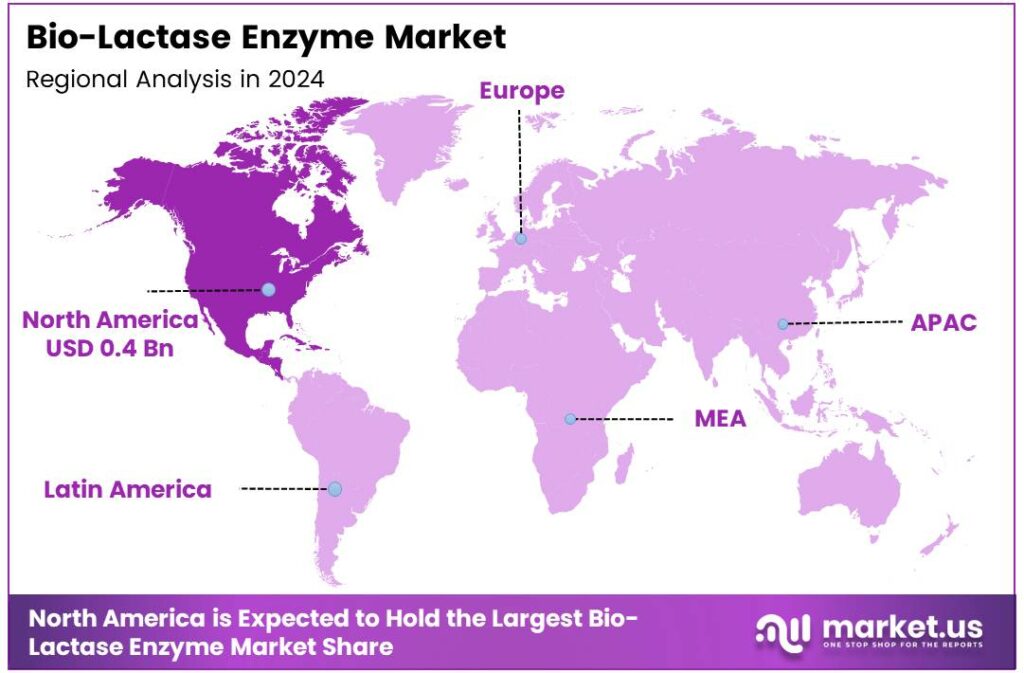

- North America is the leading regional market with a share of 37.8% and a market value of USD 0.4 billion.

By Product Type Analysis

Liquid Bio-Lactase dominates with 48.2% due to faster solubility and easy dosage control.

In 2024, Liquid Bio-Lactase held a dominant market position in the Product Type analysis segment of the Bio-Lactase Enzyme Market, with a 48.2% share. It is widely preferred in dairy processing due to quick blending, uniform activity, and smooth integration into liquid food formulations.

Powder Bio-Lactase continues to see steady demand, especially in industrial and bulk food processing. It offers better shelf stability and easier transportation, making it suitable for manufacturers focusing on long-term storage and controlled enzyme release across diverse food applications.

Capsules and Tablets play an important role in consumer-focused and clinical uses. These formats are selected for precise intake, convenience, and portability, particularly in dietary management and pharmaceutical settings where controlled enzyme delivery supports lactose digestion needs.

By Source Analysis

Microbial Bio-Lactase leads with 56.8% due to consistent efficiency and large-scale suitability.

In 2024, Microbial sources held a dominant market position in the by-source analysis segment of the Bio-Lactase Enzyme Market, with a 56.8% share. These sources are valued for high enzyme yield, stable performance, and suitability for continuous industrial fermentation processes.

Fungal sources remain important in food applications requiring gentle processing conditions. They are often used where lower temperature activity and compatibility with specific dairy products are needed, supporting traditional and specialty food manufacturing formats.

Yeast-based β-lactase serves niche processing needs, especially in specialized fermentation systems. It helps manufacturers achieve selective enzyme activity while aligning with clean-label and natural ingredient preferences in certain consumer segments.

By Application Analysis

Food and Beverage applications dominate with 48.9% driven by lactose-free product demand.

In 2024, Food and Beverage held a dominant market position in the By Application analysis segment of the Bio-Lactase Enzyme Market, with a 48.9% share. It is widely used to produce lactose-free milk, yogurt, cheese, and flavored dairy drinks.

Pharmaceuticals rely on β-lactase for digestive support formulations. These enzymes help manage lactose intolerance symptoms, improving patient comfort while maintaining consistent therapeutic performance across dosage forms. Dietary Supplements represent a growing application area, especially among health-focused consumers.

Bio-lactase supplements are commonly used to improve digestion, offering convenience and preventive health benefits through regular enzyme intake. Animal Feed and Others use β-lactase to improve nutrient absorption and feed efficiency. These applications support animal health and productivity while contributing to optimized feed formulation strategies.

By Distribution Channel Analysis

Supermarkets and Hypermarkets lead with 33.1% due to strong consumer accessibility.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel analysis segment of the Bio-Lactase Enzyme Market, with a 33.1% share. These outlets benefit from high foot traffic and strong visibility of digestive health products.

Online Stores are expanding rapidly due to the convenience of home delivery and detailed product information. Digital platforms support informed purchasing decisions and cater to tech-savvy consumers seeking enzyme supplements and specialty products. Specialty Stores focus on health, nutrition, and pharmacy-based offerings.

They provide expert guidance and trusted brands, making them important for consumers needing personalized digestive health solutions. Others include direct sales and institutional channels. These routes support bulk buying and professional use, especially in hospitals, clinics, and food service operations that require a consistent enzyme supply.

Key Market Segments

By Product Type

- Liquid Bio-Lactase

- Powder Bio-Lactase

- Capsules and Tablets

By Source

- Microbial

- Fungal

- Yeast

- Others

By Application

- Food and Beverage

- Pharmaceuticals

- Dietary Supplements

- Animal Feed

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Online Stores

- Specialty Stores

- Others

Emerging Trends

Clean-Label and Natural Processing Trends Shape Market Direction

Trending factors in the Bio-Lactase Enzyme Market include the shift toward clean-label and natural food processing. Consumers prefer products made through biological processes rather than chemicals. Bio-lactase supports this preference as it is naturally sourced.

- Brands now offer varying lactose levels to suit different consumer needs. Enzyme dosing flexibility makes this possible, increasing its industrial usefulness. The European Food Safety Authority (EFSA) highlights that enzyme activity can decline by 10–15% if exposed to improper storage temperatures during transport and warehousing.

Digital monitoring of fermentation and enzyme performance is also gaining traction. Advanced process control improves yield and consistency. These trends reflect a move toward smarter, cleaner, and consumer-focused dairy processing solutions.

Drivers

Rising Lactose Intolerance Awareness is Accelerating Market Demand

The Bio-Lactase Enzyme Market is mainly driven by the growing awareness of lactose intolerance across all age groups. Many people experience digestive issues after consuming dairy, which increases demand for lactase-added products. Food makers are responding by adding beta-lactase enzymes to milk, yogurt, and cheese to improve digestion.

- Urban lifestyles and changing diets also support market growth. Consumers want digestive-friendly foods without giving up dairy nutrition. Beta-lactase helps break lactose into simpler sugars, making products gentler on the stomach. The FDA recognizes more than 1,000 food enzymes under GRAS notifications, many of them produced using microbial fermentation, highlighting a clear regulatory preference for biologically derived inputs.

Government food safety approvals and clear labeling also help adoption. As regulatory bodies recognize the safety of enzyme-based processing, manufacturers feel confident expanding production. Together, health awareness, dietary changes, and regulatory support continue to push market growth steadily.

Restraints

High Production Cost of Enzymes Limits Wider Adoption

One key restraint in the Bio-Lactase Enzyme Market is the high cost of enzyme production. Manufacturing bio-enzymes needs controlled fermentation, advanced facilities, and skilled labor. These factors raise overall production expenses, especially for small manufacturers.

- Storage and transportation also pose challenges. Beta-lactase enzymes are sensitive to temperature and humidity. Improper handling can reduce activity, leading to losses. This increases operational costs across the supply chain. The Food and Agriculture Organization (FAO) reports that fermentation-based enzyme production can reduce water and energy consumption by 20–30% compared to traditional chemical synthesis routes.

In addition, limited awareness in developing regions affects demand. Many consumers still lack knowledge about enzyme-treated dairy. Without proper education and affordability, adoption remains slow in price-sensitive markets, restricting faster global expansion.

Growth Factors

Expansion of Functional Foods Creates New Growth Avenues

Growth opportunities in the Bio-Lactase Enzyme Market are strongly linked to the rise of functional and fortified foods. Consumers actively seek products that support digestion and gut health. Bio-lactase fits well into this trend, allowing dairy brands to launch value-added products.

- The foodservice and bakery segments also provide opportunities. Lactase enables wider use of dairy ingredients without digestive concerns. The FAO, enzyme production facilities can account for up to 30% higher operational costs compared to conventional food additive production due to fermentation control and downstream processing requirements.

Emerging markets offer further potential. Rising middle-class populations and improving food awareness create space for affordable lactose-free products. As production technologies improve and costs reduce, penetration into these regions is expected to increase.

Regional Analysis

North America Dominates the Bio-Lactase Enzyme Market with a Market Share of 37.8%, Valued at USD 0.4 Billion

North America holds the leading position in the Bio-Lactase Enzyme Market, supported by strong demand for lactose-free dairy and digestive health products. In this region, the market accounts for a 37.8% share and is valued at USD 0.4 billion, reflecting high consumer awareness and advanced food processing infrastructure. Regulatory clarity and widespread enzyme adoption in functional foods continue to sustain steady market growth.

Europe represents a mature and consistent market driven by rising lactose intolerance levels and a strong preference for clean-label dairy products. The region benefits from well-established enzyme manufacturing standards and strict food safety regulations. Growing demand from infant nutrition, specialty dairy, and pharmaceutical formulations supports long-term market stability across European countries.

Asia Pacific is witnessing accelerating growth due to expanding dairy consumption and improving digestive health awareness. Urbanization, dietary shifts, and increasing investments in food processing industries are key growth contributors. The region also benefits from a growing base of local enzyme production and expanding use in fortified beverages and dietary supplements.

The Middle East and Africa market is developing steadily, supported by rising demand for specialty dairy imports and growing health-conscious populations. Increasing use of enzymes in food manufacturing and gradual improvements in cold-chain infrastructure are aiding market penetration. Adoption remains moderate but shows strong potential in urban centers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE is viewed as a scale-driven innovator, using its strong enzyme and nutrition portfolio to serve major dairy processors. The company strategically positions lactase within broader nutritional and digestive health solutions, helping customers develop lactose-free and low-lactose dairy lines that match consumer expectations on taste, texture, and stability.

DSM-Firmenich AG leverages deep biotechnology and formulation expertise to offer highly efficient lactase solutions tailored for diverse dairy formats, including milk, yogurt, and ice cream. Its focus on clean-label, sustainability, and precise enzymatic performance aligns well with global demand for digestive wellness and premium functional dairy products, strengthening its role as a preferred development partner.

Kerry Group plc approaches the bio-lactase enzyme market from an integrated taste-and-nutrition perspective, embedding lactase into broader value propositions for dairy and beverage customers. By combining enzyme technology with flavor, texture, and fortification systems, Kerry helps brands launch differentiated lactose-free SKUs that address both health and indulgence, particularly in ready-to-drink and specialty dairy segments.

Novozymes A/S remains one of the most influential dedicated enzyme suppliers, with bio-lactase positioned as a key pillar in its food and beverage portfolio. The company emphasizes high activity, process efficiency, and flexible dosing options, enabling dairies to optimize sweetness, reduce added sugars, and improve plant utilization. Its strong application support and global reach make it a strategic partner for both multinational and regional lactose-free dairy producers.

Top Key Players in the Market

- BASF SE

- DSM-Firmenich AG

- Kerry Group plc

- Novozymes A/S

- Oenon Holdings Inc.

- Amano Enzyme Inc.

- Advanced Enzyme Technologies Ltd.

- SternEnzym GmbH and Co. KG

- Enzyme Development Corporation

- Infinita Biotech Pvt. Ltd.

Recent Developments

- In 2025, BASF is enhancing its enzyme offerings for dairy applications, including lactase-related processes, as part of its industrial enzymes strategy. This aligns with global trends in lactose-free product demand, but no new product announcements were detailed.

- In 2025, DSM-Firmenich launched MaxirenEVO, a coagulant enzyme that complements lactase applications in cheese production by improving texture and yield. While not exclusively lactase, it supports integrated enzyme solutions for semi-hard and hard cheeses, indirectly advancing bio-lactase workflows in dairy.

Report Scope

Report Features Description Market Value (2024) USD 1.2 billion Forecast Revenue (2034) USD 2.7 billion CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Liquid Bio-Lactase, Powder Bio-Lactase, Capsule and Tablets), By Source (Microbial, Fungal, Yeast, Others), By Application (Food and Beverage, Pharmaceuticals, Dietary Supplements, Animal Feed, Others), By Distribution Channel (Supermarkets and Hypermarkets, Online Stores, Specialty Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BASF SE, DSM-Firmenich AG, Kerry Group plc, Novozymes A/S, Oenon Holdings Inc., Amano Enzyme Inc., Advanced Enzyme Technologies Ltd., SternEnzym GmbH and Co. KG, Enzyme Development Corporation, Infinita Biotech Pvt. Ltd. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Bio-Lactase Enzyme MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Bio-Lactase Enzyme MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- DSM-Firmenich AG

- Kerry Group plc

- Novozymes A/S

- Oenon Holdings Inc.

- Amano Enzyme Inc.

- Advanced Enzyme Technologies Ltd.

- SternEnzym GmbH and Co. KG

- Enzyme Development Corporation

- Infinita Biotech Pvt. Ltd.