Global Aquafeed Market Size, Share, And Business Benefits By Form (Dry, Moist, Wet), By Additives (Amino Acids, Antibiotics, Vitamins and Minerals, Feed Acidifiers, Antioxidants, Enzymes, Anti-parasitic, Probiotics and Prebiotics, Others), By Feed (Grower Feed, Starter Feed, Finisher Feed, Brooder Feed), By Application (Carp, Rainbow Trout, Salmon, Crustaceans, Tilapia, Catfish, Sea Bass, Grouper, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 135923

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

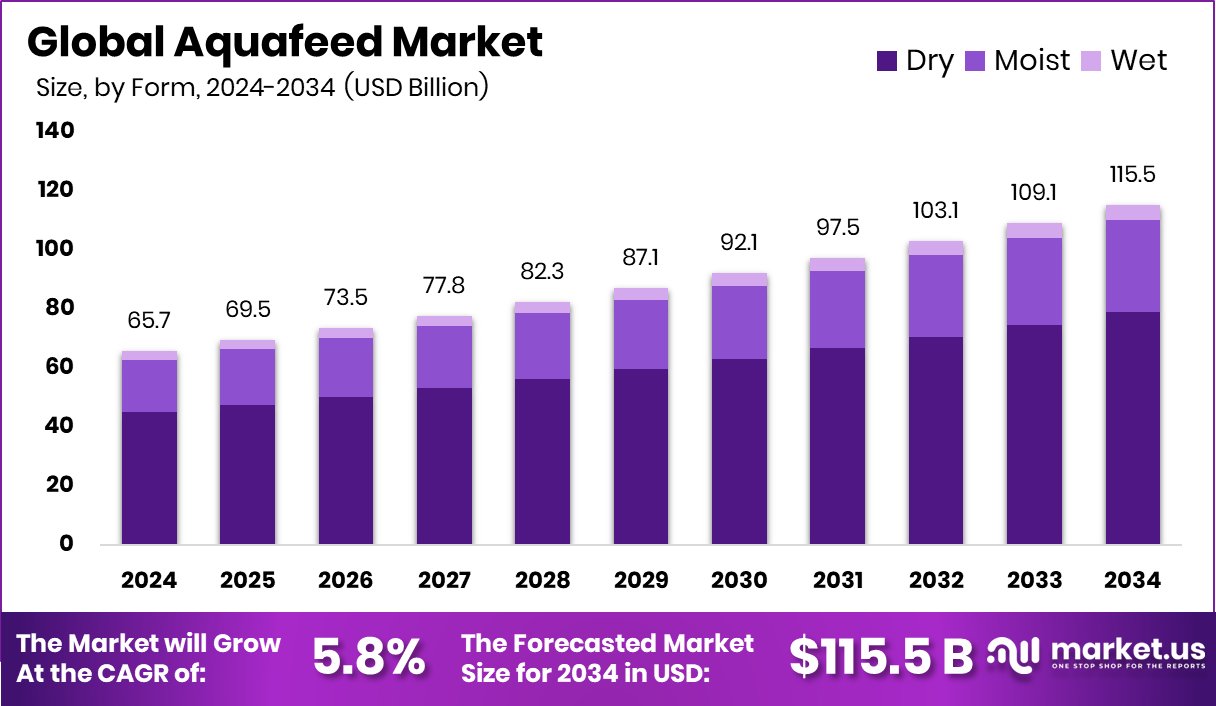

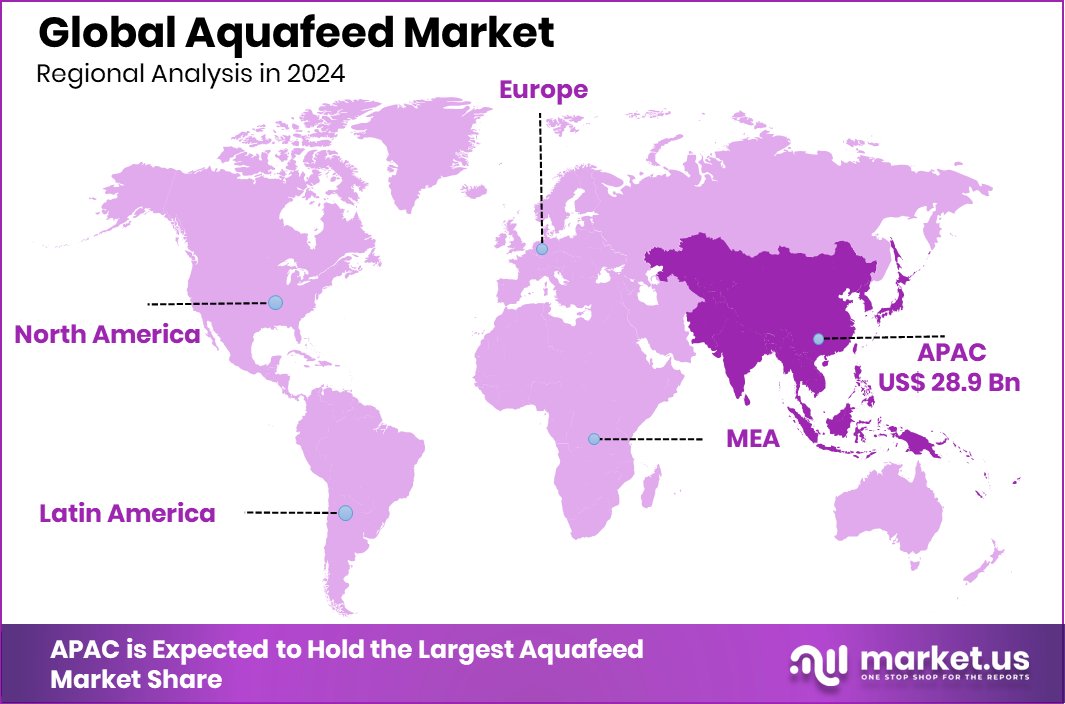

Global Aquafeed Market is expected to be worth around USD 115.5 billion by 2034, up from USD 65.7 billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034. Strong aquaculture activities in Asia-Pacific significantly supported this USD 28.9 billion market growth.

Aquafeed refers to the specialized feed formulated for aquatic animals such as fish, shrimp, crabs, and other seafood species. It typically includes ingredients like fishmeal, soybean meal, corn, vitamins, minerals, and other nutritional additives to support healthy growth, immunity, and reproductive performance in aquatic organisms. Aquafeed plays a crucial role in the aquaculture industry, where farmed seafood needs balanced and efficient nutrition to meet rising global demand.

The aquafeed market is growing steadily due to the expanding aquaculture sector. As wild fish stocks decline and global consumption of seafood rises, fish farming has become a vital solution to meet demand. This, in turn, drives the need for high-quality and cost-effective aquafeed. Farmers are investing in performance-based feeds that enhance feed conversion ratios and improve harvest yield.

One of the main growth drivers is the rising global consumption of protein-rich seafood, especially in Asia-Pacific and Europe. Changing diets, health awareness, and increasing per capita income are pushing demand for farmed fish. This pushes aquaculture operations to scale up, leading to higher feed requirements. In addition, technological improvements in feed processing and nutrient delivery are supporting consistent market expansion.

Key Takeaways

- Global Aquafeed Market is expected to be worth around USD 115.5 billion by 2034, up from USD 65.7 billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034.

- In 2024, Dry form dominated the Aquafeed Market, accounting for 68.4% of total sales.

- Vitamins and Minerals held a 21.3% share in Aquafeed additives due to rising focus on nutrition.

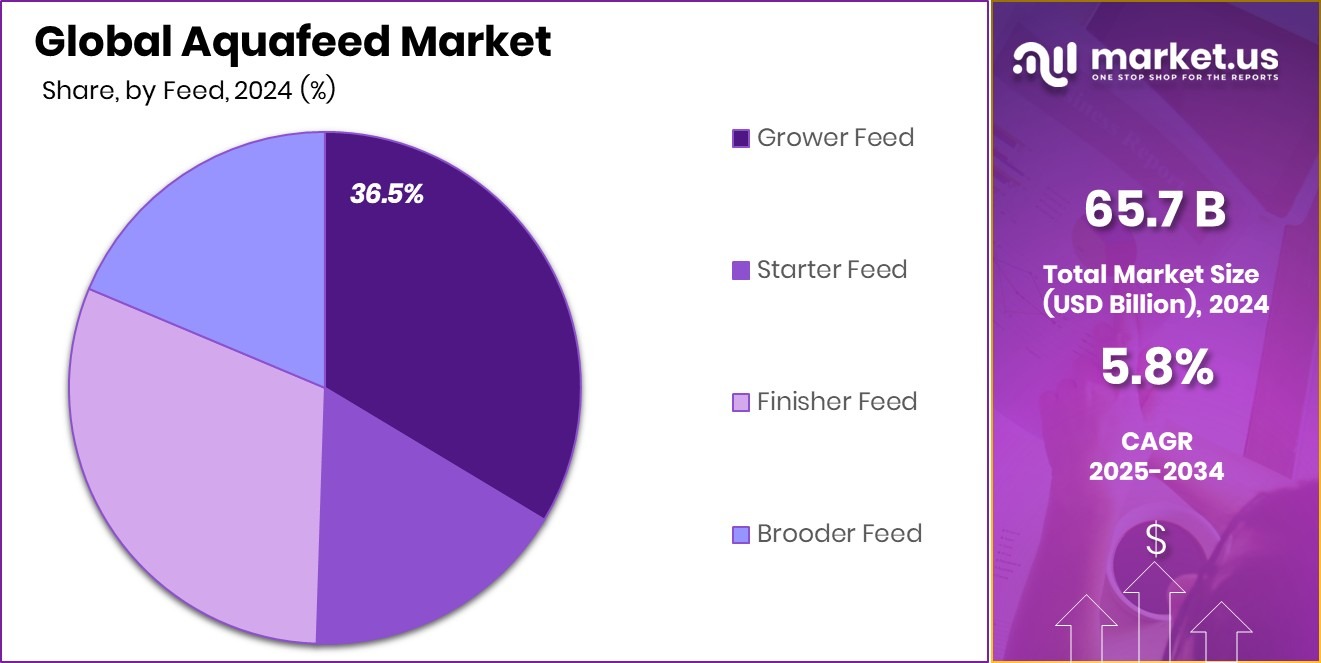

- Grower Feed led the feed type segment in the Aquafeed Market, contributing 36.5% to the overall demand.

- Carp emerged as the leading application species, representing 23.6% of total Aquafeed Market consumption globally.

- The Asia-Pacific aquafeed market reached a value of USD 28.9 billion in total.

By Form Analysis

In 2024, dry form held a 68.4% share in the Aquafeed Market globally.

In 2024, Dry held a dominant market position in By Form segment of the Aquafeed Market, with a 68.4% share. The widespread use of dry aquafeed is primarily attributed to its long shelf life, ease of storage, and cost-effectiveness in transportation. Dry feed, including pellets and crumbles, is preferred by aquaculture farmers for its controlled nutrient composition and minimal water pollution.

It allows for efficient feeding schedules and reduces feed wastage, which is a critical factor in managing operational costs in commercial fish farming. Furthermore, dry aquafeed supports automation in large-scale aquaculture operations, where precise feed dispensing plays a major role in optimizing growth performance and feed conversion ratios.

Its durability and stability in various aquatic environments make it especially suitable for species cultured in both freshwater and marine settings. As feed manufacturers continue to enhance the nutritional value and digestibility of dry formulations, the demand for this form is expected to remain strong.

The 68.4% market share reflects both its functional benefits and high acceptance across key aquaculture regions. With sustainability and cost-efficiency becoming central to the aquaculture industry, the dry form is likely to maintain its leadership in the form segment of the aquafeed market.

By Additives Analysis

Vitamins and minerals dominated the additives segment with a 21.3% share in the Aquafeed Market.

In 2024, Vitamins and Minerals held a dominant market position in the additives segment of the Aquafeed Market, with a 21.3% share. This dominance reflects the essential role of micronutrients in supporting the overall health, growth, and immunity of farmed aquatic species. Vitamins and minerals are crucial in regulating metabolic functions, improving feed conversion efficiency, and enhancing disease resistance, especially under intensive farming conditions.

Their consistent inclusion in feed formulations ensures balanced nutrition, which is critical for preventing deficiencies that could lead to poor growth rates or mortality. The 21.3% share also indicates growing awareness among aquaculture producers about the importance of micronutrient supplementation for optimizing production yield and maintaining the physiological functions of various species.

Moreover, as environmental stress and fluctuating water quality continue to impact aquaculture operations, fortified feeds with adequate levels of vitamins and minerals are gaining preference. Feed manufacturers are also standardizing the inclusion of these additives to meet the nutritional requirements set by regulatory bodies and ensure product consistency.

By Feed Analysis

Grower feed led the feed segment, accounting for 36.5% of the Aquafeed Market.

In 2024, Grower Feed held a dominant market position in the By Feed segment of the Aquafeed Market, with a 36.5% share. This segment leads due to its critical role in supporting the rapid growth phase of aquatic species, where nutritional demand is at its peak. Grower feed is specifically formulated to provide balanced proteins, lipids, and energy that meet the metabolic needs of fish and shrimp during their developmental stage.

The 36.5% market share highlights the widespread adoption of these feeds across commercial aquaculture farms aiming to optimize growth rates and shorten production cycles. Additionally, grower feed ensures better feed conversion ratios, making it economically favorable for large-scale producers focused on efficiency.

Its consistent performance in promoting weight gain and overall health makes it a preferred choice among farmers operating in both freshwater and marine farming systems. The dominance of grower feed also reflects the industry’s focus on improving yield predictability, which is vital in meeting the increasing global demand for seafood.

As aquaculture continues to scale up, the demand for targeted and nutritionally complete grower formulations remains strong, reinforcing the segment’s leadership position in the aquafeed market by feed category.

By Application Analysis

Carp application remained dominant, representing a 23.6% share in the global Aquafeed Market demand.

In 2024, Carp held a dominant market position in the By Application segment of the Aquafeed Market, with a 23.6% share. Carp farming continues to be one of the most extensive aquaculture practices globally, particularly in Asia, where it forms a staple part of the diet. The 23.6% market share reflects the high volume of carp production and the associated demand for species-specific feed that supports efficient growth and survival rates.

Carp are known for their adaptability to varied water conditions and their ability to thrive on plant-based diets, making their farming relatively cost-effective. Aquafeed for carp is typically formulated to support robust growth, immunity, and reproduction, with a focus on minimizing feed costs while maximizing yield. The dominance of carp in the application segment is also supported by the strong presence of small to mid-scale fish farms catering to regional consumption patterns.

The nutritional needs of carp vary across life stages, prompting steady demand for specialized feed types such as starter, grower, and finisher feeds tailored for this species. As carp continues to be a popular and affordable source of protein, especially in emerging economies, its leading position in the aquafeed application segment is expected to remain consistent.

Key Market Segments

By Form

- Dry

- Moist

- Wet

By Additives

- Amino Acids

- Antibiotics

- Vitamins & Minerals

- Feed Acidifiers

- Antioxidants

- Enzymes

- Anti-parasitic

- Probiotics and Prebiotics

- Others

By Feed

- Grower Feed

- Starter Feed

- Finisher Feed

- Brooder Feed

By Application

- Carp

- Rainbow Trout

- Salmon

- Crustaceans

- Tilapia

- Catfish

- Sea Bass

- Grouper

- Others

Driving Factors

Rising Global Seafood Demand Boosts Feed Needs

One of the top driving factors of the aquafeed market is the rising global demand for seafood. As people around the world become more health-conscious, they are adding more fish and shrimp to their diets due to their high protein and low fat content. This shift in food habits, especially in Asia-Pacific and parts of Europe, has led to a big increase in aquaculture activities.

Fish farming is growing quickly to meet this demand, which directly increases the need for aquafeed. Farmers now focus on high-quality feed to ensure faster growth and better health of aquatic animals. This growing seafood consumption trend is expected to keep pushing aquafeed demand even higher in the coming years.

Restraining Factors

High Raw Material Costs Impact Feed Production

One of the major restraining factors in the aquafeed market is the high cost of raw materials used in feed production. Ingredients like fishmeal, soybean meal, corn, and wheat have seen price fluctuations due to climate issues, global supply chain disruptions, and competition with other industries like poultry and livestock. These rising input costs make it harder for feed manufacturers to maintain affordable prices without compromising quality.

For fish farmers, expensive feed can increase production costs and reduce overall profit margins. Smaller farms, in particular, struggle to manage these cost pressures. As a result, feed affordability becomes a key challenge that may slow down the expansion of aquaculture operations, especially in developing regions.

Growth Opportunity

Emerging Plant‑Based Ingredients Offer Sustainable Feed Advantage

One of the top growth opportunities in the aquafeed market is the shift toward plant-based and alternative protein ingredients. As concerns grow over overfishing and environmental impact, both farmers and consumers are seeking more sustainable feed options. Ingredients like soy protein, algae, insect meal, and single-cell proteins offer high nutritional value with a smaller ecological footprint.

These alternatives can help reduce reliance on traditional fishmeal and fish oil, whose supplies are limited and often expensive. By incorporating these sustainable ingredients, feed producers can develop eco-friendly formulas that appeal to environmentally conscious buyers.

Additionally, these novel feeds can support steady aquaculture expansion without putting undue pressure on marine ecosystems. As research and production scale up, plant-based and alternative proteins are becoming viable choices that can help the aquafeed market grow sustainably over the coming years.

Latest Trends

Smart Feeding Systems Changing Aquaculture Feed Practices

A top trend in the aquafeed market is the use of smart feeding systems in fish and shrimp farming. These systems use sensors, cameras, and data to monitor fish behavior and feeding patterns in real-time. By doing this, farmers can feed the exact amount needed—no more, no less. It helps reduce feed waste, save money, and improve water quality by avoiding overfeeding.

Some systems even use AI to adjust feeding automatically based on the fish’s appetite and size. This smart approach not only makes feeding more efficient but also improves fish health and growth. As technology becomes more affordable, more fish farms are adopting smart feeding tools to increase profits and reduce environmental impact.

Regional Analysis

In 2024, Asia-Pacific led the aquafeed market with a 44.1% share dominance.

In 2024, Asia-Pacific held the dominant position in the global aquafeed market, accounting for 44.1% of the total market share with a value of USD 28.9 billion. This significant share is primarily driven by the region’s strong aquaculture base, particularly in countries like China, India, Vietnam, and Indonesia, where fish and shrimp farming form an essential part of the food supply chain.

The growing demand for seafood, increasing exports, and supportive government initiatives continue to drive the consumption of aquafeed across the region. North America and Europe also represent established markets, driven by technological integration in aquaculture practices and demand for high-protein diets.

Meanwhile, Latin America and the Middle East & Africa are witnessing gradual adoption of commercial aquaculture practices, which is expected to create steady demand for aquafeed products in the coming years. Although these regions are smaller in value compared to Asia-Pacific, their growth prospects are supported by increasing investments in aquaculture infrastructure.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nutreco has consistently stood out for its integrated, end-to-end approach in aquaculture nutrition. In 2024, their focus on optimizing feed formulations and improving operational efficiency has reinforced their market leadership. Their strong R&D capabilities and international footprint have enabled them to adapt recipes according to regional farming requirements, enhancing feed conversion ratios and supporting sustainability initiatives.

Purina Animal Nutrition LLC, a subsidiary of a well-known parent group, continues to make its mark in the aquatic feed segment by applying its broad animal nutrition expertise. While traditionally strong in terrestrial livestock, in 2024 the company has further developed specialized aquatic feed lines. Their consumer-trust legacy and rigorous quality assurance practices have served as differentiators.

Ridley Corp. Ltd. remains a notable producer focused on delivering value-driven aquatic solutions. In 2024, their regional strength, particularly in Australasia, combined with strong relationships with local fish farmers, helped solidify their position. Ridley has invested strategically in feed-mill automation and logistics to ensure timely supply and consistent quality.

Top Key Players in the Market

- Adisseo

- ADM

- Aker Biomarine

- Aller Aqua Group

- Alltech

- Avanti feeds Limited

- BENEO

- BioMar Group

- Biostadt India Ltd.

- Cargill, Incorporated

- Charoen Pokphand Foods PCL

- Dibaq Aquaculture

- dsm-firmenich

- INVE Aquaculture

- JAPFA LTD

- Norel Animal Nutrition

- Nutreco

- Purina Animal Nutrition LLC

- Ridley Corp. Ltd.

Recent Developments

- In November 2024, Aker BioMarine established Aker QRILL Company, dedicated to providing krill-derived ingredients for aquaculture feed. The move supports the broader availability of krill-based products in farmed fish and shrimp nutrition.

- In March 2024, ADM introduced Aquatrax, a new aquafeed additive derived from Pichia guillermondii. This innovative additive aims to improve growth performance and overall health in fish and shrimp by enhancing digestive efficiency and nutrient absorption.

Report Scope

Report Features Description Market Value (2024) USD 65.7 Billion Forecast Revenue (2034) USD 115.5 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Dry, Moist, Wet), By Additives (Amino Acids, Antibiotics, Vitamins and Minerals, Feed Acidifiers, Antioxidants, Enzymes, Anti-parasitic, Probiotics and Prebiotics, Others), By Feed (Grower Feed, Starter Feed, Finisher Feed, Brooder Feed), By Application (Carp, Rainbow Trout, Salmon, Crustaceans, Tilapia, Catfish, Sea Bass, Grouper, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Adisseo, ADM, Aker Biomarine, Aller Aqua Group, Alltech, Avanti feeds Limited, BENEO, BioMar Group, Biostadt India Ltd., Cargill, Incorporated, Charoen Pokphand Foods PCL, Dibaq Aquaculture, dsm-firmenich, INVE Aquaculture, JAPFA LTD, Norel Animal Nutrition, Nutreco, Purina Animal Nutrition LLC, Ridley Corp. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adisseo

- ADM

- Aker Biomarine

- Aller Aqua Group

- Alltech

- Avanti feeds Limited

- BENEO

- BioMar Group

- Biostadt India Ltd.

- Cargill, Incorporated

- Charoen Pokphand Foods PCL

- Dibaq Aquaculture

- dsm-firmenich

- INVE Aquaculture

- JAPFA LTD

- Norel Animal Nutrition

- Nutreco

- Purina Animal Nutrition LLC

- Ridley Corp. Ltd.