Global Baby Furniture Market Size, Share, Growth Analysis By Product Type (Cribs, Changing Tables, Dressers, High Chairs, Rocking Chairs, Baby Mattresses, Bassinets), By Distribution Channel (Online Retailers, Supermarkets or Hypermarkets, Specialty Stores, Department Stores, Baby Furniture Stores), By End-User (Parents, Caregivers, Hospitals & Clinics, Retailers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139364

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

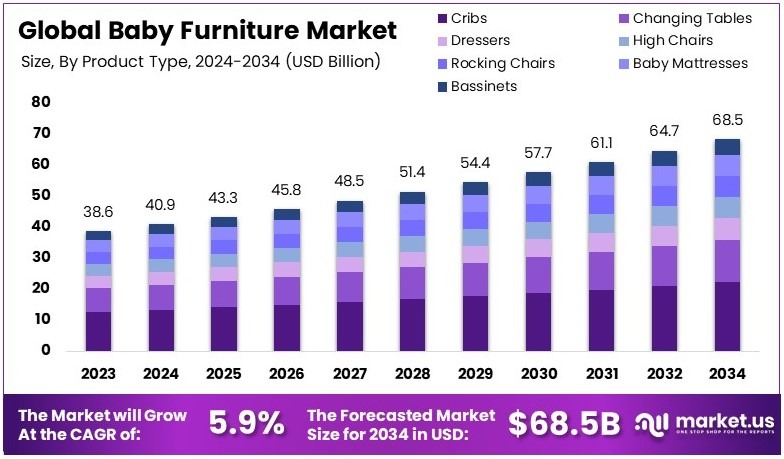

The Global Baby Furniture Market size is expected to be worth around USD 68.5 Billion by 2034, from USD 38.6 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

Baby furniture is specially designed for infants and toddlers. It includes items such as cribs, changing tables, and small chairs. The furniture emphasizes safety, comfort, and ease of use. Its design often features rounded edges, secure construction, and playful aesthetics to support the care and development of young children effectively.

The baby furniture market consists of companies that design, produce, and distribute products for infants and toddlers. It covers a variety of items including cribs, changing tables, and storage solutions. The market serves retailers and parents seeking safe, practical, and well-crafted furniture that meets the unique requirements of young children.

Baby furniture offers safety and comfort for families. Manufacturers focus on durable, non-toxic materials and modern designs. Retailers emphasize innovation and trusted brands. For example, stores in major cities report steady sales. Consumers value style and practicality. In addition, quality baby furniture remains essential for home environments and family well-being.

Baby furniture market shows robust growth. Demand rises as young families prioritize safe and stylish products. Experts observe a shift towards eco-friendly designs and innovative features. Online sales are increasing in urban areas. For instance, retailers in Los Angeles report higher growth rates. Overall, market prospects appear positive and dynamic.

Recent data boost market confidence. According to the U.S. Bureau of Economic Analysis, personal income increased by $50.5 billion. Disposable income rose by $34.2 billion. Furthermore, personal consumption expenditures climbed by $47.2 billion. These factors drive growth, fueling higher spending on quality baby furniture and related products across the country.

Market saturation remains low while competition grows. Local retailers see increasing demand and face rivalry from larger brands. On a broader scale, the baby furniture market experiences expansion. For example, small shops in suburban areas and big chains in metropolitan cities both benefit. Competition spurs innovation and better customer service.

Key Takeaways

- The Baby Furniture Market was valued at USD 38.6 billion in 2024 and is expected to reach USD 68.5 billion by 2034, with a CAGR of 5.9%.

- In 2024, Cribs dominated the product type segment with 32.5%, essential for infant safety and sleep.

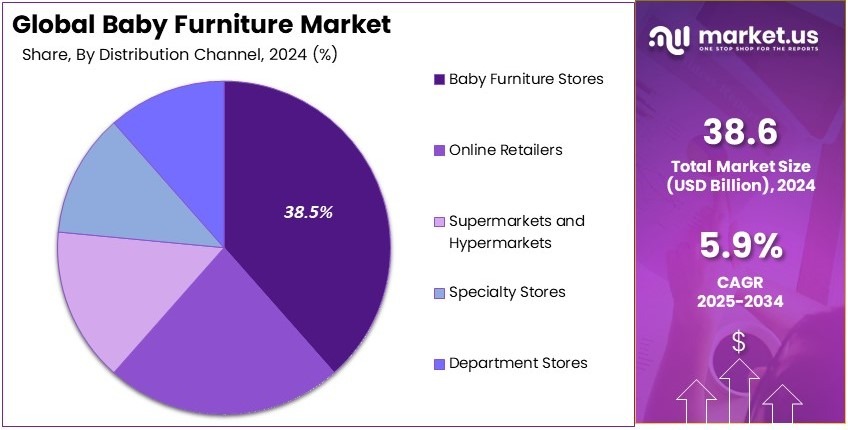

- In 2024, Baby Furniture Stores led the distribution channel with 38.5%, as parents prefer specialized outlets for baby products.

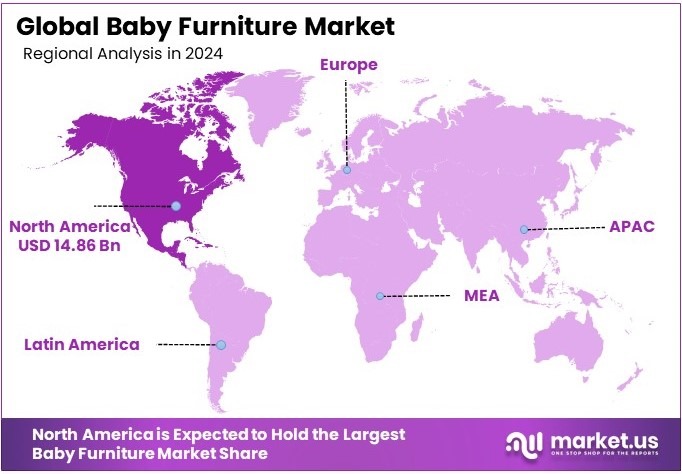

- In 2024, North America led the market with 38.5% and a valuation of USD 14.86 billion, driven by high birth rates and premium baby furniture demand.

Product Type Analysis

Cribs dominate with 32.5% due to the essential nature of the product and growing awareness among parents about safety and comfort.

Cribs are the leading product in the Baby Furniture Market, holding a significant share of 32.5%. A crib is one of the most important pieces of furniture for new parents, as it is essential for safely sleeping a baby. The demand for baby cribs is consistently strong because they are necessary for infant safety and sleep quality.

With more parents prioritizing comfort, safety features, and aesthetic design, high-quality cribs are in demand. Many modern cribs offer features like adjustable heights and convertible designs that grow with the child, enhancing their appeal. Additionally, there is a rising trend towards eco-friendly and non-toxic cribs, further increasing consumer interest.

Changing Tables follow closely as they provide practical storage and organization solutions for parents, particularly in the nursery. Dressers are also vital for storing baby clothes, and their popularity has increased as more parents opt for multifunctional furniture.

High Chairs, while not as dominant, play a crucial role in dining and feeding needs as babies grow. Rocking Chairs are another key item, valued for their comfort and calming effect during late-night feedings or lullabies.

Baby Mattresses are essential for ensuring comfort and support for babies while sleeping. Bassinets, though less popular, are commonly used during the early months when babies sleep in the same room as their parents.

Distribution Channel Analysis

Baby Furniture Stores dominate with 38.5% due to their specialization in baby-related products and personalized customer service.

Baby Furniture Stores lead the Baby Furniture Market, holding a dominant market share of 38.5%. These stores specialize in offering a curated selection of furniture designed specifically for babies, which attracts parents looking for a one-stop shop for high-quality, safe, and stylish furniture.

The advantage of Baby Furniture Stores is their expertise and focus on baby products, allowing customers to rely on knowledgeable staff who can provide personalized recommendations based on the specific needs of their child.

Online Retailers come in second, with a substantial share of the market, offering convenience and wider accessibility. Parents are increasingly turning to online platforms, attracted by the ease of shopping from home and the ability to browse through a large selection of products, read reviews, and compare prices.

Supermarkets/Hypermarkets follow, providing parents the convenience of buying baby furniture along with other essential items, though they do not specialize in baby-specific products. Specialty Stores, offering a focused range of baby furniture, play an important role for customers looking for expert advice and unique or premium furniture. Department Stores, while not as focused on baby products, still capture a portion of the market due to their broad product offerings.

Key Market Segments

By Product Type

- Cribs

- Changing Tables

- Dressers

- High Chairs

- Rocking Chairs

- Baby Mattresses

- Bassinets

By Distribution Channel

- Online Retailers

- Supermarkets/Hypermarkets

- Specialty Stores

- Department Stores

- Baby Furniture Stores

Driving Factors

Enhanced Safety and Functionality Drives Market Growth

Parents are now highly aware of the need for safe and comfortable baby furniture. This awareness has led to increased demand for products that offer both security and gentle design. Families seek furniture that protects infants while ensuring a soothing environment for sleep and play. These requirements drive many purchases.

Working parents face busy schedules and require functional furniture that supports their lifestyle. They value designs that combine practicality with ease of use. Functional baby furniture helps organize spaces and simplify daily routines. Many choose items that offer storage, multi-use features, and ergonomic support. These efficient solutions enhance family convenience.

Increased disposable income allows families to invest in premium baby furniture. Higher budgets lead to more refined designs that meet strict safety and comfort standards. Consumers now prefer products made with eco-friendly, non-toxic, and sustainable materials. These choices combine luxury with responsible living. This clear trend boosts overall market growth.

Restraining Factors

High Costs and Regulatory Hurdles Restraints Market Growth

The high cost of premium baby furniture poses a major challenge for many families. Expensive prices deter budget-conscious parents from investing in quality products. This cost barrier limits the market reach of premium items and forces some consumers to opt for lower-priced alternatives. High prices challenge market expansion and adoption.

Strict safety standards and regulations further complicate manufacturing. These rules require extensive testing and quality assurance, which increases production costs and time. Manufacturers must adhere to rigorous guidelines, adding complexity to the design and assembly of baby furniture. This regulatory pressure slows innovation and limits product variety, raising overall costs.

Limited living space in smaller homes restricts the demand for baby furniture. Many urban families face tight space constraints, reducing the need for bulky items. Compact living areas lead parents to prioritize multifunctional furniture, leaving less room for specialized baby products. This spatial limitation curtails market growth and product expansion.

Another challenge is the short product lifespan, as babies quickly outgrow their furniture. Parents often replace items within a short period, which discourages long-term investments. This rapid turnover limits manufacturers’ returns and impacts brand loyalty. Short usage duration makes it difficult to justify high upfront costs for some families.

Growth Opportunities

Versatile Innovation Provides Opportunities

Convertible and multi-functional baby furniture presents a significant opportunity. Parents now seek products that adapt to a child’s changing needs. Furniture that converts from crib to toddler bed or includes additional storage offers long-term value. This versatile design meets practical demands and maximizes space in growing families’ homes across households.

The demand for smart baby furniture is rising. Integrated technology, such as sleep monitors, automatic rocking, and adjustable features, enhances convenience and safety. These innovative products appeal to tech-savvy parents seeking modern solutions. Smart furniture not only improves functionality but also supports better care for infants in busy households today.

Online retail platforms offer new avenues for growth in baby furniture. E-commerce sites and digital marketplaces provide a wide selection of innovative products. They allow consumers to compare features, read reviews, and access competitive prices. This digital shift makes shopping easier and drives market expansion across diverse customer segments globally.

There is also a growing preference for gender-neutral and customizable designs. Parents seek baby furniture that fits their style and adapts to room décor. Customization allows for unique color schemes and modular features that can evolve with a child’s growth. This trend offers manufacturers chance to innovate and capture markets.

Emerging Trends

Smart Design and Sustainable Trends Are Latest Trending Factor

Urban living drives the adoption of space-saving baby furniture. In densely populated areas, families need compact solutions that fit small apartments. Designs that maximize functionality in limited space are in high demand. These products combine style with practicality, making them popular among city dwellers who value efficient home organization today.

There is an increasing focus on sustainable, organic materials in baby furniture. Manufacturers are using fabrics, eco-friendly woods, and non-toxic finishes to meet consumer demand. These sustainable practices appeal to parents who prioritize health and environmental responsibility. The use of organic materials adds value and promotes green living in households.

Smart cribs and high-tech baby furniture are becoming increasingly popular. Innovations include adjustable mattresses, automatic rocking features, and built-in monitoring systems. These high-tech additions improve safety and convenience for modern parents. Advanced technology in baby furniture provides greater comfort for infants while simplifying caregiving tasks for busy families every day.

Parenting bloggers and social media influence baby furniture trends. Their reviews, tips, and experiences help parents choose the best products. Social platforms spread innovative ideas and creative designs rapidly. This digital influence encourages manufacturers to update designs and meet evolving customer expectations. Online engagement drives market trends and consumer trust.

Regional Analysis

North America Dominates with 38.5% Market Share

North America leads the Baby Furniture Market with a 38.5% share, valued at USD 14.86 billion. This commanding presence is driven by high consumer purchasing power, a strong emphasis on child safety and quality, and the prevalence of premium product offerings.

The key factors contributing to North America’s substantial market share include a robust economy and high consumer spending on baby-related products. The region’s focus on safety standards and quality assurance in baby furniture resonates well with parental priorities, enhancing its market dominance. Additionally, innovative product designs that integrate technology for safety and convenience, such as cribs with built-in monitors, appeal to tech-savvy parents.

Market dynamics in North America are shaped by consumer preferences for eco-friendly and sustainably produced furniture, reflecting a broader trend towards environmental responsibility. The widespread availability of diverse brands and designs through well-established retail networks also plays a crucial role in the market’s performance.

Regional Mentions:

- Europe: Europe maintains a significant position in the Baby Furniture Market, focusing on environmentally sustainable and high-safety products. The region benefits from stringent regulations that promote the production and sale of high-quality baby furniture.

- Asia Pacific: The region shows rapid growth in the Baby Furniture Market, driven by increasing urbanization, rising middle-class populations, and enhanced awareness of child safety products among new parents.

- Middle East & Africa: Emerging market trends in the Middle East and Africa include increased investment in baby and child-specific retail formats, reflecting growing economic stability and an increasing focus on family welfare.

- Latin America: Growth in Latin America’s Baby Furniture Market is spurred by increasing urbanization and changing consumer attitudes towards child care, with a growing preference for modern and safe baby furniture designs.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Baby Furniture Market, Delta Children, Graco, Storkcraft, and Babyletto are leading the industry through innovative and safe products specifically designed for infants and toddlers.

Delta Children excels in providing safe, high-quality, and aesthetically pleasing baby furniture, focusing on cribs, dressers, and bassinets. Their strong emphasis on safety standards and commitment to child well-being makes them a favorite among new parents.

Graco is widely recognized for its durable and functional baby products, including cribs and high chairs. Their products are designed for ease of use, reliability, and comfort, making them highly sought after in the baby furniture market.

Storkcraft offers a range of baby furniture that combines functionality with classic and modern styles at competitive prices. Their products are known for their versatility and long-lasting design, providing value for parents looking for multi-functional baby furniture.

Babyletto focuses on eco-friendly and stylish baby furniture, appealing to environmentally conscious parents with their sustainable materials and modern designs. Their innovative and safe furniture designs cater to the growing demand for green nursery products.

These top players in the Baby Furniture Market are distinguished by their dedication to safety, quality, and innovation, driving their popularity among families and influencing market trends towards safer and more sustainable products for children.

Major Companies in the Market

- Delta Children

- Graco

- Storkcraft

- Babyletto

- IKEA

- Serta

- DaVinci Baby

- The First Years

- Fisher-Price

- Kolcraft

- Carter’s Baby Furniture

- Dream On Me

Recent Developments

- Flowers Foods and Simple Mills: On January 2025, Flowers Foods announced its acquisition of Simple Mills, a premium brand specializing in better-for-you crackers, cookies, snack bars, and baking mixes, for $795 million in cash. Simple Mills generated an estimated $240 million in net sales in 2024, reflecting a 14% growth compared to the previous year.

- MamaMagic Baby Expo: On October 2022, the MamaMagic Baby Expo, a leading parenting event in South Africa, returned to Cape Town at the Cape Town International Convention Centre (CTICC). Sponsored by Dis-Chem Baby City, the event showcased a wide range of baby products and services, including travel essentials, nursery furniture, maternity and baby wear, and expert advice for parents and caregivers.

Report Scope

Report Features Description Market Value (2024) USD 38.6 Billion Forecast Revenue (2034) USD 68.5 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cribs, Changing Tables, Dressers, High Chairs, Rocking Chairs, Baby Mattresses, Bassinets), By Distribution Channel (Online Retailers, Supermarkets or Hypermarkets, Specialty Stores, Department Stores, Baby Furniture Stores), By End-User (Parents, Caregivers, Hospitals & Clinics, Retailers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Delta Children, Graco, Storkcraft, Babyletto, IKEA, Serta, DaVinci Baby, The First Years, Fisher-Price, Kolcraft, Carter’s Baby Furniture, Dream On Me Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Delta Children

- Graco

- Storkcraft

- Babyletto

- IKEA

- Serta

- DaVinci Baby

- The First Years

- Fisher-Price

- Kolcraft

- Carter's Baby Furniture

- Dream On Me