Global Bio-based Polyurethanes Market Size, Share Analysis Report By Application (Foam, Coatings, Adhesives and Sealants, Elastomers, Others) By End-Use (Building and Construction, Automotive, Footwear, Electrical and Electronics, Packaging, Textiles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 18231

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

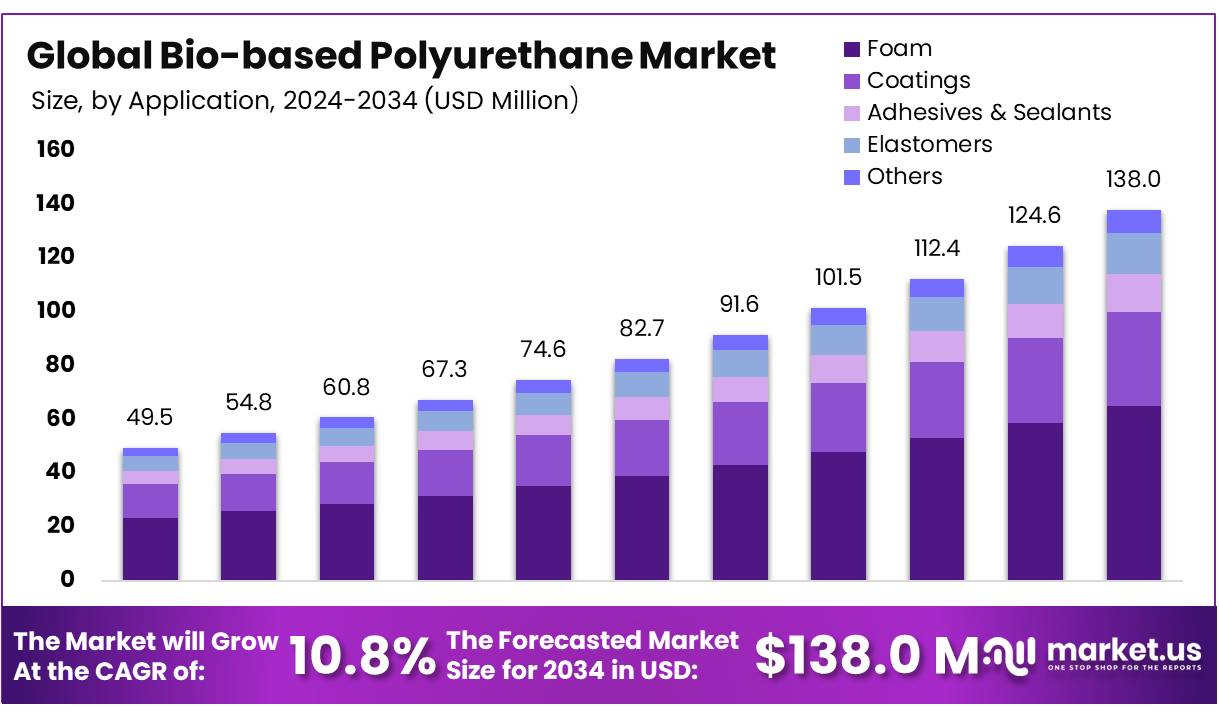

The Global Bio-based Polyurethanes Market size is expected to be worth around USD 138 Million by 2034, from USD 49.5 Million in 2024, growing at a CAGR of 10.8% during the forecast period from 2025 to 2034.

Bio-based polyurethane is a sustainable alternative to traditional petroleum-based polyurethanes, derived from renewable resources such as plant oils (e.g., castor oil) and other biomass materials. Bio-based polyurethane is widely used across several industries, including automotive, construction, footwear, and packaging, due to its versatility and eco-friendly properties. In construction, it is used for insulation, coatings, and structural components, while in the automotive sector, it is utilized in interiors, coatings, and even electric vehicle battery enclosures.

The increasing global demand for sustainable materials has boosted the growth of the Bio-based polyurethane market, as Industries Seek Solutions to Meet Environmental Regulations and Sustainability Goals. With growing awareness of the environmental impact of synthetic materials, Bio-based polyurethane adoption is expected to rise, creating new opportunities for manufacturers to innovate and expand their product offerings. As green building trends and eco-conscious consumer demand continue to grow, the market for bio-based polyurethane is projected to experience significant expansion in the coming years.

Key Takeaways

- The global bio-based polyurethanes market was valued at US$ 49.5 million in 2024.

- The global bio-based polyurethanes market is projected to grow at a CAGR of 10.8% and is estimated to reach US$ 138 million by 2034.

- By application, foam accounted for the largest market share of 47.10%. Driven by its widespread use in automotive, construction, and furniture due to its insulation, lightweight, and energy-efficient properties.

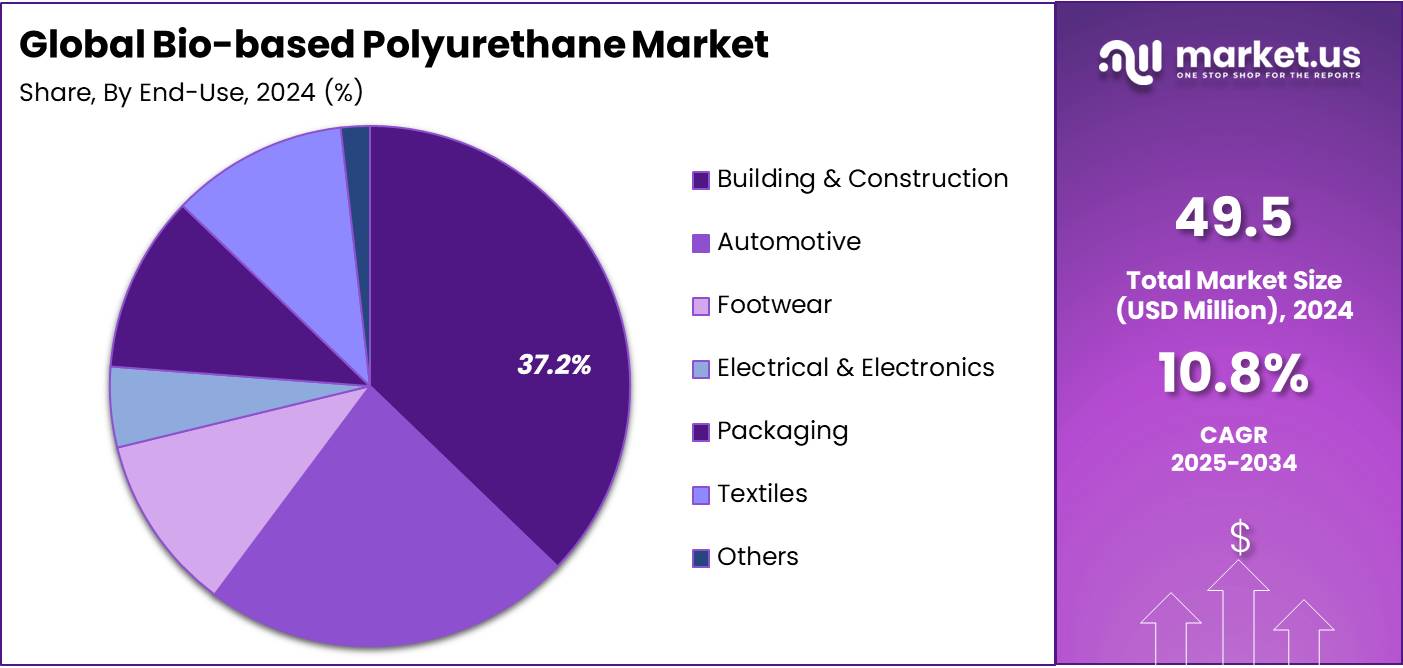

- By end-use, building & construction accounted for the majority of the market share at 37.20%. Due to its demand for sustainable materials in insulation, coatings, and sealants

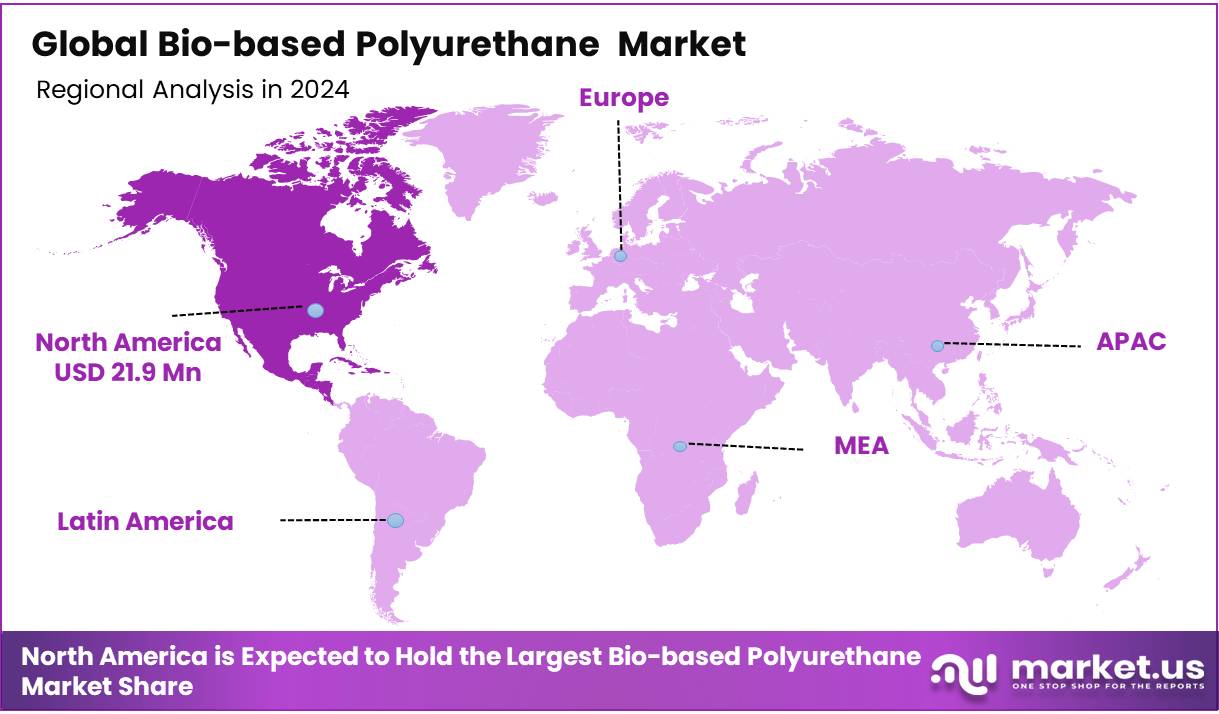

- North America is estimated as the largest market for Bio-based Polyurethanes with a share of 44.40% of the market share. Due to stringent environmental regulations, technological advancements, and growing demand for sustainable materials across industries like automotive, construction, and furniture.

- The polyurethane market is growing globally due to increasing demand for energy-efficient materials, advancements in sustainable technologies, expanding applications in construction, automotive, and packaging industries, and the rising adoption of eco-friendly and bio-based alternatives.

Application Analysis

Foam Segment Leads Bio-Based Polyurethane Market

Based on application, the market is further divided into foam coatings, adhesives & sealants, elastomers, and others. The predominance of the Foam, commanding a substantial 47.10% market share in 2024. This dominance is primarily due to the widespread application of bio-based polyurethane foams in sectors such as automotive, construction, and furniture.

These foams are valued for their excellent insulation properties, lightweight nature, and energy efficiency, making them ideal for energy-saving and comfort-driven applications. Additionally, technological advancements in foam production have further enhanced their performance, boosting their demand across various industries.

End-Use Analysis

Building & Construction Dominates Bio-Based Polyurethane Market Share in 2024

Based on end-use, the market is further divided into building & construction, automotive, footwear, electrical & electronics, packaging, textiles, and others. The predominance of the Building & Construction commanding a substantial 37.20 % market share in 2024. This is driven by the growing demand for sustainable materials in construction, where bio-based polyurethanes are used for insulation, sealants, adhesives, and coatings.

These material’s eco-friendly properties, such as reducing energy consumption and enhancing durability, make them ideal choices for meeting green building standards. Additionally, increasing urbanization and infrastructure development globally further boost the demand for bio-based polyurethanes in construction applications.

Key Market Segments

By Application

- Foam

- Rigid

- Flexible

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

By End-use

- Building & Construction

- Automotive

- Footwear

- Electrical & Electronics

- Packaging

- Textiles

- Others

Drivers

Rapid Urbanization in Emerging Markets

Rapid urbanization in emerging markets is significantly driving the growth of the global bio-based polyurethane (PU) market, especially in the construction sector. As urban populations rise, the demand for new housing, commercial buildings, and infrastructure increases the need for high-performance materials such as bio-based polyurethane for insulation, coatings, and structural components in construction. PU’s unique properties, such as energy efficiency, thermal resistance, and noise reduction, make it essential for modern construction projects, particularly in rapidly growing urban areas. As cities expand, the need for sustainable and energy-efficient building materials becomes more critical, further pushing the adoption of PU.

- With over 80% of global GDP generated in cities and nearly 70% of the population projected to live in urban areas by 2050, the rapid expansion, especially in Asia and Africa, will drive increased demand for sustainable construction materials such as bio-based PU. This growth will boost the need for eco-friendly, durable, and energy-efficient solutions in building projects.

Additionally, a shift toward sustainable building practices in emerging markets is boosting the demand for bio-based polyurethane (PU). As urbanization drives the need for smart, sustainable cities, bio-based PU’s eco-friendly properties—such as energy cost reduction and improved indoor air quality—make it a preferred choice for developers. Increasingly used in insulation, waterproofing, and structural solutions, bio-based PU is becoming essential in sustainable construction, offering new opportunities for manufacturers to meet the growing demand for green building materials.

- According to World Bank reports projected global urban population increase to nearly 7 in 10 people by 2050. Driving demand for bio-based polyurethane in construction, as it offers sustainable, energy-efficient materials that meet growing environmental regulations and consumer preferences for eco-friendly buildings.

Restraints

High-Cost Raw Material

The high cost of raw materials is one of the important factors restraining the growth of the global bio-based polyurethane market. As bio-based polyurethane is gaining popularity due to its environmental benefits and sustainability advantages, the cost of key raw materials, such as plant-derived polyols from sources such as castor oil and soy, is typically higher than traditional petroleum-based polyols. This cost variation leads to higher production expenses, making bio-based polyurethane less competitive, especially in price-sensitive markets.

As a result, the market faces challenges in achieving widespread adoption, especially in industries that prioritize cost efficiency over sustainability. Moreover, fluctuations in the availability and price of these raw materials—impacted by agricultural conditions, supply chain disruptions, and market demand—further heighten cost pressures. Additionally, manufacturers from the industry face limitations in offering bio-based polyurethane at competitive prices, delaying its broader adoption across industries and limiting its market penetration in certain sectors.

Opportunity

Increasing Adoption of Bio-based Polyurethane in Automotive Sectors

The growing adoption of bio-based polyurethanes in the automotive sector presents a significant opportunity for the global bio-based polyurethane market. As the demand for electric and hybrid vehicles rises, there is an increased need for lightweight, energy-efficient materials. Bio-based polyurethanes, known for their insulation, cushioning, and acoustic properties, are ideal for various automotive applications, including seating, interior panels, and battery enclosures. This shift to sustainable materials offers manufacturers access to a growing market for eco-friendly alternatives to petroleum-based options.

- The International Energy Agency (IEA) projects the adoption of electric vehicles (EVs) could reach 300 million by 2030, significantly increasing the demand for bio-based polyurethane in automotive applications due to its lightweight, energy-efficient, and sustainable properties.

- UNEP’s Global Electric Mobility Programme supports over 50 countries to accelerate electric mobility, with 27 nations funded by the GEF-7 partnership. This initiative drives demand for eco-friendly materials like bio-based polyurethane (PU) in electric vehicle production, including in components such as battery enclosures and interiors.

Moreover, governments worldwide are focusing on reducing carbon footprints through incentive programs creating significant opportunities for bio-based polyurethane in vehicle production. Its versatility and renewable sourcing permit manufacturers to develop innovative solutions in seating, insulation, and structural components. With a high strength-to-weight ratio, bio-based PU is ideal for electric vehicle (EV) battery enclosures, offering protection against impact, vibration, and temperature fluctuations. As the trend toward sustainability accelerates, the bio-based polyurethane market is poised for growth, providing new opportunities for manufacturers to expand their product portfolios and meet the evolving needs of the automotive industry.

- In China, the government implemented in April 2024 car trade-in policy, which subsidizes replacing old fossil fuel-powered vehicles with new energy or fuel-efficient vehicles, is expected to create significant growth opportunities for bio-based polyurethane (PU) in the automotive sector, driven by the rising demand for eco-friendly, lightweight materials in EV production.

Trends

Smart Bio-PU for Electronics

The integration of Smart Bio-based Polyurethanes in electronics is emerging as a significant trend driving growth in the global bio-based polyurethane market. These advanced materials provide a sustainable alternative to traditional plastics, with properties like flexibility, durability, and lightweight nature that make them ideal for electronic applications such as device casings, insulation, and wearables components. As the electronics industry becomes more eco-conscious, Bio-PUs align with sustainability goals while offering high performance.

Furthermore, Smart Bio-PUs, with capabilities like thermal or moisture sensitivity, are opening new opportunities for innovative electronic products. These materials can be used in temperature-sensitive components or as coatings for devices requiring specific environmental conditions. As demand for both high-tech and sustainable electronics grows, this trend towards “smart” bio-based polyurethanes is poised to open new opportunities for manufacturers to cater to the growing demand for both high-tech and eco-conscious electronics.

Geopolitical Impact Analysis

Geopolitical tariffs may slow bio-based polyurethane market growth by raising production costs and disrupting supply chains.

The recent tariff measures implemented by the US Government, including a 10% universal tariff and elevated rates on specific trading partners, are expected to have a downstream impact on the global bio-based polyurethane (PU) market, particularly within the automotive sector.

These tariffs could lead to increased production costs for automobile manufacturers, subsequently raising vehicle prices and potentially hindering the adoption of sustainable materials such as bio-based PU. Supply chain disruptions could also lead to shortages or higher prices for bio-based PU. Economic uncertainty may reduce consumer spending and delay investments in electric vehicles, further affecting demand. These factors are likely to moderate the growth trajectory of the bio-based polyurethane market.

- For instance, the 10% baseline tariff, along with increased rates on 60 trading partners, will impact the global bio-based polyurethane (PU) market by raising production costs and potentially reducing the supply of key raw materials. For example, imports from China face a 34% tariff, which could disrupt the availability of bio-based PU materials used in industries like automotive and construction. In addition, the 20% tariff on EU imports could affect European manufacturers relying on bio-based PU components. These tariff hikes may result in higher costs for manufacturers, slow down product development, and force companies to seek alternative supply chains, ultimately affecting the growth of the bio-based PU market.

Regional Analysis

The bio-based polyurethane market in North America is growing due to regulatory pressures, technological innovations, and increased demand for sustainable materials across industries.

In 2024, North America dominated the global bio-based polyurethanes market, accounting for 44.40% of the total market share, driven by a combination of regulatory, technological, and market-driven factors. Stricter environmental regulations and government initiatives focused on reducing carbon emissions are prompting industries to adopt sustainable materials like bio-based Polyurethanes. As a result, key sectors such as automotive, construction, and furniture are increasingly shifting towards bio-based Polyurethanes for their eco-friendly properties, lightweight nature, and enhanced performance, enabling them to meet stringent environmental standards.

Technological advancements in bio-based polyurethane production have further expanded its applications, improving material properties such as strength, flexibility, and heat resistance. These innovations have made bio-based Polyurethanes an attractive alternative in diverse sectors, including packaging, medical devices, and electronics. The ongoing shift towards electric vehicles (EVs) in North America has created significant opportunities for bio-based Polyurethanes in automotive components like seats, battery enclosures, and interior panels, where lightweight and energy-efficient materials are crucial for meeting fuel efficiency and emissions standards.

Additionally, the rising demand for sustainable products among consumers, coupled with growth in biomedicine and healthcare applications, has further fueled the adoption of bio-based Polyurethanes. As the market continues to prioritize sustainability and regulatory pressures intensify, the bio-based Polyurethanes sector in North America is poised for continued growth, providing significant opportunities for manufacturers to innovate and expand their product offerings.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players Driving Innovation in Polyurethane Market

The global polyurethane market is dominated by key players such as Covestro, BASF, Huntsman, and Mitsui Chemicals. These companies are driving innovation through sustainable, bio-based polyurethanes and are investing in eco-friendly solutions to reduce their carbon footprint. With a focus on industries like automotive, construction, footwear, and coatings, they are leading the charge toward greener alternatives. Their continued focus on research and development, along with strategic partnerships, positions them to meet the growing demand for sustainable products.

Major Players in the Industry

- BASF SE

- Covestro AG

- Cargill, Incorporated

- Huntsman International LLC

- The Lubrizol Corporation

- MITSUI & CO., LTD.

- Arkema

- Miracll Chemicals Co. Ltd

- Stahl Holdings BV

- Rampf Group

- Epaflex

- MCPU Polymer Engineering

- Other Key Players

Recent Development

- In September 2024 – Covestro and Beyond Leather Materials developed a bio-based leather alternative using apple waste, upcycling discarded parts like cores and seeds. The material, containing over 85% bio-based content, features a protective coating made from polyurethane dispersions with partially bio-based components, promoting sustainability in premium applications.

- In July 2024 – Changhua Chemical began constructing China’s first production plant for eco-friendly polyols made from renewable carbon sources. This facility will support the growing demand for sustainable materials and contribute to reducing the carbon footprint in polyol production.

- In October 2023 – Algenesis, a plant-based material science company, raised $5 million to scale production of its patented Soleic bio-based polyurethane (PU) made from algae and non-food plants. This eco-friendly material is biodegradable, with up to 52% bio-content, and reduces greenhouse gas emissions by up to 50% compared to petroleum-based PU. The funds will help expand product lines and strengthen production capabilities.

Report Scope

Report Features Description Market Value (2024) USD 49.5 Mn Forecast Revenue (2034) USD 138 Mn CAGR (2025-2034) 10.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Foam, Coatings, Adhesives & Sealants, Elastomers, Others) By End-Use (Building & Construction, Automotive, Footwear, Electrical & Electronics, Packaging, Textiles, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Covestro AG, Cargill, Incorporated, Huntsman International LLC, The Lubrizol Corporation, MITSUI & CO., LTD. Arkema, Miracll Chemicals Co. Ltd, Stahl Holdings BV, Rampf Group, Epaflex, MCPU Polymer Engineering, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bio-based Polyurethanes MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Bio-based Polyurethanes MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Covestro AG

- Cargill, Incorporated

- Huntsman International LLC

- The Lubrizol Corporation

- MITSUI & CO., LTD.

- Arkema

- Miracll Chemicals Co. Ltd

- Stahl Holdings BV

- Rampf Group

- Epaflex

- MCPU Polymer Engineering

- Other Key Players