Global 3D Printed Packaging Market Size, Share, Growth Analysis By Material (Plastics, Paper & Paperboard, Aluminum, Others), By Technology (Stereolithography, Fused Deposition Modeling, Selective Laser Sintering, Digital Light Processing, Multi Jet Fusion, Electron Beam Melting, Direct Metal Laser Sintering, Binder Jetting, Laminated Object Manufacturing), By Application (Food & Beverage, Cosmetics, Pharmaceutical, Consumer Goods, Industrial Goods, Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143866

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

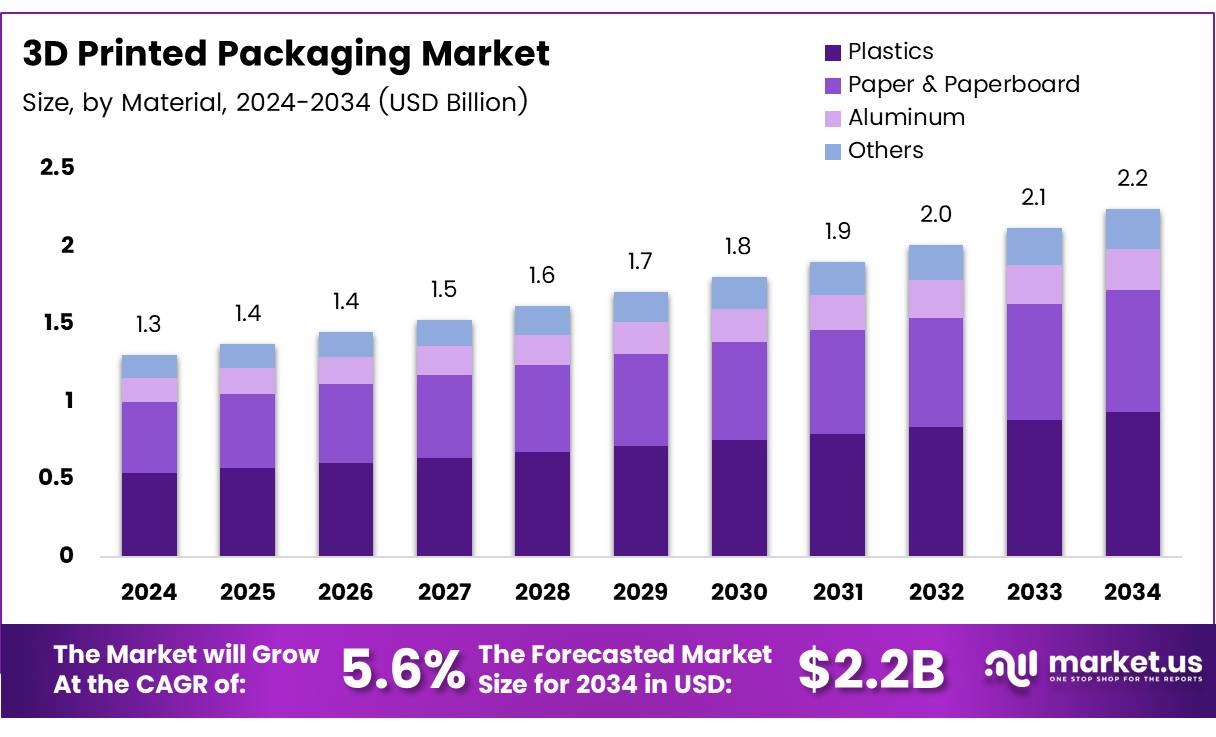

The Global 3D Printed Packaging Market size is expected to be worth around USD 2.2 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The 3D Printed Packaging Market represents a cutting-edge intersection of technology and consumer packaging, leveraging 3D printing technologies to revolutionize design, customization, and production efficiency in the packaging industry.

This market encompasses the use of various 3D printing methods such as Fused Deposition Modeling (FDM), Selective Laser Sintering (SLS), and Stereolithography (SLA) to create intricate and customized packaging solutions that are both sustainable and cost-effective.

The integration of 3D printing in packaging enables manufacturers to rapidly prototype designs, reduce material waste, and cater to the growing demand for personalized packaging experiences among consumers.

The adoption of 3D printing technologies in packaging offers significant growth and innovation opportunities. The ability to 3D print packaging materials directly from digital files significantly reduces the lead time for prototype development, as evidenced by advancements that cut lead times by six weeks and reduce costs by up to 90% according to VoxelMatters.

The 3D Printed Packaging Market is poised for substantial growth, driven by the increasing adoption of 3D printing technologies across various industries and the continuous advancements in 3D printing materials and techniques. According to ScienceDirect, the technology holds potential for valorizing food waste, with a possible reduction of 40–60% in waste disposal through innovative product designs.

Furthermore, the market is supported by governmental investments in 3D printing technology and favorable regulations aimed at promoting sustainable manufacturing practices. This environment fosters a fertile ground for further technological innovations and market expansion.

The U.S. Bureau of Labor Statistics anticipates a 13% growth in demand for 3D printing technicians by 2030, underscoring the increasing reliance on this technology in industrial applications, including packaging (MRI Network).

Key Takeaways

- Global 3D Printed Packaging Market projected to grow from USD 1.3 billion in 2024 to USD 2.2 billion by 2034, at a CAGR of 5.6%.

- Plastics lead the material segment with a 60.4% share in 2024, favored for their durability, lightweight nature, and cost-effectiveness.

- Stereolithography (SLA) technology holds a 20.5% share in the technology segment, prized for producing detailed and precise packaging.

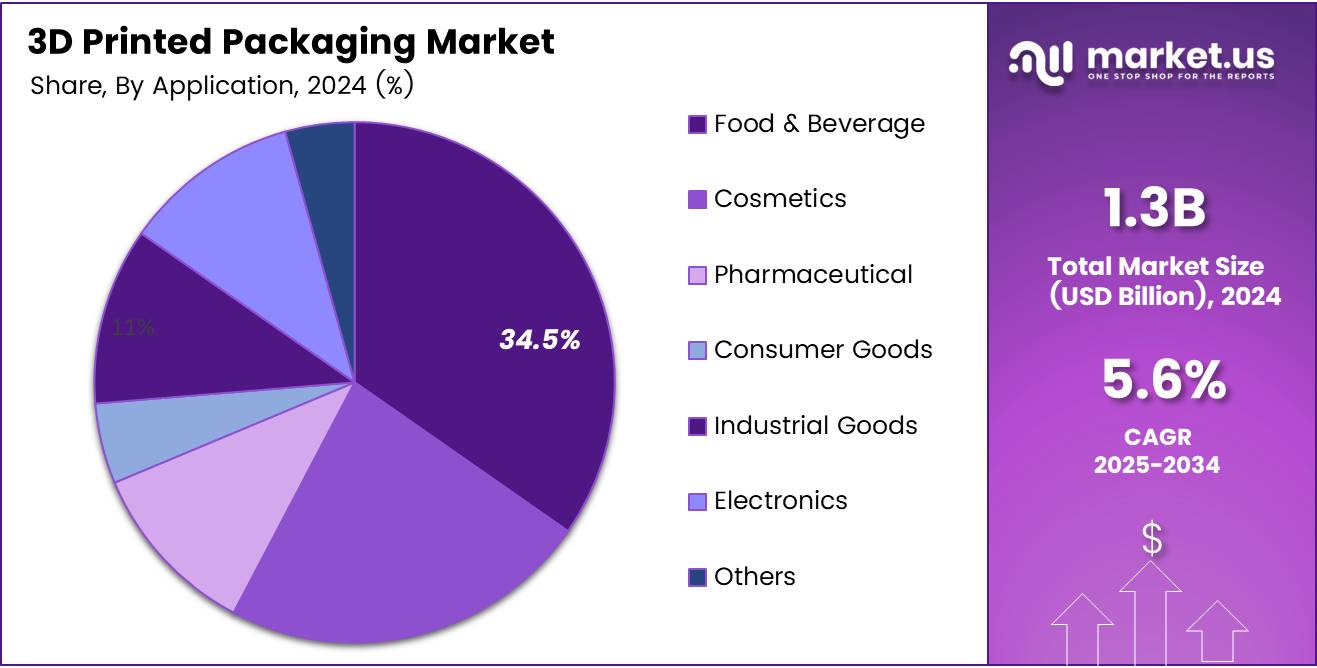

- The Food & Beverage sector dominates the application segment with a 34.5% share, driven by demand for innovative packaging that extends shelf life.

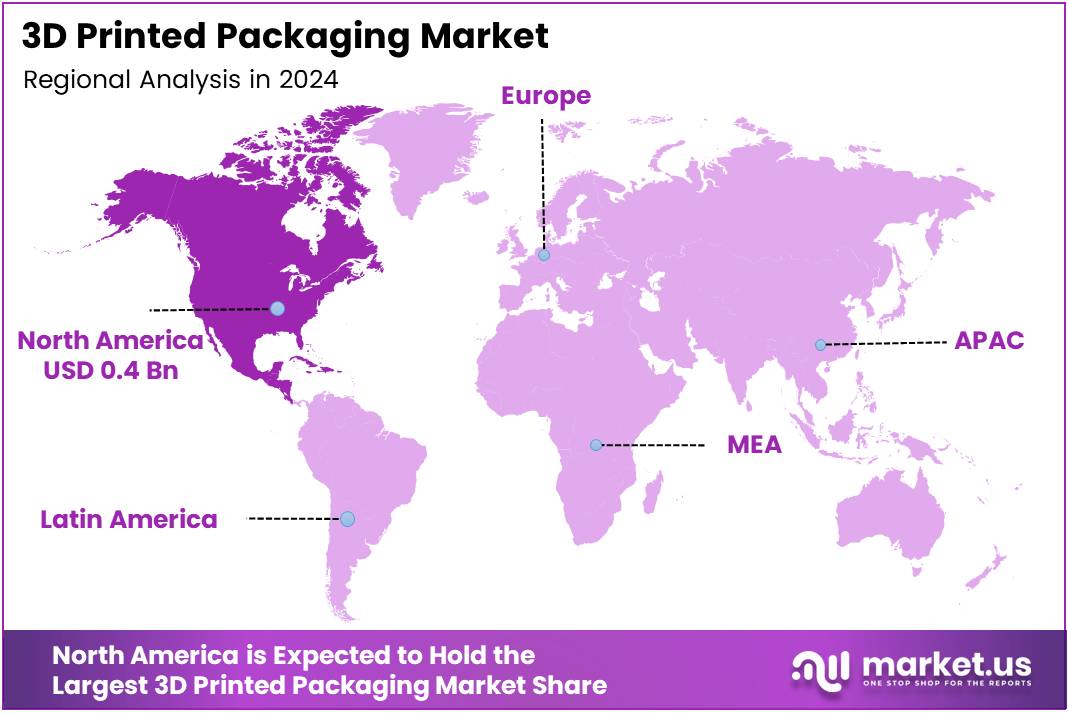

- North America leads the regional market with a 33.6% share, supported by advanced technological infrastructure and early adoption of 3D printing.

Material Analysis

Plastics Lead with 60.4% in the Material Segment of the 3D Printed Packaging Market

In 2024, plastics commanded a dominant position in the By Material Analysis segment of the 3D Printed Packaging Market, holding a substantial 60.4% share. This prominence can be attributed to plastics’ versatile properties, including durability, lightweight nature, and cost-effectiveness, which are highly valued in packaging solutions.

The material’s adaptability allows for extensive customization in 3D printing processes, making it an ideal choice for complex packaging designs that require both aesthetic appeal and functional integrity.

Moreover, the continued innovation in biodegradable and recycled plastics aligns with the growing consumer and regulatory demands for sustainable packaging solutions, further cementing plastics’ leading role in the market.

Despite facing competition from materials like paper & paperboard and aluminum, which offer their own environmental and durability advantages, plastics remain the preferred material due to their ease of use in 3D printing technologies and their ability to be repurposed efficiently.

This segment’s growth is also supported by advancements in 3D printing techniques that enhance the material’s performance and reduce waste, thereby promoting a circular economy in the packaging industry.

Technology Analysis

Stereolithography (SLA) Leads with a 20.5% Market Share Owing to Precision and Customization Capabilities

In 2024, Stereolithography (SLA) technology secured a prominent position in the By Technology Analysis segment of the 3D Printed Packaging Market, accounting for a 20.5% share. This technology is highly valued for its ability to produce highly detailed and precise packaging solutions, which are critical in industries that require exact specifications and intricate designs, such as cosmetics and pharmaceuticals.

The adoption of SLA in 3D printed packaging has been driven by its superior finish and accuracy compared to other 3D printing technologies. Manufacturers favor SLA for creating complex packaging prototypes and functional parts that require a smooth surface finish and fine details without the need for additional processing.

Moreover, the ongoing advancements in resin formulations used in SLA printing have expanded its applications in packaging. These innovations have led to the development of more durable and flexible packaging options, further cementing SLA’s role in this segment.

Application Analysis

3D Printed Packaging Thrives in Food & Beverage with a Leading 34.5% Market Share

In 2024, the Food & Beverage sector held a dominant position in the By Application Analysis segment of the 3D Printed Packaging Market, commanding a 34.5% share. This substantial market share can be attributed to the increasing demand for innovative packaging solutions that offer enhanced protection and extended shelf life for food products.

The adoption of 3D printing technologies in this sector has been driven by the need for customization and flexibility in packaging design, which is particularly beneficial for niche and premium food products.

Further analysis reveals that the use of 3D printed packaging in the Food & Beverage industry not only caters to aesthetic and functional demands but also aligns with the growing consumer preference for sustainable and eco-friendly packaging options.

The ability of 3D printing to reduce waste during the manufacturing process, coupled with the use of biodegradable materials, positions it as a key technology in the pursuit of sustainable industry practices.

Other sectors, such as Cosmetics, Pharmaceuticals, and Consumer Goods, also integrate 3D printed packaging solutions but to a lesser extent compared to Food & Beverage. These industries leverage 3D printing primarily for its precision and ability to produce complex packaging geometries that appeal to consumers seeking premium product experiences.

Key Market Segments

By Material

- Plastics

- Paper & Paperboard

- Aluminum

- Others

By Technology

- Stereolithography (SLA)

- Fused Deposition Modeling (FDM)

- Selective Laser Sintering (SLS)

- Digital Light Processing (DLP)

- Multi Jet Fusion (MJF)

- Electron Beam Melting (EBM)

- Direct Metal Laser Sintering (DMLS)

- Binder Jetting

- Laminated Object Manufacturing (LOM)

By Application

- Food & Beverage

- Cosmetics

- Pharmaceutical

- Consumer Goods

- Industrial Goods

- Electronics

- Others

Drivers

Customization Needs Elevate the 3D Printed Packaging Market

The 3D printed packaging market is experiencing significant growth, primarily driven by the increasing consumer demand for customization and personalization in packaging. This trend allows consumers to obtain unique, tailor-made packaging solutions that stand out in a crowded market.

Additionally, the technology facilitates rapid prototyping, enabling manufacturers to swiftly iterate and refine designs, significantly speeding up product development cycles. This is coupled with the inherent benefits of 3D printing, such as reduced lead times and minimized waste, which align with the growing organizational focus on sustainability.

By utilizing 3D printing, companies can produce on-demand without the need for extensive inventory, thus reducing storage costs and lessening material wastage. Moreover, the push towards environmental sustainability is further fostering the adoption of 3D printing techniques that accommodate biodegradable and recyclable materials, thereby enhancing the market’s growth prospects.

Restraints

Material Limitations Pose Challenges in the 3D Printed Packaging Market

The 3D printed packaging market faces significant restraints due to material limitations, which can hinder its expansion and widespread adoption. Currently, the range of materials available for 3D printing that are both safe for food contact and exhibit the required durability for packaging applications is quite limited. This restricts the ability of manufacturers to fully exploit 3D printing technologies in food packaging, where safety and durability are paramount.

Moreover, the absence of standardized practices and regulations in the 3D printing sector further complicates the scenario, as it leads to inconsistencies in production quality and safety, thereby deterring large-scale adoption.

These challenges not only affect the operational efficiency of businesses venturing into 3D printed packaging but also limit consumer acceptance due to concerns over quality and safety standards. Consequently, the growth potential of the 3D printed packaging market is tempered, requiring innovations in material science and regulatory frameworks to unlock its full potential.

Growth Factors

Integrating Smart Technology in Packaging Spurs Market Evolution

The 3D printed packaging market presents substantial growth opportunities by embracing the integration of smart technologies. This innovative approach facilitates the incorporation of sensors and IoT-enabled features into packaging designs, revolutionizing how products are tracked, secured, and interacted with across various industries.

This shift not only enhances the functionality of packaging but also significantly improves the consumer experience by providing enhanced interactivity and real-time data about the product’s condition and authenticity.

Additionally, the ability to customize features and adapt to specific requirements in real-time, without extensive retooling, aligns perfectly with the dynamic needs of modern supply chains. This integration positions 3D printed packaging as a pivotal solution in the digital transformation of the packaging industry, thereby driving market growth and attracting investments in smart packaging solutions.

Emerging Trends

AI-Driven Design Software Boosts 3D Printed Packaging Innovation

The 3D printed packaging market is rapidly evolving, driven by the adoption of AI-driven design software that facilitates innovative and complex packaging designs. This technology allows for rapid prototyping and customization, catering to the dynamic needs of consumers.

Collaborations between FMCG brands and 3D printing companies are enhancing product differentiation through unique packaging solutions. Additionally, the rise of subscription box services demands distinctive, personalized packaging, a niche that 3D printing serves well.

Furthermore, advancements in multi-material and multi-color printing are expanding the creative and functional possibilities of packaging. These trends collectively propel the growth of the 3D printed packaging market.

Regional Analysis

North America Leads 3D Printed Packaging Market with 33.6% Share, Driven by Technological Adoption and Innovation

The global 3D printed packaging market demonstrates significant regional diversification with North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America each contributing to the market’s expansion.

North America emerges as the dominant region, holding a substantial share of 33.6% with a market value of USD 0.4 billion. This dominance can be attributed to the region’s robust technological infrastructure and the early adoption of advanced manufacturing technologies, including 3D printing. The presence of major players in the industry also supports the widespread implementation and innovation in 3D printed packaging solutions.

Regional Mentions:

Europe follows with a strong emphasis on sustainability and customization, which drives the adoption of 3D printing technologies in packaging. The region’s stringent regulations regarding packaging waste and the increasing demand for eco-friendly solutions significantly contribute to the growth of the market. Europe’s developed economies such as Germany, the UK, and France are at the forefront, leveraging their technological capabilities to enhance packaging efficiency and design.

Asia Pacific is identified as a rapidly growing region in the 3D printed packaging market, fueled by the expanding manufacturing sector and increasing investments in 3D printing technologies. China, Japan, and South Korea are leading this growth, with their substantial investments in technology and a growing focus on sustainable packaging solutions. The region’s large consumer base and rising economic standards are additional factors propelling market growth.

The Middle East & Africa, along with Latin America, although smaller in market size compared to other regions, are experiencing gradual growth. This growth is driven by increasing awareness about the benefits of 3D printing in packaging and the gradual technological advancements in these regions. Countries like Brazil and South Africa are beginning to explore these innovative packaging solutions, aiming to improve product presentation and functionality.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global 3D printed packaging market is poised to transform significantly due to the technological advancements and innovative efforts of leading companies. Notably, Stratasys Ltd., 3D Systems Corporation, and Desktop Metal, Inc. emerge as frontrunners, driving the adoption of 3D printing technologies in packaging solutions.

Stratasys Ltd. has been pivotal in advancing 3D printing capabilities, focusing on producing high-quality, durable packaging materials that meet the dynamic needs of industries such as healthcare and consumer goods. Their investment in new materials and technologies has positioned them as a key player in enabling customized and flexible packaging solutions.

3D Systems Corporation, with its comprehensive range of 3D printers and materials, has enhanced its offerings in the packaging sector by introducing more sustainable and efficient printing solutions. Their focus on optimizing production processes aligns with the growing demand for eco-friendly and cost-effective packaging options.

Desktop Metal, Inc. stands out with its metal 3D printing technologies, which are increasingly being utilized in the production of robust packaging components that require higher strength and durability. Their innovation in metal printing opens new avenues for creating more sophisticated packaging designs that were previously unachievable.

These companies, along with others such as Formlabs, Inc. and Xometry, Inc., are not only enhancing their product offerings but also contributing to the market’s growth by pushing the boundaries of what 3D printing technology can achieve in packaging. As they continue to innovate and expand their market reach, the role of 3D printed solutions in packaging is expected to become more prevalent, offering substantial benefits in customization, waste reduction, and operational efficiency.

Top Key Players in the Market

- Stratasys Ltd.

- 3D Systems Corporation

- Desktop Metal, Inc.

- Formlabs, Inc.

- Xometry, Inc.

- CELLINK AB

- Materialise NV

- EOS GmbH

- Arcam AB

- SLM Solutions Group AG

- Nexa3D

- Protolabs Inc.

- GE Additive

- Carbon, Inc.

- Markforged, Inc.

Recent Developments

- In September 2024, SpaceX entered into a significant $8 million agreement with Velo3D, a frontrunner in the metal additive manufacturing sector, to enhance its capabilities in 3D printing technologies. This collaboration marks a strategic expansion of SpaceX’s manufacturing innovations.

- In July 2024, Mantle secured a substantial $20 million in Series C funding, aimed at advancing its pioneering metal 3D printing technologies specifically designed for high-precision tooling. This investment underscores the growing industry confidence in Mantle’s innovative approaches.

- In May 2024, Stratasys made a strategic acquisition of Arevo’s technology portfolio, significantly bolstering its position as a leader in additive manufacturing innovation. This move is intended to enhance Stratasys’s offerings and drive new advancements in the field.

- In January 2024, Align Technology completed the acquisition of Cubicure, a direct 3D printing solutions firm. This acquisition allows Align Technology to broaden its technological base and enhance its capabilities in the orthodontics and dental markets.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.2 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Plastics, Paper & Paperboard, Aluminum, Others), By Technology (Stereolithography, Fused Deposition Modeling, Selective Laser Sintering, Digital Light Processing, Multi Jet Fusion, Electron Beam Melting, Direct Metal Laser Sintering, Binder Jetting, Laminated Object Manufacturing), By Application (Food & Beverage, Cosmetics, Pharmaceutical, Consumer Goods, Industrial Goods, Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Stratasys Ltd., 3D Systems Corporation, Desktop Metal, Inc., Formlabs, Inc., Xometry, Inc., CELLINK AB, Materialise NV, EOS GmbH, Arcam AB, SLM Solutions Group AG, Nexa3D, Protolabs Inc., GE Additive, Carbon, Inc., Markforged, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  3D Printed Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

3D Printed Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Stratasys Ltd.

- 3D Systems Corporation

- Desktop Metal, Inc.

- Formlabs, Inc.

- Xometry, Inc.

- CELLINK AB

- Materialise NV

- EOS GmbH

- Arcam AB

- SLM Solutions Group AG

- Nexa3D

- Protolabs Inc.

- GE Additive

- Carbon, Inc.

- Markforged, Inc.