Global Yeast Infection Treatment Market By Product Type (Azoles, Echinocandin, Polygene, and Others), By Application (Invasive Candidiasis, Genital Candidiasis, Oropharyngeal/Esophageal Candidiasis, and Others), By Route of Administration (Oral, IV/IM, Topical, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169924

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

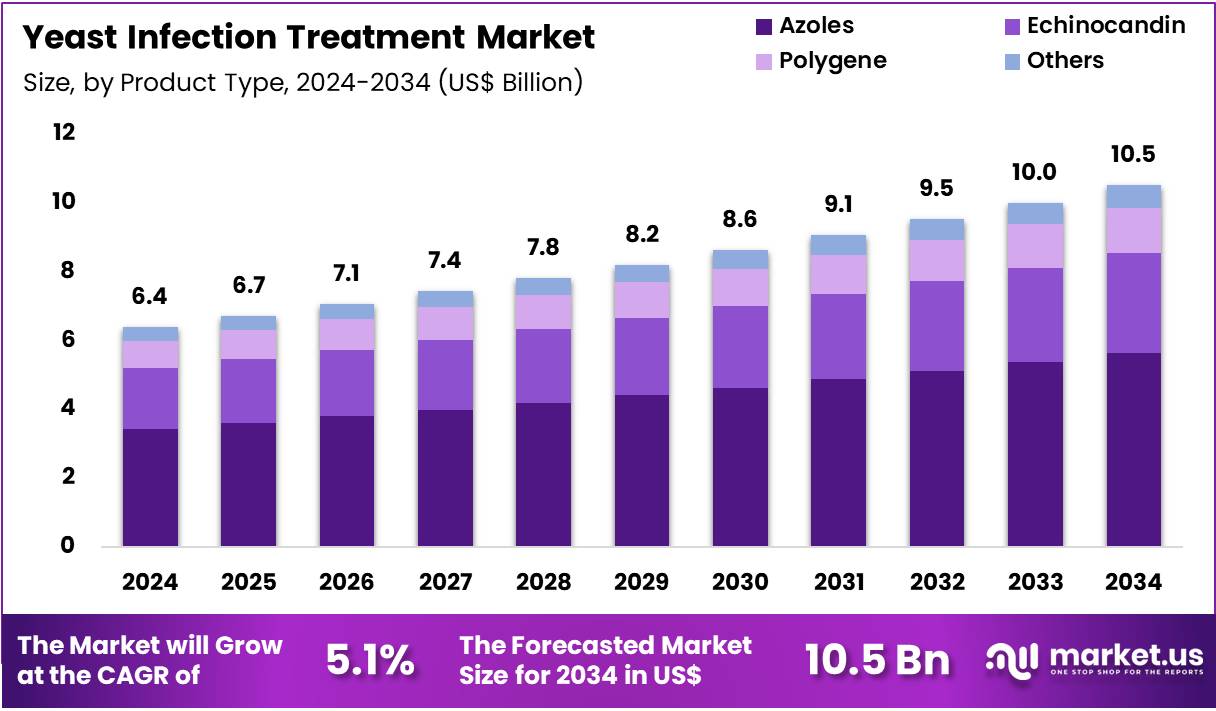

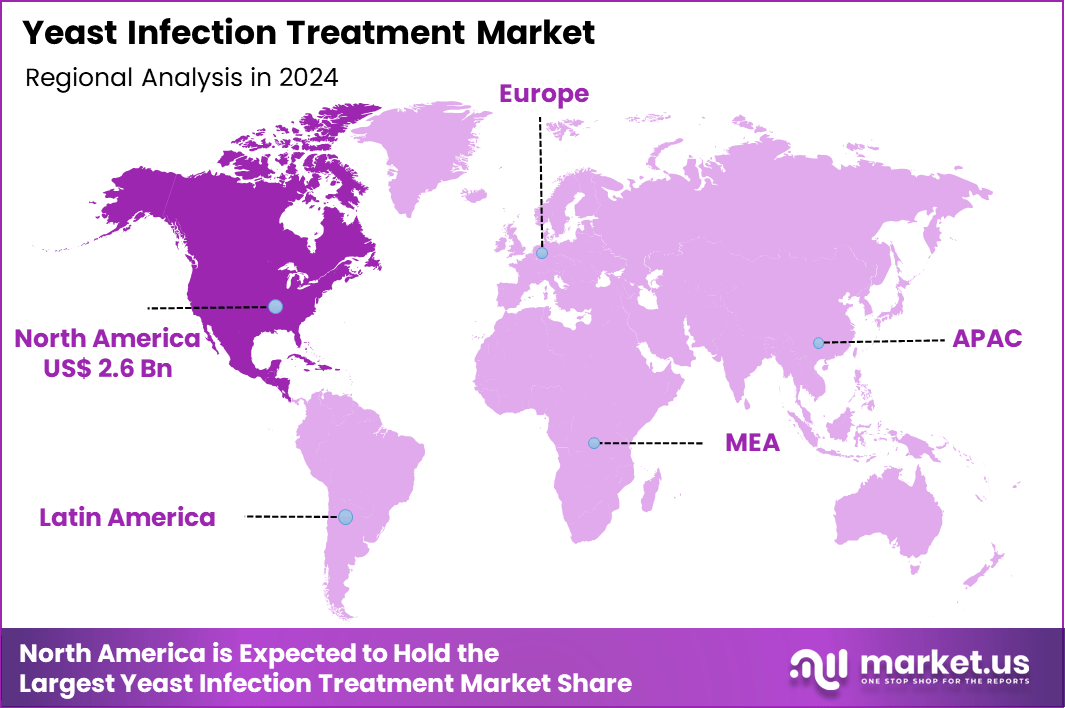

The Global Yeast Infection Treatment Market size is expected to be worth around US$ 10.5 Billion by 2034 from US$ 6.4 Billion in 2024, growing at a CAGR of 5.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.4% share with a revenue of US$ 2.6 Billion.

Increasing recognition of recurrent vulvovaginal candidiasis as a chronic concern drives the Yeast Infection Treatment market, as healthcare providers emphasize long-term management strategies to alleviate symptoms and prevent reinfections in affected women. Pharmaceutical companies advance oral and topical formulations that target Candida albicans biofilms, enhancing eradication rates and patient compliance through convenient dosing schedules.

These treatments address acute episodic flares in immunocompetent individuals, prophylactic regimens for women with four or more episodes annually, complicated infections in diabetic patients requiring extended therapy, and non-albicans species like Candida glabrata through alternative azole classes. Regulatory milestones introduce novel mechanisms to combat resistance, creating opportunities for combination therapies that integrate antifungals with probiotics for microbiome restoration.

In June 2021, the FDA authorized BREXAFEMME (ibrexafungerp tablets) for vulvovaginal candidiasis, ushering in the first new antifungal class in over two decades and revitalizing innovation in a stagnant therapeutic landscape. This approval expands clinician options and underscores the market’s potential for sustained growth amid evolving resistance patterns.

Growing adoption of over-the-counter antifungal options accelerates the Yeast Infection Treatment market, as consumers increasingly self-treat mild symptoms to avoid healthcare system burdens while seeking rapid symptom relief. Diagnostic firms pair treatments with at-home pH testing strips that confirm candidiasis before application, fostering informed self-management.

Applications extend to maintenance suppressive therapy for recurrent cases using weekly fluconazole dosing, single-dose creams for uncomplicated vaginal infections during pregnancy, boric acid capsules as adjuncts for azole-refractory strains, and tea tree oil-infused gels for mild cutaneous yeast overgrowth in intertriginous areas.

Accessibility enhancements open avenues for digital platforms that offer virtual consultations and personalized regimen recommendations based on symptom profiles. Biotechnology innovators actively explore microbiome-modulating agents to complement traditional antifungals, addressing root causes like dysbiosis.

Rising focus on antifungal resistance mitigation invigorates the Yeast Infection Treatment market, as infectious disease specialists advocate susceptibility-guided prescribing to preserve efficacy against emerging non-albicans pathogens. Researchers develop echinocandin derivatives and glucan synthase inhibitors that disrupt fungal cell walls with minimal host toxicity.

These therapies support invasive candidiasis management in neutropenic oncology patients via intravenous liposomal formulations, esophageal candidiasis resolution in HIV-positive individuals through systemic azoles, oral thrush treatment in denture wearers with nystatin suspensions, and perineal dermatitis control in incontinent elderly populations using barrier creams with miconazole.

Stewardship programs create opportunities for educational campaigns that promote judicious use and early detection. Collaborative efforts among key players emphasize pipeline diversification to tackle multidrug-resistant isolates, ensuring robust therapeutic pipelines.

Key Takeaways

- In 2024, the market generated a revenue of US$ 6.4 Billion, with a CAGR of 5.1%, and is expected to reach US$ 10.5 Billion by the year 2034.

- The product type segment is divided into azoles, echinocandin, polygene; others, with azoles taking the lead in 2024 with a market share of 53.7%.

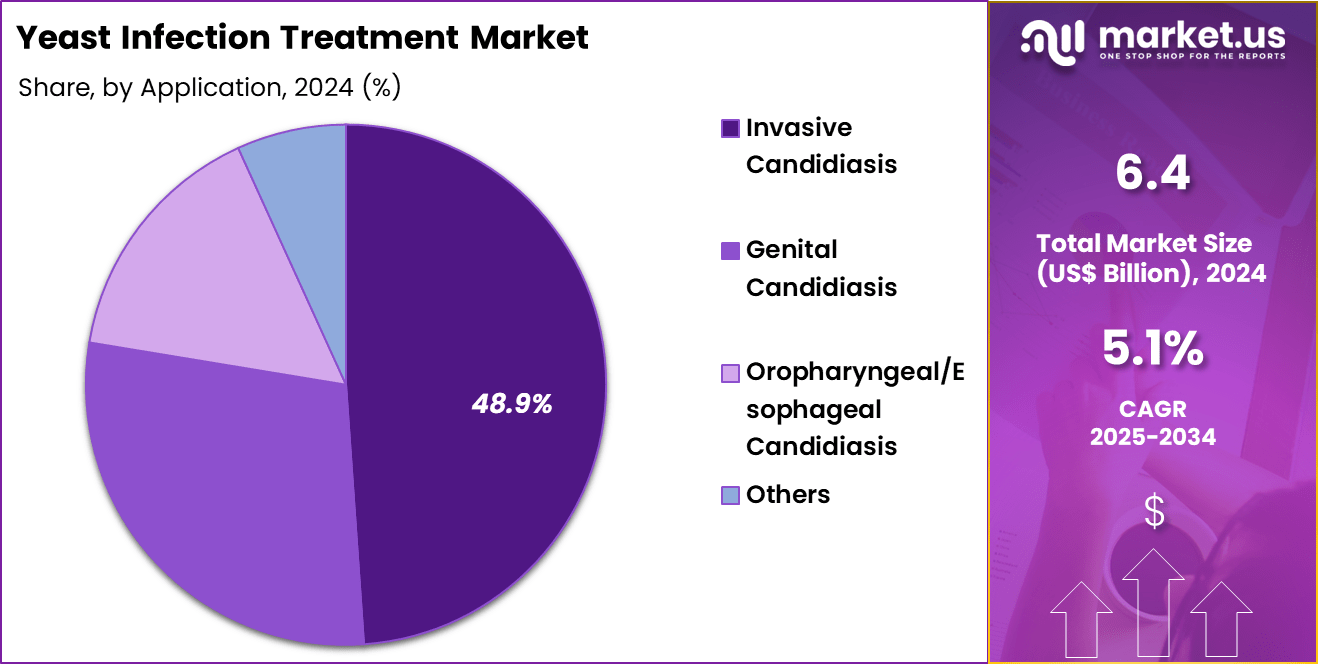

- Considering application, the market is divided into invasive candidiasis, genital candidiasis, oropharyngeal/esophageal candidiasis; others. Among these, invasive candidiasis held a significant share of 48.9%.

- Furthermore, concerning the route of administration segment, the market is segregated into oral, IV/IM, topical; others. The oral sector stands out as the dominant player, holding the largest revenue share of 51.8% in the market.

- North America led the market by securing a market share of 41.4% in 2024.

Product Type Analysis

Azoles, holding 53.7%, are expected to dominate due to their broad antifungal activity, high availability, and established clinical use across mild and moderate yeast infections. Physicians rely on azole formulations because they demonstrate strong efficacy against Candida species while offering convenient dosing schedules. Widespread availability of both prescription and over-the-counter azole products increases patient access.

Pharmaceutical companies introduce improved formulations with enhanced tolerability and reduced resistance development. Rising incidences of genital and oral candidiasis strengthen daily demand. Clinical guidelines continue to recommend azoles as first-line therapy for multiple fungal conditions. Expanding awareness of self-treatment options boosts usage of oral and topical azole forms. Growing female population and increasing chronic disease burden further expand consumption. These factors keep azoles anticipated to remain the leading product segment.

Application Analysis

Invasive candidiasis, holding 48.9%, is anticipated to dominate application usage due to rising hospitalization rates, higher ICU admissions, and increasing numbers of immunocompromised patients. Healthcare providers depend on targeted antifungal therapy to treat bloodstream and deep-tissue Candida infections. Advances in rapid fungal diagnostics enable earlier detection, increasing antifungal treatment uptake. Patients undergoing organ transplants, chemotherapy, or long-term ventilation face elevated risk, strengthening treatment demand.

Clinical research expands understanding of antifungal resistance patterns, improving therapeutic precision. Hospitals adopt treatment protocols emphasizing early and aggressive management of invasive infections. Pharmaceutical companies develop new antifungal agents addressing resistant strains, raising treatment utilization. Global awareness of fungal sepsis drives screening and intervention programs. These drivers keep invasive candidiasis projected to remain the most influential application.

Route of Administration Analysis

Oral administration, holding 51.8%, is expected to dominate as patients prefer convenient, non-invasive treatment options that support outpatient management. Oral antifungals provide effective therapy for genital, oral, esophageal, and early systemic infections, increasing broad usage. Physicians prescribe oral formulations due to reliable absorption and ease of compliance. Growth in telemedicine consultations encourages oral antifungal prescribing for at-home care. Improved oral formulations with enhanced bioavailability strengthen clinical adoption.

Rising prevalence of recurrent candidiasis increases repeat prescription patterns. Retail pharmacy access supports widespread availability of oral treatments. Patient education campaigns emphasize early treatment of symptoms through oral antifungals. These factors keep oral administration anticipated to remain the dominant route in the yeast infection treatment market.

Key Market Segments

By Product Type

- Azoles

- Echinocandin

- Polygene

- Others

By Application

- Invasive Candidiasis

- Genital Candidiasis

- Oropharyngeal/Esophageal Candidiasis

- Others

By Route of Administration

- Oral

- IV/IM

- Topical

- Others

Drivers

The Rising Annual Incidence of Vulvovaginal Candidiasis Is Driving the Market

The rising annual incidence of vulvovaginal candidiasis has become a primary driver for the yeast infection treatment market, as it heightens the demand for accessible antifungal therapies across diverse demographics. This condition, primarily caused by Candida species, manifests as itching, discharge, and discomfort, prompting frequent healthcare consultations and self-treatment. Women aged 30 to 44 years exhibit the highest rates, often linked to hormonal fluctuations, antibiotic use, and diabetes, which collectively amplify vulnerability.

In the United States, approximately 5.2% of adult women report a healthcare provider-diagnosed episode annually, translating to roughly 6.8 million cases based on population estimates. Such prevalence underscores the economic strain, with direct medical costs exceeding hundreds of millions annually due to outpatient visits and prescriptions. Key players like Pfizer, through products such as Diflucan, benefit from sustained demand for oral azoles as first-line options.

The shift toward over-the-counter availability further accelerates market penetration, enabling rapid symptom relief without delays. Public health initiatives emphasizing early intervention also contribute by reducing complications like recurrent infections. As awareness campaigns expand, more women seek confirmatory diagnostics, boosting reagent and kit sales. This driver ultimately fosters innovation in formulation and delivery to meet escalating therapeutic needs.

Restraints

Emerging Antifungal Resistance in Non-Albicans Candida Species Is Restraining the Market

Emerging antifungal resistance in non-albicans Candida species poses a substantial restraint on the yeast infection treatment market, complicating standard azole-based regimens and leading to treatment failures. Non-albicans strains, such as Candida glabrata and parapsilosis, exhibit higher intrinsic resistance profiles compared to Candida albicans, necessitating alternative therapies with potentially higher costs.

In recent laboratory data from U.S. commercial testing, non-albicans species accounted for 16.2% of vulvovaginal candidiasis isolates, reflecting a stable yet concerning proportion. This resistance often stems from overuse of over-the-counter azoles, fostering selective pressure in community settings. Clinicians face challenges in selecting empiric treatments, resulting in prolonged symptoms and increased healthcare utilization. Regulatory bodies like the CDC highlight the need for susceptibility testing, yet adoption remains low due to accessibility barriers.

The economic impact includes escalated expenses for second-line agents like echinocandins, straining reimbursement systems. Patient non-adherence rises amid perceived inefficacy, perpetuating cycles of recurrence. Disparities in access to advanced diagnostics exacerbate outcomes in underserved populations. Mitigating this restraint requires enhanced surveillance and stewardship programs to preserve treatment efficacy.

Opportunities

Development of Novel Azole Inhibitors for Recurrent Cases Is Creating Growth Opportunities

Development of novel azole inhibitors tailored for recurrent vulvovaginal candidiasis presents significant growth opportunities by addressing unmet needs in long-term management. These agents target fungal lanosterol demethylase with enhanced specificity, minimizing host enzyme interactions and reducing recurrence risks. Oteseconazole, for instance, demonstrates superior efficacy in phase III trials, achieving a 71% clinical cure rate compared to 56% for fluconazole in resistant cases.

Such innovations enable shorter regimens, improving compliance among women experiencing four or more episodes annually. Opportunities extend to integration with probiotics, combining antifungal action with microbiome restoration for synergistic effects. Pharmaceutical collaborations with gynecological societies can accelerate guideline incorporation, expanding prescriber familiarity. The focus on oral formulations aligns with telemedicine trends, facilitating remote prescriptions and follow-up.

Emerging markets in Asia and Latin America offer untapped potential, where prevalence exceeds 30% in symptomatic cohorts. Cost-effective generics post-patent could democratize access, particularly in low-resource settings. These advancements collectively promise to elevate market share through differentiated, patient-centric solutions.

Impact of Macroeconomic / Geopolitical Factors

Economic growth and rising healthcare budgets invigorate the yeast infection treatment market, as consumers prioritize accessible over-the-counter and prescription antifungals amid increasing infection rates from diabetes and antibiotic resistance. Inflation, however, elevates expenses for raw materials and drug formulation, which compels producers to hike prices and restricts availability in low-income areas.

Geopolitical conflicts, including U.S.-China trade frictions, fracture supply chains for essential pharmaceutical ingredients sourced from Asia, which leads to delivery delays and amplified costs for international firms. These conflicts, conversely, inspire governments in Europe and Latin America to support local drug development, which fosters new formulations and bolsters market resilience. Current U.S. tariffs enforce a 100% duty on imported branded pharmaceuticals starting October 2025, which burdens importers with steeper fees and diminishes affordability for American patients relying on overseas treatments.

Yet, these tariffs stimulate domestic manufacturers to invest in U.S.-based facilities, which creates jobs and fortifies national supply independence. Despite these pressures, persistent demand from women’s health initiatives and evolving therapeutic options propel the yeast infection treatment sector toward sustained progress and wider global reach.

Latest Trends

The FDA Approval of Rezafungin for Invasive Candidiasis in 2023 Is a Recent Trend

The FDA approval of rezafungin for invasive candidiasis on March 22, 2023, signals a transformative trend in yeast infection treatment toward once-weekly dosing for severe cases. This novel echinocandin, administered intravenously, targets fungal cell wall synthesis with prolonged pharmacokinetics, enabling simplified regimens in hospitalized patients. Clinical trials demonstrated non-inferiority to caspofungin, with 60.3% success rates in treating candidemia and intra-abdominal infections.

Its extended half-life reduces infusion frequency, alleviating nursing burdens and enhancing compliance in intensive care. Cidara Therapeutics’ development addresses gaps in managing multidrug-resistant strains like Candida auris, which reported 4,514 U.S. cases in 2023. The approval, the first in over a decade for invasive forms, integrates seamlessly with existing protocols for high-risk populations.

Early post-marketing data indicate decreased hospital lengths of stay, optimizing resource allocation. This trend encourages pipeline investments in long-acting antifungals, potentially extending to outpatient transitions. Regulatory endorsements validate its safety profile, with adverse events comparable to predecessors. Overall, rezafungin exemplifies 2023’s emphasis on efficacy and convenience in combating life-threatening yeast infections.

Regional Analysis

North America is leading the Yeast Infection Treatment Market

North America accounted for 41.4% of the overall market in 2024, and the region experienced strong growth as clinicians treated rising cases of vaginal candidiasis, recurrent infections, and antifungal-resistant strains. Increased prevalence of diabetes, obesity, and immunocompromised conditions boosted demand for prescription and over-the-counter antifungal therapies. Pharmacies expanded access to topical azoles and oral fluconazole, while telehealth platforms enabled faster consultations for symptomatic patients.

Hospitals strengthened diagnostic practices to differentiate resistant Candida species, prompting higher use of advanced antifungal regimens. The CDC reported that Candida caused an estimated 34,915 bloodstream infections in U.S. hospitals in 2022 (CDC – Fungal Diseases “Hospitalization and Death Estimates”), and this significant burden accelerated demand for effective treatment options. Public-health campaigns increased awareness of early symptom management, further expanding therapeutic uptake. These factors collectively supported strong regional growth in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to record sustained growth during the forecast period as healthcare providers expand fungal-infection management programs across rapidly urbanizing populations. Hospitals increase treatment of vulvovaginal candidiasis, diaper dermatitis, oral thrush, and opportunistic fungal infections linked to rising diabetes and antibiotic misuse.

Diagnostic laboratories adopt improved species-identification tools, enabling more targeted antifungal therapy. Governments intensify awareness initiatives on women’s reproductive health, encouraging earlier treatment-seeking behavior. Pharmacies broaden availability of topical and oral antifungals across India, China, Southeast Asia, Japan, and South Korea.

The World Health Organization reported that India had 74.2 million adults living with diabetes in 2022 (WHO – Global Diabetes Report 2023), and this high-risk population drives significant demand for timely yeast-infection management. Research institutions expand antifungal-resistance studies, increasing the need for updated treatment protocols. These developments position Asia Pacific for strong forward-looking market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key companies shape growth in the fungal-infection treatment market by expanding their antifungal drug portfolios, launching both topical and systemic therapies, and addressing drug-resistant and recurrent infection cases with novel formulations and longer-acting agents. They strengthen their presence by building robust distribution networks and ensuring availability across retail pharmacies, hospitals, and emerging-market drug channels to reach a broad patient base.

They invest in research and development to create broad-spectrum and targeted antifungals, improving treatment efficacy while attempting to reduce side effects and improve patient compliance. They diversify treatment options by offering creams, oral pills, suppositories, and powders to serve different patient needs and severity levels.

They pursue strategic partnerships or licensing agreements with biotech firms to bring new antifungal compounds to market faster. One prominent firm, Pfizer Inc., maintains a strong global footprint, leverages its R&D capacity and established manufacturing and distribution infrastructure to supply widely used antifungal medications that treat common yeast-driven infections, thus anchoring its role as a leading supplier in this market.

Top Key Players

- Pfizer, Inc.

- Novartis AG

- Merck & Co., Inc.

- GlaxoSmithKline plc (GSK)

- Bayer AG

- Astellas Pharma, Inc.

- Sanofi S.A.

- Johnson & Johnson

Recent Developments

- In December 2022, SCYNEXIS, Inc. (now integrated into GSK) reported that the FDA had cleared a second use for BREXAFEMME (ibrexafungerp tablets). The new indication focuses on lowering the risk of recurrent vulvovaginal candidiasis, expanding the therapeutic role of the drug.

- In September 2021, Cidara Therapeutics, Inc. (now part of Melinta Therapeutics) shared updated clinical results for rezafungin. The antifungal agent is being evaluated for preventing and treating severe fungal infections such as candidemia and invasive candidiasis, with a particular emphasis on meeting the needs of hospitalized patients.

Report Scope

Report Features Description Market Value (2024) US$ 6.4 Billion Forecast Revenue (2034) US$ 10.5 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Azoles, Echinocandin, Polygene, and Others), By Application (Invasive Candidiasis, Genital Candidiasis, Oropharyngeal/Esophageal Candidiasis, and Others), By Route of Administration (Oral, IV/IM, Topical, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pfizer, Inc., Novartis AG, Merck & Co., Inc., GlaxoSmithKline plc, Bayer AG, Astellas Pharma, Inc., Sanofi S.A., Johnson & Johnson Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Yeast Infection Treatment MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Yeast Infection Treatment MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer, Inc.

- Novartis AG

- Merck & Co., Inc.

- GlaxoSmithKline plc (GSK)

- Bayer AG

- Astellas Pharma, Inc.

- Sanofi S.A.

- Johnson & Johnson